This article focuses on the best alternatives to Bucksbunny Exchange for users who are looking for more flexible, feature-rich, and safer crypto trading platforms.

As traders look for alternatives to Bucksbunny Exchange, it is essential to know various centralized and decentralized options to choose platforms for better security, lower fees, more sophisticated trading instruments, and broader crypto asset coverage.

Key Points & Bucksbunny Exchange Alternatives

| Exchange | Key Point |

|---|---|

| Zengo | MPC wallet security with biometric login |

| Uniswap | Leading decentralized exchange with Ethereum support |

| dYdX | Advanced derivatives trading with decentralized control |

| PancakeSwap | Popular DEX on Binance Smart Chain with low fees |

| Vertex Protocol | Cross-margin trading and decentralized risk management |

| edgeX | Multi-chain decentralized exchange with strong privacy |

| Hyperliquid | High-speed decentralized trading engine |

| CoinDCX | India’s largest crypto exchange with beginner-friendly UI |

| Kraken | Global exchange known for strong security and fiat support |

| Binance | World’s largest exchange with diverse trading options |

10 Bucksbunny Exchange Alternatives

1. Zengo

Zengo excels as an alternative to Bucksbunny Exchange as it offers the first crypto trading platform as a keyless crypto wallet with trade in, and security and usability features all packed in one app.

Zengo doesn’t trade user private keys like other exchanges. Instead Zengo employs an innovative MPC cryptography coupled with biometry (your face) that abaondons the burden of private key loss, and makes recovery a breeze, even with a lost device.

Zengo offers an ultra simple user interface to buy, sell, send, receive, and trade numerous types of crypto in the wallet.

Zengo Features

Keyless MPC Wallet – Zengo uses Multi-Party Computation to create an MPC wallet which helps to mitigate the risks associated with loss and theft.

Biometric Authentication – Use face ID or fingerprint to access funds instead of having to remember complicated seed phrases.

Built-in Swaps – Swap assets instantly within the Zengo wallet and keep funds with Zengo.

Self-Custody Control – Zengo never centralizes or takes control of your access keys.

| Pros | Cons |

|---|---|

| Keyless MPC wallet increases security | Fewer advanced trading tools |

| Biometric recovery, no seed phrase risk | Limited token selection vs big exchanges |

| Simple interface for beginners | Not ideal for high-frequency traders |

| Built-in swapping without custody | Liquidity may be lower than major DEXs |

2. Uniswap

Uniswap is a frontrunner among Bucksbunny Exchange competitors since it functions as a fully decentralized automated market maker (AMM) instead of a centralized exchange.

Thus, users can swap tokens directly from their wallets with no middlemen involved. Users can also create liquidity pools where they contribute their tokens and receive rewards, which promotes liquidity and market depth.

Uniswap caters to a multitude of tokens across Ethereum and other EVM compatible chains, and tends to list projects earlier than centralized exchanges, allowing their users to access new tokens sooner than other exchanges.

Its blockchain based approach combined with customer oriented features such as on-chain trading, enhanced transparency, and user’s ability to control their trading flow, sets it apart from the conventional order-book exchanges.

Uniswap Features

Automated Market Maker (AMM) – The trading takes place through liquidity pools which provide an alternative to the use of order books.

Permissionless Tokens – Users are free to add any ERC20 token to the liquidity pool.

Direct Wallet Trading – Zengo offers seamless trading access from your wallet (eg. MetaMask) with no need for signups.

Decentralized Governance – Proposals for protocol upgrades and modification of fees are put forth by holders of the governance token, UNI.

| Pros | Cons |

|---|---|

| Truly decentralized, wallet-to-wallet | Gas fees can be high on Ethereum |

| Permissionless token listings | No fiat support |

| Deep DeFi ecosystem integration | Slippage on low-liquidity pools |

| Community governed | No native customer support |

3. dYdX

dYdX is also a potent alternative to the Bucksbunny Exchange since it also has decentralized derivatives and offers complex leveraged trading without the need for a central intermediary.

Users of dYdX can open perpetual contracts and other markets with high leverage. Built on its proprietary innovation within the Cosmos blockchain, dYdX lets customers maintain complete control over their trading assets.

Unlike with traditional exchanges, where assets are kept by the platform, dYdX offers a non-custodial structure.

On-chain settlements and community governance via the DYDX token provide strong risk control and a trust-minimized structure.

dYdX also combines professional trading features with a high level of decentralization, a unique characteristic that makes it one of the standout platforms.

dYdX Features

Decentralized Perpetuals – Trade derivatives (perpetual contracts) without having to rely on a central counterparty.

Non-Custodial Trading – Your funds stay in your wallet until the trade is executed.

Margin & Leverage – These are additional features for more adjustable risk positions.

Community Governance – The holders of the DYDX token are the ones who are accorded the ability to make decisions on the governance of the parameters of the protocol.

| Pros | Cons |

|---|---|

| Advanced perpetual & derivatives trading | More complex for beginners |

| Non-custodial with on-chain settlement | Limited spot markets |

| Strong risk management tools | Requires learning margin concepts |

| Community governance | Fees higher than simple DEXes |

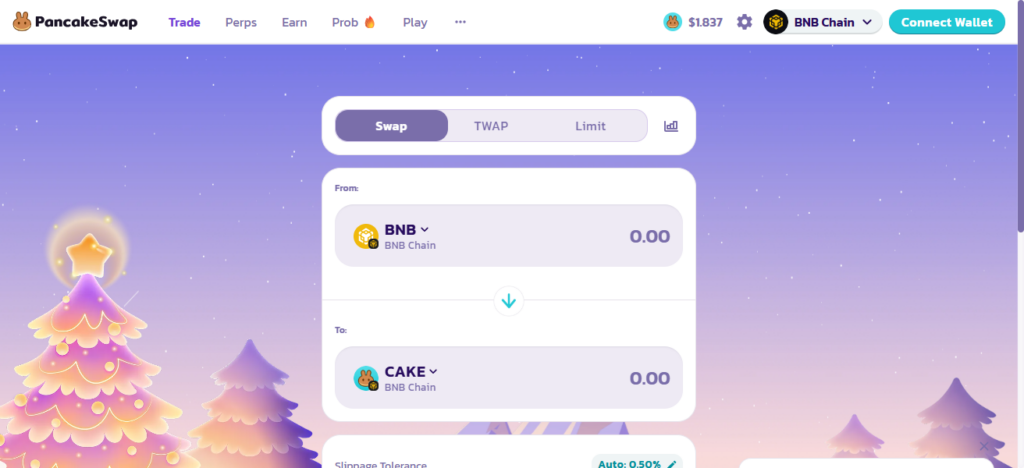

4. PancakeSwap

Decentralized Automated Market Makers (AMMs) such as PancakeSwap, Secured as one of the notable Bucksbunny Exchange competitors as they provide fast, reliable, and low token swaps over the Binance Smart Chain.

Additionally, PancakeSwap is not like the other classic exchanges because the users have control over the tokens they provide and gain rewards by yield farming and staking the CAKE token.

Furthermore, the PancakeSwap platform also provides various gamified features like NFTs, prediction markets, and lotteries.

All of this, combined with the community features that let users manage their control, provide a lot of innovative tools that assist with their DeFi needs. All of this is what’s providing PancakeSwap with an edge over the more centralized competitors.

PancakeSwap Features

AMM on BNB Chain – Offers swaps which are much quicker and cheaper when compared to Ethereum.

Yield Farming & Staking – Providing liquidity, CAKE rewards can be earned.

Gamification – Lottery, prediction markets, and NFT collectible achievements.

Cross-Chain Bridges – Offers Cross Chain access to more liquidity.

| Pros | Cons |

|---|---|

| Low fees & fast on BNB Chain | Centralized chain dependency |

| Yield farming & staking options | Token quality varies widely |

| Gamified features (lottery, NFTs) | Impermanent loss risk |

| Large DeFi community | Limited to BNB ecosystem |

5. Vertex Protocol

Among the alternatives to Bucksbunny Exchange, Vertex Protocol is unique because it combines the speed and accuracy of centralized trading with the security and decentralization of on-chain settlement.

Because it is built on Arbitrum, it offers the unique, low-latency trading of a high-performance off-chain order book with on-chain execution across several products (spot, perpetuals, and money markets) through a single integrated interface.

Additionally, its cross-margin system enhances capital efficiency and flexibility by allowing traders to manage multiple positions from a single collateral pool.

This blend of off-chain and on-chain solutions, along with deep liquidity and self-custody, makes it a better option than other centralized exchanges.

Vertex Protocol Features

Cross-Margin – Allows multiple positions to be supported by a single pooled collateral.

Perpetual & Spot Markets – Trade derivatives and spot pairs which are more advanced.

Arbitrum Integration – Offers fast finality and low-cost transactions.

Hybrid Order Book – On-chain settlement merged with off-chain speed.

| Pros | Cons |

|---|---|

| High-speed hybrid order book | Newer, less proven network |

| Cross-margin efficiency | Requires understanding DeFi |

| On-chain settlement | Liquidity can vary by market |

| Supports spot & derivatives | Not widely supported apps |

6. edgeX

EdgeX is a very good Anchor Bucksbunny Exchange alternative as it provides users with the ability to trade both perpetual and spot contracts at a more than competitive institutional level speed and liquidity while giving users the full control of their own assets.

EdgeX is built on a Layer-2 Ethereum based solution, where it offers a unique on-chain orderbook with ultra low latency execution and deep liquidity.

Users can trade cross-chain and place sophisticated orders while still being able to trade derivatives without having to relinquish custody to a centralized entity.

This hybrid structure of EdgeX is able to bring the performance of a centralized exchange while having the security and transparency of a decentralized exchange, which is why it will appeal to the more serious traders.

edgeX Features

Layer-2 Cost & Speed Efficiency – Trades on Ethereum L2 are fast and cheap.

Non-Custodial Execution – Until execution, traders retain custody.

On-Chain Limit Orders – Orders are executed on the chain.

Deep Liquidity – Suitable for large volume trading.

| Pros | Cons |

|---|---|

| Fast, on-chain order book | Complex for casual users |

| Deep liquidity on Layer-2 | Limited asset range vs global CEX |

| Advanced orders & non-custodial | New ecosystem risk |

| CEX-like experience in DeFi | Learning curve |

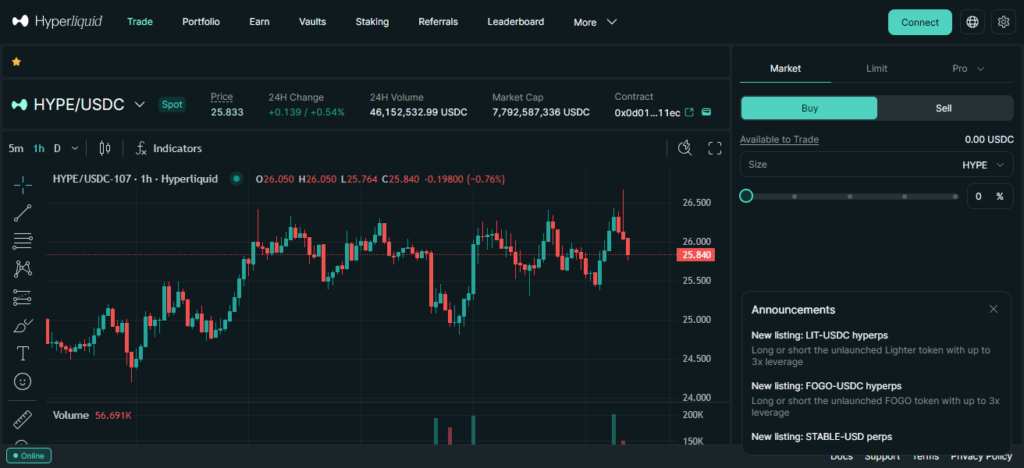

7. Hyperliquid

Hyperliquid stands out as a suitable alternative to Bucksbunny Exchange because it is a high-performing decentralized perpetual

Trading platform that operates on its own Layer-1 blockchain and merges the speed and functionalities of centralized exchanges with genuine on-chain transparency and self-custody.

Hyperliquid, unlike its competitors that deploy off-chain order books and custodial wallets, utilizes an order book that is on-chain, providing sub-second execution with ample liquidity.

This on-chain order book allows traders to place sophisticated orders and access leveraged trading markets directly from their wallets. Hyperliquid offers a unique combination of performance and decentralization.

Hyperliquid Features

Perpetual Markets – Derivatives trading built-in.

On-Chain Order Book – Blockchain settlement accompanies full transparency.

Sub-Second Execution – Orders pick and match fast for traders’ professions.

Native Layer-1 Blockchain – Made for trading with high speeds.

| Pros | Cons |

|---|---|

| Sub-second on-chain execution | Novel Layer-1 with adoption risk |

| Order book transparency | Smaller community than big DEXs |

| Self-custody with deep liquidity | Fewer supported tokens |

| Professional trading tools | Less beginner friendly |

8. CoinDCX

CoinDCX is a well-known alternative to Bucksbunny Exchange. It combines easy Indian Rupee (INR) access with a variety of supported cryptos and numerous earning features. It is one of India’s biggest exchanges and enables users to buy, sell, and trade over 500 crypto coins.

Users also have access to seamless crypto deposits and withdrawals which makes investing in crypto easy for new and experienced users.

CoinDCX also has features such as staking, lending, leveraged futures, and its new Web3 Mode which allows users to access and trade 1,000+ DeFi tokens from the app. This platform makes trading and investing in crypto easy for everyone.

CoinDCX Features

INR Support – Convenient deposit and withdrawal options in Indian rupees.

Wide Asset Range – Trade thousands of different cryptocurrencies.

Earn & Stake – Assortments like staking, lending, and other fixed-income offers.

Beginner to Pro Modes – Platforms designed for every level of expertise.

| Pros | Cons |

|---|---|

| Easy INR deposits/withdrawals | India users only for INR features |

| Wide crypto support | Centralized custody |

| Beginner & advanced modes | Fees can vary |

| Staking & lending products | Not DeFi native |

9. Kraken

Another veteran industry player that deserves mention as a Bucksbunny Exchange alternative is Kraken. They offer good security, compliance with regulations, and a variety of trading options on a reliable worldwide platform.

Kraken focuses on safety by keeping the majority of user funds in cold storage and employing authenticational security measures.

Kraken is also integrated with multiple fiat currencies, accepts deposits and withdrawals, has spot trading, margin and futures trading, and offers a variety of pricing options that are lower for users who trade more.

Combined with their reputation, their diverse trading options, and their advanced trading tools, Kraken is a better option than many other exchanges.

Kraken Features

Regulated & Secure – Excellent compliance with regulations, and strong cold storage protection.

Multiple Markets – Spot, margin, and futures are available.

Fiat Support – Deposit and withdraw in all major currencies.

Advanced Tools – Professional level charting, and order types, along with reporting.

| Pros | Cons |

|---|---|

| Strong regulatory compliance | Verification can be slow |

| High security reputation | Not decentralized |

| Spot, margin, futures available | Fees higher than some competitors |

| Fiat support | Limited DeFi integration |

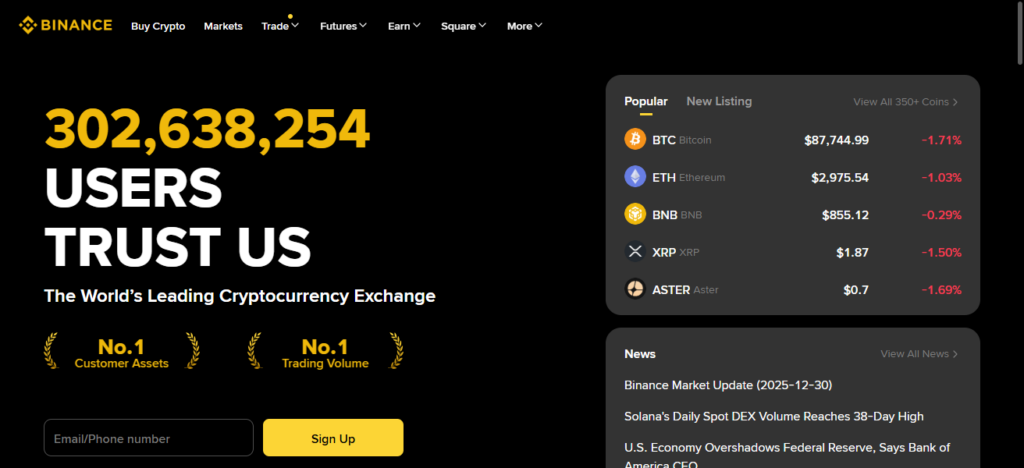

10. Binance

Binance constitutes the major alternative to Bucksbunny Exchange because of the combination of its extensive global liquidity, range of trading products, and powerful ecosystem

features all in one platform. It has hundreds of supported cryptocurrencies divided into different markets under spot, margin, futures, and options, and has low trading fees.

Advanced order types appeal to both beginner traders and professional traders. In comparison to typical exchanges,

Binance features deep liquidity and a broad range of products which makes it a versatile and competitive choice. Integrated ecosystem products like staking, NFT marketplace, launchpad for new tokens, and fiat on-crypto off-ramps give users a lot more than trading.

Binance Features

Massive Liquidity – Vast and unmatched depth of markets for hundreds of tradeable assets.

Diverse Products – Spot, futures, options, staking, and savings.

Low Fees – Incredibly low to average competitor fees.

Global Ecosystem – Extensive marketplace for tradeable NFTs, and emergency launch offerings.

| Pros | Cons |

|---|---|

| Huge liquidity & token range | Regulatory scrutiny in some regions |

| Many products (spot, futures, options) | Custodial exchange |

| Low fees | Can be complex for new users |

| Ecosystem (staking, NFT, launchpad) | Centralized risks |

How To Choose Bucksbunny Exchange Alternatives

- Security and custody: Determine if the exchange is custodial/non-custodial, if they use cold storage, or have wallet security features.

- Trading preferences: Select an exchange that best matches your needs – spot trading, derivatives, leverage, or simple swaps.

- Fees and costs: Ensure you take into consideration trading, gas, and withdrawal costs, so that you don’t have any surprises later.

- Liquidity: The higher the liquidity, the easier and quicker you will be able to make trades without price slippage.

- User experience: Make sure to choose an exchange that has the right level of functionality – simple for beginners, and advanced for pros.

- Available cryptocurrencies: Make sure that the exchange offers the cryptocurrencies that you want to trade.

- Regulation and trust: Look for exchanges that have a good reputation, are audited, and have good transparency.

- Additional services: You may also want to factor in mobile apps, DeFi services, or staking/earning products.

Conclusion

In conclusion, Bucksbunny Exchange competitors provide traders with various options including fully controlled asset decentralized platforms, centrally exchanged deep liquidity, and more sophisticated tool platforms.

By weighing security, fees, characteristics, and user-friendliness, customers can choose an alternative that aligns with their trading aspirations, risk appetite, and overall crypto proficiency.

FAQ

What are Bucksbunny Exchange alternatives?

They are other crypto platforms that offer similar or better trading, security, and features.

Why should I consider an alternative to Bucksbunny Exchange?

To access lower fees, better liquidity, advanced tools, or decentralized trading options.

Are Bucksbunny Exchange alternatives safe to use?

Safety depends on the platform’s security measures, audits, and custody model.

Which alternative is best for beginners?

User-friendly platforms like CoinDCX or Zengo are good for beginners.