In this article, I will be analyzing the Best Bitcoin Treasury Companies and how Bitcoin becomes an integral part of the corporate treasury of some of the most innovative companies.

These companies are innovative not only because of their large-scale mining and advanced exchange platforms but also because of their operational transparency, disciplined accumulation, and creative processes.

Their approaches are valuable for investors and businesses to understand how Bitcoin can be used to preserve value over time.

What are Bitcoin Treasury Companies?

Bitcoin treasury companies are a new phenomenon in the world of business where companies keep Bitcoin as part of their treasury holdings. Apart from the conventional companies that hold cash and assets as their main treasury components, these companies view Bitcoin closely as a store of value and protection against inflation.

They highly value asset appreciation, so they believe in the Bitcoin hold position for wealth preservation, financial stability, and asset appreciation. Businesses, especially those that have Bitcoin integrated operations, have disciplined treasury and operational growth with positive mining, trading, or Bitcoin technology as solutions to improve the overall corporate financial model.

Why use Bitcoin Treasury Companies

Wealth Preservation: With Bitcoin’s potential as a long-term store of value, companies can protect value from loss due to inflation, currency devaluation, or any adverse economic situations.

Portfolio Diversification: Bitcoin will add to corporate assets without affecting the value of cash, stocks, or bonds. This will reduce the financial risk by diversifying the corporate assets.

Growth Potential: Bitcoin’s value can appreciate, boosting the value of corporate reserves and thus increasing the wealth of shareholders over time.

Strategic Innovation: Companies can leverage Bitcoin to establish themselves as innovative, thereby winning a positive reputation in the marketplace.

Operational Integration: Companies that mine, mine nd or have blockchain operations can earn revenue and accumulate treasury at the same time, which compliments financial operations.

Transparency & Reporting: Pre-defined corporate governance via reporting on Bitcoin holdings increases trust among stakeholders.

Key Point

| Company Name | Country |

|---|---|

| MicroStrategy Inc. | 🇺🇸 USA |

| MARA Holdings, Inc. | 🇺🇸 USA |

| Twenty One Capital (XXI) | 🇺🇸 USA |

| Metaplanet Inc. | 🇯🇵 Japan |

| Bitcoin Standard Treasury Company | 🇺🇸 USA |

| Bullish | 🇺🇸 USA |

| Riot Platforms, Inc. | 🇺🇸 USA |

| Trump Media & Technology Group Corp. | 🇺🇸 USA |

| CleanSpark, Inc. | 🇺🇸 USA |

| Coinbase Global, Inc. | 🇺🇸 USA |

1. MicroStrategy Inc.

MicroStrategy Inc. became one of the best integrated Bitcoin treasury corporate services after the company shifted the bulk of its treasury into Bitcoin. For the first time, Bitcoin was viewed by a corporate entity as a secure long-term asset.

Their aggressive Bitcoin acquisition strategy while maintaining operational excellence has become a consistent benchmark for corporate crypto adoption. They remain the gold standard for firms seeking to integrate cryptocurrency into their corporate finances.

Their CEO, Michael Saylor, consistently states the company’s crypto acquisition strategy is ‘transparent’ and ‘disciplined’ where each Bitcoin purchased is viewed as a hedge against inflation. Other firms are learning to adopt crypto as a core asset with the aggressive adoption of Bitcoin at MicroStrategy.

MicroStrategy Inc. (Ticker MSTR) Pros & Cons

Pros:

- Due to its leveraged bitcoin accumulation strategy, it has historically performed significantly better than just owning bitcoin.

- Software-business + heavy bitcoin treasury asset strategy differentiates MSTR, which draws interest of investors looking for equity crypto exposure.

- Due to the company’s profile, and the coverage that it gets, it is easier to find information, and to buy and sell the shares.

- The company’s exposure bitcoin should offer considerable upside if the bitcoin prices increase.

Cons:

- Extremely high risk: fortunes are captured in bitcoin’s price fluctuations along with potential regulation within the crypto sphere.

- Convertible debt to fund bitcoin purchasing has resulted in large debt and increasing liabilities.

- Secondary seems to be the software/analytics core business. If the bitcoin strategy fails, core business may not be able to support.

- Falls in bitcoin price combined with negative regulatory/market sentiment could be highly damaging. (One analyst downgraded it to “sell”.)

2. MARA Holdings, Inc.

MARA Holdings, Inc. (Marathon Digital Holdings) is one of the premier Bitcoin treasury companies because of its Bitcoin mining and treasury holding strategies.

Unlike its traditional counterparts, MARA conducts Bitcoin mining on an industrial scale and energy-efficient mining operations while retaining a sizable amount of the Bitcoin it has mined. This unique approach allows the appreciation of the asset and operational growth as treasury management and production intertwine.

However, it is the lengthening of the operational horizon that is the primary focus of MARA’s treasury management, enhanced by transparent reporting and purposeful infrastructural development. This, along with the generation of cryptocurrencies, has made MARA a model corporate entity.

MARA Holdings, Inc. (Ticker MARA) Pros & Cons

Pros:

- A large-scale vertically integrated bitcoin miner—control over both power and mining operations.

- “Undervalued” narrative—trading at what some investors consider a discount relative to potential long-term gains.

- Growth potential in expanding computing power and exploring AI/data center opportunities beyond just mining.

- Upside on mining bitcoin combined with operational leverage (mining + bitcoin treasury).

Cons:

- Bitcoin price, mining economics (electricity costs, regulation, and equipment depreciation) impact is extremely high.

- Regulatory/energy risk: mining is energy intensive, and environmental and regulatory implications are severe.

- Heavy mining equipment/operation capital expenditures are severely damaging if the price of bitcoin is low.

- The risk of execution is very real, as is the possibility of the narrative being priced in and heightened expectations.

3. Twenty One Capital (XXI)

Since its inception, Twenty One Capital (XXI) has combined padded corporate investments and cutting edge corporate cryptocurrency innovation. XXI is a leader in corporate innovation in treasury management designed to meet the unique and complex risks and value maximization inherent in Bitcoin.

Unlike many firms, XXI focuses on holding significant Bitcoin on the balance sheet and on actively employing blockchain technology in risk management.

Innovative Balanced Bitcoin Value Management Policies, corporate transparency and growth alignment with value appreciation in Bitcoin have placed XXI as the benchmark in balanced Bitcoin Value Management Policies as a treasury component.

XXI is redefining Bitcoin treasury strategies and focusing Bitcoin as a capital resource to encourage corporate innovation investments in Bitcoin and blockchain technology.

Twenty One Capital (XXI) Pros & Cons

Pros:

- Invests in a blockchain focused fund, providing access to crypto and blockchain assets.

- Holds a mix of digital assets, providing more than one coin/one company.

- Active management may navigate regulatory and volatility challenges in the crypto market.

- Increased interest from investors and the institutionalization of crypto assets may enhance performance.

Cons:

- Investment fund positions on digital assets means exposure to great risks and volatility.

- Net returns impacted by fund fees and management costs.

- Many jurisdictions still have no clear tax and regulatory rules on crypto funds.

- Performance on execution risk depending on the fund manager in a fast-moving market.

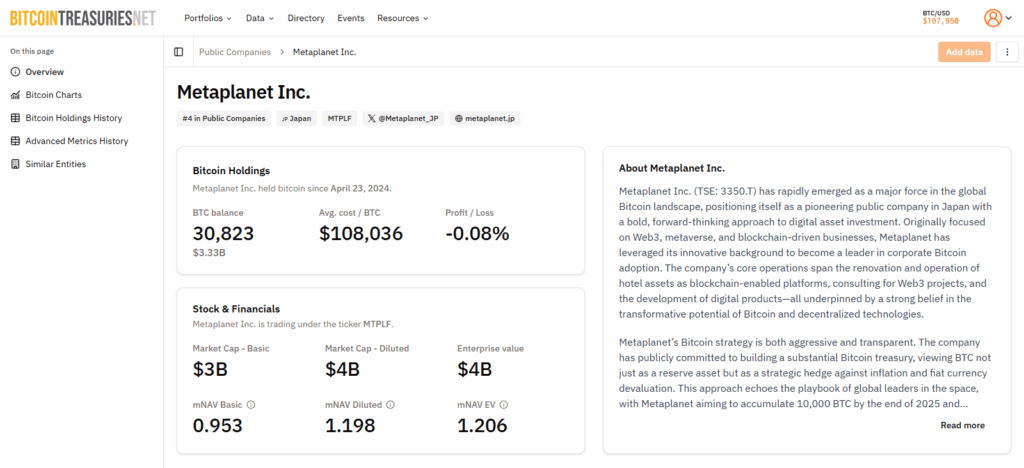

4. Metaplanet Inc.

Metaplanet Inc., is regarded as one of the best Bitcoin treasury companies because of the novel approach of embedding Bitcoin as part of the treasury within the company’s financial infrastructure.

Unlike other companies, Metaplanet has operational Bitcoin razing in consolidation as the primary treasury asset. Integrating guidelines Bitcoin accumulation with risk engineering creates the unique combination of value preservation while maximally appreciating over time.

Metaplanet intends on the active corporate treasury approach as the most aggressive and opportunistic players in the market, while the transparent corporate reporting and integrating finance principles place Metaplanet in the most favourable industry, as most companies are commercially viable and operationally relax on their Bitcoin consolidation.

Metaplanet, Inc. Pros & Cons

Pros:

- Innovator and early mover in any space they operate in may translate to potential growth.

- Continued crypto/metaverse trends/partnerships may continue to expand.

- Smaller company size may allows for more rapid pivot and business agility.

- If they capture more of the market, business model may lead to high growth.

Cons:

- Naturally higher risk: smaller firms can be affected more strongly by changes in the environment, funding, and competition.

- Additional risk if the company’s niche is more speculative, such as the metaverse or cryptocurrency.

- Having a shorter history can mean that profits are more uncertain and the investments more speculative.

- Less liquidity can result in bigger loss exposure and higher operational risk due to more extreme price fluctuations.

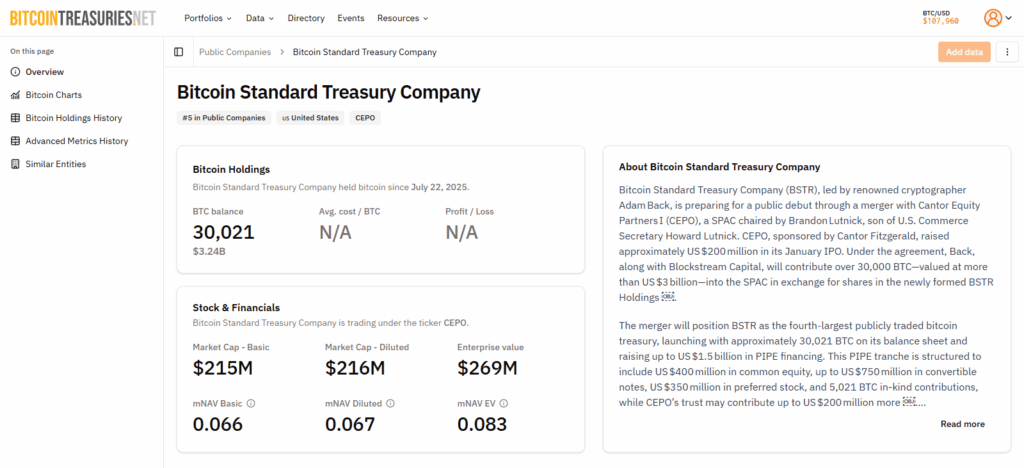

5. Bitcoin Standard Treasury Company

As one of the top Bitcoin treasury companies, Bitcoin Standard Treasury Company is hailed for using Bitcoin as the cornerstone of corporate treasury management. Unlike conventional companies, it holds and accumulates Bitcoin for wealth preservation, inflation hedging, and improved long-term financial positioning.

Besides the disciplined approach to acquiring Bitcoin, the company places great emphasis on trading-psychology, risk management, and the protective growth of digital assets.

Through clear reporting and revolutionary treasury policies, the company bitcoin-ifies corporate treasury management, demonstrating that it is possible to not only integrate Bitcoin as an investment, but as a primary asset for a coherent financial strategy and corporate resilience.

Bitcoin Standard Treasury Company Pros & Cons

Pros:

- Provides direct exposure to the underlying asset as investors can gain exposure to BTC performance through equity investments.

- Easier to assess relative value if asset allocation is clear and properly disclosed.

- Potentially higher operational risk if active bitcoin mining is pursued, but lower if the firm is primarily a treasury holding.

- Positive sentiment in the market that BTC will be more recognized by institutions.

Cons:

- Equity value is likely to drop proportionally to BTC price, when the price of bitcoin falls.

- The business risk may be more concentrated due to low operational business and unbalanced assets.

- Potential governance, trust, or regulation policy risks surrounding large holdings in crypto assets.

- Low interest income likely and dividends, if any, will be small; asset appreciation is the main source of profit.

6. Bullish

Bullish is one of the most innovative Bitcoin corporate treasury companies on the market. The company’s novel integration of balancing Bitcoin treasury operations with an exchange provided trading liquidity is unlike any other.

Whereas other companies keep treasury operations and exchange trading completely separate, Bullish innovatively integrates them, enabling the company to collect Bitcoin systematically and service the ecosystem they need to keep operational.

Bullish is able to differentiate itself by deploying, disciplined value allocation, sophisticated asset management, and value-maximizing transparency. Classifying Bitcoin as an operational asset, along with a treasury asset, demonstrates Bullish’s innovation and risk management.

Bullish Pros & Cons

Pros:

- Their place in the crypto exchange and platform area enables them to gain from the growth in crypto use and trading activity.

- When a platform expands quickly, more users can help increase liquidity, volume, and consequently, profitability due to network effects.

- Perhaps the platform is still new, so it can rapidly adjust to market and technology trends.

- There is potential to capture the intersection of fintech and crypto, attracting younger investors.

Cons:

- There is still a lot of potential competition to crypto platforms, which makes market differentiation and regulation compliance the two main possible problems.

- There is a lot of uncertainty to crypto platform regulations, which could involve licensing, judicial rulings, and general compliance.

- Revenue will mainly come from trading crypto, which makes it very volatile, and crypto market trading is very cyclical.

- A breach in platform security, stolen funds, and custody issues may harm the company profoundly and cost it its reputation.

7. Riot Platforms, Inc.

Riot Platforms, Inc. knows one of the best Bitcoin treasury companies due to large-scale Bitcoin mining synchronized with treasury management.

Unlike the typical company, Riot generates Bitcoin through energy-efficient mining while also retaining a considerable part of the mined Bitcoin on its balance sheet, matching operational output to long-term asset accumulation.

The company’s unmatched notable attributes consisting transparent reporting, disciplined buying, and sustainable infrastructure expansion.

The case of Riot Platforms, Inc. shows how a company can achieve operational expansion while also preserving Bitcoin wealth, and doing so while exposing the correct attributes and operational idiosyncratic traits to the rest of the industry.

Riot Platforms, Inc. Pros & Cons

Pros:

- It is one of the largest publicly traded bitcoin miners in the U.S. therefore, it provides exposure to bitcoin through equity shares.

- Larger operations in mining leads to greater efficiencies in the use of resources (power, infrastructure, and overall economies of scale).

- With the hash rate rising and technology improving, more bitcoin will be mined which means more growth in potential.

- There could be further investment and growth driven by institutional interest in bitcoin miners.

Cons:

- The mining business is also exposed to the more indirect risks of electricity costs, regulatory changes (environmental, zoning), and the supply chain issues of mining hardware.

- The risk of bitcoin price dropping is always present. If the price of bitcoin stops and the miner is still operating, they will quickly lose all their profits.

- High operating costs. Obsolescence costs can be detrimental to bottom lines.

- Dealing with obsolescence.

8. Trump Media & Technology Group Corp.

Trump Media & Technology Group considers on the best Bitcoin treasury companies due to the proactive-direction on integrating Bitcoin into the company’s Bitcoin treasury.

Unlike traditional companies, the firm emphasizes keeping Bitcoin as a primary treasury asset which will be used to store, preserve, and hedge against inflation while fueling the company’s other media and technology initiatives.

The company’s approach consists of accumulation with discipline, openness, and a long-range corporate plan, thus exhibiting a corporate ethos, which is rare. With treating Bitcoin as a treasury protection and a growth tool, Trump Media & Technology Group illustrates how digital assets redefine treasury management.

Trump Media & Technology Group Corp. Pros & Cons

Pros:

- Admired brand which can lead to both user engagement and monetization. Active media channels can enhance user engagement and monetization potential.

- Potential to serve niche/segment markets such as disgruntled audiences who have been neglected by mainstream social media platforms.

- Opportunity for growth if monetization via subscriptions and ads become effective and user adoption increases.

- Invest in exposure to innovation in media/technology and digital marketing, rather than only exposure to cryptocurrency.

Cons:

- Holding a prominent media position can attract intense and politically motivated regulations and controversies.

- Potential business model risk relates to the business model of strategic monetization which must be competitive with and expand in a very saturated media/tech market.

- Potential to attract legal and reputational risks which could stymie growth and undermine user trust and confidence.

- Potential to be impacted by market and trend changes as well as by failing to execute on business/strategic initiatives.

9. CleanSpark, Inc.

CleanSpark, Inc. is acknowledged as one of the premier Bitcoin treasury companies because of the company’s distinctive blend of energy technology know-how and Bitcoin management.

Unlike most, CleanSpark uses sophisticated microgrids and sustainable energy technology to power Bitcoin mining operations at scale and directly meld energy efficiency with Bitcoin value acquisition.

As part of its treasury strategy, the clean Bitcoin mined will be kept in treasury and served operational growth to maximize value over the long-term.

CleanSpark’s disciplined purchasing, sustainable infrastructure investment, and transparency around reporting all illustrate the potential of corporate models where environmental innovation and Bitcoin treasury management in strategy and operation sync as one.

CleanSpark, Inc. Pros & Cons

Pros:

- Opportunity to invest in bitcoin mining, which includes the infrastructure and growth potential of bitcoin.

- Depending on the strategic objective, may broaden to other energy infrastructure and other risk mitigation measures in energy sector.

- Possibility for profits to grow if there is a significant increase in the hash rate or improved efficiency.

- Compared to direct ownership of a mining operation, investing in equity as a shareholder of a mining company is much more accessible.

Cons

- Other mining-related risks are the same. These are increased costs to power the operations, bitcoin price fluctuations, and hardware obsolescence.

- The energy and infrastructure business is of large capital commitment and might face regulatory pressure, or low margins.

- The operational profits are likely to be of an unpredictable cyclic nature and heavily reliant on the price of bitcoin in the market and the mining difficulty.

- There might be risks of overextending the business or incorrect capital spending which becomes more likely as margins compress or mining hardware becomes obsolete.

10. Coinbase Global, Inc.

Coinbase Global, Inc. has become one of the best Bitcoin treasury companies owing to its reputation as both a major cryptocurrency exchange and as a strategic owner of Bitcoin. For one thing, unlike traditional companies, Coinbase offers billions of crypto transactions and also places Bitcoin on its balance sheet, earning operational net income while also accumulating assets.

Coinbase’s distinguishing advantage is its institutional-grade security, disciplined treasury management, and transparent reporting on the management of the digital assets, which permits the assets to be set aside for long-term growth.

Armed with market knowledge and strategically holding Bitcoin, Coinbase is a leader in demonstrating how corporate treasuries can adopt cryptocurrency for increased operational resilience and value creation for shareholders.

Coinbase Global, Inc. (Ticker COIN) Pros & Cons

Pros

- One of the most prominent and trusted cryptocurrency exchanges, which is significant in size and reputation as for most users and potential customers.

- There are several sources of revenue, such as trading fees, custodial services, and staking, making the business model more robust.

- Looking forward, they are likely to capitalize on the potential of crypto to go mainstream, regulatory uncertainty to resolve, and more crypto custodial services for institutions.

- First mover advantage in the space of regulated exchanges in the U.S., which gives an important network effect.

Cons

- If a cryptocurrency is losing value in the market, the platform will lose revenue due to decreased trading volume and fees.

- The regulatory and compliance-related risks are very high as crypto exchanges are heavily scrutinized across the world.

- The presence of many global exchanges, and decentralized alternatives to exchanges is likely to negatively impact growth.

- Security and custody risk: Any breach or major failure in systems can undermine trust and severely affect the business.

Conclusion

Indeed, the top Bitcoin treasury companies stand out because of their defensive Bitcoin purchasing, operational creativity, and their open accountability. MicroStrategy, MARA, Riot Platforms, and Coinbase showcase how Bitcoin cryptocurrency treasuries provide wealth preservation, inflation protection, and long-term value appreciation.

Each of these companies Bitcoin treasuries provide wealth preservation and inflation protection, showcasing how valuable Bitcoin cryptocurrency treasuries can be for long-term value appreciation.

The varying activities of large-scale Bitcoin mining, energy-efficient mining, media, and sophisticated exchange platforms Bitcoin buying and selling show the shifting of Bitcoin treasuries from being speculation to being considered treasury management. Each of the companies showcased celebrates the smart and responsible management of digital assets.

FAQ

Which companies are considered top Bitcoin treasury companies?

Notable examples include MicroStrategy, MARA (Marathon Digital Holdings), Riot Platforms, Coinbase Global, CleanSpark, Twenty One Capital, Bullish, Trump Media & Technology Group, Bitcoin Standard Treasury, and Metaplanet Inc.

What makes these companies unique?

Each company combines Bitcoin accumulation with distinctive strategies, such as mining operations, energy-efficient infrastructure, media integration, or exchange platforms, ensuring disciplined asset management and operational growth.

Is investing in Bitcoin for treasury safe for companies?

While it carries market volatility, disciplined accumulation, strong security measures, and transparent reporting can make Bitcoin a strategic tool for long-term financial resilience.

How does holding Bitcoin benefit shareholders?

Bitcoin holdings can increase corporate asset value, provide a hedge against inflation, and signal forward-thinking strategy, which can enhance investor confidence and long-term growth potential.