This article will explore the Best Crypto Compliance Tools for Non-Custodial Wallets give customers complete control over their money in the quickly changing world of cryptocurrency. However, there are security and regulatory obstacles associated with this independence.

Crypto platforms are depending more and more on sophisticated compliance solutions to guarantee compliance, stop fraud, and identify illegal conduct.

Chainalysis KYT, Scorechain, Elliptic, and other solutions bridge the gap between decentralization and regulatory accountability by offering real-time monitoring, wallet risk rating, KYC/KYB verification, and automatic alerts.

Key Point

| Tool | Key Point |

|---|---|

| Chainalysis KYT | Real-time transaction monitoring and risk scoring for addresses on multiple blockchains. |

| Scorechain | AML compliance platform with wallet risk assessment and alerts for suspicious activity. |

| Elliptic | Blockchain analytics for AML, sanctions screening, and investigative tools. |

| TRM Labs | Comprehensive blockchain intelligence offering transaction tracing and risk scoring. |

| Blockpass | KYC/KYB identity verification and compliance layer suitable for Web3 and wallet onboarding. |

| AMLBot | Automated AML/KYT screening with API integration for monitoring wallet transactions. |

| AMLCheckers.org | Multi-chain AML/KYT screening and continuous wallet risk monitoring. |

| Sumsub | End-to-end identity verification with AML checks and compliance workflow support. |

| KyrosAML | AML screening and real-time risk profiling for wallets and transactions. |

| ComplyAdvantage | AI-driven AML and sanctions screening with global watchlist coverage. |

1. Chainalysis KYT — Best Crypto Compliance Tools for Non-Custodial Wallets.

With Chainalysis KU, you will be able to track up to 14 types of transactions and monitor 22 billion entities hand in hand. Automated screening and risk assessment tools, coupled with custom alerts for potential suspicious activity, help regulatory compliance teams from crypto companies.

Chainalysis KYT is able to help companies tackle issues with risky transactions by giving the support needed to adjust and monitor customizable risk parameters. Staying compliant with the KYT helps the non custodial wallets stay compliant and helps reduce the risk of illicit activity.

Chainanalysis KYT

- Monitors blockchain transactions in real-time to identify suspicious transactions.

- Transactions patterns help in assigning risk to wallets.

- Compliance teams receive alerts that are tailored to their needs.

- Reporting that is audit-ready along with management of case files.

- Dashboards with real-time analytics for multiple blockchain chains.

Chainalysis KYT Pros & Cons

Pros:

- Top of the line tracking and analyzing for blockchains

- Provides alerts and risk scoring for real-time AML data

- The majority of regulators and exchanges trust them

- Has strong API integrations for wallets

Cons:

- Startups and small projects incur the large costs

- Over-dependent on centralized data sources

- In the case of users who are decentralized, it can pose privacy issues

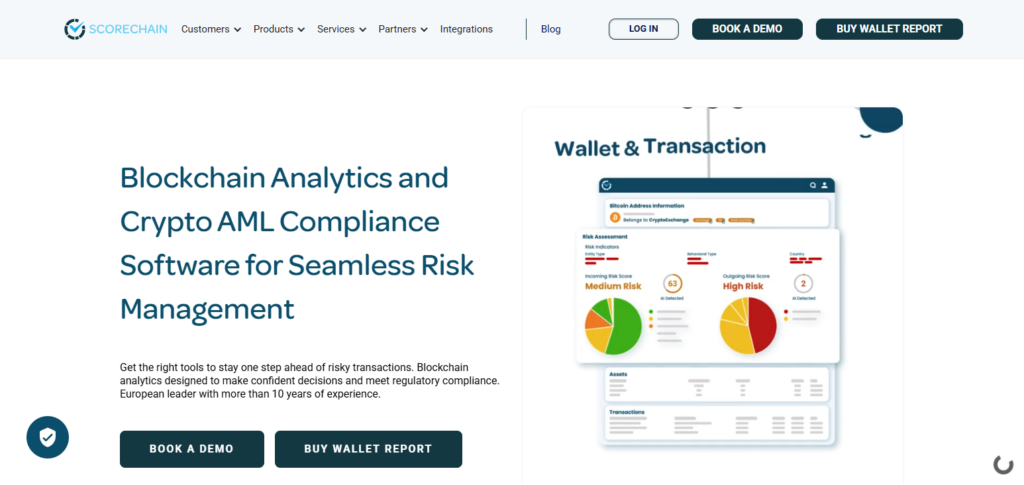

2. Scorechain — Best Crypto Compliance Tools for Non-Custodial Wallets.

With non custodial wallets, and compliant analytics tools, Scorechain gives crypto businesses analytics of wallet risk and analytics of suspicious behavior, Scorechain is offering non custodial wallets the ability to track and score the risk of their customers and customers.

Scorechain is a good fit for compliance processes that integrate seamless automated monitoring and real-time risk scoring for ongoing AML checks, particularly in fragmented user engagement.

Other than that, it provides audit-friendly reporting, API customizations, and tailored compliance strategies with globally shifting customs and Travel Rule compliance, along with adaptive monitoring and custom alerts.

Scorechain Features

- Monitoring of multiple chains in transactions along with the assessment of risk for wallets.

- Compliance rules that can be modified along with the workflows for AML and KYT.

- High risk or suspicious wallet transactions create alerts.

- Reporting audit, and Travel Rule compliance features.

- Visualization in Dashboards that simplifies investigations.

Scorechain Pros & Cons

Pros:

- Implementing custom AML/KYC policies

- Detailed dashboards for analytics across multiple chains

- Reporting functionalities that regulators request

- Provides flexibility for wallet and fintech providers

Cons:

- Compared to Elliptic/Chainalysis the adoption is less

- DeFi protocols and new assets are less available compared to other integrations

- The installation and technical integrations are require significant effort

3. Elliptic — Most Suitable Compliance Tools for Non-Custodial Wallets

Elliptic has made a name for itself by focusing on one of the most significant challenges in the industry: risk/crime compliance. Elliptic is outstanding in AML and other risk compliance frameworks, with one of the most effective digital asset risk management analytics tools.

On-chain analysis, multi-asset tracking, and real-time risk analysis for wallets are a few of the services it provides that help them identify ML, sanctions evasion, and financial crimes.

Elliptic, a top-tier client among other major exchanges, banks, and regulators, provides extensive labeled datasets, adding them one step closer to the goal of curtailing the global crypto ecosystem’s most complex contraventions.

Elliptic Features

- Analytics for blockchain to identify and analyze the currency and transactions.

- Tracking of wallet relationships via clustering of entities.

- Assessment of wallets and transactions along with risk scoring.

- Workflows and compliance platform integration.

- Tools for investigations that are detailed for the purpose of AML.

Elliptic Pros & Cons

Pros:

- Monitoring of blockchain for** almost **everything

- Tools for sanctions compliance are robust

- Major assets are covered as well as stable coins

- Worldwide trust from Financial Institutions

Cons:

- Paying to service your business is a premium

- Focus is toward larger institutions over startups and newer companies

- New and niche tokens may not be covered

4. TRM Labs — Most Suitable Compliance Tools for Non-Custodial Wallets

TRM Labs provides tools for AML compliance and cutting-edge blockchain analytics, which are tailored to assist businesses in monitoring bitcoin transactions and detecting red flags in several ecosystems.

Its platform uses machine-learning analytics and entity clustering to monitor and trace fund movements, associating wallets with real-world entities and identifying potential risks during and post transactions.

TRM’s integration options, including verification platforms like Sumsub, provide streamlined dashboards where AML teams monitor wallets in real-time, assess risk, and automate compliance tasks.

Non-custodial wallet providers who embed AML solutions while keeping users’ control keys appreciate TRM’s advanced capabilities in wallet and transaction screening.

TRM Labs Features

- Analytics and Intelligence of blockchain coupled with ML.

- Detection of suspicious transactions and wallets.

- Artificial Intelligence analytics over multiple chains (cryptocurrencies).

- Risk analysis via clustering and attribution of entities.

- Compliance notifications in real-time.

TRM Labs Pros & Cons

Pros:

- Exceptionally monitoring across multiple chains (NFTs, DeFi, stablecoins).

- Wallet address risk intelligence database

- Investigative case management tools

- Strong reputation for innovation in compliance

Cons:

- Small wallet providers have complicated implementations

- Early-stage projects may have high pricing

- Limited reach in developing countries

5. Blockpass — Best Crypto Compliance Tools for Non-Custodial Wallets

Blockpass specializes in digital identity verification and compliance with Web3 identity verification and compliance frameworks. It alleviates KYC/KYB burdens with document validation, biometric verification, and screening against global sanctions lists, enabling platforms to securely acquire and verify identities pre wallet access.

In non custodial wallet ecosystems, Blockpass can be integrated during onboarding or fiat to crypto swaps to verify customer identities, mitigate fraud, and maintain AML compliance.

Its method for decentralized networks reduces compliance friction while meeting traces of friction global compliance, making it ideal for decentralized network solutions that require reliable identity and regulatory compliance without custodial control of user assets.

Blockpass Features

- KYC/KYB for users and wallets.

- Screening for sanctions, politically exposed persons, and adverse media.

- The following are the two summaries of the remaining considerations:

- Monitoring transactions to would possible add risk scoring to the transaction.

- Implement a system that has zero-knowledge proof for on-chain KYC.

Blockpass Pros & Cons

Pros:

- KYC/AML identity verification that’s ready to go

- Users have a one-time usable digital identity

- Compliance with GDPR data processing

- Integration with DeFi and wallet software is straightforward

Cons:

- There is little to no transaction monitoring; focus is predominantly on identity

- User involvement may be needed (which is not ideal for purely non-custodial models)

- Analytics competition levels are not on par with Chainalysis or TRM

6. AMLBot – Top Tools for Crypto Compliance and Non-Custodial Wallets

AMLBot is an automated platform for crypto compliance that offers AML/KYT screening and wallet risk scoring, along with transaction verification through either an API or dashboard. AMLBot scans wallets and transactions for links with any known bad actors or risky services, flagging bad actors with high-risk transactional behavior.

From a compliance perspective, AMLBot assists with the identification of suspicious transactions. AMLBot’s risk scoring is based on several data points, which assists with lessening the burden of manual compliance.

This is a value added benefit for non-custodial wallet providers that require satisfactory and compliance driven AML risk assessments. AMLBot offers customizable risk parameters for persistent risk assessments that help teams understand and address the challenges of decentralized users while maintaining user freedom.

AML Bot Features

- Seamless AML/KYB via API integration.

- Zone of control risk scoring for crypto wallets and averse risk classification.

- Integration of multiple blockchains with real-time upgrades.

- Tailor-made compliance protocols and operational rules.

- Persistent surveillance of wallets that are not held socially.

AMLBot Pros & Cons

Pros:

- Startups can take advantage of budget friendly compliance solution

- Automated risk scoring for wallets and transactions

- Crypto services are provided with an AML API

- Integration is uncomplicated

Cons:

- Not as robust as enterprise-level tools

- DeFi/NFT activities that are complex are minimally covered

- May not be adequate for institutional compliance requirements

7. AMLCheckers.org – Top Tools for Crypto Compliance and Non-Custodial Wallets

AMLCheckers.org provides extensive multi-chain and cross-border transaction monitoring and reporting services, to assist companies with the verification of customers’ wallets and transaction histories for being in compliance with regulations.

They services and platform encompass over 50 Blockchains, which provides the user with high service accuracy and compliance with the standards of a financial institution, including transactional risk monitoring and the persistence monitoring of suspicious transactions in real-time.

Additionally, with KYC and expert consulting services, AMLCheckers.org has positioned himself/her self as a multifunctional compliance service provider for non-custodial wallets that require advanced wallet risk assessments.

AMLCheckers.org Features

- Surveillance of the wallets and interactions across several blockchains.

- Notifications of the real-time system for abnormal behavior.

- Integration of API for the adjustment of compliance protocols.

- Tools for the analysis of illicit funds in the wallets.

- Risk scoring for wallets and risk classification.

AMLCheckers.org Pros & Cons

Pros:

- Compliance screening is simple and operationally efficient

- Addresses and transactions can be scored for compliance rapidly

- Screening includes sanctions compliance and PEP checks

- Useful for compliance screening at a lower level

Cons:

- Not adequate for compliance activities at an enterprise level

- Sparse automation and poor reporting

- Small providers have little to no coverage when compared with larger vendors

8. Sumsub — Best Crypto Compliance Tools for Non-Custodial Wallets

Sumsub offers multi-faceted compliance and verification solutions through KYC/KYB identity verification, coupled with AML compliance and crypto transaction monitoring. Sumsub partners with leaders in blockchain analytics such as Chainalysis, Elliptic, and TRM Labs.

Within the Sumsub ecosystem, the Crypto Monitoring product preemptively addresses compliance by screening and monitoring crypto transaction wallet addresses and associated activity. The incorporation of the Sumsub compliance solution for non-custodial wallet service providers simplifies and streamlines the verification process.

It offers users consolidated regulation-compliant dashboards with minimal frictions. The seamless integration of advanced analytics and fraud detection mechanisms allows Sumsub compliance partners to remain compliant without sacrificing the user experience

Sumsub Features

- KYC/KYB and AML checks in a single system.

- Integration with wallet monitoring analytics on the blockchain.

- Automation of compliance through a risk-based system.

- Automation of workflows in case management.

- Monitoring of wallets and transactions on an ongoing basis.

Sumsub Pros & Cons

Pros:

- One-stop solutions for KYC and AML

- Uses biometrics and liveness for identity checks

- Compliance with most countries

- Advanced tools for fraud detection

Cons:

- Doesn’t offer blockchain analytics

- Possible data privacy issues

- Complex integration with non-custodial wallets

9. KyrosAML — Best Crypto Compliance Tools for Non-Custodial Wallets

KyrosAML offers compliance solutions specifically designed for high-volume crypto ecosystems, including robust identity verification, AML, sanctions and PEP screening, as well as real-time wallet and transaction risk profiling.

KyrosAML’s crypto AML screening is lifecycle-based, helping organizations systematically identify and mitigate risks associated with unauthorized users, unscrupulous business partners, and other harmful parties during their participation in the ecosystem.

KyrosAML’s embedding of blockchain analytics within compliance workflows makes it optimal for decentralized wallet systems wanting to understand real-time risks associated with wallets, while staying compliant and reducing fraud risks across multiple jurisdictions.

KyrosAML Features

- Support on the crypto-identity verification and onboarding.

- Real-time monitoring of AML, sanctions, and PEP.

- Risk scoring of wallets through blockchain analytics.

- Monitoring of transactions for abnormal behavior.

- Risk profiling for crypto compliance within the organization.

KyrosAML Pros & Cons

Pros:

- Targeted crypto-wallets AML monitoring

- Risk scoring and alerts for unusual transactions

- Assistance with compliance for the Travel Rule

- Tailored to regulations for developing markets

Cons:

- Not as widely known as Chainalysis or Elliptic

- Poor detection of complex DeFi protocols

- Limited ancillary services and partner ecosystem

10. ComplyAdvantage — Best Crypto Compliance Tools for Non-Custodial Wallets

ComplyAdvantage is a RegTech winner in AML, sanctions, and watchlist screening, powered by AI and machine learning for the detection and the management of the risks of financial crime for both fiat and crypto.

While it is not specifically blockchain-focused, it still offers real-time monitoring of sanctions, high-risk entities, adverse media, and risk signal, which can be added to other compliance solutions.

When combined with blockchain analytics, e.g., Elliptic, ComplyAdvantage streamlines crypto risk compliance by integrating the on-chain and off-chain risk metrics, which makes it one of the best options for non-custodial wallets with a high degree of regulatory coverage in decentralized payments.

ComplyAdvantage Features

- Screening for attribution of AML, sanctions, and PEP with the use of AI.

- Notifications of real-time changes in risk profiles.

- Monitoring clients and business for compliance.

- Risk profiles that are dynamic with auto updates.

- Reporting mechanisms and case management ready for audits.

ComplyAdvantage Pros & Cons

Pros:

- Automated screening for sanctions and PEPs

- Monitors transactions in real time

- Compliance with the FATF, EU, and US regulations

- API for wallets is well documented

Cons:

- More geared towards traditional finance than crypto-native companies

- Lack of crypto-specific applications may be problematic

- Cost is prohibitive for some early-stage companies

Key Features to Look for in Crypto Compliance Tools

Real-Time Transaction Monitoring – Tracks blockchain transactions to promptly identify any questionable or risky transactions which fosters proactive measures and better compliance with AML regulations per wallet.

Wallet Risk Scoring – Provides varying levels of risk assessments to wallet addresses based on their history of transactions, relationships with bad actors, and analysis of their behaviors.

Multi-Chain Support – Allows for the monitoring and evaluation of multiple different blockchains to ensure that wallets which traverse multiple crypto networks and multiple assets are fully supported.

KYC/KYB Integration – Embeds identity verification processes into wallet onboarding to ensure that the user is compliant with rules and to reduce fraud and AML risk.

Sanctions & PEP Screening – Scans users, wallets, and firms against sanction lists, politically exposed persons, and media to stop transactions that are illegal and/or high risk.

Automated Alerts & Notifications – Provides alerts for transactions that are suspicious and for an event of a breach of risk so that compliance can act.

Reports Ready for Auditing – Generates organized compliant reports for regulators, internal audits, and other reviews showing clear and transparent wallet activity and related casework.

Integration & API Features – Provides smooth integrations with wallets, exchanges, and compliance services, where embedded AML/KYT features allow for automated and scalable monitoring.

Benefits of Using Compliance Tools for Non-Custodial Wallets

Enhanced Regulatory Compliance – Compliance tools, protect non-custodial wallets and provider by meeting the global AML, KYC, and sanction and the fine/penalty avoidance.

Fraud and Risk Mitigation – Tools will help detect and/or avoid loss, bogus, or illegal financing by spotting potentially problematic transactions and/or wallets.

Improved Trust and Reputation – Positive users’ recommendation due to compliant tools adds to the non-custodial wallet provider/partner.

Real Time Monitoring and Alerts – Non-custodial wallet compliance tools help identify weaknesses in finances and jeopardy.

Automated Compliance Workflows – Non-custodial wallets compliance tools, save time and cost by free manual compliance, verify identities, review transactions, and classify wallet risks.

Audit Ready Reporting – Compliance tools create and identcy document plans to report to authorities, and outline the wallet activity and procedures.

Global Sanctions and PEP Screening – Tools help avoid providing or supporting illicit labor/engagement by claiming to be non-custodial, while contravening PEP and sanctioning funds.

Smooth Integration with Wallets – Incorporates compliance tools into non-custodial wallets. It does not interfere with user experience and maintains secure, regulatory-compliant transactions across different blockchains.

Conclusion

To ensure regulatory compliance, lower the risk of fraud, and preserve confidence within the blockchain ecosystem, non-custodial wallets must use crypto compliance technologies.

Real-time transaction monitoring, wallet risk scoring, multi-chain analytics, KYC/KYB integration, sanctions and PEP screening, automated alerts, and audit-ready reporting are all provided by programs like Chainalysis KYT, Scorechain, Elliptic, TRM Labs, Blockpass, AMLBot, AMLCheckers.org, Sumsub, KyrosAML, and ComplyAdvantage.

By putting these solutions into practice, wallet providers may secure users and platforms, expedite compliance procedures, and proactively identify illegal activities. All things considered, these technologies are essential for striking a balance between the advantages of decentralization and operational security and regulatory accountability.

FAQ

What are crypto compliance tools?

Crypto compliance tools are software solutions that help monitor transactions, verify identities, detect risks, and ensure AML/KYC/sanctions compliance for cryptocurrency wallets and platforms.

Why are compliance tools important for non-custodial wallets?

Even though non-custodial wallets don’t control users’ keys, compliance tools detect illicit activity, screen wallet addresses, and help platforms meet global regulatory standards.

What features should I look for in a compliance tool?

Key features include real-time transaction monitoring, wallet risk scoring, multi-chain support, KYC/KYB integration, sanctions and PEP screening, automated alerts, audit-ready reporting, and API integration.

How do compliance tools prevent fraud and money laundering?

They assign risk scores to wallets, monitor transactions for suspicious patterns, screen users against sanctions and PEP lists, and generate alerts for high-risk activity.

Can these tools integrate with non-custodial wallets?

Yes. Most tools provide APIs and seamless integration, allowing compliance workflows without controlling user keys or affecting the user experience.