The focus of this article will be on the Best Chainbeat Alternatives for Blockchain Monitoring with on-chain analytics, wallet tracking, and up-to-the-minute network monitoring.

These tools will be helpful for traders, developers, and crypto enthusiasts in tracking transactions, analyzing smart contracts, and identifying market opportunities in several blockchains.

Efficiently and accurately perform blockchain monitoring with reliable alternatives that provide a combination of excellent features.

What is Blockchain Monitoring?

All blockchain tracking involves observing the blockchain’s distributed ledger network activities in real time or retrospectively. This activity encompasses movements in virtual wallets, transactions, smart contracts, system security risks and health and threads of chain activity.

Different users, i.e. developers, fraud analysts, and system and user behavior analysts, to mention a few, use a combination of tracking tool features to balance on-chain analytics and compliance, mitigate fraud, and analyze systems.

Chainbeat Overview

Chainbeat has developed a state-of-the-art blockchain tracking and analytics system which can monitor many different blockchains, in real time, simultaneously. Chainbeat can track on-chain transactions, wallet balances and transfers, smart contract engagements, and network activity at an aggregate level and in real time, using alerts and dashboards.

Developers, traders, and other enterprises use Chainbeat to monitor abnormal system behavior, protect their systems, conduct sophisticated on-chain analytics, and reach actionable outcomes based on clear on-chain data.

Key Points

| Platform | Key Points |

|---|---|

| Nansen | Tracks smart money wallets, provides labeled wallet insights, supports multi-chain analytics, and helps identify profitable on-chain trends. |

| Glassnode | Offers deep on-chain metrics, network health indicators, long-term market signals, and institutional-grade blockchain data. |

| Dune Analytics | Allows users to create custom dashboards, query blockchain data using SQL, share community dashboards, and analyze multiple chains. |

| Token Terminal | Focuses on protocol revenue, user activity, financial ratios, and compares blockchain projects using traditional finance metrics. |

| Santiment | Combines on-chain data, social sentiment analysis, developer activity tracking, and market behavior insights. |

| CryptoQuant | Monitors exchange inflows and outflows, miner activity, market supply data, and provides trading-focused on-chain indicators. |

| Arkham Intelligence | Provides wallet labeling, entity-level tracking, transaction visualization, and real-time blockchain intelligence tools. |

| Chainalysis | Specializes in compliance monitoring, risk scoring, fraud detection, and blockchain investigations for enterprises and regulators. |

| IntoTheBlock | Uses AI-driven on-chain indicators, holder distribution analysis, price correlation models, and risk assessment metrics. |

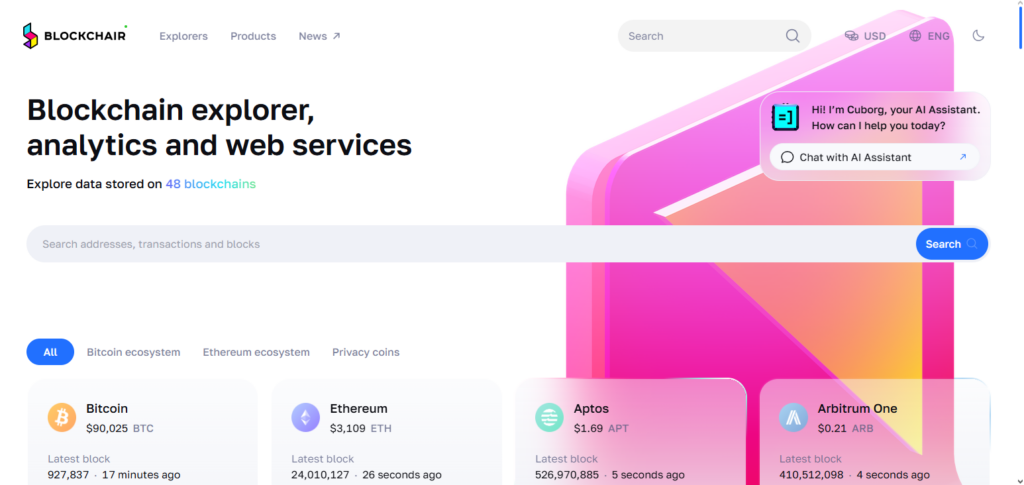

| Blockchair | Acts as a multi-chain blockchain explorer, offering transaction search, address analytics, and on-chain data visualization. |

1. Nansen

Nansen, founded in 2020 and based out of Singapore, is a blockchain analytics firm. Nansen tracks so-called smart money, offers labeled wallet analytics and supports multi-chain analytics across Ethereum, BNB Chain and Polygon.

Nansen’s primary advantage is blockchain data wallet labeling, allowing traders and institutions to render actionable insights. Nansen’s suite of products include a portfolio tracker, NFT analytics, and real-time alerts.

Nansen has recently changed its pricing to a simpler Pro plan at $49/month and $69/month which is annually billed and monthly billed respectively. This new plan offers unlimited access to the firm’s full suite of products.

Nansen Features

- Over a million tagged wallet addresses

- Track smart money flows in real-time

- Analytics for NFTs and portfolio monitoring

- Defi custom insights

Nansen Pros & Cons

Pros:

- Organizes millions of tagged addresses and has a smart wallet labeling system

- Real-time tracking for smart money flows

- Has excellent analytics for Defi and NFTs

- Investors can customize dashboards to their liking

Cons:

- Subscription fees are a high for retail customers

- Limited mainly to Ethereum and EVM chains

- Has a steeper learning curve for beginners

2. Glassnode

Glassnode was founded in Germany in 2018 and offers important mitigation of on-chain metrics and advanced analytics on blockchains supporting several networks with indicators on health, liquidity, market sentiment and long term trends from the market.

Their competitive edge is the ability to parse complex and raw data to actionable formats and insights for traders and researchers.

Customizable dashboards, advanced charting and historical data are all part of the offerings for which users can pay from29 dollars or even get a free dashboard depending on the level of analytics that they wish to access and use from the firm.

Glassnode Features

- Intelligence and on-chain metrics in the market

- Monitoring of exchange flow and liquidity

- Analysis of investors and behavior of the market

- Tools for comprehensive trading visualization

Glassnode Pros & Cons

Pros:

- Has the best on-chain metrics and market intelligence

- You can visualize data the best for trading

- Investor behavior and market liquidity are deeply analyzed

- Has a reliable historical data set

Cons:

- Premium features cost money and are locked behind paywalls

- Is mostly focused on bitcoin and Ethereum

- Not as customizable as dune

3. Dune Analytics

Recognised as a tech pioneer in Oslo, Dune Analytics was started in 2018. They democratise blockchain data as users can receive and customise data \& create dashboards.

They provide the community with real-time dashboard. Supporting seamless visualization, users can generate real-time queries, and the support multi-chains.

It offers 4 pricing, the first being free followed by Analyst ($65/month), Plus ($349/month), and Enterprises which are custom made for larger users. \Set from October 2023, there left d unds for tu analytics.

Dune-Analytics Features

- Custom dashboard and SQL queries driven by the community

- Collaboration in open source blockchain data

- Ecosystems of Eth, DeFi and NFTs

- Analytics for customization by developers and researchers

Dune Analytics Pros & Cons

Pros:

- One of the best community provided dashboards for open collaboration

- Offers Ethereum and the DeFi and NFT ecosystems

- Offers free access to community provided queries and insights

- You can customize a lot with sql

Cons:

- Offers little customer support for non EVM chains

- You may need sql for some of the advanced queries

- Data quality is a community focused effort

4. Token Terminal

Token Terminal, which was established in Finland in 2020, connects blockchain initiatives with conventional financial measurements. It focuses on financial ratios, user activity, and protocol revenue.

Applying well-known financial metrics, such as P/E ratios, to cryptocurrency protocols is one of its advantages. Standardized dashboards, project comparisons, and historical performance tracking are among the features.

A free tier, a $350 monthly Pro plan, and custom enterprise/API solutions for institutional teams are all included in the pricing.

Token Terminal Features

- Financial KPIs generated from blockchain data

- Crypto projects revenue, fees and valuation metrics

- Analytics of institutional grade

- Standardized comparisons across multiple protocols

Token Terminal Pros & Cons

Pros:– Financial KPI from blockchain data

- Metrics for revenue, fees, and valuations for crypto projects

- Analytics for investors on institutional grade

- Merges traditional finance with crypto

Cons:

- Bigger protocols are the primary focus

- Less beneficial for retail traders

- Compared to Nansen, less real time monitoring

5. Santiment

Santiment, which was established in Zug, Switzerland, in 2016, integrates social sentiment and developer activity tracking with on-chain data. Its benefit is that it combines blockchain principles with behavioral analytics.

Predictive sentiment indicators, social trend monitoring, and whale tracking are some of the features. Sanbase Pro costs $49/month or $529/year and offers complete access to real-time data and sophisticated warnings, while a free plan with restricted data is available.

Santiment Features

- Analysis of behavior and social sentiment

- Activity metrics in-chain and by developers

- Tracking of whales and insights from crowd psychology

- Tools for the prediction of market trends

Santiment Pros & Cons

Pros:

- On-chain data with social sentiment combined

- Analytics with tracking of whale’s behavior

- Tools for predicting the trends of the market

- Developer activity with analytics

Cons:

- Misleading sentiment data can result in noise

- Less intuitive interface than rivals

- Advanced metrics require subscriptions

6. CryptoQuant

Founded in 2018, CryptoQuant is a South Korean analytics platform that focuses on on-chain indicators related to trading. It keeps track of market supply information, miner activities, and exchange inflows and outflows.

Actionable signals for short-term trading are one of its advantages. Institutional-grade datasets, alerts, and dashboards that may be customized are among the features.

For enterprise-level analytics, there are four price tiers: Basic (free), Advanced ($29/month), Professional ($99/month), and Premium ($799/month).

CryptoQuant Features

- Tracking of inflows and outflows from exchanges, and reserves

- Monitoring of whale movements

- Alerts for real-time liquidity changes

- Blockchain data and market data of institutional grade

CryptoQuant Pros & Cons

Pros:

- Changes in liquidity with alerts in real time

- Tracking of outflows and inflows of exchanges and reserves

- Monitoring of whale movements

- Blockchain and market data of institutional grade

Cons:

- Primarily focused on Ethereum and Bitcoin

- Paid plans are needed for advanced features

- Compared to Dune, customizable dashboards are less

7. Arkham Intelligence

They Morel launched Arkham Intelligence in 2020 to deliver real-time blockchain intelligence via transaction visualization, entity-level tracking, and wallet labeling. Transparency and the ability to identify the entities behind wallet addresses are its main advantages.

Transaction flow maps, interactive dashboards, and wallet grouping driven by AI are among the features. Arkham provides institutional-grade intelligence capabilities with unique enterprise packages; however, pricing specifics are not publicly specified.

Arkham Intelligence Features

- Forensics on the blockchain enhanced by AI

- Wallet addresses on consolidated entity basis

- Investigation compliance tools

- AI activity insight

Arkham Intelligence Pros & Cons

Pros:

- Forensic blockchain powered by AI

- Addresses to wallets attributed by entity level

- Tools for transparency in compliance and investigations

- Activities that are suspicious are deanonymized

Cons:

- Deanonymization of wallets raises privacy issues

- Coverage is evolving, and it’s relatively new

- Less for traders and more for compliance teams

8. Chainalysis

Chainalysis is a prominent platform for blockchain compliance and investigation that was established in New York in 2014. Risk scoring, fraud detection, and regulatory monitoring are its areas of expertise.

Its benefit is that it provides reliable blockchain intelligence to governments, businesses, and regulators. Investigative tools, wallet profiling, and transaction tracking are among the features.

With solutions designed for banks, exchanges, and government organizations, pricing is enterprise-focused and customized.

Chainalysis Features

- Software for monitoring compliance and AML

- Detectors for fraud and investigations of forensics

- Transactions of crypto risk scoring

- Adoption by banks and governments

Chainalysis Pros & Cons

Pros:

- Leaders globally in anti-money laundering (AML) and compliance supervision.

- Utilized by dozens of local and central banks.

- Provides risk calculations and forensic analysis.

- Able to provide several insights due to strong collaborative relationships with regulators.

Cons:

- Pricing is steep and enterprise-level.

- Focus is not on individual retail clients or traders.

- More attention seems to go on compliance rather than analyzing insights from the trading.

9. IntoTheBlock

Founded in Miami in 2018, IntoTheBlock provides risk assessment models, holder distribution insights, and on-chain indications with AI-driven analytics. Using machine learning to find hidden blockchain patterns is one of its advantages.

Predictive signals, whale concentration studies, and price connection models are among the features. For sophisticated analytics, there are Pro and institutional programs available in addition to the free basic plan.

IntoTheBlock Features

- Analytics with a boost from AI and Machine Learning

- Indicators on and off the blockchain

- Intelligence of the portfolio and insights on DeFi

- For investors, there are signals for trading predictively

IntoTheBlock Pros & Cons

Pros:

- Analytics supported by artificial intelligence (AI) and machine learning.

- Indicators both from within and outside the blockchain.

- Intelligence from decentralized finance (DeFi) and from portfolios.

- For the purpose of investment, trading signals can be predicted.

Cons:

- Predictive models are not very transparent in some instances.

- Limited to only larger, major assets.

- Requires payment in order to access some of the advanced features.

10. Blockchair

Founded in Dublin in 2016, Blockchair is a multi-chain blockchain explorer that provides on-chain visualization, address statistics, and transaction search. Supporting several blockchains inside a single interface is one of its advantages.

Advanced filtering, query customization, and privacy-focused analytics are among the features. API access costs $19 per month, with enterprise options available for large data usage.

Blockchair Features

- Explorer for over 40 networks for multi-blockchain

- Transactions of advanced search and filtering

- Data for blockchain with a privacy-first approach

- Analytics for developers with a query custom made for them

Blockchair Pros & Cons

Pros:

- Over 40 different networks can be accessed from one blockchain explorer.

- Ability to perform complex searches and apply filters on specific transactions.

- Offers a privacy-first approach to blockchain data.

- Provides developers with analytics and allows them to run complex queries.

Cons:

- Compared to Glassnode or Nansen, not as focused on investors.

- For some casual users, the interface can seem technical.

- Less analysis visualization offered when measured against competitors.

How to Choose the Best Chainbeat Alternatives for Blockchain Monitoring?

Figure Out What Your Monitoring Needs Are

Start off by identifying what you are aiming to achieve from the blockchain monitoring tool. Some platforms concentrate on smart money tracking, while others zone in on the network’s health, compliance, and/or trading signals.

What Blockchains and Networks Are Supported

Pick a platform that caters to the blockchains that you are most active on, be it Ethereum, Bitcoin, BNB Chain, Solana, or the Layer-2 networks. The top Chainbeat competitors provide multiple chains support to give users broader coverage for future extensibility.

Quality and Timeliness of On-Chain Data

Seek for platforms that have real, timely, and historical on-chain data. For monitoring on a blockchain to be effective, the provided data must include quality metrics such as transactional flows, the actions of the wallets, distribution of the supply, and the interactions of smart contracts.

Analytics and Visualization Tools

An ideal alternative should include data visualization through dashboards, charts and other means. Tools such as Dune Analytics and Glassnode help users analyze complex data of blockchains using customized dashboards with visuals.

Alerts and Real Time Notifications

Alarms are a necessity and in real time when there are any abnormal events, whale movements, or security threats. Users of CryptoQuant and Arkham Intelligence are able to receive alerts in order to respond to rapid changes in the marketplace or network.

Compliance and Security Features

In the case of an exchange, business, or institutional user, compliance features such as AML, risk scoring, and fraud detection become omnipresent. In these cases, enterprise-grade solutions such as Chainalysis run without analytics.

Ease of Use and Technical Skills

Some platforms require technical knowledge such as SQL queries in Dune Analytics whereas others provide dashboards that are easier to understand. Pick a tool that best fits your experience level to prevent added complexity.

Pricing and Subscription Plans

Make comparisons of the pricing as per features. Various Chainbeat alternatives provide free tiers with restrictions on data whereas more expensive tiers provide more features. Ensure the pricing is in line with your budgeting and monitoring requirements.

Trustworthiness

Platforms that have a community that participates actively, provides consistent platform updates, and renders support for customers are platforms to be commended. In addition, community-generated dashboards and documentation and tutorials are valuable for dashboards with long-term use.

Chains and Metrics Versatility Values

To conclude, determine which blockchain monitoring platform is extensible and flexible according to your demands. The best Chainbeat alternatives keep adding new chains and metrics and sophisticated features to be relevant in the ever-changing blockchain ecosystem.

Conclusion

When picking out alternatives to Chainbeat, consider what features matter to you the most. That can be anything from real-time tracking, deep on-chain analytics, compliance, or market intelligence.

Some platforms suited for more advanced data visualization and analysis include Nansen, Glassnode, and Dune Analytics, while CryptoQuant and IntoTheBlock is more appropriate for traders looking for actionable market signals.

When considering enterprise compliance and risk management, the choice is Chainalysis, while transparent tracking of wallets and transactions can be found in Arkham Intelligence and Blockchair.

Overall, the best alternatives to Chainbeat provide accurate data, support multiple blockchains, and offer powerful insights that let users pivot more effectively in the ever-changing world of cryptocurrency.

FAQ

What is a Chainbeat alternative?

A Chainbeat alternative is any blockchain monitoring or analytics platform that provides similar features such as transaction tracking, wallet analysis, smart contract monitoring, and on-chain data insights. These tools help users track blockchain activity, detect risks, and make informed decisions.

Why should I use a Chainbeat alternative?

While Chainbeat offers robust monitoring, alternatives may provide additional features like multi-chain support, AI-driven insights, financial metrics, social sentiment analysis, or advanced compliance tools. Choosing the right alternative can better match your specific blockchain monitoring needs.

Which platforms are considered the best Chainbeat alternatives?

The top alternatives include Nansen, Glassnode, Dune Analytics, Token Terminal, Santiment, CryptoQuant, Arkham Intelligence, Chainalysis, IntoTheBlock, and Blockchair. Each platform offers unique strengths in analytics, tracking, and compliance.

Are these alternatives suitable for beginners?

Some platforms, like Nansen, Glassnode, and IntoTheBlock, are beginner-friendly with easy dashboards. Others, like Dune Analytics, may require SQL knowledge for custom queries. It’s important to choose based on your technical expertise.

Can these platforms monitor multiple blockchains?

Yes, most of the best Chainbeat alternatives support multiple blockchains, including Ethereum, Bitcoin, Solana, BNB Chain, and more. Multi-chain support ensures comprehensive monitoring and flexibility for diverse use cases.