The Best MetaLend Alternatives will be covered in this post, along with systems that let NFT investors enhance the usefulness of their digital assets, earn yield, and unlock liquidity.

From rental and gaming-focused platforms like ReNFT and Arcade to NFT-backed lending protocols like BendDAO and Astaria.Therefore, these substitutes offer creative methods of utilizing NFTs outside of conventional ownership.

What is MetaLend Alternatives?

Decentralized platforms known as MetaLend alternatives give NFT holders creative ways to use their digital assets outside of traditional ownership. With these options, users can engage in fractional ownership, borrow against NFTs, stake or rent them, and obtain liquidity without having to liquidate their assets.

NFT-backed loans, rental protocols, yield generation, and marketplace aggregation are just a few of the capabilities available on platforms like BendDAO, Astaria, ReNFT, and Zharta. While retaining long-term exposure to their value and taking part in community-driven governance, collectors and investors can maximize the usability of their NFTs, unlock wealth, and create passive income by utilizing MetaLend options.

Why Use MetaLend Alternatives

Unlock NFT Liquidity Without Selling: MetaLend competitors BendDAO and Astaria support NFT lenders to borrow against NFTs, allowing cash flow to NFTs value.

Passive Income Generation: Users of Arcade.xyz, ReNFT, and Pine Protocol can stake, lend, or rent NFTs, earning rewards from digital assets, along with passive income.

Fractional Ownership Possibilities: Zharta and Pine Protocol slove the problem of fractional NFTs. Additionally, owners can unlock value in high NFT collectibles and small investors can gain access.

NFT Use Cases Diversification: More than lending, other alternatives support gaming, integrations, rentals, and cross-platform staking, all of which expand the utility of NFTs.

Community and Governance: Users of Drops DAO and UnUniFi Protocol gain governance, voting, and decision-making powers, which provide control to the users over the management of assets and the roadmap of the platform.

Key Point & Best MetaLend Alternatives

| Platform | Key Point |

|---|---|

| BendDAO | Enables NFT collateralized lending, letting users borrow funds using NFTs without selling them. |

| Arcade.xyz | Focused on NFT gaming and staking, offering yield and rewards for gaming assets. |

| Zharta | Provides NFT fractionalization and liquidity solutions, enabling shared ownership of high-value NFTs. |

| Drops DAO | Community-governed platform for NFT drops and auctions, emphasizing decentralized curation. |

| Astaria | NFT lending and DeFi marketplace, bridging liquidity for digital assets with flexible terms. |

| ParaSpace | Cross-chain lending protocol allowing NFT and crypto collateralized loans with optimized interest rates. |

| Blend (Blur) | NFT marketplace aggregator, offering fast trading, bundling, and liquidity across multiple marketplaces. |

| ReNFT | NFT rental protocol allowing temporary use of NFTs for gaming, metaverse, or DeFi purposes. |

| UnUniFi Protocol | DeFi protocol providing NFT-backed lending and borrowing, with liquidity provision incentives. |

| Pine Protocol | NFT financialization platform enabling loans, staking, and fractional ownership of digital assets. |

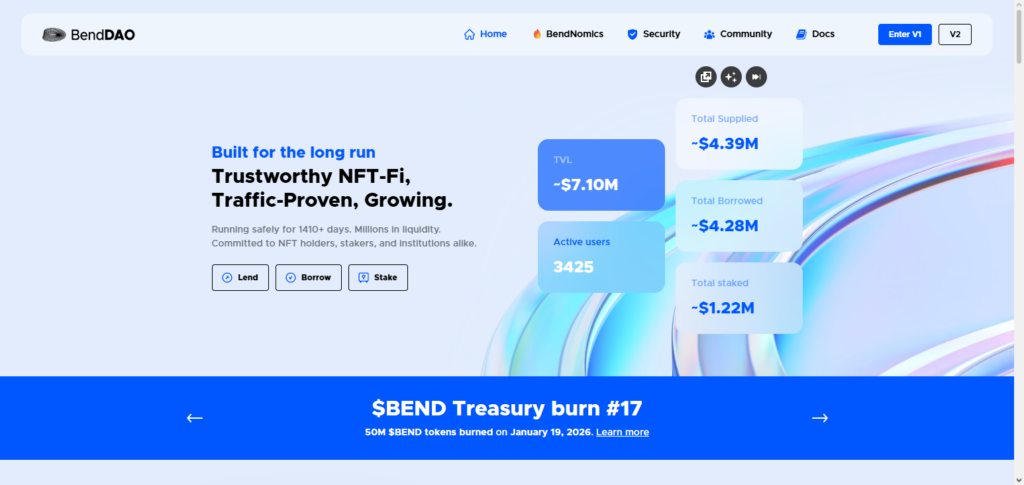

1. BendDAO

BendDAO is also a decentralized finance platform, however, it is not a traditional finance platform. Rather, it enables NFT holders to acquire loans based on their NFTs. Traditionally, NFT holders would have to sell their NFTs in order to acquire liquidity. However, in this case, NFT holders do not need to relinquish their ownership of the NFT in order to access their liquidity.

Furthermore, BendDAO’s P2P lending system enables NFT holders to access loans with transparent and fair terms. This model also allows BendDAO to compete with MetaLend and even provide superior services to NFT holders in accessing their digital assets and monetizing them.

BendDAO Features, Pros & Cons

Features

- Loans against NFTs

- Loans from peers

- Lending on high-tier NFTs

- Interest rates are clear

- No collateral asset sales

Pros

- Access funds while holding onto NFTs

- Easy loan conditions

- Pricing set by the community

- Good for high-value collectibles

- Flexible loan offerings

Cons

- Only certain NFT collections are supported.

- Liquidation is possible.

- Borrowing rates can be high.

- DeFi yields are limited.

- Not suited for short-term use.

2. Arcade.xyz

Arcade.xyz specializes in NFT gaming and NFT staking. Arcade.xyz gives gamers new ways to earn rewards from their gaming NFTs. They allow gamers to stake NFTs or other in-game assets for yield rewards. Gamers can also earn rewards by participating in tournaments and using their NFTs in different ways.

Arcade.xyz’s ecosystem supports multiple blockchains, allowing seamless cross-platform play and asset management. While Arcade.xyz can be considered an alternative to Metalend, Arcade.xyz has other features like lending. Arcade.xyz is great for gamers who want to earn yields in DeFi and play games.

Arcade.xyz Features, Pros & Cons

Features

- Use with NFT-based games

- Play for rewards

- Gaming asset yield

- Rewards in NFTs

- Cross-chain compatibility

Pros

- Supports NFTs that earn money while sitting

- Good game ecosystem

- Rewards for people who play

- Easy use of play-to-earn

- Community driven

Cons

- Gaming use is limited

- Participation in games is necessary for liquidity

- Loans are not a focus.

- Rewards can be inconsistent.

- Players had a significant upward learning curve.

3. Zharta

Zharta is one of the first NFT fractionalization platforms. Zharta breaks down high-value, illiquid NFTs into smaller, tradable pieces, helping monetization of NFT holders, increased liquidity for the NFT market, and new investors trading less than 100% NFTs.

With partial ownership of NFTs, communities can trade them and participate in voting, leading to decentralized governance of the assets. Zharta is also considered a MetaLend alternative by combining NFT holders with decentralized finance in the NFT markets for large illiquid NFTs. Zharta promotes NFT ownership and liquidity by enabling asset holders to retain their NFTs.

Zharta Features, Pros & Cons

Features

- NFTs cut into pieces

- Parts for collectibles that are

- NFTs that are divisible

- Assets of greater value can be Liquidated.

- Voting rights

Pros

- Helps in acquiring high-value NFTs

- Better liquidity

- Provides a chance for users

- Opportunities for parts trading

- Allows for more distributors

Cons

- Complicated for novices.

- Fluctuations in value for fractions

- Required coordination for governance

- Yield in lending is less direct

- Risks with secondary markets

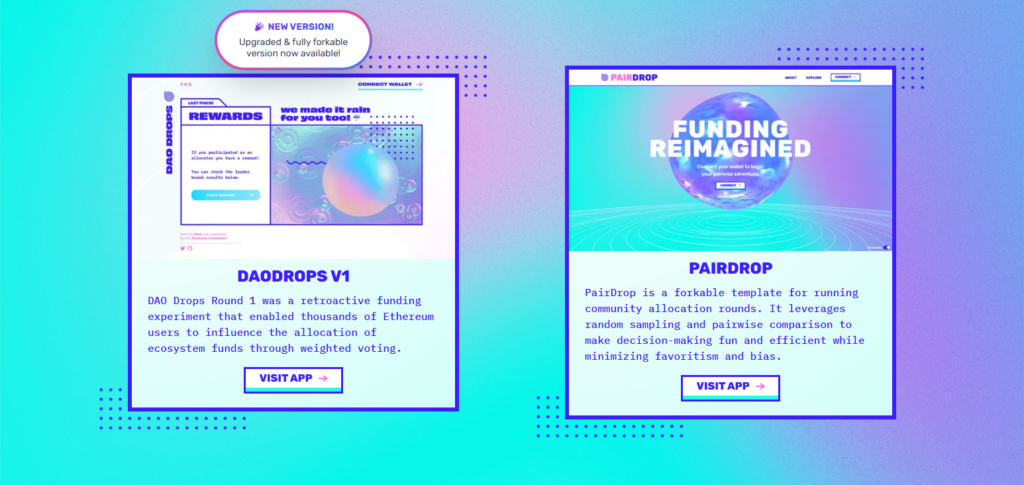

4. Drops DAO

The Drops DAO marketplace and launchpad operates under community governance. It provides users with the ability to democratize NFT drops and auctions. The model utilizes decentralized curation where users can deploy votes to curate projects.

The platform features adaptive auctioning with the ability to switch between fixed-price sales and dynamic auctions. Compared to MetaLend, Drops DAO focuses more on empowering NFT users to control the creation, distribution, and monetization of their NFTs as assets. With a community-centric focus, Drops DAO attracts Transparency and Equity to the NFT community of collectors and creators who value governance and partnership.

Drops DAO Features, Pros & Cons

Features

- Creation of Community NFTs

- Decentralized auctions

- Launchpad for NFTs

- Voting in governance

- Listings for marketplaces

Pros

- Community-driven choices

- Drops that are fair

- Auction range

- New creators are supported

- Curated assets exposure

Cons

- Does not focus on lending

- Possible auction fees

- Risk of concentrated voting power

- Subject to trend cycles

- Community interest determines liquidity

5. Astaria

Astaria’s NFT financing and marketplace DEFI solution fill digital asset liquidity gaps. NFT holders can Borrow, Participate, and Access NFTs fragmented, liquefied, and cross-platform pools. The Astaria protocol focuses on seamless, quick, and secure transactions.

It is set to help New Mid and Seasoned users enjoy the platform, as there are low fees. Astaria, as MetaLend’s substitute, provides the best of DEFI and Financialization, with its Unique Yield and Collateralized Borrowing strategies. Astaria’s interoperability with Ethereum and its partners is of utmost importance to NFT holders, as it provides liquidity without the need to sell their NFTs or have their capital exposed in NFTs.

Astaria Features, Pros & Cons

Features

- Auction for NFT loaning

- Loans secured with collateral

- Liquidity in fractions and pools

- Loans executed in a flash

- Potential for support on Layer 2

Pros

- Various borrowing choices

- Assets are supported in several forms

- Competitive terms for borrowing

- More than your peers

- Interface that is user friendly

Cons

- Risk of liquidation

- NFTs that are supported are limited

- The market dictates the rates

- Familiarity with the protocol is necessary

- Risk with DeFi still remains

6. ParaSpace

ParaSpace is a cross-chain NFT lending system that facilitates NFT collateralized loans and cryptocurrency. Stablecoins and other cryptocurrencies with favorable interest rates can be borrowed by users by leveraging their digital assets.

Additionally, the platform offers features like multi-chain asset interoperability, yield farming incentives, and liquidation protection. ParaSpace is a better option for those looking for sophisticated DeFi solutions than MetaLend because of its competitive pricing and versatility in collateral types.

A larger audience can borrow and lend thanks to its user-friendly interface and robust security measures, which bridge the gap between NFT investment and liquidity requirements in the decentralized finance ecosystem.

ParaSpace Features, Pros & Cons

Features

- Cross-border lending

- Collateral for NFTs and cryptos

- Different adjustable interest rates

- Systems for Protection against slices

- Incentives for seepage to yield-farming

Pros

- Diversified types of Collateral

- Assets that are more than one on a chain

- Seepage to the liquidity providers

- Reasonable rates

- Extensive DeFi functionality

Cons

- Complicated for newcomers

- Risks associated with smart contracts

- Relies on the value of collateral

- Some NFTs can’t be integrated

- Variable farming yields

7. Blend (Blur)

Blend, or Blur as some may know it, is a rapidly growing NFT marketplace aggregator. Blur is an NFT marketplace aggregator that is able to let users trade their NFTs more seamlessly across various trading platforms. It has NFT bundling, auctioning and instant NFT trading focus, as it strives to provide a more liquid and clear trading environment for collectors.

Using Blend for analytics and aggregated event trading, users have the ability to forecast and optimize trade events for the best market results. Variances offered by MetaLend allow NFT holders to trade their assets for cash (liquidity), be it through a sale or through a bundled liquidity event. His focus on speed and market aggregation provides rapid access to cash with no market commitment.

Blend (Blur) Features, Pros & Cons

Features

- Aggregation of NFT marketplaces

- Bundled trade functionality

- Instant listing capability

- Analytical utilities

- Liquidity across multiple markets

Pros

- NFT trades executed quickly

- Prices more transparent

- Improved liquidity across multiple markets

- Additional functionality for more sophisticated traders

- Saves time for quick trade execution

Cons

- Not a lending platform

- No yield creation directly

- Market volatility

- Costly

- Little to no focus on generating passive income

8. ReNFT

Users can lend or temporarily use NFTs for gaming, metaverse participation, or DeFi tactics using ReNFT, an NFT rental protocol. It provides flexible monetization potential by enabling short-term rentals, which establish a fresh liquidity layer without relinquishing ownership.

Renters can access valuable digital assets for certain use cases, while users can make money from unused NFTs. ReNFT, a MetaLend substitute that offers dynamic engagement and revenue production from NFTs, prioritizes utility over sheer borrowing. NFT acceptance and active usage are made possible by its smart contract-driven rental agreements, which provide trustless transactions and safe management of digital assets.

ReNFT Features, Pros & Cons

Features

- NFT rental marketplace

- Short-term rental leasing

- Smart contract leasing

- Versatile use cases

- Shared revenue model

Pros

- NFT owners can earn revenue from NFTs that are not being used

- Applicable for gaming and the metaverse

- Short and long rental terms

- Smart contracts are trustless

- Access to NFTs without ownership

Cons

- Can be no rental demand

- Unpredictability of revenue

- No lending platform

- Needs more adoption

- Complex pricing structures

9. UnUniFi Protocol

One of the protocols in the MetaLend subsegment is UnUniFi Protocol. UnUniFi Protocol is a fully decentralized lending and borrowing protocol that incorporates NFT-backed loans and also allows users to provision liquidity. Users can deposit NFTs as collateral, borrow stablecoins, and participate in liquidity pools to earn rewards.

Users are further incentivized to participate by distributing governance tokens and incentivizing yield farming. UnUniFi, as compared to MetaLend, provide a more complete ecosystem for NFT finance, DeFi rewards, and community governance that appeals to collectors as well as investors.

NFT financiers, especially those NFT holders that want to maintain exposure to the long-term value of their assets, robust smart contracts for collateral control, and a strong multi-chain ecosystem.

UnUniFi Protocol Features, Pros & Cons

Features

- NFTs as collateral for loans

- Liquidity pools

- Governance tokens

- Borrowing and lending services

- Support for multiple assets

Pros

- Fusion of DeFi yield and NFTs

- Encourages active participation

- Rewards for providing liquidity

- Secure governance framework

- Several collateral alternatives

Cons

- Complicated protocol

- Collateral market risk

- Dependent on health of the liquidity pool

- Rewards can be value dilutive

- Not beginner friendly

10. Pine Protocol

Pine Protocol aspires to financialize NFTs, integrating loans, staking, and fractional ownership functionalities. NFT holders can unlock liquidity while retaining ownership or invest in fractionalized NFTs for greater diversification. Pine’s ecosystem offers lending, borrowing, and yield generation through a single interface streamlining utility with investment.

Pine, like MetaLend, offers users capital efficiency, but unlike MetaLend, focuses on NFTs. Pine’s community governance and proprietary smart contracts provide users with transparency, safety, and the ability to bridge the divide between the ownership and liquidity of NFT assets.

Pine Protocol Features, Pros & Cons

Features

- Tools for NFT financialization

- Staking & loans

- Ownership by fractions

- Yield generation

- Governance via DAO

Pros

- Many utilities for NFTs

- Efficiently unlocks liquidity

- Accessible fractional market

- Rewards for staking

- Governance by the community

Cons

- Risk of smart contracts failing

- Could lose fractional value

- Complex staking & loans

- Adoption of the platform is crucial

- Use case dependent fees

Conclusion

To sum up, the NFT lending and DeFi ecosystem provides a variety of MetaLend substitutes, each meeting specific user requirements. Platforms that provide liquidity without selling assets, such as BendDAO, Astaria, and ParaSpace, are excellent for NFT-backed lending.

In the meanwhile, ReNFT, Arcade.xyz, and Zharta concentrate on optimizing NFT utility via fractional ownership, rentals, and staking. Marketplaces and aggregators such as Drops DAO and Blend (Blur) provide quick trading opportunities and liquidity.

Together, these platforms enable NFT holders to release capital, produce yield, and take part in cutting-edge DeFi mechanisms, guaranteeing that investors and collectors may effectively utilize their digital assets in a safe, adaptable, and lucrative manner.

FAQ

What are MetaLend alternatives?

MetaLend alternatives are decentralized platforms that provide NFT-backed lending, borrowing, staking, or liquidity solutions. They allow NFT holders to unlock capital, earn yields, or utilize digital assets without selling them. Examples include BendDAO, Astaria, ParaSpace, and ReNFT.

How do these alternatives differ from MetaLend?

While MetaLend focuses primarily on NFT collateralized loans, alternatives may offer additional features such as NFT rentals (ReNFT), gaming and staking rewards (Arcade.xyz), fractional ownership (Zharta), or marketplace liquidity aggregation (Blend/Blur). Each platform targets specific user needs and asset utilization strategies.

Can I earn passive income using these platforms?

Yes. Platforms like Arcade.xyz, Zharta, and Pine Protocol allow users to stake NFTs, lend assets, or participate in fractional ownership programs to generate passive income, while others like ReNFT enable short-term rentals for extra revenue.

Are these platforms safe to use?

Most platforms use smart contracts and decentralized governance for security, but users should perform due diligence. Look for multi-chain integrations, insurance options, audits, and community reviews to minimize risks when lending or borrowing NFTs.

Which platform is best for NFT lending?

For pure lending, BendDAO, Astaria, and ParaSpace are excellent choices due to their flexible terms, cross-chain support, and competitive rates. They allow NFT holders to unlock liquidity while retaining ownership of their assets.