In this Article, I will discuss the Best Altcoins With Governance Rewards These crypto assets are different because apart from the value in their tokens, they allow holders to partake in major decision making within their ecosystems, earning valuable rewards in the process.

Such dual-purpose altcoins are appealing to both market investors and active community members.

Key Point & Best Altcoins With Governance Rewards List

| Project | Key Point |

|---|---|

| Uniswap (UNI) | Leading decentralized exchange using automated market maker (AMM) model. |

| Aave (AAVE) | Popular DeFi lending platform with flash loan functionality. |

| Curve DAO (CRV) | Specializes in efficient stablecoin and low-slippage token swaps. |

| Maker (MKR) | Governance token behind DAI, a decentralized stablecoin. |

| PancakeSwap (CAKE) | Top DEX on Binance Smart Chain with low fees and yield farming. |

| Ethereum Name Service (ENS) | Provides human-readable .eth domain names for Ethereum wallets. |

| Compound (COMP) | Algorithmic interest rate protocol for lending and borrowing crypto. |

| Synthetix (SNX) | Enables creation and trading of synthetic assets on Ethereum. |

| yearn.finance (YFI) | Optimizes yield farming strategies via automated vaults. |

| UMA (UMA) | Protocol for creating synthetic assets with decentralized oracles. |

1.Uniswap (UNI)

Uniswap (UNI) emerges as one of the top governance reward altcoins, as it allows its users to actively participate in the determination of the platform’s future.

What sets UNI apart is its governance model based on DeFi; holders are able to propose and vote on upgrades, changes in fees, and even the treasury spending.

Unlike many other projects, Uniswap always balances user incentive with protocol growth. This approach, combined with one of the leading DEX platforms, gives UNI a true stake and value in the DeFi ecosystem for years to come.

Uniswap (UNI) Features

- Decentralized Governance – The community Excersizes leadership by voting over upgrades, fee rearrangement, and treasury distribution.

- Adoption Usage – Enables one of the DEXs bearing high usage on Ethereum.

- Liquidity Incentives – Lease dividends are aligned with governance activities and growth through ecosystem liquidity.

2.Aave (AAVE)

AAVE is one of the best governance reward altcoins owing to its active protocol for borrowing and lending. Holders of the AAVE token can participate in votes on critical matters such as model of interest calculation and listing of new assets, giving them an active role in the advancement of the protocol.

Its distinguishing trait is the Safety Module where stakers earn rewards by insuring the system. This dual model of governance and risk-aligned incentives makes Aave’s governance profoundly impactful and exceptionally rewarding.

Aave (AAVE) Features

- Risk Parameter Voting – AAVE Allows Voting Over The Slicing By Asset Class With Set Debt.

- Safety Module Staking – Collect liquidity tokens while aiding protocol security.

- Ample Loan Accessibility Features – Utility is enhanced with flash loans and credit delegation.

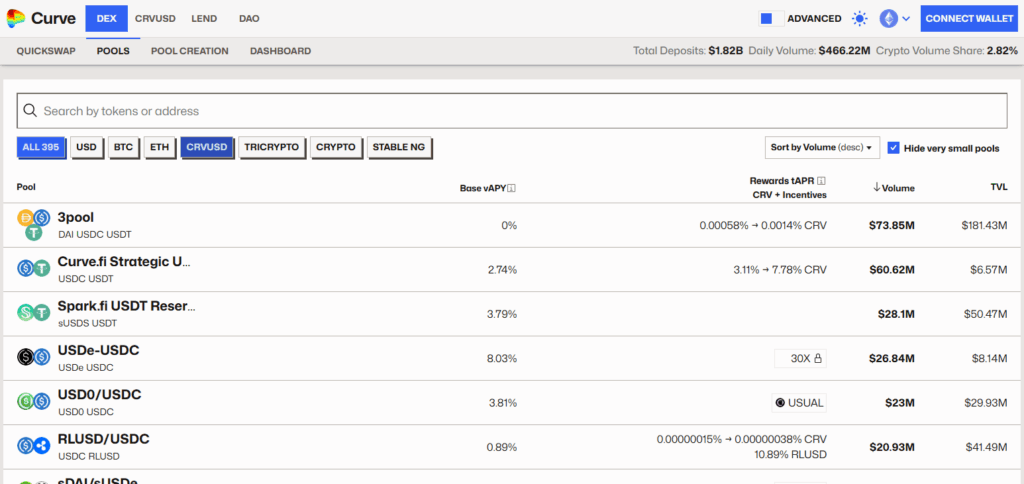

3.Curve DAO (CRV)

Curve DAO (CRV) is a notable altcoin with governance incentives particularly due to its vote-locking governance rewarding system which enhances user commitment. CRV owners have the ability to lock their tokens and in return, they receive veCRV which provides them with voting power and boosted rewards.

This system guarantees that users and the protocol will perform in unison over a longer period. Governance users take part in the voting of critical parameters such as pool rewards and fee levels, every decision is a crucial one. Curve’s system is distinguished for rewarding loyal active users, setting it apart as a governance-centric DeFi platform with real value.

Curve DAO (CRV) Features

- Vote-Escrow Model – Incrwase power and rewards through voting by locking CRV for veCRV

- Focus On Stablecoins – Target optimized swaps involving stablecoins with low price fluctuations.

- Higher Yield – Increased powercastetalkrj via governance participation in reishing by able to boosted share in liquidity rewards.

4.Maker (MKR)

MKR competes amongst the top altcoins with governance rewards because of its vital function in sustaining DAI, a decentralized stablecoin. Holders of MKR govern the Maker Protocol by voting on the risk parameters, collateral types, and possible upgrades.

Unique to this case, the governance choices taken are important for the well-being of the DAI ecosystem. The combination of the immediacy of impact and the need to maintain stability is what grants MKR holders a powerful and lucrative position in DeFi’s cornerstone infrastructure.

Maker (MKR) Features

- DAI’s Stability Control – Trust MKR holders for controlled managing of DAI’S unique stability parameters.

- Choice Of Collateral – Decides unlockable assets that are used for DAI.

- Influence Directly On Protocol – Decisions enable free movement to underline authority able for marking the shifts in DAI’S system.

5.PancakeSwap (CAKE)

PancakeSwap (CAKE) is one of the top rewarding governance altcoins as it provides both the spending of decision power and yield opportunities to users.

Participants with CAKE tokens can vote on the modification of platform functionalities, farm emission changes, and new product addition adaptations.

Its most notable feature is the merge of governance with gamified DeFi—users participate in the shaping of the protocol and at the same time enjoy lotteries, rewards, NFTs, and prediction wagering markets.

The combination of governance CAKE utility and interactive earning renders CAKE uniquely captivating in the DeFi ecosystem.

PancakeSwap (CAKE) Features

- Ability To Propose Changes With Voting – Changes comes with heavily proposed amendments like token spray or emissions burning, making collaboration quick and effective.

- Gamified Governance — Covers Lottery and prediction markets NFTs.

- Low Fees Budget DeFi user? You will appreciate low fees on BNB Chain.

6.Ethereum Name Service (ENS)

Ethereum Name Service (ENS) is impressive for its governance rewards altcoin features because it allows holders of domains to have a say directly in the future development of decentralized identity.

ENS token holders govern the protocol deciding on fee collection, integration, and treasury policies. Its distinctive worth is making Web3 more user-friendly by mapping easily intelligible names to blockchain addresses.

Participants in governance do not merely participate in voting; they shape an actively managed system for decentralized naming infrastructure which improves its long-term value.

Ethereum Name Service (ENS) Features

- Decentralized Naming** — Transforms complex addresses into human-friendly .eth domains.

- Governance of Fee Models** — ENS holders participate in governance through voting on the renewal fees and fund allocation.

- Web3 Identity Control** — Control the evolution of identity on the blockchain.

7.Compound (COMP)

Compound (COMP) is high in the ranks of altcoins with governance perks, enabling users to shape the economic structure of the protocol. Holders of COMP vote on the models of interest rate and also on the collateral that is supported alongside significant updates, thus managing partially a lending system that is decentralized.

Its auxiliary distinguishing characteristic is the open, automated proposal mechanism where all holders and even smaller ones can delegate their votes and ensure participation. Governance through direct influence to the protocol makes it possible to vote with stake and thus makes COMP an example of decentralized governance and incentivized decision making in DeFi systems.

Compound (COMP) Features

- Open Governance – All stakeholders can suggest updates if sufficient delegated voting power is obtained.

- Transparent On-Chain Voting — Every decision has a public record stored on Ethereum.

- Control of Protocol Parameters — Modify protocols, such as interest rates and market listings.

8.Synthetix (SNX)

Synthetix (SNX) is a notable governance altcoin that allows users to control an ever-changing protocol that facilitates synthetic asset trading. Users can stake SNX tokens to earn rewards and participate in the governance structures that provide control over trading fees, collateral ratios, and the introduction of new assets.

What makes Synthetix unique is its decentralized council system: selected members of the community govern proposals, thus providing a strong, versatile governance framework. This approach mixes representation and incentives to make decisions, deepening user participation and the development of the protocol.

Synthetix (SNX) Features

- Creation of Synthetic Assets — Govern and stake on created tokenized assets.

- Elected Councils — Delegate the power to make decisions to variable members of the DAO.

- Staking Rewards — Rewards go to SNX holders along with the power to influence governance.

9.yearn.finance (YFI)

“Yearn.finance” is one of the most prominent reward offering altcoins regarded for its deep decentralization and community participation.

YFI holders control protocol upgrade voting, vault strategy voting, fee voting, which enables every decision taken to be in the best interest of users.

Its distinguishing characteristic is that there was no pre-mining or founder allocation thus giving early participants unconditional governance power.

YFI governance is automated with yield optimizing scheduling which in turn makes democracy effective because governance impacts user profits directly.

yearn.finance (YFI) Features

- Pure Community Token — Users received the entire supply since there was no pre-mining.

- Vault Strategy Governance — Forge different pathways to yield optimization.

- Distribution of Protocol Fees — Allocate recovery costs among products.

10.UMA (UMA)

UMA (UMA) is a leading altcoin that provides governance rewards since it allows the creation of synthetic assets via automated purchasing agreements. UMA tokens allow users to make decisions about a protocol’s governance, which are automatically implemented such as modifying fees and setting up oracles determining active stakeholder’s value for active risk control.

Special feature of performance of UMA is its especially efficient oracle which lowers the number of disagreements submitted on chain and improves the execution rate of transactions. This primordial pseudonymity gives power to crypto holders to establish governance over policies and create new paradigms in finance in the unobstructed markets.

UMA (UMA) Features

- Optimistic Oracle System — Needs governance supervision to manage dispute resolution.

- Customizable Contracts — Governs how the structures of synthetic assets are defined.

- Economic Guarantees – Ensures correct behavior using incentives.

Conclusion

In conclusion, the most comprehensive altcoins with governance rewards do not provide holders merely monetary motivation; they give them meaningful power over protocol development and decisions.

Token holders actively participate in governance which promotes the foreseeability of incentives in the growth and sustainability of the ecosystem.

Uniswap, Aave, Curve DAO, and several others uniquely integrate innovative governance alongside active community participation, turning these altcoins into not just assets, but mechanisms of decentralized change.