I’ll go over how to purchase gold with USDT effectively and safely in this post. Using USDT (Tether) provides quick, affordable, and safe transactions whether you wish to invest in real gold or tokenized gold.

We’ll go over the procedures, top platforms, and advice to make your cryptocurrency-to-gold investment dependable and easy.

What is USDT (Tether)?

USDT (Tether) is considered a stablecoin, a cryptocurrency that is pegged to a fiat currency such as the US dollar to maintain a stable value. USDT tokens are backed 1:1 with US dollars, meaning 1 USDT is approximately valued at 1 US dollar. USDT was launched in 2014 by Tether Limited.

USDT was created to give traders the ability to move funds in and out of the crypto world without the volatility of other crypto currencies such as Bitcoin and Ethereum. It is good for trading, value transfer, and crypto arbitrage due to its low trading costs and the ability to move value across crypto exchanges quickly.

Tether is able to run its USDT tokens on a number of different blockchains such as Binance Smart Chain (BEP-20), Ethereum (ERC-20), and Tron (TRC-20), which is good for cross-compatibility with different DeFi systems and increasing its use-case.

Despite USDT’s crypto-agnostic and banking-agnostic attributes having value and allowing gold and other cryptocurrencies to be used without a bank, USDT is not without issues. Regulatory scrutiny, along with the need for Tether to use legitimate exchanges for its crypto arbitrage, increases the risks.

How to Buy Gold with USDT

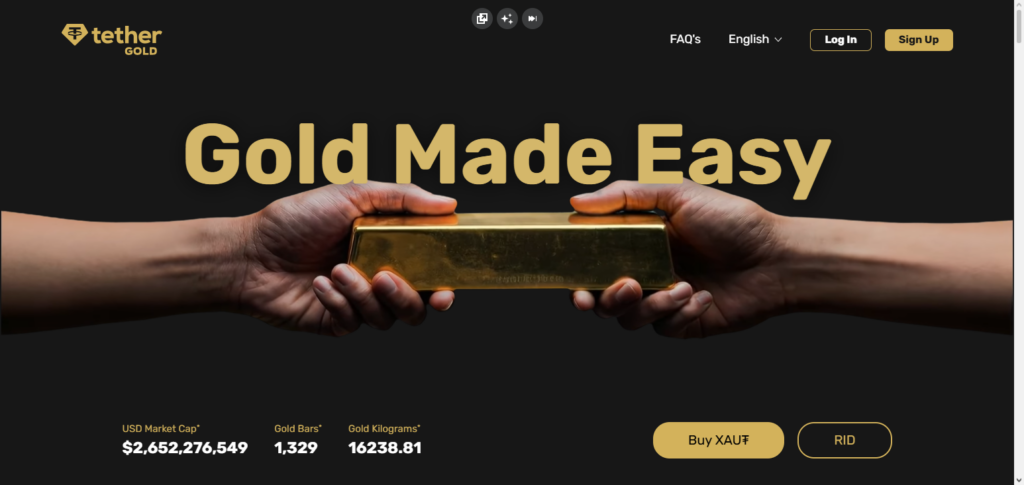

Example: Buying Tokenized Gold with USDT on a Platform like Tether Gold (XAUT)

Step 1: Choose a Trusted Platform

- Choose a reliable platform that supports gold purchases using USDT like Tether Gold (XAUT) on crypto exchanges like Binance or Bitfinex.

Step 2: Create and Verify Your Account

- Create an account and complete KYC/AML verification by submitting your ID and proof of your residential address.

- This step is important for compliance and security reasons.

Step 3: Deposit USDT

- Deposit USDT to your account from your wallet or from a different exchange.

- Make sure to choose the correct blockchain network (ERC-20, TRC-20, or BEP-20) for your deposit.

Step 4: Select Gold Type

- Choose Tether Gold (XAUT) if you are going to buy tokenized gold.

- Determine how much gold you want to buy based on your USDT balance.

Step 5: Place the Order

- Function in how much USDT you would like to buy and/or the amount of gold you would like to purchase.

- Make sure to review your gold purchase for any extra transaction fees that may have been applied.

Step 6: Receive and Secure Your Gold

- Your exchange wallet should now be showing that your tokenized gold (XAUT) purchase is complete.* For greater safety, move it to a private crypto wallet supporting XAUT.

- If purchasing physical gold, arrange delivery or vault storage from the platform.

Step 7: Monitor and Manage Your Investment:

- Regularly check back to see the status of your gold investment and the market prices.

- Each platform has its own set of rules. You will be able to sell or redeem your tokenized gold whenever the platform permits.

Why Use to Buy Gold with USDT

Steady Value: Only fluctuating within a few cents, USDT has the lowest volatility risk of any cryptocurrency.

Quick Transactions: Using USDT transfers are considerably faster than standard banking services.

Reduced Costs: Compared to traditional bank transfers and international wires, crypto transactions using USDT are typically less expensive.

Universal Usage: Using USDT anyone in the world can purchase gold without depending on local bank services.

Flexible Exchange: USDT facilitates the purchase of gold-backed tokens and gold on numerous platforms.

Safe and Clear: All transactions are safely recorded on the blockchain.

DeFi Freedom: On DeFi platforms USDT can be used to acquire or trade tokenized gold.

Highly Liquid: USDT can quickly be bought or sold on virtually any exchange or gold platform.

Benefits Of to Buy Gold with USDT

Price Stability

Because USDT is tied to the dollar, the value of your gold is protected while the crypto markets are moving.

Instant Transactions

You can buy gold instantly, without banks or middlemen getting in the way.

Low Transaction Costs

You do not need to deal with the large fees that can come with international wires or transfers.

Global Access

You can buy gold from any country without geo restrictions.

Easy Investment in Tokenized Gold

You can invest in digitally represented gold with USDT in a simple manner.

Enhanced Security

Because of the way blockchain works, there is less chance of manipulation and it is more open to the public.

Seamless Portfolio Diversification

You can easily change your crypto for gold, a more stable asset.

Flexibility

You can choose physical gold, gold ETFs, or tokenized gold depending on your preference.

Liquidity

Buying and selling gold with USDT is simple and quick since USDT is readily available.

Integration with DeFi Platforms

You can use USDT to trade for gold in a decentralized way or for any yield features.

Key Platforms to Buy Gold with USDT

| Platform | Type of Gold Offering | How It Works with USDT | Notes |

|---|---|---|---|

| Paxos (PAX Gold / PAXG) | Tokenized gold backed by physical bullion | Trade USDT for PAXG tokens on supported exchanges | Each token = 1 troy oz gold stored in secure vaults; DeFi use possible |

| Tether Gold (XAUT / XAUt) | Gold‑backed token by Tether | Buy XAUT with USDT on many exchanges | Digital token representing real gold ownership |

| Vaultoro | Direct crypto‑to‑physical gold exchange | Convert USDT into gold held in Swiss vaults | Offers real‑time trading and secure storage |

| GoldenEx (USGT) | Gold‑backed stablecoin (1g gold each) | Use USDT to buy/ redeem USGT tokens | Digital gold with option for physical redemption |

| SuisseGold.com | Physical gold dealer | Pay in USDT at checkout for bullion | Buy bars/coins with USDT; delivery options |

| OKX | Crypto exchange supporting XAUT | Trade XAUT/USDT pair | High liquidity & easy trading interface |

| KuCoin | Crypto exchange supporting XAUT | Buy XAUT using USDT on spot markets | Supports many tokens & features like staking |

| MEXC | Exchange supporting Tether Gold | Trade/ buy XAUT with USDT | Good choice for beginners & advanced traders |

Security Tips and Best Practices

Use Reputable Platforms

Stick to regulated exchanges and gold platforms such as Vaultoro, Tether Gold and Paxos.

Enable Two-Factor Authentication

Always add layers of security to your account, such as 2FA.

KYC/AML Compliance

To stay legal and safe, check if they’re regulated and compliant.

Secure Your Wallets

Safe your XAUT or PAXG to private and hardware crypto wallets.

Avoid Public Wi-Fi

Always perform transactions over personal wifi, public wifi is a huge security risk.

Double-Check Transaction Details

Always triple check recipient’s address, amount and network before sending USDT.

Keep Backups

Store backup of your wallet key or recovery phrase offline and in safe space.

Observe Transaction Confirmations

Monitor Confirmations so that your purchase of gold does not get lost.

Use Vault Storage if Purchasing Gold

With physical gold purchases, Vaults and Storage Gold insureds.

Pros and Cons of Buying Gold with USDT

| Pros | Cons |

|---|---|

| Stable Value: USDT is pegged to USD, reducing crypto volatility risk. | Platform Risk: Some exchanges or token issuers may have security or regulatory issues. |

| Fast Transactions: Quick settlement compared with traditional banking. | Fees: Trading and withdrawal fees can apply on some platforms. |

| Global Access: Buy gold from anywhere without geographic banking restrictions. | Limited Adoption: Not all gold dealers or platforms accept USDT yet. |

| Low Costs: Often cheaper than bank transfers or international wires. | Regulatory Uncertainty: Stablecoin regulations vary by region. |

| Blockchain Transparency: Transactions are recorded on-chain for auditability. | Custody Risks: Tokenized gold relies on the issuer’s claim to physical gold. |

| Liquidity: USDT is widely supported for trading and conversions. | Tech Complexity: Beginners may find wallets, networks, and token transfers confusing. |

| Flexible Options: Can buy physical, tokenized, or ETF‑like gold products. | No Interest/Yield: Holding gold/tokenized gold does not usually earn interest. |

Conclusion

Purchasing gold using USDT is a contemporary, safe, and practical way to make an investment in one of the most reliable assets on the planet. Investors can access tokenized or actual gold from anywhere in the globe, take advantage of quick and inexpensive transactions, and get beyond traditional banking restrictions by utilizing USDT.

Adhering to security best practices guarantees the safety of your investment, regardless of the platforms you select, such as Tether Gold, Paxos, or Vaultoro. USDT is a great choice for both cryptocurrency holders and conventional investors wishing to diversify their portfolios since it offers an effective link between digital currencies and physical gold with careful platform selection and study.

FAQ

What is the easiest way to buy gold with USDT?

The easiest way is to use tokenized gold platforms like Tether Gold (XAUT) or Paxos Gold (PAXG), where you can directly swap USDT for gold-backed tokens.

Can I buy physical gold with USDT?

Yes, some platforms and dealers, like Vaultoro or SuisseGold, allow you to purchase physical gold using USDT, with delivery or secure vault storage options.

Is buying gold with USDT safe?

It is generally safe if you use reputable and regulated platforms, enable 2FA, and store tokens or private keys in secure wallets.

Are there fees when buying gold with USDT?

Yes, fees can include trading fees, withdrawal fees, or storage fees for physical gold. Always check the platform’s fee structure before purchasing.