I’ll go over the Best CoinGlass Derivatives Data Alternatives. Most traders and analysts looking for reliable insights into derivatives data will want to use services that include real-time market data, funding rates, liquidations, and some form of on-chain analytics.

The alternatives include the necessary mechanisms to assist traders and analysts to make educated market gradations and develop derivatives strategies. These assists help users stay on the cutting edge of the fast derivatives market.

Key Point & Best CoinGlass Alternatives for Derivatives Data

| Platform | Key Points / Features |

|---|---|

| Laevitas | Provides institutional-grade crypto market data and advanced analytics. |

| Kaiko Derivatives Data | Offers real-time and historical derivatives market data across multiple exchanges. |

| Amberdata | Comprehensive on-chain, market, and derivatives data API with analytics tools. |

| Glassnode | On-chain analytics platform delivering insights on market trends and liquidity. |

| CryptoQuant | Data analytics for derivatives, exchanges, and miner flows with alerts & metrics. |

| IntoTheBlock | Advanced on-chain, derivatives, and behavioral crypto analytics with AI insights. |

| Santiment | On-chain, social, and development metrics for market sentiment analysis. |

| Messari Pro | Institutional research, metrics, and derivatives insights with curated reports. |

| Deribit Insights | Specialized derivatives market data and options/futures analytics. |

| OKX Insights | Market trends, futures, options, and derivatives analytics from OKX exchange. |

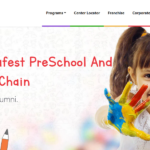

1. Laevitas

Beginning with Laevitas, it is a high-tier analytics platform that specializes in breaking down the crypto-market and giving the most needed and most up-to-date information and analytics pertaining to the crypto-market derivatives.

They cater to traders and investors at the institutional level providing them with high-quality and robust liquidity and up-to-the-minute charts within the futures and options markets.

With their fast and intuitive UIs and customizable dashboards, tracking market movements and stats has never been easier. With excellent Laevitas has definitely become one of the most Best CoinGlass Alternatives for Derivatives Data.

Laevitas Features

- Market Data Range: Provides information on derivatives from various exchanges with options on futures, swaps, and options.

- Immediate Insight: Provides information on the depth of the market, open interests, and funding rates.

- Tailored Visual Data: Provides the ability to obtain reports and customized visualizations for a particular asset or trading plan.

2. Kaiko Derivatives Data

Kaiko is one of the few providers of real-time and historic derivatives market data across multiple exchanges. They provide data on futures and options contracts, and funding rates, as well as trading metrics (i.e. open interest, trade volumes, etc.).

Their products are tailored to developers, institutions and quant researchers and Kaiko strives to provide easy to integrate data feeds for trading and analytic tools. Due to their reputable coverage, Kaiko is one of the Best CoinGlass Alternatives for Derivatives Data making it easy for traders and analysts to keep track of their market data and optimize their trading strategies on derivatives.

Kaiko Derivatives Data Features

- Market Data of a High Standard: Collects data regarding the trading of derivatives from multiple exchanges that are in the cryptocurrency market.

- Access to Data from the Past: Data that is historical is ample in order to test a trading plan before engaging in real-time trading.

- Regarding An API: There are no problems with automated trading, and there are platforms that are designed for trading and analyzing data. The integration is seamless.

3. Amberdata

Amberdata is a more generalized blockchain and crypto data provider that also offers on-chain and market data, as well as derivatives data. They provide developers, traders, and enterprises with APIs and dashboards to analyze futures, options, and spot markets.

In addition to market analytics, the platform offers tracking of liquidity, trading volume, and market trend changes in real-time. Such a comprehensive collection of data and analytics is suitable for institutions as well as retail traders, and as a consequence it is one of the Best CoinGlass Alternatives for Derivatives Data with the ability for traders to analyze derivatives markets in a reliable and efficient way.

Amberdata Features

- Support for Multiple Assets: There is coverage on the metrics for on-chain, spot, and derivatives of a cryptocurrency.

- Metrics on Order Books: Advanced trading tools are available to provide features such as order book metrics, funding rates, market volatility.

- Analytics of the Most Customizable Dashboards: The API is very promising to developers in the trading space.

4. Glassnode

Glassnode is a frontrunner specializing in providing granular on-chain analytics to offer invaluable granular data for tracking market movements, market conditions, liquidity, and directional flows on market derivatives.

They offer advanced data on futures and options instruments plus access to on-chain wallet flows and volume transactions. Traders can assess and visualize current risk exposure while leveraging sentiment on market dashboards and insightful reports.

It is the accuracy and Glassnode’s commitment to transparency that puts them head and shoulders above the competition creating derivatives data for traders, making Glassnode a finalist in the Best CoinGlass Alternatives for Derivatives Data.

Glassnode Features

- Analytics on Derivatives and the Chain: Relatively new metrics on derivatives can be provided with on-chain analysis for a better viewpoint of the market.

- Gauges of Market Sentiment: The funding rates, liquidations, and futures positions are tracked to provide the market with.

- Reports and Alerts are Automated: Automated notifications can be set up for movements in the market that are of particular interest.

5. CryptoQuant

CryptoQuant is a powerful, growing platform with a unique offering, providing analytics of derivatives market plus flows, miner movements, and key market signals. They offer data in real time and also have a comprehensive archive for future, options, and open positions for insight on market direction and funding rate movements.

Traders can monitor market risk and liquidity conditions. Their specific focus on derivatives data has made them also one of the Best CoinGlass Alternatives for Derivatives Data. CryptoQuant provides tools for Crypto traders to adjust for the market, control risk, and improve derivatives market trading.

CryptoQuant Features

- Exchange Flow Metrics: Examines changes in streams in and out of derivatives positions as well as liquidations and funding rates across a myriad of exchanges.

- Trading Signals: Derivatives market activity is converted into actionable trade signals.

- User Friendly Dashboard: Allows for tracking of metrics and trends via straightforward interface without technical nuances.

6. IntoTheBlock

IntoTheBlock uses AI analytics to offer insights on chain, derivatives, and market behavior activities. The platform predicts analytics based on trading volumes, liquidity, open interest, and market sentiment. Strengthened by features like trading dashboards, Into The Block strengthens trading and analytical activities through enhanced data visualization.

The platform is highly regarded within the crypto analytics community, and was awarded Best CoinGlass Alternatives for Derivates Data. Users received signals to derive complex market strategies from the data, and were aided in tracking market movements to develop focus strategies around on trains and derivatives metrics.

IntoTheBlock Features

- Data Driven Insights: Qualitative insights set in probabilistic models to forecast market activity are provided along with derivatives data.

- On-Chain Integration: Activity in derivatives is merged with on-chain analytics for improved insights.

- AI Powered Analytics: Market trend and price predictions are generated using analytics.

7. Santiment

Santiment provides on-chain, market sentiment and crypto development activity. The platform also delivers insights on market derivatives, like opens interest in futures, funding rate and volatility metrics which gauge market behavior. Social and development activities are also analyzed in order to derive sentiment analytics.

Santiment’s tools allow users to easily monitor these metrics. Because of this, Santiment was awarded Best CoinGlass Alternatives for Derivates Data. The platform sentiment analytics to traders and investors, enabling data from their market evaluation tools for efficient strategy development and market sentiment evaluation.

Santiment Features

- Sentiment Analysis: Market trends are identified using on-chain and derivatives metrics.

- Market Alerts: Derivatives activity is monitored for irregularities, leading to liquidation and heightened open interest.

- Data Visualization Tools: Charts and dashboards illustrate comprehensive market movement.

8. Messari Pro

Messari Pro provides institutional-level blockchain crypto asset research, crypto asset market metrics, crypto asset derivatives, and crypto asset market reports and analytics dashboards. The platform provides analytics on derivatives of crypto assets, futures, liquidity, and market exchange data.

The curated research and professional-grade datasets of Messari Pro help make high-level crypto[‘derivatives’] and crypto investment decisions. Messari Pro is reputed and reliable, which is why they are ranked one of the Best CoinGlass Alternatives for Derivatives Data as they assist traders and market analysts in evaluating and understanding market derivatives and assessing risk with great accuracy and assurance, market activity is monitored with great detail and confidence.

Messari Pro Features

- In-Depth Research: Derivatives market insight is provided along with extensive research on crypto.

- Exchange Metrics: Futures, options and funding rates on major exchanges are tracked.

- Professional Tools: Tools designed for pros, including filtering, sophisticated charts, and analytics.

9. Deribit Insights

Deribit provides analytics for open orders, market and trading volume, and active orders, for futures and options separate analytics. Deribit provides value and analytics for the trading of crypto derivatives.

The data analytics that Deribit provides assists traders in understanding the dynamics of the derivative markets. Deribit’s services, reports, and data dashboards are provided to retail and institutional trading clients and are created with focused data to assist in implementing strategies.

Deribit is focused on providing services for derivatives and is precise, and as a result of this, Deribit Insights, one of the Best CoinGlass Alternatives for Derivatives Data, assists traders in understanding crypto derivatives and provides Deribit Insights to ensure that traders and market participants can track crypto derivatives and manage risk.

Deribit Insights Features

- Options & Futures Data: Focused on Deribit exchange derivatives of BTC and ETH.

- Volatility Metrics: Provides both implied and historical volatility for traders of options.

- Depth of Market Analysis: Analyzes open interest and liquidity to inform tactics in trading.

10. OKX Insights

OKX Insight analytics help report trading analytics for futures, options, and perpetual contracts in the market. They track trading volume, open interest, and market liquidity trends, alongside funding rates. It provides traders with dashboards and market movement analytics, which are updated periodically.

It is appreciated and recognized as one of the best derivatives data providers for offering extensive analytics and insights at the exchange level, gaining the traders and analysts competitive advantages in the crypto markets.

OKX Insights Features

- Exchange Data Specific: Provides OKX users with real-time data on the derivatives market.

- Futures and Perpetual Data: comes with open interest, funding rates, and liquidation overview.

- Insights Education: Distributes market reports and other insights to assist traders in understanding the trends in the derivatives market.

Conclusion

For reliable consistent derivatives data within the sector, there are more than just CoinGlass. Laevitas and Kaiko are real time and sophisticated institutions grade market data providers and analytics for futures and options.

Amberdata and Glassnode offer the combination of on–chain data and derivatives for comprehensive market coverage. Actionable and insight analytic AI oriented CryptoQuant and IntoTheBlock, while Santiment compliments with dev activity on the strategies.

Messari Pro and Deribit Insights and OKX Insights are advanced research providers with exchange analytics on the derivatives and other metrics. Collectively, these are the Best CoinGlass Alternatives for Derivatives Data.

FAQ

What does “derivatives data” mean in crypto?

Derivatives data refers to information about futures, options, perpetual contracts, open interest, funding rates, and other trading metrics associated with derivative products. This data helps traders understand market sentiment, volatility, and risk in crypto markets.

Why would someone look for alternatives to CoinGlass?

Traders and analysts may seek alternatives for broader exchange coverage, different analytics tools, API access, customizable dashboards, or more in‑depth on‑chain and sentiment metrics. Different platforms excel in specific areas of derivatives analytics.

Which platforms are considered the best alternatives to CoinGlass?

Top alternatives include Laevitas, Kaiko Derivatives Data, Amberdata, Glassnode, CryptoQuant, IntoTheBlock, Santiment, Messari Pro, Deribit Insights, and OKX Insights — each providing valuable derivatives or market data tools.