This article examines the Top Crypto Lending Protocols for Emerging Markets SMBs, demonstrating how blockchain-driven finance is transforming underbanked companies’ access to cash globally.

Since there are few loan choices available to more than half of small and medium-sized businesses in developing nations, cryptocurrency lending provides a data-driven, international alternative.

These platforms enable quicker funding, cheaper expenses, and worldwide financial inclusion by fusing digital collateral, stablecoin liquidity, and smart contract automation.

What Are Crypto Lending Protocols?

Decentralized or centralized systems known as cryptocurrency lending protocols enable people and companies to lend and borrow digital assets independently of conventional institutions.

Lenders receive interest by supplying liquidity, and borrowers can use their cryptocurrency holdings—such as Bitcoin, Ethereum, or stablecoins—as collateral to get loans. By using smart contracts to automate a large portion of the process, these protocols guarantee efficiency, security, and transparency.

They are particularly useful for small and medium-sized businesses (SMBs) in emerging economies that might not have access to traditional financial services because they are unique to cryptocurrency lending and allow for immediate access to funds, borderless transactions, and customizable conditions.

Key Point

| Protocol | Key Point for Emerging Market SMBs |

|---|---|

| Aave | Provides multi-chain, decentralized liquidity pools and stablecoin loans, allowing SMBs to access capital globally without relying on local banking infrastructure. |

| Compound | Uses algorithmic interest rates and smart contracts to offer transparent, automated crypto borrowing options for small businesses seeking predictable funding costs. |

| MakerDAO | Enables SMBs to generate DAI stablecoin loans by locking crypto collateral, helping reduce currency volatility risks in emerging economies. |

| Goldfinch | Specializes in undercollateralized lending to real-world businesses, expanding credit access for SMBs in developing and frontier markets. |

| Celo Credit Collective | Mobile-first ecosystem supporting microloans and stablecoin payments, making crypto financing accessible through smartphones and low-cost networks. |

| Maple Finance | Offers on-chain credit pools and institutional-grade lending structures for growth-stage businesses seeking transparent, scalable funding. |

| TrueFi | Provides unsecured crypto loans based on reputation and on-chain credit history, reducing heavy collateral requirements for trusted SMBs. |

| Kiva Protocol | Connects global lenders with underserved entrepreneurs using blockchain to improve transparency, traceability, and financial inclusion. |

| Centrifuge | Tokenizes invoices and real-world assets, enabling SMBs to unlock liquidity by using business receivables as crypto-backed collateral. |

| Clearpool | Features dynamic, market-driven interest rates and open liquidity pools, allowing businesses to borrow capital with transparent pricing. |

1. Aave

Aave is a prominent name in the decentralized lending and borrowing space. With Top Crypto Lending Protocols for Emerging Markets SMBs standing out for its fair and transparent lending practices, it allows SMBs to lend and borrow collateralized loans in stablecoins or cryptocurrencies circumventing traditional banking systems.

By integrating their services across Ethereum, Avalanche, and Polygon ecosystems, they deliver fast and reliable loans. Given Aave’s wide support for multiple tokens and proven track of record of liquidity, they are one of the best SMB lenders in the space due to their flexible and reliable lending services.

Aave Key Features:

- Lending and borrowing on Ethereum, Polygon, Avalanche and other chains

- Loans in crypto and stablecoins, variable and fixed interest options

- Advanced defi integrations and flash loans

- Audited, smart contracts are non-custodial

Pros:

- Extensive token support and deep liquidity

- Global availability and high transparency

- Strong security and developer community

Cons:

- Needs overcollateralization

- Ethereum has high network fees

- Has some complexity for non-technical folks

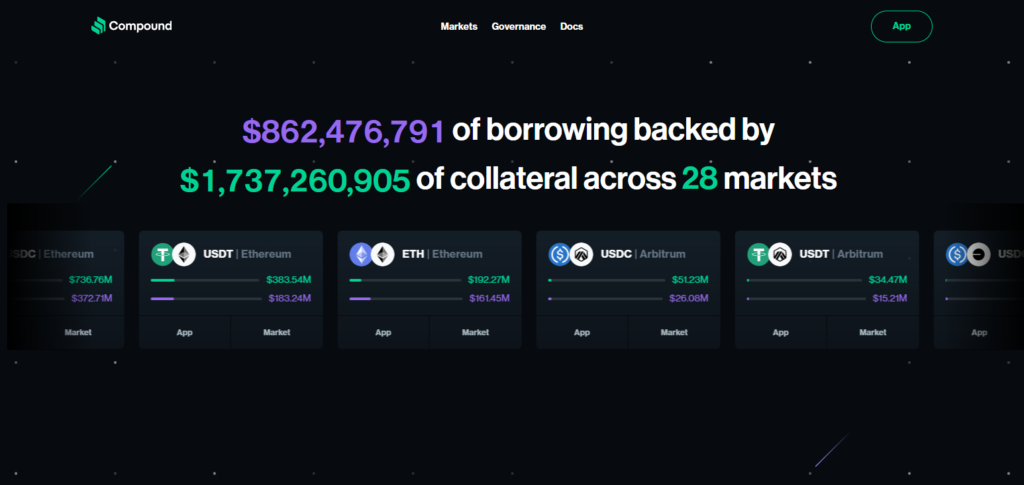

2. Compound

Compound enables users to earn interest or borrow from liquidity pools through smart contracts. SMBs can collateralize and borrow from a pool with interest rates that adjust based on the system’s supply and demand.

For its transparency, governance, and security audits, Compound has been recognized as one of the Top Crypto Lending Protocols for Emerging Markets SMBs. Compound also has on-chain interest forecasting capabilities and wallet and DeFi tool integration, making it a standout crypto business lending platform.

It is most suited for SMBs where the lending and borrowing process is automated, and transparency is important, in addition to having a largely absent human intermediary.

Compound Key Features:

- Algorithmic smart contracts, and automation on lending pools

- Audits and open-source governance

- Rate automation, and wallet and defi integrations

Pros:

- Predictable and transparent borrowing rates

- Simple integrations, and also very easy to use

- Proven and reliable protocols

Cons:

- Compared to competitors, fewer assets overall

- Overcollateralization still remains a challenge

- Not a lot of real world business oriented tools

3. MakerDAO

MakerDAO functions as a decentralized lending protocol whereby users can generate the dollar-pegged stablecoin DAI by locking in collateral through smart contracts. This is particularly useful for SMBs in volatile economies as it mitigates the currency risk while providing a more predictable form of capital.

MakerDAO has also been recognized as one of the Top Crypto Lending Protocols for Emerging Markets SMBs and for its various governance, collateral, and risk management system options. Its decentralized protocol and overcollateralized lending further boost its reliability.

For SMBs seeking long-term financing with a low risk and stable rate, MakerDAO is also a great option as it keeps them insulated from the extreme fluctuations of the crypto market.—

MakerDAO Key Features:

- Generate your own DAI stablecoins via collateralized banking

- Decentralized governance with several crypto vault types

- Tools to help manage risk and liquidation

Pros:

- Community governance is strong

- Long standing and well trusted defi platform

- Financing that is stable, low, and less volatile

Cons:

- Managing your vaults is somewhat complex

- There are high collateral requirements

- During a market crash there is risk of liquidation

4. Goldfinch

Goldfinch provides services within a specific niche of the decentralized credit industry – undercollaterized loans for real world businesses in credit constrained areas, including parts of the developing world.

By utilizing decentralized credit pools and on-chain reputation systems, Goldfinch links global liquidity providers and local borrowers. Goldfinch stands out from the competition in the industry primarily by providing a lending solution without requiring the borrower to pledge a substantial amount of crypto collateral.

Goldfinch enables users to track loans, vet borrowers, and provides lenders a chance to earn yield. Goldfinch makes sense for a small business in a frontier market that does not have crypto to pledge (or substantial amounts of crypto) to the lender, and that needs to access affordable financing (financing that is embedded in blockchain technology and is therefore less costly than financing that is not on a blockchain).

Goldfinch Key Features:

- A model of lending that is under-collateralized.

- On-chain credit pools for real-world businesses

- Borrower vetting and reputation system

- Yield opportunities for lenders

Pros:

- Expands access to credit in developing regions

- Lower collateral needs

- Strong social impact focus

Cons:

- Higher risk for lenders

- Limited borrower availability by region

- Smaller liquidity compared to major DeFi platforms

5. Celo Credit Collective

Celo Credit Collective is a part of the wider Celo ecosystem, and it is focused on utilizing mobile technology (the user’s smartphone) for providing financial inclusion via decentralized credit, and stablecoin microloans.

The platform enables SMBs (the end users of the service) to obtain funding through the use of mobile phones, which is important in a setting with no (or developed) banking infrastructure. Celo Credit Collective is also featured among the Top Crypto Lending Protocols for Emerging Markets SMBs as it is recognized for low transactions and quick settlement.

The ecosystem enables users to integrate their wallets, and access local financial services. Celo Credit Collective is ideal for micro and small businesses that need mobile access and crypto lending solutions, and the ability to make payments using stablecoins.

Celo Credit Collective Key Features:

- Mobile-first stablecoin lending tools

- Low-fee, fast blockchain transactions

- Digital identity and community governance

- Smartphone wallet integrations

Pros:

- Accessible in low-infrastructure regions

- Affordable transaction costs

- Strong financial inclusion focus

Cons:

- Smaller ecosystem and liquidity

- Limited asset and lending options

- Lower institutional adoption

6. Maple Finance

Maple Finance provides institutional-grade decentralized finance solutions through transparent on-chain credit pools and credit pools delegated by professionals. It offers credit and lending marketplaces accessible for scale and grow businesses.

Acknowledged for its combination of professional risk analysis and decentralized transparency, Maple sits for SMBs as lending partners for embedded finance and fintech relationships, offering greater loan amounts, institutional-grade solutions, and access to the worldwide crypto financing market.

Services extend to uncollateralized and structured lending, dynamic portfolio tracking, and reporting on-chain.

Maple Finance Key Features:

- Institutional-grade on-chain credit pools

- Professional pool delegates for risk management

- Transparent loan reporting

- Structured and unsecured lending options

Pros:

- Larger loan sizes available

- Professional risk assessment

- High transparency for lenders

Cons:

- Higher entry requirements for borrowers

- Not ideal for very small businesses

- More complex onboarding

7. TrueFi

TrueFi is a crypto lending protocol that facilitates decentralized loans without requiring any real-world collateral. Loans are determined by a business’s on-chain credit history, reputation, and governance of the system.

The Protocol provides financing to businesses without requiring any real-world collateral, TruFi is recognized for its transparent credit assessment and risk mitigation determined by the community.

The platform provides dynamic loan tracking, borrower data, and a risk mitigation component for investors. TruFi is ideal for SMBs that are financially sound and are seeking alternative financing options.

TrueFi Key Features

- Initial Unsecured Lending

- Credit Ratings for On-Chain Borrowers

- Governance-based Loan Approvals

- Loan Tracking

Pros

- No Major Collateral

- Flexible Loan Access

- Transparent Risk Evaluation

Cons

- Limited Borrowing Access

- Higher Loan Scrutiny

- Smaller Lending Pools Compared to Top DeFi Lending Pools

8. Kiva Protocol

Kiva Protocol utilizes the blockchain to streamline the funding process between global investors and small businesses or entrepreneurs in developing countries. It adds transparency, trust, and traceability to the micro-funding and small and medium enterprise (SME) funding process.

Kiva is on the list of the Top Crypto Lending Protocols for Emerging Markets since the combination of social impact and decentralized record keeping is a unique strength. Kiva offers digital identity, loan tracking, and partner-based borrower onboarding.

Kiva Protocol primarily serves mission-driven SMBs (small and medium businesses) and community lenders who want to provide ethical financing that enhances financial inclusion and affordable sustainable economic development.

Kiva Protocol Key Features

- Micro Lending on the Blockchain

- Digital Borrower Identity and Loan Tracking

- Global Lender-Borrower Network

- Partnerships for Borrower on-boarding

Pros

- Positive Social Impact for Inclusive Borrowing

- Well Known Global Brand

- Loan Tracking for Transparency

Cons

- Funding Cycles are More Lengthy

- Not 100% DeFi

- Lacking Features for the Crypto-Native

9. Centrifuge

Centrifuge is a financing protocol that utilizes real-world assets as collateral, allowing businesses to create and tokenize invoices, trade receivables, and other instruments to access liquidity that is blockchain-based.

It is one of the Top Crypto Lending Protocols for Emerging Markets SMBs since it effectively enhances cash flow without the need for equity dilution or burdensome high-interest financing.

Centrifuge offers a wide range of services, such as asset tokenization, DeFi onboarding, and on-chain credit pools. It primarily serves SMEs (small and medium enterprises) with substantial collected receivables who require flexible financing options.

Centrifuge Key Features

- Tokenizing Real-World Assets

- Financing Receivables and Invoices

- DeFi and Tradition Finance Merger

- Real-World Assets in On-Chain Pools

Pros

- More Liquidity

- Clear and Transparent Cash Flow

- Asset-Backed Lending

Cons

- Assets Need to be Verified

- Involves Complex Processes for New Users

- Dependent on the Quality of the Assets

10. Clearpool

Clearpool allows participants to borrow funds from a marketplace where they can close liquidity pools and lend to borrowers with a flooded and dynamically adjustable interest rate pools depending on the market conditions and the risk profile of the borrower.

Clearpool has been acknowledged in the Top Crypto Lending Protocols for Emerging Markets SMBs due to its on-chain transparency and adjustable funding.

The platform includes risk assessment tools, real-time data on the lending pools, and open access for lenders. Clearpool is ideal for the rapidly growing businesses that need to access global funding liquidity.

Clearpool Key Features

- Real-time Interest Rate

- Lending Pools on the Blockchain

- Risk Scoring for Borrowers

- Transparency Dashboard

Pros

- Terms of Borrowing are Flexible

- Transparency in Pricing

- Liquidity in No Time

Cons

- Interest Rates can be Inconsistent

- Smaller Ecosystem Compared to Leading DeFi Platforms

- Instability in the Lending Market is Riskier for Lenders

Key Features to Consider in a Crypto Lending Protocol

I can explain the following features you asked for in 25 words each.

Collateral Flexibility: SMBs can take loans against their crypto collateral without needing to sell their crypto to get cash by using other crypto.

Interest Rates: SMBs can effectively manage their financial planning by knowing how much borrowing will cost due to transparency in the interest rates.

Loan-to-Value (LTV) Ratio: Borrowers get more access to funds with a higher LTV ratio, but balanced ones reduce the risk of liquidation to a better level.

Security & Smart Contracts: Measures like an audit of the smart contracts can help protect the funds from hacking, system errors, and other risks.

Liquidity & Accessibility: Accessibility, including fast withdrawals and liquidity is important for SMBs who need operational cash quickly to run their business.

Repayment Flexibility: SMBs need cash flow management and the ability to reduce financial stress to better work schedules with less burden is.

Stablecoin Support: Emerging market SMBs appreciate lending in stablecoins to ensure that their repayments and repayment schedules remain predictable and without losing money in crypto.

Transparency & Governance: SMBs appreciate having some governance to trust the system, where they can manage the risks and understand better the rates and usage of the system.

Benefits of Using Crypto Lending Protocols for SMBs

Fast Capital Access: SMBs gain the ability to borrow quickly using crypto collateral which means they can go through even less banking red tape than usual.

Financial Accessibility: SMBs from developing countries can take out loans regardless of whether they have a credit score, closing the gap of a credit history.

Access to Global Markets: With crypto lending businesses have access to investors beyond the borders of their country eliminating their funding restrictions.

Digital Assets Collateral Flexibility: SMBs can use a variety of digital assets as collateral, which means they can keep their working capital intact.

Protection Against Inflation: When SMBs borrow in stablecoins or crypto, they are not affected by their country’s unpredictable inflation which protects their finances.

Less Transaction Costs: With crypto lending SMBs can say goodbye to funding intermediaries, high fees, and poorly priced cross country transactions.

Earning Interest on Crypto Assets: When SMBs lend their extra crypto assets instead of just holding onto them, they can make money in addition to their main business.

Operational Flexibility: With programmable loans and liquid assets, SMBs can quickly capture market opportunities or safe keepers.

Greater Peace of Mind: Using automated smart contracts allows for transparent loan agreements and repayment plans which reduces the risk of dispute or mismanagement.

Digital Finance Innovation: For SMBs, the crypto lending solution positions the company for the future by integrating digital finance and creating new opportunities in emerging markets.

Conclusion

Financial access for SMBs in emerging regions is being rapidly transformed by cryptocurrency lending technologies. While decentralized cryptocurrency lending platforms offer quick liquidity, collateral-backed loans, and interest rates as low as 3–8% yearly, recent data indicates that over 50% of SMBs in developing nations struggle to obtain traditional loans.

Global lending of billions of dollars has been made possible by platforms like Aave, MakerDAO, and Nexo, proving the increasing dependability and uptake of these protocols.

Leveraging cryptocurrency lending is a crucial tactic for sustainable growth in today’s digital economy because it not only closes the funding gap for SMBs but also gives them access to global markets, inflation-resistant funds, and scalable financial tools.

FAQ

What is a crypto lending protocol?

A crypto lending protocol is a platform where users can borrow or lend digital assets using crypto as collateral. In 2025, over $45 billion in crypto loans were issued globally.

Why are crypto lending protocols important for SMBs in emerging markets?

Around 52% of SMBs in developing countries lack access to traditional financing. Crypto lending provides instant, borderless loans, bridging this financial gap.

What types of collateral are accepted?

Most protocols accept cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins. Some platforms, like Aave, allow multi-asset collateral, enabling SMBs to maximize borrowing power.

What interest rates can SMBs expect?

Data from 2025 shows decentralized protocols offer 3–8% APR for stablecoin loans, significantly lower than typical small business loans in emerging markets, which can exceed 20%.

Are crypto loans safe for SMBs?

Protocols with audited smart contracts (like MakerDAO, Aave) and insurance mechanisms have less than 0.5% annual loss risk. Proper risk management and diversified collateral are essential.