The Best Platforms for Tokenized U.S. T-Bills will be covered in this article, along with how blockchain technology is changing investors’ access to low-risk, government-backed yields.

In 2026 market trends, you will discover how tokenized Treasury investments provide quicker settlement, more transparency, and flexible on-chain alternatives for both retail and institutional portfolios. You will also learn about top platforms, essential features, and regulatory compliance.

What are tokenized U.S. T-Bills?

Short-term US government debt is represented digitally by tokenized T-Bills, which are issued and tracked on a blockchain. Investors are exposed to the same low-risk, government-supported yields available in traditional markets since each token is backed by actual U.S.

Treasury Bills that are kept in custody. Tokenized T-Bills use blockchain technology to provide speedier settlement, increased transparency through on-chain records, worldwide accessibility through digital wallets, and integration with decentralized financial platforms for yield schemes, trading, and lending.

Why It Is Platforms for Tokenized U.S. T-Bills Matter

Global Access – Investors all around the world can access U.S. government-back yields. Investors do not have to conform to the typical banking rules because they can use blockchain wallets and digital marketplaces.

Faster Settlement – With blockchain, transactions can happen within minutes. This increases liquidity, improves the use of capital, and increases the possibilities for reinvestment.

Improved Transparency – With the use of on-chain records, proof-of-reserves, and smart contracts, asset backing, ownership, and performance can be seen at any time.

Regulatory Compliance – The best platforms offer KYC, AML, and compliance to securities laws, meaning there is safe participation within the world’s financial laws.

DeFi Integration – Tokenized T-Bills can be used in lending, staking, and liquidity protocols. This adds more yield opportunities to what the traditional market offers for fixed income.

Lower Costs – Investing in government-backed securities can be done for less. This is because there are at less intermediaries, custodial fees, and less administrative costs.

Portfolio Diversification – Low-risk, stable yield assets can now be added to traditional and crypto portfolios. With this added, the portfolio has more balance and less volatility.

Programmable Finance – Operating smart contracts that automate the distribution of interest, compliance, and reporting are more efficient.

Institutional Adoption – Tokenized fixed income markets can now attract banks, funds, and asset managers because of the integration of traditional finance and blockchain.

Access Markets Anytime – Supported blockchain platforms allow for the continuous transfer and trade of tokenized T-Bills.

Key Point & Best Platforms for Tokenized U.S. T-Bills List

| Platform Name | Key Point |

|---|---|

| Ondo Finance | Provides institutional-grade tokenized U.S. Treasury exposure through compliant on-chain funds, offering stable yields, transparent reserves, and blockchain-based settlement for global investors. |

| Superstate | Bridges traditional asset management with blockchain by offering regulated, tokenized T-Bill funds designed for accredited investors seeking compliant, low-risk, on-chain yield products. |

| Backed Finance | Issues fully collateralized, asset-backed tokens representing U.S. Treasury exposure, enabling real-time transparency, cross-chain compatibility, and decentralized finance integration. |

| Centrifuge | Connects real-world assets to DeFi by enabling tokenized T-Bill pools that provide on-chain liquidity, automated yield distribution, and institutional participation through decentralized marketplaces. |

| Clearpool | Delivers on-chain fixed-income and credit market access, allowing investors to gain exposure to tokenized Treasury-like instruments with transparent interest rates and smart contract governance. |

| TrueFi | Operates a decentralized credit protocol offering tokenized yield products backed by real-world assets, emphasizing risk assessment, transparency, and automated lending structures. |

| Arta Finance | Provides digital wealth management access to tokenized government securities, combining AI-driven portfolio tools, secure custody, and regulatory compliance for high-net-worth investors. |

| Securitize | Powers regulated tokenized securities infrastructure, enabling compliant issuance, custody, and secondary trading of U.S. Treasury-backed digital assets on approved marketplaces. |

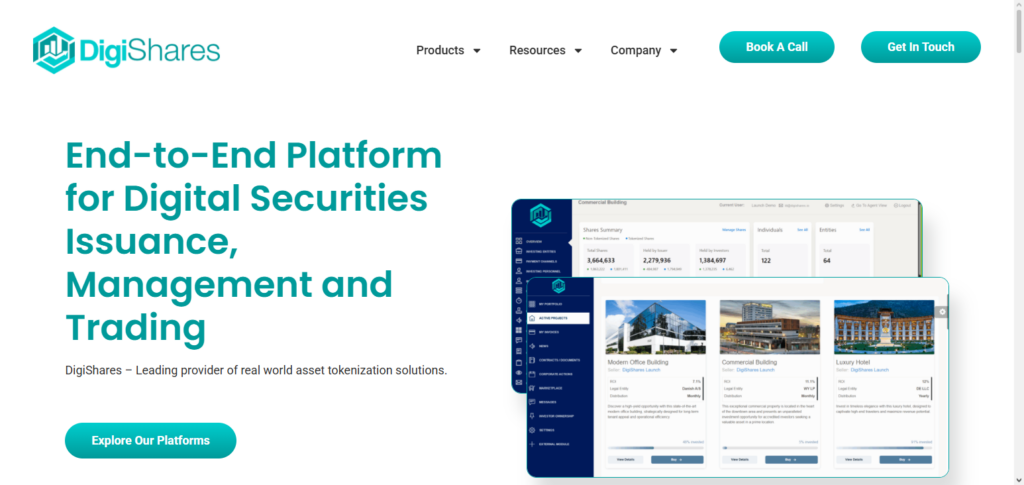

| DigiShares | Offers a full-stack tokenization platform for compliant issuance and management of real-world assets, supporting tokenized bond and Treasury-style investment products. |

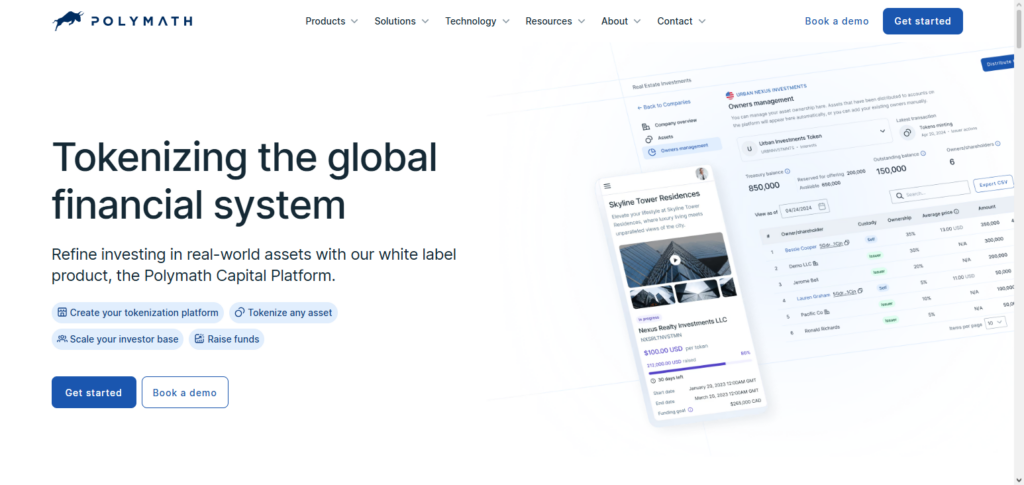

| Polymath | Specializes in security token infrastructure, helping institutions issue and manage compliant, blockchain-based Treasury and fixed-income tokens with built-in regulatory controls. |

1. Ondo Finance

Ondo Finance stands as the foremost provider of primary access to U.S. Treasury Bills through compliant, asset-backed funds, merging traditional fixed-income markets with decentralized finance. For investors, the platform provides blockchain transparency with real-time settlements and on-chain liquidity, coupled with low-risk yields.

Moreover, the platform has focused on building trust through institutional-grade custody, regulatory compliance, and reserve verification. Positioned at the center of its ecosystem, Best Platforms for Tokenized U.S. T-Bills frequently notes the seamless DeFi integration offered by Ondo Finance, which allows users to employ tokenized Treasuries across diversified lending, trading, and yield strategies while preserving capital and achieving steady returns.

Ondo Finance Features, Pros & Cons

Features

- On-chain settlement for tokenized Treasury exposure.

- Compliance and custody at an institutional grade.

- Proof-of-reserves model for transparency.

- DeFi protocol accessibility.

- Yield tracking for real-time metrics.

Pros

- Regulatory alignment that is initiative and thorough.

- Transparency and auditability at a higher level.

- Security at an institutional level.

- DeFi accessibility that is seamless.

- Yield predictability.

Cons

- Potential need for a KYC check and/or eligibility determinations.

- Restrictions for small traders/investors.

- Initially, limited support for additional blockchains.

- Not all of the functionalities are user-friendly for novices within the DeFi space.

- Centralized functionality within the reserve oversight.

2. Superstate

Superstate offers regulated, tokenized investment products combining traditional asset management with blockchain technology, specifically investments backed by U.S. Treasury Bills. Their platform is designed for accredited investors and institutions who want compliant on-chain access to government securities and enjoy reporting and fund oversight.

Superstate integrates digital wallets and custody solutions, with an emphasis on audited reserves and investor protection. When discussing Best Platforms for U.S. T-Bill Tokenization, Superstate is especially noted and favored for regulatory considerations and long-term focus. Superstate’s products help investors diversify and enhance liquidity to enjoy blockchain efficiency while keeping the protections of traditional financial systems.

Superstate Features, Pros & Cons

Features

- Tokenized Treasury funds and managed Assets.

- Structures of asset management, regulated.

- Focus on accredited investors.

- Reporting on compliance.

- Compatibility with blockchain wallets.

Pros

- Adherence to regulations, strict.

- Governance and oversight of a professional level.

- Trust on the part of the investors is heightened.

- Standards for the reporting that are clear.

- Direct integration of fiat is seamless.

Cons

- Focus on accredited investors, strict.

- Reduced options for retail investors.

- Restriction on the number of tokens available, small.

- Potential for delayed onboarding of new users, higher.

- Less liquidity available to the secondary market, limited.

3. Backed Finance

Backed Finance issues fully collateralized, asset-backed tokens financial instruments, including U.S. Treasury Bills exposure, tokens for which each has verifiable reserves. This provides transparency and confidence for the investor.

The platform intends to be cross-chain compatible so users can incorporate tokenized Treasuries into DEXes, lending protocols, and portfolio management applications.

Backed Finance is devising to be, among many, the Best Platforms for Tokenized U.S. T-Bills, especially for proof of reserves and DeFi integration. Their model provides access to stable yields while allowing investors to move freely across multiple blockchain ecosystems

Backed Finance Features, Pros & Cons

Features

- Tokenization of proof-of-reserves

- Interoperable across chains

- T о k e n s that are asset-backed

- DeFi Solutions

- Verified Transparency of Reserves

Pros

- Multi blockchain capabilities

- High reserve transparency

- Simple DeFi integration

- Versatile portfolio application

- Strong compliance emphasis

Cons

- More specialized blockchain knowledge needed

- DeFi risk (smart contracts)

- Defi market liquidity

- Ecosystem activity affects yield

- Possibly no fiat bridges

4. Centrifuge

Centrifuge enables issuers to facilitate U.S treasury backed products and tokenize them. Then, they can be offered to investors through on-chain liquidity pools. Investors can automate and gain returns through smart contracts. They can also gain access to liquidity anywhere in the world. They can also participate in the platform and liquidity pools as institutions.

They will also be able to employ community-based risk assessment. Among the Best Platforms for Tokenized U.S. T-Bills , Centrifuge is one of the best because they are able to span the bridge between traditional finance and decentralized finance.

Centrifuge Features, Pros & Cons

Features

- Tokenization of real world assets

- Liquidity pools on the blockchain

- Yield automation

- Governance decentralization

- Support for institutional investors

Pros

- Broad access to DeFi ecosystems

- Streamlined automated income distribution

- Community-led governance

- Suitable for institutional investment

- Extensive asset variety

Cons

- Proactive DeFi participation is needed

- Exposure risks of smart contracts

- Liquidity varies widely

- Defi ecosystem knowledge is needed

- Clarity on regulation is still in limb

5. Clearpool

Clearpool provides investors on-chain access to fixed income and credit marketplaces. That access can also include treasury-like instruments. Investors are given the transparency of the rate of interest, risk parameters, and profiles of the borrowers.

When these attributes are given together, they help investors make choices. They use smart contracts to automate everything, including the distribution of the yield, and the process of lending and paying back the loan while also ensuring no one controls the platform.

Among the Best Platforms for Tokenized U.S. T-Bills, Clearpool has brought credit markets of institutions in the world to the blockchain for the first time. tokenized assets that are backed by the government, and in the decentralized world, they will have liquidity and will be able to monitor the performance of the assets in real time.

Clearpool Features, Pros & Cons

Features

- On-chain fixed income market

- Simple rate transparency

- Lending via smart contracts

- Governance decentralization

- Credit and collateral monitoring

Pros

- Balanced rate of interest discovery

- Strong automation for smart contract

- Access to multiple markets

- Liquidity pools that are not constrained

- Risk parameters that are easy to see

Cons

- Knowledge of DeFi is required

- Risk of smart contracts

- Liquidity is often not sufficient

- Limited support for fiat money

- No direct passive Treasury custody

6. TrueFi

TrueFi has built a decentralized credit protocol aimed at developing risk-assessed and transparent lending markets for tokenized real-world assets (including products related to government securities) and provides solutions for on-chain governance, automated scoring, and distribution of yields on smart contracts. It also incorporates credit scoring, governance, and smart contracts to administer loans and automate yield distributions.

Investors can monitor borrower activity and portfolio performance. TrueFi’s name is a tokenized bill tracking protocol. TrueFi is recognized for its data-based risk evaluation and open access for communities to support transparent and decentralized governance. Investors also receive a steady return that is backed by assets.

TrueFi Features, Pros & Cons

Features

- Credit protocols that are decentralized.

- Credit scoring for all involved.

- Lending markets that are on the blockchain.

- Yield distribution that is automated.

- Governance by the community.

Pros

- Credit risk evaluation that is transparent.

- Lending pools that generate revenue.

- Transparency that is up-to-date.

- Lending markets that are community-owned.

- Reduced entry barriers.

Cons

- The learning curve is crypto-narrative.

- Vulnerabilities in the smart contract.

- Riskier than just Treasury exposure.

- Reliant on the status of the lending market.

- Token incentives that may be unstable.

7. Arta Finance

Arta Finance enables a digital wealth management platform combined with AI-infused portfolio management to offer high-net-worth and accredited investors access to tokenized government securities, including products backed by U.S. Treasury securities.

The platform offers a premium investment experience by integrating portfolio optimization, secure digital custody, and regulatory compliance solutions, focusing on personalized strategies, performance analytics, and frictionless onboarding. Within the category of Best Platforms for Tokenized U.S. T-Bills,

Arta Finance is noted for its blend of traditional wealth advisory services with the efficiency of blockchain. The tokenized assets offer investors the flexibility to manage modern digital portfolios while professional management provides a steady yield and the tokenized assets.

Arta Finance Features, Pros & Cons

Features

- Focus on digital wealth management.

- Asset optimization driven by AI.

- Government securities that are tokenized.

- Safe custodial services.

- Simple user interface.

Pros

- For investors with a long-term perspective

- Tools for professional portfolio management

- Impressive experience for new users

- Focus on compliance is strong

- Ability to use fiat

Cons

- May need to be accredited

- Less exposure to DeFi

- Potential for higher fees

- Blockchain assets are in short supply.

- Community involvement is lacking.

8. Securitize

Securitize’s platform is an infrastructure provider for fully regulated tokenized securities where firms can compliant issue, custody, and trade digitally securitized U.S. Treasury securities. The platform, which is fully tokenized, also helps with investor onboarding, and includes identity verification along with necessary reporting to remain compliant with various global regulations.

Additionally, the platform has integrations with regulated custodians and marketplaces for streamlined and compliant digitally backed U.S. Treasury securities custody and trading. Securitize is recognized as one of the Best Platforms for Tokenized U.S. T-Bills due to its comprehensive enterprise solutions for end-to-end regulatory compliance digitally backed U.S. Treasury securities. The technology of Securitize enables both institutions and issuers to seamlessly and securely incorporate traditional government securities into the blockchain.

Securitize Features, Pros & Cons

Features

- Infrastructure for regulated issuances.

- Compliance and verification of investors.

- Supports secondary trading.

- Integrations with custody services.

- Management of token lifecycle.

Pros

- Compliance is top-notch.

- Facilitation for institutional issuers.

- Safe custody services.

- Support for secondary markets.

- Alignment with global regulations.

Cons

- Issuers’ perspective, not the traders’.

- Complicated onboarding.

- Retail access can be limited

- Limited DeFi integrations

- Less liquidity than open exchanges

9. DigiShares

DigiShares has a tokenization platform with end-to-end solutions that are aimed at assisting issuers with the creation, management, and distribution of compliant digital securities, which also includes bond and Treasury-like investment products.

The platform includes automated investor management, dividend distribution, and regulatory reporting. The platform’s design fits asset managers and other enterprises that are modernizing their capital markets.

When talking about the Best Platforms for Tokenized U.S. T-Bills, DigiShares’ global compliance and issuance capabilities earn a spot as one of the best. The platform’s fundraising and asset management capabilities built on the blockchain, along with the reduction of complexity in investor relationships, is DigiShares’ offering.

DigiShares Features, Pros & Cons

Features

- Tokenization of different asset classes

- Prior screenings with KYC

- Distribution automation

- Compliance reporting

- Support for multiple assets

Pros

- Great for issuance

- Support for multiple jurisdictions

- Management of investors with less effort

- Reporting with clarity

- T-Bills are not the only use case

Cons

- Trading not open to retail

- Costs incurred for issuers to set up

- No integrated marketplace

- Not DeFi-first

- For issuers, it’s more complicated

10. Polymath

Polymath constructs infrastructure to support security tokens and helps institutions create and administer compliant blockchain representations of traditional financial assets, including fixed-income and Treasury-backed products.

The platform integrates end-of-the-line regulatory smart contract controls, identity verification, and evidence of regulatory compliance. Polymath supports secondary trading and the lifecycle management of customizable tokenized assets.

Within the Best Platforms for Tokenized U.S. T-Bills, Polymath is recognized for its technical competence and regulation-first approach. Polymath provides a safe, customizable, and compliant digital assets ecosystem for investors and issuers to manage and trade traditional government securities.

Polymath Features, Pros & Cons

Features

- Token standard for securities

- Compliance baked in

- ID verification

- Support for secondary trades

- Institutional issuance

Pros

- Good alignment with regulators

- Uniform token standards

- Markets for securities focus

- Liquidity of issuance is secondary

- Flexible features for issuance

Cons

- Requires advanced tech for set up

- Institutions are the primary focus

- Features for retail are few

- Limited offerings for consumers

- Dependence on partners for liquidity

Conclusion

The Top Tokenized Platforms By fusing the efficiency of blockchain technology with the stability of U.S. Treasury securities, U.S. T-Bills are revolutionizing investors’ access to low-risk, government-backed yields.

While DeFi-focused systems like Centrifuge and TrueFi showcase the power of on-chain liquidity and automated yield distribution, platforms like Ondo Finance, Superstate, and Securitize emphasize the significance of regulatory compliance, transparent reserves, and secure custody.

These platforms are making the fixed-income market more accessible, efficient, and global as tokenization adoption picks up speed. This allows institutional and retail investors to diversify their portfolios with more flexibility, transparency, and real-time financial management.

FAQ

What are tokenized U.S. T-Bills?

Tokenized U.S. Treasury Bills are digital representations of short-term U.S. government debt issued and recorded on a blockchain. They combine the safety of Treasury securities with the transparency and accessibility of digital assets.

Why invest in tokenized T-Bills?

Tokenized T-Bills offer low-risk yields backed by the U.S. government, faster settlement via blockchain, enhanced transparency, and easier access for global investors compared to traditional Treasury markets.

How are tokenized T-Bills different from regular T-Bills?

While regular T-Bills settle through legacy financial systems, tokenized versions use blockchain technology for near-instant settlement, programmable features, and on-chain liquidity with DeFi integration.

Are tokenized T-Bills safe?

Yes—when issued through reputable, regulated platforms, tokenized T-Bills are backed by actual U.S. Treasury securities held in custody. Always verify proof-of-reserves and compliance credentials.