I’ll go over the Top Crypto Custody APIs for Fintech Apps in this post. These APIs offer safe and legal ways to manage, transfer, and store digital assets.

Fintech applications can protect customer funds while providing smooth and effective cryptocurrency services by utilizing features like multi-signature wallets, MPC key management, automated processes, and regulatory compliance tools.

What is Crypto Custody APIs?

Fintech apps and organizations may safely store, manage, and transfer digital assets with the help of specific application programming interfaces known as crypto custody APIs. To stop theft or unwanted access, they offer sophisticated key management solutions such hardware security modules and multi-party computation (MPC).

Additionally, these APIs include functionality like multi-signature approvals, automated transaction workflows, compliance reporting, and interaction with DeFi systems or exchanges.

Fintech businesses can guarantee regulatory compliance, optimize operations, and safeguard user funds while providing cutting-edge cryptocurrency services by utilizing crypto custody APIs. In essence, they act as a scalable and safe link between financial apps and digital assets.

Why It Is Crypto Custody APIs for Fintech Apps Matter?

Secure Asset Storage

Crypto custody APIs protect digital assets through multi-party based computation, hardware security modules, and multi-signature wallets. For fintech applications, this protects your customers’ funds and institutional assets from hacks and theft.

Regulatory Compliance

These APIs have built-in compliance, audit-ready reporting, and global regulation support, including KYC/AML. Fintech apps seamlessly remain compliant with regulations while controlling cryptocurrencies.

Efficient Transaction Management

Custody APIs facilitate automation of transfer, settlement, and cross-exchange processes. Fintech platforms experience less operational strain with automated workflow processes and gain the ability to handle high volume transactions with less manual effort.

Access to Advanced Features

A variety of APIs offer services including staking, access to decentralized finance, cross-chain transfers, and tokenization of assets. Fintech applications are able to provide new offerings to their customers without the burden of building and maintaining complex infrastructure.

Scalability and Integration

Crypto custody APIs are built for enterprise-grade applications. They allow fintech applications to seamlessly scale their operations, integrate their services with trading platforms, and expand their offerings.

Risk Mitigation

Custody APIs provide fintech companies with financial, operational, and compliance risk mitigation with insurance coverage, policy-driven approvals, and secured asset segregation.

Key Point & Best Crypto Custody APIs for Fintech Apps

| Platform / API | Key Points |

|---|---|

| Fireblocks API | Secure MPC-based wallet infrastructure with automated policy controls, transaction workflows, DeFi access, and institutional-grade asset transfer orchestration. |

| Anchorage Digital API | Regulated crypto custody API offering secure asset storage, staking, governance, and compliance-ready key management for institutions. |

| Copper ClearLoop API | Enables off-exchange settlement and collateral management, allowing institutions to trade on exchanges without moving assets from custody. |

| BitGo Custody API | Multi-signature custody with policy-driven approvals, wallet management, transaction monitoring, and insurance-backed asset protection. |

| Coinbase Prime API | Institutional trading and custody API combining secure storage, execution, financing, and portfolio reporting within a regulated environment. |

| Gemini Custody API | SOC-certified custody API providing cold storage, audit controls, compliance reporting, and secure asset transfers for institutions. |

| Ledger Enterprise API | Hardware-secured key management API using HSM and Ledger Vault, offering governance workflows and enterprise wallet control. |

| Qredo API | Decentralized MPC custody API enabling cross-chain settlements, secure asset transfers, and policy-based transaction approvals without private keys. |

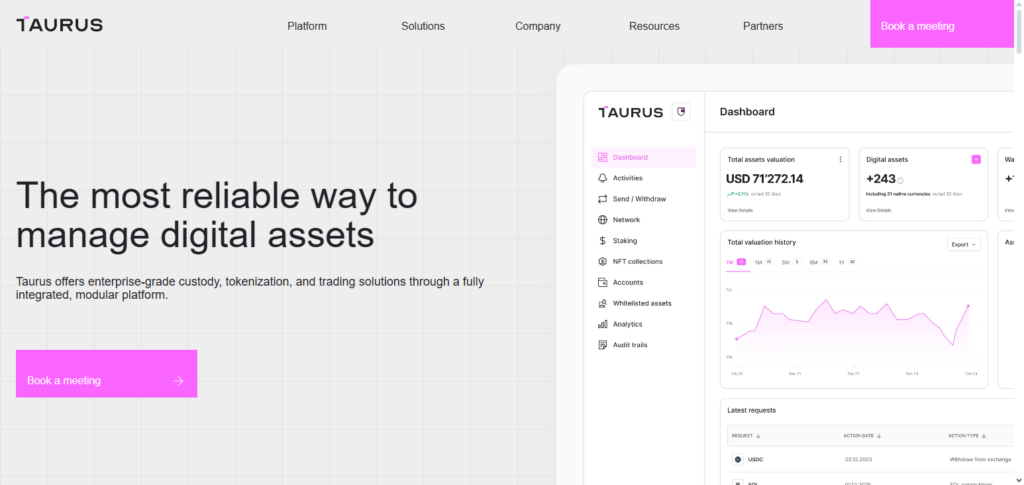

| Taurus Custody API | Digital asset custody and tokenization API supporting crypto, tokenized securities, governance rules, and compliance integrations. |

| Komainu Custody API | Institutional-grade custody API with multi-asset support, risk management controls, regulatory compliance, and secure asset segregation. |

1. Fireblocks API

Fireblocks is an API designed for institutions looking to custody and transfer digital assets securely and scalably. With the help of MPC technology, it mitigates the risk and vulnerability of private keys and maintains safe movement of assets across orders, wallets, and exchanges.

It offers automated enforcement of policies, compliance frameworks, and transaction workflows designed for Fintech. It integrates across different ecosystems and allows access to DeFi. It is one of the Best Crypto Custody APIs for Fintech Apps as it allows companies to operate securely and manage ultra-high value assets effortlessly. It is also very suitable for new companies and big players.

Fireblocks API Features, Pros & Cons

Features:

- Key management through MPC

- Wallets for institutions that are secure

- Workflows for transactions that are automated

- Settlement that crosses exchanges

- Integrations for DeFi

Pros:

- Management of your assets with primary and sub accounts

- Ability to transfer your assets rapidly, followed by an audit trail

- Straightforward integration for your developers

- Tools to ensure compliance are all-inclusive

- Grows to meet the demands of enterprises

Cons:

- More expensive for tiny companies

- New teams must undergo an adaptation phase

- Limited functions to fine tuned niche tokens

- Ecosystem dependency is pronounced

- Use cases are trivial, but the solution is over-engineered

2. Anchorage Digital API

Anchorage Digital API offers the unique opportunity to fully customize regulated and institutional-grade custody, staking and governance, and key management services. Anchorage secures your assets with industry-standard institutional Multi-Party Computation (MPC) and offers compliance-ready solutions to address your global compliance obligations.

Integration of the API into fintech apps allows seamless incorporation of asset storage, execution of transactions, and risk management functions. Anchorage is among the Mid-Paragraph of the Best Crypto Custody APIs for Fintech Apps because of the integration of our insurance, compliance, and workflow to provide the optimal solution for fintech firms that support substantial crypto holdings and wish to offer digital asset services to their customers.

Anchorage Digital API Features, Pros & Cons

Features:

- Custody that is fully regulated

- Protection of keys through MPC

- Services for governance and staking

- Compliance reporting that is audit-ready

- Support of an institutional scale

Pros:

- Compliance with regulations of all countries

- Protection of the assets is robust

- Automated staking, and yield earning

- Features that aid reporting are comprehensive

- Support is for enterprises

Cons:

- Onboarding time is longer

- Price is unfavorable for smaller applications

- Documentation for the API is challenging

- Builders who want to customize it have less room to do so

- Limited access to the public sandbox

3. Copper ClearLoop API

Copper’s ClearLoop API is the only solution that allows for secure off-exchange settlement while protecting the ability for Institutions to execute trades and retain custody of their assets to eliminate counterparty and transfer risk.

This solution will provide you with Collateral Management, Real-Time Transaction Tracking, and Compliance Monitoring. With custody of the funds, Fintech apps will be able to optimize their liquidity and improve operational efficiency during settlement.

Copper is seen as one of the Mid-Paragraph of the Best Crypto Custody APIs for Fintech Apps for its seamless integration with institutional trading desks and Exchanges and its unique ClearLoop solution that allows Fintech firms to reduce their operational risk and maintain compliance without sacrificing the speed and security of their crypto transactions.

Copper ClearLoop API Features, Pros & Cons

Features:

- Off-exchange settlement.

- Asset collateral management.

- Transaction insights.

- Automated compliance tracking.

- Real-time compliance tracking.

- Connectivity to multiple exchanges

Pros:

- Effectively limits counterparty risk.

- Accelerated settlement cycles.

- Enhanced liquidity workflows.

- Tailored for institutional trading.

- Reporting ready for audits.

Cons:

- Mostly suited for high-volume trading.

- Complexity during setup.

- Not the best fit for smaller fintech applications.

- Coverage of tokens is limited.

- Dependent on the partnerships with the exchanges.

4. BitGo Custody API

Institutional and multi-signature, BitGo Custody API is among the best for insured asset coverage, safeguarded wallets, and for the oversight of transactions. Companies that interface with various digital assets receive full trade compliance and policy-driven authorizations along with custodial frameworks and automation of compliant secured transfers.

BitGo is distinguished among the Best Crypto Custody APIs for Fintech Apps, enabling companies to hold and manage cryptocurrencies while protecting their assets and reducing operational risk through custodial frameworks that cover several jurisdictions.

BitGo Custody API Features, Pros & Cons

Features:

- Multi-signature wallets.

- Approvals driven by policy.

- Insured.

- Monitoring of transactions.

- Friendly for developers SDKs.

Pros:

- Exceptional security of assets.

- Insured protection.

- Policy configuration is clear.

- Integration is seamless for development teams.

- Extensive support for tokens.

Cons:

- Pricing is at enterprise levels.

- Steps for onboarding are quite complex.

- Some of the advanced functionalities are manual.

- Access to DeFi is limited.

- Overall, documentation may differ by region.

5. Coinbase Prime API

Customized to institutions, Coinbase Prime API is an all-inclusive custody, trading, financing, and portfolio reporting interface. Its regulated technology allows for the secure storage of digital assets, seamless transfers, and instantaneous reporting, a feature necessary for fintech applications.

The API is comprehensive, fully compliant, and equipped with risk management tools. It is also among the Best Crypto Custody APIs for Fintech Apps, allowing fintech companies to optimize the management of digital assets. Automated trade execution, custody, and reporting are included, offering seamless integrated solutions that satisfy compliance for digital assets.

Coinbase Prime API Features, Pros & Cons

Features:

- Custody and trading are combined.

- Tools for reporting on portfolio.

- Options for financing.

- Analytics for compliance and risk.

- Execution at market in real time.

Pros:

- Custody and trading are combined.

- A trusted and regulated brand.

- Reports are detailed in the dashboards.

- Can be scaled for applications at institutional level.

- Risk controls are integrated.

Cons:

- More expensive fees for lower volumes.

- Flexibility for customization is less.

- Fewer features for tokenization.

- Very reliant on the Coinbase ecosystem.

- Some regions have no or limited support

6. Gemini Custody API

What distinguishes Gemini Custody API from others are the SOC-certified cold storage, detailed audit trails, and regulatory compliance, all of which secure institutional assets. It accommodates multi-asset cold storage and insured cold storage and integrates easily with trading platforms.

Developers are able to set strict risk management policies and automated transfer rules. Gemini is recognized among the Best Crypto Custody APIs for Fintech Apps for operational excellence and security. Fintechs rely on Gemini to protect customer assets, manage compliance and regulatory obligations, and streamline portfolio management, earning Gemini the right to serve both enterprise and startup clients.

Gemini Custody API Features, Pros & Cons

Features

- SOC2 and cold vault storage

- Audit‑ready reporting

- Multi‑asset support

- Insured custody

- Secure transfer execution

Pros

- Strong compliance posture

- Insured asset protection

- Clear audit trails

- Reliable uptime

- Easy to integrate

Cons

- US‑centric focus

- No advanced trading features

- Enterprise onboarding required

- Not ideal for DeFi integrations

- Fees can be high for small apps

7. Ledger Enterprise API

To offer enterprise-grade custody solutions, Ledger Enterprise API incorporates hardware-secured key management and Ledger Vault technology. It allows multi-user and role-based access among governance workflows to fintech applications where asset security is paramount.

With the integration, automated transaction approvals and secure asset movement across networks are permitted.

Ledger is recognized in the industry with Best Crypto Custody APIs for Fintech Apps for high-security hardware-backed solutions for fintechs managing sensitive digital assets. Ledger’s combination of HSM technology, compliance features, and user-friendly API makes it ideal for companies with operational flexibility.

Ledger Enterprise API Features, Pros & Cons

Features

- Hardware‑backed key storage

- Ledger Vault governance

- Role‑based access control

- Multi‑user signing

- Secure transfer workflows

Pros

- Highest hardware‑based security

- Customizable governance policies

- Ideal for enterprise compliance

- Offline key protection

- Mature hardware ecosystem

Cons

- Pricey for small users

- Dedicated hardware required

- Setup complexity

- Limited token ecosystem

- Not ideal for fast rollout

8. Qredo API

Qredo API is MPC custody solution was the first to provide Qredo API is a decentralized cross-chain settlement and secured asset transfers without private key exposure. It has a policy transaction approval, multi-party authentication and operational risk reduction through settlement tracking.

Qredo APIs Fintech applications seamless custom access to exchanges and DeFi integrations. Mid-paragraph, it is considered one of the Most Fintech Apps Best Crypto Custody APIs. Qredo’s infrastructure has allowed confidently made Qredo to integrate governance flows and diverse secured digital assets to be managed across several blockchains.

Qredo API Features, Pros & Cons

Features

- Decentralized MPC custody

- Cross‑chain settlement

- Policy‑based approvals

- Multi‑party authentication

- Real‑time transaction visibility

Pros

- Cross‑chain support

- Decentralized security model

- Flexible approval workflows

- Reduced operational risk

- Fast settlement potential

Cons

- Smaller ecosystem

- Other setup steps that are more complex

- More limited integrations with fiat

- Expertise in development is needed

- Features are still growing in maturity

9. Taurus Custody API

Taurus Custody API supports Crypto and tokenized assets with built-in compliance policies, policy integration, and governance frameworks. It enables tokenized asset fintech applications to automate transfers, monitor transaction flows, and provide real-time reporting.

Its infrastructure compliance to regulatory frameworks and stored assets safely. Mid-paragraph it is considered among the Best Crypto Custody APIs for Fintech Apps. Taurus supports fintech companies in increased service offerings to tokenized assets in a managed secured seamless integration to both traditional and digital financial instruments.

Taurus Custody API Features, Pros & Cons

Features:

- Custody of multiple digital assets

- Supports tokenized assets

- Business governance processes

- Investments and activities of entities are regulated

- Reporting in real time

Pros:

- Asset and property tokenization

- Compliance features included

- Logs available for auditing

- Workflows are flexible

- Markets with regulations are competent

Cons:

- Users who are small pay more

- Accessibility in multiple countries is an issue

- Almost no developers

- Features in DeFi are limited

- Time taken for onboarding

10. Komainu Custody API

Komainu Custody API provides institutional-grade custody combined with multi-asset capability, safe asset segregation, as well as custody with compliance to regulation.

Risk management features, policy-driven approvals, and reporting created with audits in mind make it fit for purpose in fintech. Developers can automate transaction workflows with the ability to maintain security. Halfway through the paragraph, it name drops one of the Best Crypto Custody APIs for Fintech Apps and assists businesses in compliance to regulation with protecting their user’s assets.

Komainu’s strong infrastructure creates safe storage for assets, improved efficiency, and better flexibility for fintech companies to adapt to the management of digital assets in a complex and multi-jurisdictional setup.

Komainu Custody API Features, Pros & Cons

Features:

- Asset segregation for institutions

- Supports multiple assets

- Permissions required for policies

- Reporting on compliance

- Frameworks for risk are available

Pros:

- Compliance is regulatory and strong

- Asset segregation is safe

- Controls for risks are institutional

- Reports are available for audits

- Policies on secure transfer are available

Cons:

- Model of pricing is for large enterprises

- Applications that are small are not ideal

- Smaller support for tokens

- Complexity of onboarding is high

- Prioritize DeFi

Conclusion

Choosing the appropriate custody API is essential for fintech apps looking to guarantee security, compliance, and operational effectiveness in today’s quickly changing digital asset ecosystem.

Strong solutions for institutional and financial requirements are provided by platforms like as Fireblocks, Anchorage Digital, Copper ClearLoop, BitGo, Coinbase Prime, Gemini, Ledger Enterprise, Qredo, Taurus, and Komainu. Features including MPC-based key management, cold storage, off-exchange settlement, policy-driven approvals, and regulatory compliance are all offered by these APIs.

Fintech businesses may secure user funds, optimize workflows, and confidently grow their crypto services while upholding dependability and confidence by including these Best Crypto Custody APIs for Fintech Apps.

FAQ

What is a crypto custody API?

A crypto custody API is a secure interface that allows fintech apps and institutions to manage, store, and transfer digital assets programmatically. It ensures safe key management, transaction approval workflows, and compliance with regulatory requirements, reducing risks associated with crypto asset handling.

Why do fintech apps need custody APIs?

Fintech apps require custody APIs to safeguard digital assets, automate transfers, maintain compliance, and integrate seamlessly with exchanges or DeFi platforms. These APIs help reduce operational risks and ensure secure asset management for both retail and institutional clients.

Which are the best crypto custody APIs for fintech apps?

The leading custody APIs include Fireblocks, Anchorage Digital, Copper ClearLoop, BitGo, Coinbase Prime, Gemini Custody, Ledger Enterprise, Qredo, Taurus, and Komainu. Each offers unique features such as MPC key management, off-exchange settlements, multi-signature wallets, and regulatory compliance tools.

How do custody APIs ensure security?

Custody APIs implement advanced security mechanisms like MPC (Multi-Party Computation), hardware security modules (HSMs), multi-signature wallets, cold storage, and policy-based transaction approvals. These features prevent unauthorized access, key theft, and operational errors.

Can fintech apps integrate multiple custody APIs?

Yes, fintech applications can integrate multiple custody APIs to diversify asset storage, enhance security, or connect with different exchanges. This approach helps manage liquidity, reduce single-point risks, and optimize transaction efficiency.