In this article, I’m going to highlight the Best Crypto ETFs to Buy in 2026, zeroing in on funds that have excelled and deliver safe, regulated access to Bitcoin, Ethereum, and broader blockchain technologies.

If you’re a seasoned long-term holder or just stepping into digital assets, these ETFs let you gain exposure to crypto while skipping the hassle of wallets and private keys.

Key Point & Best Crypto ETFs to Buy

| Name | Key Point |

|---|---|

| iShares Bitcoin Trust | Spot Bitcoin ETF from BlackRock offering direct BTC exposure; approved in 2024 and managed by the world’s largest asset manager. |

| Fidelity Wise Origin Bitcoin Fund | Fidelity’s spot Bitcoin ETF providing regulated access to BTC with cold storage and institutional-grade custody. |

| ProShares Bitcoin Strategy ETF | First U.S. Bitcoin futures ETF; tracks CME Bitcoin futures prices rather than spot BTC. |

| iShares Ethereum Trust | A pending spot Ethereum ETF from BlackRock, aimed at offering direct ETH exposure through secure custody. |

| Grayscale Ethereum Trust | One of the earliest Ethereum trusts; trades OTC and offers ETH exposure at a premium or discount to NAV. |

| Amplify Transformational Data Sharing ETF | Blockchain-focused ETF with diversified holdings in blockchain and crypto-related equities. |

| VanEck Digital Transformation ETF | Invests in companies driving the digital asset ecosystem, including exchanges and miners. |

| Purpose Bitcoin ETF | First North American spot Bitcoin ETF; Canadian-listed, holds BTC directly with daily transparency. |

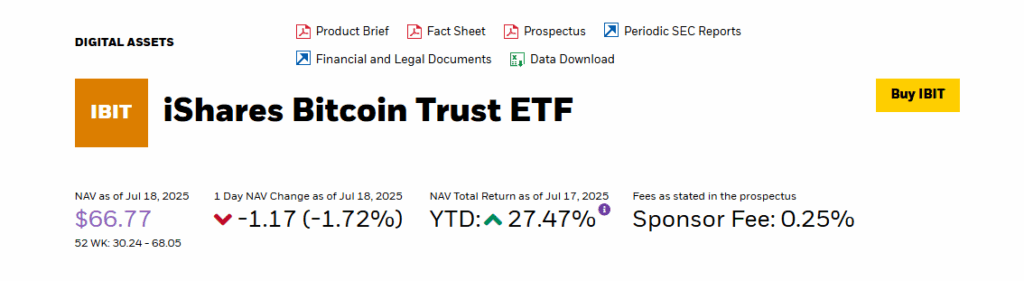

1. iShares Bitcoin Trust (IBIT)

BlackRock’s iShares Bitcoin Trust (IBIT), the first spot Bitcoin ETF sanctioned in 2024, delivers unmediated exposure to the world’s leading cryptocurrency through fortress-like custody managed by Coinbase. Investors, whether large institutions or everyday savers, can participate without the complexities of wallets or private keys.

Every share of the ETF corresponds to a specific, securely held Bitcoin, ensuring NAV precision that mimics the asset’s spot price. Robust risk oversight from the world’s largest asset manager adds a layer of reassurance.

In an evolving regulatory landscape, IBIT’s transparent, cost-effective structure and tight tracking error position it among the Best Crypto ETFs to Buy for those wanting the purity of Bitcoin, tempered by the rigor of traditional finance.

iShares Bitcoin Trust (IBIT)

- ETF Style: Spot Bitcoin ETF

- Provider: BlackRock

- Underlying Asset: Holds Bitcoin directly

- Custodian: Coinbase Custody

- Expected 1st Trading Day: 2024

- Compliance: SEC green light received

- How to Buy: Tradable through any brokerage account

2. Fidelity Wise Origin Bitcoin Fund (FBTC)

The Fidelity Wise Origin Bitcoin Fund (FBTC) stands out as a leading spot Bitcoin ETF, launched by Fidelity Investments, a name synonymous with reliability in finance. This fund delivers pure, direct exposure to Bitcoin, safeguarded by offline, cold storage to protect the underlying assets.

Unlike futures-based alternatives, FBTC mirrors the real-time Bitcoin price, ensuring a truer reflection of the asset’s dynamics. Its regulated framework and favorable tax treatment enhance its appeal, particularly for long-term holders and within retirement plans.

Supported by Fidelity’s extensive institutional network and its seasoned cryptocurrency team, the fund offers a clear, secure pathway into Bitcoin. As confidence in digital assets continues to rise, FBTC is frequently cited as one of the Best Crypto ETFs to Buy in the current, rapidly shifting market.

Fidelity Wise Origin Bitcoin Fund (FBTC)

- ETF Style: Spot Bitcoin ETF

- Provider: Fidelity Investments

- Underlying Asset: Holds Bitcoin directly

- Custody Mechanism: Fidelity Digital Assets

- Expected 1st Trading Day: 2024

- Security Layer: Institutional-grade cold storage

3. ProShares Bitcoin Strategy ETF (BITO)

ProShares Bitcoin Strategy ETF (BITO) broke new ground in 2021 as the first Bitcoin futures ETF authorized in the United States. Instead of directly purchasing Bitcoin, BITO allocates capital to futures contracts listed on the Chicago Mercantile Exchange, giving investors indirect exposure to Bitcoin’s price movements without the need to manage wallets or private keys.

This structure makes BITO appealing to traditional investors reluctant to venture into custodial solutions. One drawback is the potential for long-term underperformance compared to a spot ETF, mainly from the costs tied to rolling futures contracts.

Still, BITO offers a transparent, SEC-regulated vehicle for Bitcoin exposure within widely used brokerage accounts. For those seeking a compliant way to diversify portfolios with futures-based Bitcoin exposure, BITO is still ranked among the Top Crypto ETFs to Buy, delivering a practical mix of liquidity, regulatory oversight, and conventional investment mechanics.

ProShares Bitcoin Strategy ETF (BITO)

- ETF Style: Bitcoin Futures ETF

- Provider: ProShares

- Underlying Asset: CME Bitcoin futures contracts

- 1st Trading Day: 2021

- Compliance: 1st futures-based Bitcoin ETF in the U.S.

- Liquidity: Highly liquid; large investor penetration

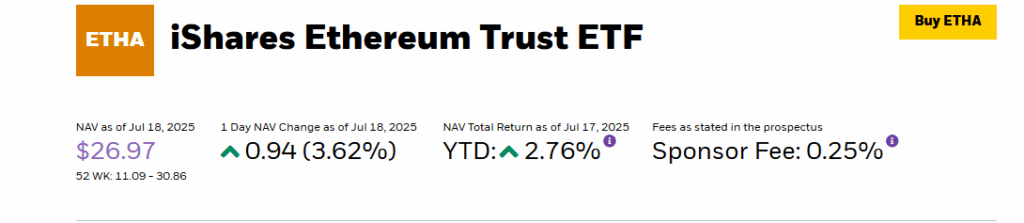

4. iShares Ethereum Trust (ETHA)

The BlackRock iShares Ethereum Trust (ETHA) is a forthcoming spot Ethereum ETF intended to closely track the price of ETH, subject to final regulatory clearance. It offers institutional investors a fully regulated path to Ethereum exposure, eliminating the complexities of wallet setup and private-key management.

The trust will store the underlying Ethereum in secure, registered custody, reportedly at Coinbase, and marries Ethereum’s transformative potential with BlackRock’s world-class governance.

With Ethereum underpinning a growing web of smart contracts, DeFi protocols, and NFT markets, ETHA positions itself as an on-ramp for traditional capital into the Ethereum landscape.

Given BlackRock’s pedigree, rising institutional appetite for ETH, and the ETF’s transparent structure, ETHA is on track to become a marquee addition to the crypto ETF space.

It will deliver the security of regulated custody, the robustness of BlackRock’s resources, and direct exposure to blockchain-led innovation in one compelling vehicle.

iShares Ethereum Trust (ETHA)

- Type: Spot Ethereum ETF (pending SEC nod)

- Issuer: BlackRock

- Asset Exposure: Anticipated direct Ethereum (ETH) holdings

- Custodian: Coinbase (expected)

- Filing Status: Under SEC review

- Target Audience: Investors bullish on ETH needing a regulated wrapper

5. Grayscale Ethereum Trust (ETHE)

The Grayscale Ethereum Trust (ETHE) was among the first ways for investors to gain Ethereum exposure through a regulated format, arriving on the scene well ahead of any Ethereum-based exchange-traded funds.

Available for trading over-the-counter, the trust permits both accredited investors and the wider public to track Ethereum without the need to hold the underlying asset. As with many similar products, ETHE can stray from its net asset value, swinging between premium and discount, which can influence the final returns for those buying and selling shares.

Still, it offers a straightforward solution for traditional investors who prefer to avoid the complexities of crypto wallets and private keys. Grayscale is currently advocating for an ETF transition, a move that, if successful, could elevate the trust’s significance among institutional players.

For investors who remain bullish on ETH but lack the technical savvy to operate on-chain, ETHE is a standout among the Best Crypto ETFs to Buy, especially for those who first leveraged it to gain institutional-grade, regulated exposure to Ethereum.

Grayscale Ethereum Trust (ETHE)

- Type: Ethereum Investment Trust (OTC)

- Issuer: Grayscale Investments

- Asset Exposure: Synthetic ETH exposure through trust shares

- Inception: 2017

- Trading Venue: OTCQX

- NAV Variance: Subject to trading premium/discount relative to net asset value

6. Amplify Transformational Data Sharing ETF (BLOK)

Amplify Transformational Data Sharing ETF (BLOK) zeroes in on companies advancing blockchain technology instead of directly acquiring cryptocurrencies. The fund’s roster features market leaders like Coinbase, IBM, and Nvidia, providing a wide-angle view of the crypto economy’s foundational layers.

BLOK’s team actively tweaks the lineup to reflect market momentum and the pace of ongoing blockchain integration. It suits investors who back the sustained rise of decentralized systems while steering clear of the price swings common in cryptocurrencies.

Thanks to its diverse sector footprint and growing institutional interest, BLOK resonates with traditional equity portfolios. For traders wanting blockchain upside through equities, BLOK stands among the Best Crypto ETFs to Buy, pairing robust growth promise with dampened crypto exposure.

Amplify Transformational Data Sharing ETF (BLOK)

- Type: Blockchain Equity ETF

- Issuer: Amplify ETFs

- Asset Exposure: Stocks of firms aligned with blockchain development

- Top Holdings: Coinbase, IBM, Nvidia, among others

- Management: Active portfolio management

- Diversification: Combines tech giants with blockchain-only players for breadth

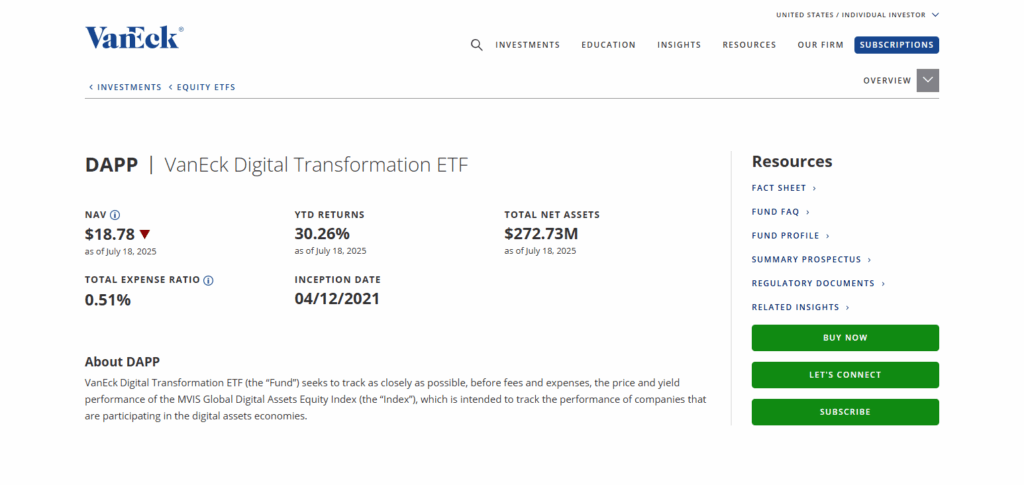

7. VanEck Digital Transformation ETF (DAPP)

The VanEck Digital Transformation ETF (DAPP) targets publicly traded companies that underpin the digital asset ecosystem. Its lineup includes exchanges, miners, and blockchain service firms—think Galaxy Digital and Marathon Digital—across developed and emerging markets.

DAPP’s approach gives investors broad, equity-weighted exposure to the pioneers of digital transformation without direct ownership of coins. While it sidesteps custody and regulatory risk, the fund’s performance historically correlates tightly with crypto price dynamics, reflecting the rapid cycle of its underlying holdings.

This makes DAPP an ideal vehicle for those who prefer the transparency of regulated markets while participating in crypto upside. As adoption of digital assets accelerates, DAPP’s focus on infrastructure players positions it firmly in the Best Crypto ETFs to Buy for long-term, growth-minded exposure.

VanEck Digital Transformation ETF (DAPP)

- Type: Blockchain and Crypto Equity ETF

- Issuer: VanEck

- Asset Exposure: Stocks of firms with crypto-centric business models

- Top Holdings: Coinbase, Riot Blockchain, Marathon Digital, and others

- Geographic Coverage: Worldwide

- Target Segment: Infrastructure and cutting-edge developments in the digital asset space

8. Purpose Bitcoin ETF (BTCC.TO)

The Purpose Bitcoin ETF (BTCC.TO) debuted in Canada in early 2021 as the first Bitcoin exchange-traded fund in the world to back each share with actual Bitcoin. The fund purchases Bitcoin directly, entrusting the coins to insured cold storage, and each day the net asset value of the ETF is calculated to reflect the current market price, ensuring full transparency.

Operating under the supervision of Canadian regulators and listed on the Toronto Stock Exchange, BTCC is accessible to both everyday investors and larger institutions. Importantly, its design permits holdings in tax-advantaged accounts such as RRSPs and TFSAs, making it appealing for those pursuing tax-efficient, long-term investment horizons.

Outside of the United States, BTCC.TO remains a reliable and secure option for Bitcoin exposure. With cryptocurrency adoption on the rise, the fund continues to shine as a leading choice among Bitcoin ETFs, delivering genuine Bitcoin exposure within a robust regulatory framework.

Purpose Bitcoin ETF (BTCC.TO)

- Structure: Spot Bitcoin ETF

- Provider: Purpose Investments

- Underlying Asset: Holds Bitcoin directly

- Storage: Cold wallets with top-tier institutional-grade security

- Inception: 2021

- Market: Toronto Stock Exchange (TSX)

Conclusion

As the cryptocurrency landscape continues to mature, regulated products such as crypto ETFs have emerged as sensible, user-friendly on-ramps for both individual and large-scale investors. Heading into 2025, standout choices include the iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC, both engineered to track Bitcoin’s price while preserving institutional-grade custody safeguards.

Ethereum proponents can look to ETHA and ETHE for direct ETH exposure, while BITO remains the go-to for futures-based Bitcoin access. On the equity side, BLOK and DAPP give investors a slice of the blockchain ecosystem without the complication of directly holding coins.

Global investors can turn to BTCC.TO for spot Bitcoin under Canadian oversight. Whether your objectives are diversification, steady appreciation, or secure access to digital assets, these funds represent the Best Crypto ETFs to Buy in 2025, combining regulatory heft, competitive returns, and sector innovation.