In this article, I will discuss Automated Bots That Simplify Crypto and Forex Trading and their transformative impact on traders’ investment management.

These bots automate strategies, execute trades 24/7, eliminate emotional mistakes, and maximize profits. Automated trading bots make crypto and forex trading quicker, more intelligent, and more effective, regardless of whether you are a novice or an expert.

Why Use Automated Bots That Simplify Crypto and Forex Trading

24/7 Trading Without Manual Effort

With automated bots, trades can be executed while users remain inactive and during periods of sleep. This is critical in the forex and crypto markets, where there can be significant, rapid, and unexpected changes in prices. Automating trades alleviates the constant and tedious supervision associated with manual trading.

Reduce Emotional Trading

Traders typically experience and express regret, fear, and greed during and after trades. Bots automate the execution of trades by following an established plan which in turn assists in the improvement of overall profitability.

Execute Complex Strategies Easily

Grid trading, DCA (Dollar-Cost Averaging), and various forms of arbitrage can be executed automatically and thus intelligently without the possibility of human error.

Backtesting and Strategy Optimization

A significant number of trading platforms permit users to test various strategies on simulated trades that are run with historical data. This identification of potential trades helps in trading performance optimization.

Automated Portfolio Management and Rebalancing

Flexibility allowed within automated bots provides them the opportunity to manage and rebalance diversified portfolios. This automation streamlines the workflow and broadens the automated strategies to ensure that the investments are congruent with your set trading goals.

Integration with Multiple Exchanges

With the ability of many trading bots to integrate with multiple platforms and exchanges, traders have the ability to view all their accounts from one interface. This presents the opportunity to manage multiple accounts in a consolidated manner and enables the trader to explore different accounts for potential trading opportunities.

Saving Time and Increasing Efficiency

The automation of repetitive tasks in trading provides bots the opportunity to save their users valuable time. With the execution of trades automated, users have the opportunity to engage in research, develop strategies, and perform market analysis with the time saved.

Key Point & Automated Bots That Simplify Crypto and Forex Trading List

| Trading Bot | Key Points |

|---|---|

| 3Commas | Smart trading terminal, portfolio management, copy trading options. |

| PickMyTrade | Automated trading strategies, user-friendly interface, backtesting tools. |

| Kryll.io | Visual strategy builder, marketplace for strategies, backtesting features. |

| Pionex | Built-in trading bots, low trading fees, grid and arbitrage bots. |

| Shrimpy | Portfolio rebalancing, social trading, exchange integration. |

| Zignaly | Signal provider integration, copy trading, low fees. |

| TradeSanta | Cloud-based trading bots, DCA and grid strategies, easy setup. |

| HaasOnline | Advanced scripting, multiple bot types, supports many exchanges. |

| Autoview | Trading automation for browser-based strategies, easy integration with scripts. |

| Gunbot | Customizable trading strategies, supports multiple exchanges, backtesting. |

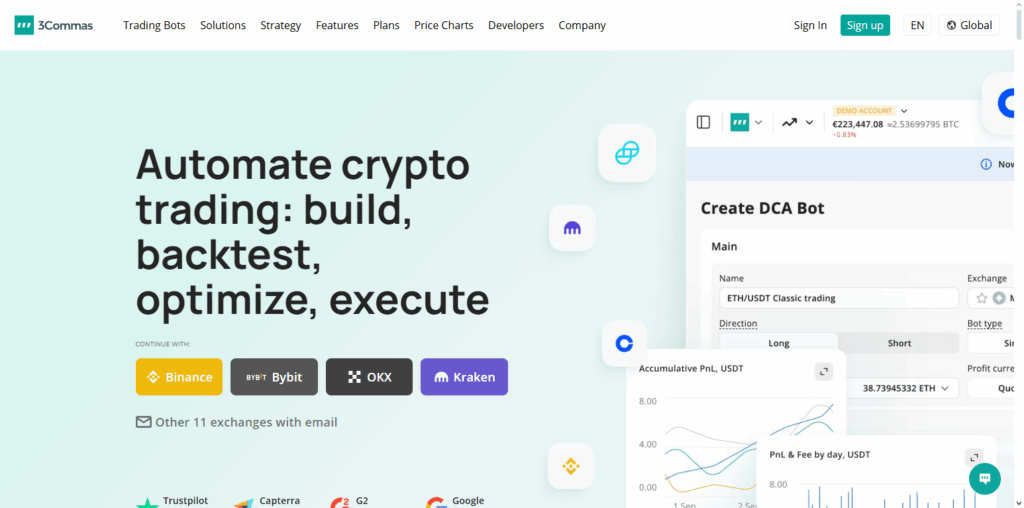

1. 3Commas

3Commas is one of the most recognized Automated Bots That Simplify Crypto and Forex Trading. It offers a smart trading terminal and comprehensive tools for advanced trading portfolio management. Users can create, backtest, and automate trading strategies without a lot of manual work.

It also offers 3 Commas tools such as grid bots, and DCA bots, and social trading for copy trading. 3Commas will analyze the real-time market environment, and assess your risk, and help manage your risks smartly. 3Commas user interface is simple and even beginners will find it an effective tool for automated trading across several exchanges.

Pros & Cons 3Commas

Pros:

- The user-friendly interface is accessible to beginners and pros.

- Social trading, portfolio management, and automation strategies.

- Multiple exchanges and advanced tools for risk management.

Cons:

- For beginners, the premium plans may be too expensive.

- Some advanced tools and features are complex.

- During high volatility in the market, users experience lag.

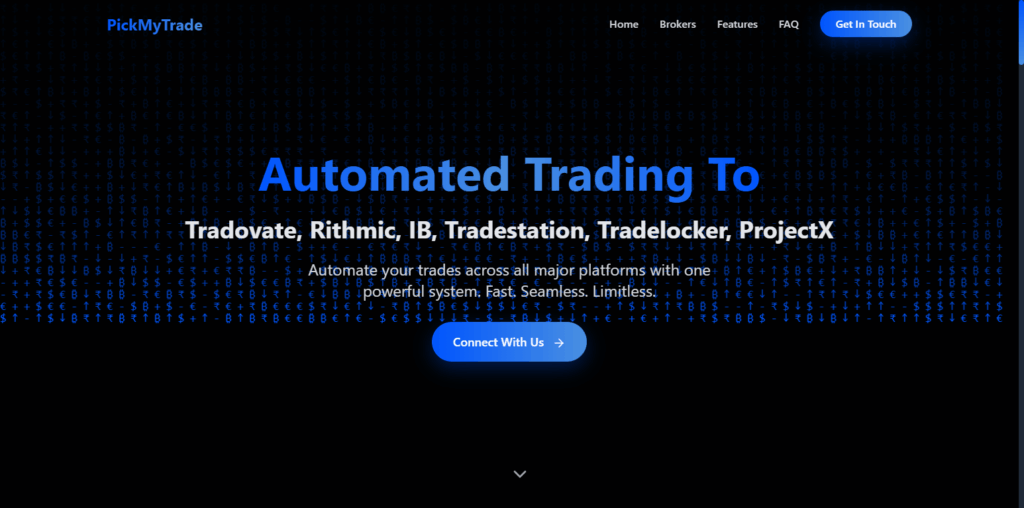

2. PickMyTrade

With an easy-to-use interface and one of the best Automated Bots That Simplify Crypto and Forex Trading systems available, PickMyTrade offers an excellent, easy-to-use interface. The system allows the users to select a pre-defined strategy or design their own.

The system allows users to backtest to analyze their strategy before using/gambling real money. PickMyTrade offers support for several crypto exchanges and offers automation for a variety of trading styles, for example, swing and day trading.

PickMyTrade offers users profitability notifications, automatic performance evaluation, and integrated risk assessment and management systems.

All of this aids users in performing optimally, whether they are beginners or advanced users. Ultimately, PickMyTrade allows users to save a considerable amount of time and manage their crypto or forex trading portfolios more optimally.

Pros & Cons PickMyTrade

Pros:

- Simple platform with ready-to-use strategies.

- Safer trades enabled by backtesting and performance tracking.

- Multiple exchange support fosters diversified trading.

Cons:

- Less advanced customization in comparison to other bots.

- Community is not as large, and tutorials are lacking.

- Internet stability is required for optimal performance.

3. Kryll.io

Kryll.io helps customize and automate crypto trading by using a visual strategy system described as one of the best Automated Bots That Simplify Crypto and Forex Trading systems available today. Users can customize automated strategies using the drag and drop system with no coding.

Users can also buy or sell optimal strategies in the Kryll marketplace. Kryll also offers strategy backtesting and paper trading to analyze performance without any risks. Kryll is integrated with several crypto exchanges, thus highly allowing flexible asset management.

Kryll offers automation to minimize time to perform analysis and to perform repetitive tasks. The system is enhanced for the users to reduce their manual trading and risks of manual errors. The crowd approach to strategy offers a system of managing performance tailored to the users. The innovation strategies make Kryll excellent for advanced users.

Pros & Cons Kryll.io

Pros:

- No coding is needed with the drag-and-drop visual strategy builder.

- A place to buy and sell strategies helps create profitable ones.

- Paper trading and strategy backtesting are great for risk-free testing.

Cons:

- For frequent traders, high monthly subscription fees aren’t ideal.

- Advanced strategy-building has a learning curve.

- Less support is given for customers compared to competitors.

4. Pionex

Pionex is a unique platform providing Automated Bots That Simplify Crypto and Forex Trading with a focus on built-in trading bots for every user.

Its low trading fees and variety of bots, including grid bots, arbitrage bots, and DCA bots, make it accessible to beginners and experts alike. Pionex allows for seamless automation of complex strategies, and eases the burden of active monitoring.

Analytical tools are provided for performance trading. Pionex allows the trader to efficiently capture market fluctuations. Pionex automation combined with low pricing, and simplicity improves a trader’s return while reducing the effort on the trader’s part.

Pros & Cons Pionex

Pros:

- Automation is provided with built-in grid and arbitrage bots.

- It’s affordable due to very low trading fees.

- Easy to use, perfect for novices.

Cons:

- You can’t modify advanced strategies much.

- Not as many integrations as other professional platforms.

- Some bots can underperform in highly volatile markets.

5. Shrimpy

Shrimpy is a platform that excels as an Automated Bots That Simplify Crypto and Forex Trading especially in portfolio management, and social trading. Users automate the process of rebalancing a portfolio on the selected strategy, which allows for stagnated long-term growth.

Additionally, Shrimpy offers the ability to copy trade, which allows user to follow, and trade in real time with expert traders. It offers the user the ability to integrate with different exchanges, which adds flexibility.

The performance of different strategies and allocations are streamlined, and analytically ways are provided to evaluate and optimize inequities in a portfolio. The automated method to portfolio management and the ability to integrate with different exchanges offers a low touch alternative without the time and emotional stress that is typically associated with trading.

It is designed for the invested trader of crypto or forex who seeks for systematic growth of their investments with little manual effort.

Pros & Cons Shrimpy

Pros:

- Offers portfolio rebalancing and social trading.

- Covers multiple exchanges for portfolio consolidation.

- Long-term investment strategies are easier to execute.

Cons:

- Active trading is not prioritized.

- Day trading strategies are not a good fit.

- For occasional traders, the subscription fee may feel excessive.

6. Zignaly

Zignaly is a multifunctional platform best known for its Automated Bots That Simplify Crypto and Forex Trading with a focus on signal provider integration and copy trading. Traders have the option to link to a professional signal and automate the execution of a trade, so they do not have to monitor it continuously.

Its affordable rates, along with a cloud-based system that allows for 24/7 active trading, make sure that every trading opportunity is captured. Zignaly covers a range of multiple exchanges which allows for flexibility in the different assets and also offers risk management tools to help prevent excessive losses.

The automation of complex trading strategies is a godsend for novice traders, while advanced users will appreciate the ability to fine-tune automation sophisticated strategies. Zignaly is best describes as the middle ground of the spectrum between trading manually to fully automated trading in crypto and forex.

Pros & Cons Zignaly

Pros:

- Provides copy trading and integrates with signal providers.

- Automates trading in the cloud, allowing 24/7 operations.

- Fees for signal provision and trading are affordable.

Cons:

- Signals from other providers might be unreliable.

- There’s not much room for advanced traders to customize.

- For newcomers, the platform can be a bit difficult to navigate.

7. TradeSanta

TradeSanta is widely regarded as an Automated Bots That Simplify Crypto and Forex Trading service. Providing cloud-based bots for DCA and grid strategies are just the start—there are also great educational resources. Supporting multiple exchanges, TradeSanta offers an integrated system of performance monitoring, risk management, and alerts.

There is no time difference or sleep opportunity as their bots work on grid systems marking every volatile market. Opportunities are never missed and, more importantly, routine tasks are automated, thus, emotional decision-making is reduced to a minimum.—

Pros & Cons TradeSanta

Pros:

- Provides cloud-based bots for DCA and grid strategies.

- Designed for easy use with a beginner-friendly interface.

- Supplies notifications, performance monitoring, risk control, and performance metrics.

Cons:

- Professionals cannot access many advanced bot types.

- Some users may feel restricted in their lower-tier plans.

- Market performance may not be reliable.

8. HaasOnline

HaasOnline is a premium platform known for Automated Bots That Simplify Crypto and Forex Trading, offering advanced scripting capabilities and multiple bot types. Leveraging the platform’s sophisticated toolsets, traders build automated and customizable strategies using the highly advanced HaasScript tool.

This offers traders fine control over active and passive execution, differentials, and the appropriation of capital for different trading positions. Each trader’s unique style is guaranteed to be catered for as HaasOnline serves many trading platforms and offers back testing and strategic optimization using historical data.

Unlike other trading platforms, HaasOnline offers advanced automated trading to reduce trading errors, provide constant uninterrupted trading, and allow highly advanced trading strategies that are complex to trade in without automation. The platform is optimally suited for advanced traders who analytics and custom bot features.

Pros & Cons HaasOnline

Pros:

- You can create deeply customized strategies with HaasScript.

- Offers many different bot types and supports multiple exchanges.

- Advanced backtesting and historical studies for optimizing strategies

Cons:

- For beginners, this has the steepest learning curve.

- More expensive than less sophisticated bots.

- Needs some technical expertise for full utilization.

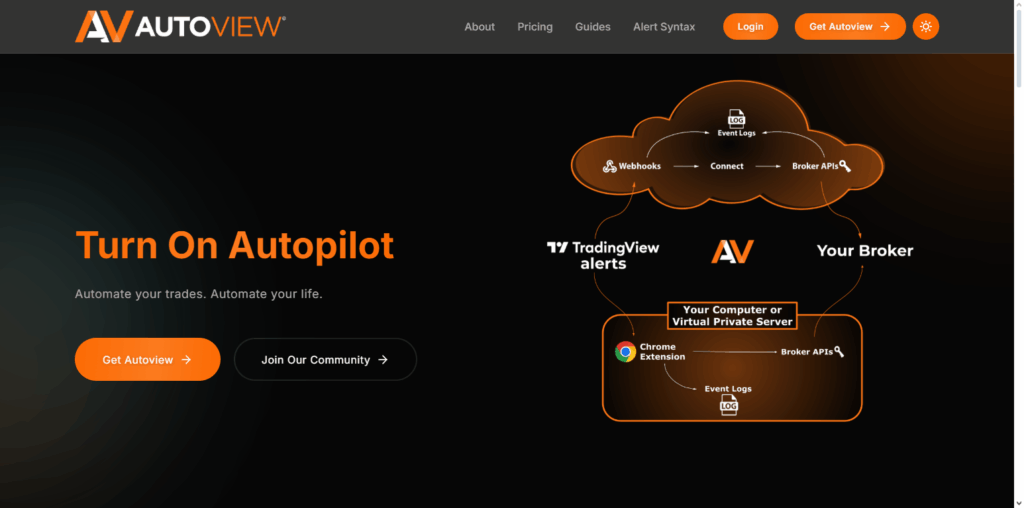

9. Autoview

Autoview is an innovative solution providing Automated Bots That Simplify Crypto and Forex Trading. Automation for strategy execution on the browser is made possible. Autoview works with Integrates with TradingView to allow users to execute scripts effortlessly as TradingView alerts and signals.

Autoview ensures that trades are made in accordance with the strategy with little to no manual intervention during trade execution. It’s versatile with multiple exchanges and custom scripting capabilities. Autoview is best for traders who use technical analysis and need consistent automated execution.

Autoview strengthens an automated execution system for trading signals, thereby minimizing human error and making it easier for traders to take advantage of changing market conditions. Autoview is best for technical analysts who use Autoview for consistent automated execution.

Pros & Cons Autoview

Pros:

- Automation in the browser and TradingView integration.

- Automatically executes scripts for alerts and signals.

- Diverse trading across multiple exchanges and automated trading.

Cons:

- TradingView scripts is a prerequisite.

- For non-tech traders, it’s less user-friendly.

- Compared to dedicated bots, built-in strategic tools are more limited.

10. Gunbot

Gunbot offers automated bots that simplify crypto and forex trading and is known for its highly customizable and automated trading strategies. It offers a variety of preconfigured strategies for grid, DCA, and trend following trading and allows users to customize strategies to their preferences while the automated system takes care of trade executions. It is compatible with different exchanges, which adds to its versatility.

By automating the repetitive tasks associated with trading, Gunbot takes care of emotional trading and ensures consistency for market participation. Having the option to backtest strategies and analyze various reports helps traders and ranges from beginners to advanced, to optimize their strategies and avoid unnecessary losses.

Pros & Cons Gunbot

Pros:

- Extremely flexible and configurable for grid, DCA, and trend-following strategies.

- Multiple exchanges and lots of pre-configured strategies.

- Tools for backtesting and reporting to fine-tune strategies.

Cons:

- For beginners, this one has a steep learning curve.

- Costly paid updates and expensive licenses are mandatory.

- Losses can happen rapidly without close monitoring.

Conclusion

To sum up, automated bots have greatly simplified the way traders engage with the crypto and forex markets. Thanks to bots available on 3Commas, PickMyTrade, Kryll.io, Pionex, Shrimpy, Zignaly, TradeSanta, HaasOnline, Autoview, and Gunbot, traders can enact their specific strategies and profit 24/7 with little to no emotional distortion.

With features like automated bots, strategy backtesting, signal integration, strategy automation, and advanced tools for portfolio management, trading becomes less daunting for novices while providing seasoned traders powerful resources. In the end, automation helps traders save valuable time, manage risk, and handle high volatility with utmost assurance and accuracy.

FAQ

How do these bots simplify crypto and forex trading?

These bots automate tasks such as executing trades, portfolio rebalancing, following signals, and backtesting strategies. This allows traders to focus on planning and analysis while the bots handle repetitive actions 24/7.

What are automated trading bots?

Automated trading bots are software programs designed to execute trades automatically on crypto and forex markets based on pre-defined strategies, signals, or algorithms. They help reduce manual effort, save time, and minimize emotional decision-making.

Are automated trading bots safe to use?

Most bots are safe if used on trusted platforms and properly configured. However, users must monitor market risks, avoid over-leveraging, and use risk management tools to prevent potential losses.

Do I need coding skills to use these bots?

Not always. Platforms like 3Commas, Pionex, and TradeSanta offer user-friendly interfaces with pre-built strategies. Advanced bots like HaasOnline or Autoview may require scripting knowledge for full customization.

Can beginners use automated trading bots?

Yes, beginners can start with simple bots and pre-configured strategies. Gradually, they can explore advanced settings and learn to optimize automated trading for better results.