In this article, I will discuss the Best Cross-chain Deflationary Tokens To Watch.

These tokens are unique because they utilize both deflationary mechanisms and cross-chain capabilities, adding value for users and improving interoperability on different blockchain platforms.

Irrespective of whether you are an experienced investor or a rookie, these tokens will be profitable in the future.

Key Point & Best Cross-chain Deflationary Tokens To Watch List

| Cryptocurrency | Key Point |

|---|---|

| Chainlink (LINK) | Decentralized oracle network, bridges smart contracts to real-world data |

| SafeMoon (SAFEMOON) | Focused on tokenomics with reflection, liquidity pool, and burn mechanism |

| Bitcoin (BTC) | First and largest cryptocurrency, decentralized peer-to-peer network |

| Flockerz (FLOCK) | Social platform-based token, combines blockchain with online communities |

| Polygon (MATIC) | Layer 2 solution scaling Ethereum with lower fees and faster transactions |

| Tezos (XTZ) | Self-amending blockchain with on-chain governance and focus on security |

| Cardano (ADA) | Research-driven blockchain with a focus on scalability and sustainability |

| Stellar (XLM) | Designed for fast, low-cost cross-border payments and remittances |

| Binance Coin (BNB) | Native token of the Binance exchange, used for trading and transaction fees |

| Ethereum (ETH) | Leading smart contract platform with decentralized applications (dApps) |

1.Chainlink (LINK)

Chainlink takes the spotlight as a multi-chain deflationary token because of its integrated decentralized oracle network that provides accurate and dependable data feeds for smart contracts across different blockchains.

Its capacity to bridge off-chain data to on-chain services makes Chainlink a vital component in decentralized finance and far beyond it.

LINK’s deflationary mechanism reduces supply over time which adds value and improve its potential in the blockchain ecosystem.

| Detail | Description |

|---|---|

| Token Name | Chainlink (LINK) |

| Primary Use Case | Decentralized oracle network connecting smart contracts with real-world data |

| Deflationary Mechanism | LINK tokens used for staking, reducing supply through network usage |

| Cross-Chain Compatibility | Interoperable with multiple blockchains and decentralized applications (dApps) |

| Transaction Speed | Fast and reliable oracle data delivery |

| KYC Requirements | Minimal KYC required for decentralized exchanges |

| Market Position | Leading oracle solution in the DeFi and blockchain ecosystem |

2.SafeMoon (SAFEMOON)

With its distinct tokenomics, SafeMoon (SAFEMOON) is undoubtedly one of the leaders in the cross-chain deflationary token market.

Its unique fee system allows deflationary burns, as a certain percentage of each transaction is given to holders while tokens are permanently removed from circulation.

This particular model allows for the increase of scarcity over time. Furthermore, SafeMoon is developing its ecosystem on a number of blockchains, increasing its reach and utility, making it one of the most interesting tokens in the crypto world.

| Detail | Description |

|---|---|

| Token Name | SafeMoon (SAFEMOON) |

| Primary Use Case | Tokenomics-driven with reflection, liquidity, and burn mechanisms |

| Deflationary Mechanism | Transaction fees are burned and redistributed to holders |

| Cross-Chain Compatibility | Expanding across multiple blockchains |

| Transaction Speed | Moderate transaction speed with low fees |

| KYC Requirements | Minimal KYC required for decentralized exchanges |

| Market Position | Popular for its unique tokenomics and growing community |

3.Bitcoin (BTC)

Bitcoin (BTC) maintains strong standing in the category of cross-chain deflationary tokens thanks to its maximum supply of 21 million coins which guarantees scarcity and deflationary pressure.

Bitcoin is the oldest and most well-known cryptocurrency and is progressively getting adopted throughout different blockchain systems, improving its utility.

Being decentralized and having a strong network makes Bitcoin a valuable asset that has capture support from many decentralized applications and cross-chain projects.

| Detail | Description |

|---|---|

| Token Name | Bitcoin (BTC) |

| Primary Use Case | Digital gold, store of value, and decentralized currency |

| Deflationary Mechanism | Fixed supply of 21 million coins ensures scarcity |

| Cross-Chain Compatibility | Increasing use in cross-chain bridges and DeFi applications |

| Transaction Speed | Relatively slower transactions compared to newer networks |

| KYC Requirements | Minimal KYC required for decentralized exchanges |

| Market Position | First and most well-known cryptocurrency, dominant in market cap |

4.Flockerz (FLOCK)

Flockerz (FLOCK) is establishing itself as a notable cross-chain deflationary token due to its integration with social platforms and online communities.

Flockerz is able to uniquely combine social interaction with blockchain technology and digital engagement that is powered by deflationary mechanics, where transaction fees are burned.

With the ability to operate across multiple blockchains, Flockerz ensures accessibility within the crypto space, increasing its value as an investment in social innovation and sustainable tokenomics.

| Detail | Description |

|---|---|

| Token Name | Flockerz (FLOCK) |

| Primary Use Case | Social platform integration, digital engagement, and community rewards |

| Deflationary Mechanism | Transaction fees burned to reduce supply over time |

| Cross-Chain Compatibility | Supports cross-chain interaction with various blockchain ecosystems |

| Transaction Speed | Fast transactions with minimal fees |

| KYC Requirements | Minimal KYC required for decentralized platforms |

| Market Position | Emerging token with a focus on social blockchain integration |

5.Polygon (MATIC)

Polygon (MATIC) emerges as a premium cross-chain deflationary token owing to its adept scaling of Ethereum at lower transaction fee and faster processing times.

Its layer-2 solution is unique in that it facilitates the operation of decentralized applications (dApps) on multiple blockchains, and it is also deflationary in nature over time.

MATIC is a phenomenal and valuable token in the crypto world because of its versatility and Polygon’s supporting ecosystem across chains makes it more appealing.

| Detail | Description |

|---|---|

| Token Name | Polygon (MATIC) |

| Primary Use Case | Scaling Ethereum with Layer-2 solutions, dApps, and DeFi |

| Deflationary Mechanism | Regular token burns to reduce circulating supply |

| Cross-Chain Compatibility | Supports Ethereum and other blockchains for interoperability |

| Transaction Speed | Fast transactions with low fees |

| KYC Requirements | Minimal KYC required for most decentralized exchanges |

| Market Position | One of the top Layer-2 solutions in crypto |

6.Tezos (XTZ)

Tezos (XTZ) is an exemplary example of a cross-chain deflationary token due to its self-amending blockchain as well as on-chain governance.

This peculiar characteristic permits evolution of Tezos without the need of hard forks guaranteeing sustainability.

Deflationary mechanics alongside focus on scalability and security makes Tezos the go-to option for multi blockchain decentralized applications. Appreciating the constant network upgrades, XTZ is the token to look out for.

| Detail | Description |

|---|---|

| Token Name | Tezos (XTZ) |

| Primary Use Case | Smart contracts, decentralized applications, and governance |

| Deflationary Mechanism | Token burns via transaction fees and governance processes |

| Cross-Chain Compatibility | Interoperable with multiple blockchains and platforms |

| Transaction Speed | High throughput with low-cost transactions |

| KYC Requirements | Minimal KYC required for decentralized platforms |

| Market Position | Known for its on-chain governance and sustainability |

7.Cardano (ADA)

Cardano’s (ADA) unique, research-focused business model makes it one of the top deflationary tokens. This is further bolstered by its use of the proof-of-stake consensus mechanism as it guarantees energy efficiency and scalability.

Furthermore, Cardano’s strong focus on multi-chain interoperability allows better utility and communication for other blockchains as well. Its capped supply guarantees long-term scarcity which is a big assist for its deflationary features.

Along with ongoing improvements, these features make Cardano a powerful and sustainable option for investors and developers looking to use cross-chain technology.

| Detail | Description |

|---|---|

| Token Name | Cardano (ADA) |

| Primary Use Case | Decentralized applications (dApps), smart contracts |

| Deflationary Mechanism | Limited token supply with staking rewards reducing circulating supply |

| Cross-Chain Compatibility | Focus on interoperability with other blockchain networks |

| Transaction Speed | Fast and scalable transactions with low fees |

| KYC Requirements | Minimal KYC required for most decentralized platforms |

| Market Position | Leading proof-of-stake blockchain with strong development focus |

8.Stellar (XLM)

Stellar XLM is one of the forerunners as a cross-chain deflationary token which facilitates fast and cheap cross-border payments.

The unique consensus algorithms for Stellar are Stellar’s deflationary model with a capped token supply SCP and a multi- blockchain token which solves the security and transaction efficiency problem.

XLM is becoming invaluable with the growing network of financial institutions and improvement of cross-chain interoperability in decentralized finance and international payments.

| Detail | Description |

|---|---|

| Token Name | Stellar (XLM) |

| Primary Use Case | Cross-border payments and remittances |

| Deflationary Mechanism | Token burns through network activity and transaction fees |

| Cross-Chain Compatibility | Enables interoperability between various financial networks |

| Transaction Speed | Fast, low-cost transactions with high scalability |

| KYC Requirements | Minimal KYC required for decentralized exchanges |

| Market Position | Key player in the remittance and financial sector |

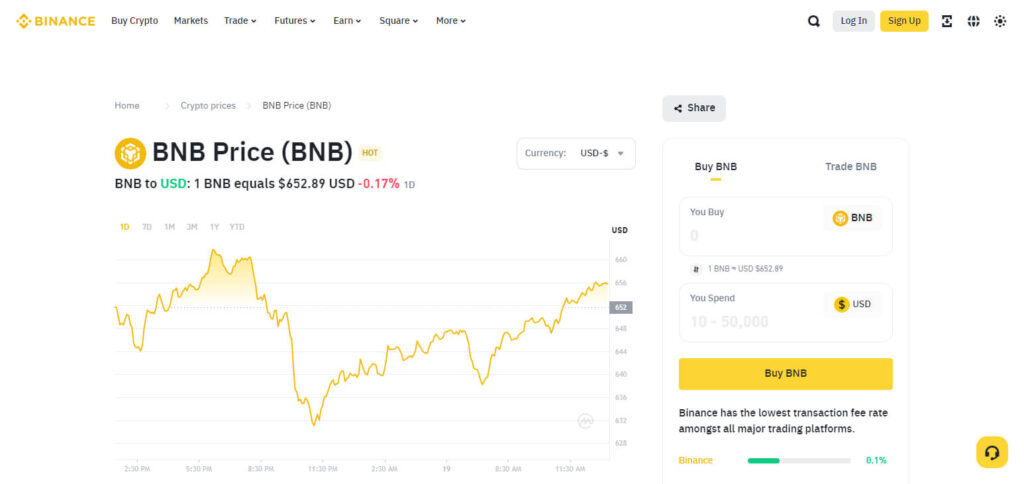

9.Binance Coin (BNB)

Due especially to its integration in the Binance ecosystem as well as its utility across multiple blockchains, Binance Coin (BNB) is well known as a prominent cross-chain deflationary token.

BNB, which serves as the native token for the Binance Smart Chain (BSC), enables rapid, inexpensive transactions along with the provision of supporting decentralized applications.

Over time, the supply is ensured to be reduced due to BNB’s regular token burns, which serve as a deflationary mechanism.

All of these factors put together, along with BNB’s expanding use cases, BNB is predicted to be one of the top tokens to watch in the crypto space.

| Detail | Description |

|---|---|

| Token Name | Binance Coin (BNB) |

| Primary Use Case | Utility within the Binance ecosystem, transaction fees, and DeFi applications |

| Deflationary Mechanism | Regular token burns to reduce supply over time |

| Cross-Chain Compatibility | Supports multiple blockchains, including Binance Smart Chain |

| Transaction Speed | Fast, low-cost transactions |

| KYC Requirements | Minimal KYC required for decentralized platforms |

| Market Position | Leading exchange-native token with strong utility in DeFi |

10.Ethereum (ETH)

Ethereum (ETH) continues to rank among the most groundbreaking cross-chain deflationary tokens due to its unparalleled position in smart contracts and decentralized applications.

Ethereum 2.0 becoming proof-of-stake further enhances its energy efficiency and scalability.

Its deflationary mechanism is the Ethereum Improvement Proposal (EIP) 1559, which contains a deflationary burning component designed to decrease the total supply of ETH over time.

Its adaptability across multiple chains and the ever-expanding ecosystem are key contributors to deflationary Ethereum’s importance in the decentralized finance (DeFi) world.

| Detail | Description |

|---|---|

| Token Name | Ethereum (ETH) |

| Primary Use Case | Smart contracts, decentralized applications (dApps), and DeFi |

| Deflationary Mechanism | EIP-1559 burning mechanism reduces ETH supply over time |

| Cross-Chain Compatibility | Increasing cross-chain capabilities via Layer-2 solutions and bridges |

| Transaction Speed | Fast transactions, with Ethereum 2.0 enhancing scalability |

| KYC Requirements | Minimal KYC required for decentralized exchanges and platforms |

| Market Position | Leading blockchain for dApps and DeFi with the largest ecosystem |

Conclusion

In summary, leading deflationary cross-chain tokens including Chainlink (LINK), SafeMoon (SAFEMOON), Bitcoin (BTC), Flockerz (FLOCK), Polygon (MATIC), Tezos (XTZ), Cardano (ADA), Stellar (XLM), Binance Coin (BNB), and Ethereum (ETH) are highly deflationary while providing strong scalability features.

Their growing supply reduction capabilities and effortless cross blockchain interoperability places these tokens at a strong position to shape the future of decentralized finance together with blockchain technology.