I want to talk about the best credit cards in Canada in this article, pointing out important features for rewards, cash back, travel, and credit building.

If you are a traveler, regular spender, or trying to increase your credit score, this list will assist you in selecting a card that will suit your finances and lifestyle in 2025.

Key Point & Best Credit Cards in Canada

| Credit Card | Key Point |

|---|---|

| American Express Cobalt® Card | Earn up to 5x points on food, drinks, and streaming; great for daily rewards. |

| Scotiabank Gold American Express Card | No foreign transaction fees; ideal for frequent travelers. |

| Scotiabank Passport™ Visa Infinite Card | Includes Priority Pass lounge access and travel perks. |

| TD Aeroplan Visa Infinite Card | Aeroplan points plus travel benefits like free checked bags. |

| Rogers Red World Elite Mastercard | 1.5% cash back on all purchases; 2%+ for Rogers customers. |

| Neo World Elite Mastercard | Up to 5% cash back at partner stores; excellent for local shopping. |

| CIBC Dividend Visa Infinite Card | Up to 4% cash back on gas and groceries; great for families. |

| SimplyCash® Preferred Card from American Express | Flat 2% cash back on everything; high earn rate without categories. |

| BMO Ascend World Elite Mastercard | Comprehensive travel insurance and 4 airport lounge visits/year. |

| Neo Secured Mastercard | Best secured card in Canada; earns cash back while building credit. |

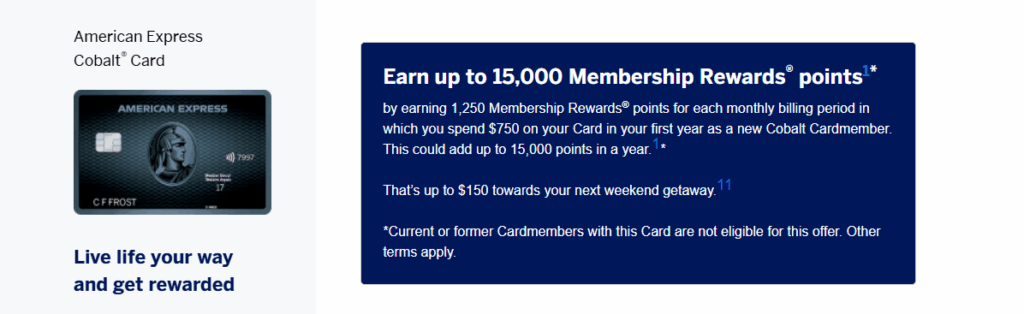

1. American Express Cobalt® Card

The American Express Cobalt® Card stands out among the best credit cards in Canada because of its ease of earning points with every dollar spent. Cardholders earn 5x points on food and drink delivery, 3x on streaming, and 2x on travel.

For every other expense, 1x point is awarded. It is perfect for individuals who regularly dine out and order groceries online. The Membership Rewards earned can easily be transferred to travel partners like Aeroplan and Marriott Bonvoy which provides great value.

The card includes travel insurance, purchase protection, and offers strong earn rates for frequent travelers.

American Express Cobalt® Card Features

- Delivery, food, and drinks have 5x points.

- 3x on streaming, 2x on both transit and travels.

- Possesses flexible Membership Rewards points.

- Monthly Payment is set as \$12.99.

- Possesses strong coverage under travel insurance.

2. Scotiabank Gold American Express Card

The Scotiabank Gold American Express Card is unique for travelers due to its 0% foreign transaction fees, a gold feature among Canadian credit cards. It includes 5x Scene+ points on groceries, dining, and entertainment, 3x on gas and transit, and 1x on all other purchases.

Points can be redeemed for travel, statement credits, and more. It offers comprehensive travel insurance and concierge services.

With a \$120 annual fee, the card is ideal for Canadians who travel internationally and want to earn high rewards on everyday spending due to no FX transaction fees.

Scotiabank Gold American Express Card Features

- 5x Scene+ points is earned via dining, groceries, and entertainment.

- Ditches foreign transaction fees.

- 3x on gas and public transport.

- Has comprehensive travel insurance.

- Requires \$120 as an Annual fee.

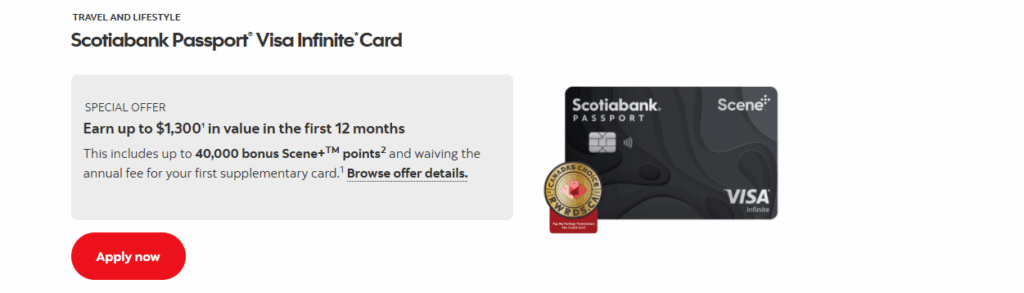

3. Scotiabank Passport™ Visa Infinite Card

Traveling becomes much easier with The Scotiabank Passport™ Visa Infinite Card since it lacks foreign transaction fees, offers six lounges visits each year through Priority Pass, and includes comprehensive travel insurance, auto renter’s insurance, and trip interruption protection.

This premium card accrues Scene+ points at a rate of 2x for all dining, groceries, entertainment, transit, and 1x for everything else, domestically and internationally. It has a global acceptance from Visa which alongside the 150 dollar fee makes it great for travelers looking for mobility.

The scene+ points are very versatile and can be redeemed for statement credits or travel which in the end makes this card a valuable multi purpose option.

Scotiabank Passport™ Visa Infinite Card Features

- No FX charges and 6 complimentary visits to the airport lounge.

- 2x Scene+ points for meals, groceries, entertainment, and public transport.

- Has extensive insurance for travel.

- Enjoys Visa Infinite perks.

- Requires \$150 as an Annual fee.

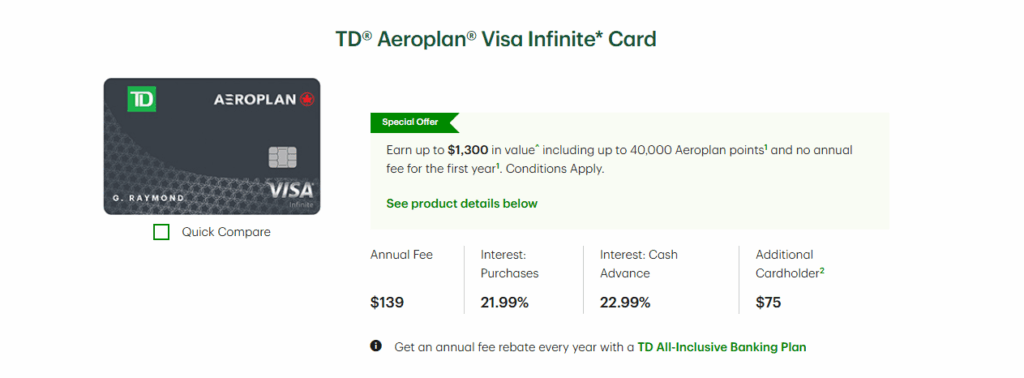

4. TD Aeroplan Visa Infinite Card

Of all cards available in Canada, the TD Aeroplan Visa Infinite Card is best suited for frequent travelers. The card earns Aeroplan points that can be redeemed for flights with Air Canada or their partners in the Star Alliance network.

Users earn points at 1.5x for gas, groceries, and Air Canada purchases, with other spending earning 1x. Free checked bags, advanced boarding, and an annual NEXUS fee rebate are just some of the perks.

The annual fee of $139 is accompanied by travel benefits that more than justify the expense, supported by generous welcome bonuses. The wide merchant acceptance of the Aeroplan loyalty program makes this card great for maximizing travel rewards.

TD Aeroplan Visa Infinite Card Features

- 1.5x Aeroplan points on groceries, gas, and Air Canada spending.

- Possesses an Air Canada ticket with free priority check-in.

- Preferred boarding & NEXUS rebate.

- Strong travel protection.

- Requires \$139 as an Annual fee.

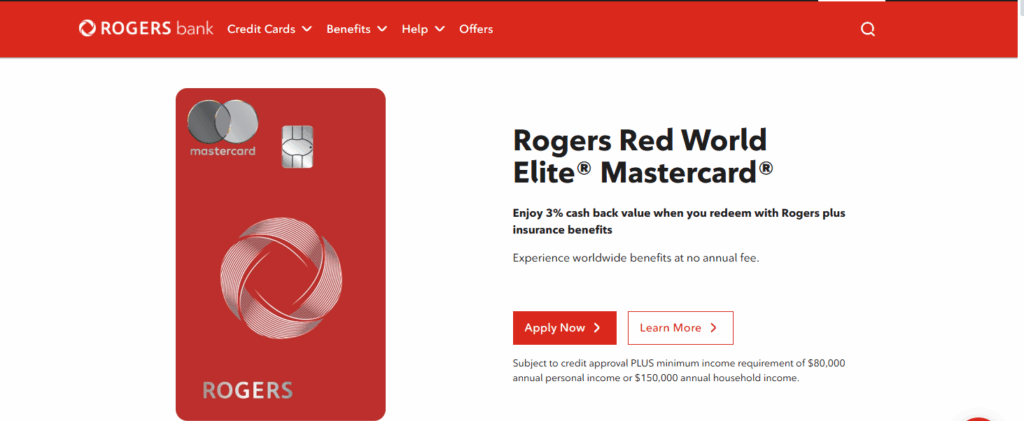

5. Rogers Red World Elite Mastercard

Rogers Red World Elite Mastercard has a competitive cash-back rewards program with no annual fee attached to it. Users earn 1.5% cash back on purchases with the percentage increasing to up to 2% for Rogers, Fido, or Shaw customers.

This Rogers card is also quite popular for its additional features including travelers insurance, insurance for renting cars, and purchase protection.

There are prerequisites that come with this card such as a minimum personal income of $80000 which restricts access to a lot of people but does come with perks like concierge service and assistance while traveling with a world elite mastercard.

Overall due to the no annual fee and solid earns for the everyday spender who utilizes Rogers services makes this card a very wise choice.

Rogers Red World Elite Mastercard Features

- All purchases reward a cashback of 1.5%.

- For Rogers, Shaw, and Fido clients, the cash back can go as high as 2%.

- Has no Annual fees

- Includes tourist protection and concierge services

- World Elite Mastercard benefits

6. Neo World Elite Maestro Card

The Neo World Elite Mastercard is a perfect fit for local shoppers, as it provides exceptional cash-back rewards and does not charge an annual fee.

Cardholders also benefit from travel insurance, mobile device protection, and exclusive offers available through the Neo app. This card differs from others in that it uses a list of growing Canadian retailers to provide better returns.

Even if rewards differ by merchant, the possibility of earning much more than the typical 1-2% cards is attractive. This card is ideal for those who want tailored rewards and premium features.

Neo World Elite Mastercard Features

- Up to 5% cashback from Neo partners.

- Rewards of your choice.

- Mobile device and travel insurance.

- No fees annually.

- With digital experience, the card comes with immediate approval.

7. CIBC Dividend Visa Infinite Card

The CIBC Dividend Visa Infinite Card is one of the leading cash-back Visa cards in Canada considering its features for families. Fuel and grocery cash backs are set at 4% while public transport, utilities, and subscriptions receive 2%.

Everything else earns a 1% cash back. This card also covers travel-related emergencies, provides mobile device protection, and protects purchases made with the card. Its \$120 annual fee is less than other cards, often waived in the first year.

Visa Infinite perks such concierge access and generous hotel booking discounts are also included. Users looking to earn cash back on essential purchases will find this card appealing, especially with the additional travel and lifestyle perks offered.

CIBC Dividend Visa Infinite Card Features

- 4% cashback on gas and groceries.

- 2% on public transit and automatic payments.

- 1% on all other expenses.

- Cable and telephone company benefits.

- \$120 yearly payment.

8. SimplyCash® Preferred Card from American Express

The SimplyCash® Preferred Card from American Express is Canada’s leader for flat-rate cash back cards. It offers 2% unlimited cash back on all purchases and up to 4% on eligible gas and grocery spending for the first six months.

The card also comes with car rental theft and damage insurance, purchaser’s insurance, and warranty insurance. It has a \$119.88 annual fee (\$9.99/month) and no income requirement. This mean lots of users can get the card.

The lack of rotating reward categories or cashback caps means this card is great for users looking for straightforward solutions to maximizing rewards on their spending.

SimplyCash® Preferred Card from American Express Features

- Any purchases attract 2% unlimited cashback.

- As well as increasing up to 4% promo on gas and groceries.

- Solid rental purchase and car insurances.

- $9.99 (monthly) / 119.88 a yr.

- No income threshold.

9. BMO Ascend World Elite Mastercard

The BMO Ascend World Elite Mastercard is arguably the best travel credit card in Canada. It offers 5x points on travel, 3x on dining and entertainment and 1x on the rest. It comes with four free airport lounge visits per year via DragonPass and comprehensive travel insurance with mobile device insurance.

There is a \$150 annual fee, but this is often waived in the first year via promo offers. Exclusive access to certain events and concierge services are also available to cardholders.

This card is strongly competitive and valuable for frequent travelers who want rewarding low-fee travel, as these features are very appealing for someone who frequently travels.—

BMO Ascend World Elite Mastercard Features

- Earn 5x points for traveling and 3x for dining and entertainment.

- Four participations of business lounge access (DragonPass) are included.

- Covers travel and personal device insurance.

- Accessible with company concierge.

- 150 a year but usually no charge first year.

10. Neo Secured Mastercard

Mastercard’s Neo Secured World Elite is the best in its class for those in Canada trying to establish or improve their credit. Even though it requires payment of a refundale security deposit, it earns cash back on purchases with partnered merchants sitting at 5%!

Unlike most secured cards, it includes perks like mobile access, tailored offers, and no annual fee. Because it is less stringent with having and maintaining good credit, it is perfect for students and newcomers to Canada.

The card is a great fit for anyone trying to raise their credit score while earning rewards and having a user friendly digital interfce.

Neo Secured Mastercard Features

- Deposit leads to guaranteed approval.

- Cashback offered through partnered merchants.

- No yearly payment.

- Good for building credit.

- Convenient control via Neo app

Conclusion

The best credit card in Canada depends on one’s spending activities and the goals set. Whether search is being made for tier one travel rewards, or top cash-back offers, or even a secured card for credit-building, there’s always something that can be turned to.

The flexibility in rewards the American Express Cobalt Card offers is at par with the Neo Secured Mastercard that aids with credit-building. These are the best cards for Canadian consumers in 2025 with consideration to value, perks, and overall savings.