In this article today, we are going to discuss some of the Best Australia-focused or catered Multi-Asset Portfolios concerning some of the conservative to some of the highest grow as you will.

These portfolios are mixed with stocks, bonds, real estate, and other alternative investments which are to minimize the risks and maximize the returns.

By looking into this, you are going to be able to make the right choices and grow as well as protect your money in the land down under.

Key Points & Best Australia-Focused Multi-Asset Portfolios

| Portfolio | Key Point |

|---|---|

| Affluence Investment Fund (AIF) | Diversified across 20–35 managers, aims for above-average returns with low volatility |

| Contrarius Global Balanced Fund | Contrarian, valuation-based strategy with flexible multi-asset allocation |

| Lonsec Defensive Portfolio | Focuses on capital preservation with conservative asset mix |

| Lonsec Conservative Portfolio | Balanced risk-return, suitable for cautious investors |

| Lonsec Balanced Portfolio | Mix of growth and defensive assets for moderate risk |

| Lonsec Growth Portfolio | Higher equity exposure, designed for long-term capital growth |

| Lonsec High Growth Portfolio | Aggressive growth strategy with strong equity weighting |

| Platinum International Fund | Global equities with hedging strategies, complements Australian exposure |

| Vanguard Diversified Growth Fund | Low-cost index-based multi-asset portfolio with global diversification |

| Perpetual Diversified Real Return Fund | Targets inflation-plus returns using flexible asset allocation |

10 Best Australia-Focused Multi-Asset Portfolios

1. Affluence Investment Fund (AIF)

Affluence Investment Fund is an Australian multi-asset fund with a goal of delivering moderate risk adjusted returns. The Fund looks to invest in equities, fixed income and alternative assets in Australia and globally.

Emphasis is on capital preservation and diversification of assets for those investors looking for income and growth.

The AIF utilizes a rules based disciplined investment approach based on high conviction ideas with risk management to mitigate drawdowns during risk off environments.

Performance is the result of astute high level macroeconomic analysis combined with detailed individual security analysis to find the best opportunities fitting the funds objectives. This makes the fund a good choice for conservative to moderately risk tolerant investors.

Features Affluence Investment Fund (AIF)

Active Management: Applies a high-conviction and research-intensive investment strategy across multiple asset classes.

Diversification: Has a global reach with investments in Australian equities and fixed income as well as alternative asset classes.

Focus on Risk: Focuses on protecting capital and trying to reduce the risks associated with downturns in the market.

Target Customers: Meets the needs of conservative and balanced investors who are looking for growth opportunities with income on a steady basis.

| Pros | Cons |

|---|---|

| Actively managed with high-conviction investment strategy. | Higher management fees than passive funds. |

| Diversified across equities, fixed income, and alternatives. | May underperform in strong bull markets favoring equities. |

| Focus on capital preservation and risk management. | Limited liquidity compared to some ETFs. |

| Suitable for conservative to moderate investors. | Returns may be modest in low-volatility periods. |

| Professional management using top-down and bottom-up analysis. | Reliance on manager skill can impact performance. |

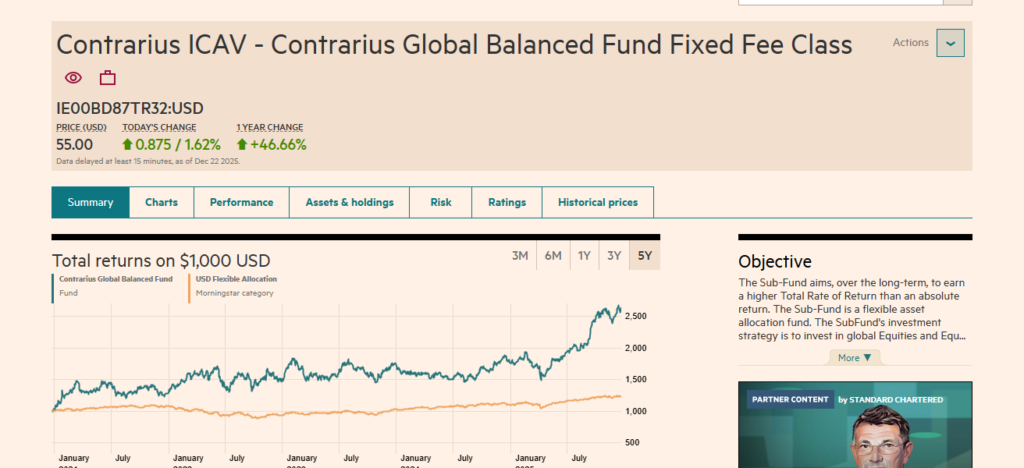

2. Contrarius Global Balanced Fund

The Contrarius Global Balanced Fund is meant for Australian investors wanting a global diversified portfolio with mitigated risk and return.

The Fund is invested in global equities, fixed income and alternative assets with a tilt toward high-quality companies and defensive assets.

The Fund aspires to achieve growth in capital while decreasing volatility, thereby making it align with a medium risk profile.

The active management of the Fund encourages the trimming and or adjusting of the portfolio based on the trends of the macro economy, the cycles of the market and available valuation opportunities.

The Fund’s global diversification lessens the constriction of the Australian markets and gives the investors the chance to invest in markets in the world that are growing.

Features Contrarius Global Balanced Fund

Global Exposure: Covers international equities, fixed income, and defensive investments.

Balanced Growth: Significant allocation to asset classes enabling investments growth and efficiency.

Active: Management adopts tactical asset allocation based as per market conditions, trends and valuation.

Target Customers: Meets the needs of medium risk investors who are looking for effective management of their portfolio.

| Pros | Cons |

|---|---|

| Provides global diversification across equities and bonds. | Currency fluctuations may impact returns. |

| Balanced approach moderates volatility. | May not outperform high-growth funds in bullish markets. |

| Active management allows tactical adjustments. | Management fees are higher than passive strategies. |

| Suitable for medium-risk investors seeking capital growth. | Limited exposure to Australian market opportunities. |

| Focuses on high-quality companies and defensive assets. | Returns may lag in low-interest environments. |

3. Lonsec Defensive Portfolio

The Lonsec Defensive Portfolio is designed for investors looking for capital protection with low volatility by investing in Australian multi-assets like cash and low-risk equities.

Fixed income assets will also be included in this multi-asset arrangement. Defensive Portfolio is best suited for investors with low appetite for risk and looking for lower end returns with very little movement on the market.

Lonsec keeps a ratio diversified structurally. Fund stability is best kept by rebalancing funds and selecting funds professionally.

Primary focus is on income and capital protection with a strong arthritis in the eye for market exercise. Defensive Portfolio is perfect for retirees/investors looking to steady a good income stream and lack the risk to exercise in the market.

Features Lonsec Defensive Portfolio

Capital Preservation. Focuses on low risk allocation of portfolio holdings to cash and fixed income.

Low Risk of Volatility: Focus on minimizing the risk of large fluctuations in the holdings of the portfolio.

Positive Growth: Includes a small allocation in equities to allow for a small positive growth in the investment.

Target Customers: Meets the needs of retirees and investors who are risk averse and prefer significant defensive assets in their portfolio.

| Pros | Cons |

|---|---|

| Low volatility, ideal for risk-averse investors. | Lower growth potential due to high cash and bond allocation. |

| Focus on capital preservation. | May underperform in strong equity markets. |

| Diversified across conservative assets. | Returns often below inflation in long-term high-growth periods. |

| Regular rebalancing to maintain stability. | Limited exposure to international equities. |

| Suitable for retirees or conservative investors. | Can be too conservative for younger investors seeking growth. |

4. Lonsec Conservative Portfolio

The purpose of the Lonsec Conservative Portfolio is to accomplish the goal of achieving a small amount of growth while at the same time protecting the assets.

The portfolio includes a small standing in equities to be used for growth as well as the defensive defensive bonds and cash.

Moderately growth potential and a low to mid-level tolerance for risk. Lonsec strategies decrease and do fund monitoring selection strategies through unstable markets.

Very long time horizons invest assets structured in equities to accomplish the goal of performance internatioanlly to receive the advnatage of diversified markets. It is structured to assure the performance for the advnatage of diversified markets.

Features Lonsec Conservative Portfolio

Balanced Defensive: A combination of bonds, cash and equities to allow for balanced and moderate growth.

Risk Management Policy: Reduce risks associated with loss when markets are down.

Regional Diversification: Has local and global assets.

Low to Moderate Risk: Best suited to conservative investors who want to achieve predictable returns.

| Pros | Cons |

|---|---|

| Balanced mix of bonds, cash, and equities for moderate growth. | Lower potential returns than growth-focused portfolios. |

| Focuses on capital protection. | Can lag in strong bull markets. |

| Diversified across domestic and international assets. | Limited upside during high equity growth periods. |

| Suitable for conservative investors with low-to-moderate risk tolerance. | May not keep pace with inflation in aggressive markets. |

| Professional fund selection and monitoring. | Exposure to equities still carries some risk. |

5. Lonsec Balanced Portfolio

The Lonsec Balanced Portfolio aims at people with a medium risk profile and combines defensive as well as growth assets.

Part of the equities include International and domestic equity which is teamed with cash, bonds and property.

This combination is designed to achieve consistent growth while keeping increases in volatility to a minimum.

Due to Lonsec’s high standards in fund selection, all asset classes include high quality portfolios.

Within a defined period, the portfolio is rebalanced to reflect changing market conditions. This portfolio is designed for investors with a willingness to tolerate moderate risk, and is looking to achieve coupled with a diversified strategy.

Features Lonsec Balanced Portfolio

Growth with Medium Risk: Balanced growth and defensive assets with low to medium returns.

Decentralization of Assets: Provides a wide array of assets in stocks equities, bonds, and cash other than property.

Management and Control: Improves stability to the investment through proper control of funds and rebalance of investment on a regular basis.

Intended Investors: Investors who are more inclined towards taking a mid-risk are most ideal.

| Pros | Cons |

|---|---|

| Balanced allocation targeting moderate growth. | May underperform high-growth equity portfolios. |

| Diversified across equities, bonds, property, and cash. | Moderate volatility may be uncomfortable for very conservative investors. |

| Professional fund selection ensures quality. | Active management fees may reduce net returns slightly. |

| Suitable for medium-risk investors. | International exposure can introduce currency risk. |

| Regular rebalancing improves long-term stability. | Returns may fluctuate with market cycles. |

6. Lonsec Growth Portfolio

This specific portfolio caters to the needs of investors with a medium to high risk appetite, with the objective of capital appreciation over the long term.

This mixes Australian and international equities, with a larger allocation to equities and a smaller allocation to fixed income and alternative assets.

The portfolio seeks to achieve net returns through a combination of skill in fund manager usage and asset allocation.

Growth investors benefit from greater diversification in equities and property, providing upside potential in the right market environment.

Lonsec focuses on long-term growth to achieve the target, with an emphasis on risk, active secondary market sales and portfolio rebalancing to mitigate the effects of market decline.

Features Lonsec Growth Portfolio

High Equity Concentration: Invest in both local and international equities to increase capital.

Moderate to High Risk: Accepts loss with hopes of greater growth in the long term.

Widely Balanced Portfolio: Mitigates risks through the inclusion of fixed assets and other investment alternatives.

Active Control: Improvement of returns by proper allocation of assets in a portfolio with regular control

| Pros | Cons |

|---|---|

| Higher allocation to equities for long-term growth. | Higher volatility compared to conservative portfolios. |

| Suitable for medium-to-high risk investors. | Potential for short-term drawdowns. |

| Diversified across domestic and international equities. | Market downturns can significantly impact returns. |

| Professional management and active rebalancing. | Fixed income portion may provide limited downside protection. |

| Targets long-term capital appreciation. | May require longer investment horizon to realize gains. |

7. Lonsec High Growth Portfolio

The Lonsec High Growth Portfolio aims high growth. This involves a major exposure to shares and other growth resources.

This is suitable for long-term capital growth for those with a higher risk. There is a small proportion of fixed income and cash so as to have a higher exposure to assets with greater return.

Lonsec uses active management and diversifies to maintain global balance to achieve optimum return with controlled volatility.

This portfolio loses from potential selection and from Sam and other selective monitoring along the growth of the market across different industries and different parts of the world.

High growth investors embrace volatility in the short-term for a likely greater result in the long-term.

Features Lonsec High Growth Portfolio

Aggressive Growth Policy: Devotes a significant portion of the portfolio to equities and other growth assets.

High Risk Acceptable: meant for investors with a high tolerance for loss.

Diversification on a Global Scale: Provides for markets and sectors across the globe.

Longer Investment Horizon: Increase capital over time.

| Pros | Cons |

|---|---|

| Aggressive equity allocation for high growth potential. | Very high volatility; not suitable for risk-averse investors. |

| Focused on long-term capital appreciation. | Short-term market fluctuations can be significant. |

| Global diversification for exposure to growth regions. | Minimal fixed income reduces downside protection. |

| Professional active management and tactical allocation. | Requires long investment horizon to manage risk. |

| Potential for superior long-term returns. | Losses can be amplified in market downturns. |

8. Platinum International Fund

Platinum International Fund is an Australian managed global equities fund focused solely on premium companies globally.

Platinum manages the fund with support from an external equity research firm. Platinum employs an empirical, research-based approach aimed at identifying the most underappreciated stocks that have the greatest value and potential growth.

The fund is committed to capital growth, with moderate diversification across regions and sectors. The fund is designed for investors with a medium to high degree of risk.

The value of the fund is to provide Australian investors with international equities. The fund aims to achieve a positive return by performing above the benchmark with a focus on capital preservation from a risk perspective.

Features Platinum International Fund

Focus on Global Equities: Invests in international markets and other undervalued companies.

Bottom-Up Research: This strategy involves picking detailed stakes in high quality, growth potential stocks.

Long-Term Growth: This involves losing potential profit by refraining from historic short term trades.

Medium-to-High Risk: This involves international diversification across assets class with growth potential

| Pros | Cons |

|---|---|

| Global equities focus for international exposure. | Currency risk can affect returns. |

| Research-driven, bottom-up stock selection. | Active management fees are relatively high. |

| Long-term capital growth orientation. | Concentrated stock picks may increase individual security risk. |

| Suitable for medium-to-high risk investors. | May underperform during global market downturns. |

| Diversified across regions and sectors. | Less focus on income generation. |

9. Vanguard Diversified Growth Fund

The Vanguard Diversified Growth Fund focuses on long-term appreciation through diversification.

The multi-asset funds invest in Australian and international equities, bonds, and growth assets. Vanguard’s target clientele for this fund are medium- to high-risk investors.

The fund offers a sectoral and geographical spread to achieve balanced risk and return. Vanguard charges low fees because of their index fund management style.

Vanguard’s Global and low-cost approach to investing should appeal to investors with this fund seeking moderate volatility.

Features Vanguard Diversified Growth Fund

Low-Cost Approach: This involves a passive indexed based strategy.

Broad Diversification: Vanguard Diversified Growth Fund undertake allocation across both Australian, international equity, and multi-asset classes.

Medium-to-High Risk: This involves positive growth of assets under a balanced strategy and moderate volatility conditions.

Rebalancing Strategy: Supports equilibrium in target allocation to achieve positive steady growth in the long run.

| Pros | Cons |

|---|---|

| Low-cost, index-based multi-asset strategy. | Limited flexibility to respond to market changes. |

| Broad diversification across domestic and global assets. | May underperform actively managed funds in volatile markets. |

| Suitable for medium-to-high risk investors. | Returns tied closely to market performance; less potential for alpha. |

| Regular rebalancing ensures alignment with target allocation. | Global equity exposure subject to currency fluctuations. |

| Efficient approach with steady long-term growth potential. | Minimal focus on alternative or niche assets. |

10. Perpetual Diversified Real Return Fund

The Perpetual Diversified Real Return Fund invests in a variety of domestic and global assets in order to achieve positive real returns above inflation while safeguarding capital.

It is strategically designed to balance long-term capital appreciation and income security for moderate risk investors.

Adjustments to asset class allocation across equities, bonds, real estate and alternative investments is determined by sophisticated real time active management to reflect prevailing market conditions.

Protection against inflation coupled with real erosion of wealth is achieved through focused asset class diversification, volatility control and Perpetual’s disciplined investment style, making the fund ideal for investors with a long-term investment horizon.

Features Perpetual Diversified Real Return Fund

Inflation Protection: This involves setting target positive returns above inflation.

Diversified Multi-Asset Portfolio: This involves equities, bonds, property, and alternative assets.

Active Tactical Allocation: This involves adjusting managed exposure to specific classes and assets based on changing market conditions.

Moderate-Risk Profile: This is a steady growth strategy with good income preservation, hence investors with this moderate profile will qualify.

| Pros | Cons |

|---|---|

| Targets positive real returns above inflation. | Moderate fees due to active management. |

| Diversified across equities, bonds, property, and alternatives. | May underperform in low-growth or low-interest environments. |

| Active tactical asset allocation for market responsiveness. | Complex structure may be harder for casual investors to understand. |

| Suitable for moderate-risk investors. | Short-term returns can be volatile. |

| Focus on capital growth and income preservation. | Reliance on manager skill for achieving real returns. |

How To Choose Best Australia-Focused Multi-Asset Portfolios

Risk Tolerances Assessment: Determine what level of fluctuation in the market you are comfortable with.

Goal Setting: Establish whether you are seeking income, growth, or protection from inflation.

Asset Allocation Review: Determine operational proportion in equities, bonds, real estate, and other investments.

Fee Comparison: Lower expenses are favorable for long-term gain of your investments.

Checking Performance: Review track records for consistency, and performance in relation to specific benchmarks over time.

Fund Manager Assessment: Competent managers are essential for getting the most out of your portfolio.

Diversification Verification: Ensure a wide variety of investments in different asset classes, industries, and regions.

Liquidity Assessment: Investments should provide you with access to your funds when necessary.

Tax Considerations Assessment: Consider the impact of capital gains and dividends.

Cocnlsuion

In summary, selecting top-performing multi-asset portfolios focused on Australia can help you build and safeguard your wealth by managing risk and optimizing returns.

Depending on one’s risk appetite, financial objectives, asset mix, and cost, different portfolios can be customized to meet an individual’s investment strategy.

Professionally managed diversified portfolios provide income and stable capital appreciation along with financial security throughout different periods in the Australian economy.

FAQ

What are multi-asset portfolios?

They are investment funds combining equities, bonds, property, and alternatives to balance risk and return.

Why choose Australia-focused portfolios?

They focus on Australian markets while offering some global exposure for growth and diversification.

Who should invest in these portfolios?

Suitable for conservative, moderate, and growth-oriented investors depending on the portfolio type.

How is risk managed?

Through diversification across asset classes, sectors, and geographies.

What returns can I expect?

Returns vary based on portfolio type, market conditions, and investment horizon.