In this article i will discuss the Best Embedded Payment APIs for Global SaaS Platforms. With the ability to do seamless transactions, inline billing, and Charge any amount on a recurring basis, and Charge any amount on a recurring basis, businesses can expense globally with ease.

The best SaaS businesses in 2026 will easy International expansion with the ease of the right payment API. for businesses expanding internationally, the right API will provide secure payments, customer trust, and new market opportunities.

Key Point

| Payment API | Key Embedded Features |

|---|---|

| Stripe Connect + Billing | Embedded checkout, AI fraud detection, multi-currency, usage-based billing |

| Adyen API | Unified payments, embedded card issuing, PSD2/SCA compliance, advanced risk tools |

| PayPal Braintree | Embedded vaulting, subscription APIs, fraud protection, PayPal ecosystem |

| Square API | Embedded invoicing, ACH + card payments, developer-friendly SDKs |

| Checkout.com API | Embedded payments, global FX support, fraud detection, tokenization |

| Rapyd API | Embedded wallets, local payment rails, compliance-ready KYC |

| Worldpay API | Embedded recurring billing, FX optimization, enterprise-grade compliance |

| Authorize.Net API | Embedded recurring payments, fraud detection suite, PCI DSS compliance |

| Mollie API | Embedded subscriptions, EU PSD2 compliance, localized payment methods |

| Usio Embedded Payments | API-first embedded payments, revenue share models, flexible payouts |

1. Stripe Connect + Billing

In 2026, Stripe Connect + Billing is still the industry standard for what the SaaS industry requires. Features such as embedded checkout, subscription management, usage-based billing, and AI-fraud detection keep the tool current.

Companies across the globe can scale while remaining PCI DSS and SOC 2 compliant, as there is multi-currency support and Stripe’s seamless integrations. Their developer-first APIs focus on speed and their marketplace-ready Connect features support complex payout structures.

Divided from the rest of their offerings, Connect + Billing is still one of the best embedded payment APIs for global SaaS platforms with flexibility and scalability for startups and enterprises.

Stripe Connect + Billing Features

- Automated and manual payment collection

- Charges for usage and subscriptions

- Automated payment fraud detection and prevention

- Global payment acceptance and compliance

- Easy payments for marketplace sellers

2. Adyen API

For Adyen API, there is one true focus, and that’s enterprise SaaS platforms. Global payments, embedded card issuing, and risk management are all unified with Adyen. Adyen is compliant with PSD2 and Strong Customer Authentication (SCA) which is what makes it ideal for SaaS businesses in Europe and abroad.

Real life complications for developers are eliminated with Adyen’s single API which, in addition to wallets and local payment methods, has cards. Transaction costs and risks are managed by their real-time risk tools and FX optimization.

Adyen API is one of the best embedded payment APIs for global SaaS platforms as it gives confidence for enterprises expanding to any level for the first time.

Adyen Features

- Global payment acceptance

- Automatic credit card issuance

- European regulatory compliance

- Sophisticated fraud prevention

- Automatic currency conversion

3. PayPal Braintree

PayPal Braintree offers subscription management, vaulting, and fraud protection services. Because it caters to multiple global currencies and digital wallets, Braintree is an excellent fit for SaaS businesses looking to gain the confidence of their consumers.

The PayPal ecosystem offers ease of transaction to customers worldwide and Braintree’s easy-to-use SDKs and secure tokenization make for simple and secure transaction integration.

Midway through its services, PayPal Braintree is continuously ranked among the best embedded payment APIs for global SaaS platforms for its reliability, consumer confidence and scalability for SaaS businesses looking to expand internationally.

PayPal Braintree Features

- Automatic payment storage

- Automatic billing for subscriptions

- Advanced fraud protection

- Global payment acceptance

- Seamless PayPal integration for consumer trust

4. Square API

Square API is optimal for Embedded invoicing, ACH and card payments, and easy-to-use SDKs for billing subscriptions, digital receipts and reporting. Square’s ecosystem is built to support small businesses with effortless onboarding and straightforward pricing, thereby making it a go-to for SaaS platforms targeting SMBs.

SaaS businesses can continue focusing on development, while Square takes care of the compliance frameworks, fraud detection, and payment processing. Midway through its services, Square API is recognized as one of the best embedded payment APIs for global SaaS platforms providers focused on small and medium businesses.

Square Features

- Automatic invoicing and payment collection

- Automated billing and payment receipt generation

- Easy to use developer tools

- No hidden fees for fraud protection and compliance

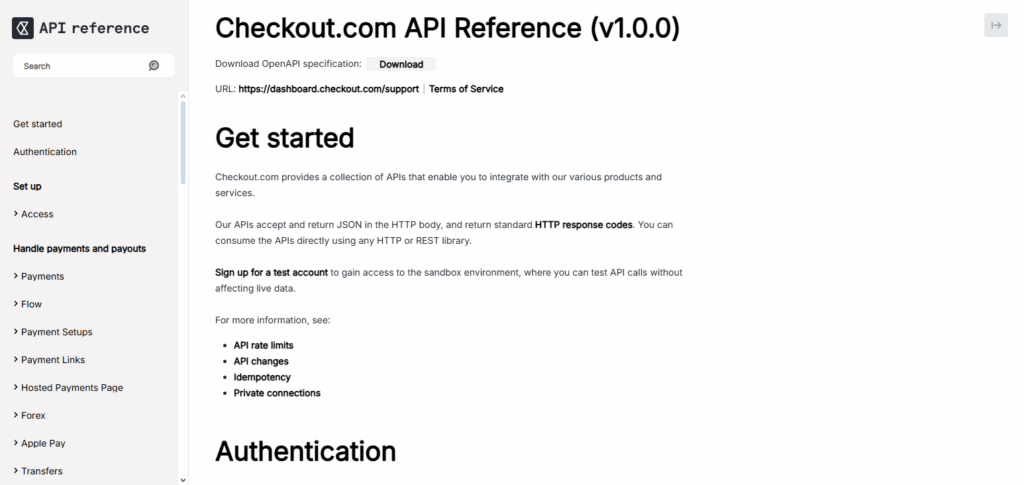

5. Checkout.com API

Checkout.com API offers embedded payments with global fraud detection, tokenization and FX features. It has been constructed for SaaS platforms which scale across different regions. Local payment rails are seamlessly integrated. PCI DSS and PSD2 are integrated for safe transactions while others gain benefit from different analytics.

Developers gain benefit from flexible APIs and real-time analytics. Halfway through its functions, Checkout.com API is one of the best embedded payment APIs for global SaaS platforms, giving them the ability to grow internationally with ease, and with no fear.

Checkout.com Features

- Payment collection systems including foreign currency payments

- Payment and identity fraud prevention systems

- Payment compliance with privacy and fraud prevention standards

- Real-time payment systems analytics

- Local payment options for worldwide growth

6. Rapyd API

Rapyd API specializes in embedded wallets, local payment rails, and a compliance-enabled KYC solution. It helps SaaS platforms grow in emerging markets by supporting it with local currencies and other forms of payment.

Rapyd receives global payments through APIs, offers payment on the go, and through a managed wallet. It is compliance managed for both AML and KYC.

It is reputed, amongst its peers, Rapyd API is one of the best embedded payment APIs for global SaaS Platforms, and is one of the main options for SaaS companies servicing the diverse international market.

Rapyd API Features

- Embedded wallets and local payment options

- Onboarding support for KYC and AML compliance

- Layer for global payment orchestration

- Wallets management, and payouts and collections

- Best suited for SaaS in developing economies

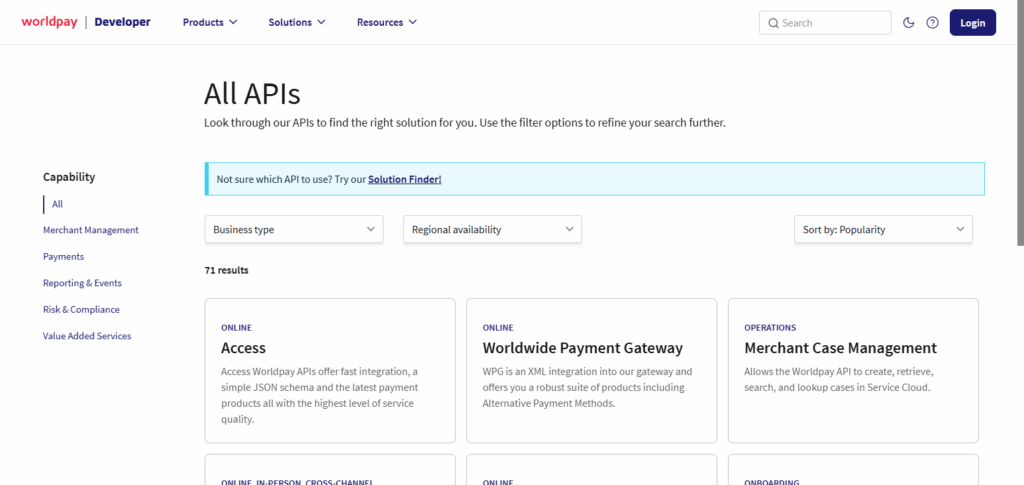

7. Worldpay API

It serves larger SaaS companies, and offers embedded recurring billing, FX optimization, and enterprise level compliance. Payments with global currencies, fraud threats secured, and tokenization is safe.

Worldpay’s infrastructure provides reliability and scalability which is mainly for SaaS companies with more complex payment systems.

It is PCI DSS, SOC 2, and PSD2 certified. Worldpay API is one of the most embedded payment APIs for global SaaS companies. It powers enterprise SaaS companies with great scalability, security, and reliability.

Worldpay API Features

- Embedded subscription billing and currency conversion

- Advanced fraud prevention for enterprises

- Complies with PCI DSS, SOC 2, and PSD2

- High transaction reliability and scalability

- Best for big SaaS companies

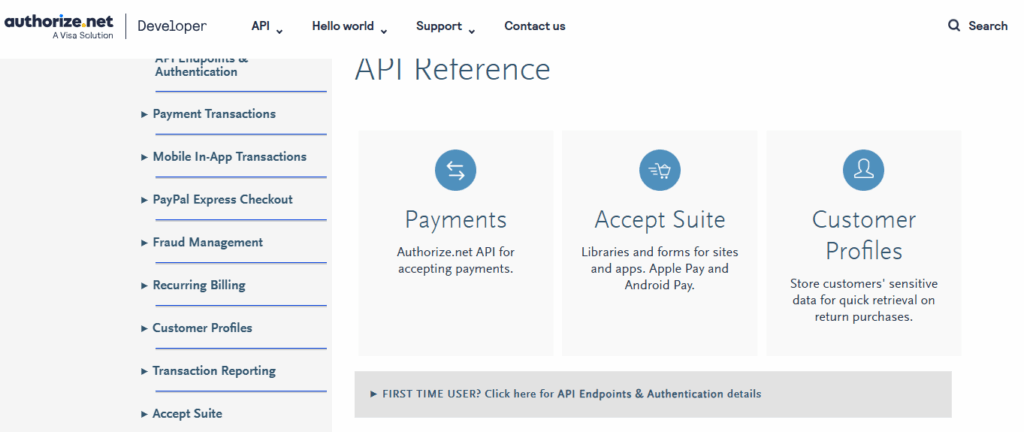

8. Authorize.Net API

Authorize.Net API offers SaaS applications embedded recurring payments and fraud detection with PCI DSS compliance. It is also one of the most famous and trusted in North America. SaaS companies can access subscription billing, tokenization, and advanced fraud prevention tools.

Its APIs are developer-friendly, enabling quick deployment for SaaS businesses. Authorize.Net API is one of the most embedded payment APIs for global SaaS companies and is tailored for SaaS companies that need stability and compliance in the U.S. and Canadian regions.

Authorize.Net API Features

- Embedded recurring payments and subscriptions

- Advanced fraud detection

- Complies with PCI DSS for secure transactions

- Tokenization for card data protection

- Most reliable in North America

9. Mollie API

Mollie API is the first choice for SaaS companies targeting eastern Europe. It provides embedded subscriptions, localized payment systems, and fulfills the requirements of PSD2.

Mollie allows easy intergration of cards, wallet, and bank transfers with their APIs that also has clear pricing, which is great for SaaS startups.

Fraud detection and tokenization implemented within the payment technology enable secure transactions. Among the characteristics of Mollie API, it consistently ranks as one of the most e Embeded payment API for Global SaaS Platforms and therefore it is a valuable choice for SaaS companies growing in the European market.

Mollie API Features

- Embedded subscriptions and recurring billing

- Localized payment options across Europe

- Complies with PSD2 and secure tokenization

- Streamlined developer onboarding with cards and wallets

- Price transparency for SaaS startups

10. Usio Embedded Payments

Usio Embedded Payments is API first flexible layouts, revenue share models, and embedded payment flows. It is for SaaS and fintech platforms that require specific payment models.

Usio’s APIs are for ACH, card payments, and digital wallets and it has built in nation compliant frameworks. Its revenue sharing makes it valuable for SaaS platforms with marketplace models.

Among the characteristics of Usio Embedded Payments, it consistently ranks as one of the most e Embeded payment APIs for Global SaaS Platforms, which helps SaaS businesses build innovative payment structures.

Usio Embedded Payments Features

- API-first embedded payment flows

- Flexible revenue sharing and payouts

- ACH, cards, and wallets

- Compliance ready for secure SaaS

- Tailored solutions for fintech and SaaS

Conclusion

By the year 2026, payment APIs are the foundation of global SaaS growth. SaaS platforms are now able to seamlessly manage every aspect of their business including, automated recurring billing, cross-border transaction fraud, compliance, and fraud.

With great enterprise compliance and scalability, Stripe Connect + Billing and Adyen API lead the pack. PayPal Braintree and Square are SMB focused and have great consumer trust. SaaS companies that are Internationally expanding are best served by Checkout.com API and Rapyd API due to their multi-currency local payment flexibility.

For large enterprises, Worldpay API and Authorize.Net API are great reliable options. Ultimately, Mollie API and Usio Embedded Payments offer great local customizations of payment flows. These 12 APIs offer the best embedded payment options for global SaaS, enabling SaaS platforms to grow internationally and grow sustainably.

FAQ

What are embedded payment APIs?

Embedded payment APIs allow SaaS platforms to integrate payment processing directly into their applications. They handle checkout, subscriptions, fraud detection, and compliance without redirecting users to external portals.

Why are embedded payment APIs important for SaaS platforms?

They enable seamless in-app transactions, recurring billing, and global currency support. For SaaS companies, this means higher conversion rates, better customer experience, and compliance with international regulations.

Which API is best for global SaaS startups?

Stripe Connect + Billing is ideal for startups due to its developer-first design, usage-based billing, and marketplace-ready payouts.

Which API is best for enterprise SaaS platforms?

Adyen API and Worldpay API excel for enterprises, offering unified global payments, FX optimization, and compliance with PSD2, PCI DSS, and SOC 2.

Which API is best for SaaS targeting SMBs?

Square API provides embedded invoicing, ACH/card payments, and transparent pricing, making it perfect for SaaS platforms serving small and medium-sized businesses.