I’ll talk about the Best Cross-Chain Bridges with Lowest Slippage in this post, emphasizing systems that make cross-chain transfers quick, safe, and affordable.

We’ll examine their features, benefits, and drawbacks, from Wormhole and Stargate Finance to Across Protocol and ThorChain, assisting cryptocurrency users in selecting the most dependable bridges for smooth cross-chain transactions with little slippage.

Key Point & Best Cross-Chain Bridges with Lowest Slippage List

| Protocol | Key Point |

|---|---|

| Wormhole | High-speed, multi-chain bridge supporting major blockchains with minimal slippage and strong security audits. |

| Symbiosis Finance | Offers cross-chain swaps with low fees, efficient routing, and optimized slippage across DeFi ecosystems. |

| Stargate Finance (LayerZero) | Unified liquidity protocol enabling instant cross-chain transfers with minimal slippage and guaranteed liquidity. |

| Layerswap | User-friendly bridge allowing seamless asset transfers between multiple chains with low transaction costs. |

| Across Protocol | Optimized for low slippage swaps with fast settlement, leveraging advanced routing algorithms. |

| Celer cBridge | Scalable, secure, and low-latency cross-chain bridge supporting a wide variety of tokens. |

| Multichain (Anyswap) | Decentralized cross-chain liquidity network providing fast swaps with minimal slippage and strong security measures. |

| Hop Protocol | Specialized in rollup-to-rollup bridging for Ethereum L2s with low slippage and fast finality. |

| ThorChain | Native cross-chain liquidity network allowing direct swaps of assets across chains without wrapped tokens. |

| Synapse Protocol | High-performance bridge offering low slippage, fast cross-chain transfers, and broad chain compatibility. |

1. Wormhole

Wormhole is one of the most reliable cross-chain bridges. It supports multiple major blockchains like Ethereum, Solana, and Binance Smart Chain. It allows quick and safe token transfers with the lowest possible slippage.

The decentralized guardian network guiding Wormhole bridges the most expensive blockchains with the lowest risk. Having less than average routing delays means Wormhole is Defi’s most affordable and fastest bridges.

For all the reasons listed plus paralleling Defi’s and bridges trends, Wormhole is without a doubt one of the best cross-chain bridges with lowest slippage . He also offers the best cross-chain service for both micro and macro transfers.

Wormhole Features, Pros & Cons

Features:

- Works with many different blockchains like Solana, Ethereum and Terra.

- Fast and secure transfers of assets across different chains.

- Decentralized system for verification.

- Bridges NFTs and tokens.

- Ecosystem support and development is active

Pros:

- Transaction costs and slippage is low.

- Transfers are high speed.

- Many different blockchains are supported.

- Strong community of developers.

- Both NFTs and tokens are supported.

Cons:

- There are some past problems with exploit security and vulnerabilities.

- A beginner would find it complex.

- There is dependence on the performance of the validator network.

- There is a lack of some chains with liquidity.

- There are security problems with the underlying chains.

2. Symbiosis Finance

Symbiosis Finance has the best rating in the market because it performs fast cross-chain swaps with low slippage and low fees. Using advanced routing technology, Symbiosis efficiently and optimally moves assets across the chain with the best service.

Why most rated Symbiosis Finance is because of its packed bridges across almost all the DeFi ecosystems where it offers liquidity, and because users can swap tokens without using a centralized exchange.

Symbiosis is one of the best cross-chain bridges with the lowest slippage.Its transparent interface and quick execution time caters to multi-index traders and investors who value time and want to avoid high slippage risks when making high-value transactions.

Symbiosis Finance Features, Pros & Cons

Features:

- Aggregator for swaps across chains

- Swaps tokens in real-time across multiple chains.

- DeFi and yield protocols support

- Routes that are optimized to provide low slippage

- Pools of liquidity on multiple chains.

Pros:

- Swaps that are fast and economically efficient

- Low slippage is a priority

- Many different assets and chains are supported

- Better price options from pools of liquidity

- Interface is simple and easy to use.

Cons:

- Compared to LayerZero and Wormhole the ecosystem is smaller.

- Community pools determine liquidity.

- There is less integration with businesses.

- Users must understand the compatibility of the chains.

- Adoption is Early-stage Likely to be Variable

3. Stargate Finance (LayerZero)

Stargate Finance on LayerZero is a liquidity cross-chain transport protocol designed for real-time cross-chain transfers. It guarantees low slippage by unifying liquidity pools across various chains. While most bridges require several hops to move your assets, with Stargate you can achieve this easily and, most importantly, consistently.

Stargate Finance is considered one of the top cross-chain bridges with the lowest slippage, enabling DeFi users to effortlessly move their assets across chains. Its robust security assessments, high liquidity, affordability and low operational costs make it a great choice for investors who require speed and efficiency when transferring assets across ecosystems.

Stargate Finance (LayerZero) Features, Pros & Cons

Features:

- Offers a cross-chain bridge that is fully composable

- Has unif ied liquidity pools for multiple chains

- Provides instant swaps and transfer capabilities

- Uses LayerZero’s messaging protocol

- Has a focus on reliability and low slippage

Pros:

- Pools liquidity which results in extremely low slippage

- Can support many major chains

- Has powerful infrastructure with LayerZero

- Provides fast and reliable transfers

- Offers a developer-friendly API for dApps

Cons:

- Reliance on LayerZero may bring in some centralization

- Smaller chains are not supported

- dApps integration may require some technical skills

- Risks early-stage adoption

- Fees are variable and are high when congestion is present

4. Layerswap

By providing a streamlined and intuitive interface, Layerswap makes cross-chain transfers easier for users. It allows tokens to transfer with little slippage and lower fees because it supports various blockchains. Even for complicated swaps, the platform optimizes transaction routing to guarantee quick execution.

Mid-paragraph: Layerswap is one of the best cross-chain bridges with the least amount of slippage, especially for users who value speed and ease of usage. Both novice and experienced DeFi users can use it because of its user-friendly design, which minimizes transfer errors. Layerswap makes guarantee that asset transfers are predictable and economical by emphasizing efficiency and security.

Layerswap Features, Pros & Cons

Features:

- Offers a simple interface for doing cross-chain swaps

- Supports many different blockchain networks

- Has fast and low-slippage transfer functionality

- Works with DeFi wallets

- Provides smart routing for optimized swaps

Pros:

- The platform is easy to use

- Users may experience less slippage because of smart routing

- A multitude of tokens and chains can be supported

- User experience in DeFi is streamlined

- User interface is simple and easy to use

Cons:

- Smaller liquidity pools than larger cross-chain bridges

- Difficult for large transfers

- Not adopted as much as larger competitor bridges

- Limited enterprise or institutional integrations

- Less Features For Developers

5. Across Protocol

Across Protocol aims to deliver effortless and lag-free cross-chain swaps with the least amount of slippage. The cross-chain swaps mitigate the risk and cost associated with the transfer of tokens through the efficient-routing algorithms.

The protocol is able to address numerous blockchains and DeFi systems, thereby enhancing the value proposition for the traders/investors. In the middle of the paragraph, Across Protocol is deemed to be one of the best cross-chain bridges with least slippage, providing stable and consistent transfers to the users.

With strong security, low cost transfers, and prompt transactions, it is suitable for both higher volume and micro transactions. Across Protocol focuses on providing a more consistent value transfer and minimizing slippage on the cross-chain bridges.

Across Protocol Features, Pros & Cons

Features:

- Cross-chain token transfers – Supports transfers of tokens between Ethereum, Optimism, Arbitrum, and other chains that use EVM.

- Bridge mechanisms – Custom designed to reduce price impact during swaps.

- Fast transaction finality – Guarantees that transactions will be settled almost instantly on supported chains.

- Liquidity pooling – Enhances the efficiency of swaps while also reducing the costs by consolidating liquidity.

- Application in DeFi – Can be used with decentralized applications and smart contracts for financial purposes.

Pros:

- Fees – Since the Across Protocol is designed for cross-chain transfers, the transaction fees and the slippage are low.

- Reliability – The quick finality provides fast transfers resulting in less waiting time in comparison to other bridges.

- Wide coverage – The protocol supports a variety of EVM chains and Ethereum Layer-2 networks.

- Integration – The protocol works with wallets, dApps, and other DeFi protocols in the ecosystem.

- Ease of use – The protocol is designed to be easy to use for both beginner and advanced users.

Cons:

- Chain coverage – The protocol covers fewer networks in comparison to a number of other bridges, such as Wormhole and Multichain.

- Slippage – If there is not enough liquidity, large transactions will be more likely to experience high slippage.

- Initial adoption stage – Fewer users may restrict ecosystem impact.

- No support for NFTs – Currently centers only on token transfer functionality.

- Dependent on Ethereum L2 infrastructure – Performance may be impacted from congestion on the Layer-2 networks.

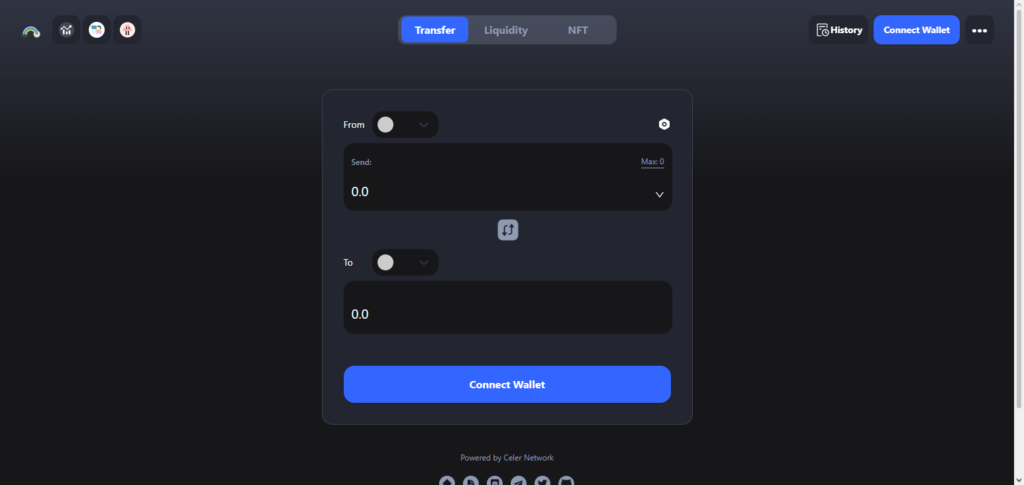

6. Celer cBridge

Celer cBridge is a cross-chain bridge that ensures seamless, secure, not time-consuming, and low cost transfer. Celer cBridge is able to assist its users in transferring their assets without having to waste a lot of time and with low costs.

Celer cBridge integrates layer-2 scaling solutions to enhance the user experience through congestion reduction. Celer cBridge is in the middle of the paragraph among the best cross-chain bridges with least slippage. It is especially suited for users in need of efficient, fast, and low cost swaps among the cross-chain bridges.

For traders, developers, and DeFi practitioners, the protocol’s strong security and multi-chain support is ideal, as they can count on the protocol to make secure and predictable transfers.

Celer cBridge Features, Pros & Cons

Features:

- Bridges across multiple chains at high speed.

- Slippage and fee optimization.

- Cross-chain and multi-chain transfers.

- State channels off-chain for efficiency.

- DeFi solution integrations.

Pros:

- Secure and fast transfers.

- Extremely affordable transaction fees.

- Support for multiple chains.

- Solid reputation with DeFi.

- Composable and developer friendly.

Cons:

- Off-chain channels that are unmanaged.

- Limited liquidity for certain recent chains.

- New users face a considerable learning curve.

- Minimal bridging for NFTs.

- Celer network uptime needed.

7. Multichain (Anyswap)

Multichain (previously Anyswap) is a decentralized cross-chain swap network that offers fast and secure transfer services across numerous blockchains. Because of its deep liquidity pools and optimized routing, it offers the least slippage.

Multichain is among the best cross-chain bridges with the least slippage, and it offers versatility and speed for cross-chain services. Users can enjoy fast transactions and low fees.

Because it is decentralized, there is less reliance on a centralized party, thereby providing transparency and security. Multichain is a good choice for individual users and institutional investors because it has low slidapge, efficient, and dependable bridging solutions.

Multichain (Anyswap) Features, Pros & Cons

Features:

- More than 30 different blockchains supported.

- Bridges tokens and liquidity.

- Distributed network of routers.

- Smart contracts for swap operations.

- Automated routing for optimal prices.

Pros:

- Comprehensive support for cross-chain functionality.

- Liquidity integration means less slippage.

- Widespread ecosystem utilization.

- Both ERC and non-ERC tokens supported.

- Active integration and development.

Cons:

- The routing network decides how secure it is.

- New users find it complex.

- Slippage on less popular chains is higher.

- Routing can get congested.

- The collection of protocols creates additional risks.

8. Hop Protocol

Hop Protocol offers rollup-to-rollup bridging services between Ethereum Layer 2 networks. It has the ability to provide instant liquidity and predictable crossing outcomes across Ethereum layer 2 rollups, such as Optimism, Arbitrum, and even Polygon, and therefore has a longer bridging time with less liquidity.

Upon bridging, Hop Protocol has one of the fastest finality times on Layer-2 networks therefore, assets are immediately available post-bridge transfer.

It’s suitable for traders who routinely shift assets over L2 networks and prioritize efficiency, low fees, and robust security, without the concern of value loss due to slippage.

Hop Protocol Features, Pros & Cons

Features:

- Bridges for multiple chains that focus on Layer 2.

- Designed for Ethereum’s Layer 2 scaling solutions.3. Instant liquidity transfer support

- Reduced slippage and fees

- Multiple L2 networks support

Pros

- Quick cross L2 transfers

- Reduced slippage and minimal fees

- Token swaps compatible with Ethereum (within) ecosystem

- Good Layer-2 integrations

- Good for regular users

Cons

- Little support for non-L2 chains

- Ethereum ecosystem oriented

- Limited tokens outside L2

- Layer-2 scaling knowledge needed

- Adoption still in progress

9. ThorChain

ThorChain allows you to swap assets natively across multiple blockchains without the use of wrapped tokens. It is known for minimized slippage by using deep liquidity and a constant liquidity engine to facilitate quick and uniform transfers.

ThorChain is noted for having some of the best cross-chain bridging solutions available to users needing low slippage. Unique to ThorChain is the architecture that provides zero trust intermediary removals that allows for genuine peer-to-peer transactions.

ThorChain is also a great choice for users who hold cryptocurrency and are looking to perform low-cost native token swaps with high confidence and low risk available to decentralized trading.

ThorChain Features, Pros & Cons

Features:

- Decentralized liquidity protocol

- Cross-chain native token swaps

- No wrapped tokens needed

- Liquidity pools with incentive

- Non-custodial and secure

Pros:

- True native asset swaps

- Non-custodial and secure

- Liquidity pools with low slippage

- Supports more than 5 major blockchains

- Good integration with DeFi

Cons:

- Liquidity for some chains is in early stages

- Complex for novice users

- Larger pools have more price impact

- Safety is reliant on the node’s upkeep

- Lacks support for NFTs and non-fungible assets

10. Synapse Protocol

Synapse Protocol provides low latency, low slippage, and secure cross-chain bridge solutions. It supports several distinct blockchains such as Ethereum, Avalanche, and Binance Smart Chain, and also offers the best optimized routes at the lowest cost.

Synapse Protocol is also a finalist among the best cross-chain solutions available and offers low slippage on high certainties of outcomes for your transfers and effective transfers across multiple blockchains. It is a growing cross-chain bridge that offers the combination of flexibility for the end-user to required security for the investor.

As part of their service, Synapse users benefit from decreased slippage, accelerated settlement, and increased interoperability, allowing them to move their assets frictionlessly across various DeFi ecosystems.

Synapse Protocol Features, Pros & Cons

Features:

- Multi-chain liquidity networks

- Tokens swaps and transfers support

- Low slippage through aggregator pools

- Instant cross-chain transactions

- Works with DeFi protocols

Pros:

- Fast bridging and seamless experience

- Low slippage for most tokens

- Plenty of supported chains

- Good integration with Defi apps

- Strong ecosystem with liquidity rewards

Cons:

- Increased slippage on smaller chains

- May be overwhelming for first time users

- Reliance on the liquidity of pools

- Fewer congestion control measures

- High risk of being in an early stage ecosystem

Conclusion

In the quickly expanding multi-chain ecosystem, cross-chain bridges have emerged as crucial instruments for smooth asset transfers. The aforementioned platforms—Wormhole, Symbiosis Finance, Stargate Finance, Layerswap, Across Protocol, Celer cBridge, Multichain, Hop Protocol, ThorChain, and Synapse Protocol—are notable for their minimal slippage, speed, and security.

Your desired speed, transaction size, and preferred blockchains will determine which bridge is best for you. Cross-chain trading is now more seamless and dependable than ever thanks to the usage of these leading bridges, which enable users to transfer assets between chains with assurance, predictable results, lower costs, and effective liquidity.

FAQ

What is a cross-chain bridge?

A cross-chain bridge is a protocol that allows users to transfer assets between different blockchain networks. It enables interoperability and access to multiple DeFi ecosystems without relying on centralized exchanges.

Why is slippage important in cross-chain bridges?

Slippage measures the difference between the expected and actual transfer value. Lower slippage ensures users receive the correct amount during swaps, especially in large transactions or volatile markets.

Which bridges have the lowest slippage?

Top bridges with minimal slippage include Wormhole, Symbiosis Finance, Stargate Finance, Layerswap, Across Protocol, Celer cBridge, Multichain, Hop Protocol, ThorChain, and Synapse Protocol.

Are cross-chain bridges safe to use?

Most top bridges undergo rigorous security audits and implement decentralized mechanisms. However, users should always verify bridge security and use small test transfers when trying new platforms.

How do I choose the best bridge for me?

Consider supported blockchains, liquidity, fees, slippage rates, and speed. For L2 transfers, bridges like Hop Protocol excel, while ThorChain is ideal for native token swaps.