In this post, I will address the best DigiPayKit alternatives for businesses and individuals looking for dependable digital payment options.

With the likes of Stripe, PayPal, Square, Razorpay, etc. These sites provide safe, effective, and scalable payment processing.

Whether it is for international transactions, in-person payments, or sophisticated business tools, this guide will help you locate the best option for Digipaykit.

Key Poinst & Best DigiPayKit Alternatives

| Alternative | Key Point |

|---|---|

| Stripe | Global leader in online payments with developer-friendly APIs and scalability |

| PayPal | Widely trusted digital wallet offering peer-to-peer and business transactions |

| Square | POS integration with strong support for small businesses and in-person payments |

| Razorpay | India-focused solution with UPI, cards, and subscription billing |

| ePayPolicy | Insurance industry specialization with compliance-ready payment features |

| Zil Money | Check printing and ACH transfers alongside digital wallet features |

| Payoneer | Cross-border payments ideal for freelancers and global businesses |

| Adyen | Enterprise-grade platform with omnichannel payment support |

| Skrill | Low-cost international transfers with prepaid card options |

| Authorize.Net | Reliable gateway with fraud detection and recurring billing |

10 Best DigiPayKit Alternatives

1. Stripe

Stripe is perhaps one of the most versatile and broad-reaching alternatives in the DigiPayKit space. Unlike DigiPayKit, Stripe offers integration on all levels with seamless functionality on over 35 different platforms, making it easy for businesses to accept payments on credit cards, digital wallets, and even cryptocurrencies.

Easy to setup, tokenized for use with subscriptions and invoicing, and backed with great documentation to support pay-flow customizable transactions, it is well suited for new and advanced businesses.

With top of the line fraud protection, strong analytics, and the ability to transact in nearly any global currency, Stripe offers a flexible digital payments solution.

Stripe:

Developer Oriented API– Offers a range of payment flow options and allows for custom payment flow, subscription payment management and invoice payment management.

Various Payment Methods Supported – Users can pay with a credit card, debit card, digital wallet, and even a cryptocurrency.

Worldwide and Multi-Currency Operational – Accepts payments from users around the world and can operate in multiple currencies.

Fraud Prevention and Payment Analytics – Offers payment analytics and fraud prevention tools.

| Pros | Cons |

|---|---|

| Developer-friendly APIs for full customization | Can be complex for beginners without technical knowledge |

| Supports multiple payment methods, including cards, wallets, and crypto | Transaction fees can add up for small businesses |

| Global reach with multi-currency support | Limited phone support; primarily online support |

| Advanced analytics and fraud detection | Some features may require add-ons, increasing cost |

| Subscription and invoicing management | Setup can be overwhelming for non-technical users |

2. PayPal

PayPal is another DigiPayKit competitor, but leads DigiPayKit in reliability and global acceptance. PayPal is a seamless, trusted currency processor for buyer/seller transactions, and customers can easily navigate the site.

Businesses, freelancers, and e-commerce customers love PayPal for the instant transactions, buyer protections, and invoicing.

PayPal is easily integrated into most websites and marketplaces, so their customers do not have to go through the extensive setup and complexity that DigiPayKit requires.

PayPal and individuals seeking a trusted, flexible business solution can feel safe due to their well earned reputation and wide array of integrated services.

PayPal:

Widespread Global Reach – Well known and trusted service for online transactions.

Multi-Currency Payment Support – Can be used in multiple currencies with simple currency conversion.

Trust and Security – Offers a protection policy for both buyers and sellers.

Easy to Use – Works with a variety of websites, online marketplaces, and invoicing tools.

| Pros | Cons |

|---|---|

| Widely accepted and trusted globally | High transaction fees, especially for international payments |

| Supports multiple currencies and instant transfers | Account freezes can occur if activity seems unusual |

| Easy integration with websites and marketplaces | Limited advanced customization for payment flows |

| Buyer and seller protection | Dispute resolution can be slow and cumbersome |

| No complex setup required | Not ideal for very large enterprises due to cost |

3. Square

Square represents an excellent alternative to DigiPayKit for firms that want an all-in-one payment and point-of-sale solution.

Best of all, the ability to consolidate online and face-to-face payments is the most seamless, letting merchants handle sales, inventory, and customers all in one place.

Additionally, unlike DigiPayKit, Square gives its users free POS software, and optional retail and restaurant hardware, as well as insightful business analytics.

Because Square is instantly payable, and features flexible invoicing and payment processing, it’s ideally suited for small and mid-sized businesses. Square is undoubtedly one of the most versatile, user-friendly and comprehensive digital payment solutions.

Square:

Multi-Channel Payment – Supports online and offline payment options.

Free Payment Management Software – A flexible sales management tool is offered for free and includes customer management, inventory management and sales management.

Speedy Payment Access – Small businesses and sellers can have quick payment access.

Sales Performance Tracking – Offers analytics for sales, customer activity, and inventory activity.

| Pros | Cons |

|---|---|

| Combines online and in-person payments | Not fully optimized for large international operations |

| Free POS software with optional hardware | Some advanced features require paid plans |

| Inventory, sales, and customer management in one platform | Limited multi-currency support |

| Instant payouts and easy invoicing | Transaction fees may be higher for some payment types |

| User-friendly interface | Some users report occasional technical glitches |

4. Razorpay

For businesses in India seeking digital payment options, Razorpay represents the best alternative to DigiPayKit.

The company has the ability to process payment with a fully integrated, customizable payment gateway supporting credit and debit cards, UPI, digital wallets, and even EMIs, all within one system.

Unlike DigiPayKit, Razorpay is particularly well suited to startups and scaleups as the company offers simple API integration, subscription management, and instant settlement.

The company has strong capabilities to detect fraud, offers detailed metrics, and has support for efficient transactions in multiple currencies. Local adaptability, scalability, and advanced features make it a top valued company for digital payment processing.

Razorpay

Multiple Payment Methods – Support for UPI, cards, wallets, and payments through EMI.

Seamless API Integration – Makes it easier for developers and start-ups to set up online payments.

Subscriptions and Recurring Billing – Perfect for SaaS companies or for payments that are ongoing.

Quick Settlements – Quick access to funds with the additional capability of supporting numerous currencies.

| Pros | Cons |

|---|---|

| Supports UPI, cards, wallets, and EMI options | Mostly India-focused; global reach is limited |

| Easy API integration and subscription management | Some advanced features can be complex for beginners |

| Instant settlements and multi-currency support | Customer support can be slow at times |

| Advanced fraud detection | Pricing for premium services can be higher |

| Ideal for startups and growing enterprises | Limited offline POS options |

5. ePayPolicy

While paying on the DigiPayKit payment platform is an option, ePayPolicy is better suited for those using streamlined payment processing for insurance and policy management.

ePayPolicy is the only platform offering the ability to accept and process digital payments and provide policy management tools.

ePayPolicy bundles payment processing with policy management to allow clients to make payments and users to monitor and manage renewals and clients all in one place. ePayPolicy integrates payment management with automated and secure payment reminders

and links, and insurance management systems to reduce administrative burden. ePayPolicy optimizes each user’s experience with payments by advanced reporting, tailored invoicing, and stronger security on more workflows.

Due to ePayPolicy’s specialization with policy payments, insurance agencies can count on ePayPolicy for increased efficiency.

ePayPolicy

Payment and Policy Management – Payment processing and insurance policy tracking in one platform.

Payment Automation – Automates reminder for payments and renewals due to clients.

Safe Payment Links – Transaction safety for insurances received.

Invoicing and Reporting – Helps to create reports that are standard for tracking payments made to clients and their policies.

| Pros | Cons |

|---|---|

| Combines payment processing with policy management | Niche focus on insurance may not suit all businesses |

| Automated reminders and secure payment links | Limited support for non-insurance businesses |

| Integration with insurance management systems | Not ideal for e-commerce or general business payments |

| Customizable invoicing and reporting | Smaller user base compared to mainstream platforms |

| Reduces administrative workload for insurance agencies | Fewer global payment options |

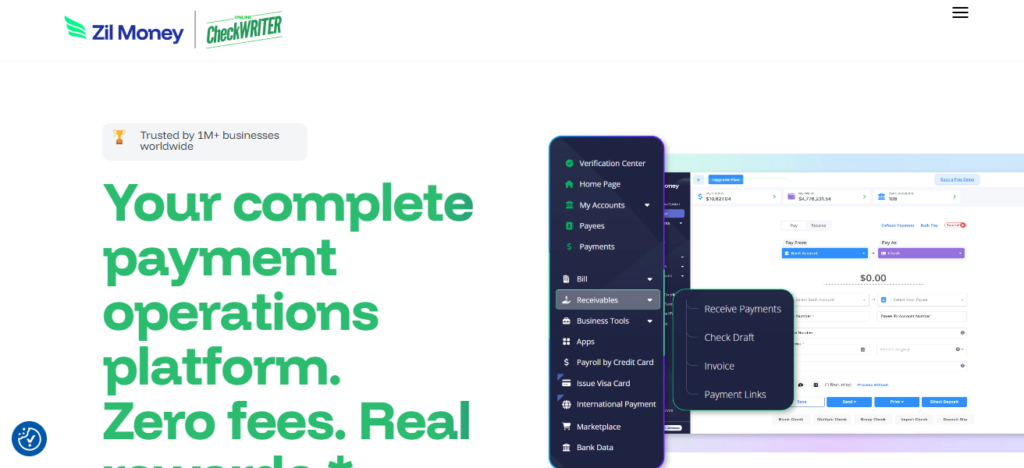

6. Zil Money

One of the best competitors to DigiPayKit would be Zil Money which combines digital payments and business banking.

While being able to Send, receive, and manage payments, on the same platform, accounting, and payroll, along with ACH transfers are handled.

Unlike DigiPayKit, Zil Money allows multi-user access with controlled permissions; thus, businesses have secure and collaborative access to their finances.

The platform is great for SMEs as it offers virtual cards, automated reporting, and tracking of transactions in real-time.

Their flexibility in payments, banking, and business management places Zil Money as one of the best alternatives for digital payments.

Zil Money

Integration with Business Banking – Merges payments with accounting, payroll, and ACH transfers.

Virtual Cards & Multi-User Access – Electronic cards with secure peer working with discretionary access.

Instant Transaction Visibility – Access to every payment and transfer in real time.

In-Depth Reporting – Synthesized financial reporting for improved insights on the business.

| Pros | Cons |

|---|---|

| Combines payments with business banking features | User interface can be overwhelming for new users |

| Supports ACH, payroll, virtual cards, and accounting | Less recognized internationally |

| Multi-user access with permissions | Limited integrations compared to mainstream platforms |

| Real-time transaction tracking and reporting | Some features require paid subscriptions |

| Ideal for SMBs needing comprehensive financial management | Fewer POS solutions for in-person payments |

7. Payoneer

Payoneer is an excellent alternative to DigiPayKit, especially for global businesses and freelancers. Its main feature is providing cross-border payments, allowing clients to receive various currencies to local bank accounts.

Unlike DigiPayKit, Payoneer offers prepaid Mastercard, mass payout, and marketplace and freelance platform integrations, easing the complexity of global payments. It also offers competitive rates, secure transactions, and easy to access dispersed funds.

This makes managing a global business easy. Payoneer is an easy to use platform and offers integrated banking, scalability and focused services to international payments. This makes it ideal for individuals and businesses to provide a digital payment platform.

Payoneer

International Payments – Receive payments from anywhere in the world and in different currencies.

Mass Payments – Compatible with large teams, freelancers, and marketplace.

Prepaid Mastercard Access – Gain access to funds directly, no traditional bank needed.

| Pros | Cons |

|---|---|

| Excellent for global cross-border payments | Fees for certain withdrawals and conversions |

| Supports multiple currencies and marketplaces | Customer support response time can vary |

| Prepaid Mastercard for easy access to funds | Not ideal for small domestic-only businesses |

| Mass payout solutions for businesses | Limited in-person payment solutions |

| Secure and reliable international transactions | Some features may require verification delays |

8. Adyen

Adyen is an excellent alternative to DigiPayKit as they also offer an enterprise-level solution to payments for international companies.

The competitive advantage Set to Adyen is that they offer all three payment channels: in-store, online, and mobile through one singular platform.

Adyen, unlike DigiPayKit, also offers more payment methods, more currencies, and an integrated solution for real-time fraud detection, along with more sophisticated analytical and reporting solutions.

Adyen also offers better payment processing as it has a more scalable infrastructure with direct acquirers to card networks which also lowers transaction costs.

Security and payment coverage are also reasons Adyen is an excellent alternative for larger companies that need a reliable and versatile solution for digital payments.

Adyen

Enterprise-Grade Solution – Targets medium and large organizations with elevated transaction levels.

Omnichannel Payments – Merges in-person, website, and mobile payment alternatives.

Advanced Risk Management – Integrated systems for fraud a weather safe payment processing.

Direct Card Network Connections – Transaction processing times and expenses are slashed.

| Pros | Cons |

|---|---|

| Enterprise-grade payment solution | Best suited for large businesses; may be costly for SMBs |

| Supports in-store, online, and mobile payments | Complex setup requires technical knowledge |

| Multi-currency and global payment methods | Transaction fees vary by region |

| Advanced analytics and risk management | Customer support can be limited for smaller accounts |

| Direct connection to card networks reduces costs | Not beginner-friendly |

9. Skrill

Skrill is DigiPayKit’s closest competitor, providing a reliable, fast, and safe digital payment solution for individuals and businesses alike.

Their major competitive advantage is their ability to transfer funds instantly in more than 100 different currencies and their ability to accept payments through various digital wallets, credit cards, and even cryptocurrencies.

Unlike DigiPayKit, Skrill is beneficial for global businesses and freelancers because they offer low-cost international transactions, prepaid cards, and provide seamless digital payment integration for online merchants.

Furthermore, they offer loyalty points, and customers get to enjoy high levels of guaranteed digital security. Skrill is a solid and reliable digital payment solution that others in the industry look up to.

Skrill

Digital Wallet Support – Facilitates quick payments via wallets, cards, and cryptocurrency.

Multi-Currency Capability – Transacts in over 100 currencies.

Prepaid Card Access – Use a prepaid card from Skrill to withdraw funds conveniently.

Merchant Integration – Works with online merchants and gaming sites to streamline payments to users.

| Pros | Cons |

|---|---|

| Fast and secure digital payments | Limited business-specific features |

| Supports 100+ currencies and crypto | Fees can be high for some international transfers |

| Prepaid cards and wallet support | Not widely accepted on all merchant platforms |

| Easy integration with online merchants | Customer service can be slow |

| Loyalty rewards and secure transactions | Less advanced invoicing or accounting features |

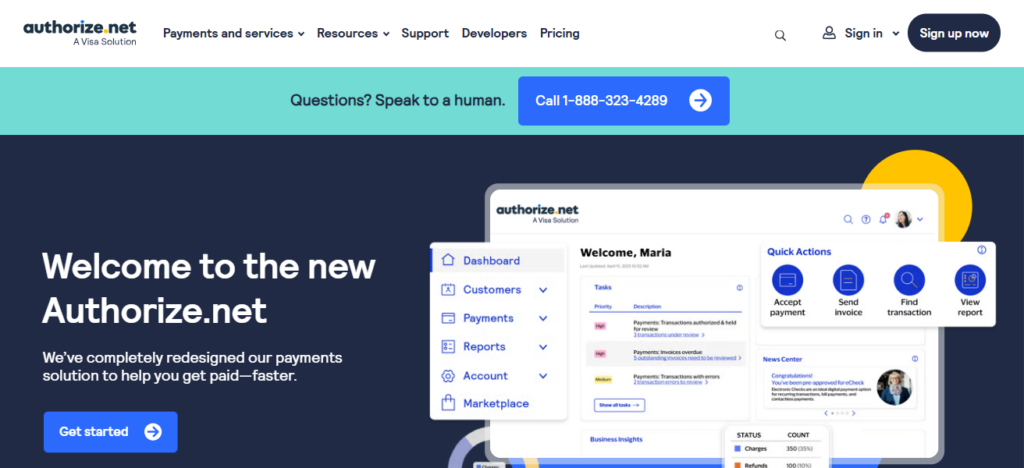

10. Authorize.Net

Authorize.Net is one of the best alternatives to DigiPayKit as it provides one of the most secure payment gateways for all types of businesses.

Authorize.Net is best known for its credit card processing, e-check payment processing, and recurring billing all on one platform.

Unlike DigiPayKit, Authorize.Net is able to integrate easily with many e-commerce platforms, accounting systems, and point of sale systems which allows customers to easily manage their transactions.

Authorize.Net also provides top-of-the-line fraud protection, customizable checkout features, and 24/7 support assistance. Based on Authorize.Net’s reliability and integrations with other services, Authorize.Net is one of the best options for most merchants.

Authorize.Net

Credit Card & e-Check Processing – Accepts a variety of payments in a secure manner.

Recurring Billing & Invoicing – Automatically handles payments for subscription services.

E-Commerce Integration – Compatible with many eCommerce platforms and payment terminal applications.

Fraud Detection & 24/7 Support – Provides customer protection and constant support.

| Pros | Cons |

|---|---|

| Reliable and secure payment gateway | Monthly gateway fees can be high for small businesses |

| Supports credit cards, e-checks, and recurring billing | Setup requires some technical knowledge |

| Integrates with many e-commerce platforms | Fewer modern features compared to newer competitors |

| Advanced fraud detection and customizable checkout | Limited global reach compared to Stripe or PayPal |

| 24/7 customer support | Less flexible for non-technical users |

Conclusion

Finally, the top DigiPayKit competitors, such as Stripe, PayPal, Square, Razorpay, ePayPolicy, Zil Money, Payoneer, Adyen, Skrill, and Authorize.Net, provide ample options for any sort of company.

All platforms provide specialized services which allow for secure, seamless, and scalable digital transactions which meet the company’s requirements.

From processing payments worldwide, and having developer-friendly integrated APIs, to a single platform that combines banking and policy management.

FAQ

What is DigiPayKit?

DigiPayKit is a digital payment solution for online transactions and business payments.

Which platforms are top alternatives to DigiPayKit?

Stripe, PayPal, Square, Razorpay, ePayPolicy, Zil Money, Payoneer, Adyen, Skrill, and Authorize.Net.

Which alternative is best for global payments?

Payoneer and Stripe are ideal for international transactions and multi-currency support.

Which platform is best for small businesses?

Square and PayPal offer easy setup and user-friendly features for small businesses.

Which is best for developers?

Stripe provides highly customizable APIs for flexible payment integrations.