I’ll go over the Top Crypto Exchanges with Robust Compliance in this post. These platforms promote security, transparency, and regulatory compliance in addition to providing a large selection of cryptocurrencies and competitive rates.

In the quickly changing cryptocurrency industry, selecting a compliant exchange guarantees safer trading, legal protection, and peace of mind regardless of your level of experience.

Benefits Of Crypto Exchanges with Strong Compliance

Improved Safety – Secure compliant exchanges have protection insurances and keep user funds in cold wallets. Also, because the exchanges are compliant, cybersecurity is more fortified.

Legal Protections – Since the exchanges operate locally and internationally, traders have legal protections in the event of a dispute or fraud.

Trust/Integrity – The exchanges are compliant and operate with internal and external audits. Also, they have flat fee structures, and they are clear with their reserves.

Secure Fiat Transactions – Users can securely use their bank, cards, and wallets to deposit and withdraw cash with a much lower risk of fraud.

Traders Relax – Compliant exchanges make it unlikely that you will face sudden legal interruptions while you are trading crypto.

Key Point & Best crypto exchanges with a strong compliance record

| Exchange | Key Feature / Note |

|---|---|

| Coinbase | User-friendly, beginner-friendly, insured USD balances |

| Kraken | Strong security, fiat pairs, margin trading |

| Gemini | Regulated, high security, Gemini Earn program |

| Bitstamp | Reliable, long-standing European exchange |

| OKX | Advanced trading, futures & margin options |

| Luno | Easy crypto access in emerging markets |

| Huobi (HTX) | Wide altcoin selection, professional trading |

| Paybis | Easy fiat on-ramp/off-ramp, instant purchases |

| Robinhood Crypto | Commission-free trading, beginner-friendly |

| KuCoin | Wide altcoin variety, staking & lending |

1. Coinbase

Coinbase has been around since 2012, and in that timespan, has managed to achieve strong compliance and operational protection of insured user USD balances. Coinbase has built a reputation as a highly reputable exchange, and is trusted by over 250 cryptocurrency holders.

The trading fees go from 0.5% for instant buys to 1.49% for standard trades. Provides strong regulation and US compliance, with a simple user interface that is perfect for beginners, as well as advanced trading options for seasoned investors, Coinbase is the best option for a trusted and compliant exchange.

Coinbase Features , Pros & Cons

Features:

- User friendly for complete beginners

- Over 250 cryptocurrencies

- Can use bank, PayPal and cards

- Insurance for users security

- Coinbase Pro available and reduces fees.

Pros:

- Easy to start trading

- His means more users

- Insurance for USD accounts

- Good mobile interface

- Coinbase Pro helps users with charts

Cons:

- Trade fees are high

- For more experienced users it’s lacking

- US users only

- They take a long time to get back to issues

- For small trades the fees are big.

2. Kraken

Founded in 2011, Kraken is a fully compliant global exchange based in the United States. It has a wide array of services including 200+ cryptocurrencies, margin trading, and staking. It has a long list of deposit methods including bank transfers, crypto, and wire.

They have low trading fees of 0.16\% (maker) and 0.26\% (taker), and high volume traders can receive a discount. Kraken has 2-factor authentication and a cold storage system for security, and is known for outstanding compliance in the United States and Europe, making it the best fully compliant cryptocurrency exchange for retail and professional traders.

Kraken Features , Pros & Cons

Features:

- More than 200 cryptos.

- Margin trading + Futures.

- Can do bank and crypto deposits

- They have security and trading protection

- Fees are lower to use.

Pros:

- They play by the rules.

- They Keep your info safe.

- They have lower fees.

- They have what pro’s need.

- They are available Nearly everywhere.

Cons:

- User interface is dated.

- Your coins could get stuck for a bit.

- They don’t have a lot of options for FIAT.

- The onboarding is slow.

- The mobile app could need an update.

3. Gemini

Founded in 2014 by the Winklevoss twins, Gemini has established itself as a regulated, compliant U.S. exchange. The exchange offers over 100 cryptocurrencies and accepts bank and wire transfer fiat deposits Gemini offers a mobile app for user-friendly trading, and charges a fee of 0.35% plus for trades.

Gemini has a strong emphasis on security, evidenced by SOC 2 Type 2 certification, cold storage, and insurance policies. Users may also earn interest on their crypto through the Gemini Earn feature. With these user protection measures and regulatroy rigors, Gemini has earned a spot on the list of the best crypto exchanges for compliance for retail and institutional investors.

Gemini Features , Pros & Cons

Features:

- A regulated US-based exchange.

- Supports 100+ cryptocurrencies

- Gemini Earn lets you earn interest on cryptocurrency

- You can deposit via bank transfer

- Trade using web and mobile platforms

Pros:

- Security and compliance are robust.

- The interface is easy for beginners to use.

- Digital assets are insured.

- You get instructional material if you are a novice.

- The fee structure is firm and easy to understand.

Cons:

- Trading fees are substantial.

- The variety of cryptocurrencies to trade is very minimal.

- They are not suitable for users who trade very often.

- Advanced instruments for trading are available in very limited supply.

- Services are limited in some countries.

4. Bitstamp

Operating since 2011, Bitstamp is one of the oldest crypto platforms in Europe. Bitstamp is trustworthy due to their stringent compliance with laws, and supports more than 100 cryptocurrencies, including Bitcoin. They accept credit card and bank transfers. Rates begin at 0.1% and can go up to 0.5% depending on the volume.

They are one of the best crypto exchanges because of their compliance, regulation, and upholding the law. They offer 2-step authentication and a cold wallet to stow funds. They are one of the best crypto exchanges because of their strong record of compliance, making them a trustworthy source for beginner and advanced traders, and their long history in the industry.

Bitstamp Features , Pros & Cons

Features:

- One of the earliest exchanges in Europe.

- Over 100 cryptocurrencies available.

- Accepts credit card, SWIFT, and SEPA deposits.

- Fees for trading are very low. (From 0.1 to 0.5 percent)

- You can trade via mobile and web applications.

Pros:

- They are attentive to regulations in Europe.

- The platform is reliable and trustworthy.

- The fee structure is easy to comprehend.

- They have a fee structure that is easy to understand.

- It is easy to use the interface and trade.

- You can move deposits and withdraws quickly.

Cons:

- The number of cryptocurrencies available is very limited.

- The offer to trade with advanced instruments is very poor.

- They do not offer the option to trade with margins.

- The mobile app can be improved upon.

- They can be slow to respond to customer support.

5. OKX

Founded in 2017, OKX supports over 500 crypto currencies. They accept bank transfers, credit card payments, and crypto deposits. Their trading fees are 0.1% for beginner spot trading and advanced traders can negotiate volume fees for their crypto assets. OKX supports derivatives and has integrated decentralized finance.

They are one of the best crypto exchanges due to their strong regulation and compliance, making them an industry leader alongside Bitstamp. They have a strong compliance record, positioning them as one of the best exchanges. They are a safe platform for advanced traders with their dedicated insurance funds and widespread advanced crypto services.

OKX Features , Pros & Cons

Features:

- Supports over 500 cryptocurrencies.

- Offers spot trading, futures, and margin trading.

- Provides support for bank and card deposits.

- Offers a variety of advanced trading features.

- Offers DeFi and staking.

Pros:

- Offers a wide variety of cryptocurrencies.

- Exceptional compliance and security protocols

- Trading fees are attractive.

- Professional traders have access to sophisticated trading features.

- Can be accessed globally.

Cons:

- Beginners might be confused by the platform.

- Very little regulation.

- For casual traders, the trading process might be seen as complex.

- Support staff might take some time to respond.

- Depending on the mode of payment, the fees might be higher.

6. Luno

Luno, which began operations in 2013, offers over 50 cryptocurrencies in developing markets like Africa and Asia. Users can deposit via bank transfer and local payment methods. Fees are trading activity dependent and fall between 0%-0.75%. Luno prioritizes compliance and promotes safe trading across all operational countries.

The Luno mobile app, website, and educational content simplify crypto trading, particularly for novice traders. Security features, such as cold storage and 2-factor authentication, contribute to Luno’s reputation as one of the best crypto exchanges for compliance and security, especially in developing markets.

Luno Features , Pros & Cons

Features:

- Mobile centric trading

- Staking and other educational materials

- Payment systems on deposits within country.

- Trading in over 50 different currencies

Pros:

- Compliant with a large number of regulations in most zones

- Great for beginners.

- Full featured mobile trading application

- Fast withdrawals and deposits

- For beginners, Quick education.

Cons:

- Limited options for trading fiat.

- Advanced traders don’t eed the platform

- Limited futures and margin trading.

- Depending on the country, fees can vary.

- Some countries have features that are not available. SDK

7. Huobi (HTX)

HTX (formerly Huobi) is a global crypto exchange founded in 2013. Users can trade over 400 coins and can use both crypto and bank transfer deposits. For both maker and taker orders, the standard trading fee is 0.2%, but there are VIP volume discounts. Huobi has placed strong compliance across various jurisdictions and works closely with regulators.

Their security features include asset insurance, cold wallets, and 2FA. Huobi is a fantastic exchange for those wanting variety to trade as digital asset selection is high and trading notes are positive as the exchange is compliance focused.

Huobi (HTX) Features , Pros & Cons

Features:

- More than 400 available currencies

- Ability to trade on margin and futures

- Support for crypto and bank deposit transactions

- Advanced trading options

- Insurance and cold storage for security

Pros:

- Good selection of assets

- Good protocols for security

- Good for compliance on several regions

- Professional features and good trading on a cheap cost

Cons:

- For beginners, the interface may be complicated.

- Head offices in less regulated areas

- Slow customer service

- Services unavailable in some countries

- Certain products have complicated fee structures

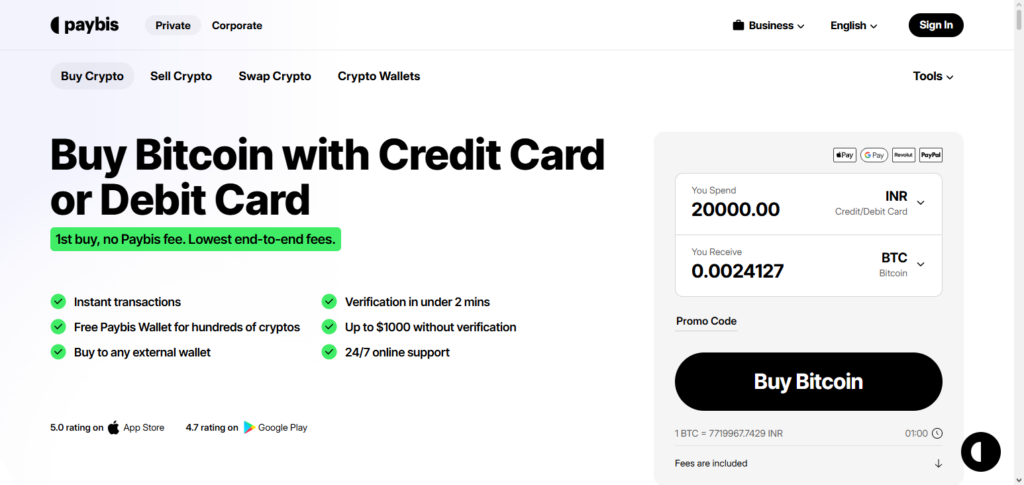

8. Paybis

Established in 2014, Paybis is a worldwide platform for converting fiat to cryptocurrency, with a reputation for quick deposits and withdrawals. Customers can buy over 50 cryptocurrencies using a financial institution, money transfers, or e-wallets. Withevery payment method, including credit cards, a fee of 2.49% will incur, while lower fees apply for bank transfers.

With a strong focus on Kyc verification and maintaining adherence to regulations for each of the areas in which they conduct business, Paybis utilizes two-step verification and secure storage to keep your business safe.

Due to its high level of compliance, transparency, and immediate fiat on-ramp and off-ramp capabilities, Paybis is regarded as one of the most reliable crypto services for users who need instant and reliable access to fiat crypto.

Paybis Features , Pros & Cons

Features:

- Gateway to exchange Fiat for crypto.

- More than 50 crypto currencies supported.

- Deposits from cards and bank transfers.

- Some coins can be purchased instantly.

- KYC and AML compliance strictly enforced.

Pros:

- Converting Fiat to crypto and vice versa is easy.

- Transactions are completed in a matter of seconds.

- They are a regulated company and the platform is secure.

- The interface is easy to use.

- Services are available globally.

Cons:

- The variety of cryptocurrencies they have is little.

- When using a credit card, Paybis will charge a large fee.

- Paybis is simple to use, which is not very good for professional traders.

- No trading on credit is available.

- The platform is not tailored for professional traders.

9. Robinhood Crypto

Robinhood Crypto, which offers a selection of over 30 digital currencies and bank transfer services, began operations in 2013. They do not charge for transactions, and the deposits are made using bank transfers.

The format is simpler than most other exchanges, but it is fully compliant with U.S. The Security Exchange offers services with two-step verification and encryption methods, but the users do not have control over the central banks, while trade operations are carried out without any commission.

Robinhood earns im the bank with the currency sold. The bank channel. Their focus on simplicity, coupled with compliance, establishes them as a premier option for novice users betting.

Robinhood Crypto Features , Pros & Cons

Features:

- Free trading of cryptocurrency.

- More than 30 cryptocurrencies available.

- Users can add money with bank transfers.

- The platform works primarily on mobile devices.

Pros :

- Trading is free and supported for novices

- Trading is supported across U.S. states

- Clean and straightforward to use

- Making minor trades is straightforward

- Casual users can use the mobile app

Cons:

- The variety of available cryptocurrencies is scarce

- Private keys are not accessible to users

- The platform does not cater to advanced traders

- There are no features for advanced trading

- There is no variety in the customer support system

10. KuCoin

Starting its operations in 2017, KuCoin has grown into a fully-fledged crypto trading platform. The exchange boasts a total of 700+ listed crypto assets and offers multiple crypto payment methods, including card and bank transfers.

The trading fee on KuCoin is 0.1%, although this fee is reduced for KCS token holders. To boost its users security, KuCoin employs a 2FA, a whitelisted withdrawal system, and an insurance fund. KuCoin is based in Seychelles but operates within a broad set of international regulations.

The exchange has become a fixture in the crypto trading space and is considered by many to be one of the most reputable crypto exchanges with a strong compliance record. Due to this, KuCoin is perfect for anyone looking for a diverse crypto trading experience, with high-level security and professional trading tools.

KuCoin Features , Pros & Cons

Features:

- More than 700 cryptocurrencies

- Staking, margin, lending, and spot

- Crypto + card deposits

- 0.1% fee for trading

- 2-factor authentication

Pros:

- Selection of digital coins

- Safe trading

- Low costs for trading

- Good features for advanced trading

- Can be used all over the world

Cons:

- Validity of regulations is different in all territories

- Ease of use and understanding is mobile for advanced traders, but complicated for novices

- Limited support for users

- In some territories, there are few methods to deposit fiat currency

- Many features may be confusing for novice users

Conclusion

To sum up, selecting a cryptocurrency exchange with a solid compliance history is essential for safe and dependable trading.

Platforms like Coinbase, Kraken, Gemini, Bitstamp, OKX, Luno, Huobi (HTX), Paybis, Robinhood Crypto, and KuCoin combine regulatory adherence, sophisticated security measures, and transparent operations to secure users’ assets and data.

These exchanges are perfect for both novice and expert traders since they prioritize compliance with international financial standards in addition to providing a variety of cryptocurrencies and competitive costs. By choosing these platforms, investors may minimize the dangers associated with uncontrolled exchanges and navigate the cryptocurrency market with confidence.

FAQ

What does “strong compliance record” mean in crypto exchanges?

A strong compliance record means the exchange strictly follows local and international financial regulations, including KYC (Know Your Customer), AML (Anti-Money Laundering), and licensing requirements. This ensures user funds are protected and trading is legal and transparent.

Which are the best crypto exchanges with strong compliance?

Exchanges like Coinbase, Kraken, Gemini, Bitstamp, OKX, Luno, Huobi (HTX), Paybis, Robinhood Crypto, and KuCoin are widely recognized for their regulatory adherence and security measures.

Are compliant exchanges safer than others?

Yes. Compliant exchanges implement rigorous security protocols, insured custody of funds, and legal oversight, which reduces the risk of hacks, fraud, or sudden shutdowns.

Do compliant exchanges charge higher fees?

Not necessarily. While some may have slightly higher fees due to regulatory costs, many compliant exchanges, like Kraken and KuCoin, offer competitive rates, often with discounts for high-volume traders.

Can beginners use compliant exchanges easily?

Absolutely. Exchanges like Coinbase, Gemini, and Robinhood Crypto provide user-friendly interfaces, educational resources, and secure onboarding, making them ideal for beginners seeking safe trading options.