Today, I will share with you the best Bitcoin or crypto lending and borrowing sites that focus on Bitcoin and other cryptocurrencies. Among these are BlockFi, which is famous for its rates in competition, as well as Celsius Network, offering high yields without requiring a minimum balance.

Other platforms, such as Nexo, provide instant loans where your crypto assets act as collateral, while Aave is decentralized and has several innovative options.

Lastly, Compound Finance has an open-source algorithmic interest rate protocol that is traceable and efficient. All of them serve different purposes in order to ensure that every individual finds the one that suits their needs best.

How to Choose a Crypto Lending Platform?

What are the main factors that you should consider when choosing the best crypto lending platforms?

Regulation and security: Ensure that your coins are insured with well-known providers such as Ledger and kept in cold storage. In order to avoid problems associated with the platform, it must be regulated appropriately by authorized regulatory bodies across its operating countries.

Coin vs Platform: For each particular coin, you have to ensure you’re using the right site. The fact that one platform has better rates doesn’t mean anything, whereas another one could have a much higher APY for depositing different coins.

Interest rates: Generally, most borrowing platforms will show you the exact annual percentage yield (APY) or interest rates for various coins or lending products. However, there is always a catch, like an increased APY, if you’re an affiliate member or if no other number goes beyond this unless you hold your money for an extended period.

Deposit limits and fees: Minimum deposit amounts on cryptocurrency lending platforms vary with some coins, while others don’t have any. A similar is true with regard to fees, but remember that we mainly focused on sites where they do not charge they do not charge deposits and commissions for lending.

Lock-in period: Some loan facilities do not need customers to lock their assets, while others may give them the liberty of selecting how long they will stay locked in, thus increasing charges for those who lock term increases.

Key Point & List

| Platform | Key Point |

|---|---|

| Arch | US-based crypto lending platform offering competitive rates for borrowing. |

| Nexo | Well-established crypto lending platform with competitive rates that currently go as high as 16%. |

| Aqru | Offers daily interest with high-security features and multi-layered deposit insurance, rates up to 10%. |

| Binance | Offers a flexible and competitive crypto lending platform with high APY for stakers. |

| CoinRabbit | Simple lending and borrowing platform requiring only a phone number to start. |

| Aave | An all-in-one crypto platform for storing, staking, insuring, borrowing, and lending various cryptos. |

| Nebeus | The best platform for DeFi lending with its token and coverage of more than ten other cryptocurrencies. |

| YouHodler | A crypto lending website offering flexibility to investors regarding the terms of their investments. |

| Compound | It is the top DeFi lending platform with its own token, supporting over ten cryptocurrencies. |

| Crypto.com | It is the top DeFi lending platform with its token, supporting over ten cryptocurrencies. |

10 Best Bitcoin or Crypto Lending and Borrowing Sites

1. Arch

Arch, being a United States-based crypto lending platform, is well known for its competitive interest rates, which have made it possible for borrowers to obtain loans without selling their assets.

They are making it ideal for people who need liquidity but still want to maintain their investment positions. Arch is reliable and efficient as far as crypto-finance fans want their financial strategies maximized safely.

2. Nexo

Nexo is a well-known crypto-lending platform that currently has some of the most competitive interest rates, up to 16%.

Its users are given a delightful experience through which they can get instant crypto credit lines and then repay them flexibly while enjoying the highest level of security.

Nexo offers a wide range of financial offerings like earning interest on idle assets as well as fiat loans backed by cryptocurrency and thus appeals even to beginners apart from seasoned cryptocurrency traders.

3. Aqru

Aqru stands out in the world of crypto lending with daily interests plus sturdy security features inherent in multi-layered deposit insurance. Aqru offers secure wallets with an annual percentage yield (APY) of up to 10%, thus giving individuals an opportunity to earn on their cryptocurrencies.

This attention to safety backed with an easy-to-use interface makes this platform great for those who want secure ways to maximize returns on their digital money holdings.

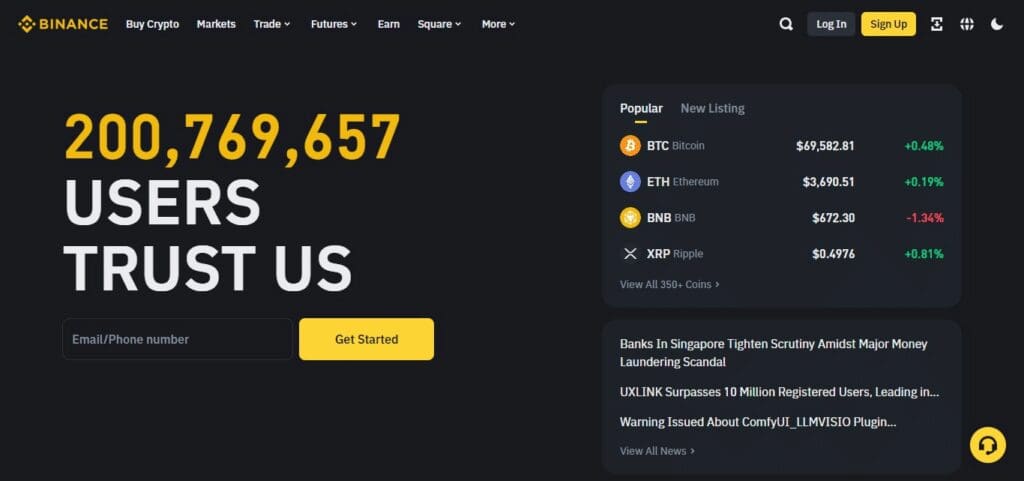

4. Binance

Binance is one of the most flexible and cost-effective crypto lending platforms for stakeholders in terms of annual percentage yields (APYs). Being among the most significant exchanges globally known for its trustworthiness,

Binance has numerous choices when it comes to borrowing or lending at favorable interest rates. Its platform supports numerous types of currencies, hence making more profits from these kinds of transactions.

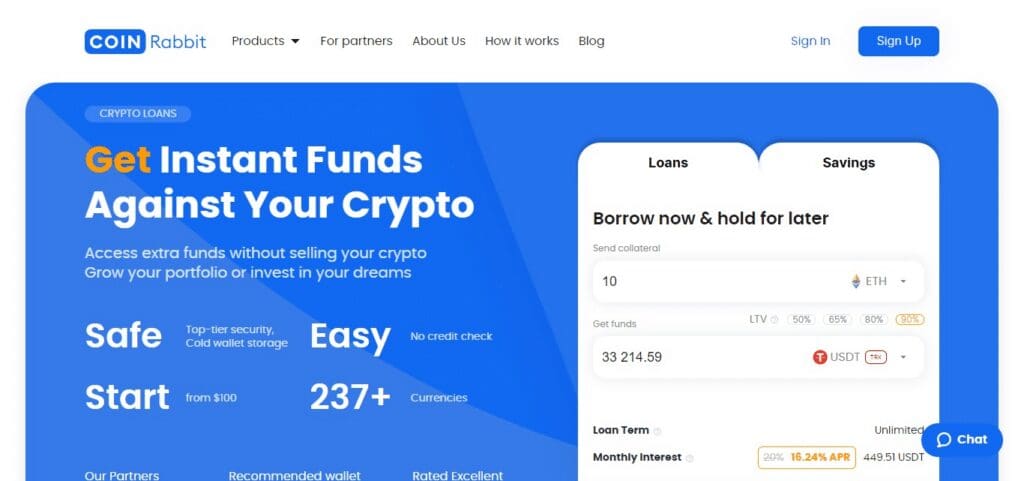

5. CoinRabbit

CoinRabbit, a lending and borrowing platform, is so simple that even a phone number is all you need to start. CoinRabbit can be used by virtually anyone, from the least experienced beginners to the most seasoned traders in the market, due to its ease of use.

Fast and safe transactions are possible via this exchange because it has made it possible for people to borrow coins they own as well. For instance, CoinRabbit aims to provide easy lending and borrowing services for cryptocurrencies without any hassles.

6. Aave

An innovative decentralized finance (DeFi) lending protocol with a variety of supported coins and unique features, Aave is best described as a leading one. Interest fluctuation ranging from 0% to 18% provides an opportunity to lend and borrow cryptocurrencies.

Notably, Aave is famous for its flash loans, which allow you to get a loan without any collateral just in case the borrowed money is returned within the same transaction. It is an advanced platform that allows users to access many alternatives in the DeFi space.

7. Nebeus

Storing, staking, insuring, borrowing, and lending digital coins are among some of the financial needs met by Nebeu’s all-in-one crypto platform. For those who need their crypto investments managed from under one roof—this approach by Nebeus would be the most fitting solution.

The company has ensured tight security through regular updates of its system while making it user-friendly so that even newcomers can use it without necessarily incurring expenses.

8. YouHodler

This site presents opportunities for investors to negotiate on different conditions but still be able to secure their investments using cryptocurrency tokens as collateral for their credits.

YouHodler offers credit arrangements based on diverse loan-to-value ratios as well as repayment terms suitable to individual preferences.

In other words, this makes it a more flexible space since there are also some other cryptos, like stablecoins, which are accepted here.

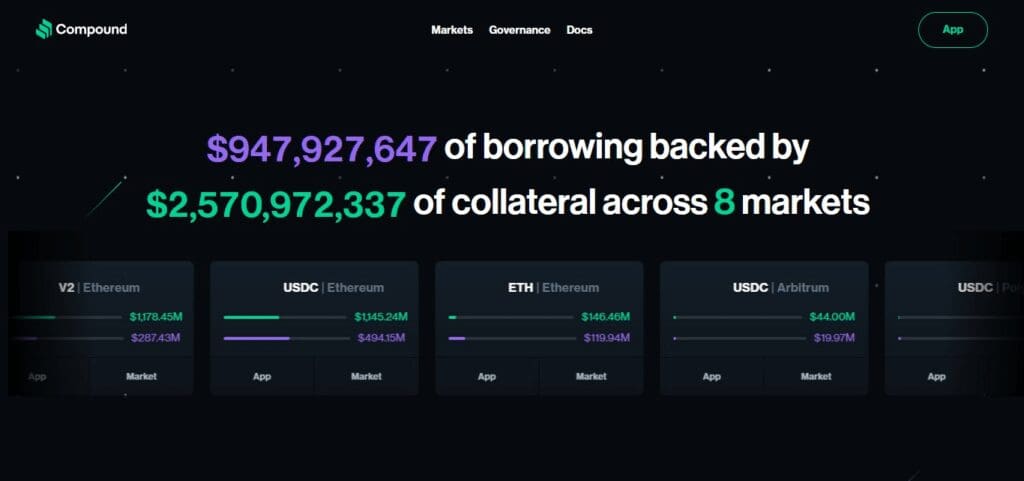

9. Compound

Among these platforms that provide DeFi lending services, Compound definitely stands out due to its algorithmic interest rate mechanism, which is driven by smart contracts only.

Users can lend/borrow a broad range of digital assets while earning interest rates determined automatically according to market forces.

Besides, the Compound has a governance token called COMP, which enables all the users to participate in the protocol decision-making. This makes it one of the leading DeFi platforms due to its transparency, efficiency, and community-driven model.

10. Crypto.com

Unlike most other sites, crypto.com is a complete platform that offers robust crypto lending and borrowing services as well as several other financial products.

The rates are very competitive, and hence, the platform has become popular among many cryptocurrency investors who prefer doing everything through their mobiles.

It supports a wide range of digital currencies and different terms for lenders & borrowers alike. Besides, its focus on customer service & security enhances trust, making crypto.com an ideal choice in this industry for most people.

What Is Crypto Lending and How Does It Work?

Crypto lending is a form of financial service where borrowers can lend out their cryptocurrency assets to borrowers in return for an interest payment or borrow some cryptocurrency by making use of their cryptocurrencies as security.

With this technique, individuals who possess digital money may earn passive income on it and freely access liquidity without the need for them to dispose of what they have invested.

Crypto Lending Works this Way:

Choice of Platform: A user selects a crypto-lending platform that suits their lending/borrowing needs, such as Nexo, BlockFi, or Aave.

Lending:

Initial Deposit: Lenders deposit their cryptocurrency into the platform’s loan pool.

Interest: This platform lends these assets to other users. The lenders receive interest, and most times, it is paid in the same cryptocurrency they have deposited.

Withdrawals: At the end of term or upon demand, as per platform specifics, lenders are allowed to withdraw the initial amount alongside interest earned.

Borrowing:

Loan Security: Borrowers provide collateral, which is usually in the form of another digital currency taking up a loan. In order to prevent default risk on the part of creditors, collateral must always be valued above the credit amount granted by the lender.

Loan Issuance: The platform may disburse this loan to a borrower in stablecoin (another type of crypto), any other digital currency, or even fiat money.

Repayment: Borrowers usually pay back both principal and interest over an agreed period. Should they fail to repay, however, a lending institution has liquidation right over pledged securities so as to recover the bad debt owed by the debtor.

Lending and borrowing Interest rates on both fixed & variable basis depends upon several things – like DeFi vs. CeFi annual percentage rates (APRs) vary from one company to another depending on numerous factors such as the underlying network being used (e.g., Ethereum), different token prices within current market indices at particular point time among many others things besides.

Defi vs. CeFi:

Centralized Finance (CeFi): BlockFi and Nexo, for instance, are centralised financial platforms whereby they carry out lending processes and demand user authentication (KYC).

Decentralized Finance (DeFi): On the other hand, Aave and Compound, among others, operate on blockchain technology without intermediaries in the provision of peer-to-peer lending services that have more transparency as well as control for participants.

Advantages of Crypto Lending

In any case, even the best crypto lending platforms can be risky. At the same time, there are various advantages associated with them. Let us take a look at them:

Easy to begin: It is much easier to lend cryptocurrencies than fiat currency. In the world of cryptos, getting loans is far less complicated than it is with banks since verification checks from banks are not necessary.

In most cases, both borrowers and lenders may connect their wallets without having to go through KYC/AML checks.

Regular payments: Daily interest rate payments are available to crypto lenders. This is higher in frequency compared to other means of lending, whereby some pay on a weekly or monthly basis.

Double-digit interest rates: For several lending solutions in the cryptocurrency market, APY can exceed 10%. Nevertheless, there is a vast choice as rates vary across sites and coins, too.

Changing crypto into another one is fast and straightforward, so you can always find an improved platform or buy a coin paying higher dividends if you lack such an asset.

Different lock-up periods: Generally speaking, savings accounts in fiat currency have set long-term periods where money cannot be accessed for up to twelve months sometimes.

As far as flexibility goes, cryptocurrency lending surpasses this limit even when specific platforms do not have lock-up periods, or they may last only about one month.

Conclusion

Therefore, the best Bitcoin and cryptocurrency lending and borrowing sites have distinct characteristics and benefits that are designed in a way that serves the needs of different types of crypto investors and borrowers.

For instance, BlockFi and Celsius Network offer easy-to-use interfaces with competitive interest rates, which makes them a good choice for users who want to receive reliable services on time.

Nexo and Aqru, known for their high returns and robust security measures, make it possible for people to maximize profits from cryptocurrency investments.

As a result, Aave or Compound will provide more innovative DeFi solutions with flexible protocols. Binance or Crypto.com will be suitable for a wide range of customers due to their inclusive systems, which are accompanied by very high APYs for stakeholders.

Finally, CoinRabbit or YouHodler offers simplicity as well as flexibility, allowing users to access liquidity while managing their crypto assets.

Each has its strong point, thereby helping clients achieve their financial objectives by selecting what works best for them individually, depending on individual interests.

FAQ

What is crypto lending?

Crypto lending involves lending your cryptocurrency to borrowers through a platform in exchange for interest payments. Borrowers use their crypto holdings as collateral to secure loans.

How do I choose the best crypto lending platform?

Consider factors such as interest rates, security features, user interface, supported cryptocurrencies, and platform reputation. Platforms like BlockFi, Nexo, and Aave each offer unique benefits tailored to different user needs.

What are the risks associated with crypto lending?

Risks include market volatility, platform security breaches, borrower defaults, and regulatory changes. Always research and choose reputable platforms to mitigate these risks.

Can I earn interest on my crypto holdings?

Yes, by lending your crypto on platforms like BlockFi, Celsius Network, and Aqru, you can earn interest on your assets, often at competitive rates.

What is the difference between CeFi and DeFi platforms?

Central authorities manage Centralized Finance (CeFi) platforms like BlockFi and Nexo and require user verification. Decentralized Finance (DeFi) platforms like Aave and Compound operate without intermediaries, offering greater transparency and user control.