This article will highlight the Best crypto flash crash and buy the dip crypto bots. These innovative trading tools allow crypto traders to automate strategies, respond quickly to flash crash events in the crypto market, and purchase assets at discounted prices.

These bots optimize profit chances during high volatility intervals using advanced algorithms and custom settings while minimizing the psychological and manual trading challenges. Additionally, they reduce the risk of emotional trading.

What is Crypto Flash Crash?

A crypto flash crash is an abrupt and steep decline in the price of a cryptocurrency in a very short time frame, even a few seconds, and recovering just as quickly. These occurrences can be due to large sell orders, thin market liquidity, erroneous trading algorithms, and panic selling driven by market manipulation and fake news.

Flash crashes can result in extreme short-term volatility, as well as the liquidation of leveraged positions, resulting in losses for unsuspecting traders. The rapid price rebounds do little to mitigate the market’s unpredictable and risky nature.

How To Choose Crypto Flash Crash and Buy the Dip Crypto Bots

Compatible Trading Strategies: Check whether the bot utilizes flash crash detection, buy-the-dip, DCA, or grid strategies, and see if they align with what you are aiming to achieve.

Supported Exchanges: Ensure the bot connects to your primary crypto exchanges for effective and dependable execution.

Speed and Automation: Opt for bots that can monitor the market and execute orders rapidly and automate processes, especially during sharp price declines.

Ease of Use: Dashboards that are easy to navigate, along with pre-configured templates, and simple setups will be beneficial for novice traders.

Risk Control Features: Automated losses can be strategically minimized if the bot has stop-loss, take-profit, and trailing features during unpredictable market shifts.

Pricing Structures: Analyze the subscription price, trading costs, and any lurking profitability-killing costs.

Safety and Trust: Bots that offer secure API, are cloud-based, and are well-known within crypto have a good reputation.

Performance Measurement: Access to analytics and strategy backtesting will allow you to make more informed and effective trading choices prior to execution.

Support Services: Technical issues or problems with strategies can be time-consuming if support teams are slow to respond.

Key Point & Best Crypto Flash Crash and Buy the Dip Crypto Bots List

| Bot Name | Key Point / Unique Feature |

|---|---|

| 3Commas DCA Bot | Automates Dollar-Cost Averaging (DCA) strategy to reduce market volatility impact and optimize long-term gains. |

| CryptoHopper Flash Crash Bot | Designed to detect sudden price drops and execute rapid buy orders during flash crashes for quick recovery profits. |

| Coinrule Buy-the-Dip Bot | Automates “buy the dip” strategies by purchasing assets when prices fall to pre-set levels. |

| Bitsgap Grid Bot | Uses grid trading to buy low and sell high within set price ranges, maximizing profits in sideways markets. |

| TradeSanta DCA Bot | Simplifies automated trading with pre-configured DCA strategies and cloud-based execution for consistent entry points. |

| Pionex DCA Bot | Built-in DCA automation with low trading fees and direct integration into the Pionex exchange. |

| WunderTrading TradingView Bot | Connects directly with TradingView signals, allowing users to automate trades based on custom chart strategies. |

| Zignaly Signal Bot | Follows expert traders’ signals automatically, ideal for users who prefer copy trading. |

| HaasOnline Flash Crash Bot | Advanced flash crash bot using HaasScript for high-speed execution during market dips. |

| Altrady Smart Bot | Smart automation with real-time market insights and multi-exchange support for active portfolio management. |

1. 3Commas DCA Bot

The 3Commas DCA Bot is regarded as one of the top bots in the market for crypto break flash crashes and Buy-the-dip bots. Its intelligent automation, flexible strategies, and risk management systems boast one of the most advanced DCA bots in the market.

3Commas DCA Dots minimizes dash volatility and maximizes profits by automatically using the DCA method to buy assets during flash crashes. 3Commas is the only DCA bot that executes DCA intelligent strategies and offers customizable take-profit and stop-loss systems on most big DCA exchanges.

3Commas DCA Bots offers a hands-off approach that is effective for the market rebounds for Buy-the-dip flash crashes. 3Commas DCA Bots provide a unique approach to DCA bot strategies, making it user-friendly for both newbies and experts.

3Commas DCA Bot Features

- Dollar-Cost Averaging (DCA) – DCA takes advantage of market volatility by automatically purchasing smaller amounts of crypto during market dips, effectively lowering the average entry price.

- Smart Trading Terminal – Enables a user to define various parameters for a single trade, as well as aids in setting stop-loss and take-profit levels.

- Cross-Exchange Support – 3Commas can utilize a single DCA bot to manage accounts across different exchanges, such as Binance, KuCoin, and Bybit.

2. CryptoHopper Flash Crash Bot

The CryptoHopper Flash Crash Bot is noted for its ability to respond quickly to sudden drops in the market and execute buy orders accordingly. It is regarded as one of the best flash crash and buy-the-dip cryptocurrency trading bots.

Featuring innovative algorithms and customizable parameters, the bots can monitor multiple exchanges for real-time price changes and determine whether price changes are rapid or not.

Where many bots buy and sell only to automate the middle of the range recovery, this bot stands out in fully automating middle recovery by oscillating between buying during the drop and selling during the quick rebounds, providing profit even to those who do not seek to control the bot manually.

CryptoHopper’s flash crash bot provides range profit opportunities even in less volatile markets due to the cloud platform that integrates trend following and other pseudo-volume-based indicators for trailing stops.

CryptoHopper Flash Crash Bot Features

- Automated Flash Crash Detection – Sniffs out market drop-offs and automatically executes buy orders.

- Trailing Stop-Loss & Take-Profit – Market profiting and loss closing dominates crypto volatility.

- Pre-built Strategies – Users get templates designed for dip buying and market crashing, removing the hassle of manual adjustments.

3. Coinrule Buy-the-Dip Bot

One of the best crypto flash crash bots and buy-the-dip bots is the Coinrule Buy-the-Dip Bot. This is due to the ease of use regarding rule-based automation and the strong ability to react to market changes. It gives traders the ability to create custom strategies that automatically prompt purchases whenever a price drop occurs, giving traders the ability to enter a market during a flash crash.

Coinrule provides a no-code option, which means that people do not need to know the programming logic required to execute complex trading algorithms.

Along with smart stop-losses and market-watching automation tools, Coinrule makes it very easy to maximize profits. It achieves the best possible automation with the best possible contro,l even in very unpredictable and volatile market scenarios.

Coinrule Buy-the-Dip Bot Features

- Rule-Based Automation – Users can set up basic automation for dip buying with simple logic statements, i.e., “If BTC drops 5% in 1 hour, buy $100.”

- No Coding Required – Users have uncomplicated logic for constructing an automated strategy.

- Multi-Exchange Integration – More diversified trading as users can connect Binance, Kraken, and Bitstamp exchanges.

4. Bitsgap Grid Bot

The Bitsgap Grid Bot is one of the most effective bots for handling flash crashes and buying the dips because of its sophisticated grid trading techniques that take advantage of the Bot and its colleagues’ market volatility.

Every small movement of the market is a profit opportunity for the trader during sudden dips. The bots’ Grid tracking and dynamic adjustments to real-time market changes keep trading fast and efficient.

Bitsgap’s user-friendly design, paired with profit tracking and risk management features, makes market dip buying a steady gain in profit for beginners and professionals alike. Being connected to all other exchanges lets the user easily visualize all Important aspects.

Bitsgap Grid Bot Features

- Grid Trading Strategy – Profits in sideways markets by buying within a preset range and selling high.

- Profit-Locking Features – Profits are automatically secured when the price reaches a designated target.

- Simulated Backtesting – Use simulated historical data to test strategies before implementing them with real money.

5. TradeSanta DCA Bot

The TradeSanta DCA Bot is one of the best DCA bot for flash crashes in crypto and dip trading due to its automation and DCA strategy. It allows paying the average cost for crypto when the market is bearish due to its ability to place orders automatically in intervals at preset descending price points.

The most advantageous factors of TradeSanta are that it is operated in the cloud and that it has an amazing ability to be configured in a matter of minutes with pre-made templates that accommodate any user’s skill level.

It is also able to automate the take profit and stop loss functions, which is helpful in flash crashes. Having to profit to automated exchanges and place orders in a certain intervals with real-time monitoring is a great feature to utilize in market rebounds.

TradeSanta DCA Bot Features

- Automated DCA Buying – DCA Bot lets users buy in smaller portions to capitalize on price dips.

- Cloud-Based Bot – Bot can operate without personal devices turning on and off.

- Flexible Strategy Templates – Options to switch between long and short strategies configured to handle rapid fluctuations.

6. Pionex DCA Bot

The Pionex DCA Bot stands out as one of the top bots for automating crypto services designed for flash crashes and dip buying. Unlike other bots that work remotely, Pionex DCA bots work on the Pionex exchange.

This greatly reduces latency and eliminates the API risks associated with trading during volatile periods. The DCA bot reduces the average position traders hold by buying during specified periods, as well as during aggressive price falls.

DCA traders will find this service especially useful since there are no subscription fees and trading fees are considerably low. Moreover, Pionex is designed with DCA and dip buying in mind, especially since the platform is designed for mobile use.

Pionex DCA Bot Features

- Low-Fee Exchange Bot – Operates on Pionex’s exchange with a trading fee of just 0.05% per order.

- Simple DCA Setup – Set to DCA buy crypto for price dips or on a scheduled interval.

- Mobile Friendly – Fully accessible and controlled through mobile applications, including updates and push notifications.

7. WunderTrading TradingView Bot

For traders who rely on technical analysis and automated trade execution, the WunderTrading TradingView Bot is one of the top options for crypto flash crash and buy-the-dip bots.

Direct integration with TradingView is one of the bot’s best features. During a flash crash, it executes buy orders when your custom signals indicate. There’s no guesswork, and every entry is perfectly timed.

The bot works with multiple exchanges, advanced DCA configurations for adaptive recovery and recovery copy trading. With versatile automation, performance statistics, and strategy options, WunderTrading offers traders the ability to profit on market dips and rebounds.

WunderTrading TradingView Bot Features

- TradingView Signal Integration – Buying and selling strategies are automated through alerts created within TradingView.

- Real-Time Automation – Execute orders the instant all of the set conditions are met.

- Multi-Exchange Support – Implemented strategies can span across different exchanges including Binance, Bybit, and others.

8. Zignaly Signal Bot

Thanks to the integration of automated trading and expert market signals, the Zignaly Signal Bot is one of the most efficient Bots available for flash crash trading and crypto buy the dip bots. This bot lets you follow the professional traders and signal providers who buy the dips and flash crashes as they occur.

When a signal is executed, the bot automatically places buy orders and capitalizes on extraordinary market opportunities. Zignaly’s profit-sharing model is an innovative concept whereby users are charged only if profit is realized.

Zignaly is cloud-based, which, paired with the automated and hands-free executed tools of portfolio management, lets traders take advantage of dip buying without surveillance.

Zignaly Signal Bot Features

- Copy Trading Signals – Trades automatically using expert trader copy signals or alerts.

- Customizable Risk Management – Allows for flexible definition of stop-loss and take profit. Also enables rules for position sizing.

- Profit Sharing Model – Only net profit is charged to customers which minimizes risk to beginners.

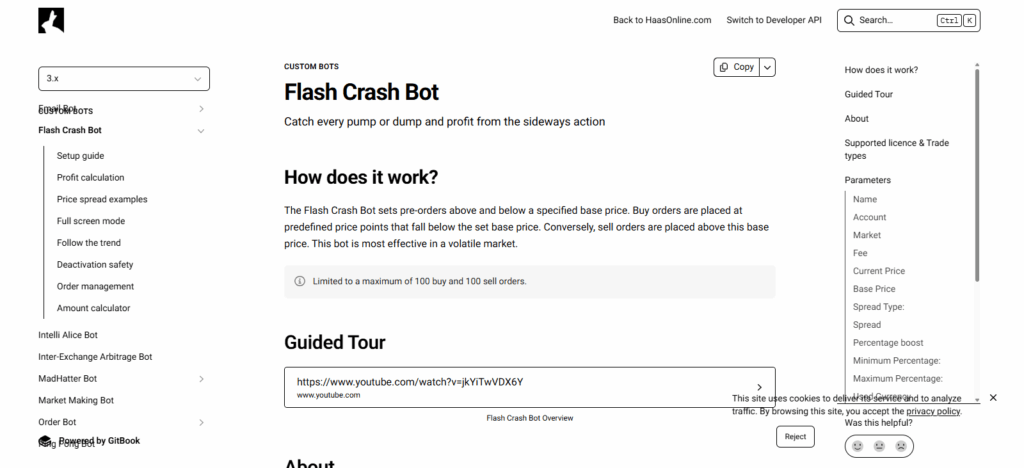

9. HaasOnline Flash Crash Bot

The Flash Crash Bot from HaasOnline is among the preeminent bots performing the crypto sector’s flash crashes and dip purchases.

This is owed to the automation and speedy execution the bot is capable of. Using the HaasScript proprietary language, the bot is able to write and deploy strategies highly customizable to the user and adaptable to unexpected market falls.

The advantage the bot is able to provide is both accuracy and adaptability. It allows traders to set intricate conditional orders, trailing buy/sell rules, and flash crash risk management.

The ability to configure risk parameters provide and the automation they offer allow experienced and professional traders to deploy security market dip strategies and risk it as inline the automated control dipped market.

HaasOnline Flash Crash Bot Features

- Advanced Flash Crash Algorithms – Detects and reacts to extreme volatility of prices.

- Highly Customizable – Users have the option to set sophisticated rules using HaasScript.

- Backtesting and Simulation – Strategies can be tested in simulation to avoid losing real funds.

10. Altrady Smart Bot

The Altrady Smart Bot is equipped with intelligent automation and real-time responsiveness to market fluctuations, distinguishing it as one of the finest bots for crypto flash crashes and buy-the-dip opportunities.

For every sudden price dip, it employs sophisticated algorithms to determine price trajectories and instantaneously execute buy orders, thus optimizing profit potential. Altrady’s Smart Trading capabilities and multi-compatibility exclusivity across exchanges are game-changers for the cryptocurrency trade community.

Users can define multiple, simultaneous take-profit, stop-loss, and trailing action strategies. This, paired with user-friendly interfaces, automated trading-adjusted dashboards, portfolio management, and automated risk control, strategically positions Smart Bot to assist every trader, novice and expert alike. This helps traders efficiently respond to flash crashes to capture the rebounds with minimal manual intervention.

Altrady Smart Bot Features

- Smart Order Placement – System automatically buys when price is decreasing and at predetermined price targets for profit sells.

- Market Scanner – Identifies price anomalies or dips across different exchanges.

- User-Friendly Dashboard – The interface enables easy monitoring of active bots and their trade history for fast decision making.

Pros & Cons

Pros

- Automated Trading: Trades are executed seamlessly during market dips without manual trading.

- Time-Saving: The bots have the ability to track several exchanges and multiple assets at the same time which saves hours of manual analysis.

- Emotionless Trading: Bots eliminate fear and FOMO to strictly adhere to trading rules, eliminating emotional trading.

- Volatility Profiting: Bots readily exploit sudden price decreases and profit from the sudden price increase that rebounds.

- Custom Strategy: Users can set rules around DCA, stop-loss, take profit, and trailing rules.

- Guaranteed Execution: Trades are guaranteed to be executed at the intended value even during flash crashes.

Cons

- Market Risk: Losses are inevitable during a prolonged downtrend.

- Technical Skills: Some bots require advanced setup and/or scripting.

- Dependent on Exchange: The agility of the exchange is a determining factor to the bots performance.

- Expenses: Bots come with subscription fees, and also trading fees.

- Over-Optimization: Fine-tuning a strategy too much can render a strategy useless on a live market.

- Wasted Moves: Bots can lose money by trading on price spikes that do not have real momentum.

Conclusion

In summary, the top bots for crypto flash crashes and for buying on dips provide traders with reliable methods for automating trades, taking advantage of sudden market declines, and easing the stress of emotional manual trading.

The 3Commas DCA, CryptoHopper flash crash, and the Coinrule buy-the-dip bots utilize sophisticated algorithms with customization options and support for multiple exchanges, all of which increase the likelihood of maximizing profits during market volatility.

The ability of these bots to pass automated trades on the market, manage risk, and decrease entry points makes them efficient for trading market volatility, saving time for the trader. These bots augment the trading manual system for all market participants, and thus, they are valuable electronic trading systems.

FAQ

Can these bots trade 24/7?

Yes, bots operate continuously in the cloud or on servers, monitoring markets and executing trades automatically, even when you are offline.

How do I choose the best bot for me?

Consider your trading goals, experience level, exchange compatibility, cost, automation features, and risk management tools before selecting a bot.

Do I need technical skills to use these bots?

Some bots, like Coinrule and TradeSanta, are beginner-friendly with no coding required. Others, like HaasOnline, may need scripting knowledge for advanced strategies.

What is a buy-the-dip crypto bot?

A buy-the-dip bot automatically purchases cryptocurrencies when their prices fall below predefined levels, helping traders accumulate assets at lower average costs.