I’ll go over the Top Forex Brokers for Foreign Traders in this post. For access to international markets, competitive spreads, and dependable execution, selecting the appropriate broker is crucial.

Finding a broker with robust regulation, cutting-edge platforms, and support for overseas accounts can have a big impact on your trading results, regardless of your level of experience.

Why Use Forex Brokers for International Traders

Global Trading Opportunities – Cross-border brokers give international traders the ability to trade in different nations’ currencies, stocks, and crypto.

Affordable Trading Costs – Global Forex brokers have tighter spreads and cheaper commissions, leading to lower forex cross-border transaction fees.

Cutting-Edge Trading Solutions – Brokers offer advanced customized trading solutions through MT4, MT5, and cTrader platforms.

Safety and Trust – Well-established forex brokers are globally certified, which ensures a safe trading environment and maintains the integrity of the traders’ funds.

Diverse Currency & Payment Alternatives – International Forex brokers offer different account currencies and several payment options.

Multilingual Customer Service – Global traders have access to international brokers’ trained customer service representatives for effective trading.

Benefits of Forex Brokers for International Traders

Access to Customers – Forex brokers recognize and seek out the trading patterns of customers from diverse backgrounds. Traders can also use a variety of different trading tools to access an extensive amount of international currency trading pairs along with trading indices, commodities, and a variety of other financial instruments.

Low Cost of Every Trade – Brokers will cross trade international currency at a very attractive spread along with very low commission fees. This will lower the overall cost and increase the possibility of profitability with every trade.

Diverse Trading Platforms – Forex brokers offer a selection of trading platforms to choose from. The options for the brokers’ trading platforms would include MT4, MT5, cTrader (which can also be an app on the trading customers’ mobile devices), and various other trading platforms. A unique selection of trading platforms will prove to be an advantage to every trading customer with their diverse and unique trading preferences.

Customer Fund Protection and a Safe Trading Environment – Forex trading customers’ funds and a properly secured trading environment is a Forex broker to be regulated in different trading jurisdictions. Such a Forex broker would also ensure a proper and safe trading environment.

Holding of Multi-Currency Accounts along with International Payment Options – Forex customers are provided with the ability to hold more than one currency account by the broker. Additionally, Forex brokers offer an assortment of international payment options, which includes: international wire transfers, credit and debit card payments, and also electronic payments.

Customer Service and Technical Support – In multilingual customer service, Forex brokers ensure the availability of quick resolution on diverse and unique trading positions.

International Market Risk and Order Management Tools – Forex brokers offer trading customers with a selection of risk order management tools (such as stop loss orders, take profit orders, and margin alerts) to the trading customers as a selection to choose from in the trading (as it is available in the currency trading) options on the International market.

Access to Leverage – Brokers provides leverage to manage risks while maximizing trading opportunities

Educational Resources & Research – News on the global market, calendars, guides, webinars, and other resources help brokers clients educate better trading decisions.

Automated & Social Trading – Brokers facilitate copy trading, social trading, and algorithmic trading, providing opportunities for traders to trade more collaboratively across borders.

Key Point & Best Forex Brokers for International Traders List

| Broker | Key Point |

|---|---|

| Exness | Tight spreads and high leverage options suitable for Forex scalpers. |

| FP Markets | Raw ECN pricing with fast execution and global regulatory coverage. |

| Pepperstone | Excellent customer support and advanced trading platforms for pros. |

| IC Markets | Low-latency execution with multiple account types for different traders. |

| Eightcap | Competitive spreads with flexible account options for Forex traders. |

| FxPro | Wide range of instruments including Forex, indices, and commodities. |

| Fusion Markets | Transparent pricing with low commissions and strong liquidity access. |

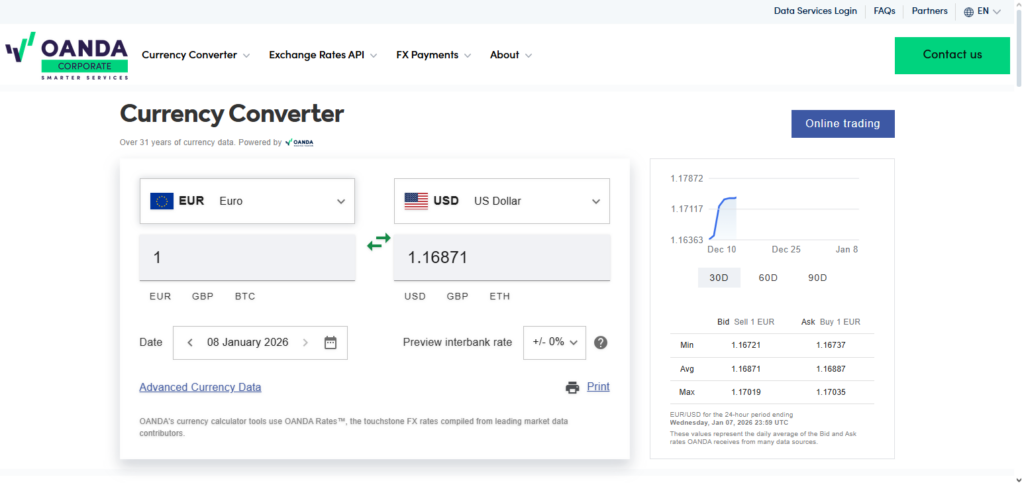

| OANDA | Regulated broker with reliable MT4/MT5 platforms and good research tools. |

| Interactive Brokers | Global broker with professional-grade trading tools and diverse assets. |

| AvaTrade | User-friendly platform with strong automated trading options. |

1. Exness

Due to fast execution speeds, flexible leverages, and tight spreads, Exness has quickly become one of the most recognizable names among Forex traders. Exness caters to both novice traders and industry veterans. There are multiple account types available, including Standard, Pro, and Zero. Fund security, along with regulatory transparency, is a key component of Exness’s promise to its clients.

With advanced MT4 and MT5 platforms, clients have access to a reliable trading environment along with customizable automated trading and advanced charting tools for over 120 available currency pairs. This reputation secures Exness among the Best Forex Brokers for International Traders.

Exness Features, Pros & Cons

Features:

- Global Payment Options, and Multi-Currency Accounts

- Access to MT4 and MT5 Trading Platforms

- Competitive Commissions, and Low Spreads

- Customer Support, 24/7, in Multipe Languages

- Leverage upto (1:2000)

Pros:

- Account Types are Flexible to Accommodate International Traders

- Trading Costs are Low, Spread, High Leverage

- Strategy Execution, Excellent, and Leverage Strategy

- Multiple Regions

- Regulatory Oversight, Strong

Cons:

- High Risk Strategy, Limited, High Leverage

- Research Tools, Fundamental, Limited

- Options, Some, are Fees for Withdrawals

- Traders, Beginner, Less Suitable for

- Region, by Vary Support, Customer

2. FP Markets

FP Markets is one of the top brokers offering lightning quick execution and deep liquidity. The broker offers raw spreads and is one of the top ECN Forex brokers. With the tools offered by FP Markets including MT4, MT5, and the IRESS platform, scalpers and long-term investors have an amazing trading experience.

FP Markets is a top choice among Forex brokers because of how strong the compliance is in Australia and the other regions, ensuring fund safety and trustworthiness. With a global reach and a variety of currencies, FP Markets is among the Best Forex Brokers for International Customers. This is because of strong customer service, market access, and a variety of currencies.

FP Markets Features, Pros & Cons

Features:

- Raw spread as low as 0.0 pips

- Access to all platforms: MT4, MT5, and IRESS

- Different account types (Standard, ECN)

- Payments made worldwide including local banks

- Strong regulatory coverage

Pros:

- Spreads are very competitive leading to a cost-efficient

- Different platforms can be used to adapt to different strategies.

- Execution and liquidity are reliable.

- There are no hidden costs.

- Extensive coverage to most parts of the globe

Cons:

- Resources to learn are very limited

- No social trading

- No social trading platform* Holiday seasons and events may cause support delays

- Direct market access accounts incur higher commission

- Not ideal for extremely small traders

3. Pepperstone

Pepperstone offers low trading fees and rapid execution, and is one of the most prominent brokers in the industry. This broker also offers unmatched platform choice with MT4, MT5, and cTrader, and is available globally. Automated trading is a valuable feature that is available on all of Pepperstone’s platforms.

Customers can trade in a variety of markets including currencies, indices, commodities, and crypto. Around the clock service is available and is offered in a number of languages. As a top choice in the trading community, Pepperstone’s emphasis on international trade execution is of great success, making it to the top of the Best Forex Brokers for International Customers.

Pepperstone Features, Pros & Cons

Features:

- Two account types: regualar and raw.

- Access to MT4, MT5, and cTrader.

- Global low latency execution.

- Global funding.

- Negative balance protection.

Pros:

- Speed of execution and low slippage.

- Multiple platforms and various strategies.

- Multiple licenses.

- Ideal for scalping.

- Friendly and responsive team.

Cons:

- Almost no support and analysis.

- Fees on some withdrawal methods.

- Larger minimum deposit on certain accounts.

- Very little education.

- More focus on Forex than other asset classes.

4. IC Markets

IC Markets is known for its raw spreads, great liquidity, and fast execution with multiple account types. They support MT4, MT5, and cTrader platforms, and cater to scalpers and institutional and algorithmic traders.

They allow access to more than 60 currency pairs, indices, commodities, and cryptocurrencies which promotes the diversification of trading portfolios.

They are strong regulators and their segregated client funds deepen the security. They are amoung the great Forex brokers because of their solid focus on tech and global support along with the high priority on global transparency and advanced trading tools.

IC Markets Features, Pros & Cons

Features:

- Raw spread trading accounts.

- Access to MT4, MT5, and cTrader.

- Up to 1:500 leverage.

- VPS for automated trading.

- Global multi-currency deposits.

Pros:

- Low trading costs.

- Ideal for scalping and traders using EAs.

- High liquidity and deep markets.

- Multiple platform options.

- Well established reputation.

Cons:

- No access to research tools.

- Inconsistent support hours based on location.

- High minimum deposit on some account types.

- High leverage increases risks of trading

- Costs associated with some funding methods

5. Eightcap

Eightcap is an ASIC regulated broker which provides competitive spreads, flexible account options for fast execution and account options for both novice and professional traders. They support MT4 and MT5 and provide charting options, automated trading, and mobile trading.

Eightcap has global reach and multiple deposit and withdrawal options which simplifyaccess to trade regionally and globally. Pricing is clear and commissions are low which are key to client satisfaction along with the quick execution and spread. These features have enabled placement for them amoung the best Forex brokers.

Eightcap Features, Pros & Cons

Features:

- MT5 and MT4 platforms

- Accounts with raw and standard options

- Global payment methods

- Spreads as low as 0.0 pips

- Regulation in Vanuatu and Australia

Pros:

- Good for active traders in low spreads

- Trading conditions are clear

- Multiple platforms

- Regulatory compliance is good

- Varied funding methods

Cons:

- No news or research resources

- No in-house trading platform

- Limited advanced education resources

- Smaller than some of the larger brokers

- Customer support is regional

6. FxPro

FxPro is a multi-asset broker that offers competitive pricing and strong liquidity for Forex, indices, commodities, and futures. With MT4, MT5, and cTrader (which also allow for automated trading and offer advanced charting tools for technical analysis), FxPro provides great service for its clients.

Additionally, FxPro emphasizes strong global regulation, segregated accounts, and transparent trading conditions. With multilingual support, different account types, and various execution methods, the broker serves traders from all over the globe.

These factors combine to make FxPro one of the Best Forex Brokers for International Traders. Their advanced technology, global accessibility, and secure trading environment make them suitable for both beginner and experienced investors.

FxPro Features, Pros & Cons

Features:

- Proprietary platform, cTrader, MT4, and MT5

- Multiple account options with different spreads

- Protection against negative balances

- Payments globally

- Great regulation

Pros:

- Several platforms for the flexibility of different methods

- Profiles of good liquidity

- Automation is allowed

- Good reputation in regulation

- Flexible accounts in different currencies

Cons:

- Some accounts with more expensive fees

- Not as much educational content

- Slow support

- Accounts with standard spreads are more

- Advanced trader preference

7. Fusion Markets

Fusion Markets offers ECN trading with low spreads, tight commissions, and fast execution. As an Australian broker, Fusion Markets provides MT4 and MT5 support, and features such as automated trading, mobile trading support, and advanced charting.

They offer transparent pricing with direct access to liquidity from Tier-1 banks. Because of their global reach, Fusion Markets is one of the Best Forex Brokers for International Traders, allowing clients access to the Forex and CFD markets. They offer affordability, effeciency, and accessibility to traders seeking high performance trading conditions.

Fusion Markets Features, Pros & Cons

Features:

- Direct access to ECN with low spreads.

- MT4 and MT5 trading platforms

- Global deposits and withdrawals

- Leverage reaching 1:500

- Transparent fee structure

Pros:

- Cost-effective trading

- Multi-platform versatility

- Rapid execution

- Clear and easy to understand fee structure

- Great for seasoned global traders

Cons:

- Research and analysis tools are scarce

- No proprietary trading platforms

- Smaller broker firm

- Customer support only during business hours

- Limited educational materials

8. OANDA

OANDA is one of the most notable Forex brokers due to its trading platform’s reliability, proven regulation, and research tools. OANDA offers online traders MT4 access, the proprietary fxTrade platform, and some of the best analytical tools in the industry.

Retail and professional traders enjoy the competitive spreads and multi-tier pricing across their accounts. Automated trading, pricing transparency, and a strong global presence with multi-lingual support and advanced trading tools, positions OANDA to be one of the Best Forex Brokers for International Traders. OANDA is user-friendly and has a secure and solid trading platform. International traders enjoy excellent market access.

OANDA Features, Pros & Cons

Features:

- Competitive spreads and no minimum funding

- MT4 and proprietary platform fxTrade

- Regulation in multiple countries

- Multi currency accounts

- Advanced analysis and charting tools

Pros:

- Platforms that are well designed and easy to use for all types of traders

- Multiple global regulators

- Outstanding charting and trading tools

- Account options are flexible

- Reliable

Cons:

- No ECN accounts

- Wider spreads during market volatility

- Less leverage compared to other brokers

- Limited number of accounts for pro traders

- Some funding methods have fees

9. Interactive Brokers

Interactive Brokers is one of the largest global brokerages in Forex, and other securities while offering customers access to dual and multi-currency accounts, options, futures, stocks, and more. Customers enjoy a sophisticated and advanced trading platform called Trader Workstation (TWS) for algorithmic trading, advanced tools, and professional-level charting.

Interactive Brokers is regulatory compliant, with a global presence, and has a reputation for deep liquidity, low spread pricing, and reliability for professional traders. For sophisticated global investors, Interactive Brokers has one of the Best Forex Brokers for International Traders by providing excellent trading with access to countries around the world.

Interactive Brokers Features, Pros & Cons

Features:

- Multi-assets (Forex, stocks, options)

- Low commissions and competitive pricing

- Advanced tools and research for trading

- Global market access plus

- Multi-currency accounts

Pros:

- Perfect for professional traders

- Global market access

- Robust analytics and trading instruments

- Competitive arrangements for trading and commission

- Excellent regulatory scrutiny

Cons:

- Platform is challenging for novices

- Steep learning curve

- Charges for inactivity

- Less emphasis on pure Forex trading

- Support may be lacking

10. AvaTrade

AvaTrade is a simple broker that makes trading Forex, commodities, indices, cryptos, and ETFs easy. They support MT4, MT5, and Ava TradeGO. AvaTrade has a focus on transparency, regulation in multiple countries, and great customer service.

They have educational tools and resources, and social trading and risk management options, making sure that all customers are able to trade in any global market. Ava Trade has all of these great features, making them one of the Best Forex Brokers for International Traders to trade and invest on a global scale.

AvaTrade Features, Pros & Cons

Features:

- MT4, MT5, and AvaTradeGO platforms

- Fixed and floating spreads

- Negative balance protection

- Multi-currency and global deposits

- Regulatory oversight in multiple regions

Pros:

- User-friendly platforms

- Good for beginners and advanced traders

- Multi-regulated broker

- Flexible funding options

- Supports automated trading

Cons:

- Spreads can be higher than ECN brokers

- Limited research tools

- Some account types have higher costs

- Customer support not 24/7 in all regions

- Less suitable for professional scalpers

Comprised Table

| Broker | Regulation | Platform(s) | Spreads / Fees | Key Advantages for International Traders |

|---|---|---|---|---|

| Exness | FCA, CySEC, FSA | MT4, MT5 | Tight spreads, low commissions | Flexible leverage, fast execution, multiple account types, strong global access |

| FP Markets | ASIC, CySEC | MT4, MT5, IRESS | Raw spreads, low commissions | ECN pricing, fast execution, deep liquidity, multi-currency accounts |

| Pepperstone | ASIC, FCA | MT4, MT5, cTrader | Very low spreads | Advanced platforms, automated trading, 24/5 multilingual support |

| IC Markets | ASIC, FSA | MT4, MT5, cTrader | Raw spreads, low commissions | Ultra-fast execution, scalable for pros, global account access |

| Eightcap | ASIC, VFSC | MT4, MT5 | Competitive spreads | Flexible accounts, automated trading, mobile-friendly, multi-currency support |

| FxPro | FCA, CySEC, FSCA | MT4, MT5, cTrader | Low spreads, moderate commissions | Multi-asset instruments, advanced analytics, secure global trading |

| Fusion Markets | ASIC | MT4, MT5 | Tight spreads, low commissions | ECN trading, transparent pricing, Tier-1 bank liquidity |

| OANDA | CFTC, FCA, IIROC | MT4, fxTrade | Competitive spreads | Reliable platforms, strong research tools, global access |

| Interactive Brokers | SEC, FCA, ASIC | Trader Workstation, IBKR | Low commissions, variable spreads | Global multi-asset access, professional tools, strong risk management |

| AvaTrade | ASIC, Central Bank of Ireland | MT4, MT5, AvaTradeGo | Fixed/variable spreads | User-friendly platforms, automated trading, multi-language support |

Conclusion

For international traders looking for reasonable spreads, dependable execution, and access to foreign markets, selecting the best Forex broker is essential. Brokers with cutting-edge platforms, robust regulation, and customer-focused services include Exness, FP Markets, Pepperstone, IC Markets, Eightcap, FxPro, Fusion Markets, OANDA, Interactive Brokers, and AvaTrade.

From professional-grade trading tools and multi-asset access to extremely low spreads and quick execution, each offers special benefits. These brokers are the Best Forex Brokers for International Traders to consistently succeed in the global Forex market because they offer a safe, transparent, and flexible trading environment for traders working across borders.

FAQ

What makes a Forex broker suitable for international traders?

A Forex broker suitable for international traders offers competitive spreads, multiple account currencies, fast execution, access to global markets, and strong regulatory compliance across jurisdictions. Additional features include advanced trading platforms, multi-language support, and diverse deposit/withdrawal options, ensuring seamless trading across borders.

Which brokers are considered the best for international Forex trading?

Top brokers for international traders include Exness, FP Markets, Pepperstone, IC Markets, Eightcap, FxPro, Fusion Markets, OANDA, Interactive Brokers, and AvaTrade. These brokers combine low spreads, robust platforms, strong regulation, and global account accessibility, making them ideal for cross-border trading.

Are these brokers regulated internationally?

Yes. Most of these brokers are regulated by top-tier authorities like ASIC (Australia), FCA (UK), CySEC (Cyprus), NFA (US), and other respected regulators. Regulation ensures client fund safety, transparency, and fair trading conditions.

Can international traders open accounts easily?

Yes. These brokers provide accounts for traders in multiple countries, supporting different currencies and convenient deposit/withdrawal methods such as bank transfers, e-wallets, and credit/debit cards.