I’ll go over the top cryptocurrency wallets that support SOC 2 compliance in this post, with an emphasis on safe and dependable options for organizations.

In today’s high-risk cryptocurrency world, these wallets’ strong security features, multi-signature restrictions, policy-based access, and audit-ready reporting allow businesses to securely handle digital assets, guarantee operational integrity, and uphold regulatory compliance.

Why It Is Crypto Wallets Supporting SOC 2 Compliance Matter

Elevated Security Policies – SOC 2 compliance means that crypto wallets use security procedures that protect against breaches.

Reliable Operations – It means that the wallet provider has strong internal controls and operates consistently.

Regulatory Peace of Mind – With an SOC 2, institutions and auditors can confirm you have been evaluated using minimum accepted industry standards.

Sensitive Data Security – Financial and customer data can be kept and monitored.

Audit Simplification – Transparency and permissive documentation makes audits and investigations easier.

Risk Decrease – Lessens the risk of operational, compliance, and internal processes for firms managing crypto assets.

Trust of Partners and Investors – More credibility from SOC 2 compliance means increased trust from institutional partners, funds, and investors.

Standardized Controls – Uniform processes become implemented for system monitoring, incident response, and access control.

Continuity of Business – Minimizes operational interruptions and downtime by improving system resilience.

Advantage Over Competition – Establishes the wallet provider as a secure and trusted solution for enterprises within the industry.

How To Choose Crypto Wallets Supporting SOC 2 Compliance

Verify Valid SOC 2 Reports – Check that the wallet provider possesses a recent SOC 2 Type II report with respect to the following trust service criteria: security, availability, processing integrity, confidentiality, and privacy.

Security Architecture – Assess whether the wallet provider has implemented security measures such as multi-signature (MPC), HSMs, and hardware wallets.

Compliance & Audit Features – Ensure that the crypto wallet contains features for audit logging, report generation, and the monitoring of embedded compliance and regulatory frameworks.

Policy Controls & Access – Consider wallets that implement role-based access control, multi-tiered approvals, and policies to control the movement of transactions.

Supported Assets, Blockchains, and Networks – Ensure the crypto wallet supports all the cryptocurrencies and tokens that the organization needs to control.

Integration Capabilities – The crypto wallet should also integrate with trading desks, treasury management systems, and enterprise APIs.

Insurance & Risk Coverage – Check that there is cyber, operational, and theft insurance to cover the crypto wallet provider.

Scalability – Assess the wallet’s ability to support a large number of users, as well as frequent transactions, and the overall scalability of the enterprise.

Pricing & Support – Assess the enterprise client’s support, onboarding, and pricing structure.

Reputation & Ecosystem – Think about other universities’ adoption and the trust, credibility, and ecosystem of the provider in the market.

Key Point & Best Crypto Wallets Supporting SOC 2 Compliance List

| Crypto Custody Solution | Key Points / Features |

|---|---|

| Coinbase Custody | Regulated in the US, institutional-grade security, insurance coverage, multi-sig support, easy integration with Coinbase ecosystem |

| Anchorage Digital | SOC 1 & 2 compliant, staking support, advanced access controls, insured digital assets, API for institutional clients |

| Ledger Enterprise | Hardware wallet integration, secure key management, multi-asset support, offline storage, enterprise-grade encryption |

| BitGo Enterprise | Multi-sig wallets, insurance coverage, compliance tools, cold & hot storage, API access for businesses |

| Fireblocks | MPC-based wallet security, instant transfers, liquidity network, compliance monitoring, integrated with major exchanges |

| Kraken Custody | Fully regulated, insured storage, staking options, enterprise API, high-security cold storage infrastructure |

| Qredo | Decentralized custody with MPC, cross-chain settlements, institutional security, instant liquidity, regulatory compliance |

| Zengo Business | Keyless security (MPC), multi-user management, regulatory-compliant, insured digital assets, simple enterprise dashboard |

| Matrixport Custody | Multi-asset support, insurance protection, staking services, institutional-grade security, integrated trading tools |

| Gemini Custody | FDIC-insured USD, regulated in US, insured crypto storage, multi-sig security, staking and lending support |

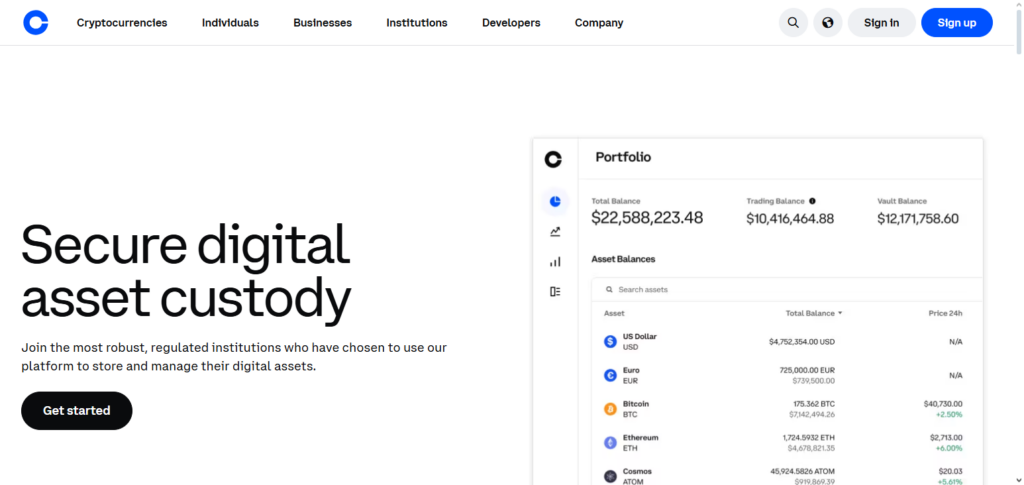

1. Coinbase Custody

Coinbase Custody is a digital asset custodian regulated as a New York trust company. It is widely used by hedge funds, asset managers, and other institutions requiring crypto custody services with segregated cold storage.

Custody has successfully completed SOC 1 and SOC 2 Type II audits for the New York trust company and has demonstrated progress with its internal systems related to Security, Availability, Confidentiality, Processing Integrity, and Privacy.

Coinbase Custody provides asset insurance, access to staking and governance, and treasury management via API. As a New York Trust company, Fireblocks and BitGo support Coinbase custody.

Coinbase Custody Features, Pros & Cons

Features

- Custody with SOC 2 Type II certification

- Integrated AML/KYC for compliance

- Cold storage backed by insurance

- APIs for institutions’ treasury and trading systems

- Reporting and logs for audits

Pros

- Coinbase for Custody has SOC 2 Compliance which means reliable operations

- Diverse cryptocurrencies for institutional balance sheets

- Audit transparency and regulators reporting

- Vault cold storage with insurance

- Coinbase Trade easily integrates

Cons

- Limited DeFi

- Workflows less flexible for policies than MPC based wallets

- Enterprise plans may be premium priced

- Additional effort for External integrations

- Workflows with multiple approvals are not very flexible

2. Anchorage Digital

Anchorage Digital has a federal banking charter with the U.S. Office of the Comptroller of the Currency (OCC), which gives the company a solid legal backing as a qualified custodian for institutional crypto assets.

It assists with digital assets combined with the latest in multi-party computation (MPC) and hardware security module (HSM) protection that is meant to provide the security of cold storage with the ability to conduct live transactions.

Anchorage’s infrastructure also allows for staking and governance services directly from custody to continue meeting the compliance standards of institutions.

Similar to other enterprise-focused platforms that target SOC 2 level control frameworks, Anchorage’s charter and audit rigor give assurance to entities that must balance custodial responsibility with operational and regulatory flexibility.

Anchorage Digital Features, Pros & Cons

Features

- SOC 2 compliance and federally chartered crypto bank

- Executed custody with AML/KYC for institutional clients

- Integrated APIs for trading and treasury systems

- Staking and governance support

- Compliance oversight with Audit reporting

Pros

- Anchorage has both SOC 2 and federally chartered crypto bank which means reliable and strong

- Operations for exchanges and funds are streamlined by Enterprise APIs

- Governance and staking support for institutional assets

- Additional layers of custody for enhanced security

- Secured by institutional investors and funds

Cons

- Restricted to select jurisdictions

- Elevated costs for premium offerings

- Not ideal for self-custody

- Can take a while to onboard

- Limited automation in DeFi

3. Ledger Enterprise

Ledger Enterprise builds on Ledger’s hardware security mastery by extending it to businesses and institutions with secure key management powered by HSM (Hardware Security Module) and enterprise-grade infrastructure.

While Ledger wallets have, until now, been purely self-custodial hardware instruments, Ledger Enterprise combines this hardware with flexible enterprise workflows, governance controls, and SOC 2 aligned compliance documentation to help firms scale key and approve management.

This solution is optimal for firms that wish to keep key control in-house with the added benefit of having processes that create predictable policy adherence Ledger’s SOC 2 aligned compliance is intended to provide what most institutional crypto custody operators seek during their first interactions with tools like Fireblocks and BitGo.

Ledger Enterprise Features, Pros & Cons

Features

- Offline key management using hardware with SOC 2 readiness

- Role-based access controls for multiple users

- Signing of transactions off-line

- Integration with internal treasury and exchange systems

- Compliance audit logs

Pros

- Ultimate protection with offline hardware keys

- Adaptable internal policy controls for groups

- No risk of a third-party custodian

- Solid governance and offline signing features

- Excellent for corporate treasuries and internal funds of exchanges

Cons

- No regulated custodian is available

- Additional external integration required for SOC 2 and AML

- Limited support for DeFi

- Internal operational expertise is required

- Overhead with hardware logistics

4. BitGo Enterprise

BitGo Enterprise is a major market player in institutional custody and is well-known for being the first to implement multi-signature wallet security, as well as other high compliance standards.

BitGo is U.S. based qualified custodian, which is certified in both SOC 1 & SOC 2 Type 2. This shows that they have strong internal controls regarding the protection of client assets. Protection of client assets is the main concern for BitGo.

They provide optional insurance, as well as great protection reporting tools needed for compliance audits. They have a great array of supported tokens. BitGo’s tech is compatible with custodial and trading workflows just like Coinbase Custody and Fireblocks. Fireblocks is another company that BitGo is partnered with.

BitGo Enterprise Features, Pros & Cons

Features

- SOC 2 Type II custody

- Architecture of multi-signature wallets

- For compliance, integration of AML/KYC

- Insurance for assets of institutions

- Enterprise APIs and reporting ready for audits

Pros

- Excellent SOC 2 compliance with enterprise level security

- Policy-based access controls that are flexible3. Digital assets, and their ability to be insured, mitigate risk

- Widespread institutional acceptance

- Multiple cryptocurrencies and tokens supported

Cons

- Competitors have more DeFi integrations

- Can be pricey for smaller organizations

- Integration is a bit of a laborious process

- Compliance-checking during onboarding can be tedious

- MPC workflows not as developed as Fireblocks

5. Fireblocks

Building on sophisticated MPC (Multi-Party Computation) key management, Fireblocks is a provider of crypto infrastructure that enables safe and effective institutional custody, transfers, and treasury operations without depending on a single private key.

Fireblocks has completed SOC-2 Type II audits as part of its enterprise-grade security architecture, which makes it an excellent option for businesses that need robust controls over data protection and operational procedures even though it is not a qualified third-party custodian.

The network of Fireblocks facilitates workflow automation and expedites transaction signature while upholding uniform compliance procedures. Other top institutional custody systems, like Coinbase Custody and BitGo, also use its SOC-aligned security methodology.

Fireblocks Features, Pros & Cons

Features

- Infrastructure for MPC wallets that are SOC 2 Type II certified

- Multi-level approvals and policy-based access controls

- Compliance and AML filters

- Support for a wide range of assets and blockchains

- Trading and liquidity platform integrations

Pros

- Enterprise-level security with SOC 2 certification

- Flexible policy workflows for internal governance

- Compliance controls for DeFi and exchange integrations

- Regulatory reporting made easier with audit logs

- Operation and key management risk mitigation

Cons

- More expensive than basic custody services

- Small internal teams may face a struggle to set it up

- As a custodian, not universally regulation compliant

- Functionality can be underutilized due to inadequate staff training

- Dependent on third-party structures

6. Kraken Custody

Kraken Custody is the qualified custodian part of Kraken Financial – a special purpose depository institution with Wyoming charters – offering digital asset custody with great controls and transparency features.

The platform has achieved its first relevant milestone regarding SOC 2 Type II compliance reporting, which illustrates it has reliable security and operational controls for reporting to its institutional clientele.

It incorporates dedicated multi-layer encryption, role-based access controls, and vault permission customization, which integrates with Kraken Prime for trading and financing while keeping assets in custody.

In addition to providing SOC 2 support, Kraken Custody’s regulated framework satisfies institutional customers’ fiduciary and audit requirements and places it in the same competitive set as SOC-compliant offerings, including BitGo, Coinbase Custody, and Fireblocks.

Kraken Custody Features, Pros & Cons

Features

- Custody for institutional clients who SOC 2 Type II certified

- MPC + HSM security

- Permissions and access controls that are role-based

- Integration with Trading Services

- Compliance reporting that is audit-ready

Pros

- For institutional and exchange use, strong SOC 2 security.

- Control and governance based on multi-user roles.

- Reasonable rates for corporate customers.

- Trading and staking integration support.

- For regulatory and internal review, there are audit logs.

Cons

- Less sophisticated AML tooling than some competitors.

- Less asset support than top providers.

- Limited in DeFi integration

- Secondary to MPC, automation of policies

- Effort for internal integration is required

7. Qredo

Qredo employs a decentralized MPC approach to crypto custody which allows firms to operate without having to give control of private keys to a centralized third party.

Rather, Qredo.encrypts and splits key control over a distributed network, and no single party can gain access to the complete key.

This combination secures and strengthens the network. Qredo’s partnerships with a number of different companies to provide custody solutions. Despite not being a qualified custodian,

Qredo’s algorithmic encryption and governance, as well as institutional-grade regulation, fall within the scope of SOC 2 compliant offerings. Companies looking to operate with self-custody while maintaining compliance often use Qredo in collaboration with fireblocks or Bitgo.

Qredo Features, Pros & Cons

Features

- Readiness for SOC 2, Decentralized MPC custody network

- Compliance checks for all chains.

- Governance multil-signatory

- Audit and Monitoring of Transactions

- Limited supportive DeFi and staking

Pros

- Custody decentralization diminishes the risk of single points.

- Strong governance workflows for internal control.

- For multiple assets, cross-chain support is available.

- Audit and transaction logs offer transparency.

- Compliance-managed DeFi access.

Cons

- Not all areas are fully bank-regulated.

- Tooling for AML is still developing.

- Internal teams experience a learning curve.

- Operations depend on a network.

- Less integration with conventional custody systems.

8. Zengo Business

An example of a crypto wallet and treasury management platform aimed at enterprises is Zengo Business. It is built on MPC technology so there is no seed phrase vulnerability or single points of failure.

This non-custodial alternative provides the ability to manage one’s assets while also incorporating institutional-grade features such as role-based access controls, whitelisting, audit trails, and compliance workflows.

While Zengo is not a typical custodian, it provides crypto and operational controls to meet industry standards and compliance expectations akin to a SOC2 framework.

It provides auditing and operational flexibility to organizations needing to balance asset sovereignty with enterprise audit readiness, and also provides real-time swaps, liquidity management, and fiat on and off ramps, similar to other SOC-focused custody wallets.

Zengo Business Features, Pros & Cons

Features

- MPC-based wallet with SOC 2 compliance.

- Access control with multiple users in roles.

- Integration of AML/KYC

- Monitoring of audits and transactions in real time.

- Access to enterprise API for internal operations.

Pros

- Certified with SOC2 for strong security

- Approval workflows and policies that are flexible

- API’s that enable easy integration

- Auditing is made easy with transparent logs

- Managing multiple assets is supported.

Cons

- Ecosystem is smaller compared to Fireblocks or BitGo.

- Limited options for DeFi and staking

- Not a regulated custodian

- Training is required for internal teams

- Limited support for some assets

9. Matrixport Custody

Matrixport’s institutional custody solution, Cactus Custody, is a regulated digital asset custodian for global institutions with tiered hot and cold wallet custody, advanced encryption, and multi-signature access controls.

Cactus Custody operates under multiple licenses (Hong Kong Trust Company, FINMA in Switzerland, MSB in the U.S.) and meets institutional compliance along with SOC-style security and audit controls.

Providing flexible DeFi access with custody security and operational transparency, Cactus Custody meets the needs of enterprise-grade custody in a regulated environment with integrated crypto financial services. Cactus Custody is similar to Coinbase Custody and BitGo in providing a compliant solution built around SOC 2 standards.

Matrixport Custody Features, Pros & Cons

Features

- Custody that is SOC 2 ready and of institutional grade.

- Integrated compliance for AML/KYC

- Controls for Internal integration with exchanges via API’s

- Support for multiple chains

- Reporting and auditing resources

Pros

- Merges custody with treasury and fund management

- SOC 2 combined with AML/KYC for compliance

- Support for staking and DeFi that is controlled

- Management of multiple assets

- Enterprise grade API’s for operational improvement

Cons

- Compared to Fireblocks, policy automation is less.

- Outside the APAC, adoption is smaller.

- For smaller teams, prices may be too high.

- DeFi has less integration

- Not fully regulated when it comes custodian services.

10. Gemini Custody

One of the most compliance-focused cryptocurrency custodians is Gemini Custody, which is provided by the regulated Gemini Trust Company in New York. Its internal controls and security procedures have been validated by both SOC-1 and SOC-2 Type-II audits. It protects client assets while offering insurance protection and audit visibility through the use of multi-party technologies, tiered governance protocols, and offline cold storage.

Gemini Custody is a great option for organizations who value auditability, regulatory compliance, and insured asset protection because of its high degree of regulatory compliance and stringent auditing, which places it alongside other leading SOC-certified custodial solutions like Coinbase Custody and BitGo.

Gemini Custody Features, Pros & Cons

Features

- Custody under NYDFS with SOC 2 Type II certs.

- Insurance with Multi Sig cold storage

- Monitoring compliance and KYC/AML

- Gemini exchange integration infrastructure

- Reporting for clients that is ready for audits

Pros

- SOC 2 and Gemini regulations are strong compliance.

- Audit and investor transparency

- Insured custody

- Extensive asset support

- Seamless integration with trading operations

Cons

- Less adaptable policy workflows than MPC platforms

- Reduced functionality with DeFi

- Enterprise services come with increased costs

- Less granular multi-approval workflows

- External integrations may be cumbersome

Conclusion

In conclusion, organizations and companies looking for strong security, regulatory compliance, and operational transparency must choose a cryptocurrency wallet that meets SOC-2 compliance.

Different combinations of audited internal controls, multi-signature or MPC security, insurance coverage, and enterprise-grade governance are offered by wallets such as Coinbase Custody, Anchorage Digital, Ledger Enterprise, BitGo Enterprise, Fireblocks, Kraken Custody, Qredo, Zengo Business, Matrixport Custody, and Gemini Custody.

These wallets guarantee that client funds are shielded from prospective breaches, operational dangers, and unauthorized access by utilizing SOC2-aligned frameworks. By incorporating such custodial solutions, organizations can improve security while also making compliance, audits, and client and regulatory trust easier.

FAQ

What does SOC 2 compliance mean for a crypto wallet?

SOC 2 compliance ensures that a crypto wallet follows strict standards for security, availability, processing integrity, confidentiality, and privacy. Wallets with SOC 2 audits demonstrate that they have robust internal controls to protect user assets and data, making them suitable for institutional and corporate use.

Which crypto wallets support SOC 2 compliance?

Some of the leading SOC 2–compliant wallets include Coinbase Custody, Anchorage Digital, Ledger Enterprise, BitGo Enterprise, Fireblocks, Kraken Custody, Qredo, Zengo Business, Matrixport Custody, and Gemini Custody. These wallets combine audited security protocols with enterprise-grade asset management.

Why is SOC 2 important for institutional crypto custody?

For institutions, SOC 2 compliance verifies that a wallet’s operational and security practices meet rigorous standards, reducing the risk of breaches or mismanagement. It also simplifies audits and regulatory reporting, ensuring trust with clients and regulators.

Are SOC 2–compliant wallets insured?

Many SOC 2–compliant wallets, such as Coinbase Custody, BitGo, and Gemini Custody, offer insurance coverage for digital assets stored under their custody, providing an added layer of protection against theft, hacks, or operational failures.

Can individuals use SOC 2–compliant wallets?

While SOC 2–compliant wallets are primarily designed for institutions and businesses, some platforms like Ledger Enterprise or Zengo Business can also be adapted for high-net-worth individuals seeking enterprise-level security and compliance.