I’ll go over the top cryptocurrency wallets for fund managers in this post, emphasizing safe, legal, and business-grade options.

Fund managers can securely store, manage, and transact digital assets while upholding regulatory compliance and operational efficiency in contemporary crypto investment strategies thanks to these wallets’ sophisticated features, which include multi-signature approvals, policy-based access, and audit-ready reporting.

Benefits Of Crypto Wallets for Fund Managers

Enhanced Security – Fund assets are protected using crypto wallets, MPC, HSM, and hardware wallets, lowering the chances of theft and unauthorized access.

Regulatory Compliance – Fund managers can meet the requirements of the regulation efficiently, aided by integrated AML and KYC, and audit-ready reporting.

Multi-Approval Workflows – Role-based access, and multi-sig approval permissions help control governance of transactions for better management of higher value transactions.

Operational Efficiency – Fund managers incur lower operational costs, as manual fund activities are reduced, due to the integrated APIs and operational merges of trading, staking, and treasury management.

Portfolio Transparency – Clients and stakeholders can see audit reports, and audits can be tracked in real time.

Support for Multiple Assets – Fund managers can control and manage multiple cryptocurrencies, coins, and tokens, and stablecoins.

DeFi and Staking Access – Most wallets allow regulated access and engagement to (under policy control) staking and DeFi protocols.

Reduced Operational Risk – Automated transaction controls and policy enforcement minimize the level of human and insider risk.

Business Continuity – Funds are governed by policies to ensure that transactions remain on scopes of approval even when there are changes in personnel.

Investor Confidence – Reporting, compliance, and security assure the investors and institutional counterparties.

Key Point & Best Crypto Wallets for Fund Managers List

| Crypto Wallet / Custody | Key Points |

|---|---|

| Anchorage Digital | Provides fully regulated, institutional-grade custody with insurance coverage; supports staking and DeFi integration. |

| BitGo Trust Company | Offers multi-signature security, regulatory compliance, and enterprise-grade custody for digital assets. |

| Fireblocks | Focuses on secure transfer, storage, and tokenization; MPC wallet technology reduces private key risk. |

| Gemini Custody | FDIC-insured for USD balances, strong compliance with US regulations, supports staking and insurance options. |

| Coinbase Custody | Regulated and insured, supports a wide range of assets, integrates with Coinbase Exchange for liquidity. |

| Kraken Custody | Offers institutional-grade security, insurance, and compliance; supports global clients with flexible custody options. |

| Copper ClearLoop | Combines multi-party computation (MPC) and smart contract automation for secure institutional transactions. |

| Qredo | Decentralized custody with MPC; allows secure cross-chain transfers and DeFi access. |

| Ledger Enterprise | Hardware wallet-based enterprise solution; offers strong cold storage and multi-authorization features. |

| Trezor Enterprise Solutions | Enterprise-focused hardware wallets; offline key management, multi-signature support, high security for institutions. |

1. Anchorage Digital

Anchorage Digital is a regulated, crypto custody platform that has institutional-grade crypto custody solutions. Some of these advanced security solutions have hardware isolation and biometric authentication.

Their compliance-first approach fits with US regulations, which is a good sign for institutional investors. Anchorage also allows fund managers to keep their assets secure and also earn. For example, managers can stake, lend, or use DeFi integrations.

With insurance coverage and 24/7 monitoring, Anchorage Digital also handles operational risks and places handles digital assets. Anchorage Digital is among the Best Crypto Wallets for Fund Managers.

Anchorage Digital Features, Pros & Cons

Features

- Crypto bank with federally chartered fund custody solutions

- Support for staking, governance, and other yield strategies

- Qualified custodian with full AML/KYC compliance

- Enterprise API for treasury system integration

- Audit ready reporting and logs

Pros

- Top tier regulatory fund compliance

- Highly secure layered cold/warm custody

- Facilitates governance and staking for institutional funds

- Investor transparency due to audit ready reporting

- Highly trusted by large asset managers

Cons

- Service limited to select jurisdictions

- Premium services have a higher fee

- Not preferred for self custody

- Delays can be lengthy during onboarding

- Manual DeFi

2. BitGo Trust Company

BitGo Trust Company, one of the first players in enterprise-grade custody, provides multi-signature wallets, top-grade safety features, and complete compliance with all global regulations. It allows institutional investors to securely custody, transfer, and manage a variety of digital assets.

Also, BitGo’s safety and risk management features mitigate the chances of cyber threats. The platform also supports integrations with trading, lending, and staking services. Its security, compliance, and institutional focus makes BitGo one of the Best Crypto Wallets for Fund Managers. Fund Managers can be sure of safe management of assets in large quantities with BitGo.

BitGo Trust Company Features, Pros & Cons

Features

- Multi-sig wallets and qualified custodian

- Full AML/KYC for fund operations

- Monitoring of transactions in real time

- Fund management via institutional APIs

- Digital assets insurance

Pros

- Fund compliance and audit along with lag capabilities

- Reduced risk with multi-sig security

- Reporting capabilities for enterprise

- Digital asset insurance improves trust

- Digital assets insurance improves institutional fund support

Cons

- Greater rigidity in work processes compared to MPC-based alternatives

- Smaller funds may find it expensive

- Defi-native adoption is still developing

- Needs to be merged with internal systems of the fund

- Onboarding is subject to compliance checks

3. Fireblocks

Fireblocks is one of the first secure digital asset platforms that combines multi-party computation (MPC) with proprietary security for transfer, storage, and tokenization. It removes the vulnerabilities of private keys by fragments of keys stored with different parties, thereby reducing the risk, and facilitating instant settlement.

Like all other systems, Fireblocks integrates with exchanges, DeFi protocols, and payment systems. This provides Fund Managers optimum operational efficiency. Considering the audit trails, compliance reporting, and coverage of insurance, these services are essential for a highly regulated institution.

This also puts Fireblocks in the Best Crypto Wallets for Fund Managers category. Here, top-notch security and several options for management are combined primarily for professional management of assets.

Fireblocks Features, Pros & Cons

Features

- Fund administration via MPC-based wallet systems

- Workflows with policy-based approvals

- Embedded AML/checks compliance

- Multiple supported assets and blockchains

- Transaction governance audit trails

Pros

- Robust fund-level AML and compliance

- Operational risk is reduced via policy-based workflows

- Seamless with trading and liquidity services

- Access to DeFi and staking for fund strategies

- No single point of failure with added security from MPC

Cons

- Smaller funds may find it difficult to implement

- Positioned in the upper-cost range.

- Not all jurisdictions recognize them as a custodian

- Staff may need to be trained to realize the full value of the various workflows

- Dependence on third-party custody

4. Gemini Custody

Gemini Custody’s clients enjoy the safety and asset management services provided by Gemini Exchange’s regulated subsidiary. Fund Managers can rely on Gemini because of its strong Staking Compliance, USD balance FDIC insurance, and robust compliance survey closures. Gemini offers fund managers more flexible options for withdrawals and transfers.

Managers can also choose to insure their accounts against the loss of digital assets. Gemini offers transparency to its clients in the form of a compliance survey closure. Due to its Survey Compliance and transparency, Gemini Custody is trustworthy for fund managers and low-crypto portfolio managers.

Gemini Custody Features, Pros & Cons

Features

- Custodial services for institutional funds under regulation by the NYDFS

- Cold storage with an insurance policy

- Compliance and reporting tools that are audit ready

- Integrated with Gemini trading systems

- Built-in AML/KYC

Pros

- Comprehensive coverage for regulation and compliance

- Asset protection via insurance

- Fund audit reports made easy

- Integrated with trading services with ease

- Ideal for U.S. funds that require custody with regulation

Cons

- Automation policies offer less than MPC wallets.

- Some new tokens have insufficient asset support.

- Premium institutional services may incur high costs.

- Not DeFi-native.

- Less options for automating workflows.

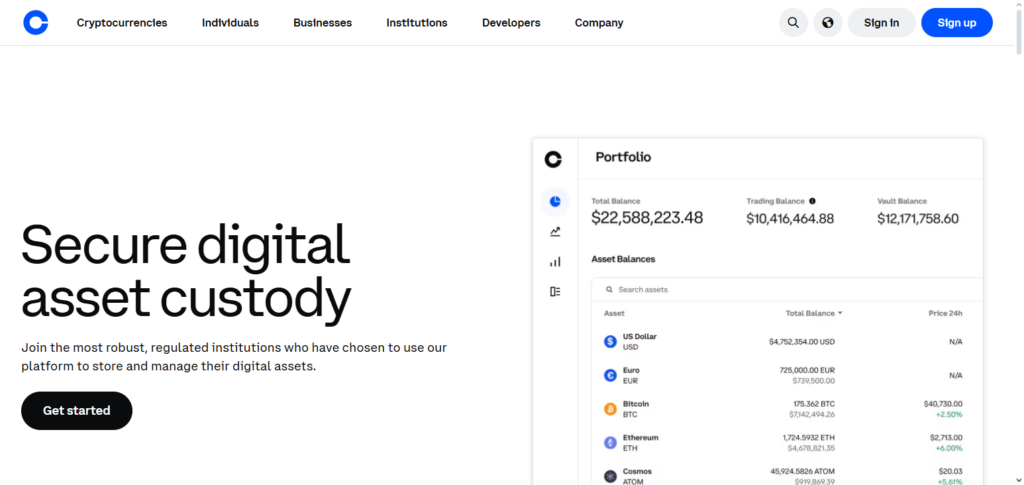

5. Coinbase Custody

Coinbase Custody offers the safe storage of various digital assets. Their Partner Exchange, Coinbase, offers insured cold storage and consistent regulatory compliance. Coinbase also offers Staking, Governance, and Audit reporting to their clients. Fund Managers custom to patience and confidence manage digital assets.

They will manage the digital assets of the fund’s managers without delay. Managers of Coinbase Custody offer robust infrastructure to Fund Managers scaling their operations. These digital managers will also offer regulatory compliance to the fund’s managers. These factors make Coinbase Custody one of the best Fund Managers’ Crypto Wallets.

Coinbase Custody Features, Pros & Cons

Features

- Integration of AML/KYC Procedures.

- API access for institutions and associated reporting.

- Insured cold storage.

- Multiple fund structures supported.

- Transaction monitoring and compliance.

Pros

- Worldwide Regulatory Compliance.

- Utilization of Coinbase trading infrastructure.

- Extensive asset coverage.

- Rapid onboarding for institutions.

- Insured storage within cold vaults.

Cons

- Less flexibility with policy workflows compared to MPC-based platforms.

- Minimal DeFi features.

- Expensive premium services.

- More limited workflows with less granular approvals.

- Restricted external integrations.

6. Kraken Custody

Kraken Custody became one of the first custody services to offer digital asset custody to institutions in a legally compliant manner. They pride themselves in being compliant with both national and international regulations.

They also offer insurance protection, multi-signature wallets, and in-depth reporting for all their services. Kraken also provides more than one type of custody service, offering hot and cold custody services, which allow asset managers to strike a good balance between operational flexibility and liquidity.

Kraken’s infrastructure allows automatic transfers of assets between different DeFi services and other tradable services. Because of all these things, Kraken Custody is one of the Best Crypto Wallets for Fund Managers and also provides a lot of trust for institutions with large amounts of crypto assets under management.

Kraken Custody Features, Pros & Cons

Features

- Compliance with institutional fund AML/KYC.

- HSM + MPC Custody.

- Role-based access and reporting.

- Trading and Staking integration support.

- Fund operations logs with audit readiness.

Pros

- Comprehensive fund compliance.

- Cost-effective services.

- HSM + MPC Custody with robust security.

- Custody integration with trading.

- Role-based access control at the fund level.

Cons

- Less developed AML tools compared to some exchanges.

- Policy automation second to MPC.

- Support is limited compared to competitors.

- Integration is tricky.

7. Copper ClearLoop

Copper ClearLoop is one of the major players in combining the use of Multi-Party Computation (MPC) with automated smart contracts in order to create safe and efficient transfers of assets. This allows fund managers to perform high-volume transfers with little to no risk at all, while remaining compliant to all regulations.

The ClearLoop platform has integrated trading, lending, and even staking, allowing institutions to get the most value out of their digital assets.

ClearLoop also has insurance coverage and audit-readiness in reporting for all of their services. All of these attributes have helped rank Copper ClearLoop as one of the Best Crypto Wallets for Fund Managers, combining safety, compliance, and efficiency for professional institutions.

Copper ClearLoop Features, Pros & Cons

Features

- Custody via MPL for enhanced security of institutional funds

- Dashboards for KYC/AML reporting

- Work streams for approvals by multiple parties

- Funding management via Enterprise APIs

- Cold and warm storage that is integrated

Pros

- Robust support for AML and compliance

- Funds security via MPL

- Customizable workflows for approvals

- Integration capabilities that are enterprise ready

- Treasury and fund operations are supported

Cons

- Ecosystem is smaller than leading providers

- Potentially high fees

- Time intensive onboarding

- Limited integration for DeFi

- Less penetration outside of institutions

8. Qredo

Using MPC and Layer 2 technologies, Qredo builds a separate layer for the custody of digital assets while facilitating cross-chain transactions. Fund managers can utilize liquidity on different blockchains and DeFi protocols.

Qredo’s operational APIs create audit trails and manage private keys, improving operational risk. With its exclusive architecture, Qredo enables real-time settlement and seamless cooperative trading between counterparties.

With robust risk management and digital asset protection, Qredo is one of the Best Crypto Wallets for Fund Managers as it offers a secure and decentralized solution for institutional digital asset management.

Qredo Features, Pros & Cons

Features

- A network of decentralized custody with MPC

- Cross-chain compliance checks

- Multi-signatory governance

- Audit and transaction monitoring

- Fund strategy integration with DeFi

Pros

- Decentralized custody eliminates single-point risk

- Robust workflows in fund governance

- Support for cross-chain assets

- DeFi access with controlled policies

- Transparent logs for transactions

Cons

- Not bank-regulated in some areas

- Developing AML tooling

- Fund teams face a learning curve

- Reliance on network infrastructure

- Less integration with traditional custody solutions

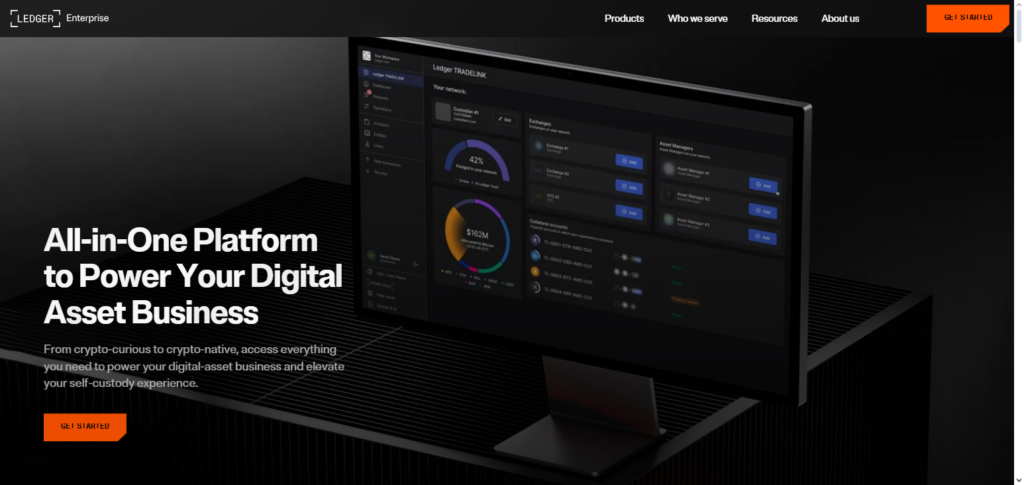

9. Ledger Enterprise

For institutional investors who want the highest level of protection, Ledger Enterprise has a custody solution. Ledger Enterprise uses secure elements, offline key storage, and multi-user authorizations, which protects systems from cyber threats. With console assets, digital ledger, and staking, Ledger Enterprise can integrate into other financial systems.

Fund managers can employ operational mechanisms while maintaining their key control. Their focus on secure mechanisms, multi-user authorizations, and audit-ready systems makes Ledger Enterprise one of the Best Crypto Wallets for Fund Managers, especially for organizations that want cold storage solutions.

Ledger Enterprise Features, Pros & Cons

Features

- Fund security through hardware key isolation

- Enforcement of policies offline

- Permission controls based on roles

- Corporate tools with integrated AML

- Workflows for secure signing

Pros

- Optimal security and isolation

- Control of internal fund policy

- Elimination of third-party custodian risk

- Reliable signing and hardware security

- Suitable for treasuries of corporate funds

Cons

- Custodian regulation is absent

- AML tools rely on external partners and are downstream

- Overhead for integration

- Limited support for DeFi

- Internal operational expertise is needed

10. Trezor Enterprise Solutions

With Trezor Enterprise Solutions, clients can benefit from secure custody and care with hardware-based breaches. After all, offline key storage and multi signature failures protect against unauthorized access and cyber attacks.

Trezor Enterprise Solutions also delivers on enterprise-level governance, compliance reporting, and other integrations with financial and trading platforms. This aids users for being professional fund managers.

Usability and security coupled with regulatory compliance in the Trezor platform foster institutional asset protection and operational efficiency. Trezor Enterprise Solutions is categorized as one of the Best Crypto Wallets for Fund Managers and solidifies their position as a versatile enterprise seeking compliant, secure, and scalable custody solutions.

Trezor Enterprise Solutions Features, Pros & Cons

Features

- Control of offline hardware keys for funds

- Workflows of policies for multi-party approvals

- Integration of AML through partners

- Authorization of transactions securely

- Governance layering for corporations

Pros

- Complete control over fund with self-custody

- Defined governance for fund teams

- No third-party custodian risk

- Transparency on audits

- Supports treasury activities

Cons

- Continuity of AML functionality depends on third-party integrations

- No regulated custodian

- Restrained connectivity to exchanges

- Limited functionality for DeFi

- Not a complete AML solution

Conclusion

In conclusion, fund managers who place a high priority on security, compliance, and operational effectiveness must choose the best cryptocurrency custody solution. Platforms that cater to the specific requirements of institutional investors include Anchorage Digital, BitGo Trust Company, Fireblocks, Gemini Custody, Coinbase Custody, Kraken Custody, Copper ClearLoop, Qredo, Ledger Enterprise, and Trezor Enterprise Solutions.

These wallets guarantee the security and accessibility of digital assets through everything from sophisticated multi-party computation and hardware-based cold storage to smooth integration with trade and DeFi protocols. Selecting the Best Crypto Wallets for Fund Managers enables organizations to confidently manage huge portfolios while reducing risk in the quickly changing cryptocurrency market.

FAQ

What are crypto custody wallets for fund managers?

Crypto custody wallets are secure platforms or devices designed to store, manage, and transfer digital assets for institutional investors. They provide advanced security measures, regulatory compliance, and operational features that ensure fund managers can safely manage large portfolios of cryptocurrencies.

Why do fund managers need institutional-grade crypto wallets?

Fund managers handle significant amounts of digital assets. Institutional-grade wallets offer multi-signature protection, cold storage, insurance coverage, and regulatory compliance, minimizing the risk of theft, loss, or operational errors while ensuring adherence to legal standards.

What features should fund managers look for in crypto wallets?

Key features include multi-signature authorization, cold and hot storage options, multi-party computation (MPC), insurance coverage, staking support, regulatory compliance, audit-ready reporting, and seamless integration with exchanges and DeFi protocols.

Are these wallets insured?

Many institutional wallets, like Coinbase Custody, Gemini Custody, and BitGo Trust Company, offer insurance coverage against theft or hacking. Coverage limits vary by platform, so fund managers should review policies carefully.

Can these wallets support staking and DeFi?

Yes. Wallets like Anchorage Digital, Fireblocks, and Qredo support staking and DeFi integrations, allowing fund managers to earn additional returns on their assets while maintaining secure custody.