I’ll talk about the Crypto Tax Calculator India in this post. Since cryptocurrencies are becoming more and more popular in India, it is crucial to calculate taxable gains and losses precisely.

By keeping track of transactions, calculating profits, and producing ready-to-file reports, a crypto tax calculator streamlines this procedure. It guarantees adherence to Indian tax regulations whether you trade, invest, or make money through staking and NFTs.

What is a Crypto Tax Calculator?

A Crypto Tax Calculator is a program or a tool used to determine the tax gains or losses that a cryptocurrency trader or an investor incurs. It does this by tracking each individual buy, sell, trading, or swapping, then automatically tracks the profits, losses and tax laws in that jurisdiction and calculates tax liabilities for the trader or investor.

Crypto tax calculators in India will implement tax regulations, including a flat tax rate on crypto gains, and a clause for TDS (Tax Deducted at Source) to be compliant with the Income Tax Department of India’s regulations.

These calculators will additionally prepare a report that will be submitted to the relevant authorities, complete and manage the reporting of the tax liability for cryptocurrency staking, report airdrop gains, manage DeFi activity, and save a lot of time relative to manually calculating tax liabilities on each trading activity. Tax calculators help reduce the stress of reporting taxes for a trader or investor and are a good tool for record keeping as well as avoiding mistakes.

How to Use a Crypto Tax Calculator in India

Example: Crypto Tax Calculator in India

Step 1: Choose a crypto tax calculator

Pick one of the tools like Koinly India or CryptoTaxCalculator.in that are compliant with the Indian tax laws.

Step 2: Autofill your transactions

Do your variable transactions like CoinDCX or WazirX exchanges by uploading your CSV document. You can also do it through a link to your wallet or exchange with an API.

Step 3: Mark your transactions

You will do it with the calculator, while some do the classifications of your transactions as short term or long term, to state that it is classified as a buy, sell, trade, airdrop, or staking reward, it is your responsibility.

Step 4: Examine the gains and losses

It is your responsibility to ensure that every transaction is present.

Step 5: Make the tax report

Total gain, the tax deducted at source (TDS), and the tax liability are the common accepted reports of the Indian tax authorities.

Step 6: Pay your taxes

It is now your responsibility to trust the report and declare your crypto income, so pay taxes and collect your income tax return (ITR).

Popular Crypto Tax Calculators for India

CoinLedger

CoinLedger is a popular cryptocurrency tax calculator that facilitates the calculation of taxable gains for traders and investors by supporting Indian cryptocurrency rules. Through CSV or API connection, customers can import transaction data from worldwide exchanges as well as several Indian exchanges, like WazirX and CoinDCX.

CoinLedger accurately calculates capital gains in accordance with Indian tax rules and automatically classifies transactions as buy, sell, trade, or staking income. Additionally, it manages intricate transactions like airdrops, NFTs, and DeFi. In order to ensure accurate filing, save time, and reduce human error, users can create ready-to-file reports that are compatible with income tax returns.

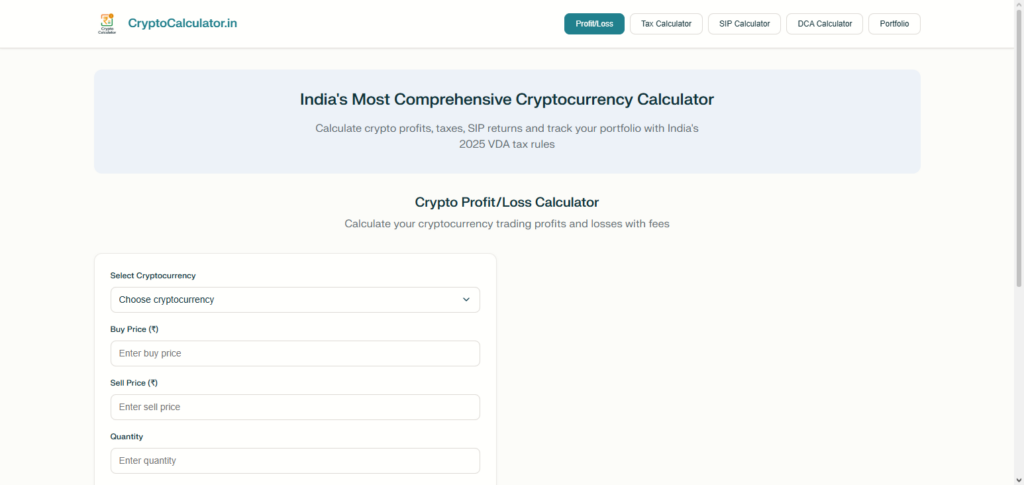

CryptoTaxCalculator.in

An Indian platform called CryptoTaxCalculator.in was created especially to assist cryptocurrency users in adhering to regional tax laws. It automatically computes both short-term and long-term gains, enables imports from major Indian exchanges, and takes into account the consequences of TDS on cryptocurrency transactions.

The site is easy to use and provides both novice and experienced traders with detailed instructions. It can manage token swaps, NFT sales, and staking rewards, making sure that all taxable events are covered.

The process is made easy and error-free by allowing users to create downloadable reports that are prepared for submission with ITR forms. Its design, which is focused on India, guarantees adherence to the most recent crypto tax regulations.

Benefits of Using a Crypto Tax Calculator

Calculate Gains & Losses Accurate

Calculates profits and losses automatically and reduces mistake to nothing.

Calculating is a Waste of Time

Tracks hundreds of crypto transactions across exchange and wallets automatically.

Covers You Legally

Crypto tax calculators take into account TDS and Flat Tax rates to ensure you don’t get fined by the Income Tax Department.

Dealing with Complicated Transactions is Hassled

Crypto tax calculators simplify the process of calculating staking rewards, airdrops, Defi transactions, and token swaps.

Ready-to-File Reports

Tax reports made by Crypto tax calculators can be used for filing Income Tax Returns (ITR)

Records Transactions

Crypto tax calculators saves digital history of activities in crypto.

Tips for Accurate Crypto Tax Filing

Maintain Detailed Records: Create detailed documentation for all transactions including buying, selling, trading, transferring, airdrops, and staking.

Use a Reliable Crypto Tax Calculator: Find a calculator that customizes for Indian tax laws so that you don’t do manual calculations.

Include All Wallets and Exchanges: Find all transactions from all wallets and all crypto exchanges because each trade is a taxable event.

Regularly Update Your Records: Update the tax calculator with new transactions coming in so that you don’t have a last minute issue.

Verify Automated Reports: Check all the gains and negatives and tax amounts that have been calculated in a report before you file.

Separate Short-Term and Long-Term Gains: Be sure that you are separating your trades to meet all the tax obligations.

Keep Supporting Documents: For all of the auditing nuances , keep the CSV reports, invoices , and wallet statements.

Seek Professional Help if Needed: If the number of your transactions and/or your crypto portfolio is large, consider consulting a tax professional.

Common Mistakes to Avoid

Transactions May Be Missing

Not including trades on all exchanges and wallets may result in underreporting of gains.

Income Classification Error

Income resulting from trading, mining, staking, or airdrops is incorrectly classified and can lead to erroneous tax calculations.

Ignorance of Tax Deducted At Source (TDS)

Not considering TDS on some crypto trades could create problems with the tax department.

Failure To Record Transactions In Real Time

Recording transactions at the last moment can lead to errors and missing records.

Failure To Consider DeFi and NFT Transactions

Gains made from platforms in decentralized finance (DeFi) or NFTs are taxable and mostly ignored.

Manual Computation

Manually calculating gains may lead to errors and may create problems as far as compliance is concerned.

Proof of Transactions May Be Missing

Some people do not seem to understand that the loss of invoices, CSV files of transactions, wallet statements, and others can create problems during audits.

Indian Tax Law Ignorance

Tax calculators that do not comply with Indian tax laws give erroneous results.

Conclusion

Every cryptocurrency trader and investor in India must use a crypto tax calculator. Compared to manual techniques, it saves time, guarantees compliance with Indian tax regulations, and streamlines the difficult process of computing gains and losses.

These calculators assist prevent errors, lower the risk of penalties, and simplify the filing of income tax returns by precisely recording transactions, including trades, staking, NFTs, and airdrops. One wise move toward well-organized, stress-free crypto tax management in India is to use a trustworthy crypto tax calculator.

FAQ

Do I need a crypto tax calculator in India?

Yes. It helps you accurately calculate gains and losses, ensures compliance with Indian tax laws, and saves time compared to manual calculations.

Can I use an international crypto tax calculator for India?

Not recommended. International calculators may not follow Indian tax rules, TDS, or flat tax rates, which can result in errors. Use India-specific tools.

What types of crypto transactions can a calculator handle?

Most calculators handle buys, sells, trades, staking rewards, airdrops, NFT sales, and DeFi transactions. Always check if your calculator supports these.

How do I import transactions into a crypto tax calculator?

You can upload CSV files from exchanges or connect wallets/exchanges via API to automatically fetch transaction data.

Are crypto tax calculators free in India?

Some offer free basic versions for a limited number of transactions, while advanced features and tax reports usually require a paid plan.