The Best HFT Brokers with Zero-Latency API for Traders will be covered in this article. High-frequency trading requires dependable platforms, deep liquidity, and lightning-fast execution.

Making the correct broker choice is essential to reducing slippage and increasing strategy effectiveness. Here, we look at brokers that are perfect for professional and algorithmic traders since they offer ultra-low latency APIs, sophisticated tools, and strong regulation.

Key Point & Best HFT Brokers with Zero-Latency API for Traders

| Broker | Key Points / Highlights |

|---|---|

| Exness | Offers ultra-low spreads, flexible leverage, strong execution speed, and multi-asset trading. |

| Eightcap | ASIC-regulated, competitive spreads, supports MT4/MT5, and fast order execution. |

| ThinkMarkets | Advanced trading platforms, strong analytics, and reliable customer support. |

| AvaTrade | Global regulation, multiple trading platforms, social trading, and automated trading options. |

| OANDA | Trusted broker, transparent pricing, strong research tools, and user-friendly platform. |

| FOREX.com | Large market access, strong regulation, advanced charting, and educational resources. |

| Pepperstone | Low spreads, fast execution, multiple platforms (MT4/MT5/cTrader), strong liquidity. |

| IC Markets | True ECN broker, ultra-low spreads, high-speed execution, and institutional-grade liquidity. |

| Capital.com | AI-powered trading insights, intuitive platform, wide range of instruments, and tight spreads. |

| FXCM | Regulated broker, advanced tools, algorithmic trading support, and strong market research. |

1. Exness

Established in 2008 with the goal of balancing technology and ethics in financial trading, Exness is a well-known Forex and CFD broker worldwide. With hundreds of thousands of active traders worldwide and a monthly handling volume of several trillion dollars, it has become one of the biggest brokers by trading volume.

High-frequency and algorithmic traders are drawn to Exness’s ultra-low spreads, adjustable leverage, numerous platforms (MT4, MT5, proprietary apps), and lightning-fast execution. The Exness brand is used by a number of regulated companies in several jurisdictions, including the UK’s FCA, CySEC, FSCA South Africa, CBCS Curacao, and others.

Exness – Pros & Cons

| Pros | Cons |

|---|---|

| Ultra‑low spreads suitable for tight execution | High leverage can increase risk for new traders |

| Fast order execution ideal for HFT strategies | Not as beginner‑friendly |

| Wide range of regulated entities | Some services vary by region |

| MT4/MT5 & API access | Customer support response varies by time zone |

| Strong liquidity and global market reach | Advanced tools may overwhelm newbies |

Exness Features

- Variable pricing with tight spreads

- Integration with TradingView

- Compatibility with MT4 & MT5

- High flexibility with leverage

- System for withdrawals that is quick

2. Eightcap

ASIC, CySEC, FCA, and the SCB are among the key regulatory bodies that oversee Eightcap, an Australian online broker that was founded in 2009. Eightcap, which is well-known for its cheap pricing and narrow spreads, provides MT4 and MT5 platform compatibility along with quick order execution, extensive liquidity, and access to international markets.

With its ECN/STP paradigm, high-frequency traders that use automated methods or APIs can benefit from transparent pricing and reduced latency. Customers gain from having access to cryptocurrencies, commodities, FX, and indexes through a variety of account kinds. Eightcap is a great option for both professional and algorithmic trading due to its strong technological infrastructure and regulatory presence.

Eightcap – Pros & Cons

| Pros | Cons |

|---|---|

| Competitive pricing on Raw accounts | Fewer asset classes than larger brokers |

| ASIC & FCA regulation | API features limited compared with ECN brokers |

| Fast execution speeds | Less advanced research tools |

| Supports both MT4 & MT5 platforms | No proprietary platform |

| Clear pricing and order routing | Limited educational resources |

Eightcap Features

- Raw spreads with ECN pricing

- TradingView integration

- MT4/MT5 support

- Regulation by ASIC & VFSC

- Several account types

3. ThinkMarkets

Founded in 2010, ThinkMarkets is a multi-regulated online broker with offices and customers all around the world. In addition to offering access to FX, indices, commodities, stocks, ETFs, and cryptocurrencies, it also supports cutting-edge platforms designed for algorithmic trading and quick execution.

ThinkMarkets attracts high-frequency traders who need dependable API connectivity because of its tight spreads, institutional-grade liquidity, and instant order fills. Strategy versatility is increased by its industry-standard MT4/MT5 compatibility and unique ThinkTrader platform. In addition to providing experienced traders with broad market access and advanced trading tools, being licensed in many countries guarantees local compliance and customer safety.

ThinkMarkets – Pros & Cons

| Pros | Cons |

|---|---|

| Excellent analytical and charting tools | Liquidity is smaller than major ECN brokers |

| Multi‑platform support | API access not as extensive for HFT |

| Fast fills with low slippage | Pricing can be higher on certain accounts |

| Strong risk management features | Fewer customization options |

| FCA & ASIC regulated | Tools may be complex for beginners |

ThinkMarkets Features

- Link with TradingView

- ThinkTrader, MT4/MT5

- Regulated by FCA, ASIC, FSCA

- Consistent spread pricing

- CFD & FX products

4. AvaTrade

Established in 2006 in Dublin, Ireland, AvaTrade has developed into a multi-asset broker with international regulation. It provides access to MT4, MT5, AvaTradeGO, and other platforms for trading in FX, equities, commodities, indices, and cryptocurrencies. Through API interfaces and third-party platforms, its infrastructure facilitates automated trading, competitive spreads, and low-latency execution.

The EU, Australia, Japan, and South Africa are just a few of the many jurisdictions that oversee AvaTrade, providing traders with assurances of safety and compliance. AvaTrade caters to both high-frequency traders and larger investor audiences with its robust trading ecosystem and educational materials.

AvaTrade – Pros & Cons

| Pros | Cons |

|---|---|

| Wide variety of tradable assets | Spreads may widen during market events |

| Multi‑platform choices including MT5 | Speed slightly lower than pure ECN |

| Automated trading support | API accessibility limited |

| Strong global regulation | Fees higher on some products |

| Social & copy trading available | Advanced features can be complex |

AvaTrade Features

- Proprietary platforms and MT4/MT5

- Integration with TradingView

- Access to multiple assets (FX, crypto, indices, metals)

- Multiple regional regulations

- Abundant educational resources

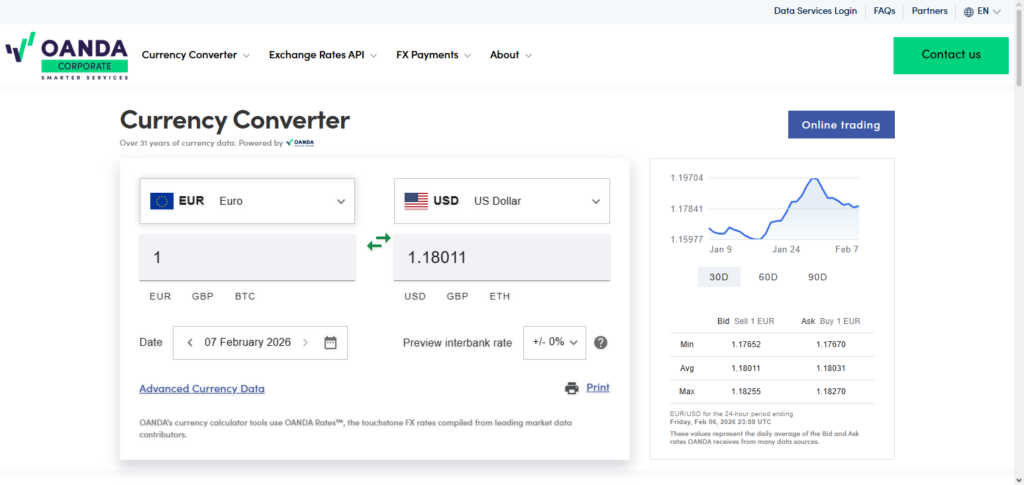

5. OANDA

One of the oldest and most reputable online forex brokers is OANDA, which was co-founded in 1996 by Drs. Michael Stumm and Richard Olsen. With its sophisticated trading platforms, APIs, and automated strategy support, it was a pioneer in web-based currency trading and data services. OANDA has extensive liquidity and clear pricing, and it operates internationally under several authorities.

Operational resilience is highlighted by recent performance reports that demonstrate robust revenue and profit growth in specific locations. OANDA continues to be a strong option for traders looking for high-frequency and API-driven execution due to its extensive product coverage, which includes FX, indices, and commodities, as well as its strong technical infrastructure.

OANDA – Pros & Cons

| Pros | Cons |

|---|---|

| Very transparent pricing and execution | CFD offerings limited compared to others |

| Advanced API capabilities | Spreads may be wider in some markets |

| Deep liquidity | Best suited for forex heavy trading |

| Long‑standing industry reputation | API setup requires technical skill |

| Strong research & data feeds | Not ideal for ultra‑high leverage strategies |

OANDA Features

- fxTrade platform

- Support for TradingView

- Micro-lots

- Outstanding research and news services

- Global regulation

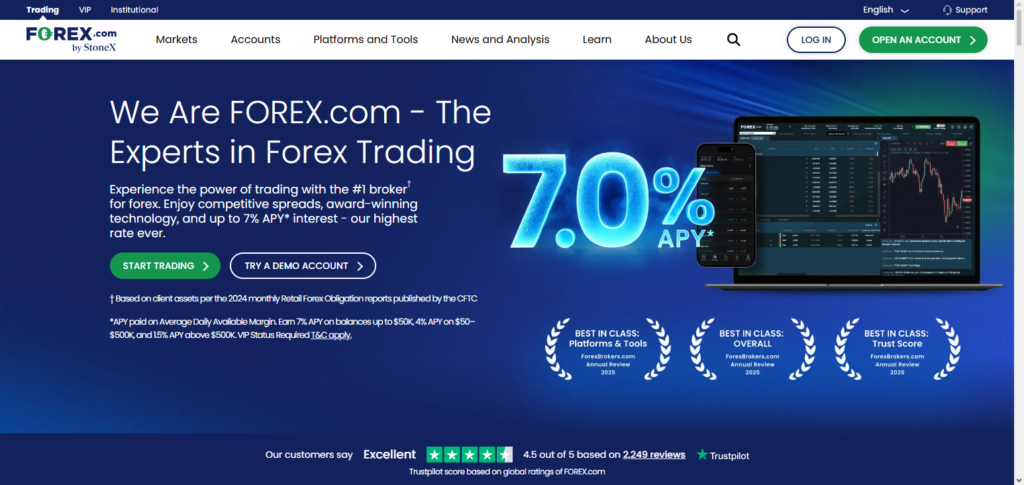

6. FOREX.com

A prominent international FX and CFD broker, FOREX.com was established in 2004 as a division of GAIN Capital Holdings. It provides broad market access with leveraged trading across currencies, commodities, indexes, and cryptocurrencies. It is currently a member of the StoneX Group and has its headquarters in the United States.

FOREX.com enables API trading and algorithmic techniques, offering cutting-edge platforms that provide quick execution speeds and deep liquidity. The company works under a number of regulatory regimes, including the U.S. CFTC/NFA, UK FCA, ASIC Australia, and Japan FSA. Its continued growth and incorporation of former FXCM accounts confirm its position as a major supplier for HFT methods and professional traders.

FOREX.com – Pros & Cons

| Pros | Cons |

|---|---|

| Institutional‑grade liquidity | Execution speed can vary by server location |

| Extensive market access | Complex fee structure for some products |

| API & algorithmic trading support | Platform feels overwhelming for newbies |

| Deep research & educational tools | Crypto access limited |

| Multi‑regulated and trusted | Higher non‑trading fees |

FOREX.com Features

- Direct integration with TradingView

- Proprietary platform and MT4/MT5

- Comprehensive FX product offering

- Quality news and research

- Regulation in US, UK, EU, AUS

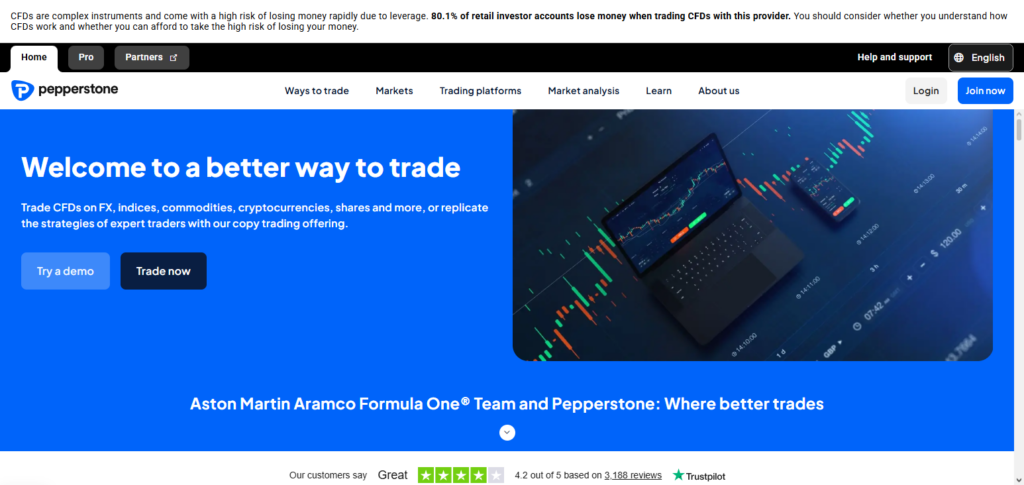

7. Pepperstone

Established in 2010 in Melbourne, Australia, Pepperstone has emerged as a prominent broker for algorithmic trading and low-latency execution. Major platforms that are optimized for narrow spreads and quick order routing—two essential components of high-frequency strategies—such as MT4, MT5, and cTrader are supported.

Pepperstone, regulated by the FCA, CySEC, ASIC, and others, offers competitive price together with dependability. ECN pricing methods that reduce slippage and extensive liquidity pools are advantageous to clients. Professional traders looking for strong API access and low latency like it because of its global reach and technological infrastructure.

Pepperstone – Pros & Cons

| Pros | Cons |

|---|---|

| Raw ECN pricing ideal for HFT | Spread widening in major news events |

| Fast execution with deep liquidity | Some tools limited on certain platforms |

| cTrader support for advanced traders | Margin requirements can be high |

| VPS support for low latency | Limited proprietary analytics |

| ASIC & FCA regulation | Learning curve for new traders |

Pepperstone Features

- ECN pricing that is genuine

- Direct TradingView connection

- MT4/MT5 and cTrader available

- Regulation by ASIC, FCA, CySEC

- Execution with low latency

8. IC Markets

When IC Markets was founded in 2007, it immediately became well-known for its ultra-low spreads, raw ECN pricing, and speedy execution—features that are particularly appealing to high-frequency and algorithmic traders. By providing MT4, MT5, and cTrader platforms, it lowers latency considerably while offering deep liquidity and execution at major data centers such as Equinix NY4 and LD5.

IC Markets provides VPS solutions for reliable performance and facilitates sophisticated API access for automated strategies. IC Markets, one of the world’s most active brokers, provides the speed and dependability that are essential for professional trading.

IC Markets – Pros & Cons

| Pros | Cons |

|---|---|

| True ECN environment | Educational tools are basic |

| Ultra‑low latency execution | Requires technical skill for APIs |

| Deep institutional liquidity | Not beginner‑focused |

| VPS available for consistent performance | Funding fees may apply |

| Supports multiple platforms | Complex pricing for new traders |

IC Markets Features

- Raw spreads on ECN

- Support for TradingView integration

- cTrader, MT4/MT5

- High speed of execution

- Regulation by CySEC, SCB, and ASIC

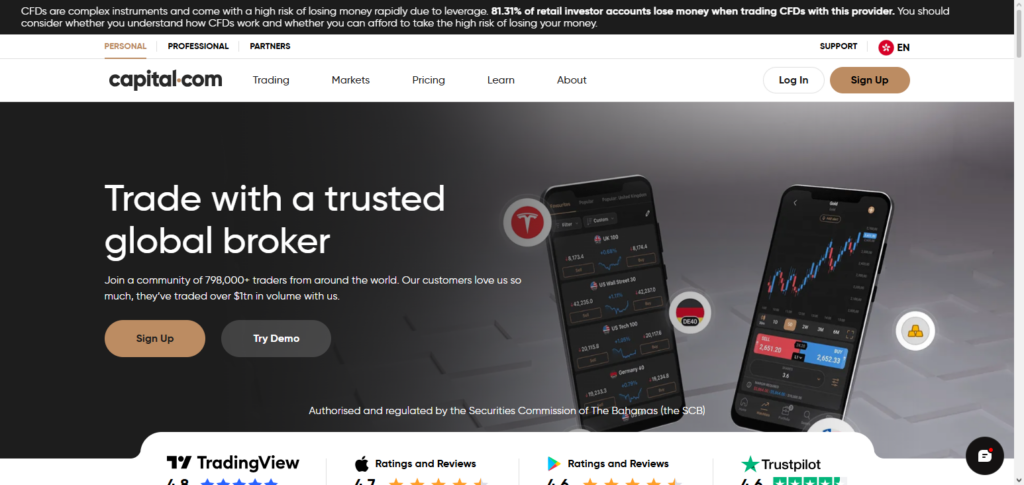

9. Capital.com

Founded in 2016, Capital.com is a tech-driven brokerage that integrates advanced analytics and artificial intelligence into online trading. It offers access to thousands of CFD products, such as stocks, currency, and cryptocurrencies, and operates internationally through regulated companies in the UK, Cyprus, Australia, the UAE, and the Bahamas.

Rapid expansion was evident in the trade volumes recorded by Capital.com, which exceeded $1.7 trillion. Its proprietary platform facilitates API connectivity for algorithmic tactics, as does its interaction with tools like as TradingView. Both professional and algorithmic traders seeking quick execution and wide market access find Capital.com appealing due to its emphasis on user experience and data insights.

Capital.com – Pros & Cons

| Pros | Cons |

|---|---|

| AI‑driven insights | Spreads higher on niche assets |

| Intuitive trading platforms | APIs less powerful than ECN brokers |

| Broad instrument range | No direct stock ownership |

| Multi‑jurisdiction regulation | Execution speed slower than some peers |

| Strong analytics & data tools | Not optimized for pure HFT |

Capital.com Features

- analytics powered ai

- TradingView integration

- Web and mobile platforms

- Major pairs with tight spreads

- Regulated by FCA and others

10. FXCM

Established in 1999 in New York, FXCM (Forex Capital Markets) was a pioneer in electronic forex trading. FXCM gained a reputation for broad market access and no-dealing desk execution through its history of expansion, acquisitions, and platform development.

Despite ongoing regulatory issues, it is still a prominent broker with support for APIs and automated trading on well-known platforms. For traders who use programmatic techniques and look for low execution latency, FXCM is important because to its extensive industry presence and development of cutting-edge execution technologies.

FXCM – Pros & Cons

| Pros | Cons |

|---|---|

| Long industry history | Past regulatory issues impact trust |

| API & automated trading supported | Execution not as fast as ECN rivals |

| MT4 & ProFX platform support | Liquidity less deep than larger brokers |

| Reasonable pricing on majors | Limited crypto products |

| Global regulatory licenses | Not ideal for purely high‑speed trading |

FXCM Features

- Integrated with TradingView

- Supports MT4 and NinjaTrader

- Variety of CFDs along with FX

- Proprietary platforms

- Multiple region regulation

Conclusion

Selecting the appropriate broker can have a significant impact on high-frequency trading, which demands accuracy, speed, and dependable infrastructure.

To enable algorithmic and professional trading techniques, brokers such as Exness, Eightcap, ThinkMarkets, AvaTrade, OANDA, FOREX.com, Pepperstone, IC Markets, Capital.com, and FXCM offer ultra-low latency execution, sophisticated API access, and strong liquidity.

Each broker ensures traders can work with little slippage and maximum efficiency by combining competitive pricing, state-of-the-art technology, and strict regulation. These brokers are the greatest choices for HFT traders looking for speed, transparency, and dependability in the hectic trading world of today.

FAQ

What is a zero-latency API in trading?

A zero-latency API allows traders to execute orders almost instantly, minimizing delays between placing and filling trades. This is crucial for high-frequency trading (HFT), where milliseconds can impact profitability. Brokers offering zero-latency APIs ensure faster order routing, deep liquidity, and reliable server infrastructure for algorithmic strategies.

Why are zero-latency APIs important for HFT traders?

HFT strategies rely on executing multiple trades in fractions of a second. Any delay can lead to slippage or missed opportunities. Brokers with zero-latency APIs provide speed, accuracy, and reliability, allowing algorithms to perform optimally in volatile markets.

Which brokers offer the fastest execution for HFT?

Top brokers for HFT include Exness, Eightcap, ThinkMarkets, AvaTrade, OANDA, FOREX.com, Pepperstone, IC Markets, Capital.com, and FXCM. They provide advanced platforms, deep liquidity, and low-latency execution suitable for professional and algorithmic traders.

Can I use algorithmic trading with these brokers?

Yes. All the listed brokers support algorithmic trading through APIs, MT4/MT5, cTrader, or proprietary platforms. Traders can deploy automated strategies, backtest algorithms, and execute trades instantly with minimal delays.

Are these brokers regulated?

Yes. Each broker is regulated by top authorities, including FCA, ASIC, CySEC, and NFA, depending on the region. This ensures client funds’ safety, transparent pricing, and compliance with international trading standards.