In this post , I will analyze the most Reliable Defensive Investment options in Australia that provide stability and continuous returns, even in times of economic turmoil.

Defensive investment options are the most suitable for investors with a low risk appetite, and who are looking for a consistent stream of income with low market fluctuations.

I will analyze the most reliable sectors and firms that provide consistent dividends with essential services and the capacity for sustained growth for a more fortified investment strategy.

Key Points & Best Defensive Investment Options In Australia

| Defensive Investment Option | Key Point |

|---|---|

| Commonwealth Bank (CBA) | Large, stable bank with consistent dividends |

| Wesfarmers (WES) | Diversified retail and industrial group, steady earnings |

| Telstra (TLS) | Telecommunications giant, essential services demand |

| Transurban Group (TCL) | Toll road operator, long-term infrastructure contracts |

| Coles Group (COL) | Supermarket chain, stable consumer demand |

| QBE Insurance Group (QBE) | Global insurer, defensive against economic swings |

| Brambles (BXB) | Logistics and supply chain services, recurring revenue |

| APA Group (APA) | Gas pipeline operator, regulated income streams |

| TPG Telecom (TPG) | Telecom provider, recurring subscription revenue |

| NextDC (NXT) | Data centre operator, growing digital infrastructure demand |

10 Best Defensive Investment Options In Australia

1. Commonwealth Bank (CBA)

One of the largest banks in the country, Commonwealth Bank of Australia (CBA), offers security and steady profits.

As a defensive investment, the company benefits from a diversified income stream from retail, business, and institutional banking.

Its strong history of dividend payments and its earnings that continue to be strong in times of downturns, are the reasons many risk adverse investors would consider the company.

CBA’s strong defensive through risk management and industry leading position in the Australian banking sector secures market down turns a reliable stream of income.

Features Commonwealth Bank (CBA)

Market Leadership: It is one of Australia\’s largest bank, with a commanding positions in retail, business, and institutional banking.

Dividend Reliability: A long and consistent track record of paying dividends.

Financial Strength: Their sound balance sheet and level of risk management ensures they won’t take a loss during a recession.

Diversified Revenue: They have several business lines and are not reliant on one sector for income.

| Pros | Cons |

|---|---|

| One of Australia’s largest banks with a dominant market position. | Exposure to economic downturns affecting loan portfolios. |

| Strong dividend history providing consistent income. | Regulatory changes in the banking sector can impact profitability. |

| Diversified revenue streams: retail, business, and institutional banking. | Sensitive to interest rate fluctuations. |

| Resilient during market volatility due to strong balance sheet. | Competition from fintechs and digital banking. |

2. Wesfarmers (WES)

In Australia, Wesfarmers works in retail, industrials, and the resources sector, including such companies as Bunnings, Kmart, and Officeworks.

Wesfarmers is a defeniesed company, as they are stable and do not collapse. Cash flow is steady, and dividends are given even when the company is in a bad condition.

For defensive investors, Wesfarmers is a better pick than others. Investors know Wesfarmers, because they are a great pick for a balanced defensive Portfolio, and they are retail dominant.

Features Wesfarmers (WES)

Diversified Conglomerate: They operate in retail, industrial, and have resource businesses, which lowers risk.

Strong Retail Brands: Their retail division includes Bunnings, Kmart, and Officeworks which are all major retailers and bring in a lot of sales.

Consistent Cash Flow: Their income is stable and consistent which allows them to offer dividends without concern.

Conservative Management: They have a consistent and responsible management which guides the business on a safe path.

| Pros | Cons |

|---|---|

| Diversified conglomerate with retail, industrial, and resources exposure. | Large portion of revenue tied to retail, which can face margin pressure. |

| Strong cash flow and consistent dividend payouts. | Industrial and resources segments can be cyclical. |

| Bunnings, Kmart, and Officeworks provide stable revenue. | Complex management due to diversified business segments. |

| Conservative management reduces risk for investors. | Growth may be slower compared to high-growth tech stocks. |

3. Telstra (TLS)

Telstra (TLS) is Australia’s biggest telecom company with mobile, broadband, and enterprise services.

Telstra’s core services are essential and this makes them demand steady earnings and consistent profits. Telstra has long span history in plasma cash flow and stable stream of dividends.

Recent regulatory changes and investments in 5G Telstra’s free cash flow for the long term are strongest.

Telstra is a strong defensive option for those limited risk investors looking for stable income as the economic cycles are not a concern for the company.

Features Telstra (TLS)

Telecom Leader: They are the biggest mobile, broadband, and enterprise telecom service provider in Australia.

Essential Services: Their products are required, giving them risk during a recession.

5G Network Expansion: They are investing in infrastructure which means they will grow in the coming years.

Reliable Dividends: Their cash flow allows them to pay consistent dividends to shareholders.

| Pros | Cons |

|---|---|

| Market leader in telecommunications with essential services. | Intense competition in telecom market can pressure margins. |

| Stable dividends and predictable cash flows. | Regulatory reforms can impact pricing and profits. |

| Infrastructure investments in 5G enhance growth potential. | High capital expenditure requirements. |

| Defensive during economic downturns due to demand for communication services. | Legacy network maintenance costs may affect profitability. |

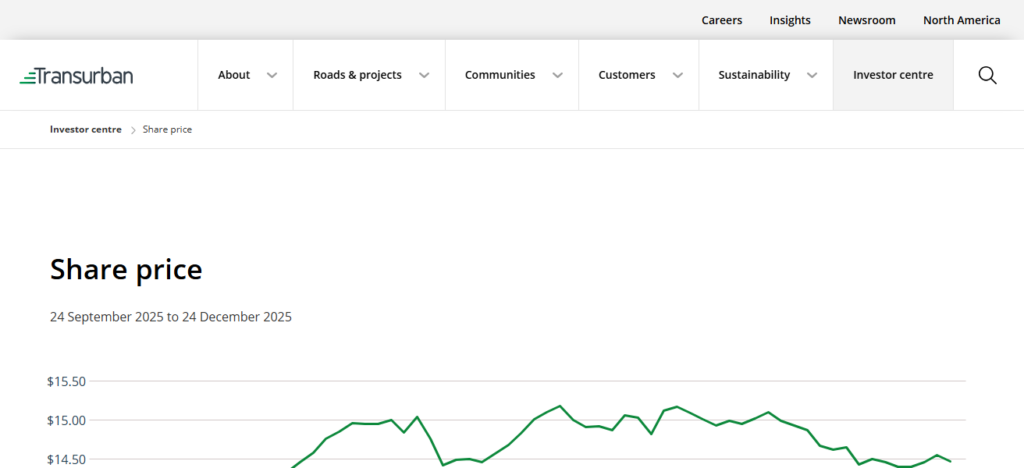

4. Transurban Group (TCL)

As one of the largest toll road operators Australia and North America, Transurban Group (TCL) enjoys the relative letancy of toll road earnings compared to other business segments.

Revenue streams are always predictable as tolls can be collected and toll rates adjusted over time (upwards) to account for inflation.

In addition to offering predictable and growing revenue, road tolls and traffic volumes are highly correlated. Tat all else constant, an urban toll road will always be growing.

Investment in TCL is defensively attractive due to their strong balance sheet and diversification. Defensive investors will appreciate the dividends and reliable earnings.

Features Transurban Group (TCL)

Road Operator: Receives predictable revenue related to ownership of urban toll road.

Inflation Indexed Revenue: Returns are secured due to toll increases related to inflation.

Geographic Diversification: Assets in different locations in Australia and North America.

Defensive Infrastructure: Transport is a basic service, offering a long-term defensive option.

| Pros | Cons |

|---|---|

| Operates major toll roads with predictable revenue streams. | Traffic volumes can be affected by economic slowdown or pandemics. |

| Inflation-linked tolls provide income stability. | High debt levels may increase financial risk. |

| Diversified portfolio of urban toll roads in multiple regions. | Regulatory and political risks in tolling agreements. |

| Defensive investment due to essential transport infrastructure. | Expansion projects may take years to become profitable. |

5. Coles Group (COL)

Coles Group (COL) is one of the biggest supermarket chains in the country, selling essential goods and grocery items that see stable demand in any economy.

The company’s defensive nature stems from the grocery staples that consumers purchase, and the company’s strong market position and steady revenue.

Coles Group is cost-efficient, has supply chain optimiztation and effective loyalty programs. They also pay steady dividends, increasing their appeal to income seeking investors.

Consumer staples, and therefore groceries, continue to see demand even in recession. This adds to why COL is a great choice for defensive investors looking for low risk in the Australian market.

Features Coles Group (COL)

Consumer Staples: Major players in grocery retailing with steady demand.

Operational Effectiveness: Profits are influenced by supply chain and management of loyal customers.

Payout Dividends: Regular cash flow enables dividends to be paid.

Defensive Revenue: Non-durables are recession-proof.

| Pros | Cons |

|---|---|

| Large supermarket chain with consistent demand for consumer staples. | Highly competitive retail market can affect margins. |

| Stable revenue and reliable dividend payouts. | Sensitive to commodity prices and supply chain disruptions. |

| Operational efficiency and loyalty programs support profitability. | Growth limited in a mature retail market. |

| Defensive during economic downturns due to essential goods. | E-commerce competition requires continuous investment. |

6. QBE Insurance Group (QBE)

QBE Insurance is an underwriter headquartered in Australia with a worldwide reach. It has a defensive posture due to a multitude of offerings in the Insurance sector–general, life, and reinsurance.

QBE collects steady premiums and cash flow, and due to their rigorous risk management strategies, they lose less than many of their competitors in the volatile markets.

The company operates in many countries which diversifies and lessens their exposure to the remote risk of one economy.

For investors, QBE is a Defensive Insurance company due to the steady cash flow, and strong dividends, a rarity in the financial defensive sector.

Features QBE Insurance Group (QBE)

Multinational: Low exposure to a single market helps by providing operations across several.

Insurance Diversification: Risk is spread with general and life reinsurance.

Premium Income: Consistent flow of cash is assured with insurance policies and reinsurance.

Volatility Risk: Disciplined stable approach to risk management to insulate financial loss.

| Pros | Cons |

|---|---|

| Diversified insurance products reduce risk exposure. | Vulnerable to natural disasters and large claims events. |

| Global operations reduce dependence on a single market. | Insurance is cyclical and sensitive to market volatility. |

| Predictable cash flow from premium collections. | Regulatory changes in insurance sector can impact profits. |

| Disciplined risk management enhances stability. | Dividend payments may fluctuate depending on claims experience. |

7. Brambles (BXB)

Brambles (BXB) is involved in supply chain logistics and focuses on container pooling and pallet pooling solutions around the world.

They were more or less immune to the challenges faced by the retail industry due to the recurring revenue contracts with major retail and manufacturing companies.

Brambles have significant influence over retail logistics and holds a high value network internationally.

Their commitment to the balance of profitability with sustainability and efficiency strengthens the value of the organization.

Brambles (BXB) is ideal for a defensive strategy and growth is slow. They have low volatility and high resilience to downside shifts.

Features Brambles (BXB)

Supply Chain Specialist – Offers global pallet and container pooling initiatives for supply chain.

Recurring Revenue – Long-term deals from retailers guarantee predictable revenue stream.

Global Operations – This type of exposure to different regions spreads risk.

Essential Service – Performs a crucial role in logistics and supply chain networks.

| Pros | Cons |

|---|---|

| Recurring revenue from logistics and pallet pooling contracts. | Global exposure exposes it to currency fluctuations. |

| Strong relationships with major retailers and manufacturers. | Growth can be moderate, not high. |

| Critical role in global supply chains ensures long-term demand. | Sensitive to industrial production cycles. |

| Defensive due to steady demand for logistics services. | Capital-intensive operations require ongoing investment. |

8. APA Group (APA)

APA Group is an Australian energy infrastructure company focusing on natural gas pipelines and electricity assets. APA’s defensive nature comes from predictable cash flows, resulting from long-term, regulated contracts.

There’s consistent demand in APA’s energy transport and infrastructure services. There’s a strong history of dividends and inflation-linked revenues in the company, creating a reliable income.

Defendable investment with low market risk and growth potential in the energy sector is a priority for the company, and the consistent earnings and infrastructure focus allows for that.

Features APA Group (APA)

Energy Infrastructure – Activities include the management of gas pipelines and the ownership of electricity assets in Australia.

Long-Term Contracts – Steady income from contracts that are regulated and long-term.

Inflation-Linked Revenue – Revenue in a cash flow growing with inflation for stability.

Defensive Asset Class – Lesser exposure to market cycles, as energy transport is essential.

| Pros | Cons |

|---|---|

| Operates essential energy infrastructure with long-term contracts. | Dependent on energy demand and regulation. |

| Predictable cash flows and inflation-linked revenues. | Pipeline maintenance and expansion require significant capital. |

| Defensive investment due to energy transport being critical infrastructure. | Commodity price fluctuations may indirectly affect business. |

| Strong history of dividends and stable income. | Limited high-growth potential compared to technology sectors. |

9. TPG Telecom (TPG)

TPG Telecom, or TPG, is a prominent broadband, mobile, and enterprise telecommunications service provider in Australia.

TPG’s defensive characteristics stem from the recurring revenue and essential nature of its services. The predictable earnings are a result of the strong customer loyalty and market presence.

Network upgrades are continuous, which increases TPG’s stability and competitiveness over time. For investors, TPG is a solid income investment as dividends are consistently paid.

TPG also provides less exposure to the economic cycle, which is why it is considered a defensive investment, especially in essential services, and provides moderate growth.

Features TPG Telecom (TPG)

Telecom Services Provider – Broadband, mobile, and enterprise services.

Recurring Revenue Streams – Customer subscriptions are a reliable source of cash flow.

Moderate Growth Potential – Encouraged by network upgrades, moderate and long-term growth is expected.

Essential Service – Less impact from economic downturns.

| Pros | Cons |

|---|---|

| Provides essential telecom services with recurring revenues. | Intense competition from larger telecom providers. |

| Stable customer base ensures predictable cash flow. | Network expansion requires high capital expenditure. |

| Moderate growth potential with technology upgrades. | Regulatory changes can impact pricing and margins. |

| Defensive investment due to essential services in all economic conditions. | Dividend yield may be lower than other defensive stocks. |

10. NextDC (NXT)

NextDC (NXT) is an Australian data center operator that offers protected and dependable buildings for cloud and IT services.

NextDC’s defensive appeal is based on the need for data storage and critical digital infrastructure that is less restricted during economic downturns.

NextDC does long-term leases with its enterprise clients which brings in reliable revenue. Technology advancements to the center will continue to bring in revenue for the building.

NextDC is an expansion sector and less restricted from the loss of clients. NextDC is a great defensive investment because of the technology sector infrastructure.

Features NextDC (NXT)

Data Center Operator – Supplies important infrastructure for cloud and IT services.

Long-Term Leases – Revenue from enterprise clients on a regular basis.

Growing Sector – Growth is supported by the increasing demand for data storage.

Defensive Investment – Unlike the other investments, digital infrastructure is essential and market cycles do not affect it.

| Pros | Cons |

|---|---|

| Operates critical data center infrastructure with long-term leases. | High capital expenditure for building and upgrading data centers. |

| Steady demand for cloud storage and IT services. | Dependent on corporate IT budgets and digital adoption. |

| Predictable revenue and recurring income from enterprise clients. | Growth may fluctuate depending on technology trends. |

| Defensive in nature due to essential digital infrastructure. | Competition from global cloud and data center providers. |

How To Choose Best Defensive Investment Options in Australia

Consistent Performance: More prudent investors only focus on long-term consistent earners, both in revenue and profit, even in a recessionary economic climate.

Consistent Payout: It is also wise to include defensive stocks that pay dividends consitently, and at higher rates than industry averages.

Necessity: Companies that sell essential goods or services, such as utilities, telecommunication, and food, should also be defensive stock targets as they have inelastic demand.

Less Price Fluctuation Risk: It is best to focus on stock that have lower beta, for they have less of a risk of greater price swings.

Strong Financials: Companies should have a low debt ratio and solid expected demand in order to remain safe in a recessionary climate.

Multi-Industry Venturing: Companies in multiple industry diversfication should be less risky.

Low Risk Income: Infrastructure, utilities, and insurlance companies are often reliable and low risk.

Growth: Investing is best in companies that have a solid and sustainable business model, and the potential to expand.

Conclsuion

To sum it all up, The most defensive investment options in Australia are those which offer stability, reliable dividends, and decreased correlation with the market.

Companies such as CBA, Telstra, Coles, and Transurban provide defensive income and consistent returns. Defensive portfolios focus on essential services, stable balance sheets, and broad industry coverage, yielding the calmness that comes with decreased uncertainty.

FAQ

What are defensive investments?

Defensive investments are assets that provide stable returns and are less affected by market volatility, such as utilities, consumer staples, and infrastructure stocks.

Why invest in defensive stocks in Australia?

They help protect your portfolio during economic downturns by providing consistent income and lower risk compared to growth stocks.

Which sectors are considered defensive in Australia?

Banks, telecom, consumer staples, insurance, energy infrastructure, and logistics are typically defensive sectors.

Can I earn good dividends from defensive stocks?

Yes, many defensive stocks, like CBA, Telstra, and Coles, offer reliable and regular dividend payouts.

Are defensive stocks risk-free?

No, they are lower risk than growth stocks but still face market, regulatory, and economic risks.