In This Post I Will Talk About the best bridging aggregator with the lowest transaction times in this article. Cross-chain transfers are becoming faster and more efficient as blockchain ecosystems expand.

Choosing the correct aggregator guarantees swift, affordable transactions with minimal wait times. I will analyze leading platforms that offer excellent bridging solutions across several networks with low latency.

Key Points & Best Bridging Aggregator for Minimal Transaction Times List

| Platform | Key Points |

|---|---|

| 1inch | Aggregates liquidity across multiple decentralized exchanges (DEXs), optimizing trade execution. |

| DeFiLlama Meta-Aggregator | Provides insights into DeFi protocols, including liquidity aggregation and analytics. |

| OpenOcean | Multi-chain liquidity aggregator with low slippage, offering optimized token swaps. |

| Matcha | User-friendly interface for liquidity aggregation, ensuring low fees and optimal pricing. |

| ParaSwap | Optimizes trading through decentralized liquidity providers, enhancing efficiency and savings. |

| Across Protocol | Facilitates cross-chain transfers with low-cost, fast bridging solutions. |

| Synapse Protocol | Cross-chain bridge and liquidity hub, allowing seamless asset transfers across various networks. |

| Portal Token Bridge | Decentralized bridge for cross-chain token transfers with a focus on security and speed. |

| Hop Protocol | Offers fast, low-cost asset transfers between Ethereum and Layer 2 networks. |

| Allbridge | Facilitates seamless asset transfers between various blockchains, ensuring security and speed. |

10 Best Bridging Aggregator for Minimal Transaction Times

1.1inch

1inch is considered the best bridging aggregator for minimal transaction times. It minimizes slippage and transaction costs by optimizing trade execution, ensuring a seamless experience on the platform.

1inch aggregates liquidity from different decentralized exchanges (DEXs) to guarantee the best prices and transit speed for users.

The platform also enables cross-chain swaps which facilitate fast asset movement through several blockchains without intermediaries. 1inch excels in low-latency transactions, making it ideal for DeFi users that want minimal wait times.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from multiple decentralized exchanges (DEXs) for optimal price execution. |

| Transaction Speed | Optimizes routing to ensure minimal transaction times and fast execution. |

| Cross-Chain Compatibility | Supports multiple blockchains, allowing seamless cross-chain asset transfers. |

| Slippage Minimization | Reduces slippage by selecting the best trade routes, ensuring more efficient swaps. |

| User Experience | Simple, user-friendly interface designed to streamline the bridging process for speed and ease. |

| Cost Efficiency | Minimizes transaction fees by selecting optimal paths with lower gas costs. |

| Routing Algorithm | Advanced routing algorithm for faster and more efficient token swaps. |

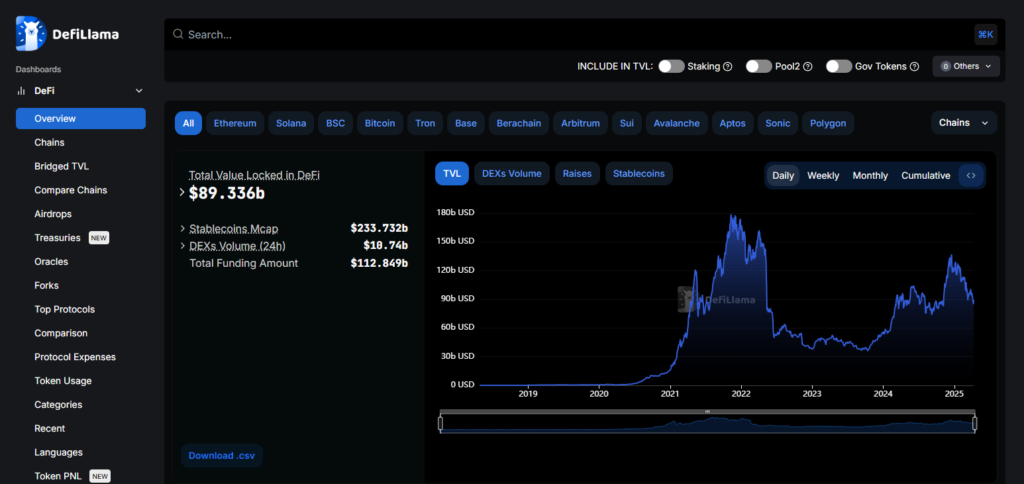

2.DeFiLlama Meta-Aggregator

DeFiLlama Meta-Aggregator has proven to be the best option. Users can access information on various liquidity sinks and transaction efficiencies through DeFiLlama’s aggregation of data from multiple DeFi protocols.

It makes use of its meta-aggregation capabilities to optimize bridging routes for cross-chain transfers so that they are completed as quickly as possible.

The platform provides analytics on the available liquidity and transaction costs, assisting users in planning ahead and using time efficiently.

By integrating numerous sources of liquidity, DeFiLlama ensures that asset transfers between blockchains are executed swiftly and economically

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates data from multiple DeFi protocols to optimize bridging routes and reduce transaction times. |

| Transaction Speed | Ensures fast cross-chain transfers by providing insights on the most efficient liquidity sources. |

| Cross-Chain Compatibility | Supports a wide range of blockchain networks for seamless asset transfers. |

| Analytics Integration | Provides detailed analytics to help users select the fastest and most cost-efficient transfer routes. |

| Slippage Minimization | Helps minimize slippage by offering optimal paths based on liquidity data. |

| Cost Efficiency | Reduces transaction costs by selecting the most efficient and cost-effective liquidity pools. |

| User Experience | Intuitive interface for easy cross-chain navigation and fast bridging with minimal delays. |

3.OpenOcean

OpenOcean remains the frontrunner as the best bridging aggregator due to its minimal transaction time. As a multi-chain liquidity aggregator, OpenOcean optimizes token swaps across DEXs, guaranteeing users the best prices and slippage.

It uses its broad liquidity pool to enable fast and effective cross-chain asset transfers. With a simple interface

OpenOcean reduces delays by optimizing the quickest route for asset transfers. The platform specializes in high-speed, low-cost transactions, making it a favorable option for users requiring efficient bridging with minimal transaction time.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from multiple decentralized exchanges (DEXs) to ensure fast and efficient transfers. |

| Transaction Speed | Optimizes routing to minimize transaction times and deliver fast cross-chain asset transfers. |

| Cross-Chain Compatibility | Supports various blockchain networks, facilitating seamless bridging across chains. |

| Slippage Minimization | Reduces slippage by routing transactions through the most liquid and efficient paths. |

| Cost Efficiency | Minimizes transaction costs by selecting optimal liquidity sources with low fees. |

| User Interface | Simple, easy-to-use interface designed for fast and efficient cross-chain bridging. |

| Routing Algorithm | Advanced algorithm to ensure minimal delays and optimal transaction execution across multiple chains. |

4.Matcha

Matcha serves as an excellent bridging aggregator with minimal transaction times. It automatically arbitrages liquidity across a large number of DEXs for optimal token prices and trad execution.

It does fast and cost-effective asset transfers by optimizing routes and minimizing slippage. The interface of the platform is very user friendly enabling quick bridging of assets across different blockchains without any delay.

The advanced routing algorithm of Matcha chooses most effective route cutting down transaction times and providing fast and smooth cross-chain transfer. It is great for fast bridging.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from multiple decentralized exchanges (DEXs) to optimize trade execution. |

| Transaction Speed | Minimizes transaction times by selecting the fastest and most efficient trading routes. |

| Cross-Chain Compatibility | Supports a wide range of blockchains, allowing fast and seamless cross-chain asset transfers. |

| Slippage Minimization | Uses advanced routing to reduce slippage and improve price efficiency during trades. |

| Cost Efficiency | Minimizes gas and transaction fees by finding the lowest-cost liquidity sources. |

| User Interface | User-friendly interface designed for quick and efficient bridging with minimal delays. |

| Routing Algorithm | Intelligent routing system to ensure low-latency transactions and optimal execution. |

5.ParaSwap

As a bridging aggregator, ParaSwap stands out for its near-instant transaction execution. Successful trades on ParaSwap are completed almost in real-time since it pulls out liquidity from multiple DEXs which guarantees optimal trade execution and fast asset transfers across chains.

While executing transactions on its platform, slippage is reduced to a minimum, which means that the transaction speed and price users receive are the best possible.

ParaSwap’s infrastructure is built in a fashion that focuses on eliminating friction from inter-blockchain transactions

Which makes bridging effortless. The platform also features Delay-in-Execution Trusted Modes with user-friendly interfaces, making ParaSwap an ideal candidate for speedy cross-chain bridging.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from decentralized exchanges (DEXs) to ensure fast and efficient trades. |

| Transaction Speed | Optimizes transaction routing for minimal delays and fast cross-chain asset transfers. |

| Cross-Chain Compatibility | Supports various blockchains, enabling seamless bridging across different networks. |

| Slippage Minimization | Reduces slippage by selecting the best liquidity sources for optimal pricing. |

| Cost Efficiency | Minimizes transaction fees by routing trades through the most cost-effective liquidity pools. |

| User Interface | Easy-to-use interface for quick and efficient bridging with minimal transaction times. |

| Routing Algorithm | Advanced routing algorithm that ensures quick, low-latency cross-chain transfers. |

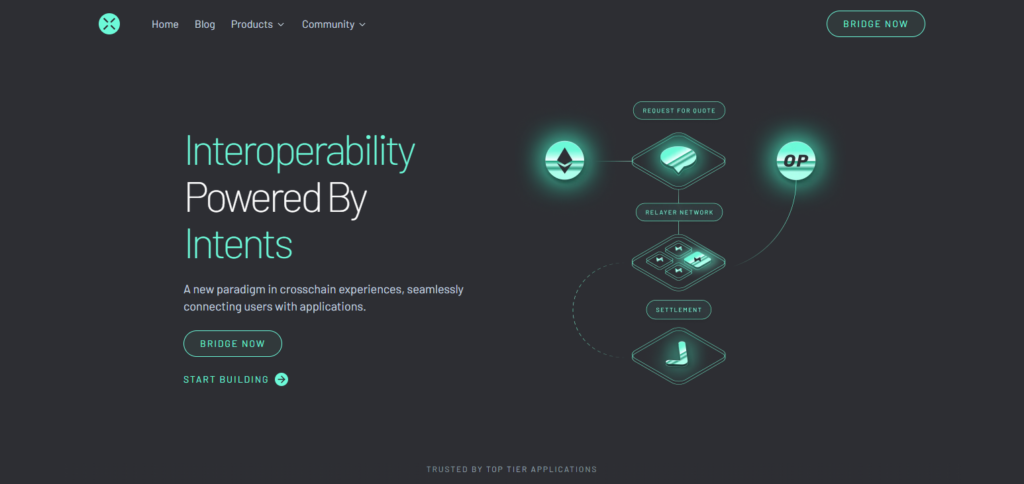

6.Across Protocol

As a bridging aggregator with the most efficient transaction speeds, Across Protocol ranks at the top.

Its peculiar architecture guarantees the least possible latency while facilitating fast and low-cost cross-chain transfers, further optimizing Across Protocol’s speed across several blockchains.

Furthermore, the proprietary intelligent routing system ensures quick execution while attaining smooth integration for more efficient asset bridging.

Because of the focus on minimizing gas fees and optimizing the transaction paths, Across Protocol is swift and reliable for users looking for delayed transfers on multiple networks.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from various protocols to ensure efficient cross-chain transfers. |

| Transaction Speed | Optimizes routing to reduce delays and provide fast asset transfers across multiple blockchains. |

| Cross-Chain Compatibility | Supports bridging between numerous blockchain networks, enhancing seamless asset transfers. |

| Slippage Minimization | Ensures minimal slippage by selecting optimal liquidity sources for fast and accurate transfers. |

| Cost Efficiency | Focuses on minimizing transaction fees through efficient liquidity pools and routing. |

| User Interface | Simple, intuitive interface for fast, low-latency cross-chain transactions. |

| Routing Algorithm | Efficient routing system that ensures minimal transaction times for bridging assets. |

7.Synapse Protocol

Synapse Protocol stands out as a bridging aggregator with low transaction times. Designed for quick and easy cross-chain transfers, Synapse Protocol helps ensure fast and low-latency transactions from one blockchain network to another.

Its liquidity hub connects numerous chains, enabling smooth bridging of assets with minimal waiting times.

The protocol also prioritizes slippage avoidance by using the fastest routes for transactions. Users benefit from smooth and prompt asset transfer, making Synapse Protocol a favorable option when minimizing transaction costs is prioritized.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from multiple sources to ensure fast and efficient asset transfers. |

| Transaction Speed | Optimizes cross-chain transactions to minimize delays and enhance speed. |

| Cross-Chain Compatibility | Supports a wide range of blockchains for seamless asset bridging. |

| Slippage Minimization | Minimizes slippage by selecting the most liquid paths for asset transfers. |

| Cost Efficiency | Reduces transaction costs by routing through cost-effective liquidity pools. |

| User Interface | Intuitive interface for easy, low-latency cross-chain asset transfers. |

| Routing Algorithm | Advanced algorithm ensures optimal paths with minimal delays for fast and efficient transactions. |

8.Portal Token Bridge

The efficiency of a bridging aggregator with minimal transaction times can be clearly seen in Portal Token Bridge. Low latency execution and speed are of great importance at Portal Token Bridge which provides smooth cross-chain asset transfers.

A decentralized architecture is used for fast and secure bridging between different blockchains. The platform optimizes transaction paths for lower delays, while its efficient routing mechanism slackens slippage and transaction costs.

As a quick, economical transfer solution, Portal Token Bridge renders users swift, effective, and reliable solutions for cross-chain transactions with little to no wait.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity across multiple blockchain networks to ensure fast and efficient transfers. |

| Transaction Speed | Optimizes routing for low-latency and fast cross-chain asset transfers. |

| Cross-Chain Compatibility | Supports bridging between various blockchain ecosystems, allowing seamless asset transfers. |

| Slippage Minimization | Reduces slippage by selecting the most efficient liquidity sources for faster transfers. |

| Cost Efficiency | Focuses on minimizing transaction costs by routing through optimal, low-fee liquidity pools. |

| User Interface | Simple, user-friendly interface designed for efficient bridging with minimal delays. |

| Routing Algorithm | Advanced routing system that ensures minimal transaction times and efficient execution. |

9.Hop Protocol

As a bridging aggregator, Hop Protocol has minimal transaction times with its fast, low-cost asset transfers between Ethereum and Layer 2 networks.

Through cross-chain bridging, delays are kept to a minimum. Hop Protocol uses its innovative routing technology to optimize transaction paths which reduces overall delays and improves transaction speeds.

Users seeking fast and seamless bridging across multiple blockchain networks will find an ideal solution in the platform since it focuses on reducing gas fees and overall transaction costs while executing them quickly.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from multiple Layer 2 networks and Ethereum for efficient cross-chain transfers. |

| Transaction Speed | Optimized for low-latency transactions, enabling fast and seamless cross-chain transfers. |

| Cross-Chain Compatibility | Specializes in bridging between Ethereum and Layer 2 networks, ensuring smooth asset transfers. |

| Slippage Minimization | Minimizes slippage by using efficient liquidity paths between Ethereum and Layer 2 chains. |

| Cost Efficiency | Reduces gas fees through Layer 2 optimizations, offering cost-effective transactions. |

| User Interface | Easy-to-use interface designed to ensure quick, low-latency cross-chain transfers. |

| Routing Algorithm | Advanced routing to ensure fast and efficient execution with minimal transaction delays. |

10.Allbridge

As a bridging aggregator, Allbridge stands out as a top pick given its fast transaction speeds. Allbridge connects several blockchains for low latency cross-chain asset transfers that are fast and secure.

Fast liquidity routing guarantees minimal delays and slippage, optimizing the flow of funds to achieve quick transaction execution.

User experience is enhanced at the interface by optimizing speed and cost when users traverse the different blockchain ecosystems.

With highly efficient processing of transfer velocities and transaction frequencies, Allbridge emerges as a robust answer for users with cross-chain movements of assets who demand prompt transaction processing.

| Feature | Details |

|---|---|

| Liquidity Aggregation | Aggregates liquidity from multiple blockchains to ensure fast and efficient cross-chain transfers. |

| Transaction Speed | Optimizes routing to minimize transaction times and provide quick transfers across various chains. |

| Cross-Chain Compatibility | Supports bridging across a wide range of blockchain networks, enabling seamless transfers. |

| Slippage Minimization | Reduces slippage by selecting the most efficient paths with the best liquidity sources. |

| Cost Efficiency | Focuses on minimizing transaction fees by routing through cost-effective liquidity pools. |

| User Interface | Intuitive and user-friendly interface designed for fast and easy cross-chain bridging. |

| Routing Algorithm | Efficient routing mechanism that ensures minimal transaction times for optimized asset transfers. |

Conclusion

To sum up, the optimal routing aggregator to select for the lowest possible transaction times will always depend on liquidity, speed, and cross-chain compatibility.

1inch, Synapse Protocol, and Hop Protocol stand out among the rest for efficiently optimizing routing to guarantee speedy and economical transfers.

With a proper choice of aggregator, the users will realize smooth and effective cross-chain transfers of assets without considerable waiting times.