In this article I will cover the 10 Best Bridging Aggregator For Quick Swaps. In today’s world of fast advancing technology, the need for a seamless cross-chaining aggregator is becoming a necessity.

Rango, Jumper and Socket, to mention a few, provide speed and efficiency alongside minimal KYC requirements. This guide underlines the best choices that will allow you to swap assets as quickly as possible across numerous blockchains.

Key Features & Best Bridging Aggregator For Quick Swaps

| Aggregator | Key Features |

|---|---|

| Rango Exchange | Supports 60+ EVM & non-EVM blockchains; aggregates bridges (Stargate, cBridge) and DEXs (1inch); ideal for complex multi-hop swaps. |

| Jumper Exchange (Li.Fi) | Powered by LI.FI SDK; aggregates 15+ bridges and 20+ DEXs; fast, optimized routing across Arbitrum, Optimism, Solana, Base. |

| Socket (Bungee) | Ultra-fast native-to-native swaps; aggregates Hop, Stargate, Across; seamless bridging across EVM chains. |

| Odos.xyz | Smart routing engine; combines swaps and bridging; minimizes slippage and gas; excellent multi-path UI. |

| Squid Router | Cross-chain swaps via Axelar; supports Cosmos + EVM; handles asset conversion in a single click. |

| XY Finance | Aggregates cBridge, Multichain, Thorchain; supports 20+ chains; fast routing with wide token compatibility. |

| Across Protocol | Not an aggregator but widely integrated; fastest bridging from L2s; low fees and instant finality. |

| Chainswap | Combines bridging and swapping in one step; handles token approvals; NFT cross-chain support. |

| Symbiosis Finance | One-click cross-chain swaps; built-in bridge + DEX support; stablecoin and altcoin compatible. |

| OpenOcean | Aggregates CEXs, DEXs, and bridges; best-price optimization; supports EVM and select non-EVM chains. |

1.Rango Exchange

Rango Exchange is the leading bridging aggregator for quick swaps, primarily because of its cross-chain connections with various DEXs and blockchains all within a single interface. What sets Rango apart is its intelligent routing algorithm which seeks out the most optimal and cost-effective path across chains for executing orders, slashing both transaction time and slippage.

Its coverage of an extensive range of blockchains and wallets gives it unparalleled interoperability. This makes it a popular choice for users prioritizing speed, ease of use, and trust in cross-chain asset swaps.

| Feature | Details |

|---|---|

| Name | Rango Exchange |

| Primary Function | Cross-chain swap aggregator |

| Supported Chains | 50+ blockchains (EVM and non-EVM) |

| Wallet Compatibility | Supports major wallets (MetaMask, Trust Wallet, Keplr, etc.) |

| KYC Requirement | No KYC required for standard swaps |

| Routing Logic | Intelligent multi-bridge and multi-DEX routing |

| Speed | Fast execution with real-time route optimization |

| User Interface | Simple, unified dashboard for cross-chain swaps |

| Security Model | Non-custodial; direct wallet-to-wallet transactions |

| Unique Advantage | Supports widest range of chains and assets with minimal user friction |

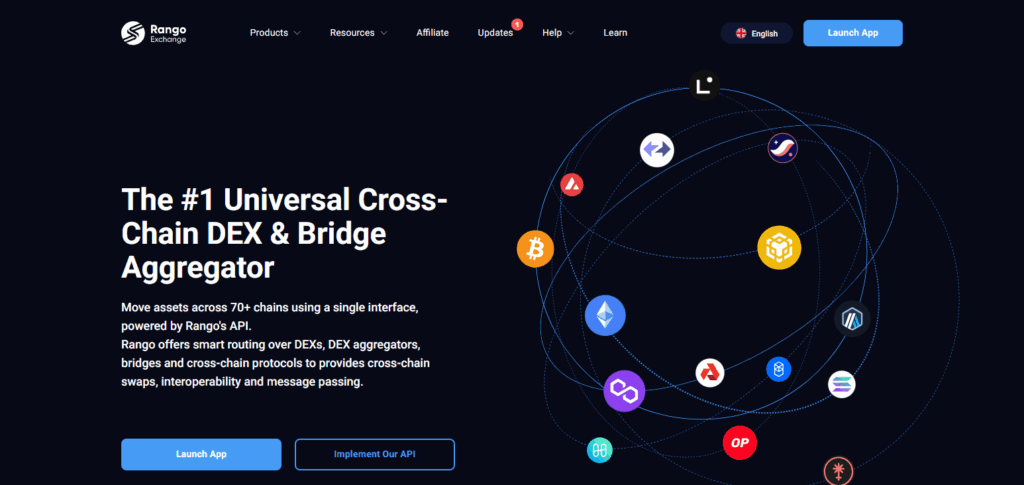

2.Jumper Exchange (Li.Fi)

Jumper Exchange is a bridging aggregator that offers speedy swaps. This is made possible through the integration of several bridges and DEXs via a single API. One of the most interesting features of Jumper is its smart pathfinding, which chooses the most secure and quickest way to transfer assets across chains in real-time.

Jumper’s approach to minimizing user complexity by optimizing everything “under the hood” ensures that gas costs, speed, and reliability are all taken into consideration. Because of the deep integration and optimization in real-time, Jumper is suited for effortless and fast cross-chain transactions with little user involvement.

| Feature | Details |

|---|---|

| Name | Jumper Exchange (by Li.Fi) |

| Primary Function | Cross-chain swap and bridge aggregator |

| Supported Chains | 20+ major blockchains |

| Wallet Compatibility | Compatible with MetaMask, WalletConnect, Coinbase Wallet, and more |

| KYC Requirement | No KYC required for non-custodial swaps |

| Routing Logic | Smart routing across bridges and DEXs via Li.Fi API |

| Speed | Fast, optimized swap execution |

| User Interface | Clean, multi-chain interface with step-by-step guidance |

| Security Model | Non-custodial; users retain control of assets |

| Unique Advantage | Aggregates top bridges in real time for the most efficient swap route |

3.Socket (Bungee)

Socket’s Bungee platform stands out as a leading bridging aggregator for instant swaps due to its execution speed and ergonomic interface. Its primary strength is the real-time simulation of transactions which guarantees optimal routing prior to confirming a swap.

Bungee performs smart routing by combining multiple bridges and DEXs focusing on speed, cost, and success rate. With dozens of chains supported and low failure rates, Bungee provides smooth, safe, and incredibly fast cross-chain swap transactions, making it perfect for both novice and seasoned traders.

| Feature | Details |

|---|---|

| Name | Socket (Bungee) |

| Primary Function | Cross-chain bridging and swap aggregator |

| Supported Chains | 25+ blockchains |

| Wallet Compatibility | MetaMask, WalletConnect, Rainbow, and others |

| KYC Requirement | No KYC needed for standard operations |

| Routing Logic | Real-time optimized routing with transaction simulation |

| Speed | Near-instant execution with low latency |

| User Interface | Intuitive and minimal with route preview and cost breakdown |

| Security Model | Non-custodial; assets remain in user wallets |

| Unique Advantage | Transaction simulation ensures best path before execution |

4.Odos.xyz

Odos.xyz stands out as a leading bridging aggregator for quick swaps because of its unique multi-route execution engine which splits and optimizes transactions across multiple liquidity sources at the same time. This helps to enable faster and more efficient swaps while reducing slippage and cost.

Unlike other traditional aggregators, Odos takes real-time automation of load balancing between performance and cost efficiency which makes Odos outperform other competitors in the market. For users, cross-chain asset transfers are performed through a seamless interface in conjunction with advanced routing logic ,and as such, customers using Odos gain speed, reliability, and precision.

| Feature | Details |

|---|---|

| Name | Odos.xyz |

| Primary Function | Cross-chain and multi-route swap aggregator |

| Supported Chains | Major EVM-compatible blockchains |

| Wallet Compatibility | MetaMask, WalletConnect, and others |

| KYC Requirement | No KYC required |

| Routing Logic | Multi-route execution across DEXs and bridges |

| Speed | Fast execution with dynamic path optimization |

| User Interface | Visual swap planner with cost and slippage transparency |

| Security Model | Non-custodial; direct interaction with user wallet |

| Unique Advantage | Splits swaps across multiple routes for better pricing and efficiency |

5.Squid Router

Squid Router is one of the most notable bridging aggregators for quick swaps, especially owing to its seamless integration with Axelar’s cross-chain infrastructure. With Squid, users can perform two unique feats that give it an edge over competitors; first, cross-chain swaps and second, contract calls, both executed in one single transaction.

Squid acts as an intelligent routing layer, it routes assets across chains with optimized paths, minimizing routing delays and fees. Allowing true cross-chain interoperability with minimal friction empowers developers and end-users alike to perform fast swaps devoid of security and performance compromises.

| Feature | Details |

|---|---|

| Name | Squid Router |

| Primary Function | Cross-chain swaps and contract calls via Axelar |

| Supported Chains | 50+ chains connected through Axelar |

| Wallet Compatibility | MetaMask, WalletConnect, Coinbase Wallet, etc. |

| KYC Requirement | No KYC required |

| Routing Logic | Executes swaps and contract calls in a single cross-chain transaction |

| Speed | Fast execution with minimal user interaction |

| User Interface | Simple UI with automatic path selection |

| Security Model | Non-custodial; leverages Axelar’s secure cross-chain messaging |

| Unique Advantage | Enables cross-chain swaps and function calls in one seamless transaction |

6.XY Finance

XY Finance is a leading bridging aggregator for ease-of-use and efficiency in one-click cross-chain swaps because of its “meta-routing” engine which integrates multiple bridges and DEXs into one unified swap.

Its competitive advantage is adaptive routing, optimizing real-time conditions for speed and costs. Serving over 20 chains, XY Finance offers low-latency transactions with high success rates. Such efficiency, together with an intuitive interface, makes it particularly well-suited for users seeking fast and dependable cross-chain swap solutions.

| Feature | Details |

|---|---|

| Name | XY Finance |

| Primary Function | Cross-chain swap and bridge aggregator |

| Supported Chains | 20+ blockchains including EVM and non-EVM networks |

| Wallet Compatibility | MetaMask, WalletConnect, OKX Wallet, and more |

| KYC Requirement | No KYC required |

| Routing Logic | Meta-routing with real-time adaptive optimization |

| Speed | High-speed execution with low latency |

| User Interface | Streamlined interface with auto-optimized paths |

| Security Model | Non-custodial; secure and user-controlled asset flow |

| Unique Advantage | Adaptive routing engine ensures fast, cost-effective swaps |

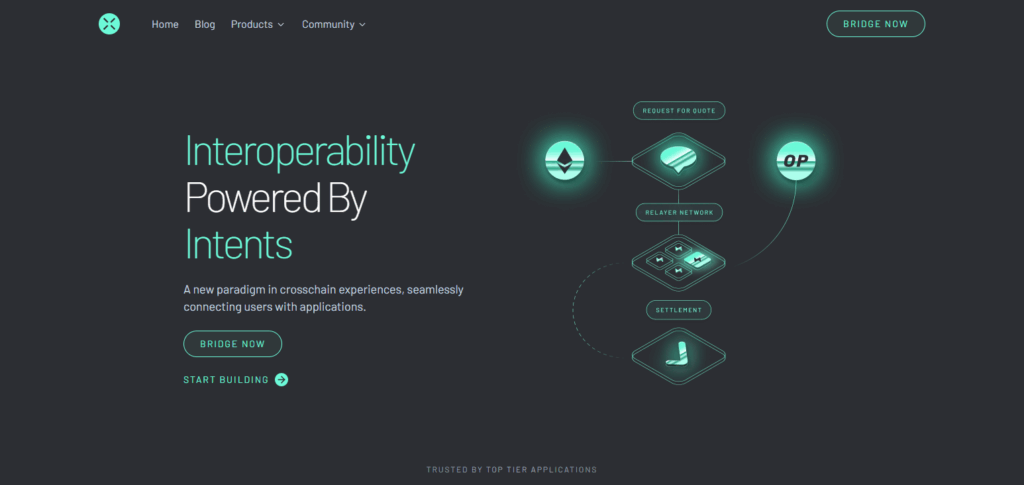

7.Across Protocol

Across Protocol stands out as a leading bridging aggregator for quick swaps due to its proprietary optimistic oracle system which allows for near-instant transfers at very low fees. Across still utilizes traditional bridges, but instead of paying the expensive wait times and gas prices like other users, Across uses a relayer network to front liquidity.

Specifically, Across solves for speed, capital efficiency, and security by settling transfers asynchronously. As a result of this innovative architecture, users have fast and cheap access to cross-chain swaps which makes Across ideal for haste and low-cost DeFi users.

| Feature | Details |

|---|---|

| Name | Across Protocol |

| Primary Function | Fast cross-chain bridging and asset transfer |

| Supported Chains | Major EVM chains (Ethereum, Arbitrum, Optimism, Base, etc.) |

| Wallet Compatibility | MetaMask, WalletConnect, Coinbase Wallet, and more |

| KYC Requirement | No KYC required |

| Routing Logic | Uses optimistic oracle and relayers for efficient bridging |

| Speed | Near-instant swaps with low latency |

| User Interface | Clean interface focused on fast transfers |

| Security Model | Non-custodial; relies on secure relayer and oracle architecture |

| Unique Advantage | Relayers front liquidity for fast, low-cost, and secure transactions |

8.Chainswap

As one of the leading bridging aggregators for fast swaps, Chainswap has the capacity to link EVM and non-EVM blockchains through a single portal. Its singular advantage is the effortless exchange of tokens and contracts, enabling swift cross-chain asset or data transfers for both developers and users without the need for numerous utilities.

Chainswap minimizes delay by route pre-optimization for swaps and also provides custom logic for bridging which is very helpful in cross-chain dApps that require fast performance and ease of use from swap services.

| Feature | Details |

|---|---|

| Name | Chainswap |

| Primary Function | Cross-chain asset and data bridging |

| Supported Chains | EVM and non-EVM chains |

| Wallet Compatibility | MetaMask, WalletConnect, and other Web3 wallets |

| KYC Requirement | No KYC required |

| Routing Logic | Pre-optimized routing for asset and contract interoperability |

| Speed | Fast execution for token and contract-level swaps |

| User Interface | Developer-friendly and simple user interface |

| Security Model | Non-custodial; secure asset flow across chains |

| Unique Advantage | Supports seamless interaction between EVM and non-EVM ecosystems |

9.Symbiosis Finance

Symbiosis Finance is remarkably efficient in facilitating instant token swaps due to its one-click cross-chain swap feature. It stands out as one of the bridging aggregators for the rapid swaps. Its primary cross-chain liquidity aggregation provides a notable advantage in minimizing slippage and increasing transaction speed.

Symbiosis guarantees near-instant execution along with a high transaction success rate by simplifying bridging complexity, which makes Symbiosis incredibly user-friendly. It is best suited for DeFi users who prefer quick and effortless cross-chain seamless transactions.

| Feature | Details |

|---|---|

| Name | Symbiosis Finance |

| Primary Function | One-click cross-chain swap aggregator |

| Supported Chains | 20+ blockchains (EVM and non-EVM) |

| Wallet Compatibility | MetaMask, WalletConnect, Coinbase Wallet, and others |

| KYC Requirement | No KYC required for standard swaps |

| Routing Logic | Unified liquidity pool spanning multiple chains |

| Speed | Near-instant execution with optimized route selection |

| User Interface | Intuitive one-click swap with real-time insights |

| Security Model | Non-custodial; user retains full control |

| Unique Advantage | Aggregates cross-chain liquidity into a single pool to reduce slippage and accelerate swaps |

10.OpenOcean

OpenOcean is a leading bridging aggregator for fast swaps, distinguished by its complete aggregation of both centralized and decentralized exchanges over several chains. Its key advantage lies in its hybrid routing algorithm that examines liquidity, slippage, and gas fees over real time to provide the most efficient swap path.

OpenOcean streamlines intricate cross-chain transactions to single-click processes with maximal precision. This blend of exceptional liquidity access and advanced optimization strategies provide OpenOcean with an edge over other platforms for speedy and inexpensive swaps.

| Feature | Details |

|---|---|

| Name | OpenOcean |

| Primary Function | Hybrid swap aggregator (centralized + decentralized liquidity) |

| Supported Chains | Multiple EVMs and non-EVMs |

| Wallet Compatibility | MetaMask, WalletConnect, Wallet3, and more |

| KYC Requirement | No KYC required for standard swaps |

| Routing Logic | Hybrid routing across CEXs and DEXs with real-time optimization |

| Speed | Fast execution with intelligent route selection |

| User Interface | Unified dashboard showing best paths and fee estimates |

| Security Model | Non-custodial with secure smart contract execution |

| Unique Advantage | Combines depth of centralized exchange liquidity with DEX efficiency |

Conclusion

Not to revisit your notes, but I would also suggest coming back to Rango Exchange and Jumper (Li.Fi). Socket (Bungee), Odos.xyz, Squid Router, XY Finance, Across Protocol, Chainswap, Symbiosis Finance, and OpenOcean also offer competitive services as bridging aggregators and have proven to be some of the best serving quick asset swaps.

All of these stand out because of how they automate the multi-layer transaction process. Speed, low operational cost, and simpllicity to use guarantee best services for the ever-changing demands of customers. The ease crypto traders now enjoy owing to these offering autometers is simply unparalleled.