The Top Crypto Treasury Yield Optimization Platforms will be covered in this post. By automating yield techniques, compounding rewards, and controlling risk across various DeFi protocols, these solutions assist treasuries in optimizing yields on cryptocurrency assets.

Businesses and investors can effectively develop their funds while lowering manual labor and guaranteeing safe, optimal returns by utilizing these technologies.

Why Use Crypto Treasury Yield Optimization Platforms

Maximize Returns Automatically: These programs automate the moving of funds across DeFi protocols to achieve the highest yields. This frees treasury managers of the tedious task of tracking multiple programs manually for their performance.

Reduce Operational Complexity: Asset and strategy DeFi multi-asset strategy management gets complicated. Yield optimization programs automate compounding and reallocating funds to less complex approaches.

Diversify Risk Across Protocols: Spreading assets across multiple lending, staking, and farming protocols helps treasuries mitigate the single platform risk and assures relatively stable returns.

Save Time and Effort: Automation means that treasury teams do not need to monitor setups constantly and can focus on strategy and other operational priorities.

Access Professional-Grade Strategies: Risk-adjusted efficient yield generation is no longer the preserve of professional investors. Platforms now make it available to all treasuries.

Enhance Transparency and Reporting: These platforms enhance analytic capabilities, usually with multiple dashboards for performance, risk tracking and management decision optimization.

Benefits of Crypto Treasury Yield Optimization Platforms

Maximized Return: Allows treasuries to earn yield optimally as automates allocation across several DeFi protocols.

Time Saving: Automates time-consuming treasury management tasks such as compounding, rebalancing, and switching protocols.

Risk Mitigation: Allocates funds across different protocols and strategies to not be overexposed to a single protocol, asset and reduces overall risk.

Greater Transparency: Detailed dashboards and analytics, and reporting tools enable users to track performance and yield and risk metrics.

Access to Premium Yield Strategies: Automated leverage, risk strategies and multi asset optimization yield strategies can be hard to manually implement. The platform then able to provide such strategies.

Liquidity Flexibility: Treasuries can yield positively when funds are not in placed, meeting operational demands.

Operational Efficiency: In multi-chain environments, transaction costs are lowered and strategy is optimized as funds are moved or compounded.

Flexible and Scalable: Grows treasury assets, tapering to small like assets and large institutional assets.

Key Point & Best Crypto Treasury Yield Optimization Platforms List

| Platform | Key Points |

|---|---|

| Yearn Finance | Automated yield optimization across DeFi protocols; maximizes returns for users. |

| Beefy Finance | Multi-chain yield optimizer; supports auto-compounding of crypto assets. |

| Instadapp | Smart wallet for DeFi; allows leverage, automation, and asset management. |

| DeFi Saver | Advanced DeFi management; supports automation, portfolio rebalancing, and leverage. |

| Harvest Finance | Yield farming aggregator; auto-compounds user rewards for maximum yield. |

| Autofarm | Cross-chain yield optimizer; focuses on auto-compounding and low fees. |

| Idle Finance | Flexible yield management; optimizes stablecoins and crypto lending strategies. |

| Vesper Finance | Easy-to-use yield platform; offers various “grow pools” for passive income. |

| Balancer | Automated portfolio manager and liquidity provider; allows custom LP strategies. |

| Compound Treasury | Institutional-focused yield platform; provides lending and yield management tools. |

1. Yearn Finance

One of the most well-known DeFi yield optimization solutions is Yearn Finance. To maximize yield for users, it streamlines the process of transferring money between several lending protocols. By automatically compounding returns across protocols including Aave, Compound, and Curve, its “Vaults” technique enables cryptocurrency treasuries to generate passive income.

Treasury managers can profit from highly optimized yield strategies while minimizing manual intervention with the help of the best cryptocurrency treasury yield optimization platforms, such as Yearn Finance. Institutional and large-scale DeFi investors now turn to Yearn Finance because of its modular solutions and governance-driven approach.

Yearn Finance Features, Pros & Cons

Features:

- Automated yield creation, based on the vault strategy.

- Self-compounding of gains.

- Support for multiple protocols (Aave, Compound, Curve).

- Strategies determined through governance.

- Asset allocation based on risk metrics.

Pros:

- Yield is maximized.

- Manual management is significantly decreased.

- Support is available from a large community.

- Platform has undergone auditing and is trustworthy.

- Supports multiple asset types.

Cons:

- Inefficiency from high gas fees on Ethereum.

- Beginning users may find it difficult.

- Protocols that integrate with the platform must be relied upon.

- Contracts in the system are at risk.

- Support is only available for a certain range of assets.

2. Beefy Finance

Beefy Finance is a multi-chain yield optimizer that automates the compounding of returns to liquidity providers. Beefy integrates with many blockchains and protocols to allow crypto treasuries to efficiently and effectively capture high-yield farming opportunities. Beefy Finance is one of the best crypto treasury yield optimization platforms due to its flexible and secure service.

Users can stake their assets to various optimized vaults without the need for continuous manual tweaking. This characteristic auto-compounding makes Beefy Finance perfect for any user, instutional or retail, that is looking to passively income compounding from a treasury highly optimized from multiple defies networks.

Beefy Finance Features, Pros & Cons

Features:

- Yield optimizer for multiple chains.

- Vaults that automatically compound.

- Numerous DeFi protocols are supported.

- Low fee structure.

- Cross-chain asset compatibility.

Pros:

- Flexibility across multiple chains.

- Yield is increased.

- Treasury management is simple and easy.

- Compounding is automated.

- Tokens are widely supported.

Cons:

- There is a risk of smart contracts failing.

- Strategies cannot be customized.

- There is a risk of impermanent loss.

- The platform is relatively new, and untested.

- Platform is built on a singular foundation.

3. Instadapp

Instadapp is a smart DeFi OS that enables users to manage, leverage, and optimize their crypto assets across multiple protocols. It provides various automated strategies, including yield farming, leverage management, and asset rebalancing for treasury optimization.

As one of the Best Crypto Treasury Yield Optimization Platforms, Instadapp augments treasury management and operation by simplifying a multitude of complex maneuvers in the DeFi space to a single click.

Treasury managers are provided with the means to efficiently and effectively deploy, track, and manage their capital in a secure environment while optimizing for risk, creating a top platform for crypto professional asset management. Its interoperability with all major lending protocols makes it operationally efficient while providing enhanced yield opportunities.

Instadapp Features, Pros & Cons

Features:

- There is a smart DeFi OS.

- Integrates with multiple protocols.

- Automated leverage and asset management.

- Includes access to risk management tools.

- Offers portfolio tracking and analytics.

Pros:

- DeFi operations are simplified for the user.

- Helps in using resources effectively.

- Decrease in mistakes.

- Higher-order functionality.

- Works with all significant platforms.

Cons

- Needs learning DeFi first.

- Minimal yield production.

- Needs connected systems.

- The UI is complicated.

- Threats from smart contracts.

4. DeFi Saver

DeFi Saver is one of the most sophisticated platforms built for managing DeFi protocols with a primary focus on automation, portfolio rebalancing, and yield optimization. Users can create customized automation rules such as refinancing loans, managing leverage, or compounding return.

DeFi Saver made it to the tier of the Best Crypto Treasury Yield Optimization Platforms because it helps treasury managers with minimal supervision, blocking the opportunity for funds to be utilized in the most profitable yield.

This platform is undoubtedly ideal for treasury automation, as it conducts sophisticated yield-risk trade-offs, enabling most of the risk to be eliminated, and helps maximize returns. It has integrated support for Aave, Compound, and MakerDAO, which helps yield diversification and thus a more stable return.

DeFi Saver Features, Pros & Cons

Features:

- Manages the portfolio automatically.

- Adjusts the loan terms and leverage.

- Strategy for rebalancing.

- Support for all protocols.

- Certain rules for risk management.

Pros:

- Less manual work.

- Efficient leverage optimization.

- Supports all lending protocols.

- Risk minimized through automation.

- Great and dependable analytics.

Cons:

- Higher-level knowledge is needed.

- Automated processes come with costs.

- Limited asset support.

- Relies on DeFi liquidity.

- Vulnerabilities in smart contracts.

5. Harvest Finance

Harvest Finance is a yield farming aggregator that optimizes returns by implementing automatic compounding strategies. Harvest pools users’ funds into high-performance farming strategies and reinvests the rewards on a continuous basis. For this reason, Harvest is one of the Best Crypto Treasury Yield Optimization Platforms as it offers treasury managers a low supervision option to yield generation across multiple DeFi protocols.

It simplifies the process of implementing complex farming strategies, and in doing so, lowers the risk and operational task burden. The trust that both the retail and the institutional crypto treasury operations have towards Farming Finance stems from the transparent yield distribution and the opportunity to empower governance through the community, which has built a consistent base of passive yield income.

Harvest Finance Features, Pros & Cons

Features:

- Asset farming optimizers.

- Auto-composition of rewards.

- Works with many protocols.

- Clear and open governance.

- Strategies from the community.

Pros:

- No effort needed to earn.

- Rewards are gained in a clear manner.

- Supported asset diversity.

- Decreased operational costs.

- Optimized growth of treasury.

Cons:

- Contracts are prone to risk.

- Unstable loss.

- Health of the protocol depends on.

- Fewer advanced capabilities.

- Volatile market exposure.

6. Autofarm

Autofarm lets users to grow their crypto treasury via auto-compounding methods. Autofarm is a cross-chain yield optimizer that accepts users from multiple blockchains. The company is recognized among the Best Crypto Treasury Yield Optimization Platforms as it allows users to reduce fees and grow their treasury funds through efficient management.

Auto farm’s diversifed income via DeFi integrations lets users bypass and minimize the growing opportunity costs of income-generating crypto assets and strategies. Easy-to-use systems and strong vaults make Autofarm a great choice to crypto treasuries aiming to optimize return and risk management across multiple assets and chains at the same time.

Autofarm Features, Pros & Cons

Features:

- Yield optimization for several chains.

- Vaults that auto-compound.

- Supports many protocols.

- Transactions cost very little.

- Supports stablecoins & crypto assets

PROS:

- Supports multiple chains.

- Yield maximization is efficient.

- Assets are deployed with ease.

- Strategy reporting is transparent.

- Treasury growth is hands-off.

CONS:

- Less advanced strategy customization.

- Risk of smart contract failure.

- Relies on other protocols.

- Less liquidity pool risk.

- Lesser-known community.

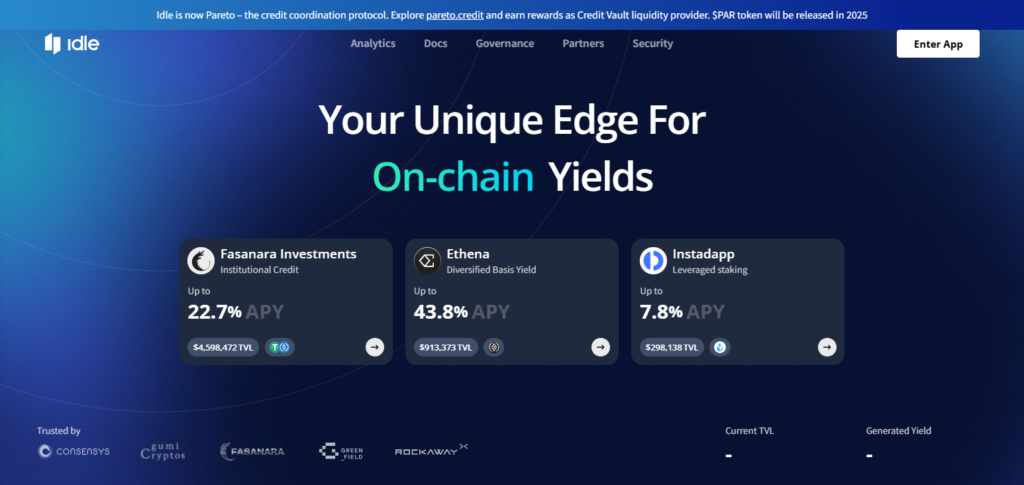

7. Idle Finance

Idle Finance increases the yield on stablecoins and crypto lending. Idle Finance automates the process of dynamically reallocating your funds and strategies to the most yield-optimizing crypto lending protocols and pools. Idle Finance is recognized as one of the Best Crypto Treasury Yield Optimization Platforms and allows treasury managers to automate their strategies within a certain liquidity range.

The system’s risk allocation gives the treasury manager the choice of conservative, neutral, or aggressive in terms of risk level. Idle Finance gives your treasury a balanced and customized crypto strategy through algorithms, diversified blockchains, protocol and stable coin lending to yield optimize your treasury in a secure and efficient way.

Idle Finance Features, Pros & Cons

Features:

- Yield optimization on stablecoins and other crypto.

- Funds are dynamically reallocated.

- Offers risk-adjusted strategies.

- Automatic return compounding.

- Integrates with multiple different protocols.

Pros:

- Offers a variety of strategies for yield.

- Returns are adjusted based on risk.

- Income is passive with no oversight.

- Other assets are supported.

- Clear and concise analytics shared.

Cons:

- Fewer assets offered for high growth.

- Complex for beginners.

- Relies on other protocols for growth.

- Smaller community for support.

- Risks related to smart contracts.

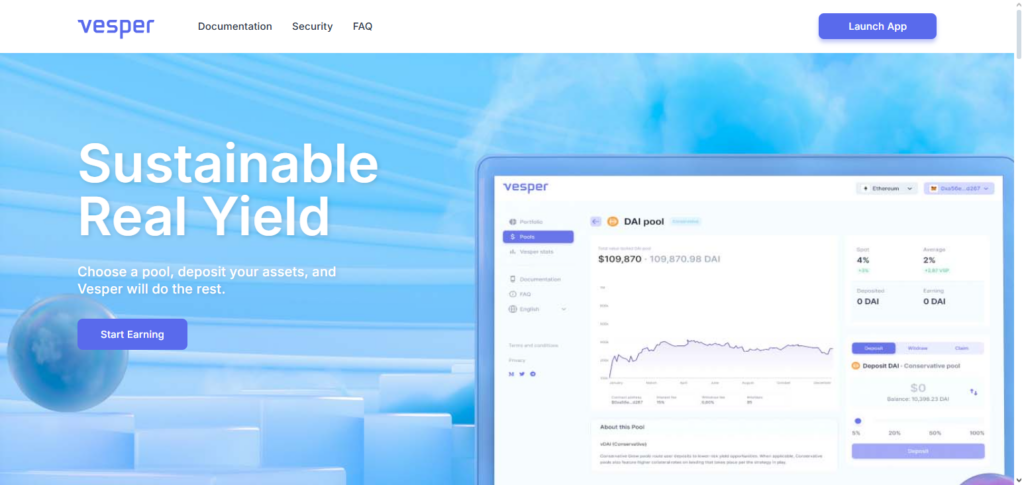

8. Vesper Finance

Vesper Finance is a very engaging yield platform that facilitates access to the “grow pools”, where you get auto-compound yield returns on differing assets. Vesper Finance is focused on yield generation for crypto treasuries which has been regarded as one of the Best Crypto Treasury Yield Optimization Platforms. Vesper Finance’s strategies are optimized for volatile as well as stable coins.

Treasury managers get the integration of automated compounding and risk-adjusted allocations to boosted to offset the operational burden. Vesper Finance is a reputable and reliable platform where professional treasuries get more to set and forget on yield growth.

Vesper Finance Features, Pros & Cons

Features:

- ‘Grow Pools’ for automated return compounding.

- Integrates with many protocols.

- Both stable and volatile assets are supported.

- Offers different strategies for different levels of risk.

- Improvements voted on by the users.

Pros:

- Offers a simple interface.

- Generates yield automatically.

- Different asset types are supported.

- Development is transparent.

- Treasury growth is maximized.

Cons:

- Advanced tools limited.

- Smaller community.

- Risks of losing assets impermanently.

- Less support for multiple chains.

- Heavily dependent on the health of the protocols.

9. Balancer

As a crypto portfolio manager and provider of automated of Liquidity Balancer is a crypto treasury manager that can offers active portfolio management while treasury Managers optimization of their yield Balancer is able to manage top Video treasury’s.

Once a treasury is able to decide on a stragety that a Balancer can use to earn trading fees and provide the treasury with a yield through Balancers defi tools. Treasury integrates Balancers defi tools Treasuries while trading floor and using the Balancer for a yield on there crypto assets def eliminate a trade on Capital for the treasury.

Balancer reduces the Crypto Treasury Managers Manual effort on there Capital and for Track loss. Crypt treasury’s are seek for yield and it’s a complete portfolio management.

Balancer Features, Pros & Cons

Features:

- Automated management of portfolios

- Availability of customizable liquidity pools.

- Capitalizing on fee earning through liquidity providing.

- Keeping with the automated rebalancing.

- Compatibility with the DeFi yield earning protocols.

Pros

- Yield-enhanced portfolio optimization.

- A liquidity providing strategy with flexibility.

- A reduction of manual rebalancing.

- Passive income from fees.

- Pooling of multiple tokens is supported.

Cons

- The risk of impermanent loss.

- Complexity that is not beginner friendly.

- The risk of smart contract vulnerabilities.

- Network fees that are particular to the Ethereum blockchain.

- Performance monitoring to keep watch on the pool.

10. Compound Treasury

Compound Treasury is a yield platform that is focused on institutions and offers various lending and yield management offerings for crypto treasuries. It provides access to a range of DeFi lending protocols and offers varying degrees of safety and compliance.

Ranked one of the Best Crypto Treasury Yield Optimization Platforms, Compound Treasury allows treasuries to manage liquidity risk and earn interest on their assets, including USDC, DAI, and ETH.

Compound Treasury’s transparent interest accrual and integration with Compound’s lending protocols make it a trustworthy candidate for advanced treasury management. It offers a comprehensive array of reporting facilities, interest management automation, and institutional-grade secured treasury ranges for advanced treasury management, and is built to yield the highest returns with the least effort.

Compound Treasury Features, Pros & Cons

Features:

- Yield-earning platform is of institutional grade.

- Lending and borrowing are available.

- Interest is accrued with full transparency.

- Management of yield is automated.

- The compound protocol is integrated.

Pros:

- Designed with institutions in mind.

- Security and compliance are in place.

- Interest grows with no active involvement.

- Reporting is fully transparent.

- Effective management of treasury.

Cons:

- Types of assets are limited.

- Designed for institutional use primarily.

- The compound protocol is a key dependency.

- Retail users have limited options.

- Risk from contracts that are self-executing.

Conclusion

Optimizing your crypto treasury yield has never been easier. With automation and simplification of previous manual labor tasks, yield farming becomes manageable for top protocols like Yearn Finance, Beefy Finance, Instadapp, and DeFi Saver, while others like Harvest Finance, Autofarm, and Idle Finance yield farming automation is further developed to efficiently manage your treasury for steady income. Compound Treasury, Vesper Finance, and Balancer also provide advanced segregated supplies for DeFi treasury management.

These protocols provide the best yield optimization in the crypto treasury world, helping treasury managers to further profitability, decentralize the full treasury management process, and relax while the system fully manages the deployed assets to the best of its capabilities, and also allows for advanced treasury liquidity and sustainable growth within the protocols core of DeFi.

FAQ

What are crypto treasury yield optimization platforms?

Crypto treasury yield optimization platforms are DeFi tools that help individuals, businesses, and institutions maximize returns on their crypto holdings. They automate strategies such as lending, staking, liquidity provision, and yield farming across multiple protocols. By optimizing capital allocation and auto-compounding rewards, these platforms ensure treasuries earn the highest possible yields with minimal manual intervention.

Why are these platforms important for crypto treasuries?

These platforms enable treasury managers to grow assets efficiently while reducing operational complexity. Manual yield farming can be time-consuming and prone to errors, but optimization platforms automatically monitor, adjust, and compound returns. This ensures liquidity is maximized, risks are minimized, and treasuries consistently benefit from the evolving DeFi ecosystem.

Which are the best crypto treasury yield optimization platforms?

Some of the leading platforms include Yearn Finance, Beefy Finance, Instadapp, DeFi Saver, Harvest Finance, Autofarm, Idle Finance, Vesper Finance, Balancer, and Compound Treasury. Each offers unique features, from automated vault strategies and multi-chain support to portfolio management and institutional-grade security, making them top choices for treasury managers.