This article will review the best InvoXPay alternatives that assist companies in safely and seamlessly accepting cryptocurrency payments.

The listed platforms include enhanced invoicing options, fast settlements, multi-currency support, and easy integration, making them ideal for merchants looking for dependable, scalable, and state-of-the-art digital payment solutions that go beyond InvoXPay.

What is InvoXPay Alternatives?

Alternatives to InvoXPay include cryptocurrency and digital payment systems that offer comparable or improved online payment acceptance, management, and settlement capabilities. These systems provide features like secure checkout, multi-currency support, crypto-to-fiat conversion, invoicing, and business connectors.

Businesses of all sizes looking for dependable and scalable digital payment processing might choose InvoXPay alternatives because they offer cheaper rates, improved global reach, quicker settlements, or more flexible payment options.

Key Point & Best InvoXPay Alternatives List

| Platform | Key Points |

|---|---|

| BitPay | Established crypto payment processor supporting Bitcoin and major altcoins, offers fiat settlements, invoicing, and global merchant tools with strong compliance. |

| PayPal (Crypto Checkout) | Allows merchants to accept crypto payments while receiving fiat instantly, backed by PayPal’s trusted ecosystem and broad customer base. |

| Strike | Bitcoin-focused payment platform using the Lightning Network for instant, low-fee cross-border transactions with seamless fiat conversion. |

| OpenNode | Bitcoin and Lightning payment gateway designed for businesses, offering fast settlements, API integrations, and optional fiat payouts. |

| Crypto.com Pay | Multi-crypto payment solution with cashback incentives, strong mobile app integration, and support for both online and in-store payments. |

| AlfaCoins | Simple and flexible crypto payment processor supporting multiple cryptocurrencies, known for easy setup and low processing fees. |

| Plisio | User-friendly crypto payment gateway offering auto-conversion, plugins for popular e-commerce platforms, and broad coin support. |

| Blockonomics | Non-custodial Bitcoin payment solution that lets merchants receive funds directly to their wallets with no KYC and full control. |

| GoCrypto | Crypto payment network focused on retail adoption, enabling in-store and online payments with multi-currency support. |

| Paystand | Blockchain-enabled B2B payment platform specializing in automated invoicing, AR tools, and fee-free digital payments for enterprises. |

1. BitPay

BitPay is one of the first crypto payment processors, allowing sellers to easily accept Bitcoin along with other major altcoins. They provide invoicing, payment buttons, and other billing tools, as well as integrations with large e-commerce stores.

As one of the Best InvoXPay Alternatives, BitPay is well known for its regulatory compliance, multi-currency, and the ability to settle directly into fiat or stablecoins, thereby reducing volatility for businesses.

Providing secured wallets, merchant dashboards, and fraud prevention, BitPay attracts sizable enterprises and small online stores willing to crypto economically expand their payment liquidity.

BitPay Features, Pros & Cons

Features

- Acceptance of Bitcoin and major alternative coins

- Automatic conversion to a local currency

- Invoicing and billing software for merchants

- E-commerce integrations (Shopify, WooCommerce)

- Integration with secure wallets

Pros

- Fast and straightforward onboarding process for merchants

- Strong global reach

- Eliminates the risks of crypto volatility.

- Customer assistance is dependable.

- Has a good track record and is reputable

Cons

- For small merchants, costs may be higher.

- Limited assistance with regard to lesser-known cryptocurrencies

- Know Your Customer (KYC) compliance

- Standard UI may feel a little old-fashioned.

- Not completely non-custodial.

2. PayPal (Crypto Checkout)

PayPal’s Crypto Checkout is transforming how merchants do business, empowering them to accept digital currency payments from any crypto user for retail transactions from PayPal’s global base (330 million accounts).

PayPal’s users can purchase cryptos (Bitcoin, Ethereum, Litecoin, Bitcoin Cash) at any time, and merchants receive payments instantly and in local currencies (fiat). Existing PayPal merchants can integrate this service at virtually no cost, and there are no changes to their and their customers’ payment processing experiences.

PayPal reputation, compliant user protections and risk controls add to businesses’ and their customers’ peace of mind. PayPal is an exceptional option for crypto wallet and volatility risk management.

PayPal (Crypto Checkout) Features, Pros & Cons

Features

- Supports Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

- Payments are settled in local currency instantly.

- Comes with PayPal’s checkout integration out of the box.

- Provides options for buyer protection.

- Supports both mobile and web.

Pros

- Well-known and trusted all over the world.

- Old users of PayPal can onboard quickly.

- Instant currency conversion is available.

- Not having to create multiple wallets saves time and simplifies the process.

- The checkout process is unchanged and is very familiar.

Cons

- Limited crypto coins available.

- Some users may find the costs to be higher than other options.

- Funds are completely controlled by the provider.

- The service is not decentralized in any way.

- The terms of service for merchants are subject to change at any time.

3. Strike

Strike is a payment platform that works with the Lightning Network to facilitate real-time global payments via Bitcoin for a minimal transactional fee. Strike has consumer and merchant models that enable the instant conversion of Bitcoin to local currency with no price volatility risk and is considered by many as Best InvoXPay Alternatives.

Its self-settlement feature and ease to integrate attract global participants for eCommerce, remittances, and POS transactional environments. Strike views Bitcoin only as a payment rail, the company’s focus on speed and accessibility to the payment network sets these payment processors apart. Fast and affordable payment solutions with immediate transaction confirmations attract cross-border merchants and service providers.

Strike Features, Pros & Cons

Features

- Supports the Bitcoin Lightning Network

- Instant Payments with Low Fees

- All Around The Globe Remittances

- API Integrations

- Payments Automatically Convert to Fiat

Pros

- Transactions Occur Very Quickly

- The Fees are Very Low

- It is Perfect for World’s Border Commerce

- They are Very Focused on Bitcoin

- Very Small Payments are Allowed

Cons

- Limited Support for Other Altcurrencies

- Quite Central on Bitcoin

- Not Many People Use It

- Small Ecosystem

- Fewer Tools for Merchants

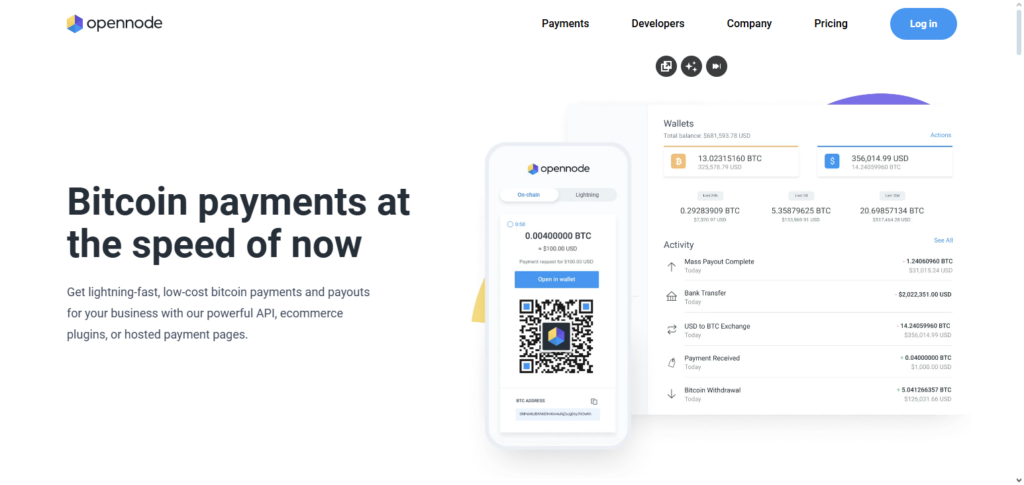

4. OpenNode

OpenNode is an exemplar among Bitcoin-centric payment processors with on-chain and lightning payments accepted. For iVOXPay affiliates, processing multi-crypto payments with on-chain and lightning Bitcoin, ephermal wallet, and auto fiat conversions make OpenNode an ideal candidate.

Merchants receive same day and secure settlements with imbalanced currency preferences faster than competitors. OpenNode provides fast fiat conversions and payments, fast and secure endpoint for Elasticsearch, iSCSI interface, and lSASS, fast approval and payment onboard, and architectural.

Instant settlements and support for micropayments make OpenNode especially relevant for digital goods, gaming, international, and merchants where fast, cost-effective payments with great crypto support.

OpenNode Features, Pros & Cons

Features

- Payments On-Chain and via Lightning

- Automatically Convert to Fiat

- API and Other Plugins

- Provides Reports on the Dashboard

- Friendly to Developers

Pros

- Very Fast Bitcoin Payments

- Digital Services and Payments

- They Have a Strong API

- Fees are Not a Mystery

- Good Customer Service

Cons

- Payments Are Bitcoin-Only

- Not Many Tokens are Supported

- If You Want to Non-Custodial You Have to be Smart

- Not Good for Large Businesses

- Not Many Marketing Promotions

5. Crypto.com Pay

With its Pay option, Crypto.com offers the chance to engage an even larger base of crypto customers due to their diversified cashback rewards and ability to consume services from various vendors. Being a part of the wider Crypto.com services ecosystem, customers enjoy cashback rewards on various services.

Merchants enjoy a suite of crypto wallets, analysis, and merchant tools, including streamlined onboarding and tracking; all of which, simplify servicing the crypto-engaged. Merchants have the option of receiving payment(s) in crypto or converted to the local fiat for a flexible management of revenue.

Targeting crypto customers and also mainstream non-crypto customers, Pay offers a wide array of services including plugins to popular online store vendors and integrated points of sale for physical merchant locations.

Crypto.com Pay Features, Pros & Cons

Features

- You Can Accept Many Cryptocurrencies

- Provides Cashback for Spending Payments

- Integrates with Mobile Wallets

- Offers Plugins for E-Commerce

- Can Settle Payments in Fiat

Pros

- Payments with Cashback are Rewarded for Spending Payments

- Offers Many Different Tokens

- Mobile Apps are Emphasized

- Offers Other Services under the Same Brand

- Simple on-Boarding for Merchants

Cons

- Conditions Are Attached to Cashback

- Fees are Complicated

- Centralized

- You Need to Have a Crypto.com Account

- Not Available in All Areas

6. AlfaCoins

AlfaCoins is a seamless crypto payment processor with cryptocurrency support, simple setup for online merchants, and seamless adaptability. With low processing fees, automatic invoicing, and frictionless integration, we rank AlfaCoins among the Best InvoXPay Alternatives in the Industry. Customers can either receive funds directly or settle them in fiat to reduce exposure to crypto volatile price levels.

AlfaCoins easily integrates with ecommerce platforms, adaptable for both small and maturing firms as it offers developer API. Order management and transaction history services are available to support merchants. Added to the long list of crypto payment processors, and especially for those with low pricing, AlfaCoins is an excellent choice.

AlfaCoins Features, Pros & Cons

Features

- More than 1 Cryptocurrency is Supported

- Invoicing automation

- Settlements in fiat

- Integrations for e-commerce

- Payment Processing

Pros

- Setup is straightforward

- Costs are kept low

- High level of currency flexibility

- Perfect fit for very small businesses

- User-friendly interface

Cons

- Missing more advanced capabilities

- Reporting is rudimentary

- Support is slower to respond

- Not the best choice for larger companies

- Less widely recognized

7. Plisio

Plisio’s ease of use and the ability to cater to multiple merchants enables the platform to process a large volume of transactions, and could be considered a frontrunner in the crypto space. The crypto payment gateway offers automatic conversions and secure wallets. The crypto payment gateway’s sophisticated tools, such as automatic conversions and secure wallets, ease the experience for non-technical customers.

The platform’s comprehensive dashboard, featuring customizable payment pages, invoicing, and detailed analytics, simplifies business operations. The non custodial and custodial services allow the platform to serve businesses with mixed requirements. Its overall platform flexibility makes it a strong contender for online merchants, self-employed individuals, and businesses dedicated to offering crypto payment services.—

Plisio Features, Pros & Cons

Features

- Excellent crypto coverage

- Automatic conversion to fiat currency

- Support for many plugins

- Customizable pages for payments

- Multiple secure wallet options

Pros

- Simple to use

- Perfect for freelancers and small retail businesses

- Robust analytics capabilities

- High token support

- Seamless integration with other services

Cons

- Unpredictable fee structure

- Not very popular among users

- Non-crypto features are less

- Smaller user base

- Lack of comprehensive tools for large companies

8. Blockonomics

Blockonomics enables Bitcoin payments via non-custodial payments direct to merchants’ wallets, where they maintain all funds. For businesses placing high emphasis on self-custody, Blockonomics is one of the Best InvoXPay Alternatives.

His company does not collect KYC even in basic setups, reinforcing the company’s philosophy of autonomy privacy and self-custody, balanced against the provision of merchant dashboards, email invoices, and e-commerce plugins. Wallet payments directly to merchants diminish risk exposure to third parties.

Blockonomics fits best with businesses that aim to complete operations in Bitcoin and prioritize their privacy. Blockonomics enables customers to transact from anywhere in the world for a nominal fee. This offering is especially attractive to customers wanting to avoid third-party custody of their crypto.

Blockonomics Features, Pros & Cons

Features

- Allows Bitcoin payments without custody

- Instant wallet payouts

- Invoicing via email

- Plugins for e-commerce

- Basic setup with no KYC

Pros

- Complete control of funds

- Emphasis on user privacy

- Only Bitcoin accepted (greater simplicity)

- Fees are easy to understand

- Simple for users who are businesses

Cons

- No support for other cryptocurrencies

- Not a good option if you want to convert Bitcoin to fiat

- Understanding wallets is required

- Interface is very basic

- Lacks many helpful tools

9. GoCrypto

GoCrypto is a payment system for retailers and online businesses that incorporates digital currencies, allowing instant payments using a variety of cryptos and integrating digital currencies into daily transactions.

Merchants experience ease of onboarding, instant payments, and real-time currency conversions, which helps them avoid costly payment processors.

GoCrypto solves the problem of supporting a digital currency payment system with traditional retail. This allows companies to easily accept digital currencies while expanding customer options, enhancing modern retail payments, and supporting the movement of digital currency into the retail payments mainstream.

GoCrypto Features, Pros & Cons

Features

- Retail and online payment options

- Payments using QR codes

- Discounts on multiple crypto-supporting platforms

- Integrating with other computer software

- Immediate confirmation on payments

Pros

- Efficient for making payments at stores.

- Quick payment processing.

- Support for many different crypto tokens.

- Simplicity for the customers.

- Helpful for combined online (ecommerce) and offline (retail) selling.

Cons

- Less popular than others (market share).

- Less features for larger companies.

- Some effort is needed for companies to sign up.

- Limited options for sending payments.

- Not much information on the software.

10. Paystand

Paystand stands out among the Best InvoXPay Alternatives for enterprise use, as it not only fully automates the invoicing, accounts receivable, and digital payment processing of crypto, ACH, and card networks, but also eliminates traditional credit card processing fees due to the company’s unique blockchain technology and business model, rendering the entire process virtually cost-free. It also offers enterprise cash flow tools for payment optimization and automation.

The company’s platform integrates with enterprise accounting and ERP systems, and provides specialization in reporting and reconciliation. Because of the strong demand for sophisticated, modern digital billing solutions and increased financial operational flexibility with digital currencies, Paystand’s Interchange and blockchain technology settlement fees appeal to most enterprises.

Paystand Features, Pros & Cons

Features

- Invoicing customers in B2B transactions automatically.

- Payments made using blockchain technology.

- No fees during payment processing.

- Able to merge computer software.

- Accept customized payments.

Pros

- Best for large companies.

- Provides many features for managing money.

- Card fees are eliminated.

- Grows with the client.

- Keeps up with the law.

Cons

- Difficult to set up.

- Best for B2B.

- Not intended for retail stores.

- Less features for users who want to use only crypto.

- Needs to be learned more than other platforms.

Conclusion

Your target market, payment preferences, and business size all play a role in selecting the best InvoXPay alternatives. While PayPal Crypto Checkout and Crypto.com Pay are suitable for retailers seeking mainstream adoption and ease of use, platforms like BitPay, OpenNode, and Strike are perfect for enterprises looking for quick, secure Bitcoin and Lightning payments.

Solutions like AlfaCoins, Plisio, and Blockonomics offer dependable choices with robust control over funds for flexibility and minimal fees. GoCrypto and Paystand, on the other hand, handle B2B and retail invoicing. All things considered, these top InvoXPay substitutes provide scalable, safe, and cutting-edge cryptocurrency payment options for international companies.

FAQ

What are the best alternatives to InvoXPay for crypto payments?

Some of the top alternatives include BitPay, PayPal (Crypto Checkout), Strike, OpenNode, Crypto.com Pay, AlfaCoins, Plisio, Blockonomics, GoCrypto, and Paystand. Each offers unique features like multi-currency support, fiat settlement, Lightning Network integration, and merchant tools.

Which alternative is best for small online businesses?

For small online merchants, solutions like BitPay, Plisio, and AlfaCoins are recommended due to ease of setup, low fees, and seamless integration with popular e-commerce platforms.

Which platform is best for Bitcoin-only payments?

OpenNode, Blockonomics, and Strike are excellent for Bitcoin-centric payments, offering options for non-custodial wallets, Lightning Network support, and fast settlements.

Can I accept crypto and receive fiat payouts?

Yes — BitPay, PayPal (Crypto Checkout), AlfaCoins, and OpenNode all allow automatic conversion of crypto payments into fiat to reduce volatility risk.

Which alternatives support Lightning Network payments?

Strike and OpenNode both support Lightning Network transactions, enabling fast, low-fee bitcoin payments ideal for global commerce.