In this article I will discuss the Best PayFlex Crypto Alternatives: Flexible, safe and convenient payment solutions for daily expenses and cryptocurrency transactions.

Digital finance is on the rise. Search for alternatives to PayFlex. We will examine the platforms that offer buy-now, pay-later, and crypto solutions, and the ease of spending management.

Key Points & Best PayFlex Crypto Alternatives

| Alternative | Key Point |

|---|---|

| PayPal Payments | Global reach and crypto support |

| GoCardless | Recurring payments and bank debit |

| Sunbit | Retail BNPL with flexible installments |

| Sezzle | Interest-free installment plans |

| Klarna | Popular BNPL with shopping integration |

| Afterpay | Split payments over 6 weeks |

| Affirm | Transparent financing with no hidden fees |

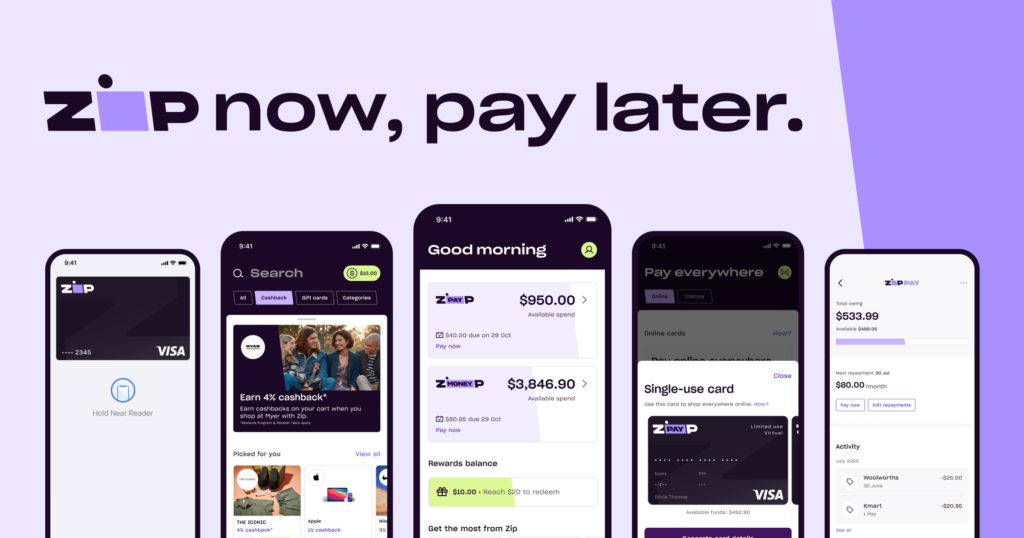

| Zip (Quadpay) | Flexible pay-in-4 model |

| Skrill | Digital wallet with crypto transactions |

| Stripe | Developer-friendly payments and crypto integration |

10 Best PayFlex Crypto Alternatives

1. PayPal Payments

Paypal Payments is the freighted standard for PayFlex crypto alternatives because of how it integrates multi crypto functionality with traditional digital payments like no other.

While PayFlex is PayPal lets you buy, sell, and hold crypto on a reputable and trusted platform. Their instant transfers and interface make crypto accessible for all. In addition

Paypal’s global presence and compatibility with millions of merchants make their offering unique. They provide the ability to spend and trade crypto on a single trusted platform.

Features PayPal Payments

Multi-Currency Support – You can make payments and send money around the world in various currencies and cryptocurrencies.

Instant Transfers – Payments can be moved almost instantly.

Buyer and Seller Protection – Users of PayPal Payment have a reliable system in place to help protect them from issues that can occur in a payment dispute.

Wider Acceptance – PayPal has partnerships with many stores that allows them to pay with crypto or fiat currency

| Pros | Cons |

|---|---|

| Widely trusted and globally recognized platform | Higher fees for some crypto transactions |

| Supports multiple cryptocurrencies | Limited control over blockchain-based transactions |

| Instant transfers and easy-to-use interface | Some countries have restrictions on crypto usage |

| Secure and buyer-protected environment | Not fully decentralized |

2. GoCardless

GoCardless has built a reputation as one of the best PayFlex crypto alternatives because it specializes in automated recurring payments and direct debit solutions.

GoCardless is optimized for businesses that need to manage subscriptions and/or make crypto payments on a regular basis.

GoCardless is not like PayFlex because it makes payment collection automated and much cheaper than the manual payment collection process.

GoCardless is reliable as it makes payments on time and processes payments in a compliant manner. This makes GoCardless a safe, efficient, and user friendly substitute for PayFlex crypto and other regular payments for businesses.

Features GoCardless

Direct Debit – GoCardless is able to set up automatic payment for subscriptions and services so that payments can be paid with ease and convenience.

Low Transaction Fees – Payments made through GoCardless have a small fee to reduce the cut that businesses have to pay to other service providers.

Cross-Border Payments – GoCardless allows payments to be transferred internationally.

Automated Payment – GoCardless automatically collect payments so that customers do not have to do it manually

| Pros | Cons |

|---|---|

| Excellent for recurring payments and subscriptions | Limited crypto-specific features |

| Low transaction fees for direct debits | Not widely used for instant purchases |

| Cross-border payment support | Focused more on businesses than individual users |

| Automated payment collection | Less suited for casual crypto buyers |

3. Sunbit

Sunbit shines as a terrific alternative to PayFlex crypto as it provides flexible point of sale financing for everyday purchases as a alternative to traditional payments and crypto.

Sunbit is not like PayFlex because it offers instant approval of consumer credit and easier payment plans so consumers can use and spend digital assets on a more responsible level.

Sunbit is able to provide a truly one of a kind alternative to those looking for a more personable option to PayFlex.

Sunbit is able to provide both merchants and customers a level of seamless and secure transaction that is truly one of a kind.

Features Sunbit

Flexible Instalm – Sunbit allows customers to set a payment plan that allows them to pay for a purchase over a few months with small payments.

Point of Sale – Sunbit allows customers to purchase an item quickly by integrating their payment system with the item that is being bought.

User-Friendly – Sunbit streamlined the process so that it is easy to use for small startups and small businesses.

Responsible Payment – Sunbit allows customers to pay for an item in a structured plan that encourages budgeting

| Pros | Cons |

|---|---|

| Flexible point-of-sale financing | Limited crypto asset support |

| Instant credit approvals | Mainly focused on merchant financing, not crypto trading |

| Easy installment plans for purchases | Not globally available |

| Practical for everyday transactions | Less mainstream awareness compared to others |

4. Sezzle

Sezzle is one of the best alternatives to PayFlex as it user the buy-now-pay-later model and easy crypto accessibility to broaden the scope of digital purchases.

Sezzle differs from PayFlex because it lets customers split purchases into multiple transaction via intersest free installments.

This makes the transaction more financially easy to sustain as customers leaves financially stress free.

This is very useful to younger and more tech-savvy consumers as they can use the flexible schedules to control their spending while not losing access to digital assets.

With easy approval the frequency of use to merchants is broad. This makes it a smater more secure option for customers wanting financial freedom.

Features Sezzle

Buy Now, Pay Later – Treasury charges are split coupons to lessen the financal burden.

Instant Approval – Easy, quick approval of credits.

Budget-Friendly – Empowers users to limit control of their spending while shopping online.

Tech-Savvy Focus – Offered digital purchasces and retail crypto-relate services, standing tech-savvy consumers.

| Pros | Cons |

|---|---|

| Interest-free installment payments | Requires credit check for approval |

| Ideal for younger, tech-savvy users | Limited global merchant acceptance |

| Encourages responsible spending | Not suitable for large crypto investments |

| User-friendly digital platform | Mainly focused on retail payments |

5. Klarna

Klarna is one of the best PayFlex crypto alternatives because of its buy now, pay later, and crypto service integration.

Klarna touts greater versatility in repayment than PayFlex competitors. It manages to touch all user experience pillars, including seamless integration, flexible payments, and merchant partnerships, easing their ability to service the customer.

Klarna’s strength is in the ability to let users manage their spending, and empowerment in crypto. It is easy to recommend Klarna to anyone seeking a flexible, user-friendly PayFlex alternative.

Features Klarna

Flexible Payment Options – Pay in installments, after a period, or immediately.

Global Merchant Network – Accepted in many physical and online stores.

User-Friendly App – Facilitates easy spending and payment tracking.

Budget Management Tools – Keeps track of your spending to help make large purchases more manageable.

| Pros | Cons |

|---|---|

| Flexible buy-now-pay-later options | Late fees can apply |

| Smooth, easy-to-use app | Not all merchants support crypto |

| Globally recognized for retail | Limited direct crypto trading features |

| Helps manage spending efficiently | Not designed for large-scale investments |

6. Afterpay

Afterpay’s first as PayFlex’s crypto alternative, as they offer interest-free split payment solutions making it easier to buy just about anything crypto related.

Afterpay focuses on speed and simplicity, as they offer instant transaction approvals and the ability to pay over time.

Financial great responsibility, Afterpay’s advantage is the merchant acceptance and they offer a seamless online experience.

Flexibility, reliability and overall great function as a payment method makes Afterpay the first choice to a crypto spaced Payflex.

Features Afterpay

Buy Now, Pay Later – Spreads payments out in 4 installments, without any interest.

Quick Sign-Up & Approval – Instant eligibility checks improve efficiency.

Retail-Focused – Partnered with various online and offline shops, making payments simpler.

Spending Discipline – Responsible payment to self is encouraged, instilling timely payments.

| Pros | Cons |

|---|---|

| Interest-free installment payments | Payments must be timely to avoid fees |

| Simple and fast approval process | Limited crypto-related features |

| Widely accepted by merchants | Focused mostly on consumer retail |

| Promotes responsible spending | Not ideal for complex crypto transactions |

7. Affirm

What makes Affirm a leading PayFlex crypto alternative is its ability to provide clear, flexible funding options for everyday spendings and additional cryptocurrency transactions.

Unlike PayFlex, Affirm’s terms are clear and straightforward with no hidden fees, making it evdident how much to pay each month to eliminate uncertainty in variable payments.

What stand out about Affirm is its ability to combine trust with simplicity for more accessibilty to the responsible use of digital asset markets.

Affirm’s widespread partnerships in addition to a easy to use interface make budgeting more efficicent while exploring crypto, making Affirm a solid alternative to PayFlex.

Features Affirm

Transparent Financing – Easy to understand. No unexpected costs, no surprises.

Flexible Repayment Plans – Weekly, bi-weekly, or monthly repayments are all available.3. Broad Merchant Integration – Many online merchants around the world recognize this.

| Pros | Cons |

|---|---|

| Transparent financing with no hidden fees | High APR for some users |

| Flexible payment plans | Limited crypto support compared to digital wallets |

| Broad merchant acceptance | Not instant for crypto trading |

| Reliable and user-friendly | Primarily for retail purchases |

8. Zip (Quadpay)

From October 2023, Zip (previously Quadpay) became a wonderful alternative to PayFlex crypto, where the user has the ability to split purchases into 4 installments that are interest free, making spending crypto much easier.

Zip was, unlike PayFlex, offering instant approvals, a simple yet versatile mobile app, and broad merchant compatibility to keep purchases within a user’s desired financial comfort zone.

The most important peculiarities where the user experience to budget their money and the service speed. Therefore, Zip became the most apt alternative to PayFlex modernistically.

Features Zip (Quadpay)

Four Interest-Free Payments – Pay in four interest-free payments.

Instant Approval – Quickly and easily approved for credit.

Mobile-Friendly – Payments and app functionalities are easy and intuitive.

Wide Acceptance – Accepted at many shops and ecommerce sites.

| Pros | Cons |

|---|---|

| Split payments into four interest-free installments | Late fees if payments missed |

| Instant approvals and mobile app convenience | Limited global presence |

| Easy budgeting for purchases | Not designed specifically for crypto investments |

| Widely accepted by merchants | Focused mainly on retail payments |

9. Skrill

Skrill stands out as a major competitor and alternative to PayFlex because of the flexibility offered by their digital wallet, which permits a mix of traditional and crypto payments.

Unlike PayFlex, Skrill users can make instant deposits, withdrawals, and cross-border transfers, which increases its attractiveness to users around the globe.

The company’s one-of-a-kind offering of low-cost payments and the ability to transact with a variety of cryptocurrencies sets the company apart from their competitors.

There is a strong demand for digital asset management, and Skrill offers that possibility to users with their digital wallet and asset management products.

Along with rest of the market, crypto users are looking for a digital wallet alternative to PayFlex, and Skrill provides that.

Features Skrill

Crypto and Fiat Support – Send and receive tradiditional and digital currencies.

Fast Cross-Border Transfers – Pay internationally at low cost and quickly.

Secure Digital Wallet – Industry-leading security and 2FA.

Merchant and Personal Payments – Used for online shopping and sending money.

| Pros | Cons |

|---|---|

| Supports both crypto and fiat payments | Higher fees for certain transactions |

| Instant transfers and cross-border payments | Some features restricted in certain regions |

| Secure digital wallet with fraud protection | Interface may be confusing for beginners |

| Access to multiple cryptocurrencies | Limited merchant integration compared to PayPal |

10. Stripe

Stripe is one of the best PayFlex competitors because of its highly developer-friendly payment service, which offers traditional payment processing services and crypto integrations.

PayFlex’s competitors cannot match the scalability of the Stripe platform. Businesses of all sizes can accept payments from anywhere in the world with Stripe’s API and increased security measures.

Its valuable combination of flexibility, advanced payment processing, and detailed analytical tools allow users and merchants to actively manage their digital assets.

These unique qualities make stripe one of the most reliable and versatile modern payment options in the market, especially when it is compared to PayFlex.

Features Stripe

Developer-Friendly APIs – Simplifies the online payment process for users.

Crypto and Traditional Payment Support – Process payments in both crypto and fiat.

Scalable Platform – Designed for small and mid-market companies and large companies.

Advanced Analytics & Reporting – Helps companies manage their budgets more effectively.

| Pros | Cons |

|---|---|

| Developer-friendly with powerful APIs | Not a traditional wallet for casual users |

| Supports global payments and crypto integrations | Requires technical knowledge to maximize features |

| Scalable for businesses of all sizes | Less focused on individual consumer financing |

| Advanced analytics and instant processing | No interest-free installment options |

How To Choose Best PayFlex Crypto Alternatives

Security and Trust. Security means fraud protection and the ability to transact safely.

Flexibility in Payment. Does the platform have options like installment plans, buy now, pay later, or crypto?

Costs. What are the transaction, withdrawal, and any potential hidden fees?

Global and Merchant Acceptance. Is it commonly accepted for both online and offline payments?

Experience. Transactions are smoother with easy-to-use apps or platforms.

Integration. Does the platform allow for the buying, selling, or holding of cryptocurrencies?

Promptness of Support. Good support means they have a system to get you issues solved quickly.

Conclusion

To sum up, PayFlex’s Best Crypto Alternatives have flexibility, safety, and convenience when it comes to payments and crypto transactions.

PayPal, Klarna, Sezzle, and Skrill have user-friendliness, global availability, and creativity. Selecting an alternative gives better control over finances, allows for easier transactions, and better control over digital assets.

FAQ

What are the best alternatives to PayFlex for crypto payments?

Platforms like PayPal, Skrill, Stripe, Klarna, Sezzle, Afterpay, Affirm, Zip (Quadpay), Sunbit, and GoCardless are top alternatives.

Can I buy and sell cryptocurrencies with these alternatives?

Yes, platforms like PayPal and Skrill allow buying, selling, and holding cryptocurrencies directly.

Which alternative is best for installment payments?

Klarna, Afterpay, Sezzle, Affirm, and Zip are ideal for buy-now-pay-later or split-payment options.

Are these alternatives secure for online transactions?

Yes, all listed platforms offer strong security features and fraud protection for safe payments.

Can I use these alternatives globally?

Most, like PayPal, Stripe, and Skrill, support international transactions, while some are region-specific.