In 2026, the demand for Best Decentralised Crypto Wallets continues to climb as people seek full control, security, and privacy over their digital assets. Without the need for centralized middlemen, these wallets enable users to access Web3 applications, manage numerous cryptocurrencies, and engage with DeFi platforms.

Decentralized wallets, which combine user-friendliness, multi-chain compatibility, and cutting-edge security features, have emerged as a crucial tool for both novice and seasoned cryptocurrency aficionados.

Key Point

| Wallet Name | Key Points |

|---|---|

| Best Wallet | Fully decentralized wallet with rich Web3 features, multi-chain support, built-in DEX access, NFT management, and enhanced user privacy controls. |

| Walletium | Web3-focused wallet platform offering mild staking rewards, easy asset management, intuitive UI, and seamless dApp connectivity. |

| Ledger Nano X | Premium cold storage hardware wallet with Bluetooth connectivity, offline private key storage, wide token compatibility, and top-tier security. |

| Binance Wallet | All-in-one crypto wallet for trading, staking, swaps, DeFi access, and direct integration with the Binance ecosystem. |

| Trezor Model One | Budget-friendly hardware wallet featuring open-source firmware, offline key storage, simple interface, and strong security for beginners. |

| OKX Wallet | Multi-chain hot wallet supporting DeFi, NFTs, swaps, and strong in-app security with easy cross-chain asset management. |

| Margex | User-friendly crypto platform wallet with no-KYC signup, fast onboarding, simple trading interface, and enhanced privacy options. |

| Cypherock | Advanced seedless cold wallet using distributed key storage, tamper-resistant hardware, and multi-part backup security system. |

| Tangem | Innovative tap-to-use hardware wallet with NFC cards, multi-card backup system, mobile app integration, and seedless security design. |

| Zengo Wallet | Secure MPC-based wallet eliminating seed phrases, biometric authentication, strong encryption, and beginner-friendly mobile experience. |

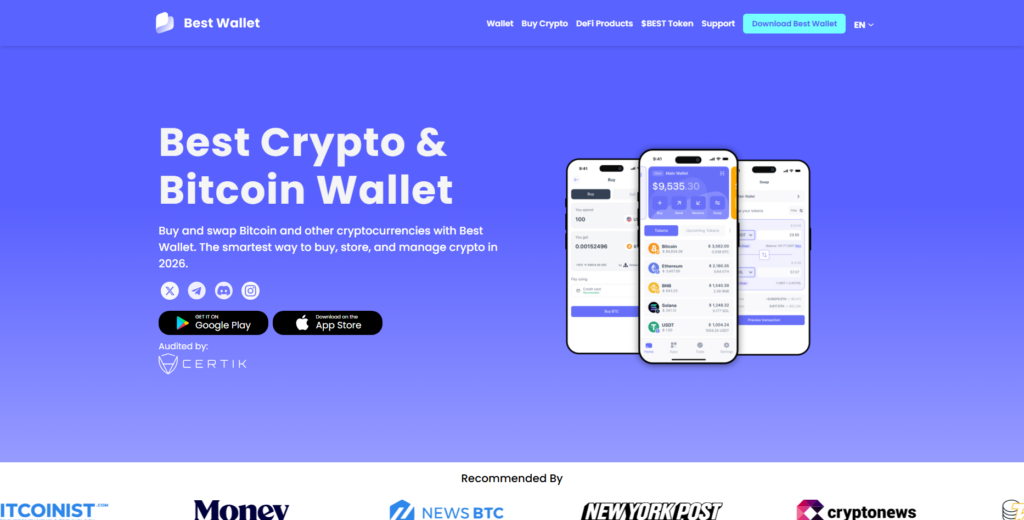

1. Best Wallet – Best Decentralised Crypto Wallets in 2026

Best Wallet has been awarded Best Decentralised Crypto Wallets in 2026 for its excellent Web3 functionality and user experience. The mobile software wallet has no costs and is compatible with 50+ blockchains such as Bitcoin, Ethereum, Solana, Polygon and BNB Chain.

Users can manage, swap, stake and participate with DeFi and NFTs with no hassle. Users do not have to complete KYC to create an account, although some fiat on-ramps may require it.

Biometric seed phrase and sophisticated crypto replacement offer better security and convenience for new and seasoned crypto users.

Best Wallet Key Details

- Type: Decentralized software wallet

- Founded Year: N/A / Emerging leader in 2026

- Price: Free

- KYC Required: No

- Supported Blockchains: Multichain (Ethereum, Solana, BNB, Polygon, etc.)

- Features: Web3 dApps, NFTs, staking, swaps, privacy, etc.

Best Wallet Pros & Cons

Pros:

- Completely decentralized and non-custodial.

- Excellent Web3 (dApps, NFTs, staking, and swap) connectivity.

- No KYC regulations for basic use

- Great User Friendly experience.

Cons:

- Changing ecosystem, frequent updates

- Advanced trading features may still be unavailable.

- Mobile/web access dependent.

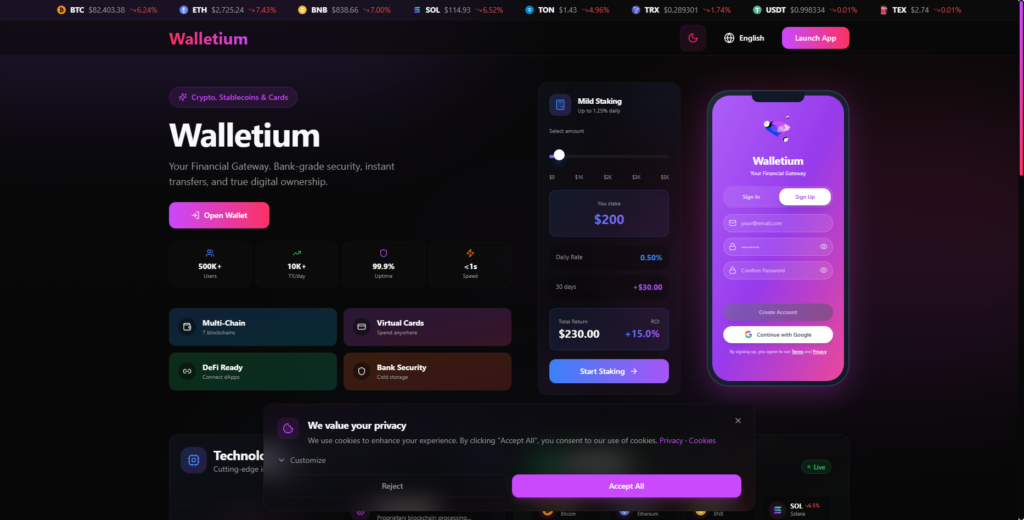

2. Walletium – Best Decentralised Crypto Wallets in 2026

Among the Best Decentralised Crypto Wallets in 2026 Walletium is an embedded crypto wallet within the Telegram ecosystem, which also offers social-integrated asset management.

To enhance the management of both types of currencies through Telegram chats, Walletium has launched a use case that accepts a variety of digital currencies (including BTC, ETH, TON, BNB, TRX, and SOL) and does not require KYC for basic wallet functions.

The wallet itself is free and contains features that are powered by the company’s proprietary token TEX which can be used for staking and internal swaps for little to no fees. The wallet has flexible custody options, 2FA, and instant swap features.

Walletium Key Details

- Type: Web3 wallet platform

- Founded Year: 2021

- Price: Free

- KYC Required: No (optional for some services)

- Supported Blockchains: BTC, ETH, BNB, TON, TRX, SOL

- Features: social/Telegram, dApp, staking

Walletium Pros & Cons

Pros:

- Mild staking rewards.

- Multi-chain assets.

- No KYC required for basic wallet use.

- Web3 wallet with social/Telegram functionality.

- Easy setup.

Cons:

- Limited trading and DeFi features.

- Yield rewards may be low.

- Reliant on integrated 3rd parties.

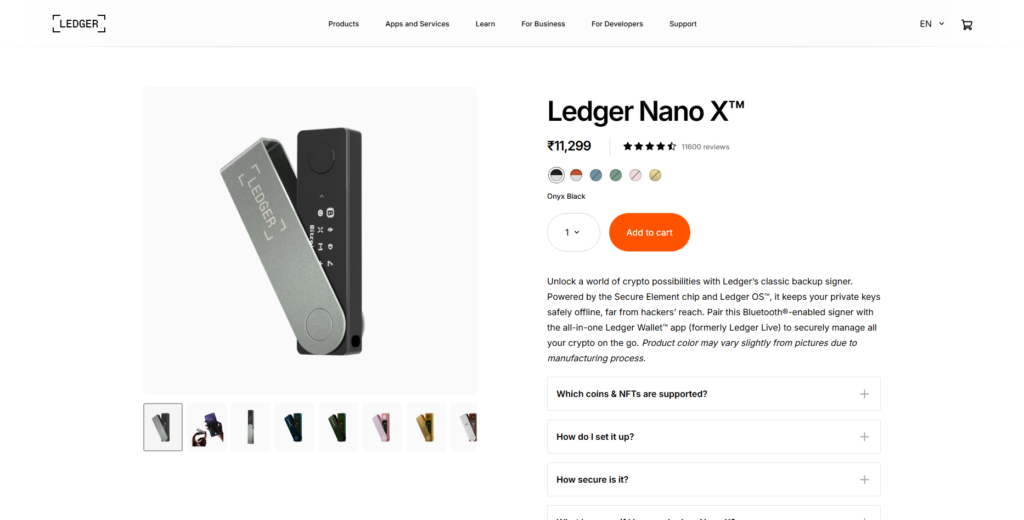

3. Ledger Nano X: Best Decentralised Crypto Wallets in 2026

Another stalwart among the lists is the Ledger Nano X, which is a premium hardware wallet and a must for every crypto holder that wants to secure their tokens. Ledger launched the cold storage device for a fee of approximately $149 and a secure element chip CC EAL5+ that ensures that the user’s private keys can be stored offline and shields them from internet-based attacks.

The wallet also provides support for 5,500+ coins and tokens across a variety of major blockchains. The wallet is also fully non-custodial and you do not need to do KYC to use the wallet, though KYC is often a prerequisite for connected services.

Ledger Nano X Key Details

- Type: Hardware cold wallet

- Founded Year: 2014

- Price: ~$149

- KYC Required: No

- Supported Blockchains: 5,500+ coins and tokens

- Features: Bluetooth, Ledger Live, staking, offline key

Ledger Nano X Pros & Cons

Pros:

- Offline storage of private keys.

- Bluetooth functionality.

- 5,500+ stored assets.

- Top-notch hardware protection.

- Ledger Live ecosystem.

Cons:

- Higher initial costs for the device.

- Minor bluetooth access point for vulnerabilities.

- Physical device required for use.

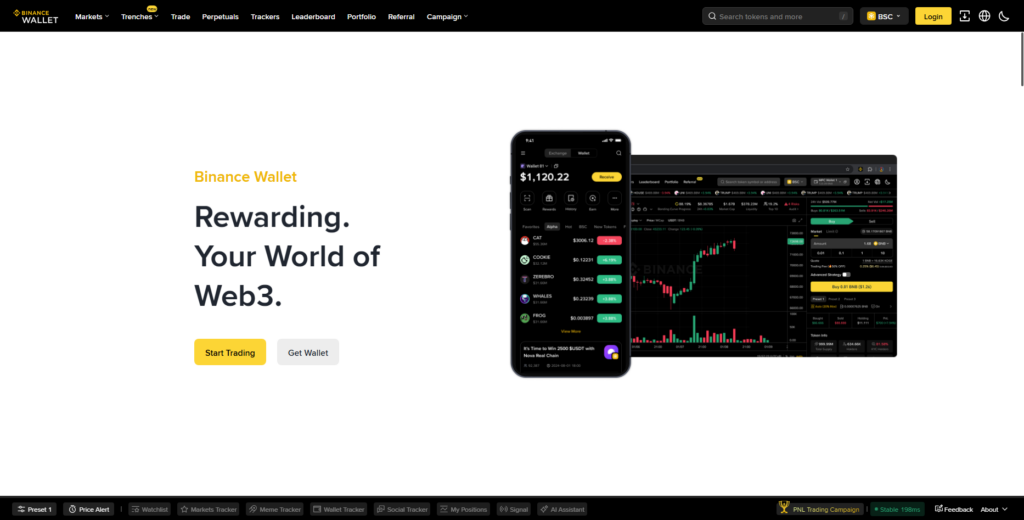

4. Binance Wallet – Best Decentralised Crypto Wallets in 2026

Now consider the Binance Wallet. Binance Holdings Ltd. created Binance Wallet, which is featured in Best Decentralised Crypto Wallets in 2026. It is a software wallet that is highly integrated with the ecosystem of a large exchange.

Though it is a hot wallet, it allows you to store over 300 cryptocurrencies on various blockchains with no primary fee. It is a mobile app, a website, and a browser extension. While you do not have to do a KYC to use the wallet, doing a KYC is a requirement to access exchange features.

Users have the ability to DeFi and NFTs, as well as store, transfer, and swap cryptocurrencies. Users who prefer a more custodial controlled experience would have the semi-custodial option.

Binance Wallet Key Details

- Type: Hot/software wallet

- Founded Year: 2017

- Price: Free

- KYC Required: For exchange features only

- Supported Blockchains: 300+ assets, multichain

- Features: Trading, staking, DeFi, NFTs, Binance ecosystem

Binance Wallet Pros & Cons

Pros:

- All in one trading, staking, DeFi, and NFTs.

- Links with 300+ assets.

- Simple wallet creation.

Cons:

- KYC for access to complete features.

- Privacy-focused users may find the centralized aspects troublesome.

- The direct link with the exchange may reduce decentralization.

5. Trezor Model One – Best Decentralised Crypto Wallets in 2026

Another hardware wallet option is the Trezor Model One, which features a more affordable price option in the Best Decentralised Crypto Wallets in 2026 selections.

It is more suitable for beginners, who self-custody their wallets and prefer to have a little more physical security by buying the wallet. It is a cold wallet, so it requires a single hardware purchase which is typically in the vicinity of $49–$60.

It is a non-custodial wallet that supports over 1,200 cryptocurrencies on different blockchains. There is no KYC required, and you can operate the device without it.

Users can recover funds with a seed phrase if a device is misplaced. It has a simple interface and open-source software that provides a good first step into secure, self-custody that is fully decentralized.

Trezor Model One Key Details

- Type: Hardware wallet

- Founded Year: 2014

- Price: ~$49–$60

- KYC Required: No

- Supported Blockchains: 1,200+ cryptocurrencies

- Features: Open-source firmware, offline key storage, simple interface, beginner-friendly

Trezor Model One Pros & Cons

Pros:

- Budget-friendly hardware wallet

- Keeps your keys offline

- Firmware that’s open-source

- Simplistic for newbies

- Great community around it

Cons:

- Lower end supports less assets than other models

- No Bluetooth or wireless

- The screen is less sizeable

6. OKX Wallet – Best Decentralised Crypto Wallets in 2026

The OKX Wallet is a hot wallet and browser extension. It provides multi-chain compatibility and security, which is why it is included in the Best Decentralised Crypto Wallets in 2026 for Web3 and DeFi. It is non-custodial and free to use. It has over 40 blockchains and 1,000 DApps

Other features include social recovery, account abstraction, and cross-chain swaps. There is no KYC obligation to use the wallet, but some integrated services may require the user to verify their identity.

It is designed to be user-friendly and has NFT and DeFi support, which is why it is one of the most popular wallets among Web3 active users and traders.

OKX Wallet Key Details

- Type: Hot wallet / mobile & browser

- Founded Year: 2017

- Price: Free

- KYC Required: No (for wallet only)

- Supported Blockchains: 40+ chains, 1,000+ DApps

- Features: NFT support, DeFi integration, social recovery, multi-chain swaps

OKX Wallet Pros & Cons

Pros:

- Supports multiple chains, NFT’s, and DeFi

- Can do swaps across chains

- Uses a browser or app

- Recovery by social means

- No KYC needed for wallet functionality

Cons:

- A few services are tied to the OKX community

- Doesn’t have top-level hardware security

- Works on hot wallet connection

7. Margex – Best Decentralised Crypto Wallets in 2026

Established in 2019 as a crypto exchange, Margex includes a simple wallet that gets it recognition in Best Decentralised Crypto Wallets in 2026 for its simplicity and no KYC requirement. It is also a derivatives trading ecosystem, but its wallet provides users the ability to deposit and trade over 50 assets with the security of cold storage.

While onboarding customers, the platform doesn’t require KYC for basic trading accounts. Margex may be used in different jurisdictions. It is better for traders who enjoy basic accessibility, copy trading, and integrated leverage. Margex is free (not including trading fees). It is better for traders who enjoy basic accessibility, copy trading, and integrated leverage.

Margex Key Details

- Type: Exchange platform wallet

- Founded Year: 2019

- Price: Free (trading fees apply)

- KYC Required: No (for basic use)

- Supported Blockchains: 50+ crypto assets

- Features: cold storage for funds, leverage & copy trading, no-KYC signup, Simple interface

Margex Pros & Cons

Pros:

- Registration that requires No KYC

- A wallet for trading that is simple to use

- Funds have the protection of cold storage

- Quick to onboarding

Cons:

- Mostly a wallet for a trading platform

- Lacks the Web3 functionality that is in other wallets

- Not meant for long-term self-custody

8. Best Decentralised Crypto Wallets in 2026 – Cypherock

Best Decentralised Crypto Wallets in 2026, especially Cypherock, is a seedless cold wallet that is more innovative than the rest. It employs a cutting-edge technology, Shamir’s Secret Sharing, which transfers private key shares onto various physical NFC cards.

This cold wallet also supports thousands of assets on countless blockchains and lowers the risk of having multiple faster points of failure. This means, not needing KYC and having decentralized flexible card wallet storage is appreciated by Individuals who prioritize premium self-custody security.

Cypherock Key Details

- Type: Seedless cold wallet

- Founded Year: 2018

- Price: Varies (~$200+)

- KYC Required: No

- Supported Blockchains: Thousands of assets

- Features: Tamper-resistant hardware, multi-device backup, distributed key storage

Cypherock Pros & Cons

Pros:

- No seed cold wallet

- Extra security with distributed key storage

- Backup with multiple devices

- Wallets that are not custodial

Cons:

- More expensive than some secondary wallets

- It is a cold wallet that is fully physically integrated

- Not as widely accepted as Ledger or Trezor

9. Best Decentralised Crypto Wallets in 2026 – Tangem

In 2017, Tangem AG created the Tangem Wallet which is featured as one of the Best Decentralized Crypto Wallets in 2026 for its innovative use of a cold storage system by NFC technology.

Your wallet utilizes an EMV card-shaped design (EAL6+ secure chip) that costs $55+ (hardware purhcase) and supports over 81 blockchains and 13,000 assets, signing data references offline (with no battery needed) and wires tapping via NFC.

They value physical design, no seed backup, and wires hand a self-custodian wallet (with no)\disposable battery) KYC required wallet.

Tangem Key Details

- Type: NFC hardware wallet / card-based

- Founded Year: 2017

- Price: ~$55+

- KYC Required: No

- Supported Blockchains: 81+ chains, 13,000+ assets

Tangem Pros & Cons

Pros:

- Hardware wallet that is NFC

- Has a simple and seedless design

- Backup is multi-card

- The form factor is physical and simple

Cons:

- Doesn’t have the most advanced UI

- The hardware has to be accessed physically

- Less frequent updates than software wallets

10. Zengo Wallet – Best Decentralised Crypto Wallets in 2026

Zengo Wallet is a secure, user friendly mobile wallet that uses MPC cryptography (meaning traditional seed phrase is eliminated, making it one of the best in Best Decentralised Crypto Wallets in 2026).

Zengo, a Tel Aviv based, launched in 2017, created the wallet for free, supporting hundreds of cryptos across the main blockchains, such as Bitcoin, Ethereum, Polygon and so on. Zengo uses Multi Party Computation and 3FA that includes biometrics on the mobile making it so that the user does not lose their wallet seed;

it is not KYC friendly as it does not have KYC measures, but certain fiat services may ask for KYC. It is made for the masses because it is simple and secure.

Zengo Wallet Key Details

- Type: Mobile MPC crypto wallet

- Founded Year: 2017

- Price: Free (in-app services optional)

- KYC Required: No (for wallet only)

- Supported Blockchains: Major chains including BTC, ETH, Polygon

Zengo Wallet Pros & Cons

Pros:

- Biometric authentication

- User-friendly mobile application

- Multiple blockchain support

- No seed phrases to misplace

- Seed phrases are a thing of the past thanks to MPC cryptography

Cons:

- Server dependence for MPC

- More limited control compared to seed-phrase wallets

- Experience limited to mobile only

What Is a Decentralized Crypto Wallet?

A decentralized cryptocurrency wallet is a digital wallet that, instead of depending on a third party, gives consumers complete control over their bitcoin by keeping their own private keys.

These wallets offer direct access to assets across several blockchains, including Bitcoin, Ethereum, and Solana, as well as self-custody and improved anonymity.

They frequently facilitate Web3 integration, allowing communication with NFTs, DeFi systems, and decentralized programs (dApps). Decentralized wallets prioritize security, autonomy, and user control over digital funds with robust encryption and optional hardware support.

Benefits of Decentralised Crypto Wallets

Informed Ownership: Users have complete control of all private keys and funds. This means that they are not dependent on any 3rd party services.

Safe from Hacks: Your funds are protected in the wallets by some form of encryption, a seedphrase, or a hardware solution.

No KYC: Privacy is a big advantage of using these wallets. You are not subject to any KYC verification systems and can remain anonymous.

All in One Spot: One wallet can manage a variety of crypto holdings that are on different chains such as Bitcoin, Solana, and Ethereum.

DeFi and dApps Access: Users can interact directly with their wallets to get to decentralized apps, NFT marketplaces, and even DeFi services.

Self Visibility Control: You can monitor all of your transactions and have full control of your funds. There is no way to intervene or compromise your autonomy.

With You Anywhere: A lot of wallets are mobile or even hardware based, to allow a customer to crypto manage anywhere they want and stay secure.

Risks of Using a Decentralized Wallet

Loss of Private Keys: Nobody can recover your funds if you lose your private key or recovery seed. All access remains solely in your possession.

Phishing Scams: Fake websites, malicious apps, and social engineering can make you lose your wallet information or your cryptocurrency. Scams remain an omnipresent danger.

Lack of Customer Support: A decentralized wallet has no customer support. Your recovery options are non-existent. There’s no one to call in case of errors.

User Mistakes: A wallet can be configured ineptly. Assets can be lost through typing errors, transfers on the wrong network, or through myriad other blunders.

Malware and Hacking: Wallets are compromised if the device and network you are using are affected. Your private key can be exposed, risking funds.

Less Insurance: Most decentralized wallets do not provide insurance or technical protection, whereas centralized exchanges do. Theft protection is absent, too.

Difficult For New Users: New users are more likely to make mistakes. This increases the probability of key mismanagement, lost backups, or overlooking multi-chain assets.

Conclusion

In 2026, decentralized crypto wallets have become vital for secure, self-custodial cryptocurrency management, enabling full control, multi-chain functionality, Web3 integration, and greater anonymity.

From hardware-level security to user-friendly mobile access, top wallets like Best Wallet, Walletium, Ledger Nano X, Binance Wallet, Trezor Model One, OKX Wallet, Margex, Cypherock, Tangem, and Zengo Wallet each offer special benefits.

Users must be wary of dangers including private key loss, phishing attempts, and the lack of centralized recovery solutions, even as benefits include autonomy, privacy, and dApp connectivity.

By selecting the appropriate wallet, users can safely engage in the expanding decentralized economy by striking a balance between security, convenience, and functionality.

FAQ

What is a decentralized crypto wallet?

A decentralized crypto wallet allows users to fully control their funds by holding private keys. It supports multi-chain assets, Web3 apps, DeFi, and NFTs without relying on a third party.

Are decentralized wallets safe?

Yes, they provide strong security through encryption, seed phrases, or hardware storage. However, safety depends on how securely users manage private keys and avoid phishing scams.

Do I need KYC to use these wallets?

Most decentralized wallets, including Best Wallet, Walletium, Cypherock, Tangem, and Zengo, do not require KYC for wallet access. KYC is only needed for exchange-related features.

Which wallet is best for beginners?

Wallets like Best Wallet, Zengo Wallet, and Trezor Model One are beginner-friendly, offering intuitive interfaces, simple backups, and easy multi-chain access.

What are the risks of using decentralized wallets?

Risks include losing private keys, falling victim to phishing, user errors, malware attacks, and lack of customer support or fund insurance.