This article outlines some of the best MerchantHub Crypto Alternatives that allow businesses to accept cryptocurrency payments instantly and securely.

These options include features of multiple coins, quick settlement, and low fees, as well as simple integration for online and physical store merchants. These solutions help businesses broaden their payment possibilities and improve customer satisfaction while controlling volatility and operational costs.

Why Use MerchantHub Crypto Alternatives

Competitive Pricing: Other crypto payment processors charge much less than the traditional card networks, so merchants save on transaction costs and increase profit margins even more.

Improved Cash Flow: Compared to bank-dependent payment methods, crypto payment systems, especially ones that utilize the Lightning Network, settle payments with virtually instantaneous cash flow (in seconds or minutes).

Greater Diversity in Payment Options: Alternatives tend to support dozens of cryptocurrencies, including BTC, ETH, and various stablecoins, which broadens payment choices for customers and reduces friction.

Increased Ability to Serve International Customers: There are no banking border restrictions for crypto payments, which allows simplify payment acceptance from international customers.

Self-Custody of Funds: Non-custodial or self-hosted (e.g., BTCPay Server) systems allow merchants to self-custody their private keys and funds, and hence, are less dependent on third parties.

Minimized Risk: Decentralized/blockchain payment gateways lower the digital footprint and reduce the centralized risk of traditional payment processors.

Seamless Compatibility: Most of the alternatives integrate easily with e-commerce plugins and API interfaces (i.e., Shopify, WooCommerce, Magento), which saves a lot of time for developers (e.g., low code).

Automatic Fiat Conversion: Any of the payment processing companies that automatically convert crypto sales to local currency for a lower risk case scenario give merchants that volatility protection.

Better Customer Experience: Merchants looking to attract technologically advanced customers to improve conversion rates gain a competitive advantage with the faster checkout times crypto sales offer.

Key Point & Best MerchantHub Crypto Alternatives List

| Platform | Key Points / Features |

|---|---|

| Paystand | Focuses on B2B payments with blockchain integration, enabling faster, fee-free payments and recurring billing. |

| GoCrypto | Allows merchants to accept crypto payments easily; supports multiple cryptocurrencies and instant settlements. |

| Blockonomics | Bitcoin-focused payment gateway; enables direct peer-to-peer payments without intermediaries. |

| Plisio | Multi-cryptocurrency payment processor; offers invoicing, API integration, and low transaction fees. |

| AlfaCoins | Crypto payment gateway for online stores; supports over 20 cryptocurrencies and fiat conversion. |

| Crypto.com Pay | Part of Crypto.com ecosystem; allows merchants to accept crypto with cashback rewards for users. |

| OpenNode | Bitcoin Lightning Network integration; instant BTC payments, low fees, and easy merchant onboarding. |

| Strike | Lightning Network wallet and payment platform; focuses on fast, near-zero fee bitcoin payments globally. |

| CoinGate | Supports crypto payments for merchants and invoicing; offers a wide range of cryptocurrencies and fiat settlement. |

| BTCPay Server | Open-source, self-hosted Bitcoin payment processor; privacy-focused and highly customizable for merchants. |

1. Paystand

Paystand charges a simple flat fee of 2.75% of the total transaction amount, regardless of the payment method. ACH, Credit Cards, and Cryptocurrency are accepted by Paystand, making it a flexible option for the payment methods used in your organization.

This MerchantHub crypto alternative also has fraud controls and integrations with typical enterprise resource planning (ERP)/ customer relationship management (CRM) systems. Low-cost and on-chain payments enable wallets and other crypto payment providers to retain a more significant portion of the transaction amount. It is important to note that Paystand is focused more on adapting to enterprise customers.

Paystand — Key Features

| Feature | Explanation |

|---|---|

| Blockchain Billing | Uses blockchain tech to automate and secure digital payments with reduced fees. |

| Multi‑Payment Support | Accepts crypto, ACH, and card payments in one system for business flexibility. |

| Recurring Payments | Built‑in recurring billing capabilities for subscription‑based businesses. |

| ERP/CRM Integration | Connects with systems like Salesforce or NetSuite for unified workflows. |

| Cash Flow Optimization | Tools to accelerate receivables and lower processing costs. |

Paystand Pros & Cons

Pros:

- Transaction fees are lower than, or are zero, with traditional payment processors.

- Offers both cryptocurrency and fiat billing in one place.

- Offers Major ERP/CRM systems for enterprise workflow integrations.

- Offers features for recurring billing and automated invoicing.

- Emphasis on optimizing business cash flow.

Cons:

- Setup should be more complicated for small vendors.

- Less community support as compared to open-source.

- E- commerce support is reliant on the integrations.

- Advanced features may necessitate minor training.

- Less concentration on the retail/point- of-sale use case.

2. GoCrypto

For physical and online merchants alike, GoCrypto facilitates safe and uncomplicated access to numerous cryptocurrencies. GoCrypto allows merchants to accept, settle, and withdraw crypto payments in local fiat and currencies such as Bitcoin, Ethereum, and various stablecoins.

Consequently, merchants such as those in hospitality and retail who desire real-time payment flexibility without opaque payment gateway solutions have increasingly embraced GoCrypto.

Merchants seeking to accept crypto payments can also access numerous point-of-sale plugins and e-commerce modules to streamline and simplify payment acceptance while enhancing customer payment flexibility and choice. Ultimately, GoCrypto expands merchant access to global market to maximize customer choice.

GoCrypto — Key Features

| Feature | Explanation |

|---|---|

| Multi‑Crypto Acceptance | Lets merchants accept many cryptocurrencies at checkout. |

| Point‑of‑Sale (POS) | Supports in‑store crypto payments via easy POS integration. |

| Instant Settlement | Converts crypto to local currency quickly to avoid volatility. |

| E‑commerce Plugins | Works with major platforms like WooCommerce and Shopify. |

| Simple Merchant Dashboard | Easy dashboard for tracking transactions and reports. |

GoCrypto Pros & Cons

Pros:

- Quick and easy onboarding process for both online and in-store merchants.

- Handles several different cryptocurrency types.

- Instant deposits and currency conversion.

- Connects with popular e-commerce systems.

- Offers both POS and checkout systems.

Cons:

- Limited and basic invoicing functionalities.

- Settlement fees can be higher than other crypto-native options.

- Less open documentation for developers.

- Primarily retail oriented.

- Less extensive features for enterprise billing.

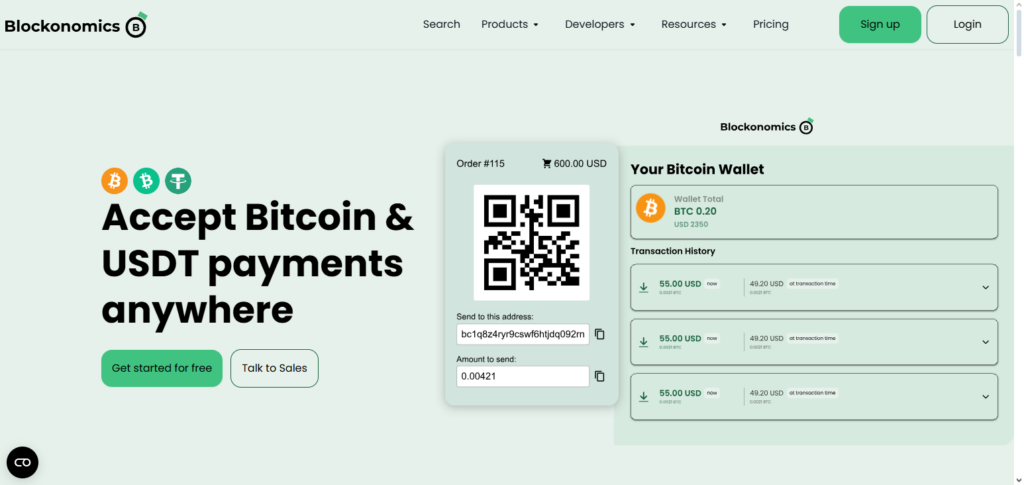

3. Blockonomics

Through a focus on Bitcoin, Blockonomics allows its merchants to receive crypto payments directly to their wallets, avoiding third-party processors. Blockonomics prioritizes self-custody, privacy, and open standards to enable seamless payment processing and tracking, as well as email invoicing.

Although custodial solutions such as OpenNode and BTCPay Server offer their customers decentralized payment processing without block size fees, Blockonomics stands out for its crypto security and merchant control.

For developers seeking user-friendly payment solutions on Bitcoin’s Lightning Network, Blockonomics offers merchants a minimalist payment processing solution. However, Blockonomics is limited to Bitcoin, as is Blockonomics’ growing customer base.

Blockonomics — Key Features

| Feature | Explanation |

|---|---|

| Non‑Custodial Payments | Merchants receive BTC directly into their wallet — no third‑party holds funds. |

| Bitcoin‑Only Gateway | Focused solely on Bitcoin payments for specialization. |

| Email Invoices | Allows merchants to send BTC invoices directly via email. |

| Minimal Setup | Quick to install for Bitcoin payments without complex backend needs. |

| Privacy‑Focused | Reduces data sharing and preserves merchant/customer privacy. |

Blockonomics Pros & Cons

Pros:

- Merchants have full control of funds as it is non-custodial.

- Bitcoin payments are easy to set up.

- Invoicing via email is simple.

- No exposure to third‑party wallets.

- It is light and developer friendly.

Cons:

- Support is Bitcoin only, all others are altcoins.

- Wallet management is required for manual settlements.

- The dashboard features are limited.

- Not the best fit for bigger multi‑currency organizations.

- There are fewer plugins available than bigger competitors.

4. Plisio

Plisio covers multiple cryptos for payment processing. Businesses may choose to accept dozens of tokens with personalized invoices, API, and low fees. It connects with most ecommerce providers and offers real time automated exchange.

For MerchantHub’s crypto alternsatives, CoinGate and GoCrypto offer similar integrations with more cryptos and fiat options.

Merchants can able to manage and track their transactions, create payment buttons, and balance their books through the service’s dashboard. Both digitally Llisted and online merchants may use their service to crypto-enable their payments, as their verstatile, accounting-friendly integrations with crypto and other cilture.

Plisio — Key Features

| Feature | Explanation |

|---|---|

| Multi‑Coin Support | Accepts a wide range of cryptocurrencies. |

| API & Plugins | Provides APIs and plugins for seamless integration with stores. |

| Automatic Conversion | Converts crypto to preferred settlement asset automatically. |

| Real‑Time Pricing | Shows live crypto prices during checkout. |

| Merchant Dashboard | Central panel for tracking sales and payouts. |

Plisio Pros & Cons

Pros:

- It is easy to work with multiple cryptocurrencies.

- There are auto conversion features for payments.

- There is e‑commerce API and plugin integration.

- There are simple fees.

- There is an easy to use merchant dashboard.

Cons:

- Coverage and liquidity are not the same for all coins.

- Higher exchange rates may need to be monitored.

- It is still a lesser known brand than most others.

- It takes some advanced coding knowledge to customize.

- Smaller tokens may have settlement delays.

5. AlfaCoins

AlfaCoins allows online stores to automatically convert and accept crypto payments to fiat or stable coins. It allows 20 plus cryptos and connects with major carts such as Woo Commerce and Magento. Along with MerchantHub’s crypto alternatives,

Crypto.com Pay and Paystand also assist merchants in payment diversification while controlling payment settlement risks. AlfaCoins helps to manage volatility by offering real time pricing, itemized invoices, settlement transparency, and no hidden fees.

It also offers multi currency and cross border options for flexible checkout for ecommerce. For crypto and volatility reduction option, Fraud detection and automated settlement options, AlfaCoins is a good option for retailers.

AlfaCoins — Key Features

| Feature | Explanation |

|---|---|

| 20+ Cryptocurrency Options | Supports many cryptocurrencies for broader customer choice. |

| Auto‑Settlement | Converts received crypto to fiat or stablecoin automatically. |

| E‑commerce Integration | Works with Magento, OpenCart, WooCommerce, etc. |

| Real‑Time Rates | Displays live crypto‑to‑fiat conversion rates. |

| Reporting Tools | Offers transaction histories and financial reports. |

AlfaCoins Pros & Cons

Pros:

- A range of over 20 cryptocurrencies are supported.

- Auto conversion to stablecoin or fiat currency.

- Integration for e‑commerce is included and simple.

- The pricing is in real time.

- There are tools for transaction history and reporting.

Cons:

- It can be a more complicated fee structure compared to others.

- There are fewer developer resources available.

- The pay out options for fiat currency depend on the region.

- Response times for support can be inconsistent.

- There are not many advanced analytics to work with.

6. Crypto.com Pay

Through the Crypto.com ecosystem, Crypto.com Pay is a merchant service that offers the option to accept crypto payments with cashback rewards. As a merchant, you can choose to settle in crypto or fiat, and the cashback rewards can boost loyalty and conversion.

GoCrypto and AlfaCoins, the best alternatives to MerchantHub, also offer crypto and fiat payments and have a better pricing model for online and in-person sales.

Crypto.com Pay offers automated, compliant, and secure payment processing that is easily integrated with e-commerce shops via plugins and APIs. The merchants can reach active crypto users because of the association with the Crypto.com app. The service also allows users to bridge digital and traditional financial services.

Crypto.com Pay — Key Features

| Feature | Explanation |

|---|---|

| Multi‑Asset Acceptance | Allows crypto payment via several supported tokens. |

| Cashback Rewards | Customers can earn rewards, boosting conversion. |

| Global Wallet Connectivity | Integrates with Crypto.com app users easily. |

| Fiat Payouts | Merchants can choose to receive fiat settlement. |

| E‑commerce Plugins | Built‑in support for platforms like Shopify. |

Crypto.com Pay Pros & Cons

Pros:

- It is integrated with a large ecosystem of cryptocurrencies.

- Customers are given cashback incentives.

- Ability to accept multiple coins.

- Designed for all businesses and use-cases.

- Quick settlements for merchants.

- Configuration of plugins is easy and takes no time at all.

- Available payout options include fiat.

Cons:

- Only available on the Crypto.com platform.

- Reducing merchant profits is a possibility due to cashback cost.

- Customers may see the need for a wallet as a hassle.

- The requirements for AML verification can be strict.

- Depending on the coin and region, fees may be higher.

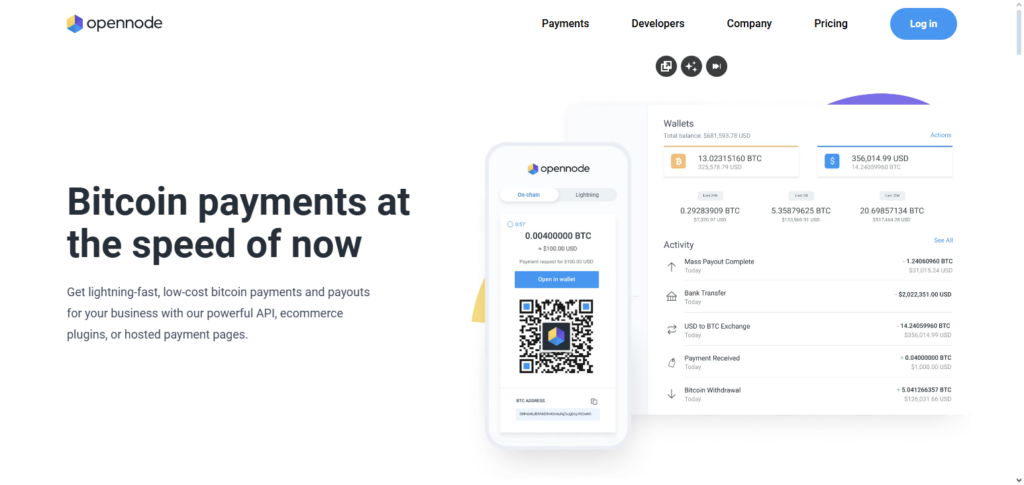

7. OpenNode

OpenNode is an expert in handling payments in Bitcoin with the ability to handle payments both on-chain and on the Lightning Network, allowing for instant transactions with minimal costs. Merchants are able to invoice clients in BTC and then settle in Bitcoin or fiat afterward, with developers able to use flexible API tools.

OpenNode’s focus on Lightning payments helps make it easier to almost eliminate fees for transactions, making it ideal for microtransactions make it attractive to digital services and tip services. OpenNode provides and complies with KYC/AML procedures, offering businesses looking for for fast, seamless Bitcoin transaction acceptance the ability to strike the right balance between user experience and performance.

OpenNode — Key Features

| Feature | Explanation |

|---|---|

| Bitcoin & Lightning Payments | Supports on‑chain Bitcoin and Lightning Network for fast payments. |

| Low Fees | Lightning Network enables near‑zero transaction costs. |

| Instant Settlement | Payments confirm quickly via Lightning. |

| Developer APIs | Comprehensive API suite for custom integrations. |

| Flexible Payouts | Settle in BTC or fiat based on business needs. |

OpenNode Pros & Cons

Pros:

- Accepts Bitcoin payments and supports the Lightning Network.

- Transaction fees are very low.

- Payments are settled almost instantly.

- Offers both on-chain and off-chain payments.

- Provides APIs for developers and has other integrations.

Cons:

- Supports Bitcoin only, and no altcoins.

- The liquidity of the Lightning Network can affect routing.

- Users must have an understanding of the Lightning Network and Bitcoin.

- Converting to fiat as a settlement may take a longer time than expected.

- Not a great choice for businesses that deal with many different currencies.

8. Strike

Strike is a Bitcoin Lightning Network payment app that allows for international money transfers for little to no fee. Customers can use or accept Bitcoin or a local currency. Users can send or accept money instantly. OpenNode and BTCPay are alternatives Strike’s MerchantHubs but Strike is lightning fast.

Merchants do not need to understand the complexities of settling an invoice at a blockchain. If a merchant is selling cross border or accepting remittance payments, they need Strike. Strike has a compliant, user friendly interface that allows merchants to accept payments via crypto

Strike — Key Features

| Feature | Explanation |

|---|---|

| Lightning Network Payments | Enables ultra‑fast and low‑cost Bitcoin transactions. |

| User‑Friendly App | Simple mobile app for sending and receiving payments. |

| Global Transfers | Works across countries without traditional banking fees. |

| Point‑of‑Sale Support | Can be used for retail and service payments. |

| Fiat & BTC Exchange | Converts between BTC and local currency. |

Strike Pros & Cons

Pros:

- Provides instant payments with almost no fees on the Lightning Network.

- User and merchant experience is very seamless.

- Users can send payments globally, without having to use a traditional bank.

- Offers an exchange to Bitcoin from fiat.

- Integrates very well with mobile wallets.

Cons:

- There are very few options for altcoins.

- The Lightning Network can become difficult to use due to low liquidity.

- Compared to other options, there are fewer plugins for e-commerce.

- The platform is mostly just an app.

- Some fiat may not be supported in certain markets.

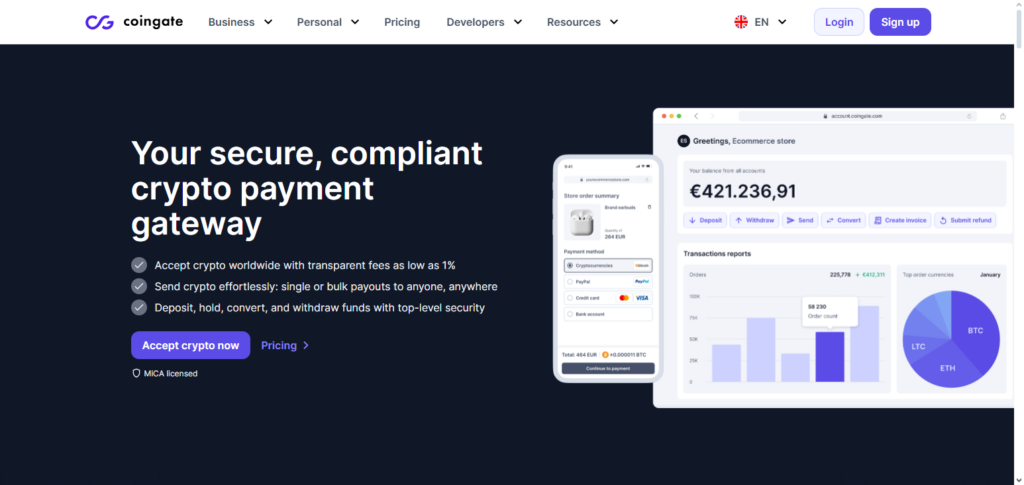

9. CoinGate

CoinGate is one of the oldest cryptocurrency payment processors, supporting over 70 cryptocurrencies and allowing merchants the ability to accept payments and settle in either crypto or fiat. CoinGate offers plug ins for major e commerce solutions, API, invoicing, and extensive reporting.

Among the best MerchantHub crypto alternatives, Crypto.com Pay and Plisio also support a wide range of assets and offer easy to use integration. CoinGate’s flexible settlement options reduce exposure to volatility and helps in accounting as settlement is in either crypto or fiat. Because CoinGate is also an exchange, merchants are able to efficiently utilize and manage their funds.

CoinGate has developed the strongest infrastructure of any crypto payment processor to support digital assets and offer transparency to their pricing. Along with available developer tools and infrastructure, CoinGate is the best option for any online business that requires a wide selection of crypto coins, a transparent pricing model with scalable payment options.

CoinGate — Key Features

| Feature | Explanation |

|---|---|

| 70+ Crypto Support | Accepts a very broad range of coins. |

| Automatic Fiat Settlement | Converts crypto sales into fiat for accounting ease. |

| E‑commerce Plugins | Plugins available for major platforms. |

| Merchant Dashboard | Detailed dashboard for sales, reports, and payouts. |

| Invoicing Tools | Built‑in invoice generator for businesses. |

CoinGate Pros & Cons

Pros:

- Supports over 70 cryptocurrencies.

- The option to automatically settle in fiat currency.

- Has e-commerce plugins and invoices.

- Merchant dashboard including reports.

- Established experience in crypto payments.

Cons:

- Fee structures can be expensive for small merchants.

- Advanced feature API can be complicated.

- Some areas might experience payout option limitations.

- Automated conversion setups are needed.

- It might be a lot for those just starting.

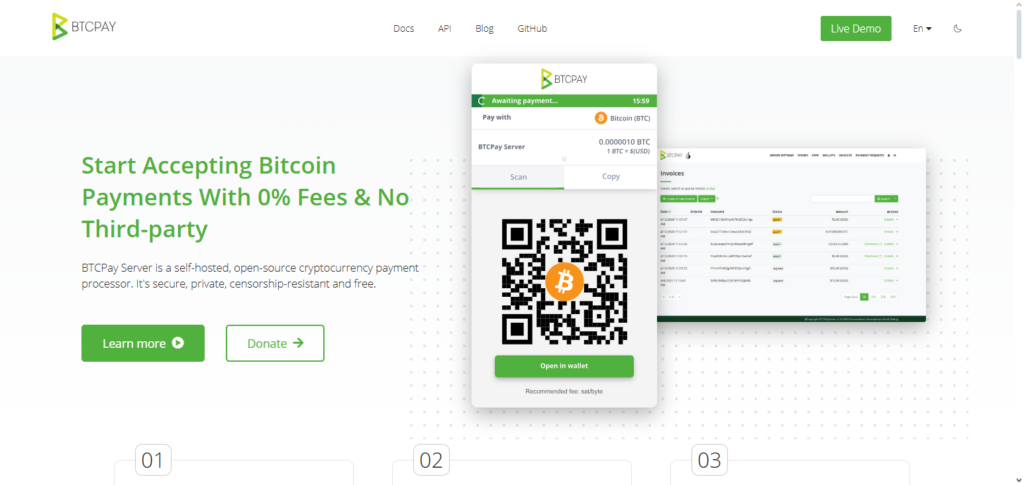

10. BTCPay Server

BTCPay Server is an open-source, self-hosted payment processor for Bitcoin, allowing BTCPay Server users to retain custody of their keys as well as their payment information. BTCPay has no intermediary fees for on-chain or Lightning Network payments, and offers features which many alternative solutions don’t offer.

Among the best MerchantHub crypto alternatives, BTCPay Server offers the most customization. BTCPay Server is a great option for merchants that place a high value on privacy as well as software developers that want bridging with e-commerce, POS, and so on.

Because BTCPay Server is self-hosted, there are no monthly subscription fees, allowing full control of security, settlement, and other system features. it offers a powerful option for those in business to deliver fully transparent and censorship resistant crypto payment infrastructures to their communities.

BTCPay Server — Key Features

| Feature | Explanation |

|---|---|

| Open‑Source & Free | Completely free, open‑source crypto payment server. |

| Self‑Hosted | Businesses host their own infrastructure for full control. |

| Privacy‑First | No third‑party data collection or custody. |

| Lightning Network Support | Enables rapid, low‑fee Bitcoin payments. |

| Custom Integrations | Developers can tailor workflows with APIs. |

BTCPay Server Pros & Cons

Pros:

- 100% free and open-source.

- Self-hosted with full control of your funds.

- Accommodates both Bitcoin on-chain and Lightning.

- No fees or custodial services from third parties.

- Excellent features for enhanced confidentiality and safety.

Cons:

- You are responsible for hosting and advanced setups.

- No established in-house customer support.

- Does not have the ability to convert cryptocurrencies to fiat automatically.

- Ongoing maintenance for plugins.

- Significant technical proficiency required.

Conclusion

In conclusion, the market for merchant cryptocurrency payment solutions is broad and quickly developing, giving companies a variety of safe and effective ways to take digital currencies. Paystand, GoCrypto, Blockonomics, Plisio, AlfaCoins, Crypto.com Pay, OpenNode, Strike, CoinGate, and BTCPay Server are just a few of the platforms that offer distinct benefits.

These range from seamless e-commerce integration and multi-cryptocurrency support to privacy-focused, self-hosted options and instant payments enabled by the Lightning Network. Your company’s goals will determine which MerchantHub cryptocurrency option is best for you.

These demands may include convenience of usage, global reach, cheap costs, or complete control over cash. Merchants may reliably accept cryptocurrency payments while maximizing cost, speed, and customer experience by investigating these options.

FAQ

What are MerchantHub crypto alternatives?

MerchantHub crypto alternatives are payment processing platforms that enable businesses to accept cryptocurrency payments without relying on MerchantHub. These alternatives support a range of digital assets, offer integration tools, and may provide features like instant settlement, invoicing, or self‑hosted infrastructure.

Why should a business consider MerchantHub crypto alternatives?

Businesses may seek alternatives to MerchantHub for lower fees, broader currency support, greater control over funds, decentralized processing, or enhanced privacy options. Different platforms offer unique strengths suited to varying merchant needs.

Which platforms are considered top alternatives to MerchantHub?

Some widely recognized alternatives include Paystand, GoCrypto, Blockonomics, Plisio, AlfaCoins, Crypto.com Pay, OpenNode, Strike, CoinGate, and BTCPay Server, each with distinct features tailored for different use cases.

Are these crypto payment alternatives easy to integrate?

Most alternatives provide plugins, APIs, and e‑commerce platform support (like WooCommerce, Shopify, Magento), making integration straightforward for online stores and POS systems.

Can I settle payments in fiat currency?

Yes. Many alternatives (such as CoinGate, AlfaCoins, and Crypto.com Pay) allow merchants to automatically convert received crypto into fiat, reducing volatility risks and simplifying accounting.