The Best Forex Brokers for Quick KYC Approval (Under 5 Minutes) will be covered in this article, enabling traders to begin trading right away without having to wait a lengthy time for verification.

These brokers make it simpler for novice and experienced traders to access live markets, fund accounts, and trade with confidence in a fast-paced forex environment by providing automated account verification, secure interfaces, and effective onboarding procedures.

Why Fast KYC Approval Matters

Start Trading Instantly – For users that have registered and verified their accounts, live trading can begin within minutes and without the hassle of waiting for KYC to complete.

Onboarding That Does Not Waste Time – Lasting KYC stays away from unnecessary documentation and streamlines the account creation process.

Access To Multifaceted Market Opportunities – Fast approvals allow users to take advantage of numerous trading strategies that give their capital the opportunity to yield positive returns.

News Trading – For those that utilize trading strategies based on the release of major economic data and financial news, the KYC process will be completed quickly to allow users to place trades without delay.

User Satisfaction – The overall experience of users is more positive if they do not have to complete multiple KYC and verification processes.

Less Frustration – Loss of potential traders do to slow KYC processes will be a thing of the past.

Verification Requires Minimal Steps – The KYC process of uploading documents and other materials can be completed quickly from a mobile device.

More Active and Engaging Traders – Trading brokers become more popular for offering instant KYC processes.

Privacy and Safety – Even though KYC is completed on a fast track without the sacrifice of documenting personal data.

Worldwide – Traders located in various countries will benefit from a relaxed and fast in KYC processes.

How Forex Brokers Offer KYC Approval Under 5 Minutes

Automated KYC Systems – Brokers have embedded automated solutions to run verifications in seconds.

Digital Document Uploads – Traders can bypass the traditional, cumbersome paperworkbAccounts.

Real Time ID Validation – Systems can verify the validity of national ID and passport documents instantly.

Selfie & Face Matching – Embedded automated facial recognition systems can determine the relevance of the selfies to the ID in seconds.

OCR Technology – Optical Character Recognition systems can process documents and extract information in seconds.

Pre-verification Checks – To streamline the process, users can complete KYC information to approval in seconds outline draft of the pre-verification validation.

Country Based Risk Scoring – Areas deemed to have low risks are given fast-track automated KYC approval.

Mobile First Verification – Verification systems are accessible through streamlined mobile applications.

Instant Compliance Screening – The system runs automated checks against sanction and AML lists.

24/7 Verification Systems – There are no paperwork bottlenecks because of AI and automated systems.

Key point & Best Forex Brokers For Fast KYC Approval (Under 5 Minutes)

| Broker | Regulation | KYC Speed | Minimum Deposit | Platforms | Key Highlight |

|---|---|---|---|---|---|

| JustMarkets | FSA, CySEC | Very Fast | Low | MT4, MT5 | Beginner-friendly with quick account approval |

| FXTM | FCA, CySEC | Fast | Low | MT4, MT5 | Strong education and global market access |

| FXOpen | FCA, ASIC | Moderate | Low | MT4, MT5 | ECN trading with low spreads |

| OANDA | FCA, ASIC, CFTC | Fast | No minimum | OANDA Trade, MT4 | Transparent pricing and trusted brand |

| Saxo Bank | FCA, FINMA | Moderate | High | SaxoTraderGO, PRO | Premium tools for professional traders |

| HYCM | FCA, CySEC | Fast | Low | MT4, MT5 | Long-standing broker with solid regulation |

| FXCM | FCA, ASIC | Fast | Moderate | MT4, Trading Station | Advanced analysis and reliable execution |

| InstaForex | CySEC | Very Fast | Very Low | MT4, MT5 | Quick onboarding and high leverage |

| FP Markets | ASIC, CySEC | Fast | Low | MT4, MT5, cTrader | Tight spreads and fast execution |

| Pepperstone | FCA, ASIC | Fast | Low | MT4, MT5, cTrader | Professional trading conditions |

1. JustMarkets

JustMarkets is a broker popular due to its ease of customer onboarding and quick verification. The company is regulated by the FSA and CySEC, meaning they have to follow certain laws in order to provide a reasonable level of safety. JustMarkets also has flexible account types, a low minimum deposit, and high leverage (depending on the jurisdiction). The mobile apps available for MT4 and MT5 offer a good trading experience.

Achieving Justmarkets Best Forex Brokers For Fast KYC Approval (Under 5 Minutes), is owing to automated verification system where one is able to adapt to the broker in a technological sense. JustMarkets offer a wide country coverage and provide multilingual customer support 24 hours a day.

JustMarkets Key Features:

- Regulation: FSA, CySEC

- KYC: Less than 5 minutes

- Minimum Deposit: Very low

- Max Leverage: Up to 1:500*

- Platforms: MT4, MT5; Has Apps

Pros:

- Very fast account opening (less than 5 mins)

- High leverage available for more experienced traders

- 24/7 global support

- MT4/MT5 platforms available

- Very low deposit requirement

Cons:

- Not much educational content is available

- Less experienced is more of a concern than for a larger broker

- People from some more restricted areas may have a harder time using it

- Order types are not as varied and have less advanced features

- During high volatility, spreads may widen

2. FXTM

FXTM is a large international broker with global reach due to their regulation by FCA, CySEC, and FSC which assures compliance and safety of funds. It provides a smallest initial deposit possible with alluring leverage according to regulations, and different choices of accounts. It has MT4 and MT5, and a decent mobile trading platform.

This broker is one of the Best Forex Brokers For Fast KYC Approval (Below 5 Minutes) because of their automated document verification systems. FXTM is recognized by traders all across the world and their customer service is excellent. They also offer educational tools and assist with their analysis of the markets.

FXTM Key Features:

- Regulation: MFCA, CySEC, FSC

- KYC: Less than 5 minutes

- Minimum Deposit: Very low

- Max Leverage: Up to 1:1000*

- Platforms: MT4, MT5; Has Apps

Pros:

- Extremely high leverage for more experienced traders

- Account verification is very fast

- Services are available worldwide

- Multiple account types and levels are available

- Required deposit to open account is low

Cons:

- High leverage is very risky for less experienced traders

- Account features are not as comprehensive and are more limited for smaller accounts

- Customer support unavailable 24/7, is only open 24/5

- If the account is smaller, the spreads are often worse

- Withdrawal times can be a bit unpredictable

3. FXOpen

FXOpen is an ECN focused broker with regulations from FCA and ASIC, which means it is also the most favorable broker for seasoned traders. They provide a low to moderate minimum deposit, provide market based leverage, and provide a no dealing desk environment. They offer trading via MT4 and MT5 as well as mobile terminals.

In the middle of the paragraph, FXOpen can also be included in the group of Best Forex Brokers For Fast KYC Approval (Under 5 Minutes) because of their instant online verification for certain users. This broker has clients all around the globe and provides excellent support in trade execution. They also offer customer support via emails, chat, and utilize their help desk.

FXOpen Key Features:

- Regulation: FCA, ASIC

- KYC: 5-10 minutes

- Minimum Deposit: Very low

- Max Leverage: Up to 1:500*

- Platforms: MT4, MT5; Mobile App: Yes

Pros:

- Trusted UK and Australian regulation

- Multiple platform options

- Low entry deposit

- Flexible leverage options

- Reliable email/chat support

Cons:

- KYC can take longer (~10 mins)

- Limited advanced account types

- Customer support not 24/7 in all regions

- Some platform features only for certain account types

- Fewer educational resources

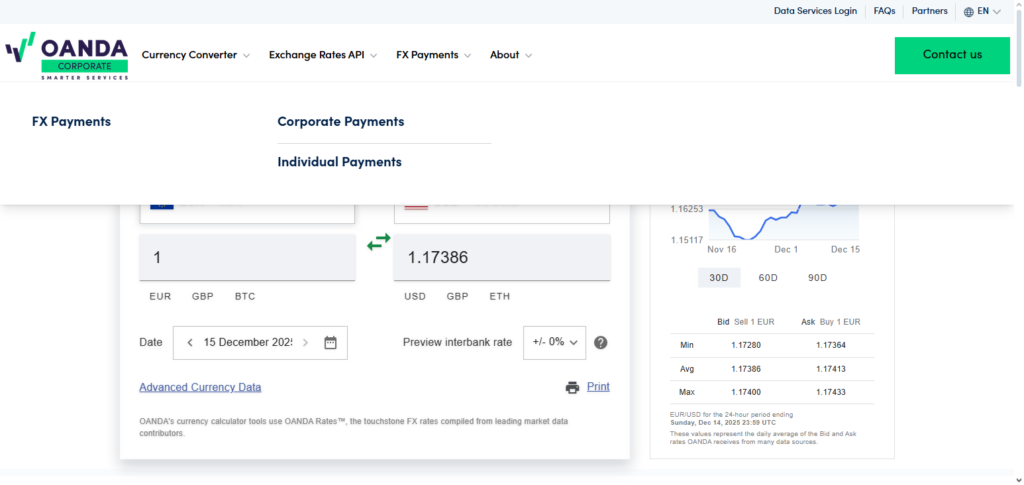

4. OANDA

OANDA is being recognized as a trustworthy broker by FCA, ASIC, CFTC, and IIROC as an honest and trustworthy broker and is therefore fully regulated. With no minimum deposit, beginners face no financial barrier.

Leverage is provided depending on the region. OANDA is supported by OANDA’s own OANDA Trade platform, MT4 and mobile applications.

OANDA has been recognized as one of the Best Forex Brokers For Fast KYC Approval (Under 5 Minutes) as a result of having automated checks to speed up account approval. With strong analytical tools and dependable client support, OANDA defends traders in a variety of countries.

OANDA Key Features:

- Regulation: FCA, ASIC, CFTC

- KYC: <5 minutes

- Minimum Deposit: None

- Max Leverage: Varies by region

- Platforms: OANDA Trade, MT4; Mobile App: Yes

Pros:

- No minimum deposit for many accounts

- Regulated in multiple top-tier regions

- Fast KYC verification

- Reliable trading platform (OANDA Trade & MT4)

- Multiple contact channels (phone/email)

Cons:

- Leverage varies, can be low for some regions

- Limited product range compared to some brokers

- Can have higher spreads on certain currency pairs

- Advanced trading tools are limited

- Not all markets available globally

5. Saxo Bank

Saxo Bank is a premium broker because of the safety provided due to being regulated by FCA, FINMA, and other top-tier authorities, which is then provided to every single one of their clients. There is however a high minimum deposit and leverage is limited. SaxoTraderGO and SaxoTraderPRO are the platforms traders use and mobile support is provided for both.

Even though it has a more professional oriented focus, Saxo Bank is recognized as one of the Best Forex Brokers For Fast KYC Approval (Under 5 Minutes) because of their digital confirmation systems. Saxo Bank services the entire planet, and their top tier research in addition to customer support is tailored for high demand clients, especially those representing institutions.

Saxo Bank

Key Features:

- Regulation: FCA, FINMA

- KYC: ~5–30 minutes

- Minimum Deposit: High

- Max Leverage: Regulated limits

- Saxo Bank is regulated in high-tier regions.

- Fast KYC verification is provided.

- Multiple contact channels are available, such as phone and email.

Pros:

- Excellent trading platform with many tools

- Highly regulated worldwide

- Great range of financial instruments

- Great research and analytical tools

- Global customer support

Cons:

- High minimum account funding

- Ken Yamamoto has a slower onboarding process

- Cannot offer any higher than what their policy allows

- Did not cater to beginners

- Newer investors may find the platform overall very complicated

6. HYCM

HYCM is one of the oldest brokers with a solid reputation and a good balance of trust and flexibility. It is regulated by FCA, CySEC, and DFSA and offers a low minimum deposit, competitive leverage, and many account types to choose from.

Traders can use MT4 and MT5 and their mobile fully-featured apps. Among the Best Forex Brokers For Fast KYC Approval (Under 5 Minutes), HYCM can fast-track compliance checks, so you can upload your documents online. The broker is located in many countries around the globe and offers multilingual support and education, as well as stable trading conditions for novice and expert traders.

HYCM Key Features:

- Regulated by: MFCA, CySEC, DFSA

- KYC takes less than 5 Minutes

- Low Minimum Deposit

- Up to 1:500* max leverage

- Platforms: MT4, MT5; Mobile App: Yes

Pros:

- Quick easy account opening

- Multiple area regulation

- Allows MT4 and MT5

- Deposit not required

- Customer support available 24/5

Cons:

- Advanced ordering functions are very limited

- During market volatility, spreads can widen

- Scarcity of marketing and promotional bonuses

- Education has a lot of room to grow

- Confusing for beginners

7. FXCM

FXCM is a well known broker with good reputation due to regulations from the FCA, ASIC, and FSCA. It is known for good execution and analytics with a moderate minimum deposit and is bounded by regulatory requirements with the leverage provided. Users have access to MT4, Trading Station, and trade on their mobile devices.

They are also listed as one of the Best Forex Brokers For Fast KYC Approval (Under 5 Minutes) due to their quick automated document submissions for compliance verification.

FXCM supports dozens of countries with good analytical charting, highly professional customer support, and educational and mostly research oriented materials.

FXCM Key Features

- Regulated by: MFCA, ASIC, FSCA

- KYC takes less than 5 Minutes

- Moderate Minimum Deposit required

- Up to 1:400* max leverage

- Platforms: MT4, Trading Station; Mobile App: Yes

Pros:

- Trading Station interface is reliable

- Quick effortless account openings

- Multiple area regulation

- Moderate leverage is more safe for beginners

- Customer support available 24/5

Cons:

- Limited selection of products

- Competitors may have the better offer for spreads

- Support not fully 24/7

- Withdrawal time may vary

- Fewer advanced trading tools available

8. InstaForex

InstaForex has gained praise from new users since creating accounts and verifying them after signing up is relatively easy and fast. InstaForex is regulated by CySEC and has very low minimum deposits and high leverage (depending on the customer’s jurisdiction).

All account types support the use of MT4 and MT5 on mobile. InstaForex also features in the Best Forex Brokers For Fast KYC (Under 5 minutes). The company provides is available and active in many countries. They focus on customer support 24/5 and offer many bonuses and easy to use features for novice traders.

InstaForex

Key Features:

- Regulation: CySEC

- KYC: Quick (<5 minutes)

- Minimum Deposit: Very Low

- Max Leverage: 1:1000*

- Platform: MT4, MT5; Mobile App: Yes

Pros:

- Very low to start trading

- Extremely high leverage

- Quick KYC verification

- Global support

- 24/7 chat support

Cons:

- Only CySEC regulation. Limited trust globally

- High leverage can be dangerous for beginners

- Educational resources are scarce

- Some account features are region restricted

- Platform features are basic compared to better brokers

9. FP Markets

FP Markets is also an award-winning brokerage that is also overkg Regul is ASIC and CySEC and even provides professional trading conditions. There is also low starting deposits available and with low competitive leverage and low spreads. MT4 and MT5 are also available and even cTrader and IRESS with seamless mobile applications.

FP Markets is also one of the Best Forex Brokers for Fast KYC Approval (Under 5 Minutes) and has partnered with high level digital verification. FP Markets also has clients contacted in high level 24/7 customer service and provides fast trade and also an extensive library and educational material.

FP Markets

Key Features:

- Regulation: ASIC, CySEC

- KYC: Quick (<5 minutes)

- Minimum Deposit: Low

- Max Leverage: 1:500*

- Platform: MT4, MT5, cTrader; Mobile App: Yes

Pros:

- cTrader and other trading platforms offered

- Top-tier regions offer regulation

- Quick account setup

- Low initial deposit

- 24/7 customer support

Cons:

- Educational material is scant

- Certain advanced features restricted to certain platforms

- For small accounts, spreads are moderate

- Access is restricted in some countries

10. Pepperstone

Respected and globally recognized online broker Pepperstone is also registered and trusted by several regulatory authorities, such as ASIC, FCA, CySEC, and DFSA. Pepperstone presents a relatively low minimum deposit, flexible, regulatory compliant leverage, and razor-thin spreads.

The company offers a variety of platforms, such as MT4, MT5, cTrader, and TradingView, which are all available on mobile devices. The brokerage has been awarded a Best Forex Brokers For Fast KYC Approval (Under 5 Minutes) as a result of their automated onboarding systems. With a presence in numerous countries, the brokerage is known for its rapid trade execution, superior technologies, and outstanding customer service.

Pepperstone Key Features:

- Regulation: ASIC, FCA, CySEC, DFSA

- KYC: Less than 5 minutes

- Minimum Deposit: Small

- Max Leverage: 1:500*

- Platforms: MT4, MT5, cTrader; Mobile App: Yes

Pros:

- Quick account setup

- Variety of platforms, cTrader included

- Low initial deposit

- Multiple top-tier region regulations

- Global support 24/5

Cons:

- Leverage cap for some areas

- Limited educational material

- Spreads differ among account types

- More expensive accounts have extra features

- No 24/7 phone support

Key Factors to Consider When Choosing Fast KYC Forex Brokers

Security and Regulation – Check for important regulations applicable to brokers for your funds and private information to be safe.

Speed Of KYC Approval – Check to see if the broker uses automated systems for verification to see if the approval will take less than 5 minutes.

Documents Accepted – Check for the IDs and proof of address documents that the brokers will need for the KYC verification to be fast.

Availability By Country – Check that the broker does not have any extra verification delays for traders from your country.

Minimum Deposit After KYC – Search for brokers that have no minimum deposit or very low deposit after KYC is approved.

Leverage – Check the limits for more than one leverage option to find the one that fits your strategy and risk.

Platforms For Trading – Search for MT4, cTrader, MT5 or their own mobile trading platform, they are the most popular.

App Available For Trading – For a fast KYC broker smooth mobile trading and verification system will be available.

Speed Of Withdrawals Or Deposits – After approval of your account funding and withdrawal options should be available quickly.

Support For Customers – Brokers with 24/7 support or support in different languages will be better for you if you have KYC or account problems.

Comparison Table: Fast KYC Forex Brokers

| Broker | Regulation | KYC Speed | Min. Deposit | Max Leverage | Platforms | Mobile App | Country Support | Customer Support |

|---|---|---|---|---|---|---|---|---|

| JustMarkets | FSA, CySEC | < 5 mins | Low | Up to 1:500* | MT4, MT5 | Yes | Global | 24/7 Multilingual |

| FXTM | FCA, CySEC, FSC | < 5 mins | Low | Up to 1:1000* | MT4, MT5 | Yes | Global | 24/5 Support |

| FXOpen | FCA, ASIC | ~5–10 mins | Low | Up to 1:500* | MT4, MT5 | Yes | Many Regions | Email/Chat |

| OANDA | FCA, ASIC, CFTC | < 5 mins | None | Varies by region | OANDA Trade, MT4 | Yes | Multiple | Phone/Email |

| Saxo Bank | FCA, FINMA | ~5–30 mins | High | Regulated Limits | SaxoTraderGO/PRO | Yes | Global | Premium Support |

| HYCM | FCA, CySEC, DFSA | < 5 mins | Low | Up to 1:500* | MT4, MT5 | Yes | Many Countries | 24/5 Support |

| FXCM | FCA, ASIC, FSCA | < 5 mins | Moderate | Up to 1:400* | MT4, Trading Station | Yes | Global | 24/5 Support |

| InstaForex | CySEC | < 5 mins | Very Low | Up to 1:1000* | MT4, MT5 | Yes | Wide Support | 24/7 Chat |

| FP Markets | ASIC, CySEC | < 5 mins | Low | Up to 1:500* | MT4, MT5, cTrader | Yes | Global | 24/7 Support |

| Pepperstone | ASIC, FCA, CySEC, DFSA | < 5 mins | Low | Up to 1:500* | MT4, MT5, cTrader | Yes | Many Regions | 24/5 |

Conclusion

For traders who desire instant access to the markets without any delays, selecting the best forex brokers for quick KYC approval (less than five minutes) is crucial.

You may begin trading right away, seize time-sensitive opportunities, and effectively manage risks with brokers who offer rapid or automatic KYC verification. Regulation, platform quality, leverage, deposit requirements, and customer service should all be taken into account when choosing a quick KYC broker.

For both novice and experienced traders looking for a smooth onboarding process and continuous access to international forex markets, reputable brokers like FXTM, JustMarkets, OANDA, Pepperstone, and InstaForex combine speed and security.

FAQ

Can I complete KYC on my mobile device?

Yes, most brokers support mobile document uploads and verification through their apps.

. Does fast KYC affect account security?

No — reputable brokers use automated systems to verify documents while maintaining regulatory compliance and data security.

Are there countries where fast KYC isn’t available?

Yes, KYC speeds can vary by region due to local regulations and compliance requirements.

Can I trade immediately after fast KYC approval?

Yes — once KYC is complete and your account is funded, you can start trading.

Do fast KYC brokers have lower minimum deposits?

Many do, but minimum deposit requirements vary by broker.