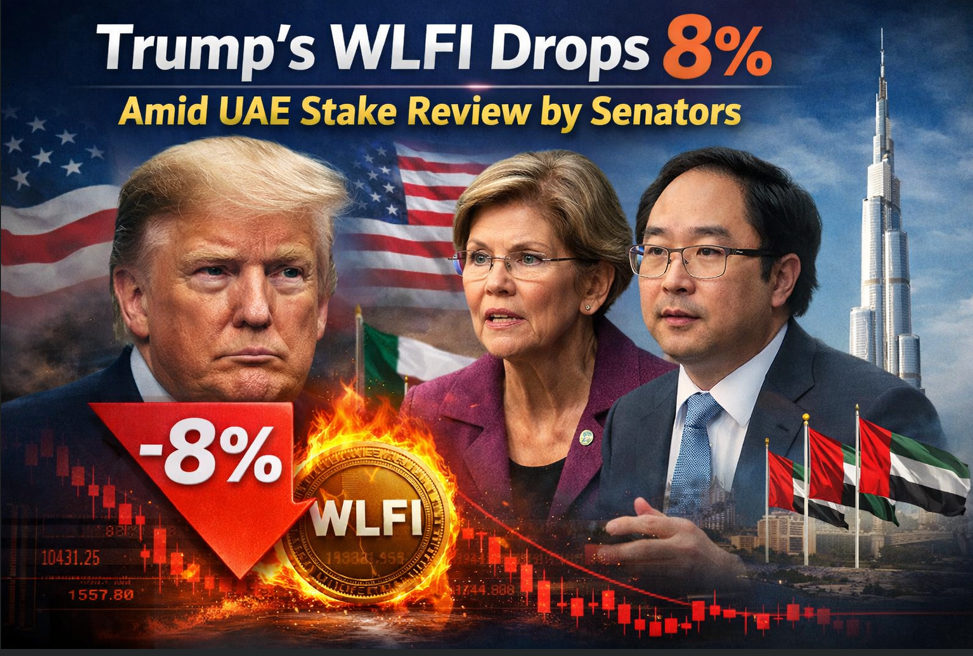

WLFI Token Falls 8% as Senators Request Probe Into UAE Stake in World Liberty

WLFI Token, connected to Donald Trump’s business, is down nearly 8% as the political and regulatory headwinds rise. Senators Elizabeth Warren and Andy Kim have requested the UAE’s $500 million stake in World Liberty Financial be investigated for possible national security concerns.

Bessent leads the Committee on Foreign Investment in the United States (CFIUS) and is the WILFI case for the 49% UAE ownership and its potential to be a national security threat. The noted that World Liberty Financial potentially has access to highly sensitive data and a review might be warranted if the a foreign power (especially the UAE or China) has access to that data.

The concerns about World Liberty are not just limited to data issues. Warren and Kim cited US intelligence showing G42, a UAE-based tech firm with a history of partnerships with Huawei, provided services to aid China’s military. This has led to bipartisan concerns about the company’s growth and foreign investment partnerships.

Political and regulatory scrutiny on World Liberty Financial, which was incorporated two months before Trump won the 2024 election, has been intense and ongoing. During a House Financial Services Committee hearing last week, Bessent was asked about World Liberty and was told to withhold a national trust bank charter application, which the company has been waiting for from the Office of the Comptroller of the Currency (OCC) since January and they are still processing it despite the scrutiny.

Notwithstanding the challenges with regulators, World Liberty is still looking to expand its business. This week the firm announced that it will start operating in the forex trading sector via a platform called World Swap.

Co-founder Zak Folkmann said that more details will be disclosed at the forthcoming Mar-a-Lago event. On the other hand, WLFI token is still being adopted by the market, and the growth of WLFI’s market cap to over $5 billion is a sign of increased interest by crypto traders, despite the political heat.

Nowhere else is the combination of political attention, expansion and regulatory scrutiny more apparent than with WLFI investors. An 8% drop in the token is cited by some analysts as an indication of a short-term phenomenon.

More positive growth initiatives and a larger market demand will in the long run set the price at more than its current value. There are clearly several layers to this case as it taps into aspects of crypto trading, international investments and the U.S. national security framework.