In this article, I will cover the Best BSC Tokens To Stake, detailing the most rewarding tokens, along with their governance rights and idle earning opportunities.

Staking on Binance Smart Chain (BSC) is an excellent way to earn extra while participating in DeFi systems.

All these tokens offer great profits whether you choose to farm for yields or stake for stable coins.

Key Point & Best BSC Tokens To Stake List

| Token | Key Points |

|---|---|

| Binance Coin (BNB) | Native coin of Binance; used for trading fees, staking, and DeFi. |

| PancakeSwap (CAKE) | Leading DEX on BSC; enables yield farming, staking, and lotteries. |

| Venus (XVS) | Decentralized lending and stablecoin protocol on BSC. |

| BakeryToken (BAKE) | DEX and NFT marketplace on BSC with automated market maker (AMM). |

| Autofarm (AUTO) | Yield optimizer that auto-compounds returns from DeFi investments. |

| Alpaca Finance (ALPACA) | Leverage yield farming and lending platform on BSC. |

| ApeSwap (BANANA) | Automated yield optimization platform focused on stablecoins. |

| Ellipsis (EPS) | Stablecoin swapping platform offering low-slippage trades. |

| Beefy Finance (BIFI) | Multi-chain yield optimizer with automated compounding. |

| Spartan Protocol (SPARTA) | DeFi liquidity protocol with synthetic assets and swaps. |

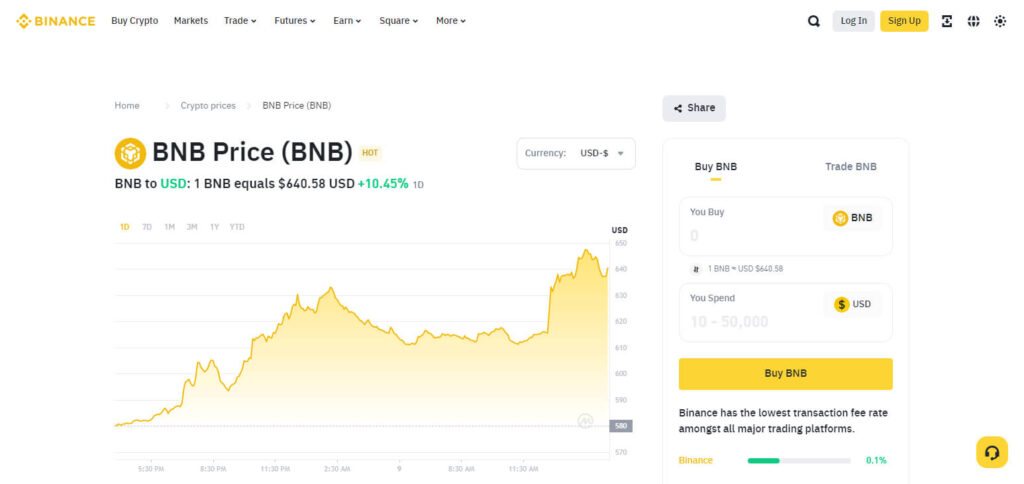

1.Binance Coin (BNB)

Staking on BSC is great with Binance Coin (BNB) because it incurs reasonable rewards.

For example, users can make passive income throught staking BNB on Binance’s platform or other DeFi chains.

BNB staking allows for liquidity pools, yield farming, governance, and other features which makes it a great asset in the BSC ecosystem.

BNB provides competitive yields because of the expanded utility, any high investor activity, and increase use of Binance.

Binance Coin (BNB) Features

- Makes it possible to pay BNB Chain gas fees and lowers the cost of transactions.

- Utilized across many DeFi, NFT, and metaverse ecosystems.

- Provides exclusive token sales on Binance Launchpad.

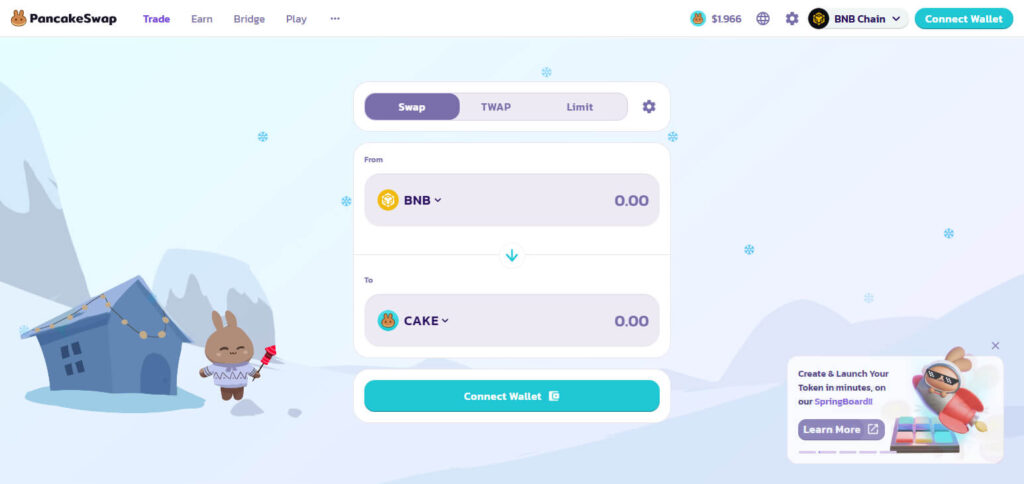

2.PancakeSwap (CAKE)

PancakeSwap (CAKE) takes the lead as one of the best tokens to stake on BSC for the high yield rewards offered.

Users earn additional tokens by stakng CAKE in Syrup created by high APY earning pools.

CAKE is a critical asset for liquidity farming, trading on the PancakeSwap DEX, and even fee discount governance.

The platform introduces staking CAKE often, making this asset favorable for registered DeFi users who readily want to earn passive income.

PancakeSwap (CAKE) Features

- Permits inexpensive cross-chain token exchanges.

- Offers lottery and staking on NFTs.

- Holds IFO (Initial Farm Offerings) for new initiatives.

3.Venus (XVS)

Venus (XVS) is a top staking token on BSC that allows sybil resistant targeting for self sovereign rewards by allowing users to stake collateral in securing a decentralized lending and stablecoin system.

By staking XVS, a holder is able to contribute to governance, make decisions regarding the platform, and receive xvs as a reward.

Venus also enables yield farming and borrowing against collateral which creates even more demand for the XVS token.

With an emphasis on DeFi and lending markets, XVS staking offers great yield while contributing to the leading money market protocol on BSC.

Venus (XVS) Features

- Permits borrowing within the protocol without collateral at a fixed algorithmic rate.

- Lets users mint VAI stablecoin against collateral.

- Grants voting power to the community for protocol changes.

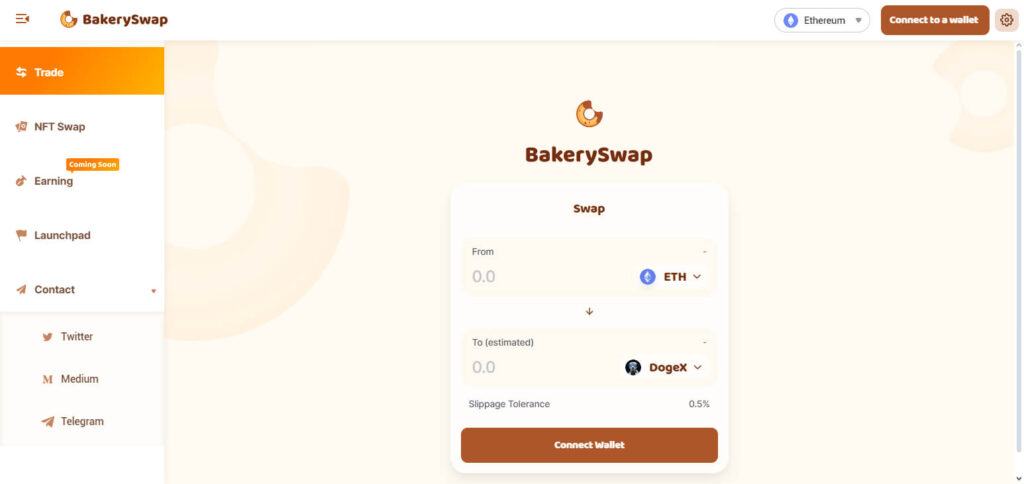

4.BakeryToken (BAKE)

BakerySwap is a prominent decentralized exchange and NFT marketplace that makes BAKE more sought after.

Because of this, it has become a go to token to stake on BSC, thanks to the high rewards offered through liquidity mining and staking pools.

BAKE can be used to stake on the platform and earn more BAKE tokens and other tokens. These frequent staking, AMM model, and NFT features make BAKE an ideal candidate for passive income investors on BSC.

BakeryToken (BAKE) Features

- Lets users trade NFTs in the marketplace distinctively.

- Allows users to earn BAKE along with other associated rewards by farming.

- Lets users stake in the game with distinct rewards.

5.Autofarm (AUTO)

Autofarm (AUTO) for miners and holders of coins on other PLATFORMS is one of the leaders in cross-chain yield farming and staking on BSC.

It has automatic reward reinvestment strategies and staking confectioners for multiple DeFi protocols.

Stake AUTO and receive part of the governance and profit for using the platform. Being a multi-chain yield aggregator Autofarm has best returns so it makes AUTO a good passive earning coins.

Employing yield farming automation guarantees constant growth while preventing the potential loss of funds useful for DeFi investment. With a single stroke, stakers of AUTO are able to diversify resources and maximize their return on investment.

Autofarm (AUTO) Features

- Maximizes yield by optimizing gas fees for superb efficiency.

- Enables multi-chain integration through cross-chain vaults.

- Distributes platform fees back to users that hold the AUTO token.

6.Alpaca Finance (ALPACA)

Alpaca Finance (ALPACA) is a platformed market maker that is able to deploy a wide BSC token for farming and borrowing ALPACA tokens through the PF form of token stakes.

As a reward, users can get the right to withdraw the fees generated within the network. Its users as a Ponzi scheme which allows non risk users to lend freely on the website.

Moreover, they offer every user using the platform a viable sustainable APY option for lengthy token lock up staking. Still, the majority of value is generated thanks to the effective allocation of capital.

Due to these factors, efficient use of farmland, and aggressive farming ALPAGA remains a better deal for lenders that care more about their ALPACA value.

Alpaca Finance (ALPACA) Features

- Lets users leverage by borrowing to invest in yield farming while taking care of the risk automatically.

- Gives other financial instruments built on NFTs for extra incentives.

- Evades liquidation by auto-repayment to keep balances in check.

7.ApeSwap (BANANA)

ApeSwap (BANANA) is one of the best tokens on the Binance Smart Chain. Users can yield farm or participate in liquidity mining to earn rewards.

ApeSwap allows users to stake their BANANA in their staking pools to earn more BANANA and other tokens.

As a DEX and AMM, ApeSwap has simple to use interfaces and powerful trading tools which attract a lot of liquidity. Aside from earning in other tokens, stakers receive governance rights as well as other exclusive farming opportunities.

The expanding ecosystem and high APY makes BANANA staking appealing to DeFi users.

ApeSwap (BANANA) Features

- Allows earning from many different chains through cross chain staking pools.

- Enables the community to make decisions through DAO governance.

- Gives liquidity providers the benefit of earning dual token rewards.

8.Ellipsis (EPS)

EPS natives are issued as rewards for staking for the users that participate actively in the growth of the protocol through its technology powered swap service.

As users stake EPS, they earn passive income known as revenue shares stemming from transaction fees and liquidity perks.

Ellipsis enables efficient trading of low-slippage stablecoin pairs, satisfying a critical need in the DeFi service industry. Staking EPS also allows users to participate in governance and earn yields from liquidity pools.

EPS staking offers a respectable option for reliable and consistent returns because of its role in stablecoin trading plus its minimal impermanent loss.

Ellipsis (EPS) Features

- Offers slippage free stablecoin swaps for effective trading.

- Implemented veTokenomics for incentivizing long term staking.

- Integrates multi-chain liquidity support for stable assets.

9.Beefy Finance (BIFI)

Beefy Finance (BIFI) is the best BSC token to stake because it features automatic compounding reward optimization for different chains.

BIFI holders earn a portion of the platform’s performance fees, which has been coined the yield earning term.

Rewards are automatically reinvested to derive greater returns from passive income, maximized by Beefy Finance’s reward reinvestment strategies.

Using BIFI for staking gives users long-term value due to governance assets and cross-chain capabilities. Investors can benefit from using BIFI as advanced vault strategies and DeFi reputation make it a preferred option for staking.

Beefy Finance (BIFI) Features

- Enables automated reinvestment of returns across multiple chains.

- Grants revenue sharing rewards for BIFI token staking.

- Guarantees real-time APY tracking for non-misleading returns.

10.Spartan Protocol (SPARTA)

Spartan Protocol (SPARTA) is a leading BSC token for staking that is build for Liquidity Pools, Synthetic Assets and Automated Market Maker.

SPARTA stakers are rewarded for supporting the decentralized liquidity system of the protocol. The platform promotes adoption and participation with attractive yield and governance incentive.

SPARTA becomes an interesting option for staking because of its focus on efficient capital use and DeFi development.

SPARTA’s value proposition is also enhanced with strong staking rewards and integration in synthetic assets, making it a good option for long term DeFi investors.

Spartan Protocol (SPARTA) Features

- Allows the generation of synthetic assets using their own algorithmic pricing.

- Supports stable swaps using liquidity-sensitive bonding curves.

- Enables deprecated insurance pools for decentralized risk sharing.

Conclusion

Earning passive income in Binance Smart Chaint (BSC) is easy with multiple tokens with exceptional rewards due to staking. Each token has unique staking perks such as governance rewards or auto-compounding. ‘

Whether you seek liquidity farming, stablecoin, or yield optimization, these tokens provide various staking approaches.

Overall, the popular BSC ecosystem continues to grow and earn through crypto which makes staking a token profitable and efficient. ?