In this post, I’m breaking down the best digital wallets you can use day-to-day. Digital wallets have gone from nice-to-have to must-have, letting you pay faster and safer than ever.

Whether you buy something online, send cash to a friend, or settle a bill, the right wallet makes money management way easier. So, lets jump into the top picks on the market today.

Key Points & Best Digital Wallets For Daily Use List

| Digital Wallet | Key Point / Feature |

|---|---|

| Apple Pay | Seamless integration with iOS devices |

| Google Pay | Easy payments across Android and web platforms |

| Samsung Pay | Supports both NFC and MST for wider acceptance |

| PayPal | Popular global wallet with buyer protection |

| Venmo | Social payments with easy splitting features |

| Cash App | Instant peer-to-peer payments and investing |

| Skrill | Supports multi-currency and international transfers |

| Alipay | Widely used in China with QR code payment support |

| Zelle | Fast bank-to-bank transfers in the US |

| Paytm | Popular in India, supports bill payments & recharges |

10 Best Digital Wallets For Daily Use

1.Apple Pay

Apple Pay works only on Apple devices-iPhone, iPad, Mac, and even the Apple Watch-yet that closely-held setup helps keep the whole process super slick and quick.

Once a card is added, users wave their phone over a contactless terminal or tap a button when shopping online, and the payment happens in a heartbeat.

Behind the curtain, tokenization and Face ID or Touch ID swap out real card data for temporary codes, so sensitive info rarely leaves the device. The service also lets friends send or request cash through Apple Cash, while loyalty cards and transit passes sit in the same digital wallet.

Features Apple Pay

Device Integration. It links with your iPhone, iPad, Apple Watch, or Mac so you can pay almost anywhere.

Strong Security. Every transaction uses tokenization plus Face ID or Touch ID, keeping your card info safe.

Tap-to-Pay. Just hold the device near a contactless reader and the payment goes through in stores, apps, or on a website.

Apple Cash. You can send money in an iMessage and the receiver gets it instantly, like a quick digital tip.

2.Google Pay

Google Pay is a handy mobile wallet that works on both Android and iPhone. You can tap to pay in stores, shop online, or send money to a friend all from the same app. Because it links straight to your Google account, setup is quick, and extras like stored tickets, loyalty cards, and bill reminders come in the package.

Payments are protected through tokenization and whatever lock you set on your phone, whether it is a fingerprint or pin. Thanks to its broad app and hardware support, many people and small businesses reach for Google Pay every day, enjoying its simple layout and strong safety tools.

Features Google Pay

Cross-Platform. Works on most Android phones and even iPhones, letting you pay online, in a store, or inside an app.

All-in-One Wallet. Cards, tickets, loyalty cards, and boarding passes stay together, so you always have what you need.

Smart Security. Tokenization plus whatever screen lock you use guard your personal data from unwanted eyes.

Send Money. Tap a name in your contact list to give or request cash, and it syncs straight with your linked bank account.

3.Samsung Pay

Samsung Pay shines because it speaks to almost every card reader out there. Beyond near-field communication (NFC), it uses Magnetic Secure Transmission (MST) to fake a sliding card swipe, so even old machines accept the payment.

That week when the grocery store swap, move, or update a pin pad, MST still helps the phone work. Available on most Galaxy phones and smartwatches, the app holds cards behind Samsung Knox and asks for a fingerprint, iris scan,or secure pin before spending.

Users can rack up points, buy in apps, or shop online the same way. With wide terminal support, tough locks, and deep Galaxy integration, Samsung Pay keeps its spot as one of the worlds top wallets.

Features Samsung Pay

Dual Technology. It uses both NFC and Magnetic Secure Transmission (MST), letting you pay even at older swipe-only terminals.

Wide Device Support. Almost any recent Galaxy phone or smartwatch supports the app, so you dont need a flagship model.

Rewards Program. Earn points or receive small cashback whenever you buy with the app, turning spending into small savings.

Secure Payments. Biometrics and tokenization work together for each purchase, making fraud almost impossible.

4.PayPal

PayPal is the go-to online wallet for people around the world, known for keeping money safe and backing buyers. You can send cash, shop, or link a bank account and credit card all from one place.

The app works in many currencies and is accepted by millions of stores online and off. It also lets small businesses send invoices, collect payments, and does easy peer-to-peer transfers. Backed by strong encryption and fraud checks, PayPal handles day-to-day money moves for personal users and companies alike.

Features PayPal

Global Reach. Millions of online stores welcome PayPal, from big marketplaces to neighborhood shops that ship worldwide.

Buyer Protection. If your order doesnt match the description or never arrives, PayPal helps resolve the problem and may refund your money.

Linking Options. You can attach bank accounts or cards from every major issuer, diversify funding sources, and switch them around easily.

One-Tap Checkout. Saved addresses, cards, and bank info mean you can pay with a single button tap at checkout, speeding up your online buys.

Multi-Currency Support: Lets you send or receive money in several currencies while handles quick, automatic exchange.

Business Tools: Offers invoicing, subscription billing, and business payments along with regular personal transfers.

5.Venmo

Venmo-subsidiary of PayPal-has turned money sharing into a casual, almost social habit, especially for younger Americans. The app shows a friends feed that quietly tracks who paid whom, keeping exact amounts private.

People use it to split dinners, settle rent, or chip in on group gifts without awkward cash. You can link bank accounts, debit cards, or credit cards, then choose a quick transfer for a small fee.

Venmo even issues a debit card, so unused balance can be spent at any store. By mixing friendly updates with effortless payments, Venmo acts like a pocket-sized daily wallet.

Features Venmo

Social Payments: Features a news feed so you can see and share friends’ payments, adding a fun social angle.

Peer-to-Peer: Transfers money between friends and family in seconds, usually with just a few taps.

Instant Transfers: For a small fee, move cash straight to your bank account in minutes instead of waiting days.

Venmo Card: The free debit card uses your Venmo balance and works online or in-store just like any Visa.

6.Cash App

Cash App is an easy-to-use digital wallet that millions rely on for quick money transfers between friends and everyday shopping. Along with peer payments, the app gives users a free Visa debit card, a simple way to buy and sell Bitcoin, and even stock trading.

People can have paychecks or other direct deposits drop right into the app, turning it into more than just a pocket change holder. For emergencies, the instant transfer feature sends money in seconds, though rushing the swap can carry a small fee.

Thanks to the clean layout and extra money tools, Cash App has become a favorite for younger folks who want convenience and a taste of investing all in one spot.

Features Cash App

Money Transfers: Send money fast using a phone number or unique $Cashtag, no bank info needed from the receiver.

Investment Features: Buy, sell, and trade stocks or Bitcoin inside the same app without opening a second account.

Cash Card: Personalize a Visa debit card with your chosen colors or drawings; it spends directly from your app balance.

Direct Deposit: Set up payroll so paychecks go straight into your Cash App, letting you use money almost immediately.

7.Skrill

Skrill is an international digital wallet built for anyone who sends money across borders or needs to hold cash in different currencies. The service shines for people who regularly pay family abroad or settle global bills, because it offers fair fees and solid exchange rates.

Users can keep cash inside Skrill, send funds, and pay for online shopping with strong security the whole way. A prepaid card linked to the account means they can also spend the balance in stores or at ATMs.

Freelancers, gamers, and crypto fans love Skrill, and its sturdy safety features paired with wide global reach make it a trusted everyday tool for anyone doing international business online.

Features Skrill

International Transfers: Send and receive cash around the world at lower fees than traditional banks or services.

Multi-Currency Wallet: Keep euros, dollars, pounds, and other currencies side-by-side, swapping them instantly when needed.

Prepaid Card: A linked Mastercard lets you spend the Skrill balance anywhere you travel, online or offline.

Security: Strong encryption, ongoing monitoring, and two-factor sign-in keep your account safe from unauthorized access.

8.Alipay

Alipay is China’s leading digital wallet, with more than a billion users. People rely on it to pay in stores, shop online, settle utility bills, and board buses or trains. Because it works with simple QR codes, even basic smartphones can use it easily.

Beyond payments, Alipay lends money, sells insurance, and offers saving plans and investment products. While the service sits at the heart of Alibaba’s business, it also partners with thousands of other shops and brands.

Strong security features, like facial scans and tough encryption, give users in China-and now many travelers abroad-peace of mind each time they tap or scan.

Features Alipay

Huge User Base: Alipay counts over one billion registered users, mostly in China, and is accepted almost everywhere shoppers go.

QR Code Payments: Customers simply point their phone at a stand or a merchant scans the code to settle the bill in seconds.

Financial Services: Beyond payments, it provides personal loans, insurance, money-market funds, and even a central credit score.

Top Security: Alipay combines fingerprint scans, facial recognition, and 24/7 fraud alerts to keep users and merchants secure.

9.Zelle

Zelle is a speedy U.S. payment service that lets friends and family trade cash straight from their bank accounts. Because it sits inside many big banks apps, people rarely need to download another program.

To send or grab money, you only need an email address or phone number-no extra usernames or passwords. Since Zelle never holds funds in a middle wallet, almost every transfer arrives within minutes and costs nothing.

That blend of speed and zero fees makes Zelle the go-to tool for splitting dinner bills, paying rent, or settling any group expense across America.

Features Zelle

Bank Integration: Zelle lives inside dozens of U.S. banks apps, so there’s no extra download and your bank already knows you.

Instant Transfers: Send money and it usually pops into the recipient’s account in only a minute, no waiting days.

No Fees: Because banks sponsor Zelle, most users pay zero fees, even for large transfers between friends or family.

Simple Setup: Just enter a phone number or email linked to another bank, and the money moves without a routing number.

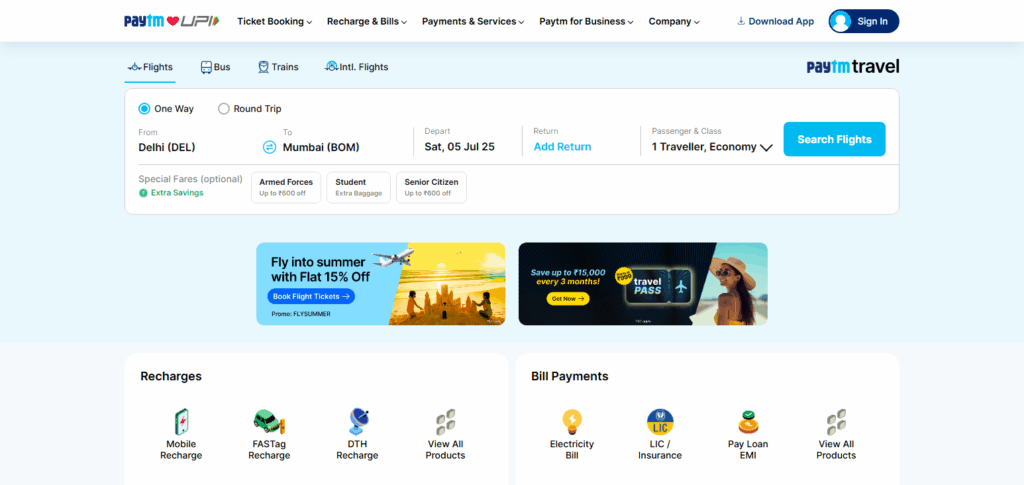

10.Paytm

Paytm has become one of India’s go-to digital wallets, letting people quickly pay phone bills, recharge phones, shop online, or settle a café tab at the neighbourhood mall. Thanks to UPI, users can also move money straight from their banks with no fuss, on top of using the wallet balance.

The Paytm app bundles extra services like small loans, insurance plans, and even gold-buying, which keeps customers coming back.

Wide merchant tie-ups, regular cashback deals, and easy-scanning QR codes turn everyday spending into rewards and make the platform hard to beat.

Strong security features and a simple interface have helped Paytm stay at the front of India’s booming cashless scene.

Features Paytm

UPI Integration: Paytm taps India’s UPI system, letting users pay directly from their bank without storing extra wallet money.

Broad Acceptance: You can recharge phones, settle utility bills, shop online, or scan a code at a café and it all syncs.

Financial Products: On top of payments, Paytm issues loans, sells insurance, handles mutual funds, and lets users buy gold.

Rewards and Cashback: Regular promos and guaranteed cashback keep users engaged and make every transaction feel rewarding.

Conclusion

In conclusion, the 10 best digital wallets—Apple Pay, Google Pay, Samsung Pay, PayPal, Venmo, Cash App, Skrill, Alipay, Zelle, and Paytm—offer secure, convenient, and versatile payment solutions for daily use.

Each wallet excels in unique features like broad acceptance, peer-to-peer transfers, or financial services, making it easy to manage money anytime, anywhere. Choosing one depends on your device, region, and needs.

FAQ

What is a digital wallet?

A digital wallet is an app or service that securely stores payment information for easy online or contactless payments.

Are digital wallets safe to use?

Yes, they use encryption, tokenization, and biometric authentication to protect your data.

Which digital wallet works best for iPhone users?

Apple Pay is the best choice for iPhone users due to its seamless integration.