In this article, I will talk about the Best Cross-Chain Aggregators For Small Transactions, noting their quick processing times, low fees, and smooth cross-chain swapping.

No matter if you want the most cost-efficient deals, low slippage, or extensive blockchain support, these aggregators efficiently solve the problem of transferring assets between networks at minimal expenses. Let’s examine the best options!

Key Features & Best Cross-Chain Aggregators For Small Transactions

| Aggregator | Key Features |

|---|---|

| 1inch | A decentralized exchange (DEX) aggregator that optimizes trades by finding the best prices across multiple exchanges. |

| DeFiLlama | A decentralized finance (DeFi) analytics platform providing data on Total Value Locked (TVL) across multiple protocols. |

| OpenOcean | A cross-chain DEX aggregator that offers optimal prices by comparing liquidity across different DEXes. |

| Matcha | A DEX aggregator with a focus on providing the best price for trades and low fees. |

| ParaSwap | Offers smart routing to find the best prices on the DeFi market with reduced slippage. |

| Across Protocol | Enables cross-chain transfers, optimizing for the lowest cost and fast bridging between blockchains. |

| Synapse Protocol | Facilitates cross-chain liquidity and interoperability for DeFi applications. |

| Portal Token Bridge | Provides seamless cross-chain token transfers with a focus on speed and cost-efficiency. |

| Hop Protocol | A cross-chain liquidity protocol that provides fast and low-cost transfers across Ethereum Layer 2 networks. |

| Allbridge | A cross-chain bridge allowing users to transfer assets between different blockchains. |

1. 1inch

1inch is a decentralized exchange (DEX) aggregator that consolidates liquidity from numerous DEXs to provide users with the best possible rates for token swaps.

Its Pathfinder algorithm determines the optimal trading path for every token swap to limit slippage as well as costs.

Operates on Ethereum, Binance Smart Chain, Polygon, and others, 1inch is more beneficial for smaller transactions since it can split orders among several liquidity providers which helps guarantee better prices and lower rates on fees.

1inch

Pros:

- Aggregation: Provides the best rates by pulling liquidity from various DEXs.

- Competitive Rates: Advanced algorithm drives better prices most of the time.

- User-Friendly: Both beginners and advanced users will love the interface.

- Gas Optimization: Cost on gas fees is lowered by splitting trades across platforms.

- Wide Token Support: A diverse selection of tokens spanning several chains is supported.

Cons:

- Complexity: Beginners might have trouble navigating advanced features.

- Slippage: Trades of large volume may still encounter slippage despite aggregation.

- Dependence on Liquidity: Rates depend heavily on external DEX liquidity.

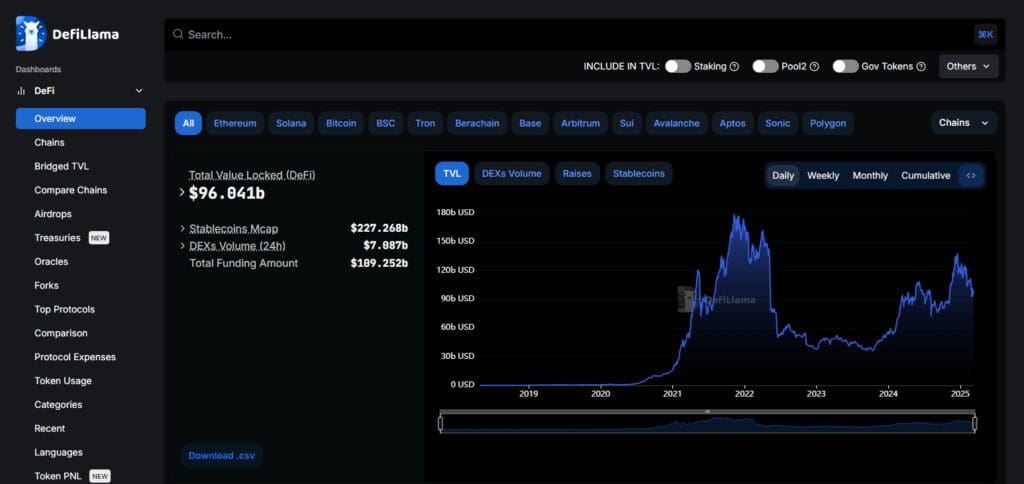

2. DeFiLlama

DeFiLlama is an exhaustive DeFi analytics solution that consolidates information from multiple protocols and blockchains.

DeFiLlama is not a classical DEX aggregator, but it offers a wide range of data pertaining to liquidity pools, total value locked (TVL), and other relevant metrics.

Such data can help users decide where it is best to perform small transactions by choosing ones with sufficient liquidity and optimal trading conditions.

DeFiLlama

Pros:

- Comprehensive Data: Tracks the TVL of protocols and chains, at the core of DeFi.

- Transparency: Devoid of bias, the data presented is trustworthy and clear-cut.

- Free to Use: You do not have to shell out money for data and analytics.

- Multi-Chain Support: Offers support for varying protocols and chains.

Cons:

- No Trading: Direct trading or swapping is unavailable as it is an analytics tool.

- Overwhelming Data: The amount of data may be so voluminous that it confuses beginners.

- Delayed Updates: Current info is not guaranteed.

3. OpenOcean

OpenOcean is a cross-chain DEX aggregator which combines both centralized and decentralized exchanges to provide clients with the best available prices.

OpenOcean’s liquidity check across numerous platforms guarantees the lowest slippage and competitive rates, which is favorable for small transactions.

OpenOcean also operates on Ethereum, Binance Smart Chain, and Solana among others, giving users access to a wide range of trading options.

Open Ocean

Pros:

- Cross-Chain Support: Liquidity is aggregated from multiple chains and blockchains.

- Best Price Routing: Algorithms determine optimal trade route.

- Low Fees: Lower fee compared to others.

- User-Friendly: Easy for all traders due to simple interface.

Cons:

- Limited Features: Does not offer advanced options like 1inch.

- Smaller Ecosystem: Aggregate has less liquidity and fewer integrations.

- Slippage Risk: Slippage still affect some large orders.

4. Matcha

To give users the best trading prices from multiple DEXs, Matcha skims the liquidity of all DEXs. With its straightforward design and clear pricing, both beginner and veteran traders can easily use it.

Matcha’s enhancement of cross-chain token swaps allows for effortless blockchain token trading.

This versatility increases value for minor transactions since fewer steps and lower fees are required.

Matcha

Pros:

- Powered by 0x: Reliable trading system infrastructure is provided by 0x.

- Best Price Execution: Makes sure customers cash out on the best deals by aggregating liquidity.

- User Friendly: Simple to follow and quite uncluttered.

- Low Fees: Competitive pricing compared to other platforms.

Cons:

- Limited Chains: Remains centered around Ethereum.

- Less customization: Does not allow changeable trade features.

- Dependence on 0x: 0x adds liquidity with and infrastructure unto its stock meaning less flexibility.

5. ParaSwap

ParaSwap is a DEX aggregator that aims to achieve the most optimal token swapping on the market using the latest technology.

By employing a number of DEXs and market liquidity providers, ParaSwap efficiently manages cuts in trading of low-value trades.

Its connections with other blockchains like Ethereum and Polygon gives users more freedom as to where they can buy and sell their assets.

ParaSwap

Pros:

- Multi-Chain Support: Ethereum, Binance Smart Chain, Polygon, etc.

- Gas Optimization: Routing efficiency lowers gas fees.

- Wide Token Support: A large number of tokens are covered.

- API for Developers: Developers are encouraged to work on integrating ParaSwap.

- Slippage: Even bigger trades are still vulnerable to slippage.

- Limited Liquidity: Not as large as the liquidity pools for the leading DEXs.

Cons:

- Currently supports only seven blockchains, limiting cross-chain capabilities.

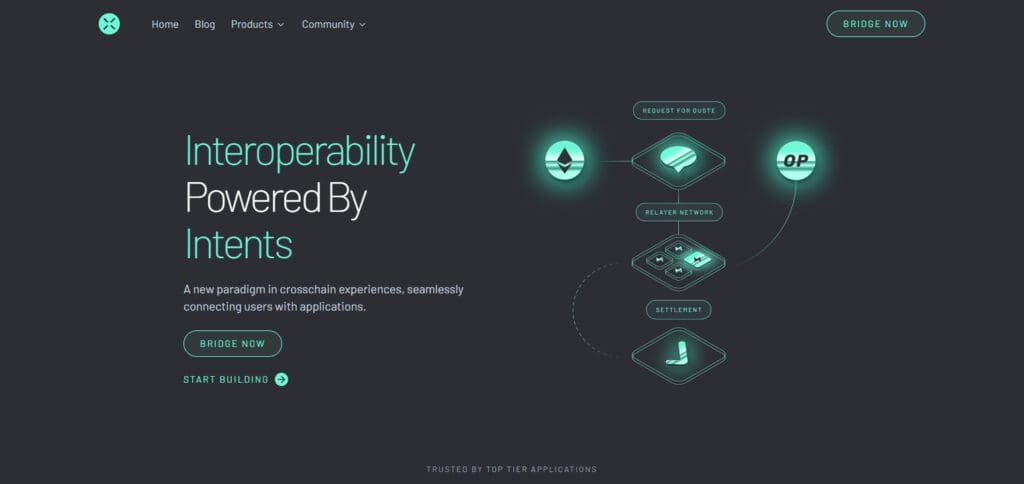

6. Across Protocol

Across Protocol is a cross-chain bridge to quickly and economically send assets from Ethereum to Layer-2, or the other way.

With an intents-based architecture, Around Protocol effortlessly passes the threshold to make those lightning fast transfers possible while keeping costs at a minimum.

That’s why it’s perfect for small businesses. The sole purpose of receiving cross-chain assets makes it ideal for secure transfers.

Across Protocol

Pros:

- Fast Cross-Chain Transfers: Strives for speed and efficiency.

- Low Fees: Affordable rates are offered for cross-chain swaps.

- Security: Cross-chain switch utilizes a decentralized validator network for transaction security.

- User-Friendly: Transfers can be easily made through the interface.

Cons:

- Limited Chains: Offers fewer chains than a lot of participants in the race.

- Less Liquidity: Less liquid markets for various tokens.

- Early Stage: Development stage so there are limited features.

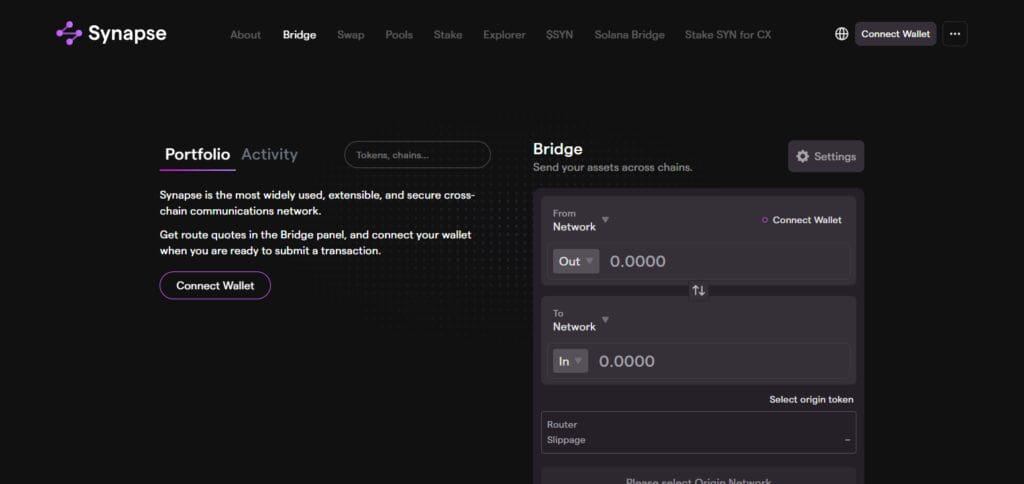

7. Synapse Protocol

Emphasizing security and speed, Synapse Protocol supports the swaps and transfer on the multiple blockchains.

The different forms of liquidity that are brought together through the bridging mechanism ensures high liquidity while minimizing slippage.

Ethereum, Binance Smart Chain and Avalanche are some of the blockchains Synapse Protocol supports which helps users who perform smaller transactions because of its flexibility.

Synapse Protocol

Pros:

- Cross-Chain Swaps: Allows hassle-free swaps in several chains.

- Staking Options: Additional staking rewards are offered.

- Low Fees: Reasonable charges are associated with cross-chain transactions.

- User-Friendly: The platform can be operated without prior training.

Cons:

- Limited Chains: Fewer blockchains that can be used in comparison to other service providers.

- Less Liquidity: Limited amount of liquid assets that can be used for certain tokens.

- Early Stage: Still developing, so may have fewer features.

8. Portal Token Bridge

With an emphasis on decentralized token bridge assets, Portal focuses on different blockchains.

It provides a cheaper method for moving assets from one network to another by enabling effortless cross-chain token transfers.

The service is designed for users who wish to make small transactions quickly and without steep service fees pour value.

Portal Token Bridge

Pros:

- Cross-Chain Support: Allows for transfer of tokens across multiple blockchains.

- Security: Relies on decentralized validators for transaction security.

- User-Friendly: Simple interface for cross-chain transfers.

- Low Fees: Reasonable charges are associated with cross-chain transactions.

Cons:

- Limited Chains: Fewer blockchains that can be used in comparison to other service providers.

- Less Liquidity: Smaller liquidity pools for specific tokens.

- Develoment: Still in progress, thus may lack some features.

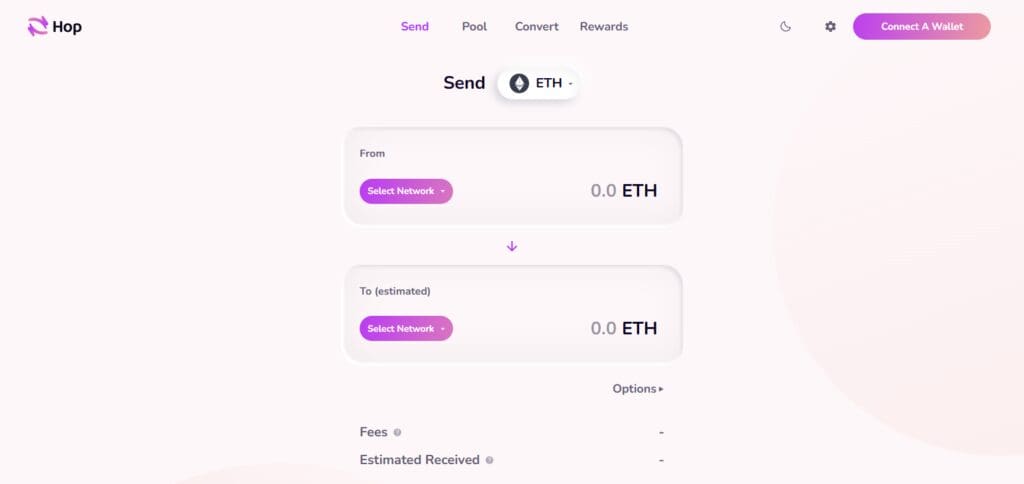

9. Hop Protocol

Hop Protocol serves as a cross-chain liquidity protocol that offers users quick and affordable transfers within Ethereum’s Layer-2 networks.

Optimism and Arbitrum are two layer 2 solutions that Hop Protocol uses to transfer tokens from Ethereum which ensures transactions are processed at a low cost.

It is designed for those looking for smaller transactions by ensuring quick and cheap movement of assets.

Hop Protocol

Pros:

- Fast Transfers: Designed for efficient cross-chain transfer speed.

- Low Fees: Affordable fee structure for swaps between chains.

- User-Friendly: Intuitive for new users.

- Wide Token Support: Accepts numerous tokens.

Cons:

- Less Popular Chains: Less supported chains when compared to other protocols.

- Less Liquidity: Smaller liquidity pools for certain tokens.

- Development: Still in progress, thus lacking some features.

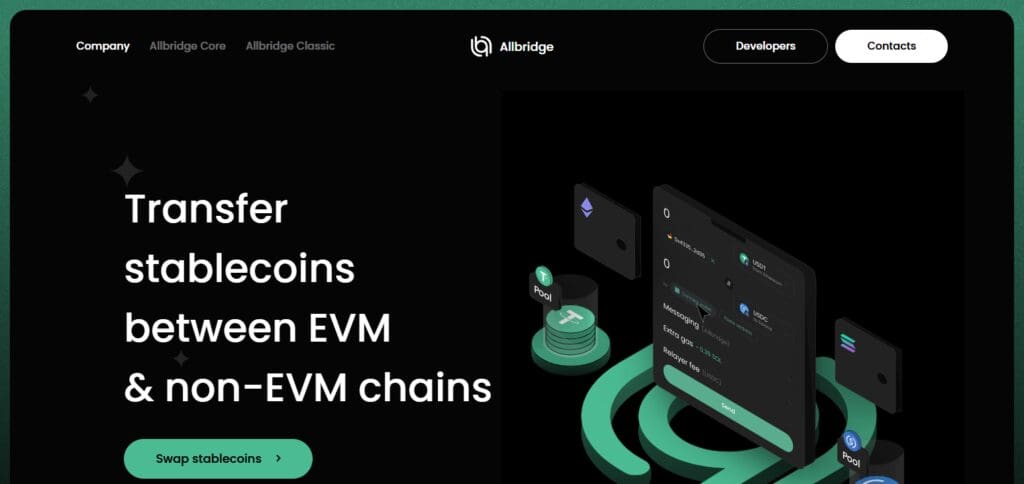

10. Allbridge

Users can transfer assets from different blockchains using Allbridge a crosschain bridge.

Allbridge provides convenience to users seeking to transfer assets between ecosystems by allowing them to operate in multiple networks.

The platform’s interface is easy to navigate, and its low-fee policy makes it inexpensive for small transfers, enabling users to bridge assets without incurring hefty charges.

Allbridge:

Pros:

- Cross-Chain Support: Allow transfer of tokens across diverse blockchains.

- Wide Token Support: Accepts and supports many types of tokens.

- Low Fees: Affordable fee structure for swaps between chains.

- User-Friendly: Easy to navigate especially for new users.

Cons:

- Less Popular Chains: Less supported chains when compared to other protocols.

- Less Liquidity: Smaller liquidity pools for certain tokens.

- Development: Still in progress, thus lacking some features.

Conclusion

1inch, OpenOcean, ParaSwap, and Matcha are convenient options for cross-chain aggregators that handle small transactions because of their extensive UI and blockchain coverage.

Their algorithms make it easier to route transactions therefore reducing waiting periods, slippage, and cost. These attributes help users with low budget cross-chain swaps. Also, across specific networks, there are other protocols like Synapse Protocol and Across Protocol which provide tailored services for quick and cheap transfers, further aiding ultra low budget transactions.