In this post, I will talk about the Best Balance Transfer Cards that offer low fees or no charges in order to save you more money when paying down debt.

These cards also offer additional benefits such as rewards programs, credit-building features, and 0% APR introductory windows. Managing your finances becomes simpler and more affordable when you choose the correct card.

Key Point & Best Balance Transfer Cards

| Credit Card | Key Point |

|---|---|

| Citi Diamond Preferred® Card | Longest 0% intro APR on balance transfers – up to 21 months. |

| Wells Fargo Reflect® Card | Up to 21 months of 0% APR with on-time payments. |

| Citi Double Cash® Card | Earn 2% cash back while enjoying 18 months of 0% balance transfer APR. |

| Citi Simplicity® Card | No late fees or penalty APR – ever. |

| U.S. Bank Visa® Platinum Card | 0% APR for 20 billing cycles on balance transfers and purchases. |

| Chase Freedom Unlimited® | 1.5% unlimited cash back plus 15 months of 0% APR. |

| Discover it® Balance Transfer | 5% cash back on rotating categories + 18 months of 0% balance transfer APR. |

| BankAmericard® Credit Card | Low ongoing APR after intro period. |

| Chase Slate Edge℠ | $0 balance transfer fee if made within the first 60 days. |

| Navy Federal Credit Union Platinum Credit Card | 0% balance transfer fee and low ongoing APR. |

1. Citi Diamond Preferred Card

Citi® Diamond Preferred® Card is the best option for balance transfers since it offers 0% intro APR for 21 months on purchases completed within 4 months, 12 months on purchases, and 17.24%–27.99% variable APR after that.

Additionally, it comes with a 5% fee for balance transfers (minimum $5). Although the fee is standard, the extensive intro period offers a good chance to clear significant balances. Since there’s no annual fee, cardholders benefit from cost efficiency.

They also gain access to Citi Entertainment for event tickets. FICO credit scores above 670 suilt those in roffer the card, but for borrowers looking for a long repayment window without penalties, this is ideal.

The card does not offer penalties, making it suitable for long-term repayment. However, it is less suited for lasting use post-debt repayment due to lack of rewards.

Citi® Diamond Preferred Card

- Intro APR: 0% for 21 months on balance transfers

- Regular APR: Variable 18.24% – 28.99%

- Balance transfer fee: 3% (minimum \$5)

- Annual Fee: \$0

- Best for: Longest 0% balance transfer period

2. Wells Fargo Reflect Card

Wells Fargo Reflect® Card offers 0% intro APR for 21 months on balance transfers and purchases (transfers made in the first 120 days, enhances Wells Fargo Bank’s standing). After that there’s a variable APR of 17.24% – 28.99%.

It has one of the longest introductory periods available, giving unrivaled opportunities for debt relief, but also has a 5% balance transfer fee (min $5).

It has no annual fee and has additional features like cell phone protection ($600 worth with a $25 deductible) and My Wells Fargo Deals for cash back offers.

Best for those mastering credit scores (FICO 720+), it’s tailor-made for borrowers who’d like to minimize interest for using time for paying off balances, though lack incentives for ongoing use.

Wells Fargo Reflect® Card

- Intro APR: 0% for up to 21 months on purchases and qualifying balance transfers

- Regular APR: Variable 17.24% – 28.99%

- Balance Transfer Fee: 3% (minimum \$5)

- Annual Fee: \$0

- Best for: Extended intro APR period on both purchases and balance transfers

3. Citi Double Cash Card

Offering a blend of rewards and benefits, the Citi Double Cash® Card comes with a 0% intro APR for 18 months (within 4 months) on balance transfers, then variable 18.24%–28.24% APR afterwards.

Its balance transfer fee is 3% of the amount (with a minimum of $5) for the first 4 months, then 5% thereafter. This card has no annual fee, making it economical alongside its 2% cash back program (1% on purchases and 1% when paid), making it beneficial in the long term.

It is also attainable to those with fair credit (FICO 580 and above), ideal for borrowers looking to pay off debt while earning rewards.

The card also allows access to free FICO scores, enhancing its appeal as a financial management and credit building tool.

Citi Double Cash® Card

- Intro APR: 0% for 18 months on balance transfers.

- Regular APR: Variable 19.24% – 29.24%.

- Balance Transfer Fee: 3% (minimum \$5)

- Annual Fee: \$0

- Rewards: 2% cash back (1% when you buy, 1% when you pay)

4. Citi Simplicity Card

The Citi Simplicity® Card best suits individuals looking for the ability to control their finances; it provides 0% intro APR for 21 months on balance transfers (within 4 months) and 12 months on purchases, then a variable APR between 18.24%–28.99%.

Balance transfers also have a competitive transfer fee of 3% (minimum $5) for the first 4 months (then increasing to 5%). This card comes with no annual fee and no late fees, making it easier on the budget if payments are missed.

It is optimized for good credit card holders (FICO score of 670 and above) since it offers free FICO score access and Citi’s Identity Theft Solutions.

While this card may impose restrictions in terms of rewards for long-term spending, it is tailored for borrowers who need extended intro periods and flexible payment schedules.

Fourth, Citi Simplicity® Card

- Best For: Chargebacks on purchases with a long intro period.

- Intro APR: 0% for 21 months on balance transfers.

- Regular APR: Variable 19.24% – 29.99%.

- Balance transfer Fee: 3% (minimum \$5).

- Annual Fee: \$0.

- Best For: No late fees or penalty APR

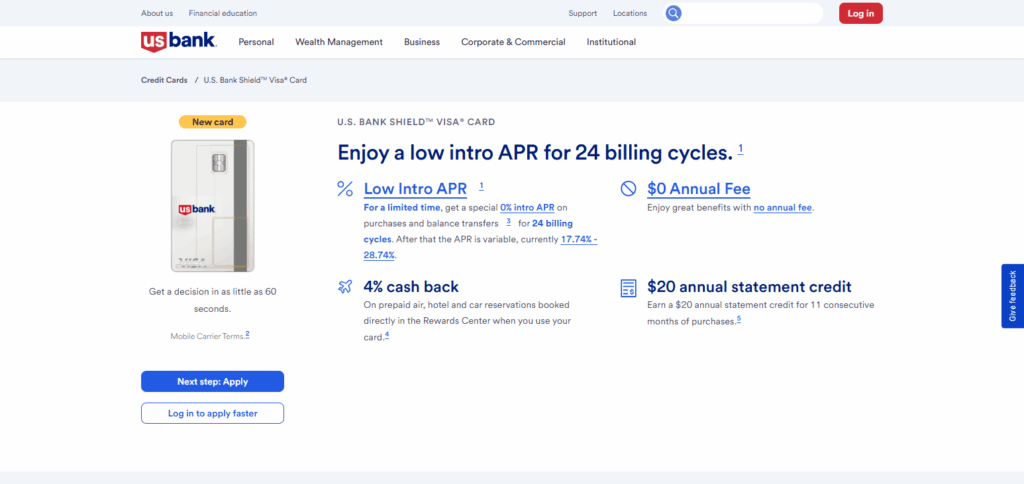

5. U.S. Bank Visa Platinum Card

The U.S. Bank Visa® Platinum Card comes with a $0 yearly fee and a 0% intro APR for balance transfers and purchases (transfers must be made within 60 days) for the first 18 months. After this period, a variable APR of 18.24%–28.24% applies.

Furthermore, the card’s $5 (3% of balance transfer) fee is more forgiving than many others within its market, also making the card more cost-effective.

With U.S. Bank’s roadside dispatch service and other notable features, the card provides additional value on top of being budget-friendly.

It has basic rewards, albeit lacking significant perks, making it ideal for borrowers looking to pay off debt. In other words, while this card is best suited for moderate FICO users (670+).

it is also optimal for users with moderate card balances lacking the desire for a more complex payment structure. The simple repayment structure paired with a long intro period grant the user hassle-free payment.

Fifth, U.S. Bank Visa® Platinum Card

- Best For: Long intro APR period but have no annual charges ([usrisingnews.com][3], [AP News][1], [Free Job Alert][6]).

- Intro APR: 0% for 20 billing cycles on balance transfers.

- Regular APR: Variable 18.74% – 29.74%.

- Balance transfer Fee: 3% (minimum \$5).

- Annual Fee: \$0.

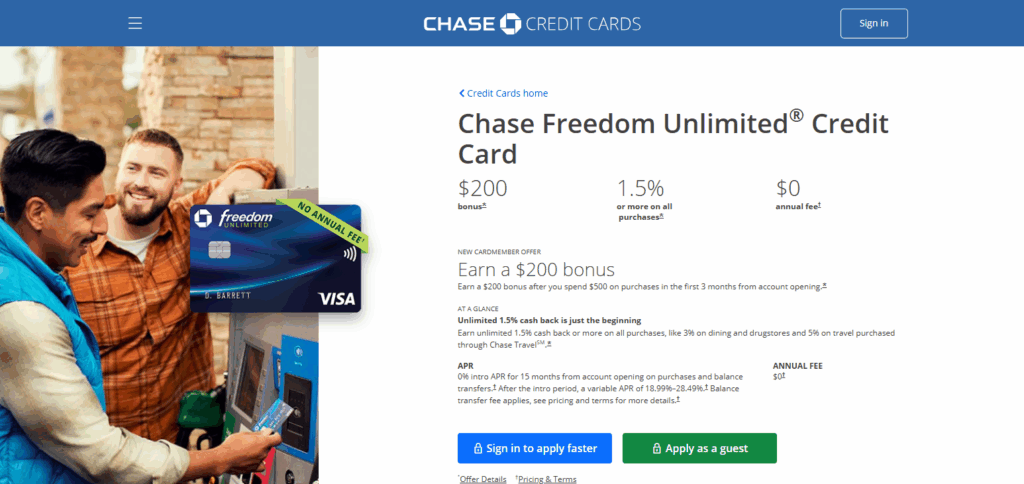

6. Chase Freedom Unlimited

The Chase Freedom Unlimited ° offers an introductory 0% APR on balance transfers and purchases (transfers within 60 days) for 15 months, with a subsequent variable APR of 20.49-29.24%.

Its 3% ($5 minimum) balance transfer fee for the first 60 days (then 5%) is quite reasonable. No annual fee is charged, and it earns 5% cash back on Travel booked through Chase, 3% on dining and drugstores, and 1.5% on all other purchases, in addition to a $200 bonus after spending $1,000 in 90 days.

Suited for good credit holders (FICO 670+), it is best for those managing repayment of debt while trying to earn rewards, though lesser balances would be preferrable because of the shorter intro period.

Chase Freedom Unlimited

- Best For: Earning cash back flat-rate while using the card with a great intro APR ([Fox Business][4], [Business Insider][7], [usrisingnews.com][3]).

- Intro APR: 0% for 15 months on purchases and balance transfers.

- Regular APR: Variable 19.99% – 28.74%.

- Balance Transfer Fee: 3% (minimum \$5).

- Annual Fee: \$0.

- Rewards: 1.5% cash back on all purchases.

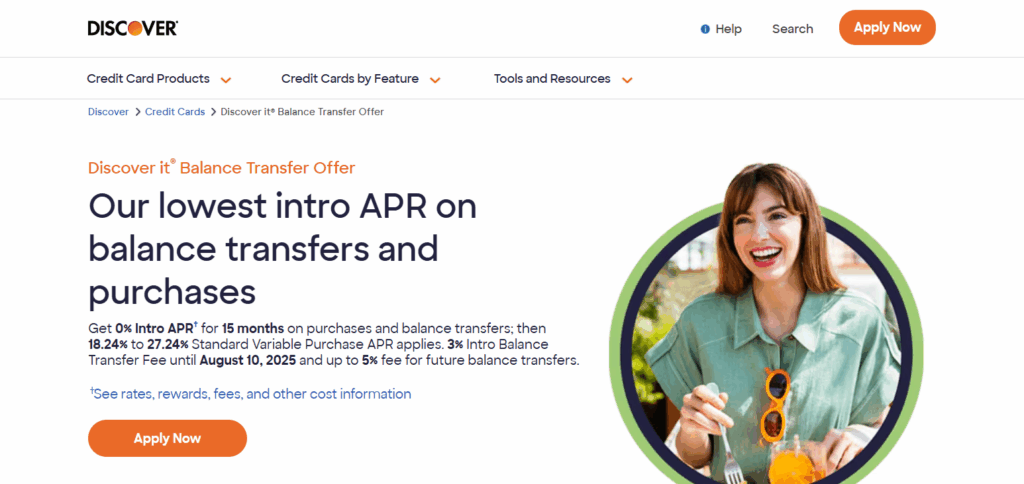

7. Discover it Balance Transfer

The Discover it® Balance Transfer card offers 0% intro APR for 18 months on balance transfers and 15 months on purchases leading to an 18.24%–27.24% variable APR. It’s 3% intro balance transfer fee (up to 5% later) is competitive and there is no annual fee.

It earns 5% cash back on certain categories (quarters) up to 1,500 dollars for activaton and 1% on other purchases, along with Discover’s Unlimited Cashback Match for new cardholders.

FICO holders (670+) and good credit holders will find it ideal; for those paying off debt while earning rewards, it’s helpful. Added convenience comes from fast balance transfer processing, taking as little as 4 days.

Discover it® Balance Transfer

- Regular APR: Variable 17.24% – 28.24%.

- Balance Transfer Fee: 3% (5% after the promotional period)

- Annual Fee: $0

- Rewards: 5% cash back in rotating categories (up to $1,500 per quarter), 1% on other purchases

- Best For: Cash back rewards with a long intro APR

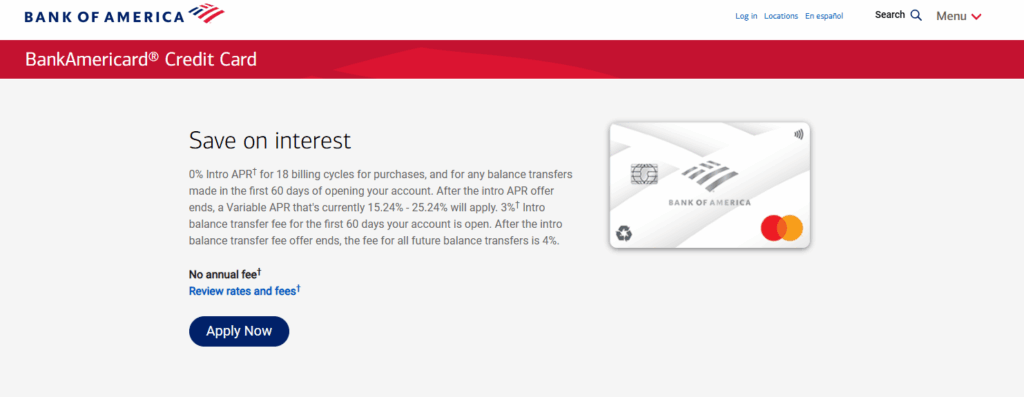

8. BankAmericard Credit Card

The BankAmericard® Credit Card is one of the best options for balance transfers considering that there is a 0% intro APR for the first 18 billing cycles on balance transfers and purchases (the transfers should happen within 60 days), afterwards there is a 15.24%–25.24% variable APR.

It also offers one of the lowest fees ($0 for the first 60 days then 4% afterwards) on balance transfer fee of 3% (minimum $0) for the first 60 days (then 4%). Since it lacks an annual fee, it remains cost-effective.

It’s also helpful that most of the time having an APR is disadvantageous, but in this case it may help those who are not able to pay off their debt during the introductory phase.

This card is best for those with good credit (FICO 670+) but is still great for borrowers who value low fees as well as those who want a simple card that helps them pay off their debt without rewards or added perks.

BankAmericard® Credit Card

- Intro APR: 0% for 15 billing cycles on balance transfers

- Regular APR: Variable 13.99% – 23.99%

- Balance Transfer Fee: 3% (minimum $10)

- Annual Fee: $0

- Best For: BankAmericard credit card holders who want a low regular APR after the intro period

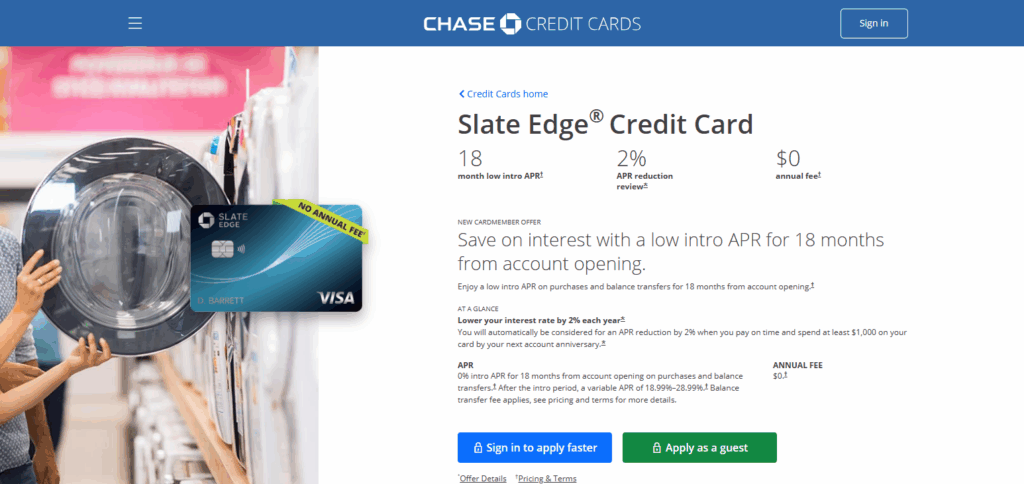

9. Chase Slate Edge℠

With the Chase Slate Edge℠ card, you receive a promotional period of no interest for 18 months on balance transfers and purchases (transfers within 60 days), thereafter carrying a variable APR of 20.49%—29.24%.

The card’s balance transfer fee of 3% for the first 60 days and then 5% afterward is competitively priced ($5 minimum).

There is no annual fee but other notable features including an automatic potential APR cut of 2% per year (if you spend $1,000 and make your payments) and other increases in spending limit for responsible use.

This card is aimed at good credit holders (FICO 670+) and is ideal for those paying off moderate balances while building credit, although, due to lack of ongoing spending perks, rewards are nonexistent.

Chase Slate Edge℠

- Intro APR: 0% for 15 months on balance transfers

- Regular APR: Variable 14.99% – 23.74%

- Balance Transfer Fee: $0 during the first 60 days

- Annual Fee: $0

- Best For: Recipients who want no balance transfer fee within the first 60 days

10. Navy Federal Credit Union Platinum Credit Card

The Platinum Credit Card from Navy Federal Credit Union comes with 0% intro APR for 12 months on balance transfers (within 60 days). After that, a variable APR of 9.65%–18.00% applies, which is one of the lowest regular APRs available.

Its balance transfer fee of 2%–3% and no annual fee are also very attractive. For members of Navy Federal, which include military personnel, veterans, and some family members, it is available with good credit (FICO 670+) only.

The card includes cell phone protection and no foreign transaction fees, making it best for borrowers with lower balances seeking low ongoing costs. Although less ideal for large debts due to a shorter intro period, the card’s low APR benefits long-term value.

Navy Federal Credit Union Platinum Credit Card

- Intro APR: 0.99% for 12 months on balance transfers

- Regular APR: Variable 10.99% – 18.00%

- Balance Transfer Fee: $0

- Annual Fee: $0

- Best For: Recipients who want no balance transfer fee and low ongoing APR

Conclusion

The right balance transfer credit card differs for each person based on their financial goals such as maximizing interest-free periods, avoiding fees, or earning rewards while paying off debts.

For instance, Wells Fargo Reflect® and Citi Diamond Preferred® offer longer repayment periods whereas debt relief assisting with Citi Double Cash® and Discover it® Balance Transfer offer cashback rewards.

Each card caters to a different need which if targeted could result in significant savings on interest and better management of finances. Remember to assess repayment timelines, credit scores, and other pertinent fees prior to account opening.