I’ll go over the Best CoinOS Checkout Alternatives in this post for companies trying to take cryptocurrency payments more effectively. Even if CoinOS Checkout is a dependable choice, many retailers go for substitutes that provide less costs, more extensive cryptocurrency compatibility, quicker settlement times, and sophisticated integration capabilities.

In a fast-changing digital payments world, organisations can increase payment flexibility, improve customer experience, and scale crypto transactions safely by investigating the appropriate option.

Why Businesses Look for CoinOS Alternatives?

High Transaction Fees

Particular merchants believe the fees from CoinOS are too pricey, especially for numerous transactions. Therefore, merchants are motivated to find competitors with cheaper or more transparent fees.

Limited Cryptocurrency Support

Businesses require more cryptocurrencies, but CoinOS customers are unsupported. Therefore, businesses sold to more customers. Competitors are more widely accepted, resulting in businesses to cryptocurrency.

Integration Challenges

CoinOS does not seamlessly work with all e-commerce platforms or point-of-sale systems. Businesses favor competitors that provide simple plugins, APIs, and adaptable integration.

Slower Payment Settlements

Cash flow can be affected by how quickly businesses can receive funds. They seek to have real-time pay settlements, otherwise, they are choosing some CoinOS competitors.

Insufficient Customer Support

Limited support is reported by some customers using CoinOS. Competitors with more responsive customer service provide a smoother onboarding experience.

Lack of Advanced Features

Businesses are more inclined to use competitors for more robust features such as invoicing, analytics, and recurring payments, especially if CoinOS is limited.

Security Concerns

Merchants want additional security measures, insurance, and cold storage, which CoinOS does not have, but they do remain secure.

Best CoinOS Checkout Alternatives in 2026

| Rank | Key Features |

|---|---|

| BitPay | Enterprises needing fiat conversion |

| NOWPayments | SaaS & subscription businesses |

| CoinGate | E-commerce merchants |

| Breez | Small businesses & retail |

| B2BinPay | Enterprises & fintech platforms |

| PayBito | Regulated businesses |

| Coinbase Commerce | Businesses wanting Coinbase ecosystem |

| OpenNode | Bitcoin-focused merchants |

| GoCrypto | Retail chains & travel merchants |

1. BitPay

BitPay was founded in 2011, making it the oldest in the industry. They maintain a cost of 1% per transaction and zero monthly fees. Merchants are able to accept Bitcoin, Ethereum, Dogecoin, Litecoin, XRP, and US backed stablecoins DAI, USDC, and BUSD.

They also accept fiat in USD, EUR, GBP, and INR, making it easier for businesses to ensure compliance and work within the needed legal boundaries.

BitPay also provides daily fiat settlements, Quickbooks integration, and a high standard of KYC/AML. BitPay is the oldest of the competitors, and the only one with fiat.

BitPay Features:

- Accepts payments in Bitcoin, Ethereum and stablecoins

- Fiat settlement ** in USD, EUR, GBP, INR

- 1% transaction charge and no fixed fees

- has QuickBooks, Shopify and WooCommerce integrations

- There is KYC/AML compliance on enterprise level

BitPay

| Pros | Cons |

|---|---|

| Established in 2011, highly trusted | Limited crypto support compared to newer gateways |

| Fiat settlement in multiple currencies (USD, EUR, GBP, INR) | 1% transaction fee may be higher than rivals |

| Strong compliance & fraud protection | Custodial model reduces merchant control |

| Integrations with QuickBooks, Shopify, WooCommerce | Focused more on enterprises than small merchants |

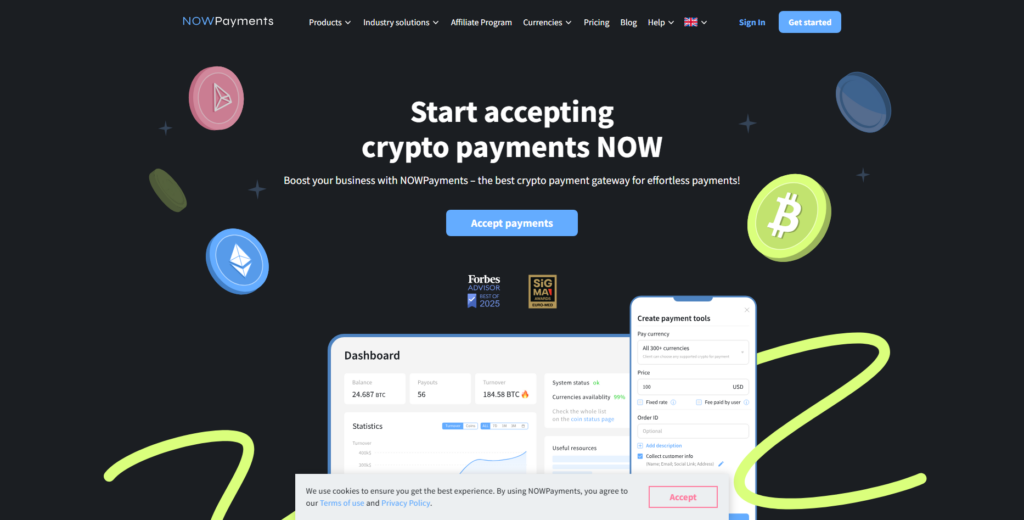

2. NOWPayments

A subsidiary of ChangeNOW, NOWPayments operates a non-custodial gateway. Nowpayments started in 2019 and has grown to support more than 250 coins.

There is a 0.5% fee for transactions in a single currency, and 1% for transactions in multiple currencies, and fixed-rate payments. Merchants can accept payment in bitcoin, ethereal, and some custom tokens and receive wallet payouts.

Numerous plugins for e-commerce support and donations, as well as donations and recurring payment support are available.

NOWPayments is popular for SaaS and subscription businesses due to its recurring billing and non-custodial model. NOWPayments is more flexible, has lower prices, and supports more coins than its alternative, CoinOS.

NOWPayments Features:

- Accepts 250+ cryptocurrencies

- Non-custodial gateway (merchant wallets remain unblocked)

- Charges of 0.5%–1% depending on whether it is a transaction of type

- provision of tools of both Recurring billing and donations

- Plugin available to Shopify, WooCommerce, WHMCS

NOWPayments

| Pros | Cons |

|---|---|

| Supports 250+ cryptocurrencies | No fiat settlement (crypto-only payouts) |

| Non-custodial — merchants keep control of funds | Fees up to 1% for fixed-rate payments |

| Recurring billing & donation tools | Less suited for regulated industries |

| Easy plugins for Shopify, WooCommerce, WHMCS | Requires crypto-savvy merchants |

3. CoinGate

CoinGate is based in Lithuania and operates in 72 countries. CoinGate was founded in 2014 and is one of the longest operating crypto payment providers, and supports 70+ cryptocurrencies, including Bitcoin, Ethereum, and a variety of stablecoins.

Standard pricing is 1% per transaction, with no monthly fees. Merchants can crypto and fiat and benefit from Lightning Network support for instant BTC payments.

CoinGate integrates with Shopify, WooCommerce, and other popular e-commerce frameworks and services over 100,000 merchants around the world.

In the marketplace of CoinOs alternative payment processors, CoinGate offers the Lightning Network and easy e-commerce plugins and fast fiat payouts.

CoinGate Features:

- Accepts payments in 70+ cryptocurrencies. Notable ones are BTC, ETH, stablecoins

- Lightning Network support for swift BTC payments every second

- 1% of the transaction charge

- USD/EUR Fiat settlement

- has Shopify, WooCommerce, and gaming platforms integrations

CoinGate

| Pros | Cons |

|---|---|

| Supports 70+ cryptocurrencies | Limited fiat settlement (EUR/USD only) |

| Lightning Network for instant BTC payments | 1% transaction fee standard |

| Strong e-commerce integrations (Shopify, WooCommerce) | Less enterprise-grade compliance tools |

| Global merchant adoption | Focused mainly on EU region |

4. Breez

It is a Lightning activity first mobile wallet with no zero ces points and which enable instant bitcoin payments. It does charge zero point four percent for channel creation and sending payment does incur routing fees which are determined through lquidity.

It is non custodial and provides merchants payment points without any KYC, which is a know your customer measure. The only currency is Bitcoin via Lightning, which makes it ideal for retail and small businesses.

It also has Podscasting 2.0 but you stream payments. It is a CoinOS checkout alternative. Breez is ideal for micro merchants and traders because it allows quick, low-cost BTC payments.

Breez Features

- A Lightning-first wallet to enable swift BTC payments

- Focuses on non-custodial privacy, which is

- Merchant integrations for QR payments

- 2.0 podcasts streaming payments

- Microtransaction routing fees are low

Breez

| Pros | Cons |

|---|---|

| Lightning-first, instant BTC payments | Bitcoin-only (no altcoins or stablecoins) |

| Non-custodial, privacy-friendly | Limited fiat settlement options |

| POS tools for small merchants | Best for retail, not large enterprises |

| Low routing fees for microtransactions | Requires Lightning familiarity |

5. B2BinPay

B2BinPay is a payment processor for crypto with functions and features for large scale enterprises. July 201 and has grown with his industry. It also has fees which depend only on the cube, the monthly volume, with a range from 0.5 to 5.

It has in her coin BTC and Ethereum as well as other known crypto. It is the same functions in EUR and USD. It’s advanced metrics and seamless SWIFT/SEPA paired with its 0.5% fees helps.

It is B2BinPay as coinOS check out alternative. It also is the best working with large scale enterprises which is primarily the fintech platforms.

B2BinPay

- Crypto payment gateway of business / corporate level

- Crypto currency payment options of Bitcoin, Ethereum, XRP, pegged currencies, tokens on ERC-20

- Tools for detailed reporting, regulatory compliance

- Charges 0.25%–0.40% based on transaction volume

- Settlements for crypto in real time, currencies USD, EUR

B2BinPay

| Pros | Cons |

|---|---|

| Enterprise-grade crypto gateway | Complex setup for small merchants |

| Supports BTC, ETH, XRP, stablecoins, ERC-20 | Fiat withdrawals incur extra fees |

| Advanced reporting & compliance tools | Focused on enterprises/fintechs |

| Low fees (0.25%–0.40%) | Less accessible for startups |

6. PayBito

PayBito is a crypto exchange and payment gateway launched by HashCash Consultants. It has maker/taker fees on the low end of the range of 0.2%–0.3% and offers discounts for higher-tier clients. PayBito allows conversion of Bitcoin, Ethereum, and XRP and Litecoin to INR.

It offers KYC/AML compliance, making it an optimal for customers in end markets. Merchants benefit from INR, instant deposits and withdrawals and an easy to use interface.

PayBito is an alternative to CoinOS Checkout with strengths in India due to an easy interface with the payment compliant and transactional use case.

B2BinPay Features

- Crypto payment gateway of business / corporate level

- Crypto currency payment options of Bitcoin, Ethereum, XRP, pegged currencies, tokens on ERC-20

- Tools for detailed reporting, regulatory compliance

- Charges 0.25%–0.40% based on transaction volume

- Settlements for crypto in real time, currencies USD, EUR

PayBito

| Pros | Cons |

|---|---|

| Supports BTC, ETH, XRP, LTC, INR | Gateway secondary to exchange services |

| Strong KYC/AML compliance | Limited fiat settlement options |

| Maker/taker fees ~0.2%–0.3% | Less developer-friendly APIs |

| Available in 100+ countries | Smaller ecosystem compared to Coinbase/BitPay |

7. Coinbase Commerce

Coinbase Commerce has been operating since 2018 and allows users to transact in Bitcoin, Ethereum, USDC, DAI, Dogecoin, and a few other coins. Coinbase Commerce has a 1% per transaction fee and instantly gets converted to USDC to avoid downside price volatility.

Merchants can integrate the software with WooCommerce, Jumpseller, and Primer to transact in cryptocurrencies.

Coinbase Commerce offers services in all countries with custodial and non custodial accounts. CoinOS Checkout alternative, Coinbase Commerce is best suited for enterprises that need global, fiat stable payment ecosystem, and trust in Coinbase.

Coinbase Commerce Features

- Payment acceptance in BTC, ETH, USDC, DAI, DOGE, LTC, and others

- Can turn USDC in an instant

- Payment services charge 1% of value

- Complying with integrations of WooCommerce, Jumpseller, Primer

- Global merchants use this service in confidence

Coinbase Commerce

| Pros | Cons |

|---|---|

| Accepts BTC, ETH, USDC, DAI, DOGE, LTC | 1% transaction fee |

| Instant conversion to USDC to avoid volatility | Custodial/non-custodial split may confuse merchants |

| Easy onboarding & integrations | Limited fiat settlement compared to BitPay |

| Backed by Coinbase trust | Focused more on US/EU markets |

8. OpenNode

The company specializes in payment processing and was established in 2018. They process on-chain and lightning Bitcoin payments. They charge 1% for smaller businesses and 0.5% for larger businesses to process larger payments.

They automatically process payments in Bitcoin and convert payments to usd and eur. They settle payments instantly to merchants. Merchants easily integrate and are protected against fraud.

OpenNode is the best payment processing alternative to CoinOS Checkout for merchants who are focused on Bitcoin and need instantaneous processing and conversion to fiat.

OpenNode Features

- Payment gateway to transact solely in Bitcoin, enables Lightning + on-chain support

- Charges a service fee 0.5%–1% based on volume

- Automatic fiat currency conversion (USD, EUR, GBP)

- Payment API and hosted Payment pages

- Split settlement for flexible payments

OpenNode

| Pros | Cons |

|---|---|

| Bitcoin-only with Lightning + on-chain | BTC-only (no altcoins) |

| Low fees (0.5%–1%) | Requires Lightning familiarity |

| Automatic fiat conversion (USD, EUR, GBP) | Less suited for multi-currency merchants |

| API & hosted payment pages | Narrower scope than multi-crypto gateways |

9. GoCrypto

GoCrypto began in 2018 and has expanded to 70 countries. Depending on the merchant and the business plan, GoCrypto charges around 1% in fees, as is customary in the industry.

It allows payments in Bitcoin, Ethereum, and stablecoins, along with cash conversion to the country’s fiat. It has a point of sales (POS) terminal, QR code system, and mergers for both the travel and retail industries.

It has a GoCrypto 2.0 protocol which includes finance capabilities such as staking and decentralized autonomous organization (DAO) governance.

GoCrypto is best for travel-related businesses and retail conglomerates in need of CoinOS Checkout alternatives and expansive global capabilities.

GoCrypto Features

- Operates in 70+ countries

- Accepts BTC, ETH, stablecoins, and local fiat

- POS terminals + QR payments for retail

- Real-time transaction tracking

- Integrates with accounting tools and e-commerce platforms

GoCrypto

| Pros | Cons |

|---|---|

| Operates in 70+ countries | Fees ~1% standard |

| Supports BTC, ETH, stablecoins, local fiat | Focused on retail/travel, less SaaS |

| POS terminals + QR payments | Limited enterprise-grade compliance |

| Real-time transaction tracking | Less developer API flexibility |

How to Choose the Right Alternative

Assess Your Business Needs Understand your transaction volumes, payment goals, and cryptos you intend to accept. Determine your business size, sector, and customer demographics, and pick accordingly.

Compare Supported Cryptocurrencies Make sure your customers’ preferred coins are supported. Broader coverage on cryptos supported, will help you convert more and cater to users with diverse preferences.

Check Integration Compatibility Target platforms that offer straightforward integrations with your e-commerce platform, POS, or website through plugins or APIs to facilitate a seamless integration.

Evaluate Fees and Pricing Assess transaction fees and settlement pricing. Transparent, lower fees are better for profit retention and therefore scaling.

Review Security Measures Business and customer protection are critical. Look for platforms with industry-grade safeguards such as multi-signature wallets, cold storage, and fraud detection.

Consider Payment Settlement Speeds Opt for a provider that settles faster to meet your cash flow needs. Prompt payment settlement ensures you meet your cash flow needs.

Test Merchant Tools and Features Check if they offer invoicing, analytics, dashboards, and tools for recurring billing. Enhanced features facilitate operational efficiency and more informed decisions.

Evaluate the Quality of the Customer Support Integrated customer support is a tremendous benefit on onboarding and issue resolution as responsive and knowledgeable support minimizes downtime and improves overall experience.

Check Reputation and User Reviews Review sites, case studies, and community feedback provide relevant information regarding customer support and overall satisfaction. Good reputation and trustworthiness are found with the more established and reliable options.

Evaluate Worldwide Availability and Compliance Check if the platform is able to perform International payments, complies with the jurisdiction and provides multi-step configurations for a global audience.

Benefits of Using CoinOS Alternatives

Reduced Costs per Transaction A number of the alternatives to CoinOS provide a reduction on the amount charged per crypto transaction as well as give a more clear cost structure for transaction fees which is beneficial to businesses, especially those that run highly transactional crypto businesses.

Wider Crypto Acceptance Merchants are able to accept more than one crypto currency with the alternatives which means they can appeal to more customers.

Quick Payment Settlement For some platforms, payments are almost instant and on the same day which results to better cash-flow management and a reduction of delays in receiving money.

Improved Integration With Other Applications Other applications like drop-in e- commerce, POS, and APIs can be integrated to CoinOS and other alternative platforms easily which is a more convenient and more extensible management.

Improved Security Options To ensure safe transactions, alternatives provide better security, like multi-signature wallets, cold storage, and Fraud Prevention Systems.

Better Tools for Merchants Automated invoicing, payment analytics, dashboards, recurring payments and payment tracking give businesses better controls for their operational processes.

Improved Responsiveness Strong customer service and support ensures that businesses receive onboarding, troubleshooting and transaction support quickly to avoid reducing the operational disruption to the business.

More Payment Options There are a number of customizable payment options for businesses, like, branded payment pages and tailored checkout processes.

Global Reach Many other CoinOs alternatives integrate international payment capabilities allowing companies to service customers anywhere in the world without worrying about the complexities of currency conversion.

Scalability The other alternatives give you the flexibility to scale your operation smoothly helping you to optimize it as the volume of transactions, as well as the adoption of crypto, continue to grow.

Conclusion

For companies looking to securely and effectively accept cryptocurrency payments, selecting the best CoinOS Checkout substitute is crucial. Although CoinOS is easy to use, there are plenty of other options that offer more extensive cryptocurrency compatibility, less fees, quicker payouts, and sophisticated merchant features.

Different business sizes and payment requirements are served by platforms such as BitPay, NOWPayments, CoinGate, OpenNode, and Coinbase Commerce.

Businesses can choose a solution that improves customer experience, boosts cash flow, and fosters long-term growth in the developing crypto payments ecosystem by weighing variables like fees, integrations, security, and scalability.

FAQ

What are CoinOS Checkout alternatives?

CoinOS Checkout alternatives are crypto payment platforms that allow businesses to accept digital currencies, often offering lower fees, more cryptocurrencies, and better integration options.

Why should businesses consider CoinOS alternatives?

Businesses look for alternatives to access advanced features, faster settlements, wider crypto support, improved security, and more flexible pricing structures.

Which CoinOS alternative is best for small businesses?

Platforms like NOWPayments, CoinGate, and Coinbase Commerce are popular for small businesses due to easy setup, transparent fees, and wide cryptocurrency support.

Are CoinOS alternatives secure?

Yes, most reputable alternatives use strong security measures such as encryption, multi-signature wallets, two-factor authentication, and fraud protection.

Can I accept multiple cryptocurrencies with CoinOS alternatives?

Most CoinOS alternatives support multiple cryptocurrencies, including Bitcoin, Ethereum, stablecoins, and altcoins, helping businesses serve a wider audience.