This article mentions the best alternatives to Dynamic.xyz payment systems which assist companies in processing and receiving secure online payments, managing subscriptions, and processing payments globally.

These alternatives are flexible in pricing, secure, beneficial for international payments and transaction processing, and are equipped with tools suitable for developers which makes them perfect for small companies, big enterprises, and expanding online businesses that are in need of reliable and efficient payment systems that go beyond Dynamic.xyz.

What is Dynamic.xyz Payment Alternatives?

Dynamic.xyz Payment Alternatives are payment processors other than Dynamic.xyz. Payment processors are services used to facilitate transactions, accept payments, and handle other financial activities. Alternatives to Dynamic.xyz payment processors provide similar functions, and sometimes more features, such as online payment security, automated billing, multiple currency transactions, fraud detection, and website and/or app integrations.

They service varying business sizes and types, including small businesses, large businesses, and everything in between. They offer flexible pricing, worldwide service, and various payment processing tools. By selecting the right payment processor, businesses are able to provide their customers with a pleasant payment experience.

How To Select Dynamic.xyz Payment Alternatives

Business Size & Needs: Is your business a startup, a small to a mid-sized business, or an enterprise? Platforms like Square and PayPal Business work well with small businesses. On the other hand, Adyen or Stripe work better with businesses on a larger scale.

Transaction Fees & Pricing: Cost comparisons should be made to assess monthly fees, fees per transaction, and currency conversion costs to obtain the best value.

Supported Payment Methods: Review the payment options your audience needs that the site accepts. Some support credit/debit cards, others digital wallets, UPI, or international payments.

Security & Compliance: Look for features that ensure PCI-DSS compliance, protection against fraud, and encrypted secure payment protocols.

Integration & Developer Tools: Easy integration with your site, app, or e-commerce platform is a must, including other automation options like APIs and plugins.

Customer Support: Quality chat, email, or phone support is essential to a business for servicing customer needs in a timely fashion.

Global Reach: For businesses operating in a lot of countries, obtaining payment solutions that support multiple currencies is great. In addition, obtaining local payment methods and quick cross-border payments is valuable.

Scalability & Features: Features that allow your business to grow should be considered like management of subscriptions, invoicing, analytics, and billing that is recurring.

Key Point & Best Dynamic.xyz Payment Alternatives List

| Payment Platform | Key Points |

|---|---|

| Stripe Payments | Developer-friendly payment gateway offering powerful APIs, global payment methods, recurring billing, fraud prevention, and seamless integration for SaaS and online businesses. |

| PayPal Business | Widely trusted payment solution enabling global payments, PayPal wallet access, buyer protection, invoicing, subscriptions, and easy checkout for small to mid-size businesses. |

| Square Payments | All-in-one payment ecosystem with POS hardware, inventory management, analytics, and flat-rate pricing, ideal for retail stores and service-based businesses. |

| Adyen | Enterprise-grade payment platform providing unified commerce, advanced risk management, real-time analytics, and global acquiring for large multinational companies. |

| Worldpay (FIS) | Scalable payment processing solution supporting card, online, and in-store payments with strong security, global reach, and enterprise-level reliability. |

| Authorize.Net | Established payment gateway offering secure credit card processing, recurring billing, fraud detection, and integration with multiple merchant accounts. |

| Razorpay | India-focused payment gateway supporting UPI, cards, wallets, subscriptions, smart routing, and automated payouts for startups and growing businesses. |

| Payoneer | Cross-border payment platform enabling businesses and freelancers to receive international payments, manage multi-currency accounts, and withdraw locally. |

| Wise (ex-TransferWise) | Low-cost international money transfer service offering transparent exchange rates, multi-currency accounts, and fast global payouts for businesses and individuals. |

| Skrill | Digital wallet and online payment solution supporting international transfers, prepaid cards, crypto payments, and multi-currency transactions. |

1. Stripe Payments

In 2010, Patrick and John Collison founded Stripe as an online payment processing tool with various utilities and custom APIs, targeting software developers and businesses needing online and mobile payment facilities.

Stripe’s payment processing fees are standard, around 2.9% and 0.30 cents with every payment transaction, and its added features are billing and subscription management, fraud prevention (Radar), terminal (Radar), and fraud management.

Stripe, however, has developed and maintained a highly secure platform with PCI-DSS compliant processing, complex and encrypted transactions, and online fraud detection.

Stripe assists its users with documentation, a community forum, paid enterprise support, etc. Enterprise level solutions like Adyen or Worldpay or more simple solutions like PayPal or Razorpay are among best Dynamic.xyz Payment Alternatives here.

Stripe Payments Features , Pros & Cons

Features:

- Processing both online and mobile payments.

- Managing subscriptions and recurring billing.

- APIs and SDKs for developers.

- Advanced fraud prevention through Radar.

- Global reach with multi currency support.

Pros:

- Global payments support for over 135 currencies.

- Scalable plans with clear and transparent pricing.

- Robust security and compliance support with PCI.

- Abundant support through detailed documentation and community.

- Highly flexible and customizable payment solutions.

Cons:

- Complicated for users lacking technical experience.

- Support provided to smaller accounts is not a priority.

- Some features are only available with an extra payment.

- Without additional hardware, in-person point of sale support is not available.

- For transactions flagged as high-risk, accounts may be temporarily restricted.

2. PayPal Business

One of the most famous digital payment services, PayPal (originally named Confinity) was created in 1998. PayPal Business allows merchants to accept payments via debit/credit cards, PayPal wallets, invoices, and even subscriptions.

Prices are dependent on location and volume, but for merchants in the U.S. the cost is typically 2.29%-3.49% + fixed fees for each transaction with additional fees for currency conversion on international sales. The services have strong fraud detection and protection programs, but the company has dealt with several cybersecurity issues.

Their support is though virtual centers and phone/email support. The best alternatives to Dynamic.xyz for payment processing are Stripe for flexible payment out APIs, and Wise or Payoneer for international payments.

PayPal Business Features , Pros & Cons

Features:

- Payment acceptance via cards, PayPal, and wallets.

- Managing subscriptions and invoices.

- Buyer/seller sided protection programs.

- Payments in multiple currencies and across the globe.

- Easy to integrate with multiple e-commerce solutions.

Pros:

- Global and widely accepted service.

- Setup is hassle-free for small businesses.

- Payments can be set to recur.

- Payments can be facilitated through mobile devices.

- International payments can be initiated quickly.

Cons:

- Informed that more transaction fees are applied as compared to rivals.

- Present payment option is not customizable for the checkout.

- Risk of accounts being frozen as a deterrent.

- You might lose money to currency conversion fees.

- Sometimes the customer service is not responsive.

3. Square Payments

In 2009 Square was founded by Jack Dorsey and Jim Mcclay and It specializes in point-of-sale systems and payments, both in person and online, for Square’s clients. It has clear fees of 2.6% + 10 cents for in-person transactions and 2.9% + 30 cents for online transactions, and caters mostly to small businesses.

The tools offered to users include inventory, analytics, payroll, and CRM tools. For security, the users are protected with PCI compliant, end-to-end encryption. For more help, users can reach out through the website or by phone. Best Dynamic.xyz Payment Alternatives to Square include Paypal for more international transactions, or Stripe for more functionalities.

Square Payments Features , Pros & Cons

Features

- POS hardware & software

- Online payment processing

- Inventory & employee management

- Reporting & analytics tools

- Flat rate pricing

Pros

- Great for service or retail businesses

- The POS system is easy to use

- Fees are clear

- Compatible with eCommerce

- Business management is available from the mobile app

Cons

- International Support is Limited

- Online payment processing not as good as Stripe

- Some of the extra services cost more

- Heavy volume customers may experience longer wait times for support

- Big businesses may not be able to use this

4. Adyen

Adyen is a Netherlands company founded in 2006 that provides a global, integrated, and end-to-end omnichannel payment solution for businesses. Adyen has online, mobile, and in-store payments. The company is one of the few that supports over 250 payment methods and over 150 different currencies with real-time analytics and advanced risk management.

For size and region, custom fees are estimated to look like flat rates, although this will likely not be the case to lesser volume and region focusing enterprises. The company is PCI-DSS compliant with fraud protection, and to be low risk, security and compliance are extremely high. For customer support, the company provides account management with a whole integration team.

Adyen Features , Pros & Cons

Features

- Payments processing globally in all channels

- Supports 250+ payment methods

- Fraud detection

- Real-time reporting & analytics

- Payments are unified for Online & offline

Pros

- The scalability is for enterprises

- Good for International clientele

- Strong Risk management

- Checkout solutions available for all custom requests

- Big clients receive personalised service

Cons

- Pricing is complex

- Not available for smaller businesses

- The type of Integration needed can be complex

- Setup isn’t easy, you need to work with an account manager

- Less favourable rates for smaller transactions

5. Worldpay (FIS)

Worldpay (FIS) from FIS, is a global leader in payment processing for several currencies and types of transactions. It has been in existence since 1971 as Midwest Payment Systems, and serves e-commerce, mobile, and POS payments. Pricing for merchant services is customized based on the size of the business.

Support for onboard merchant services includes account management, 24/7 tech support, and various security tools such as PCI compliance, fraud detection, and advanced settlement. Other Best Dynamic.xyz Payment Alternatives include Adyen for large corporations with global payment needs.

Worldpay Features , Pros & Cons

Features

- Card & Online Payment Processing

- Point of sale and electronic commerce assistance

- Transactions in multiple currencies

- Tools for detecting fraud and compliance

- Reporting and analytics on payments

Pros:

- Enduring reliable trust across the globe

- Accommodates businesses on an enterprise scale

- Extensive management of risk and fraud

- Provides various methods for processing payments

- Customer service and account management are excellent

Cons:

- For small businesses, pricing is likely to be complicated and costly

- There is little customization for developers

- For new merchants, the setup process may take a while

- Transaction fees are not well explained

- Many of the features require contracts that last a long time

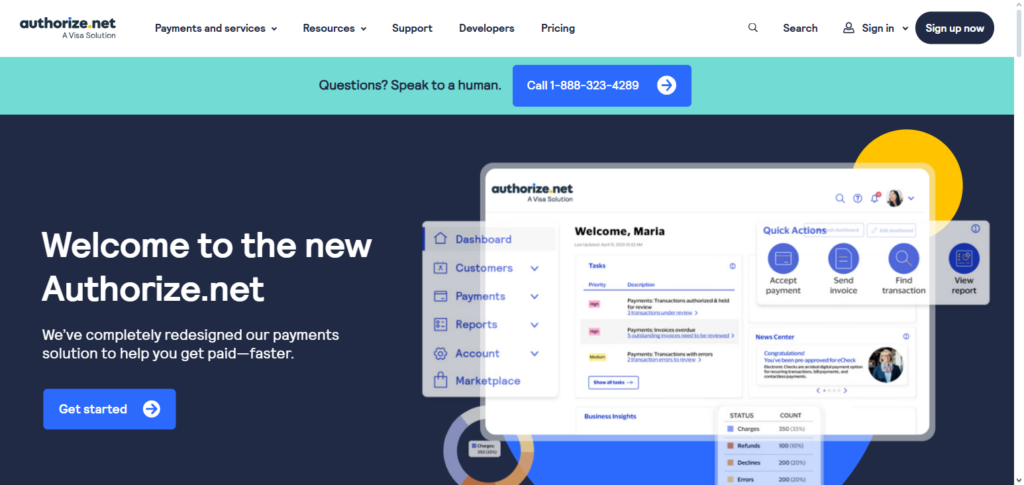

6. Authorize.Net

Founded in 1996, Authorize.Net is amongst the first payment gateways, now owned by Visa via CyberSource, and is widely used by smaller and medium businesses.

They facilitate credit and e-check payment processing via websites and virtual terminals, as well as subscriptions, billable services, and offer fraud detection tools. Pricing is mainly a monthly gateway fee, plus a per-transaction charge, typically around $25 + 2.9% + $0.30, although plans differ. They are PCI-DSS certified and offer several fraud prevention tools.

Support can be contact by phone, email, or through comprehensive guides for developers. Dynamic.xyz Payment Alternatives is Stripe for best modern API, and Square for businesses focused on point-of-sale.

Authorize.Net Features , Pros & Cons

Features:

- Processing of credit cards and e-checks

- Billing and invoicing on a recurring basis

- Suite for the detection of fraud

- Payments through a virtual terminal

- Integration of multiple merchant accounts

Pros:

- Gateway that is established and trusted

- Shopping cart integration is uncomplicated

- PCI compliance and security

- Payments that are recurring are also supported

- Service that is stable and dependable

Cons:

- There are monthly fees for the gateway

- Not the best choice for payments done internationally

- The interface is becoming increasingly outdated

- There is little support for hardware needed for POS

- The setup process may be overly complex for beginners

7. Razorpay

Razorpay is a payment and fintech company from India founded in 2014 by Harshil Mathur and Shashank Kumar. Since it was established, it has been servicing both local and international clients. As with any merchant payment service, close to 2% is paid for a domestic transaction, in with GST, and for international transaction, and they offer more services, the service price is higher.

This service is used in industries that process with cards, UPI, and eWallets, and in payment that is done with a payment API, payment links, and is paid for in installments, and payments in installments.

The service is PCI compliant, and has documented business and account managers as support mentorship opportunities and has provided to support services. Best Dynamic.xyz payment alternatives for Indian businesses. Hover PayPal business account or across payment to flows Payoneer.

Razorpay Features , Pros & Cons

Features:

- UPI, credit & debit cards, Digital wallets, and Net banking.

- Recurring payment and subscription management

- Payment links and invoices options

- Automation of payouts

- Comprehensive integration APIs

Pros:

- Excellent for Indian companies

- Affordable rates for payments within the country

- Fast onboarding and setup

- Accepts more local payment options than competitors

- Great documentation and tools for developers

Cons:

- Options for accepting external payments are very few

- Many advanced options are not included in the base price

- Customers have mentioned that the support team takes a while to respond

- Support is limited to smaller businesses outside the country

- Due to the nature of some transactions, your account may be put on hold

8. Payoneer

Payoneer started in 2005 in order to offer cross-border payments. mostly to freelancers, marketplaces, and small to medium-sized businesses. Payoneer allows companies and SMBs to accept worldwide payments in different currency, keep the funds, and withdraw money locally, and tends to earn money on exchange rate margins and transaction fees.

While the company has considerable security through PCI compliance, account monitoring, and two-factor authentication, customers also report the company has rather poor support, though there is a help center, live chat, and some support staff in the customers’ regions. Best Dynamic.xyz Payment Alternatives include PayPal, and Wise for low-cost FX, and other companies for real-time global payments.

Payoneer Features , Pros & Cons

Features:

- Pay anyone in the world and hold funds in multiple currencies

- Work and get paid on freelance websites

- Withdraw bank funds in different currencies

- Business prepaid visa

- Send money to many recipients in a single transaction

Pros:

- Flexible payments for self employed and companies with international exposure

- Cheap payments and conversions

- Easily get paid in multiple currencies

- We pay out quickly, especially in some countries

- We are a regulated and encrypted company

Cons:

- We do have fees that come with modified transactions

- Payments can’t be automated with some ecommerce sites

- Customers in some countries have reported slow support

- We do not support our payment method for in-person transactions

- Support is sometimes absent

9. Wise (ex‑TransferWise)

Wise has been operating since 2011 and has become well-known for international money transfers for low fees and for having an exchange rate that is essentially only a little over the mid-market exchange rate for the currencies being exchanged.

Wise also lets its customers open a multi-currency business account that allows them to hold money and make and receive payments in dozens of currencies for low fees depending on the type of transaction. Wise has used encryption and protection data compliance to safeguard money.

They offer support through online self-service support, helping others collaborate in a community on Wise, and authorized additional support aimed at businesses. Applicable to customers of Dynamic.xyz. The best service alternatives to global payments for customers of Dynamic.xyz are marketplace payments via Payoneer and online payments via PayPal.

Wise (ex TransferWise) Features , Pros & Cons

Features:

- Pay anyone overseas quickly

- Open accounts that hold multiple currencies.

- Clients can hold funds in multiple currencies and we offer them borderless accounts.

- Users always know the cost of sending and converting currencies

- Users can initiate multiple payments in one transaction.

Pros:

- Low foreign exchange costs and pricing is clear.

- The interface is user friendly.

- The speed of international money transfers is outstanding.

- The ability to hold multiple currencies in an account enables seamless transactions.

- Great for payments between businesses in different countries.

Cons:

- Very few tools to assist merchants during check out.

- The gateway solution is incomplete and no point of sale systems available.

- In some countries, features are unavailable.

- Direct credit card payments cannot be facilitated.

- In online sales, there is no advanced detection of fraudulent activities.

10. Skrill

Skrill started its life in the UK in 2001 under the name Moneybookers. It later rebranded to its current name and started to offer digital wallets and other online payment services. It was the first service to offer payment to international accounts.

It’s still offered today and is one of the more popular international payment services around. Though convenient, the service can be costly, especially when it comes to withdrawing the currency from your account and converting it.

Security is solid, with transaction encryption and fraud protection, though their history of security breaches does lend some credibility to the concern. Customer support is self-service with an online account. Alternative options to dynamically payment include Wise Payments and Paypal.

Skrill Features , Pros & Cons

Features:

- Digitised wallet capacity for web-based transactions.

- Support for various currencies.

- Preloaded cards for cash withdrawal.

- Digital currencies facility.

- Integration for merchant checkout.

Pros:

- Payment and wallet services on global scale.

- Straightforward wallet digital transfers.

- Facility for digital currency payments.

- Flexibility for multiple currencies.

- System is secure and well supervised.

Cons:

- High charges for transactions and currency conversion.

- Limited integration for e-commerce.

- Support for clientele is often late.

- Not as well known as PayPal and Stripe.

- Inappropriate for businesses with high volume.

Conclusion

Selecting the best Dynamic.xyz payment alternative is influenced most by the scale of the business, payment preferences, geography, and technical requisites. Adyen and Stripe Payments are champions for API-first, and enterprise-level payment systems.

PayPal Business and Square Payments are the best options for small and middle-market vendors looking for easy and trusted systems. For cross-border and local functionalities, Razorpay, Payoneer, and Wise are the best. For coverages with compliance, and dependability, Authorize.Net, Worldpay, and Skrill are more than decent options.

All in all, these Best Dynamic.xyz Payment Alternatives give the businesses the ability to adapt to their flexibility, and their ranking in the market gives a business the ability to devise a payment strategy for their business.

FAQ

What are Dynamic.xyz payment alternatives?

Dynamic.xyz payment alternatives are other payment platforms you can use instead of Dynamic.xyz to process online transactions, manage subscriptions, accept global payments, and handle payouts. These include services like Stripe, PayPal, Razorpay, Payoneer, and others that support businesses with secure and scalable payment processing.

Which payment alternative is best for global payments?

For global payments, Stripe Payments, Adyen, and PayPal Business are top choices due to wide international support, multiple accepted currencies, and reliable compliance and fraud protection. Wise (ex-TransferWise) is also excellent for low-cost cross-border transfers.

What is the best alternative for small businesses?

Square Payments and PayPal Business are ideal for small businesses due to simple setup, transparent pricing, user-friendly dashboards, and strong customer support. Stripe also works well if you need customizable checkout and subscription tools.

Which alternative works best in India?

Razorpay is one of the best alternatives for Indian businesses because it supports UPI, cards, wallets, and local payments with competitive pricing and localized features.

Which alternative is best for enterprise-level businesses?

For enterprise needs, Adyen and Worldpay (FIS) are highly recommended due to advanced risk management, global acquiring capabilities, and unified commerce tools that handle large volumes seamlessly.