In this article, I will discuss the Best Ether.fi Ecosystem Coins By Market Cap in regards to market capitalization. These coins serve an important purpose in the Ethereum staking and DeFi market by providing value propositions such as liquid staking.

Governace participation, and increased yield generation. I will focus on the leading assets in the Ether.fi ecosystem and emphasize their unique benefits for investors and ecosystem participants.

Key Point & Best Ether.fi Ecosystem Coins By Market Cap List

| Asset | Key Point |

|---|---|

| Wrapped eETH (weETH) | A tokenized version of eETH compatible with bridges and DeFi protocols. |

| Ether.fi Staked ETH (eETH) | Liquid staking token representing ETH staked via Ether.fi. |

| Ether.fi (ETHFI) | Governance token of Ether.fi, used for protocol decisions and rewards. |

| Bridged weETH (Linea) | weETH transferred to the Linea L2 network, enabling lower-cost transactions. |

| Ethereum (ETH) | Native cryptocurrency of the Ethereum network, used for gas and transactions. |

| Lido Staked Ether (stETH) | Liquid staking token from Lido, representing ETH staked via their platform. |

| Rocket Pool ETH (rETH) | Decentralized liquid staking token from Rocket Pool with staking rewards. |

| Frax Ether (frxETH) | Frax Finance’s ETH-pegged token optimized for DeFi liquidity. |

| Ankr Staked ETH (ankrETH) | ETH staked via Ankr, with rewards and liquidity across DeFi platforms. |

| StakeWise ETH2 (sETH2) | StakeWise’s representation of staked ETH, part of a dual-token model. |

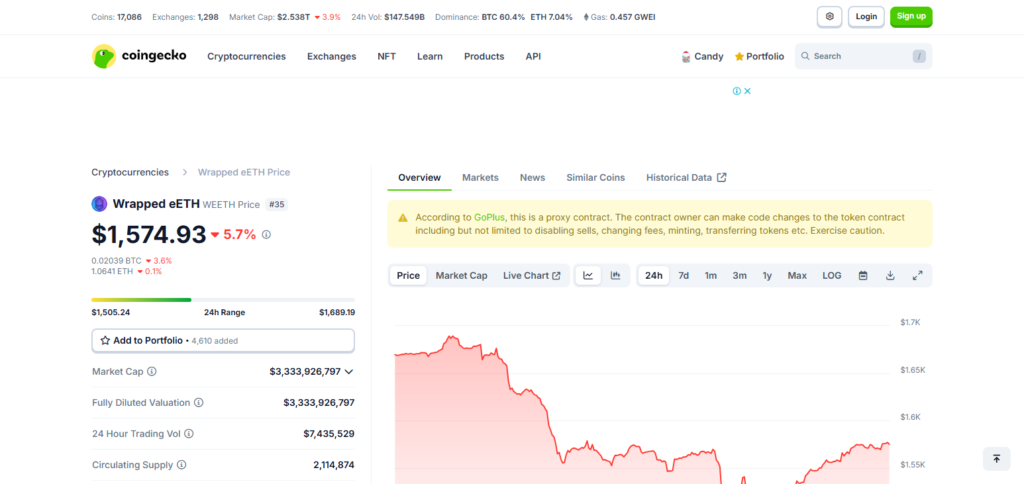

1.Wrapped eETH (WEETH)

Wrapped eETH (weETH) claims the title of best Ether.fi ecosystem coin by market cap for its effortless integration across DeFi ecosystems and multi-chain networks.

As a tokenized version of staked ETH (eETH), weETH preserves yield garnished below while providing greater liquidity and utility.

Its unique position stems from bridging Ether.fi’s staking model with advanced DeFi participation through yield farming, trading, and lending without staking reward loss, thus making it a potent asset within the Ether.fi ecosystem.

Features

- Liquidity Across DeFi: Wrapped eETH (WEETH) has full interoperability with all DeFi protocols, allowing users to access their staked ETH, and not lose any staking rewards.

- Cross-chain Utility: Bridging WEETH across multiple networks improves its accessibility on different ecosystems and makes it more usable.

- Staking rewards: Users are able to trade or use their wrapped assets while retaining the benefits of staking rewards.

2.Ether.fi Staked ETH (EETH)

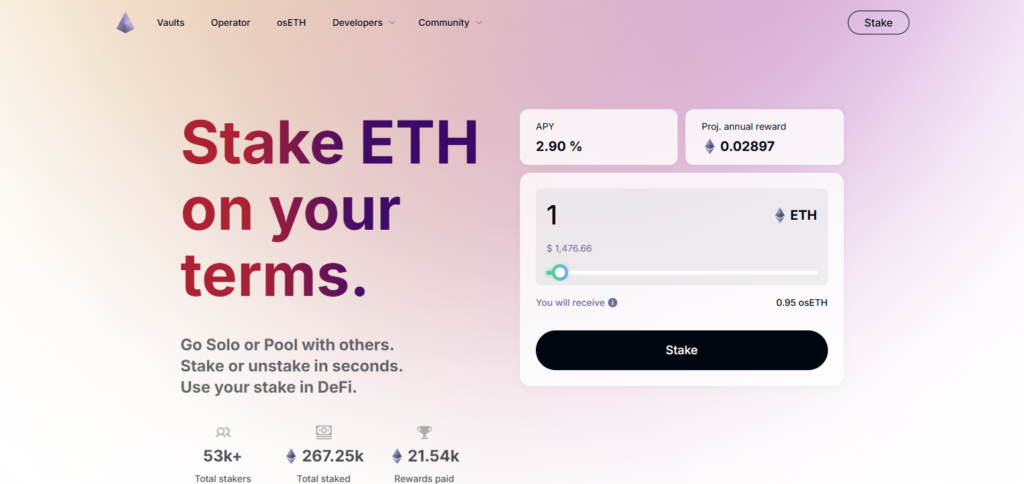

Ether.fi Staked ETH (eETH) represents one of the largest Ether.fi ecosystem coins by market cap as it synergizes Ethereum staking security and DeFi flexibility.

Its main differentiator is user-controlled staking where delegators controlled their keys which improved decentralization and trust.

This innovative approach minimizes custody risks while still earning rewards, appealing to individual and institutional stakers. eTH’s strong demand for secure, non-custodial staking solutions makes it a cornerstone asset within the Ether.fi ecosystem.

Features

- Non-Custodial Staking: Users remain in control of their staked assets through a non-custodial staking model offered by EETH.

- Governance Participation: Holders EETH are able to take part in the governance activities of the Ether.fi protocol.

- Yield Generation: Ether.fi Staked ETH (EETH) attracts individual and institutional stakers by providing liquidity alongside staking rewards.

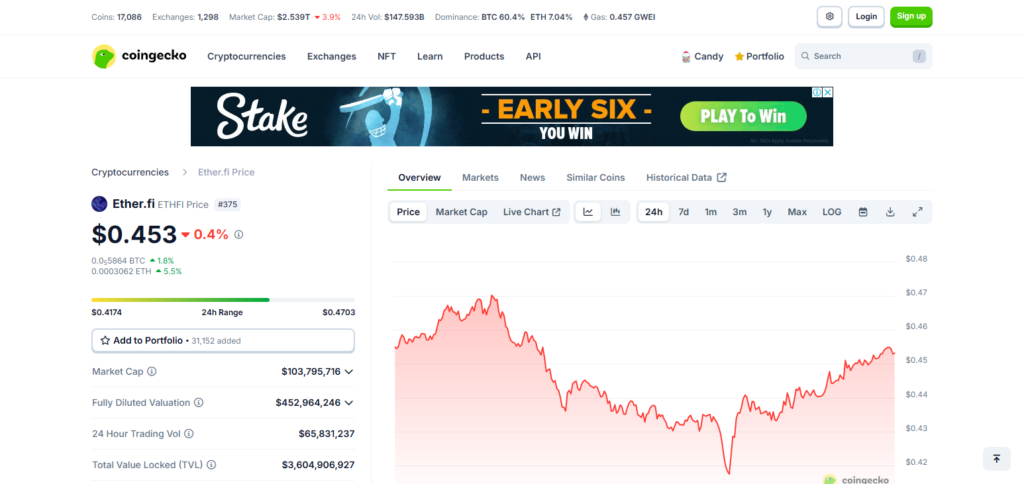

3.Ether.fi (ETHFI)

Ether.fi (ETHFI) is the largest coin in the Ether.fi ecosystem by market cap and offers governance and utility within the platform.

ETHFI provides holders with significant control over the protocol’s execution, direction, and operational policies, which permits decisions to be made in a truly decentralized and community-oriented manner that the ensures full autonomy.

Also, ETHFI helps holders to intervene in the governance of the rewards allocation, thus making it essential for all participants in the Ether.fi ecosystem. Decentralized governance creates stronger demand, supporting its status as a flagship token.

Features

- Governance Token: With ETHFI, holders can make decisions that influence the development of the Ether.fi platform and thus vote on proposed changes to the platform.

- Reward Distribution: Distribution of staking rewards to participants of Ether.fi ecosystem is one of the main attributes of ETHFI.

- DeFi Integration: Staking, earning rewards while participating in governance and rewarding users through ETHFI is made possible because of integration to DeFi protocols.

4.Bridged weETH (Linea)

Bridged weETH (Linea) is noted as a top Ether.fi ecosystem coin by market cap because it bridges Ether.fi’s staking with Layer 2 on the Linea network.

This integration provides users with a smooth passage between the mainnet and the cheaper and faster region of Linea.

The strongest feature of bridged weETH is its scalablity which allows users to enjoy faster transactions and lower fees while still earning staked ETH rewards, making it more appealing to DeFi users.

Features

- WeETH Bridging Along With Staking: The Bridged weETH on Linea has quicker transactions and cheaper gas fees without losing the benefits of staked ETH.

- Increased Access to Funds: Users can effortlessly access liquidity from the Layer 2 while simultaneously earning staking rewards from the mainnet of Ethereum.

- Inter-Network Mobility: Facilitates bridging staked ETH from the Ethereum network towards Line and vice versa.

5.Ethereum (ETH)

Ethereum (ETH) remains the largest and most established asset in the Ether.fi ecosystem as it holds the first position by market cap due to it being the foundational asset of the network.

Ether also has a wide ecosystem from smart contracts to decentralized applications and needs a primary censtral asset that is Ethereum native cryptocurrency known as ETH.

Its primary advantage lies in it’s adoption and integration which makes it the core of Ether.fi’s staking and DeFi operations. ETH is going to retain a strong market dominance along with continued utility which makes sure sustains relevance and growth within the ecosystem.

Features

- Key Digital Token: Used as gas fees and for executing smart protocols, ETH is the main currency of the Ethereum blockchain.

- Staking means mastering: Considered the most popular, ETH is the dominating and globally accepted cryptocurrency functioning in Ethereum’s blockchain system.

- Serving Staking Core and Peripheral Systems: Staking solutions in the Ether.fi ecosystem and beyond bases themselves on ETH.

6.Lido Staked Ether (stETH)

Lido Staked Ether (stETH) a leading coin in the Ether.fi ecosystem by market cap ecosystem because of its liquidity and interoperability with DeFi protocols.

Its main distinguishing feature is that it provides liquid staking, which affords users the ability to earn staking rewards on Ethereum while still being able to utilize the token in DeFi protocols.

This attribute increases the desirability of stETH for many investors who wish to engage in staking activities without having their assets restricted. This, in turn, has propelled its adoption and market cap.

Features

- Decrease DeFi Protocol’s Trust Level: Unrestrained wiht limited access to lending, stETH facilitates staking of ETH by the users whereby enabling use in DeFi applications.

- Rewarding Returns: Operating as a liquid staking token, stETH increases automatically the compounding staking rewards over time.

- Licky Lidi estin]][most paws)*: By far the most liquid tokens are adopted and managed in various DeFi platforms integrated into stETH.

7.Rocket Pool ETH (rETH)

rETH is a leading reservoir token in the Ether.fi ecosystem by market cap, known for its decentralized and trust-minimized approach to staking. It allows users to liquidate their staked ETH while staked representing assets.

Rocket Pool’s model is unique in its decentralization which provides better security and control than centraliz- ed options. By enabling users to take part in Ethereum’s staking process at lower risks and higher rewards, rETH represents a crucial asset in the Ether.fi ecosystem.

Features

- Decentralized Staking: Network security is enhanced as node operators allow users to stake ETH through rETH.

- Liquidity for Staked ETH: rETH is similar to stETH in the sense that it is a liquid staking token and allows users flexiblity in the DeFi space.

- Reward Distribution: rETH benefits users who wish to reward themselves while having the ability to retain their assets by providing staking rewards and maintaining liquidity.

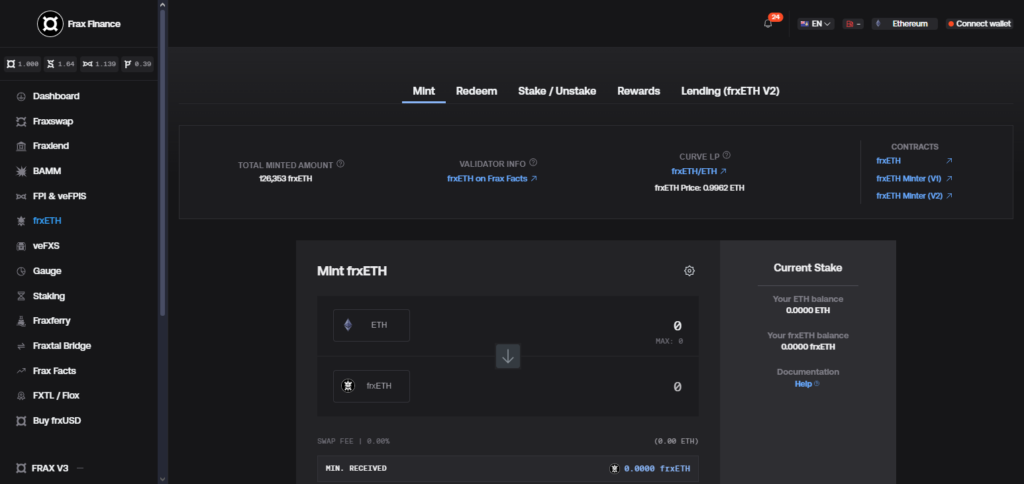

8.Frax Ether (frxETH)

Frax Ether (frxETH) is among the leading coins in the Ether.fi ecosystem by Market cap. It provides a unique dual-token system for better staking yield and simpler DeFi integration.

In contrast to single-token systems, frxETH is pegged to Ethereum (ETH)while holding its value, and staked Frax Ether (sfrxETH) earns staking rewards. This enables users to partake in staking with uncompromised validator management burdens, balancing complexity and rewarding efficiency simultaneously.

Features

- Dual-Token Model: Yield optimization is done with the existence of two tokens, frxETH and sfrxETH under Frax Ether.

- DeFi Liquidity: EFrax can be used in DeFi proctols while its paired token sfrxETH allows users to earn staking rewards.

- Scalability: The tokenomics provide high scalability in DeFi which increases liquidity and provides consistent staking returns making it very appealing.

9.Ankr Staked ETH (ankrETH)

Ankr Ethereum Staked (ankrETH), is regarded as a top coin in Ether.fi ecosystem by market cap and offers a unique solution to liquid staking by blending DeFi liquidity with staking rewards.

Different from traditional staking, ankrETH allows users to stake their ETH with no locking of assets required which provides liquidity on demand and a chance to earn additional rewards through DeFi platforms.

This approach improves flexibility and potential yields from staking further raising ankrETH’s value as a top asset in the Ether.fi ecosystem.

Features

- Liquid Staking Solution: With ankrETH, users can stake ETH while retaining liquidity, allowing them access to DeFi platforms while still earning rewards.

- Low-Cost Entry: Compared to traditional methods of staking ETH, Ankr offers users more affordable fees increasing the accessibility for users.

- Wide Integration: Users can make use of their staked assets with enhanced flexibility as ankrETH is supported by various DeFi Protocols.

10.StakeWise ETH2 (sETH2)

StakeWise ETH2 (sETH2) is one of the leading coins in the market cap of Ether.fi ecosystem because of its unique dual token model that separates the principal value from its rewards.

This model improves the capital efficiency by permitting users to sidethat manage their ETH and rewards independently.

sETH2’s key distinguishing feature is that users can compound their staking rewards on the StakeWise platform which enables them to reinvest their earnings and thus increase their annual percentage yield (APY). The control over yields and flexibility with staking rewards makes sETH2 a powerful asset in the Ether.fi ecosystem.

Features

- Divided Ownership: StakeWise uses a different two-token approach by splitting a principal and its rewards for better capital use with both wstETH2 and sETH2.

- Staking Yield Optimization: StakeWise helps users earn additional yield over time by automatically reinvesting rewards received from staking.

- Staking Yield Optimization: With sETH2, users can participate in various DeFi apps which let them earn have their ETH yield optimized while staking.

Conclusion

To summarize, the top Ether.fi ecosystem coins by market cap have distinct features that improve Ethereum staking and DeFi activities.

Assets like stETH and rETH offer liquidity and staking options while eETH provides decentralized governance. frxETH and sETH2 increase rewards, providing users with security and liquidity. Their advancements and solid market presence assure their positions as major Ether.fi ecosystem constituents.