I’ll be talking about the Best Regulated Crypto Coins in this post, with an emphasis on innovative and compliant cryptocurrencies. These coins are perfect for consumers and investors alike since they provide security, transparency, and legal legitimacy.

We will examine the leading regulated coins that guarantee stability, trust, and long-term growth in the cryptocurrency market, ranging from Bitcoin and Ethereum to Ripple and Cardano.

What is Regulated Crypto Coins?

Regulated crypto coins are classified as cryptocurrencies that adhere to the established financial regulations and guidelines that governing bodies and regulators put in place. These coins are usually listed on legally compliant exchanges and abide by anti-money laundering (AML) and know-your-customer (KYC) policies, as well as operational transparency.

When compared to unregulated projects, regulated crypto coins are shielded by the law, have more safety, and offer greater protection to the investors. Such coins tend to have well development, audited mechanisms, and institutional partnerships. Therefore, they can be considered to have a high degree of reliability and can be used for long term investments, trading, and for practical purposes in a real world economy.

Key Point & Best Regulated Crypto Coins List

| Cryptocurrency | Key Points |

|---|---|

| Bitcoin (BTC) | First and largest cryptocurrency by market cap; decentralized; widely accepted as digital gold. |

| Ethereum (ETH) | Smart contract platform; supports DeFi & NFTs; transitioning to energy-efficient proof-of-stake. |

| Ripple (XRP) | Focused on cross-border payments; fast and low-cost transactions; centralized aspects may concern some investors. |

| Stellar (XLM) | Designed for global payments and remittances; low fees; partnership with financial institutions. |

| Cardano (ADA) | Proof-of-stake blockchain; research-driven development; scalable and energy-efficient. |

| Algorand (ALGO) | High-speed, low-cost transactions; pure proof-of-stake; focuses on scalability and security. |

| Solana (SOL) | Extremely fast and low-cost blockchain; supports DeFi & NFTs; occasional network outages reported. |

| Chainlink (LINK) | Decentralized oracle network; connects smart contracts with real-world data; widely used in DeFi. |

| Hedera (HBAR) | Enterprise-focused public network; fast and energy-efficient; uses hashgraph consensus instead of blockchain. |

| Polygon (MATIC) | Ethereum layer-2 scaling solution; low transaction fees; supports dApps and DeFi projects. |

1. Bitcoin (BTC)

Bitcoin is the first Cryptocurrency ever created. It was established in 2009 by the Satoshi Nakamoto. Operating on a peer-to-peer and decentralized network, Bitcoin was the first to pioneer the digital scarcity technology, giving it the title “digital gold”. BTC transactions are secure and recorded on a public blockchain.

After several years of Bitcoin’s existence, it has gained global recognition and is supported by several financial institutions. Bitcoin is considered one of the Best Regulated Crypto Coins because of its vast global acceptance and growing compliance with regulations in several countries.

Bitcoin (BTC) Features, Pros & Cons

Features:

- First to create a decentralized cryptocurrency

- Max supply is of 21 million

- Secure Proof-of-Work network

- Accepted by many

- Many businesses use Bitcoin

Pros:

- Most reliable crypto to invest in

- Can easily buy/sell

- Stores your wealth (digital gold)

- Legal acceptance

- No one can stop you to use it

Cons:

- Slow payments

- High fees when busy

- Mining <80% energy

- Not many smart contracts

- Prices changes a lot

2. Ethereum (ETH)

Ethereum made history as the first blockchain that enabled programmers to develop smart contracts and to run decentralized applications (dapps). Ethereum was co-founded by Vitalik Buterin, and started in 2015. Ethereum is the fuel (eth gas) that runs the Ethereum blockchain.

Ethereum is the backbone of the blockchain, as most of the NFTs (non-fungible tokens), Defi (Decentralized Finance) projects, and many more projects run on Ethereum. Ethereum 2.0 changed the consensus mechanism to proof of stake to minimize energy consumption and to scale the network.

Ethereum is one of the Best Regulated Crypto Coins because most of the institutions have regulatory clarity to hold Ethereum, and because of Ethereum’s market adoption, more and more blockchain projects are being developed.

Ethereum (ETH) Features, Pros & Cons

Features:

- Can create smart contracts

- Enables DeFi apps, NFTs, and dApps

- Uses Proof-of-Stake

- Many developers

- Constantly updates

Pros:

- Many uses on one blockchain

- Accepted by big companies

- Doesn’t use a lot of energy

- Can be bought and sold easily

- Can improve with Layer-2 technology

Cons:

- Transaction fees can be costly

- Slow network

- Complicated

- Competing platforms

- No upgrades on time

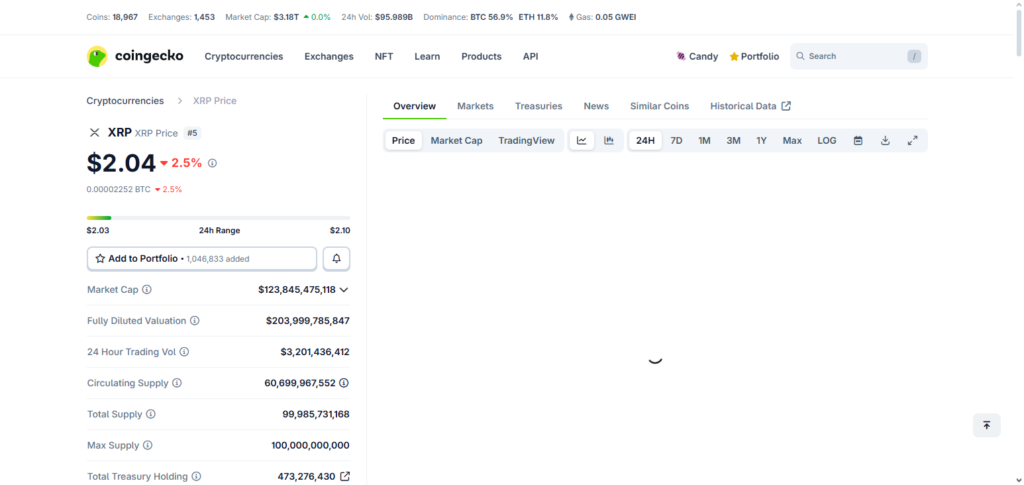

3. Ripple (XRP)

Ripple is the first digital currency that allows fast and cheap international payments. Ripple uses XRP as a bridge currency and provides liquidity to financial institutions to convert fiat currency to XRP and back to fiat. Ripple settled payments in seconds as compared to the conventional banking system that takes days.

Ripple is one of the Best Regulated Crypto Coins because of XRP’s transparent legal status and the ongoing litigation with the regulatory bodies in the United States, which many consider to be a poorly regulated country. XRP is the crypto asset that many international banks and payment providers use, and that’s why there are strong legal partnerships with XRP.

Ripple (XRP) Features, Pros & Cons

Features:

- Payment system to send money internationally

- Quick to send payments

- Pay low fees

- Partners with banks

- Good for a lot of payments

Pros:

- Very quick to send

- Good price

- Uses it many businesses

- Uses a little energy

- Can be used by people in many countries

Cons:

- Not very decentralized

- No clear laws about it

- Can’t do smart contracts

- Reliance on Ripple Labs

- Community perception is diverse

4. Stellar (XLM)

Stellar is a blockchain solution for cross-border payments that connects ‘every one’ (individuals, banks, and payment systems) seamlessly. Stellar makes it possible for banks and payment systems to settle cross-border payments for a minimal fee. Stellar has been operational since 2014 and uses XLM to carry out it operational transactions.

Stellar is open-source, thus, Stellar is a good option for start-ups and developers to build and deploy financial apps. Because of it compliance with growing adoption standards, Stellar is one of the Best Regulated Crypto Coins for investors who want to send money cross-border with/suffering from strict user safeguards while in the system.

Stellar (XLM) Features, Pros & Cons

Features:

- Target markets include the payment sectors.

- Transactions at very low cost.

- Settlements in a very short period of time.

- Has an open-source network.

- Strong ties with non-profit organizations.

Pros:

- Purpose-built for remittance payments.

- Charges a very low transaction cost.

- Transactions are processed very quickly.

- Operates on an environmentally friendly network.

- Provides the economically disenfranchised access to payment systems.

Cons:

- The scope of the DeFi ecosystem is very small.

- The demand for the market is very low.

- Has a very small community of developers.

- The network is not as decentralized as Bitcoin is.

- Innovation is very slow.

5. Cardano (ADA)

Cardano is a proof-of-stake network that focuses on the goals of Scalibility, Interoperability, and Sustainability. The Cardano network has been operational since 2017. With a base layer and secondary layer (settlement layer), Cardano can build smart contracts and decentralized applications with all the required components of a security.

The Cardano network has the unique consensus protocol called Ouroboros that is able to provide Energy Ephicienncy and Speed that exceeds the other available alternatives. Due to the academic compliance Cardano has been given the reputation of being one of the Best Regulated Crypto Coins providing a balance of core innovation to the investors from Regulated network.

Cardano (ADA) Features, Pros & Cons

Features:

- Development is based on empirical research.

- Has Proof-of-Stake consensus.

- Smart contracts are supported.

- Designed to be environmentally friendly.

- Possesses a lot of potential for scalability.

Pros:

- Transactions can be processed very quickly.

- The network is environmentally friendly.

- Provides a secure network.

- The system is open for academic and non-academic peers to review.

- The project is designed with a far-distant future in mind.

Cons:

- Growth of the ecosystem is very sluggish.

- Decentralized applications (dApps) are far less in number as compared to Ethereum.

- The architecture of the project is very complex.

- Network upgrades have been very slow.

- The project has not achieved a lot of market penetration up to this point.

6. Algorand (ALGO)

As a high-performance blockchain, Algorand achieves fast, secure, and scalable transactions through a pure proof-of-stake protocol. Founded by MIT Professor Silvio Micali, the company focuses on decentralized apps, finance, and enterprise blockchain solutions.

Developer and user appeal stems from Algorand’s network providing low fees and near-instant transaction finality. Algorand has earned a spot as one of the Best Regulated Crypto Coins due to its commitment to regulatory compliance, making it a go-to option for investors and institutions who need reliable, legally compliant blockchain solutions.

Algorand (ALGO) Features, Pros & Cons

Features:

- Has Pure Proof-of-Stake.

- Provides very fast finality for transactions.

- Fees for transactions are very low.

- Provides a high level of scalability.

- Suitable for enterprises.

Pros:

- Transactions can be processed very quickly.

- Provides a secure network consensus.

- The network consumes a low amount of energy.

- Operational expenses are low.

- The network is supported by an academic community.

Cons:

- Visibility of the network in the market is very low.

- Adoption of DeFi is limited.

- Distribution of tokens is very centralized.

- The ecosystem is very small.

- The network has a moderate amount of liquidity.

7. Solana (SOL)

Since launch in 2020, Solana has used proof-of-stake and proof-of-history for blockchain speed and low-cost transactions. Solana’s offerings include decentralized apps, DeFi, and NFT projects. The Solana ecosystem has grown due to a large number of developers and investors who have sought alt blockchain solutions to Ethereum.

Solana has occasionally experienced network outages, but this has not deterred growth and adoption. Provided global privacy regulation and transparent services, Solana has earned the title of one of the Best Regulated Crypto Coins aimed toward high performers in the blockchain space.

Solana (SOL) Features, Pros & Cons

Features:

- Blockchain with a high level of speed.

- PoH (Proof-of-History) mechanisms

- Network transaction costs

- Support for DeFi and NFTs

- Flexible, scalable architecture

Pros:

- Very impressive throughput

- Minimal costs

- Ecosystem continues to grow

- Considerable interest from devs

- Simple for users

Cons:

- Outages on the network

- Nodes require powerful hardware

- The risks of centralization

- Security concerns

- Strong, competing rivalry

8. Chainlink (LINK)

LINK (Chainlink) is a payment mechanism for blockchain oracles,network operators, and other nodes who provide trustworthy and value-adding information to various distributed ledger technology (DLT) decentralized applications (dapps).

It is a necessary part of decentralized finance (DeFi), insurance, and many other segments. With a focus on getting secure Legally Compliant Solutions, highly Audited, and a dependable Smart Contract feed for developers, Chainlink remains one of the Best Regulated Crypto Coins. LINK was founded in 2017.

Chainlink (LINK) Features, Pros & Cons

Features:

- Decentralized network of oracles

- Integration of real-world data

- Support for smart contracts

- Security of node operators

- Heavily utilized DeFi

Pros:

- Critical to DeFi

- Strong and numerous partnerships

- Reliable data streams

- Utility with a high demand

- Interoperable across multiple chains

Cons:

- Uses for it are rare outside oracles

- Pricing of the token is speculative

- Reliance on the Ethereum network

- Highly complicated tech

- Nodes run the risk of being centralized

9. Hedera (HBAR)

Hedera builds public distributed ledgers with a unique mechanism called hashgraph instead of the traditional blockchain. It enables the Hedera network to obtain very high throughput, low latency, and superior energy efficiency as compared to other blockchain networks. In Hedera, HBAR, the native token, is used to pay for transactions and network services.

Hedera promotes a unique approach to enterprise adoption, governance, and scalability. It enables enterprises to build secure applications. With enterprise grade governance, compliance to regulations, and transparency, Hedera holds a special place as one of the Best Regulated Crypto Coins.

Hedera (HBAR) Features, Pros & Cons

Features:

- Unique consensus mechanism: Hashgraph

- Network of enterprise-grade

- Extremely high transaction speed

- Very low energy consumption

- Model of a governing council

Pros:

- Extremely fast and very secure

- Incredibly low transaction fees

- Considerable corporate backing

- Environmentally friendly

- Highly scalable

Cons:

- Extremely centralized governance

- Minimal decentralization

- Limited number of developers

- Still growing adoption

- Reduced influence of the community

10. Polygon (MATIC)

Polygon has specialized in Ethereum Layer 2 scaling solutions that improve transaction speeds as well as reduce transaction costs on the Ethereum network. MATIC provides network fees, governance, and staking. Polygon has enhanced Ethereum’s usability by supporting a myriad of decentralized applications and DeFi projects.

Because of its considerable interoperability, scalability, and integration by top-tier ecosystems, it has emerged as the top Layer 2 networks. Polygon provides users with a legally compliant means of interacting with Ethereum-based applications, and its strong efforts at regulatory compliance make it one of the Best Regulated Crypto Coins.

Polygon (MATIC) Features, Pros & Cons

Features:

- Solution on Layer 2 of Ethereum

- Extremely fast transactions

- Very low gas fees

- Compatibility with multiple chains

- Strong integration with DeFi

Pros

- Efficiently scales Ethereum

- Minimal transaction fees

- Great adoption potential

- Solid developer backing

- Ecosystem is interoperable

Cons

- Dependent on Ethereum

- Security is tied to validators

- Tough competition on Layer-2

- Risk of token inflation

- Complex network

Conclusion

Selecting innovative and compliant digital currencies is vital. Only assessing coins like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Stellar (XLM), Cardano (ADA), Algorand (ALGO), Solana (SOL), Chainlink (LINK), Hedera (HBAR), and MATIC, becomes proven, reliable, actively compliant, and regulative.

For transparency, global compliance, and institutions, these coins become the Digital Assets with Significant Best Compliance (DASBC) for the regulatory crypto investors.

FAQ

What are Best Regulated Crypto Coins?

Best Regulated Crypto Coins are cryptocurrencies that operate in compliance with global financial regulations, offering transparency, security, and legal clarity. They are widely accepted by exchanges, institutions, and investors for their reliability and adherence to legal standards.

Why should I invest in regulated cryptocurrencies?

Investing in regulated cryptocurrencies reduces the risk of fraud, legal issues, and exchange bans. These coins offer greater trust, liquidity, and institutional backing, making them safer for both short-term trading and long-term holding.

Which cryptocurrencies are considered best regulated?

Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Stellar (XLM), Cardano (ADA), Algorand (ALGO), Solana (SOL), Chainlink (LINK), Hedera (HBAR), and Polygon (MATIC) are among the most recognized Best Regulated Crypto Coins globally.

Are regulated crypto coins safe from market volatility?

While regulatory compliance adds a layer of security, regulated crypto coins are still subject to market fluctuations. Investors should combine regulation with research, diversification, and risk management strategies.

How do regulated coins differ from unregulated ones?

Regulated coins comply with legal standards, often have clearer governance, and are supported by major exchanges. Unregulated coins may offer high-risk, high-reward potential but come with less transparency and legal oversight.