It is more crucial than ever to comprehend and manage automated agents as artificial intelligence becomes increasingly integrated into cryptocurrency trading and decentralized finance.

The Top “Know Your Agent” Tools for AI Crypto Agents enable users to monitor, confirm, and control how intelligent bots process data, carry out transactions, and communicate with one another across blockchains.

By combining security, customisation, and transparency, these platforms enable traders and developers to comfortably use automation while lowering risks, guaranteeing wiser choices, and fostering confidence in more independent digital ecosystems.

What Are “Know Your Agent” (KYA) Tools?

Systems and frameworks known as “Know Your Agent” (KYA) technologies are made to assist users in comprehending, keeping an eye on, and managing the actions of AI-powered cryptocurrency agents working in trading, data, and blockchain ecosystems.

These technologies give users insight into the decision-making process of automated agents, the data sources they use, and the actions they are permitted to carry out, including trading or dealing with smart contracts.

To make sure agents behave within predetermined bounds, KYA technologies frequently contain activity logs, transparency dashboards, authorization management, and risk controls.

KYA technologies help lower operational risks and facilitate the safer adoption of autonomous AI agents in decentralized financial and cryptocurrency applications by enhancing trust, accountability, and user oversight.

Key Point & Top “Know Your Agent” Tools for AI Crypto Agents List

| Platform | Key Point |

|---|---|

| Quantum AI | AI-driven crypto trading with predictive algorithms for market trends. |

| Fetch.ai | Decentralized autonomous agents that perform tasks and optimize crypto operations. |

| Autonio | AI-powered trading bot platform for automated strategy execution and optimization. |

| Superalgos | Open-source trading automation and analytics platform for data-driven decisions. |

| 3Commas | Smart trading terminal with bots, portfolio management, and risk mitigation tools. |

| Bitsgap | Unified platform for trading bots, arbitrage, and portfolio management across exchanges. |

| Coinrule | User-friendly platform to automate crypto trading strategies without coding skills. |

| Ocean Protocol Agents | AI agents leveraging decentralized data marketplace for optimized crypto strategies. |

| Rango Exchange | Cross-chain swap aggregator enabling AI agents to execute multi-chain trading. |

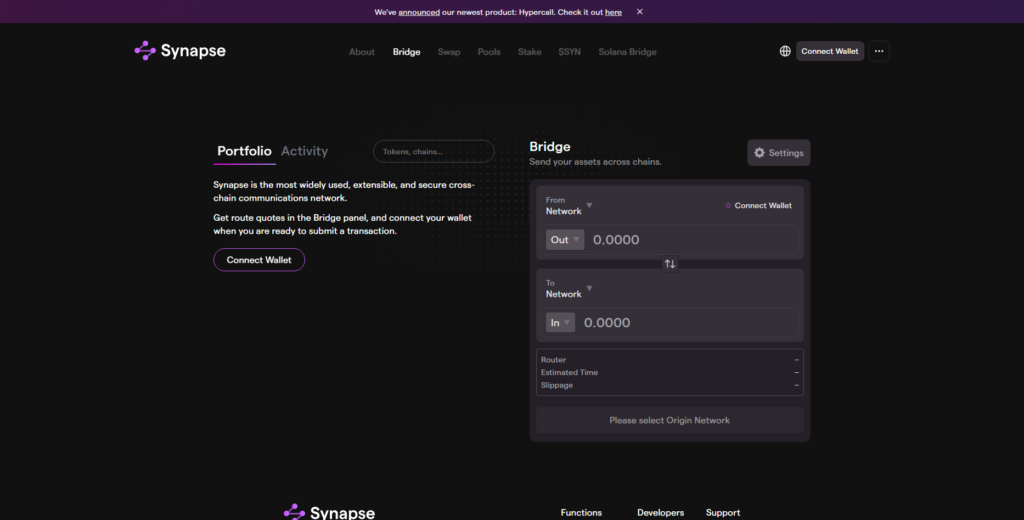

| Synapse Protocol Agents | AI-enabled agents for liquidity management and seamless cross-chain transactions. |

1. Quantum AI

In order to assist traders in navigating the intricate cryptocurrency markets, quantum AI is a new generation of trading technology that blends sophisticated artificial intelligence with automated execution.

Quantum AI technologies can predict trends, identify possible entry and exit locations, and execute trades with little assistance from humans by utilizing pattern recognition, machine learning, and real-time data analysis.

While built-in risk-management tools like stop-loss and take-profit assist safeguard money, these systems seek to lessen emotional decision-making and relieve users of continual surveillance.

Quantum AI’s intelligent automation is intended to assist novice and seasoned traders in making better educated, data-driven decisions, even though it is not perfect.

Quantum AI Pros & Cons

Pros

- AI-Powered Predictions: Quantum utilizes AI to make predictions based on machine learning models.

- Automated Trading: Quantum has the ability to execute trades based on automated strategies.

- Time Saving: Spend less time on manual chart watching and order placing.

- Risk Tools: Set automated loss and take profit orders to manage your risk.

Cons

- Not Guaranteed: Even with AI predictions, big volatility events can cause predictions and models to fail.

- Black-Box Nature: It is rather opaque and difficult for the users to understand how prediction signals are created.

- Overdependence Risk: Some traders may become over reliant on automation.

- Performance Varies: The effectiveness of this tool can vary with the changing conditions of the overall market.

2. Know Your Agent Tools for AI Crypto Agents – Fetch.ai

Fetch.ai is an AI and blockchain-powered, fully decentralized, autonomous economic agent (AEA) network that processes and economically quantifies millions of value transactions autonomously without human participation.

Fetch.ai AEA can autonomously optimize and respond to a variety of logistics, smart city (IoT), supply chain, and DeFi automation use cases (on-chain and off-chain).

Fetch.ai, along with Ocean Protocol and SingularityNET, is part of the Artificial Superintelligence Alliance (ASI) and aims to enhance decentralized AI interoperability by merging the tokens FET and ASI. Encouraging the use of decentralized autonomous agents, Fetch.ai offers a variety of Web3 AI tools and models.

Fetch.ai Features

- Autonomous AI Agent: Provides decentralized self-executing agents for independent data sharing, trading, and decision-making.

- Blockchain Integration: Transparency and trustless executions are provided through decentralized ledger technology.

- Interoperability Support: Crossing multiple blockchain ecosystems and digital worlds is facilitated for agents.

- Token Utility: The native token provides payment for network services, staking, and transactional services.

Fetch.ai Pros & Cons

Pros

- Autonomous Agents: Intelligent agents can execute tasks on their own.

- Decentralized Network: No central authority can make changes to the network.

- Flexible Use Cases: Agents can optimize data sharing, trading, and logistics.

- Ecosystem Growth: Interoperability with other projects means other projects can spur growth.

Cons

- Complexity: There is a steep learning curve to create and manage agents.

- Adoption Dependent: The value of the agents increase with the amount of people using the network.

- Technical Setup: Some developers may require specific tools and abilities.

3. Know Your Agent Tools for AI Crypto Agents – Autonio

Autonio is a decentralized autonomous organization (DAO), fully operational on the Ethereum blockchain, and is an AI-powered Algorithmic Trading Platform. Autonio offers a means for the automation of crypto trading using smart trade bots and the ability to create customized trading strategies.

It allows users to develop, evaluate, and implement automation for a set of trading parameters, thus producing flexibility and encouraging the creation of personalized algorithmic trading strategies to be utilized by traders at various levels of complexity.

Autonio utilizes its AI to evaluate trends relating to time, prices, orders, and volumes to determine and automate the execution of buy/sell orders. This are to minimize the emotional biases inherent in human traders.

The native token, NIOX, facilitates governance, premium feature access, and other ecosystem activities. Regardless of skill level, Autonio’s unique marketplace and user-friendly design encourage partnership and the exchange of ideas.

Autonio Features

- AI Trading Bots: Provides automated trading bots for price, volume, and indicator analysis.

- No-Code Strategy Builder: Trading strategies can be made and customized without any coding.

- DAO Governance: Development and platform growth decisions can be voted on by token holders.

- Strategy Marketplace: Users can create a marketplace for trading strategies where they can share, sell, and adopt strategies.

Autonio Pros & Cons

Pros

- Automated Trading: Trades autonomously using AI bots.

- No Coding Required: Strategy construction using visual tools.

- Strategy Collaboration: Marketplace for community strategies.

- Decentralized Governance: Rule change proposals by token holders.

Cons

- Strategy Quality varies: Effectiveness of strategies varies by user.

- Bots Misbehavior: Supervision is required for bots.

- Basic Analytics: No advanced institutional tier analytics.

- Beginner’s Complexity: New users require time to understand the system.

4. Know Your Agent Tools for AI Crypto Agents – Superalgos

Superalgos is a community-driven ecosystem designed for free, open-source crypto trading bots and automation, allowing users to collaboratively create, build, and deploy automated trading systems.

It provides users with visual tools to design algorithmic trading bots that can be tested and executed across multiple exchanges without proprietary software. As a community project, data mine contributors, indicators, and models share and build community-structure tokens to earn for their contributions.

In addition, Superalgos provides a balance of transparency, flexibility, and visual scripting that allows for a collaborative and social retail, and algorithmic trading experience.

Superalgos Features

- Open-Source Framework: Fully transparent and community-driven trading bot and analytics platform.

- Visual Strategy Designer: Empowers users to construct trading systems using easy-to-understand visual tools instead of complex codes.

- Data Mining Tools: Gathers, processes, and analyzes market data for backtesting and optimization of strategies.

- Community Collaboration: Users can construct and share indicators, bots, and autonomous insights within a decentralized ecosystem.

Superalgos Pros & Cons

Pros

- No Cost: No subscription fee.

- Collaborative: Community driven.

- Visual Strategy: Use building blocks to develop bots.

- Extensive Data Mining: Tools for analysis and collection of market data.

Cons

- Setup Complexity: Installing and configuring the system is complicated.

- Community Support: Only community support, no help-desk.

- Overwhelming: New traders may find the process daunting.

- Self-Maintenance: Systems require manual updates by the users.

5. Know Your Agent Tools for AI Crypto Agents – 3Commas

3Commas is an integrated AI crypto trading automation platform that offers users the ability to build, backtest, and deploy trading bots on various exchanges with customized strategies.

3Commas allows traders to set up bots for automated trading 24/7 with features such as dollar-cost averaging, backtesting, smart portfolio management, and signal generation.

It uses TradingView for trading and offers customizable risk management features including take-profit and stop-loss. 3Commas aims to streamline trading by making it algorithmic in such a way that it limits manual trading and emotional decision making.

3Commas Features

- Multi-Exchange Integration: Links with different crypto exchanges using safe API connections.

- Smart Trading Bots: Provides DCA, Grid, and unique bots for implementation of automated strategies.

- Advanced Order Management: Offers conditional orders, and support for take-profit, trailing stops, and conditional trading.

- Portfolio Tracking: Monitors the performance of all connected accounts in real-time.

3Commas Pros & Cons

Pros

- Multiple Exchange Capabilities: Supports all the major exchanges.

- Smart Order Function: Advanced order types (like trailing stops) available.

- Variety of Bots: Offers DCA, Grid, and other customizable bots.

- Multi-Exchange Portfolio Tracking: Net assets evaluation across linked exchanges.

Cons

- Cost of Subscription: Paying for a plan is required to enable full functionality.

- Not Completely Decentralized: Relies on a centralized service.

- Secured API: Users must take responsibility for the safeguarding of the API.

- Existing Market Risk: Under unfavorable conditions, the Bots can incur losses.

6. Know Your Agent Tools for AI Crypto Agents – Bitsgap

Bitsgap is simple and uses a one-stop solution to crypto trading that has crypto trading bots, automated trading, a trading dashboard, and a trading portfolio for analytics and trading over at least 15 exchanges for crypto trading. Bitsgap connects safely using the API, trading strategies, and Grid bots.

Bitsgap also has demo trading, smart order MPC, and risk strategies, and offers analysis all in one dashboard. Beginners especially like the dashboard where they can drag and drop their bots and using the bots that are set to default, while the experienced traders like the Advanced trading strategies with their portfolio insights.

Bitsgap Features

- Unified Trading Dashboard: Overviews accounts of different exchange accounts from a single dashboard.

- Automated Bots: Provides DCA, Grid, and hybrid bots for all market conditions.

- Arbitrage Tools: Discovers profit-making opportunities by spotting price variances across different exchanges.

- Portfolio Analytics: Monitors trading history, performance, and account balances in real-time.

Bitsgap Pros & Cons

Pros

- Integrated Interface: Consolidate multiple exchange accounts.

- Automated Bots: Provides strategies for grid, DCA, and hybrid.

- Arbitrage Tools: Identifies and assists with pricing disparities.

- Portfolio Tracking: Provides balance and performance updates in real-time.

Cons

- Paid Subscription: Paying for a plan is required to gain access to the full selection of features.

- API Dependency: The performance can be negatively impacted by issues with the API of the exchanges.

- Arbitrage Opportunity Limits: The windows for profit can be small and/or fleeting.

- Not AI-Driven: The systems are more advanced but less intelligent.

7. Know Your Agent Tools for AI Crypto Agents – Coinrule

Plug and play crypto trading bots are Coinrule’s specialty. They also provide platforms that are user friendly for creating bots.

Using basic “If-This-Then-That” logic, traders can devise unique strategies to implement on major exchanges like Binance, Coinbase, Kraken, OKX, and others.

Coinrule offers hundreds of templates for varying market situations (e.g., trend-following, scalping), works with both spot and futures markets, and provides non-custodial protection through API integration.

Its visual strategy builder and ready-made bot templates can accommodate both novices who need an uncomplicated interface and experts who prefer to fine-tune every aspect of their automation.

Coinrule Features

- Rule-Based Automation: Allows users to develop trading rules based on the ‘if-this-then-that’ principle, all without the need for coding.

- Strategy Templates: Has different ready-made strategies for various market conditions.

- Exchange Connectivity: Integrates with all centralised exchanges through secure API.

- Backtesting Tools: Lets users analyze strategies with prior market data.

Coinrule Pros & Cons

Pros

- No Code Operator: Users can easily create rules through a builder using templates.

- Templates Were Pre-Constructed: Templates enable a quick set up to address various market scenarios.

- Backtesting: Analyze the outcomes of rules through historical data.

- Support on Numerous Exchanges: Numerous leading exchanges are supported.

Cons

- Customization Limits: Scriptable bots can offer considerably more flexibility.

- Templates of a General Nature: The template may not align with the unique trading discipline of every trader.

- Paid Subscription: More advanced features necessitate payment.

- Rules: Building complex strategies may be difficult because of the limitations involved.

8. Know Your Agent Tools for AI Crypto Agents — Ocean Protocol Agents

Ocean Protocol is a pioneer in decentralized data exchange protocols that allows secure and privacy-preserving data sharing for AI applications.

It once participated in the Artificial Superintelligence Alliance (ASI) with Fetch.ai and SingularityNET to merge and cross-utilize tokens for decentralized AI infrastructure, but the collaboration was short-lived as they scaled their projects in different directions.

Ocean’s main innovation is in developing decentralized data marketplaces where data sets can be tokenized and monetized.

This service can drive significant revenue while also providing AI agents with data to perform training and prediction tasks. Ocean’s tools support data-centered agent workflows across DeFi and AI ML marketplaces.

Ocean Protocol Agents Features

- Decentralized Data Marketplace: Users can share data and earn in a secure manner.

- Data Tokenization: Users can control access for data to be turned into a dataset tokens on the blockchain.

- Privacy-Preserving Compute: Users can run AI on data and keep the raw data hidden.

- AI Integration: Users can train and run AI models with data from a trusted source.

Ocean Protocol Agents Pros & Cons

Pros

- Data Marketplace: Facilitates the first mechanisms to share and monetize data.

- Tokenized Data Access: Data can be used, purchased, and sold through tokens.

- Privacy Features: The data owner can enforce privacy with the

compute-to-datatechnique that prevents the exposure of raw data. - Supports AI Training: Supply accumulation of datasets that support AI model training.

Cons

- Not a Trading Tool: Value is focused on data infrastructure, most along the trading.

- Technical Use: Involvement of the data markets and tokens is a must.

- Market Adoption Impact: Value will only grow if the data ecosystem continues to be expanded.

- Indirect ROI: Return on investment will be long-term and reliant on the ecosystem.

9. Know Your Agent Tools for AI Crypto Agents — Rango Exchange

Rango Exchange is a decentralized exchange aggregator that operates on multiple blockchains and claims to enable and optimize swaps and liquidity routing across different chains. In contrast to pure AI agent platforms, it is centered on embedding tools for cross-chain trading and bridging within the DeFi ecosystem.

Exercise your discretion, however, as some members of the community have raised issues regarding transparency and legitimacy, and there is enough of such discussion on the internet for users to warrant conducting their own research with respect to the platform’s credentials, audits, and endorsements before conducting transactions.

Official documentation and community assessments should be prioritized to mitigate the risk of automated environments incorporating potentially malicious integrations or poor security measures.

Rango Exchange Features

- Cross-Chain Swaps: Users can exchange tokens from different blockchain networks.

- Liquidity Aggregation: Users can access the best trading routes for several decentralized liquidity pools.

- Non-Custodial Trading: Users can manage their own wallets and private keys freely.

- Developer APIs: Users can build interfaces in wallets and dApps.

Rango Exchange Pros & Cons

Pros

- Cross-Chain Swaps: Allows tokens to be exchanged on various blockchains.

- Non-Custodial: Wallet control remains entirely with the user.

- Liquidity Aggregation: Gathers and pools the best available rates.

- Integration APIs: Developers can integrate swapping functionalities into their apps.

Cons

- Variable Liquidity: The quality of the swap is reliant on the network and the token.

- Bridging Risk: Cross chains provide potential security risks.

- Not AI-Focused: Lacks built-in automation and AI for most manual tasks.

- User Complexity: The idea of using chains may be hard for some users to understand.

10. Tools for AI Crypto Agents You Should Know – Agents of Synapse Protocol

Synapse Protocol is a cross-chain messaging and interoperability platform that allows for the secure transfer of both assets and information across multiple blockchains. It also provides support for decentralized applications, cross-chain bridging, and the interoperability of smart contracts, simplifying the work of developers aiming to enhance the complexity of interactions between DeFi and cross-chain AI agents.

Although it is not, strictly speaking, an AI trading agent, Synapse’s infrastructure design enables cross-network AI agents to communicate and perform transactions, thus, simplifying more complex automated processes in systems of multiple blockchains.

The SYN token is native to the network and functions as a governance, liquidity, and utility token for ecosystem services. It also supports automated services that are more interoperable within the ecosystem.

Synapse Protocol Agents Features

- Cross-Chain Bridging: Users can send assets securely across different blockchain networks.

- Interoperability Messaging: Users can send messages from one smart contract to another across different chains.

- Shared Liquidity Pools: Users can access the same liquidity pool and reduce the cost and hassle from transactions.

- Developer Toolkits: Users can access tools to create decentralized apps that run on multiple blockchains.

Synapse Protocol Agents Pros & Cons

Pros

- Cross-Chain Connectivity: Transfers assets and information across various blockchains.

- Shared Liquidity Pools: Enhances operational efficiency and minimizes friction.

- Smart Contract Messaging: Allows communication between different blockchains.

- Developer Infrastructure: Assists in the creation of interoperable decentralized applications (dApps).

Cons

- Technical Complexity: Involves a lot of research about bridge blockchains.

- Not a Trading Bot: Automation of trading is not the focus, but rather interoperability.

- Security Risks: There is a risk of bridge exploits.

- Indirect Benefits: The primary value is captured by developers rather than end-users or traders.

Key Criteria for Evaluating KYA Tools for AI Crypto Agents

- Security & Trust: Measures the level of user info and funds protection, along with the APIs user governance risk by assessing data encryption, audits, and access controls.

- Automation Capabilities: Assesses the degree to which AI agents automate trade execution, portfolio management, and other activities based on programmed rules and market-triggered adaptive learning.

- Interoperability: Measures the efficiency with which the tool operates the AI agents across multiple blockchains, wallets, exchanges, and protocols to facilitate diverse crypto systems.

- AI Intelligence Level: Evaluates the effectiveness of the predictive analytics and machine learning models used to enhance the performance of agents based on market data.

- User Control & Customization: Measures the level of ease which determines how users configure strategies, rules, risk parameters, and dashboards to sync AI agent behavior with trading goals.

- Transparency & Explainability: Assesses the quality of the descriptions of the steps undertaken by AI agents to automate processes in a user-verifiable and trusted way.* Performance & Scalability: Evaluates the system’s capacity to manage increasing volumes of transactions, the speed of data processing, increasing user requirements, def without speed, dependability, or operational consistency erosion.

- Value & Cost Efficiency: Evaluates the potential return vis-a-vis the features of the system considering the subscription cost, fees per transaction, tokens, and, hence, aids in determining the affordability versus the benefits in the long run.

- Support & Community: Evaluates the existence of user documentation, step-by-step user guides, developer forums, quick support response to help users set up, solve problems, and improve their use of AI agents.

- Risk Awareness & Compliance: Evaluates whether the tool offers guidance to stay within the boundaries of applicable regulations, risk warning, and jurisdiction-appropriate features to help users operate responsibly within new, developing, or changing legal and financial environments.

Conclusion

Using AI-powered agents has become crucial for traders and investors looking for efficiency, accuracy, and security in the quickly changing world of cryptocurrencies. The aforementioned systems, which provide sophisticated automation, transparency, and trustworthy performance verification, are the Best “Know Your Agent” Tools for AI Crypto Agents.

Each technology enables users to leverage AI while preserving control and trust, from cross-chain optimization with Synapse Protocol Agents to predictive trading with Quantum AI. You may improve decision-making, reduce risks, and maintain an advantage in the cutthroat world of digital assets by incorporating these platforms into your cryptocurrency strategy.

FAQ

What are “Know Your Agent” (KYA) tools for AI crypto agents?

“Know Your Agent” tools are platforms or frameworks that allow traders to verify, monitor, and control AI-driven crypto agents. They ensure transparency, reliability, and secure execution of automated trading, portfolio management, or liquidity strategies. Using KYA tools, users can trust that their AI agents act according to predefined rules and adapt safely to market conditions.

Why are KYA tools important in crypto trading?

AI crypto agents can make rapid decisions, but without monitoring, they may behave unpredictably or risk funds. KYA tools provide verification, analytics, and real-time tracking to minimize errors, optimize strategies, and maintain security across exchanges and blockchain networks.

Which are the top KYA tools for AI crypto agents?

Some of the most trusted platforms include Quantum AI, Fetch.ai, Autonio, Superalgos, 3Commas, Bitsgap, Coinrule, Ocean Protocol Agents, Rango Exchange, and Synapse Protocol Agents. Each offers unique features such as AI trading, cross-chain automation, decentralized intelligence, and portfolio management.

Can beginners use these KYA tools?

Yes! Many platforms, like Coinrule and 3Commas, are beginner-friendly, offering no-code interfaces and pre-built strategies. Others, like Superalgos and Fetch.ai, provide more advanced customization suitable for professional traders.