I’ll talk about Australia’s Top Capital Protection Investment Options in this post. Selecting the appropriate capital-protected investments is essential for investors looking for security and steady returns.

Australia has a number of ways to protect money, control risk, and assure long-term financial security while retaining modest growth potential, from Treasury Indexed Bonds and high-interest savings accounts to conservative superannuation plans and capital guaranteed bonds.

Why It Is Capital Protection Investment Options in Australia Matter

Keep Your Principal Capital Intact: No matter what the market is doing, we protect the investment by keeping in intact, which is probably the most important aspect for all capital protection investment options. No market drop will affect the amount of principal you worked hard for. Having market volatility protection will really matter for retirees and all the risk adverse investors in the market.

Steady Returns: Capital protection investment include, reserve downturn options super, term deposit, and treasury indexed bonds. It will impact the rate of return in a positive way, and it will make a financial planner’s job a little easier for some short and medium future goals.

Less Risk on the Investment: Investors will have less risk on the account by having protective of volatility, remove having the overall protective of risk.

Financial Security for the Future: Capital investment protection is a financial backup plan, resulting in positive savings that will have to grow unnecessarily.

Add to Other Investment Strategies: It will act as a protective barrier and stabilizing the overall portfolio, thus the investors will able to freely take measured risks in other place.

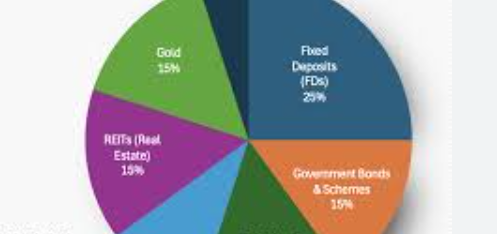

Key Point & Best Capital Protection Investment Options in Australia List

| Investment Option | Key Point |

|---|---|

| Treasury Indexed Bonds (TIBs) | Government-backed bonds that protect capital and returns against inflation through CPI indexation. |

| High-Interest Savings Accounts (APRA-regulated banks) | Low-risk savings with government deposit protection (up to AUD 250,000 per institution). |

| Term Deposits | Fixed interest returns over a set period, offering capital stability and predictable income. |

| Superannuation Conservative Options | Low-volatility super funds focused on capital preservation and steady long-term growth. |

| Capital Guaranteed Investment Bonds | Structured products providing principal protection with modest investment growth potential. |

| Capital Protected Structured Products | Offer downside protection while allowing limited exposure to market-linked returns. |

| Diversified ASX Blue-Chip Dividend Stocks | Established companies providing reliable dividends and long-term capital growth. |

| Australian Real Estate Investment Trusts (A-REITs) | Income-focused property investments offering regular distributions and diversification. |

| Insurance (Life, Health, Income Protection) | Financial risk management tools that protect income, assets, and family security. |

| Infrastructure Funds (Australian & Global) | Long-term investments in essential assets delivering stable cash flows and inflation resilience. |

1. Treasury Indexed Bonds (TIBs)

Treasury Indexed Bonds (TIBs) are Australian Government securities designed to protect investors from inflation while preserving capital. The bond’s principal value and interest payments are indexed to the Consumer Price Index (CPI), preserving real purchasing power over time.

Backed by the Australian Government, TIBs are at a low risk of default and are therefore good investments for conservative investors.

When considering long-term portfolio planning, Best Capital Protection Investment Options in Australia includes TIBs as a must due to inflation being a hedge problem. TIBs are perfect for retirees or risk-averse investors looking for steady returns with capital security.

Treasury Indexed Bonds (TIBs) Features

- Government-Backed Security: Investments are issued by the government, and therefore, it is a guarantee that the government is backing every investment, which makes the default risk very low.

- Inflation Protection: TIBs value increase with inflation, so your investment will never fall victim to the inflationary consumer price index (CPI).

- Fixed Interest Payments: TIBs pay interest rates about every 6 months.

- Long-Term Investment: Bonds are TIB are usually held for many years (7 and up) to secure the protection of your capital while also receiving inflation-linked growth.

- Low Volatility: Bonds are less exposed to the market, which makes them a perfect investment for conservative investors.

Treasury Indexed Bonds (TIBs) Pros & Cons

| Pros | Cons |

|---|---|

| Protects capital with government backing | Long-term investment may reduce liquidity |

| Inflation protection through CPI indexing | Moderate returns compared to equities |

| Predictable interest income | Interest rate changes may affect resale value |

| Very low default risk | Not suitable for short-term goals |

| Suitable for conservative investors | Limited capital growth potential |

2. High‑Interest Savings Accounts (APRA‑regulated banks)

Of all the banks in Australia, APRA-regulated banks offer high-interest savings accounts, providing one of the safest places to keep money. Through the Financial Claims Scheme, such accounts secure your savings to the amount of AUD 250,000 per bank. Investors experience high liquidity, low to zero market risks, and attractive interest rates when compared to regular savings accounts.

For short-term objectives and emergency funds, Best Capital Protection Investment Options in Australia often recommend these accounts as a staple. Though returns might be lower than inflation, the accessibility, certainty, and government endorsements make these accounts the best for investors whose primary focus is safety.

High Interest Savings Accounts (APRA-regulated banks) Features

- Deposit Safety: Financial deposits with APRA which are monitored and regulated. Financial deposits up to AUD 250,000 are also covered under the Financial Claims Scheme.

- Liquidity: You can access your funds anytime with no penalties.

- Interest Income: You will earn interest that is higher than the average interest earned when funds are held in a regular savings account.

- Low Risk: There is no market or investment risk (in about 99.99999999% of cases).

- Simple Management: There aren’t many obstacles to open access to finances, and that is also the case with investment funds.

High‑Interest Savings Accounts (APRA-regulated banks) Pros & Cons

| Pros | Cons |

|---|---|

| Government-protected deposits up to AUD 250,000 | Returns may not beat inflation |

| High liquidity and easy access | Interest rates may fluctuate |

| No market risk | Limited long-term growth |

| Simple to manage | Minimum balance requirements may apply |

| Ideal for emergency funds | Interest is taxable as income |

3. Term Deposits

Term deposits enable investors to keep a fixed interest rate for a stipulated amount of time, which may range anywhere from a couple of months to multiple years. These are provided by banks and financial institutions, allowing them to offer secure revenue and protection from volatility and fluctuations in the market.

Capital is completely reimbursed upon maturity, as long as the institution is solvent. Within conservative portfolios, Best Capital Protection Investment Options in Australia often incorporates term deposits because of the protection, simplicity, and peace of mind they provide (in a volatile market). Although returns may lag inflation and earlier withdrawals may incur penalties, terms deposits are still highly suitable for investors willing to take limited risks, as they will guarantee the returns.

Term Deposits Features

- Fixed Interest Rate: There is a predictable interest rate that is locked in for the specified term.

- Capital Guarantee: As long as your capital is held until maturity, it is guaranteed that your principal will be secured with no risk.

- Flexible Terms: Can be short-term (months) or long-term (years).

- APRA Protection: Each institution protects your deposits up to AUD 250,000.

- Low Risk: No exposure to market fluctuations, ideal for cautious investors.

Term Deposits Pros & Cons

| Pros | Cons |

|---|---|

| Principal guaranteed | Early withdrawal penalties apply |

| Fixed, predictable returns | Returns may lag inflation |

| Flexible terms from months to years | Limited growth potential |

| APRA protection up to AUD 250,000 | Not suitable for emergency funds |

| Low risk and stable | Interest is taxable |

4. Superannuation Conservative Options

Conservative superannuation options concentrate on safeguarding your money while providing minimal growth from defensive assets such as cash, bonds, and fixed-interest securities. These options tend to allocate a smaller portion to equities, which, in turn, allevi overall market exposure risk.

These options are generally ideal for retirees or those approaching retirement as they help shield and preserve your savings. Within retirement planning, conservative super funds are often used as a benchmark and reference for their low volatility in the market, as documented in Best Capital Protection Investment Options in Australia.

While these options surely do not match growth funds in terms of overall growth, they do offer a potential long-term growth guarantee, and during times of volatility, they are a stable option to preserve funds and provide income reliability.

Superannuation Conservative Options

- Low-Risk Asset Allocation: Invests mainly in cash, bonds, and other low-risk assets.

- Capital Preservation Focus: Extreme volatility protection and retirement savings.

- Tax Advantages: Contributions and earnings receive more favorable tax treatment.

- Long-Term Growth: Returns, although slow, are reliable; can be used for retirement.

- Professional Management: Super fund specialists conservatively manage for you.

Superannuation Conservative Options Pros & Cons

| Pros | Cons |

|---|---|

| Focused on capital preservation | Lower long-term growth than growth super funds |

| Reduced market volatility | Access restricted until retirement |

| Tax-efficient for retirement savings | Returns affected by fund fees |

| Regular compounding of returns | Inflation may reduce real value |

| Professionally managed | Slight exposure to market downturns |

5. Capital Guaranteed Investment Bonds

Capital guaranteed investment bonds are a long-term investment option in which the original capital is guaranteed to be returned at the end of the bond, or in other words, at maturity. These bonds are generally offered by insurance companies and usually provide investment exposure to conservative and balanced portfolios.

They can be attractive for certain estate planning as tax obligations may be paid at the bond issuer’s end.

These bonds are relatively in the limelight when assessing Best Capital Protection Investment Options in Australia as they do provide a level of security and low upside growth for moderate to conservative investors. Although they do come with longer investment terms and capped returns, the guarantee offered by the bonds tends to appeal to investors with a low risk appetite.

Capital Guaranteed Investment Bonds Features

- Principal Protection: Guarantees capital will be fully refunded once the bond matures.

- Insurance-Backed: Bonds are most often issued by insured entities and are guaranteed.

- Moderate Growth: Tied to conservative portfolio returns or fixed interest.

- Tax Efficiency: Even if earnings are taxed, the investor tax burden could be less.

- Long-Term Investment: To realize all advantages, the bond will be held for many years.

Capital Guaranteed Investment Bonds Pros & Cons

| Pros | Cons |

|---|---|

| Principal guaranteed at maturity | Long-term lock-in period |

| Predictable returns | Moderate returns |

| Issuer-backed (insurance companies) | Limited flexibility |

| Tax-efficient in some cases | Early redemption penalties may apply |

| Suitable for conservative investors | Not fully inflation-protected |

6. Capital Protected Structured Products

Capital protected structured products join fixed income financial instruments with derivatives to provide protection on the downside while allowing some participation on the upside, in case markets go up.

Such instruments are linked to stock prices, indices, or other asset collections. Investors get thier initial investment back at the end of the investment period, as long as the issuer is solvent. In sophisticated portfolios, Best Capital Protection Investment Options in Australia normally have these structured products for diversification.

However, these products can have the downsides of complexity, opportunity costs, and capped returns ranging from the small to the moderate sized. They are fit for sophisticated investors who are seeking for some custom exposure to risk moderated upside and downside linked profiles.

Capital Protected Structured Products Features

- Principal Protection: You can expect your capital to be returned, provided you hold till maturity and the issuer is solvent.

- Market-Linked Upside: You get to partake in the equity or index performance, albeit partially.

- Diversification: Risk-managed exposure to several assets.

- Customizable: Structured around particular risk-return characteristics.

- Medium to Long-Term: Obligatory commitment to achieve guaranteed protection is required.

Capital Protected Structured Products Pros & Cons

| Pros | Cons |

|---|---|

| Protects principal if held to maturity | Complex structure |

| Provides partial participation in market gains | Capped upside returns |

| Diversification benefits | Dependent on issuer solvency |

| Can be customized to risk preference | Limited liquidity |

| Useful in risk-managed portfolios | Fees may reduce net returns |

7. Diversified ASX Blue‑Chip Dividend Stocks

Diversified ASX Blue-Chip Dividend Stocks are part of the ASX and represent the largest companies in Australia with good financial health and good historical dividends. While the entire stock market is subject to some risk, blue-chip stocks are regarded as being at the more secure end of the spectrum, and less risky, especially in economic downturns.

In the medium to long run, some stock market price volatility is normal and can even be positive, but to grow and to protect the investment from inflation, dividend income is positive. In risk balanced portfolios, Best Capital Protection Investment Options in Australia at times have blue-chip stocks in them.

However, stock prices are not guaranteed and can fall in value. Portfolios in which dividends are reinvested, and which maintain a good diversification in other asset classes, benefit the investors the most in the long run.

Diversified ASX Blue-Chip Dividend Stocks Features

- Established Companies: Invests in big Australian stocks that are large-cap and financially sound.

- Dividend Income: Cash inflow on a consistent basis.

- Moderate Volatility: Less risk compared to the smaller and growth-oriented stocks.

- Capital Growth Potential: Long-term growth and income is offered.

- Diversification Benefits: Spreads risk across several sectors and firms.

Diversified ASX Blue‑Chip Dividend Stocks Pros & Cons

| Pros | Cons |

|---|---|

| Regular dividend income | Not capital guaranteed |

| Potential long-term capital growth | Market volatility risk |

| Moderate volatility compared to smaller stocks | Dividends not guaranteed |

| Diversification across sectors | Requires active monitoring |

| Suitable for long-term wealth accumulation | Exposure to sector-specific risks |

8. Australian Real Estate Investment Trusts (A‑REITs)

Investors are able to invest in A-REITs and own commercial properties, such as office buildings, shopping malls, and warehouses, without direct purchasing. A-REITs provide income liquidity through rental income and from the sale of A-REIT stocks on the stock exchange.

A-REITs are probably one of the Best Capital Protection Investment Options in Australia as they are income producing and are backed by real assets. However, A-REIT values are sensitive to changes in interest rates and the real estate market. High-quality A-REITs are relatively stable and, while they are not without risk, they are able to provide the investor with income and capital preservation over the longer term.

Australian Real Estate Investment Trusts (A-REITs) Features

- Property Exposure: Invests in advertising, residential and industrial estates.

- Income Focused: Produces consistent income from rentals.

- Liquidity: More accessible than owning direct property.

- Diversification: Excess property exposure with no direct ownership.

- Inflation Hedge: Property rents and values often rise with inflation.

Australian Real Estate Investment Trusts (A-REITs) Pros & Cons

| Pros | Cons |

|---|---|

| Regular income distributions | Not fully capital-protected |

| Access to real estate without direct ownership | Sensitive to interest rate changes |

| Diversification across property assets | Market value fluctuations |

| Traded on ASX, providing liquidity | Management fees reduce returns |

| Inflation-linked income potential | Performance affected by economic cycles |

9. Insurance (Life, Health, Income Protection)

The purpose of insurance is not to earn money, however, it is very important in money wealth and income. Life, Health, and Income Protection Insurance ensure the individual and family do not receive a financial shock due to illness, injury, or death. Protection insurance also is the first step in the risk assessment/defensive strategy in money and wealth Protection.

As a financial strategy, Best Capital Protection Investment Options in Australia will in the outcome document insurance. Income protection insurance is a financial safety net as it protects income, and prevents the need to sell investments and clear out savings. It covers financial emergencies and protects the future income and earnings.

Insurance (Life, Health, Income Protection) Features

- Wealth Protection: Events mitigated – loses unexpected such as capital and savings.

- Income Replacement: Supports expenses during illness or injury.

- Family Security: Financial protection to dependent members in the policyholder’s demise.

- Risk Transfer: Moves financial risk to the insurer.

Insurance (Life, Health, Income Protection) Pros & Cons

| Pros | Cons |

|---|---|

| Protects wealth and savings | Premiums are ongoing expenses |

| Replaces income in case of illness or injury | Does not generate investment returns |

| Financial security for family | Policies may have exclusions |

| Transfers risk to insurer | Coverage terms can be complex |

| Supports long-term capital preservation | Benefits only paid on claim |

10. Infrastructure Funds (Australian & Global)

Infrastructure funds are investments in critical, long lasting, and value retaining assets such as toll roads, airports, and utilities, and renewable energy projects.

Such assets are generally backed by long-term contracts and produce stable, inflation-linked streams of cash flow. Infrastructure funds, Australian and global, provide diversification and defensive characteristics during an economic contraction.

Given the long term nature of infrastructure investment and income streams, Best Capital Protection Investment Options in Australia Including infrastructure as the investment type is common.

While infrastructure investments are not completely shielded from market risks, the less volatility is common in comparison to equities and is a better fit for an investor demanding income certainty along with some degree of inflation protection.

Infrastructure Funds (Australia & Global) Features

- Stable Cash Flows: Holds stakes in critical infrastructure with steady cash flows.

- Inflation-Protected Assets: Some assets feature revenues that adjust with inflation, preserving capital value.

- Diversification: Includes exposure to real, physical, long-term assets, unlike equities.

- Patient Growth: Appropriate for long-term investors looking for consistent growth.

- Expertise: Performance and risk mitigation are maximized by professionals.

Infrastructure Funds (Australian & Global) Pros & Cons

| Pros | Cons |

|---|---|

| Stable, predictable cash flows | Not fully capital-guaranteed |

| Inflation-linked returns in some assets | Some market and regulatory risks |

| Diversification beyond equities | Limited liquidity for unlisted funds |

| Long-term growth potential | Fund management fees |

| Managed by professional fund managers | Requires long-term investment horizon |

Conclusion

Having safe and secure investments and generating income in the long run are priorities for a risk-averse investor\, and for them\, the best capital assured investments in Australia are Treasury Indexed Bonds, high-interest savings accounts, term deposits, conservative superannuation funds, etc. These options are also safe as they are backed by the government and other regulated institutions.

On the other hand, capital protected bonds, infrastructure funds, and high-quality A-REITs are a middle ground between long term protection and small growth. These investments, when combined with the right insurance, minimize risk, inflation, and overall market wealth protection. A thoughtful approach to diversification and the risks involved are crucial to achieving long term financial objectives and maintaining capital.

FAQ

What are capital protection investment options?

Capital protection investment options are financial products designed to preserve the original investment while providing modest returns. They are ideal for risk-averse investors or those nearing retirement who want to safeguard their savings from market volatility.

Which are the safest capital protection investments in Australia?

Some of the safest options include Treasury Indexed Bonds (TIBs), high-interest savings accounts (APRA-regulated), term deposits, and conservative superannuation options. These are typically backed by the government or regulated institutions.

Can I earn returns while preserving my capital?

Yes. Investments such as capital guaranteed bonds, capital protected structured products, and infrastructure funds provide limited growth potential while protecting your principal.

Are blue-chip dividend stocks considered capital-protected?

Not fully. While diversified ASX blue-chip dividend stocks offer income stability and some downside resilience, they carry market risk and are not guaranteed.

How do insurance products fit into capital protection?

Insurance like life, health, and income protection doesn’t grow capital but protects your wealth and income. They prevent forced liquidation of investments during emergencies, complementing capital-protected strategies.