The Best Crypto Blockchain Monitoring APIs that assist developers, traders, and businesses in effectively tracking on-chain activity, market data, and wallet behavior will be covered in this post.

In the quickly developing blockchain ecosystem, these APIs are crucial for developing DeFi applications, tracking investments, guaranteeing compliance, and powering sophisticated crypto dashboards since they offer real-time insights, multi-chain support, and analytics tools.

What is the Criteria for Selecting Crypto Blockchain Monitoring APIs?

These are the most important factors when choosing a Crypto and Blockchain Monitoring API. Each point will have an additional thirty-word explanation.

Blockchain Coverage Choose APIs that offer comprehensive coverage of major blockchains and networks, and all important elements, including the Bitcoin and Ethereum blockchains and their various Layer 2s and other emerging chains.

Real-Time Data & Alerts The API being considered must offer the ability to monitor transactions, and in particular, provide block updates and alerts in real time to allow for timely action.

Data Accuracy & Reliability Reliability and data accuracy are two additional metrics to consider. The API must provide a consistent and dependable source of up-to-date transactional data and balances with no downtime.

Scalability & Performance The API must be able to accept a large number of calls and provide a low latency response. The API must also be able to provide a good response when the application

Historical Data Access For use cases, including analytics, audits, identification of trends, reviews of compliance, and backtesting, the API must provide clean, well-organized, historical blockchain information that is readily accessible.

Security & Compliance Features The best APIs provide encryption and strong, rate-limiting authentication, and allow compliance features such as anti-money laundering risk scoring, sanctions screening, and the monitoring of suspicious activities.

Ease of Integration Having endpoints and SDKs that are well documented and that respond with data in predictable ways can facilitate faster integration and development of that module with less effort in development work in the primary system or application.

Customization & Filtering Custom filtering of events by address, token, and/or value and/or risk level is helpful to teams that want to monitor thin slices of the overall blockchain activity and minimize data noise.

Uptime & SLA Guarantees Providers that are dependable and have a reputation of giving uptime and SLAs with status monitoring, will be able to have the API in a reliable fashion for their critical applications.

Pricing & Usage Limits Long term affordability is mostly about transparent pricing, flexible pricing plans, and reasonable rate limits that will monitor and restrict unexpected costs.

Key Points – Leading Crypto & Blockchain Data APIs

| API Platform | Key Point |

|---|---|

| Token Metrics API | Provides AI-driven crypto market analytics, including predictive signals, ratings, and on-chain insights designed for investors and quantitative models. |

| CoinGecko API | Delivers comprehensive real-time and historical cryptocurrency market data, including prices, market caps, trading volumes, and token metadata across thousands of assets. |

| CryptoCompare API | Offers reliable global crypto price feeds, historical market data, social sentiment indicators, and exchange-level metrics for analytics and financial applications. |

| Nomics API | Focuses on transparent, high-quality historical price and market cap data sourced directly from exchanges, suitable for institutional research and backtesting. |

| Glassnode API | Specializes in advanced on-chain metrics such as wallet behavior, network activity, and holder analysis to assess blockchain health and investor trends. |

| Messari API | Provides structured crypto research data, including fundamentals, governance metrics, project profiles, and standardized asset intelligence. |

| Santiment API | Combines on-chain data with social media sentiment, developer activity, and behavioral indicators to track market psychology and trends. |

| IntoTheBlock API | Delivers actionable on-chain indicators like holder profitability, liquidity signals, and concentration metrics powered by machine-learning models. |

| Chainalysis API | Enables blockchain monitoring for compliance by offering transaction tracing, risk scoring, and illicit activity detection across multiple blockchains. |

| Dune API | Allows programmatic access to custom SQL-based on-chain analytics and dashboards built from decoded blockchain data. |

1. Token Metrics API

The Token Metrics API focuses on tracking crypto assets and delivering AI-driven analytics on top of standard crypto market data, including price, volume, and other fundamental and qualitative metrics. Predictive features include ratings and sentiment.

They provide data on numerous assets and exchange pairs, along with ML forecasts on the price and risk. They provide real-time data streaming and can generate alerts based on price movements and/or sentiment shifts and/or changes in fundamentals.

Predictive features include ratings and sentiment. It is an accurate API with considerable value in predictive context, both for trading and for research.

Token Metrics API Features, Pros & Cons

Features

- On-chain metrics and indicators

- Price and trend analysis

- AI-based asset scoring model

- Historical datasets

- Alerts and sentiment insights

Pros

- Forecasting model powered by AI

- Supports portfolio management

- Data coverage is extensive

- Predictive trend indicators available

- Alerts facilitate better decision making

Cons

- High pricing for the top tier

- Available features on the free plan are limited

- Steep learning curve

- Not designed for raw on-chain data

- Slower than other specialized fuzzed APIs

2. CoinGecko API

CoinGecko API provides one of the widest coverage of data in the industry and has live pricing, market caps, volume, historical data, on-chain DEX, and other token metadata along with DEX information and other multi-chain support spanning thousands of assets across hundreds of exchanges.

Also, it provides WebSocket streams in some paid out tiers of the service along with sub-second price updates. There is even the ability to automatically track price movements and/or other price movement indicators.

The breadth of data available stretches across both traditional metrics and Defi metrics, including market data on NFTs. CoinGecko is known and afforded strong regard for the accuracy and reliability of the data and the aggregation of it on the market.

Developers are able to use it with great ease because of the strong documentation of the API and the aggregation of the methods on the market.

CoinGecko API Features, Pros & Cons

Features

- Market & Price Data

- Volume and liquidity

- Token & Exchange Listings

- REST API endpoints for developers

- Community sourced data

Pros

- High limits for free plan

- Data on all assets globally

- Seamless integration

- Data is refreshed regularly

- Well written guides available

Cons

- Few advanced on-chain analytics

- Limited on the fly data streaming

- No wallet level metrics

- Data focus is market driven

- Community sourced data

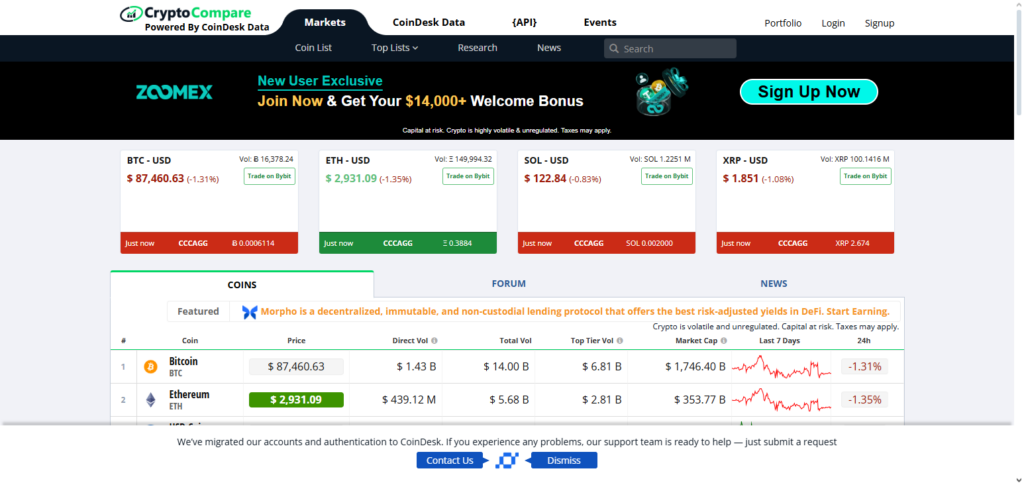

3. CryptoCompare API

Spot prices, historical OHLCV data, and exchange metadata compiled from numerous international exchanges are all included in the extensive market data offered by the CryptoCompare API.

Price feeds, trading volumes, basic on-chain blockchain statistics, sentiment signals, and news features are all included in its data coverage, allowing for a more comprehensive understanding of the market.

CryptoCompare offers structured endpoints for websocket or REST calls in addition to regular updates that are appropriate for dashboards and trading apps for real-time data and notifications. Social sentiment and derivatives data improve its data comprehensiveness, providing more than just price data.

Clear documentation and adaptable designs are advantageous to developers; integration is made to be usable by both individuals and businesses. Because to sophisticated aggregation processes, reliability is typically high.

CryptoCompare API Features, Pros & Cons

Features

- Prices available in real-time

- OHLCV data in the past

- Collection of exchanges in an aggregated format

- Blockchain and mining analytics

- Social sentiment metrics

Pros

- Multiple forms of data

- Extensive coverage of exchange data

- Valuable for graphical representations and analytical tools

- Insights for multiple markets

- Combines data and sentiment

Cons

- Limitations on the free tier

- Advanced functionalities require payment

- Not on-chain analytics centric

- More intricate endpoints

- There is considerable variation in the volume data provided by different exchanges.

4. Nomics API

Nomics API allows you to get real-time and historical data for the crypto market. You can get crypto data by asset and by market such as price and pricing data, market cap, supply and volume data, and charting.

Nomics can cover thousands of coins and pairs and can retrieve data for you with clean and gapless historical records. You can also get streaming price updates, real-time data, and market updates over REST or WebSockets, which also makes it a good API for tradig and analytics platforms.

The analytics and portfolio tracking market metrics are covered as well, making the API comprehensive. Nomics also allows high-frequency update access and solid response times. Developers also have a good integration experience with the API, due to the good documentation, CSV and JSON support, and good accuracy.

Nomics API Features, Pros & Cons

Features

- Streamed price and market data with noise removed

- Sourced data with transparency

- Availability of time series data in the past

- Tickers of exchanges and their volume

- Tokens and markets metadata

Pros

- Extremely accurate price information

- Policies on data quality are transparent

- Availability of adequate past data

- Endpoints are user-friendly

- Targeted at larger institutions

Cons

- Premiums are charged for plans with higher quotas

- There are a limited available on-chain metrics.

- Analytics features are not as expansive.

- There is less data on attitudes and behaviors.

- Compared to competitors, documentation is basic.

5. Glassnode API

Instead of only focusing on market prices, the Glassnode API shines in on-chain analytics and network health indicators. Deep foundational insights are provided by its data coverage, which covers hundreds of on-chain variables across key blockchains, including active addresses, transaction volumes, hodler distribution, network activity, and more.

Glassnode provides near-real-time and historical metric retrieval that can enable alerts regarding network behavior or miner/whale activity, however real-time data and alert capabilities are dependent on subscription tiers.

Its extensive data set contains derivative statistics and sophisticated network indicators, which are crucial for long-term research. Although some complex metrics may need to be handled carefully, developers integrate using well-documented REST APIs. Glassnode is renowned for its institutional-grade dependability and great data correctness.

Glassnode API Features, Pros & Cons

Features

- On-chain market metrics

- Various metrics for health of the network

- Analytics of the network supply and liquidity

- Statistics on address activity and their usage

- Data visualization on an advanced level

Pros

- Best on-chain insights

- Signals tailored for institutions

- Good metrics of the network

- High quality of data

- Comprehensive a large number of data for a long time

Cons

- The cost of the pro tiers is high.

- Beginners may find it challenging

- No price-agnostic endpoints

- Minimal data on NFT markets

- Overly complicated for users with simple requirements

6. Messari API

Combining market statistics, protocol measurements, on-chain insights, research papers, and event tracking, the Messari API offers a wide range of quantitative and qualitative crypto data. Exchange statistics, on-chain network analytics, curated research, and comprehensive price and volume data for thousands of assets are all included in its data coverage.

Messari provides endpoints such as Intel event streams and sentiment signals that can be integrated into monitoring solutions for real-time data and alarms. Rich contextual data, such as protocol usage metrics and governance details, improve its data comprehensiveness.

Strong integrations are made possible by comprehensive API documentation, adaptable query architectures, and several endpoint categories that enhance developer experiences. The precision and depth of Messari’s data are highly valued in analytical procedures.

Messari API Features, Pros & Cons

Features

- Fundamentals and asset profiles

- Research on markets and projects

- Institutions-grade metrics

- On-chain and off-chain data

- News and regulations

Pros

- Research-driven data is extensive

- Excellent asset profiling

- Ideal for analysts

- Clean and structured access

- Combines regulatory with market data

Cons

- Full library comes at a price

- Primarily non-real-time API

- Beginners may feel overwhelmed by dataset complexity

- Live streaming is limited

- Research skill is needed for setup

7. Santiment API

To provide a comprehensive picture of cryptocurrency ecosystems, the Santiment API integrates market data with social, developmental, and on-chain analytics. Price fluctuations, development activities, social mood measures, and on-chain signals across significant assets are all included in its data coverage.

Santiment’s API offers current time series for real-time data and alerts, which can be used to set off alerts for activity or sentiment surges. Its data comprehensiveness goes beyond only price; it also includes developer dynamics and community behavior.

GraphQL, which allows for exact, adaptable queries customized to certain use cases, is used for integration; however, developers must be familiar with that paradigm. When integrating market trends with behavioral insights, Santiment’s data is dependable.

Santiment API Features, Pros & Cons

Features

- Metrics on the social and behavioral aspects

- Data on-chain indicates activity

- Accessibility for developers at endpoints

- Token trends and sentiment indexes

- Alpha signals for market movement

Pros

- Excellent for strategies based on sentiment

- Merges social and on-chain data

- Unique market signals

- Research tools are available

- Community features

Cons

- Access is limited on the free tier

- Data may be complex for beginners

- Not optimized for pure price feeds

- Sometimes social signals are not reliable

- Less data from traditional exchanges

8. IntoTheBlock API

Metrics like whale transactions, liquidity positions, and probabilistic insights are among the data indications and signals that the IntoTheBlock API provides based on on-chain and market activity.

Its data coverage offers statistical signals and thematic indications for hundreds of assets in addition to basic pricing. IntoTheBlock offers current indicators and pattern alerts for real-time data and alerts that assist traders in identifying new trends or anomalous activity.

Unique analytics including order-book depth and concentration measurements are part of the API’s extensive data. Analytics use case-specific documentation and structured interfaces facilitate developer integration. Trend analysis and decision support can benefit from the platform’s accuracy and dependability.

IntoTheBlock API Features, Pros & Cons

Features

- Count and activity insights for wallets

- On-chain and off-chain intelligence

- Distribution of token and ownership

Pros

- Deep wallet-level insights

- Useful for institutional research

- Helpful for DeFi risk metrics

- Strong visualization options

- Unique analytic signals

Cons

- Paid subscription required

- Not ideal for simple price tracking

- Complex API structure

- Less real-time exchange coverage

- Smaller community support

9. Chainalysis API

With data covering transaction flows, flagged addresses, and compliance signals across several chains, the Chainalysis API is intended for blockchain monitoring, risk analysis, and compliance. It is essential for keeping an eye on suspicious activity because it covers illicit activity indicators, risk grading, and tracking money between wallets and exchanges.

A key component of Chainalysis’s value is real-time monitoring and alerts, which allow for automated fraud detection triggers and compliance notifications. Instead than focusing on price, data comprehensiveness is deep on the forensic and compliance side, capturing behavioral insights across on-chain transactions.

Strong SDKs and documentation for interacting with compliance systems are part of the development experience. When it comes to blockchain risk modeling, Chainalysis is renowned for its high accuracy and corporate dependability.

Chainalysis API Features, Pros & Cons

Features

- Fraud and illicit activity flags

- Compliance and anti-money laundering tools

- Transaction risk scoring

- Risk analytics and reporting

- Custom institutional tools

Pros

- Highest quality analytics

- Most reputable and trusted

- Strong tools to meet regulatory compliance

- Excellent for fraud activity detection

- Excellent quality for risk analytics

Cons

- Highly expensive

- Strong anti-money laundering focus

- Not a focus on activity

- Not for inexperienced devs

10. Dune API

With the help of the Dune API, developers and analysts may create dashboards or automated insights by executing custom SQL queries on indexed blockchain data. Transactions, protocol usage, wallet data, and DeFi measurements across several chains are all included in its data coverage.

Dune is an effective tool for custom monitoring since it allows you to establish conditions and notifications depending on query results for real-time data and alerts. Because you provide the precise metrics you require, its data comprehensiveness is unmatched for custom analytics.

Its export options and API make integration easier, but creating effective SQL queries takes more expertise. On-chain records and community dashboards strongly correspond with data accuracy.

Dune API Features, Pros & Cons

Features

- Custom visualizations and dashboard

- Community supported datasets

- SQL for flexible data queries

- Support across multiple blockchains

- Chart export

Pros

- Excellent for flexible visualizations

- Excellent for community contribution

- No node management required

- Excellent being multi-chain

Cons

- Requires SQL

- Requires more advanced users

- Free tier is data limited

- Not real-time updates

- Not a standard API for price feeds

Conclusion

Developers, analysts, traders, and businesses need the Best Crypto Blockchain Monitoring APIs in order to effectively access precise on-chain and market data. From real-time price feeds to wallet analytics and compliance monitoring, platforms such as Token Metrics, CoinGecko, CryptoCompare, Nomics, Glassnode, Messari, Santiment, IntoTheBlock, Chainalysis, and Dune offer a variety of features.

These APIs are essential for developing DeFi applications, monitoring market trends, guaranteeing regulatory compliance, and obtaining useful insights in the quickly changing crypto environment since they lower infrastructure costs, facilitate multi-chain data access, and enable advanced analytics.

FAQ

What are crypto blockchain monitoring APIs?

Crypto blockchain monitoring APIs provide programmatic access to on-chain data, market metrics, price feeds, wallet activity, and analytics, enabling developers, traders, and enterprises to track and analyze blockchain activity efficiently.

Why are blockchain monitoring APIs important?

They reduce the need to run nodes or build custom infrastructure, offer real-time insights, and support analytics, compliance, portfolio management, and DeFi applications.

Can these APIs support multi-chain data?

Yes, most leading monitoring APIs support multiple blockchains, including Ethereum, Bitcoin, and Layer 2 solutions, allowing seamless cross-chain analysis.

Which are the best crypto blockchain monitoring APIs?

Top APIs include Token Metrics, CoinGecko, CryptoCompare, Nomics, Glassnode, Messari, Santiment, IntoTheBlock, Chainalysis, and Dune.

Do these APIs provide real-time data?

Yes, many APIs offer real-time or near-real-time updates for price feeds, wallet activity, transactions, and market sentiment.