The US Crypto market is projected to grow in 2026 with regulation details providing a positive outlook. With major decisions coming in, both investors and start-ups are positioned to determine the outcome for the crypto market.

During his second term, President Donald Trump imposed an innovation-friendly digital assets policy. The proxy officials, who are thought to be representing the Trump Administration, have shown the conviction to ‘let crypto be’ untamed and have closed a number of investigations into crypto firms.

Meanwhile, Banks are also operating with more certainty on the holding and managing of crypto. Lienka for YouHodler asserts, The crypto and digital assets discipline is more refined in the major economies, and so is the acceptance of digital assets, pointing to more positive trends in the future.

The US has been developing legislation to govern the regulation of crypto and has not been able to pass it into Senate as of late December of 2025. It has been Proposed that the discussions may carry into 2026.

The US has not been able to pass it into Senate as of late December of 2025, with hopes of being discussed into the new year. The US has been developing legislation to govern the regulation of crypto. with hopes of being discussed into the new year.

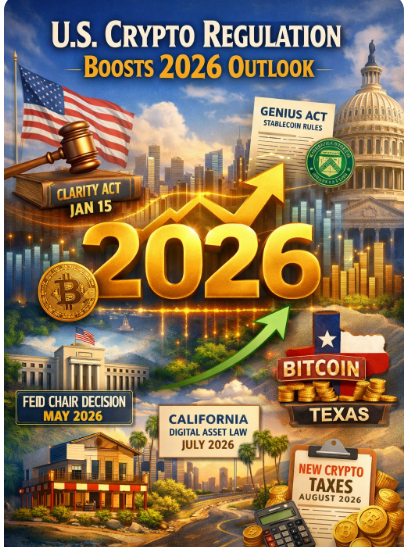

The new legislation clarifies which federal agencies regulate which parts of the crypto market, specifically between the SEC and CFTC. The Senate Banking Committee is set to discuss the CLARITY Act on January 15, 2026. This gives the possibility of a Senate floor debate sometime in the first half of the year.

The other major development is the GENIUS Act, enacted mid-2025, which is the first federal legislation on stablecoins as a means of payment. Implementation of the Act has been delayed, and in early 2026 the US Treasury is expected to publish proposed rules following a period of public comment.

The FDIC also published guidelines explaining when a bank subsidiary may issue stablecoins. The SEC is also expected to provide an ‘innovation exemption’ which will permit certain crypto startups to test ‘regulatory sandbox’ products without full compliance.

Momentum has been building at the state level, too. In California, a new law on Digital Financial Assets will take effect on July 1, 2023, and will require firms to obtain a license if they provide services to California residents. Texas will launch a Bitcoin reserve fund and will begin purchasing Bitcoin in 2026. Arizona and New Hampshire, among others, are also looking into legislation of this nature.

New tax regulations for cryptocurrency, including for staking, lending, and micro transactions, will potentially go into effect in August 2026.

The U.S. crypto market in 2026 will be influenced by new both new federal and state regulations. The introduction of new regulations, along with innovative exemptions and state initiatives, will likely empower investor confidence and create a bullish market for mainstream adoption.