I’ll go over the top BitPay Card substitutes in this post for people who want to spend and handle cryptocurrencies more effectively.

These cryptocurrency cards offer a variety of choices beyond BitPay, including cashback benefits, multi-currency support, and DeFi connectivity.

The options discussed here can improve your regular digital spending, whether you’re looking for inexpensive fees, worldwide use, or cryptocurrency benefits.

How To Choose BitPay Card Alternative

Supported Cryptocurrencies

Make sure to check what coins the card accepts. A lot of cards are limited to the top coins like Bitcoin and Etherum, while others are much more flexible (stablecoins, alternative coins, etc.). Get a card that is more in line with the coins that you own.

Fees & Charges

Look at the various fees that the cards charge. Things like monthly fees, ATM fees, foreign transaction fees, and more can all impact the total value you get when you spend your crypto.

Rewards & Cashbacks

Look at what rewards are currently available with cards. You want to see if something like a crypto cashback reward is available, or perhaps a tier reward system where users can get more rewards for staked tokens.

Geographic Availability

Some cards are more limited in their geographical reach than others. You need to ensure that the card is available in your country and that you can use the card without any additional restrictions.

Security & Reputation

You want to make sure that the card you are using is from a reputable provider. Look for additional security features like 2-factor authentication, and encryption. It is always good to make sure the provider is compliant with financial regulations.

Conversion Speed & Mechanism

It can be frustrating when you spend a lot of time at checkout when the crypto is being converted to the local currency. Most people prefer to spend crypto on a card when the conversion happens instantly, so check for cards with that feature.

Other Potential Features

Evaluate other potential features that may add long-term value that don’t involve spending. These may include built-in wallets, DeFi features, credit and interest earning, and a mobile app.

Funding & Use

Make sure you can easily load crypto from your wallet or exchange, and that the app is simple for use and for tracking your transactions and balances.

Key Point & Best BitPay Card Alternatives List

| Crypto Card | Key Points |

|---|---|

| Shakepay Card | Instant crypto-to-CAD conversion, cashback rewards in Bitcoin, no monthly fees. |

| Plutus Card | Earn crypto cashback, multiple fiat options, supports DeFi integration. |

| CryptoPay Card | Wide crypto support, easy top-up, multi-currency wallet features. |

| SpectroCoin Card | Prepaid crypto card, supports multiple cryptocurrencies, low transaction fees. |

| Uphold Card | Instant crypto spending, multi-asset wallet, linked to trading account. |

| Monolith Card | Ethereum-based, customizable spending limits, DeFi wallet integration. |

| Revolut Card (Crypto) | Buy, hold, and spend crypto, instant conversion, global spending perks. |

| Wirex Card | Crypto cashback, multiple crypto & fiat support, contactless payments. |

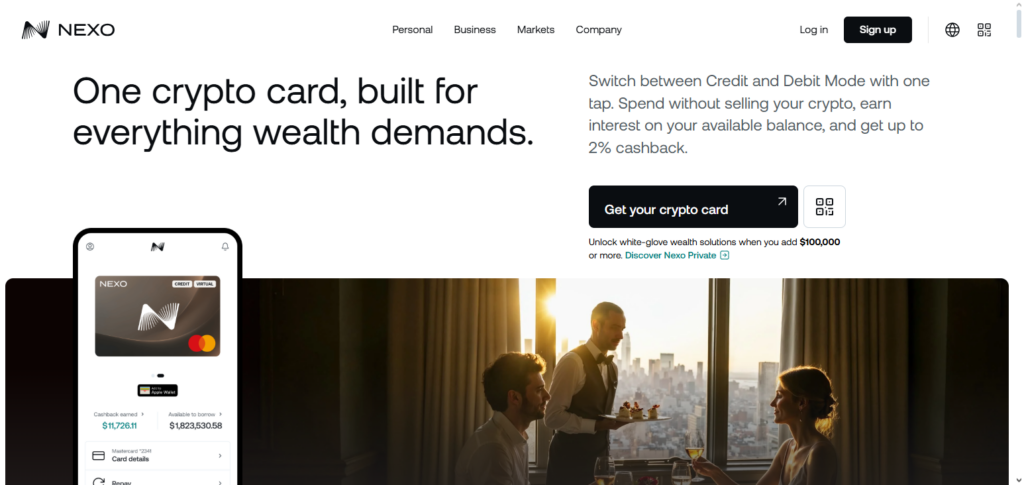

| Nexo Card | Earn interest on crypto, instant crypto-to-fiat conversion, rewards program. |

| Coinbase Card | Direct crypto spending, instant conversion, supports multiple cryptocurrencies. |

1. Shakepay Card

The Shakepay Card stands out as one of the Best BitPay Card Alternatives for those wishing to engage in stress-free crypto spending. Cardholders can spend Bitcoin or Ethereum and instantly convert those cryptocurrencies into Canadian dollars at the point of sale. Therefore, customers can make everyday transactions quickly and conveniently.

Cardholders can also receive Bitcoin cashback on their purchases, growing their crypto balance while spending. Moreover, the card has no monthly fees, and Canadians can top up their cards hassle-free from their Shakepay accounts. The app has fast transfer capabilities and tracks balances in real-time.

Shakepay Card – Features

| Feature | Description |

|---|---|

| Supported Cryptos | Bitcoin, Ethereum |

| Cashback Reward | BTC cashback on eligible spending |

| Fees | No monthly/annual fee (basic) |

| Geographic Availability | Canada |

| Conversion Speed | Instant crypto‑to‑fiat at point of sale |

ShakePay Card Pros & Cons

Pros

- Payments can be made using instant crypto-to-fiat conversion.

- Eligible users are rewarded with Bitcoin cashback.

- Basic use incurs no monthly and no annual fees.

- Users like the interface of the app due to its simplicity.

- Transfers to the wallet are fast, and balances are updated in real time.

Cons

- Functionality of the app is limited to users in Canada.

- Users cannot send multiple types of cryptocurrencies (compared to some competitors).

- Compared to other cards, users can find that the reward rates are low.

- Users do not have the option to use DeFi or staking.

- Users may be charged for withdrawals from ATMs.

2. Plutus Card

The Plutus Card is one of the Best BitPay Card Alternatives because of its unique combination of standard banking features and crypto rewards. Users can make purchases and earn PLU token cashback, which is stakeable for increased yields, and spend multiple fiat currencies backed by crypto.

The card offers various funding methods and supports DeFi integrations for advanced users. Plus, Plutus Card has a reward system where perks increase with each level, and the competition fees and easy-to-use layout make it a great card for users who want more than typical crypto spending.

Plutus Card – Features

| Feature | Description |

|---|---|

| Cashback Token | PLU tokens |

| Reward System | Tier‑based rewards |

| Fiat & Crypto Support | Multi‑currency |

| DeFi Integration | Yes, supports staking and DeFi tools |

| App Features | In‑app wallet and staking management |

Plutus Card Pros & Cons

Pros

- On all spendings, users earn cashback with the PLU token.

- Users can transact in multiple currencies (both crypto and fiat)

- Users can earn more benefits through the use of staking, in with the DeFi system.

- As users go up the tiers, they receive incentives with a better reward system through.

- There is a strong emphasis on the communities through partnerships and activities within the app.

Cons

- There is PLU staking, and users are required to have a certain tier for the use of some features.

- Users can incur costs based on the tier that they possess.

- The app is not globally available.

- For the use of the PLU token, some rewards are lost.

- Users may find it is complicated to use the app.

3. CryptoPay Card

The CryptoPay Card is one of the most popular Best BitPay Card Alternatives because users can easily manage the card and it supports most cryptocurrencies. Users can load the card with a number of major cryptocurrencies, and when purchases are made, it converts the crypto to fiat.

The card supports multiple countries and is available for instant purchase with low management fees, which is great for new users and advanced users. Users can manage their balances and track their spending with the dedicated app. The card offers users a simple and flexible way to spend their crypto, which is why it is so popular.

CryptoPay Card – Features

| Feature | Description |

|---|---|

| Supported Cryptos | Multiple top coins |

| Top‑Up Methods | Wallet, exchange transfers |

| Spend Conversion | Instant crypto‑to‑fiat |

| Dashboard | Mobile spend tracking |

| Entry Requirements | Easy, beginner‑friendly |

CryptoPay Card Pros & Cons

Pros

- Users may choose from a large number of cryptocurrencies to fund the card.

- Quick loading and checkout fiat conversion.

- Easy wallet or exchange top-up.

- Spend analytics mobile dashboard.

- Cost-effective pricing on base plans.

Cons

- In some areas, global reach is restricted.

- Variable pricing models.

- Rewards lower than many competitors.

- Less recognition than other big players.

- Limited additional features (e.g., reward tiers).

4. SpectroCoin Card

SpectroCoin Card makes it to the Best BitPay Card Alternatives due to its global acceptance and its ability to support multiple cryptocurrencies. SpectroCoin is a prepaid card, so you can load it with Bitcoin and a handful of other altcoins, which will convert to the local currency at the point of sale.

With ATMs available for withdrawals and flights to distant countries, SpectroCoin is especially great for crypto travelers. Competitively priced exchange rates add to card’s versatility. The card integrates with the SpectroCoin wallet, which is great for travelers. Its versatile prepaid card system is great to use for day-to-day purchases. The card’s funding and fees add to the card’s reliability.

SpectroCoin Card – Features

| Feature | Description |

|---|---|

| Supported Cryptos | Bitcoin, altcoins |

| ATM Access | Global fiat withdrawals |

| Prepaid Card | Yes |

| Exchange Rates | Competitive |

| Wallet Integration | Linked to SpectroCoin wallet |

SpectroCoin Card Pros & Cons

Pros

- Ability to spend different cryptocurrencies.

- Withdrawals via ATMs all over the world.

- Predictable limits in a prepaid design.

- Competitive rates at point of sale.

- Full crypto wallet ecosystem linked.

Cons

- ATM and foreign exchange fees may be added.

- Less popular than larger cards; less used.

- The mobile app is less than others.

- Limited on other cards.

- Availability may vary by region.

5. Uphold Card

The card that is tied to the multi-asset Uphold platform is one of the best alternatives to the Bitpay card. The Uphold card instantly converts a number of cryptocurrencies, fiat, and precious metals, giving you a ton of flexibility on how you spend. You can choose to pay with crypto, or Uphold can auto-convert at the time of checkout.

The card gives the user peace of mind with Uphold’s security and regulatory compliance. The card is integrated with a financial ecosystem that allows you to do more than just spend; it offers a mobile app with full portfolio tracking, transfers across assets, and real-time updates. It is best for customers who want a complete financial tool crypto card.

Uphold Card – Features

| Feature | Description |

|---|---|

| Asset Types | Crypto, fiat, precious metals |

| Conversion | Instant at checkout |

| Security | High (regulatory compliance) |

| Portfolio Tracking | Built into app |

| Multi‑Asset Wallet | Yes |

Uphold Card Pros & Cons

Pros

- Directly connected to Uphold multi asset system.

- Ability to spend in crypto, fiat, and metals.

- Conversions happen instantly at checkout.

- High levels of security and compliance.

- Spend tracking in-app.

Cons

- Fees on some transactions and conversions.

- Support for cryptocurrencies differs by region.

- Very modest rewards system.

- Monolith isn’t as crypto-centric as some competing cards.

- Needs another Uphold card.

6. Monolith Card

The Monolith Card ranks highly among the Best BitPay Card Alternatives for users who want spending capability directly linked to Ethereum. The Monolith Card is the first in the industry to be linked to a non-custodial DeFi wallet.

That means you retain control of your private keys while using your crypto to pay for purchases. With Monolith, payments with ERC-20 to your merchant are converted to fiat. That means you don’t have to wait for your tokens to be transferred to a central provider.

You have the option to set individual spending limits and to control your card directly from the Monolith app. Given Monolith’s integration of DeFi and their focus on card holder security, the Monolith Card will be a preferred product for crypto enthusiasts to have full control of their digital assets and have the ability to spend them in everyday situations.

Monolith Card – Features

| Feature | Description |

|---|---|

| Wallet Type | Non‑custodial DeFi wallet |

| Supported Tokens | Ethereum + ERC‑20 |

| Spending Conversion | On‑the‑fly ERC‑20 to fiat |

| Control Level | Full private key control |

| DeFi Tools | Integrated |

Monolith Card Pros & Cons

Pros

- Has an integrated non-custodial Ethereum/DeFi wallet.

- Users keep their private keys and funds.

- Checkout utilizes instant conversion for ERC-20 tokens.

- Users can set and adjust individualized spending ceilings.

- Attracts users interested in DeFi.

Cons

- Users can only transact with Ethereum ecosystem assets.

- Interactions with the wallet may incur gas fees.

- Less legacy rewards (e.g., cashback).

- More geared towards crypto savvy users.

- Acceptance isn’t as widespread as more traditional cards.

7. Revolut Card (Crypto)

The Revolut Card (Crypto) is one of the Best BitPay Card Alternatives as it offers the features of a regular bank card, as well as those of a crypto card. With the card, you can spend a variety of cryptocurrencies (which get automatically converted to fiat currency), as well as enjoy instant global spending, competitive foreign crypto exchange rates, and budgeting features.

Users can crypto and fiat wallets, and more. Overall, the app’s banking and crypto spending integration is what makes it one of the most flexible offerings on the market.

Revolut Card (Crypto) – Features

| Feature | Description |

|---|---|

| Banking + Crypto | Unified platform |

| Spend Conversion | Auto crypto conversion at POS |

| Global Usage | Broad |

| Budget Tools | In‑app analytics |

| Multi‑Asset Wallet | Yes |

Revolut Card (Crypto) Pros & Cons

Pros

- The service merges existing banking functions with crypto.

- Users can hold, convert, and spend crypto without complications.

- The card can be used in most countries and has good foreign exchange rates.

- The in-app budgeting and analytics functions are handy.

- Users can manage multiple asset crypto wallets under the same account.

Cons

- The service provided with respect to crypto differs depending on the region.

- Users may incur fees due to some exchange and conversion processes.

- The level of rewards depends on the subscription tier.

- The card service isn’t exclusively focused on crypto.

- To gain optimal benefits the user has to subscribe to a more expensive package.

8. Wirex Card

Wirex is one of the best alternatives to the Bitpay card because of its great features, support, and rewards, both in crypto and fiat. Users are able to spend a variety of cryptocurrencies and earn 2% cashback in crypto when spending WXT (Wirex’s native token). The card also has excellent foreign exchange and wallet top-up capabilities.

Users are able to contactless spend and spend at ATMs globally. The app has excellent features including spend tracking and top foreign exchange rates. Overall, Wirex has great security, transparency, and is excellent for users wanting a card that has traditional spending features, along with crypto rewards. Wirex is great for users wanting a card with top crypto rewards.

Wirex Card – Features

| Feature | Description |

|---|---|

| Cashback | Up to ~2% in WXT |

| Crypto Support | Wide variety |

| Contactless Payments | Yes |

| ATM Withdrawals | Supported (limits apply) |

| FX Support | Multi‑currency |

Wirex Card Pros & Cons

Pros

- Users can obtain up to 2% crypto cashback on purchases.

- The card can be used to spend multiple cryptocurrencies and fiat.

- It has contactless payment capabilities and can be used globally.

- There is a mobile wallet that provides updates in real time.

- New users can join easily.

Cons

- Highest cashback rewards require holding WXT tokens.

- Foreign exchange fees might apply.

- Certain reward tiers require staking WXT.

- Available in select locations only.

- Withdrawals subject to limits and fees.

9. Nexo Card

The Nexo Card is considered to be one of the Best BitPay Card Alternatives due to the ability to earn interest while spending. The Nexo Card allows you to use your crypto as collateral, so you don’t ever have to sell your crypto, and can function as an instant credit line, allowing you to pay with fiat, while earning yields on your crypto.

With no annual fees, the Nexo Card has competitive rewards, offering up to 2% cashback on NEXO tokens. Repayment options are flexible, and because the Nexo Card can be integrated into Nexo’s additional ecosystem with earning and lending products, the Nexo Card is designed as a financial solution to users without having the need to liquidate their crypto. The Nexo Card is one of the more unique cards due to the credit and cashback features.

Nexo Card – Features

| Feature | Description |

|---|---|

| Rewards | Cashbacks in NEXO tokens |

| Credit Line | Crypto‑backed instant credit |

| Interest on Holdings | Yes |

| No Annual Fee | Base tier |

| Ecosystem | Integrated earn/lend features |

Nexo Card Pros & Cons

Pros

- Earn interest on crypto instead of selling it.

- Receive cashback in NEXO tokens.

- Automated credit lines with crypto collateral.

- No annual fees for the basic plan.

- Robust ecosystem with earn/lend products.

Cons

- Optimization of rewards heavily favors NEXO token holders.

- Credit-based access might be a limiting factor.

- Adding collateral comes with extra complexity.

- Less variety than competitors in supported cryptocurrencies.

- Regulations differ across countries.

10. Coinbase Card

The Coinbase Card is one of the cards recognized as one of the Best BitPay Card Alternatives especially for users who are part of the Coinbase ecosystem. As part of the ecosystem, a user is able to spend different types of crypto from their Coinbase accounts, and the Coinbase Card allows instant conversion to the local currency seamlessly using the crypto.

The card has built strong geo coverage and due to the regulatory compliance, it is a safe option for new crypto holders and experienced holders to be able to spend fiat when crypto is held on the exchange.

Coinbase Card – Features

| Feature | Description |

|---|---|

| Supported Cryptos | Many top‑tier coins |

| Spend Conversion | Instant at checkout |

| Rewards | Crypto rewards |

| App Integration | Full Coinbase app sync |

| Security | High (regulated exchange) |

Coinbase Card Pros & Cons

Pros

- Spend money directly out of your Coinbase account.

- Supports a variety of cryptocurrencies.

- Use of real-time notifications with card activity.

- Highly regulated and secure.

- Earn crypto rewards on some purchases.

Cons

- Fees apply to some transactions/conversions.

- Not all countries support the service.

- Competitors offer higher rewards than Coinbase.

- Customers must register for a Coinbase account.

- Crypto must be converted in order to use the card.

Conclusion

The way you spend, earn, and manage your digital assets can be greatly improved by selecting the appropriate cryptocurrency card. Shakepay, Plutus, CryptoPay, SpectroCoin, Uphold, Monolith, Revolut (Crypto), Wirex, Nexo, and Coinbase are some of the best BitPay card alternatives.

They provide a variety of features, including quick crypto-to-fiat conversion, cashback benefits, multi-currency compatibility, and DeFi integration. These alternatives offer versatile solutions for all types of users, regardless of your priorities: low costs, global usability, rewards, or ownership over your cryptocurrency. You can choose a card that best suits your lifestyle and maximizes the usefulness of your cryptocurrency holdings by comparing features and perks.

FAQ

What are the best alternatives to the BitPay Card?

Some of the top alternatives include Shakepay Card, Plutus Card, CryptoPay Card, SpectroCoin Card, Uphold Card, Monolith Card, Revolut (Crypto) Card, Wirex Card, Nexo Card, and Coinbase Card—each offering unique rewards and features.

How do BitPay alternatives work?

Crypto card alternatives let you convert cryptocurrency to fiat at the point of sale. You load your card with crypto or fiat, then spend like a regular debit/credit card, often with rewards or cashback.

Which card offers the best rewards?

Cards like Wirex and Plutus often provide higher cashback rewards in crypto. Nexo Card also offers lucrative token‑based rewards. Choose based on the reward type and frequency you prefer.

Are these alternatives available globally?

Availability varies by region. Cards like Coinbase and Wirex have broad availability, while others (like Shakepay) may be limited to specific countries.

Do these cards charge fees?

Yes. Fee structures differ—some charge monthly or annual fees, ATM withdrawal fees, or foreign transaction fees. Always check the fee schedule before applying.